Economic powerhouse Texas first got hit by the Oil Bust then by the Coronavirus. Expect similar confluence of unrelated factors in other regions.

By Wolf Richter for WOLF STREET:

Most of the economic data is released weeks and months after the fact. But surveys of manufacturing and service companies foreshadow what will happen with the official data when it finally appears.

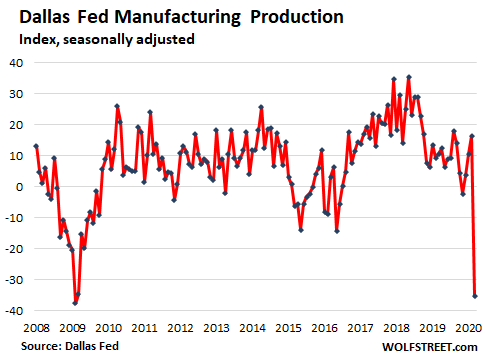

The Texas manufacturing production index, for which data was collected between March 17 to 25 from 110 Texas-based unnamed manufacturers, plunged from +16.4 in February to -35.3 in March, the largest month-to-month drop in the history of the index going back to 2004, the Dallas Fed reported this morning:

Many manufactures in Texas supply the oil and gas industry, where mayhem had broken out long before the coronavirus lockdowns started impacting the economy.

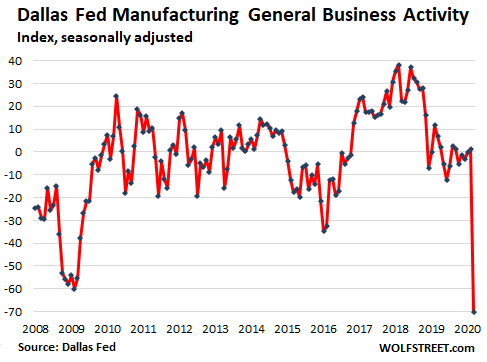

Manufacturer’s perceptions of broader business conditions collapsed from an already low 1.2 reading in February to -70.0, the lowest in survey history. The report observed laconically: “Perceptions of broader business conditions turned quite pessimistic in March”:

The price of crude-oil grade West Texas Intermediate (WTI) has now plunged into the range of $20 per barrel, which is catastrophic for the entire oil and gas sector. This is down from a range of $80 to $110 per barrel from 2010 through mid-2014. In an effort to stay alive a little longer, exploration-and-production companies and oil-field services companies are cutting operations, and as they’re running out of funds, they are slashing orders for equipment and supplies. And this ripples through the Texas economy.

The comments made by the executives in the survey ranged from:

“We are mostly just concerned.”

…to something more apocalyptic:

“If we see this downward trend continue, we will run out of cash within four months. New orders and inquiries have stopped instantly. Our work in-house will be finished mid to end of April, with no new orders coming in, all due to this real or imagined shutdown. I believe the country will be in a depression by the fall unless the work environment changes dramatically.”

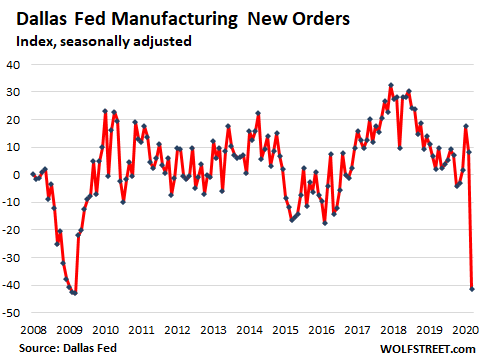

The index for new orders collapsed from +8.4 to -41.3, the lowest since March 2009 during Financial Crisis 1. One of the executives explained it in the comments: “The business disruption due to COVID-19 is causing cancellations and holds from a majority of large customers. We are looking at the possibility of heavy losses for the coming months until the national health emergency stabilizes.”

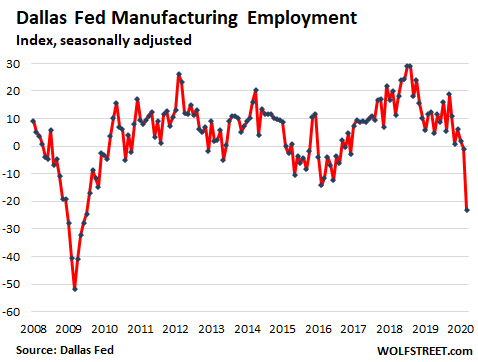

This is starting to have an impact on employment: As 26% of the companies in the survey reported net layoffs in March (only 3% reported net hiring), the Employment index plunged to -23 from the already beaten-down near-zero reading in February.

One of the executives explained it in the comments this way: “The coronavirus impact primarily will hit contractor populations in the short term. Longer term, it will hit company employees.”

These types of surveys (which include the PMIs) are among the early indicators as to what companies are up against. And what they’re up against is that the health crisis now reverberating through the economy came on top of numerous other issues.

On top of these other issues is the record indebtedness of US businesses that made them more vulnerable and more fragile even under a regular mild run-of-mill business-cycle downturn.

Then came Oil Bust 2, which started in late 2018, just as the industry thought it was already recovering from Oil Bust 1, which had started in mid-2014. In early March 2020 came the Saudi-Russian price war that directly attacked the US shale oil space.

Texas is an economic power-house. And the oil-and-gas industry is a huge customer of manufactured goods and equipment, including tech equipment; it powers construction from high rises to pipelines; it drives numerous services, from technology services to transportation services, such as trucking.

Other economic power-house regions in the US also already struggled with different economic factors in 2019 – such as the deflation of the unicorn-startup bubble in San Francisco and Silicon Valley. And now on top of it all, there’s the COVID-19 health crisis, the shutdowns and the mindboggling uncertainties that come with it. And the early data shows just how tough this is going to be.

And this is just the first inkling of what’s in store for home sales. Read… How Will Coronavirus Lockdowns Impact the US Housing Market? First Data Points Are Out. They’re Ugly

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

In reference to all the above graphs.

And in reference to the saying “Nothing goes to heck in a straight line.”

One of them is in need of refinement or in need of an additional corollary.

It’s really different this time.

2banana:

You mean even curved bananas are going straight!

On a log-scale everything goes to hell on an apparently on long link chain of straight lines.

“Graphs are like a box of chocolates, you almost always know what your going to get”

I have a one-man machine and metal fabrication shop. A lot of my work comes from sub-contractors to Intel. This work is still holding up, and my suppliers are all up and running, from steel service centers, to hardware to tooling they are delivering as usual with no delays so far. For how long this will go on is anyones guess. Luckily my overhead is very low and I have plenty of savings.

I maintain websites for dozens of small manufacturers across the country. Most are in the precision machining / precision fabrication end of the industry. So far, almost all of them are busy and their supply chains are intact. I believe that can last for a while, but if this crisis goes past the June/July time frame… all bets are off. Hoping for the best, planning for the worst.

The chain works until Intel, or say Dell or similar, see softness and then the ripple effect starts. Having worked in that SC for many cycles it can be long and brutal. GL and keep saving.

Looks like everything is on schedule.

We have couple of months left, then everything begins to crumble.

Think about the knock on, knock effects…… I live in Manchester UK which normally has 60,000 students, all have gone home with their money and taken all the Uber drivers with them..

Same in the USA….Apple have not sold a phone for ages, is anyone still using Uber, nobody is thinking , gosh I must go and buy a car and then I’ll drive my new car and buy a house wearing all the new clothes I keep buying from all the not open stores. On top of that after buying the new car and house I might book a holiday on a cruise or even better, to a crowded Disneyland……

Knock, knock

Who’s there

nobody

nobody who

…………………

I’m also from the UK and until recently I worked at the university of Essex which loved nothing more than getting students from everywhere except Essex. They have been on their knees making cuts to try and keep going. I’m sure this will be the end of them.

The world will definately charge after this.

What happened to domestic toilet paper mfg? I would think they should have jobs. Clorox is in demand.

People without jobs may pull back from spending. They try to use smaller quantities as necessities are back ordered awaiting fulfillment. Amazon is hiring.

Extreme shutdowns might result in economic collapse and famine. There are frightening stories about the situation in India. Natives in South America have blockaded their villages.

Expecting more first time jobless claims. The largest first time jobless number in history was reported last week. Weeks ago they proclaimed the lowest unemployment in history.

I read Amazon workers in NY are refusing to go to work today.

Lots of online products for sale that does not require using Amazon. Our rural mail is still being delivered and packages are dropped off at the door.

Today I received 8 cubic yrds of fish compost soil mix. Imagine my surprise when the driver jumped out and I knew him. Small world. I had not talked with him for almost 10 years! Anyway, he told me (from 10 feet away) that the company was run off its feet and could not keep up with orders. So many people are at home and are now deciding to put in large gardens and grow food. Our compost order was to rejuvenate our soil in the new greenhouse.

Online seed producers are running out of seeds and supplies. I guess our routine of saving seeds and trading with others suits the times, even though it is an ancient practice Monsanto cannot yet control. Hopefully, the rest of the economy doesn’t follow suit and we go back to a barter system.

Son flies back to Ft Mac tomorrow to resume his maintenance job in the Oil Sands. For now, it is business as usual, despite the low price for WCS.

This reminds me of the 1983 recession, everybody panicked, nobody had a job, you could buy a house for $15k in the city and $5k at the beach ( even less jobs at the beach )

But if you looked around and saw who was making money, you could do that too,

Just like now, can you imagine say if you have a roto-tiller and advertise? I mean most people can’t or don’t run them anymore, and you can charge $100/hr no problem

People have money, but most are lazy; Guys/Gals that want to make a lot of money, can and will in any kind of economy.

Here’s another toss, all our ‘gardeners’ are going to need ‘fertilizer’, so you go around to horse places, pig, cow, .. and get material free, and then sell it by the LB for a lot of money to the ‘green acre’ crowd

In Italy you have to pay people to clean the horse corrals, if you offer to clean ( mostly soiled hay ), they don’t have to pay a guy to clean, you get free material that every winery will buy. You think they’ll quit making wine?

Even in early 1980’s nobody had a job, but it was the best time ever in computers, as nobody knew how to program them, you could BS your way into any company and get a stock-package.

Same now, there are always companys in dire need of a specialty, and most often the specialists really don’t know anything a clever guy can’t learn in a few days.

About 15 years ago we had a new mechanical tech come on the floor.

Really nice and smart guy.

Came over from a domestic diaper manufacturer/factory in the area.

He was ordered to teach his Chinese worker replacements on how to run the diaper machines.

He opened the manual and gave it to the Chinese workers and said “You can learn just like I did…from the manual.”

He was let go later that day from the diaper manufacturer.

I always had a huge respect for that guy. Great worker too.

Which was a lie of course Take a gander at the labor participation rate And the metrics they use to determine exactly what “employed” means Lots of smoke and mirrors employed since the GFC

It’s not just this crisis, the tastes are changing away from fast fashion and the latest Apple and definitely anything Disney…the youngest generation under 25 is amazing. Brands, corporate vacations, fast food….they are the New Realists. A coffee is a coffee is a coffee….

And the stock market is going Up n Up .. V shape recovery.

TPTB will do anything they have to, to keep the house of cards afloat!

End of quarter re-balancing. Tons of pension plans and 401k’s have a preset stock to bond ratio as far as value. With the stocks down so much in the quarter they need to buy to get re-balanced before the 1st and the start of the next quarter.

Thanks Lance, I’ve been trying to figure this one out and that totally makes sense. I’ve already got close to $10k invested in various puts, including September puts in the SPY.

I balanced it with gold miner stocks in case I’m wrong. A breakthrough treatment for the Covid-19 symptoms, like that malaria drug they talk about leading to an early end to shut downs should push the gold miners way up with all that fed money.

If I’m right, I figure that gold miners will take less of a beating than everything else.

Yeah, I find it amazing and disgusting. I was waiting for a real bottom to be put in but the government and the Fed has other plans I guess.

Don’t worry EC, it coming: With the St Louis Fed predicting unemployment at 47MM out of just the 67MM most at risk jobs, it won’t take too long to arrive IMHO, about 4 weeks.

Watch for the results of the next report of claims,,, and then, watch for when the totals of cases and deaths from this virus reach toward the peaks recently suggested as ”reasonable” not to mention if they reach the levels suggested as possible.

This ain’t over til it’s over, and that’s a bit down the road or slope if you will.

Just wait for earnings reports over the next 3-4 months. They will put P/E ratios in to perspective.

My son just got told from next week they have a 25% pay cut and only 30hrs pay per week. Better than being laid off he said. But, multiple these actions for those that still have jobs (for now) along with the mass unemployed and you have an economic depression.

What industry if you don’t mind?

This happened in tech in 2009, though it was typically a 10% cut whilst hours were not cut. It was advertised as saving jobs and people were okay with it because revenue had fallen through the floor.

A characteristic of this crisis is that, in general, the U.S. tech sector can keep humming because the U.S. is light on tech manufacturing. Everyone is working from home full time.

Now, if all of China and Taiwan shut down, forget about it.

Tech is in for a hurting.

The Unicorns are all dead, they just don’t know it yet.

VC have been spending like drunks in a saloon, but they are about to sober up.

My daughter is in tech at a large “start-up.” They just laid off 20% of the company and gave the rest an 8% pay cut.

My Calif friends are all in ‘oil’ they were told two months ago that massive layoffs were coming. No problem all my friends are of retirement age, and have been waiting for the ‘golden parachute’

I think a lot of this ‘bailout’ money will be used as a cash incentive to ‘ just walk away’.

Lastly, back in the day at all the oil companys you were promised ‘health care’ for life, that’s why most punched in their entire lives at these same oil companys, well about 10 years ago they reneged on that promise of ‘free health care for life’. So now the very reason they signed on as a ‘lifer’ is long gone, they like zombies just keep showing up, because they could-a, should-a started their own companys when they were young but didn’t.

Mike: My daughter-in-law got let go last Friday from her $100,000/year job with a small oil producer here in Texas. She was the royalty account manager, and at 50+ years old, she may never find a job like that again.

Truly awful challenge…like when the linotype operators were fired to make way for photo offset newspapers…or telephone operators were fired in favor of whatever it was.

I was trained as a phone operator in 1969…it was the job of jobs. When I quit after 6 weeks the supervisor told me I was making the biggest mistake of my life because it ensured my whole future and security.

But oil??? Truly, I’m sorry and pray she finds an even better job, if lower pay, and weathers this.

I learned computers in the 1960’s on my own. There was a college near me that had free use of an IBM-360, back then you had a card-punch to program. ( Sure I could ‘card-punch’ but I thought it would be the most boring job on earth. )

In the early 1970’s they were telling everybody in high-school to be a ‘card puncher’, you could make in those days a whopping $15/hr, which was equivalent to a brain-surgeon. By mid 1970’s everything had gone from ‘batch’ ( punched-cards ) to ‘interactive’ ( keyboard-interrupt )

It’s amazing how fast the ‘job of future’ went from infinite to zero.

…

I really think this recession like most, the money will be in the easy stuff, especially given the ‘snow-flake’ population where 90% can’t fix anything, nor know how anything works.

Recall that prior to the Chinese junk invasion of the 1980’s, and Japan in 1970’s going back to 1960’s an earlier, all stuff came from Sears, had a life warranty. My how times of changes, and a guy could fix anything, if you didn’t carry a tool-box in your truck, you were an idiot, if you couldn’t fix your own truck on the road you were an imbecile. Look at what we have now?

The sick part is that she won’t be eligible for the $1200 stimulus because they’re means-testing based on 2018 or 2019 tax returns.

Should have paid EVERYONE $1200 immediately and then recoup from high-earners based on 2020 returns.

Well if shes 50 and been working for 100grand a year for a while she should be perfectly fine if she has half a brain…..

Are the CEO and executives taking a 25% pay cut?

Sometimes getting laid off isn’t so bad Depends on how determined you are Was the best thing that ever happened to me in 1981 though at the time it was horrifying There are always opportunities to be found in these situations if you look hard enough

Wolf, what you’re really saying here, is you’ve decided to go long on equities right ?? Because we’ve reached the bottom and JNJ has a cure ?!

We will all have to go long on equities to a certain extent to make up for lack of fixed income interest and yields. But I will keep percentage of stocks low. Those that bought and held and are down have a different problem for sure.

SP 500 pe is *still* at 20, weeks into this – using *pre*-pandemic earnings.

Long term pe average…15.

ZIRP has shoved dollar based savers into a corner (for two decades) but taking yield refuge in equities is jumping out of the frying pan into the fire.

Except at extremes, everyone has a lot more control over their personal expenditures than the actual absolute return of their investments.

Yeah I mean in all seriousness I simply cannot imagine being 80-90% in equities yet. I’ve sort of dipped in and out but I think the real pain comes in this quarter as it starts to dawn on people that this is for real and lockdown is going to cause – at the very least – a temporary depression. Look at how long it has taken Italy to flatten the curve

That being said I’ll be buying the next leg down

I’m going long on rifles and short on pistols. Something tells me these preppers got it right.

And its now a state by state contest to see who can shut down the longest.

I have state/local govt. inspectors who refuse to do site inspections ( open air/rural settings ). And yet they will set @ home and get a check & a pension.

At least they are not in my way. All I’m required is a 72hr notice. If they fail to inspect, I backfill and move on. If our farmers all having problems finding help, I have a lot of candidates for them. None of them illegal.

Do we have reports of layoffs of employees (not contractors) from any of the big players thus far? The tech companies are not doing too bad, NASDAQ down 19.5% compared to 25% for DJIA. The makers of tech equipment (Cisco, Apple etc.) already feeling the pinch either from very low (consumer) demand or impacted supply chains. For those that don’t manufacture anything tangible (Facebook, Twitter), I wonder if advertising revenue is going to be impacted in any way, even though user traffic is still up there, if not more so as everyone is cooped up in their homes spending increased time on gadgets.

The user traffic would be there but what about the revenues for bizs who would be spending ad money on these online platforms.

If the bizs dont have money.. they wont spend on ad

Ad spending will fall off a cliff on Wednesday.

Refiners are running in the red?

I wondered what businesses would do well from the Covid depression then l remembered that all this spending has to be paid and so nobody will do well.

Vulture capitalists have a blank check from the Fed.

dear mr.wolf

reading the comments above i sincerely believe that a new category is

needed -the new world economic order after a pandemic.

For starters,

1.home office in -downtown office working out

2.Online grocery /apparel shopping in – shopping centers out

3.Less public/private transport- shared transport in the peripherials of the city

which means Less concrete/steel in downtown and more green spaces,less pollution…

İ certainly would like to read about the implications of this pandemic and would try to reposition my assets/targets/ beliefs/…etc accordingly

sincerely

Remember Meno – one man’s ‘pollution’ is another man’s job. there will be winners and losers out of this pandemic, hopefully not too skewed toward losers.

The drug cartel doesn’t want drug manufacturing returning to the US from China. They like the cheap labour, they like their monopolies, they like tax evasion, and being transnational corporations they can evade laws.

They also have armies of lobbyists to keep the US government under their thumbs.

Try ‘‘Swamp Creatures’ Attack Effort to Make Medicines American Again” on theAmericanConservative dot com.

They don’t care about the casualty lists. They want those rentier profits, dammit. Lo Greed is marching on!

Our prescription meds are about the only product from China that doesn’t have to be labeled ‘Made in China’. And my pharmacist says ‘country of origin’ doesn’t have to be labeled on the wholesale packages he fills prescriptions from. Don’t you love being the last to know what our “Leaders” are (NOT) doing for us?

Right you are BL: When I told my geriatric internist a decade or so ago that I preferred wine as my ”pain meds,” he said that at least I would know where it was coming from, and went on to say he could not know where any drug he prescribed came from, nor could the pharmacist ,,, how that came about should be the focus of the congress instead of the current ”harpy” messages.

Anyway, the wine has worked so far, except I failed to obtain sufficient when I ”panic bought” a case 3 weeks ago when I first became convinced that I would not be able to get my current fave, a Spanish white almost as good as the CA white that never goes out of Santa Barbara county. (Because the locals are waiting at the gate when it’s released, eh)

(How’s that Wolf, for no ”plugs?”)

Many signs of a sharp and may-or-may-not be short slowdown ahead.

Stocks keep rising.

Just saw an analysis of individual country ”bell curves” that, although based on preliminary evidence, indicate a two to four week periodicity from first few daily cases to peak and back down.

“Generalizing on insufficient data.” was one of the critiques my dad taught me early on as part of his attempts to teach me analysis technique; even so, as a preliminary approach, this concept appears promising, and perhaps, as we approach and pass one percent of one percent of the world population, we will be able to make more clear predictions of the path of this virus.

And, with the immense improvements in the medical sciences and delivery of medical services since 1918-20, it seems very likely to me that we will be able to reduce the death toll equally immensely.

Even if you do nothing the curve will flatten eventually when you run out of people to infect. Same for the deaths curve.

A flattening curve is a problem, which extends the life of this thing. Its the deaths per recovery ratio that matters. In NY it is about 30%. We just don’t know if there are more people who recovered than were originally counted. When counting the dead do they count the underlying condition as cause? Suppose the victim only had 50% lung capacity before the illness? A lot of gray area in here. There will no doubt be a lot of law suits, and the bean counters know how to put a price on every life. We will find out then how serious the illness was.

Then stocks to back down??? Keep rising. Please, bear market rallies are a must.

Oil price volatility seems to be here to stay. To be fair, peak oil theorists told us 15 years ago it would be this way. I wouldn’t be surprised if producers weren’t coming up with business models that are capable of sustaining multi-year pricing whiplashes.

But I also wouldn’t be surprised to hear that everyone’s had their fingers in their ears singing la la la la la.

Could you please speak up, MF? I can’t hear you.

Don’t worry about oil. The world runs on oil. The world’s militaries run on oil. There’s loads of oil out there. The problem is that the world’s oil producers are overproducing and driving the price below the cost of production. They’re greedy, and they need the money, except US shale producers, which are fronts for economic warfare using oil as a weapon.

There’ll be bankrupties among the small fry, sure, collateral damage. The industry is subsidized with trillions every year, so it will be okay.

The planet will overheat before it runs out of oil so people won’t be able to use all of it anyway.

Saudi cost of production is $5. They sell it for $10 and they have a 100% margin. Now that is unrealistic since the monarchy has to dole out so much to keep them in power.

It costs billions to keep 10,000 Saudi princes in The Style In Which They Have Become Accustomed.

Just the other day I was told that a basic minimum income would generate decadence in the US underclass. I think the guy was being sarcastic.

Does the kingdom still have to dole out to all the royals? I thought MBS seized most of their wealth a couple of years ago.

No, peak oil idiot extrapolators said it would be this way 20 years ago along with AlGore having us underwater right now.

Dude.

KMOUT

From 2012:

“Detractors misrepresent Hubbert and point to the unconventional shale oil revolution. Both sides ignore economics and price.”

“Oil production appears to be on an undulating plateau, the shape of which will be determined by price. With higher prices oil production would gently increase as demand is choked. Lower prices will quickly crush producer cash flows given today’s very high cost of marginal production. The catalyst for the shale revolution was a new much higher price deck.”

https://seekingalpha.com/article/846571-peak-oil-undulating-plateau-shaped-by-price

Conventional peaked in 2005. This Covid event made the roller coaster fly off the tracks, though.

KSA oil produces at $20 now, not $5. However, the Monarchy needs $80 to run their budget.

Peak oil people vastly underestimated human ingenuity.

Happy1: You are ignoring the fact that the average energy cost of extracting oil has gone up and up. Extracting oil from an offshore field that is located 5,000 ft. underwater and extracting it from shale have higher costs and consume more energy than extracting oil from a large field of oil in Texas or Saudi Arabia. If more energy is consumed than is actually produced in the discovery, processing, and shipment of oil, then the point of no return will have been reached. The best oil fields have already been discovered and they are being depleted.

In addition, it should be kept in mind that billions of dollars in subsidies to the oil industry every year can cause oil exploration and production to continue even when it becomes uneconomical to do this.

It is funny to me that 5 days of action to the upside and everyone starts talking about a v shape recovery. Every rally looks like a v-shape recovery, right up until it plunges to a new low. JNJ does not have a vaccine btw, they are talking about starting state 1 clinical trials which means the best case scenario with JNJ is a vaccine sometime next year.

I am wondering how long this so called recovery will maintain given the fact that the E in the P/E ratio is about to implode when companies start reporting earnings.

Not defending it…but the pe’s did bizarro things in the wake of the 2009 implosion..in May 2008 the SP 500 pe was about 25…by May 2009 it was…124.

My guess is that 1) V shaped earnings recovery gambles and/or 2) asset values put something of a floor under share prices, despite massive earnings hit.

Not saying it made sense then (earnings recovered…but over yrs) or that the same dynamic will happen now…merely observing how non DCF-minded the mkt can be.

There are 100’s of companys all over the world that claim to have a ‘vaccine’ for the virus.

If the JNJ were any thing else than Hopium, then the price would be north of $1k, its still just $130, not even close to the all-time high of 150.

So is Trump going to buy JNJ, and sign an EO that only USA citizens can take this vaccine??? Like he tried to do in Germany, but got busted, and the CEO who signed the billion USD deal with Trump got fired by the founder.

…

The problem is it takes months if not years to get everybody vaccinated; Normally they have to go on a lottery system the first year;

If they say Sep-2019 for the public, then why wouldn’t the rich&connected have access now? If it worked, then why isn’t the stock to infinity?

So forgive my financial ignorance – I’m a retired systems/software engineer with no financial training. But I used to hear the term “velocity of money” and it was considered to be very important. Now it seems to be approaching zero. I cannot see how any Feds in any country can keep up with it – how can they print enough to outrun it? Other than costs rising in a few essentials, how can we get anything other than a deflationary depression?

Many have predicted it would start “the upcoming recession/depression” out as a deflationary depression and then become an inflationary depression. This means that at first the UD Dollar does super well then it crashes. This was the theory I found most likely. That was before the CCP Coronavirus though. This is a massive wildcard “coronavirus”, if played right the US Dollar could remain strong and boost Americas economy into the future. Basically, America has to move everything important out of China asap, handle the coronavirus well, bring alot but not all manufacturing back and much more “cut all sanctions bulls**t”. How likely that is depends. Right now, America’s best chance “because our politicians suck” is to fumble less than the EU and China “EU politicians and Chinese dictators also suck”.

Originally though, as economies around the world panicked in the recession “the would have been, non coronavirus one” they would have “individuals, companies, and governments” in ours and foreign countries droped assets like stocks, property, and more and keep cash on hand “this includes in banks”, they would hold that cash as US Dollars though “mostly”, as it as seen as safest. This would hugely boost US Dollar and could be currently happening. However, depending on how depression dragged on they could lose confidence in US Dollar, leading to a crash and wild inflation. The reasons they could lose confidence in the US Dollar are many, massive runaway spending to save stock market which can’t be saved is one possibility, US economy failure to spring back is another, continued massive increasing deficits, sanctions bulls**t, threatening random countries in general, and more.

I like the Russian approach. Just tax the superwealthy and give to the bottom. Because of the way the economy and debts are structured, most of it will trickle right back up to them anyways.

Rinse and Repeat.

Have you ever been to Russia?

Taken from The Mises Institute website:

——————————–

Velocity = Value of transactions / supply of money

This expression can be summarized as

V = P*T/M

Where V stands for velocity, P stands for average prices, T stands for volume of transactions and M stands for the supply of money.

This expression can be further rearranged by multiplying both sides of the equation by M. This in turn will give the famous equation of exchange

M*V = P*T

This equation states that money times velocity equals the value of transactions. Many economists employ GDP instead of P*T thereby concluding that

M*V = GDP = P*(real GDP)

————————

The mantra of modern economist is: “GDP has to at least stay equal or preferrably has to go up”. So it’s easy to conclude that when V goes down, M must go up. This explains the trillions of $$$ that have to be created.

It took all those bankers years of studying and it’s all so easy to explain.

What they studied is not economics, but rigging the system and how to get away with it.

JudiBlueHen: You ask a very good question, and it has been not-answered for decades.

That “velocity” problem is a gigantic, obvious and fundamental problem with developed economies. As productivity and globalism rise, the value of labor falls. As productive capacity is concentrated in the hands of the few, the ability of the average worker to earn a living falls.

Left untended, that lack of buying power would stall the economy. Since we’re not willing/able to increase labor’s buying power, we need a crutch.

Enter “the Debt”. The reduction in labor’s pricing power has been temporarily papered over by borrowing from the future. Household, state and national goverment is borrowing at an astonishing rate. Now it’s $5T at a whack.

Here in the U.S., our politics is all about “who gets the debt proceeds”.

We don’t debate questions like “who do we invest in” or “what new industries can we create today” or “how can we fix the environment while we earn our living”. We’re not asking those sort of long-term-health questions.

The velocity of money is a bleakly accurate tell-tale of economic decay. Preventing the collapse of our decayed economic structure is Job One of the Fed and the Federal Government. They understand very clearly what is at stake. Hence the hysteria and extremes.

Notably absent from the discussion -almost anywhere, even so-called “capitalist” or “conservative” venues – is “what to do about it”.

The structure of our economy is on its last legs. It reminds me of Galloping Gertie – the bridge over Tacoma Narrows, right before it broke apart.

A related topic. Does anyone know what California is planning for the crop harvest this summer and fall? Usually done by transient labor from down south. I’ve seen the buses moving labor from farm to farm and they don’t have room for six feet of separation social distancing.

Does anyone know what California is planning for the crop harvest this summer and fall?

Disaster, I imagine. It’s a pretty good guess that the underclass that handles your food won’t be tested.

On a related note, what are you planning to eat this summer and fall?

You wouldn’t happen to have a good recipe for humble pie, would you?

Lisa_Hooker and Unamused,

Yes, it’s complicated. But farms and farm workers are considered “essential,” and they’re working for now.

Working outdoors is likely the smaller problem. The bigger one is workers being packed into buses and vans that take them out to the fields and being packed into housing for seasonal workers.

There are however disruptions in processing the seasonal farm visas H2-A at US consulates in Mexico due to the Covid-19 impact on staffing. And farmers fear a shortage of these seasonal workers over the summer.

It would be interesting if you could do an article on how bad California’s finances will be hit by the market crash.

I assume we’re going back to 2010’s blight, but it would be good to hear it from someone who knows.

Well, it’s gonna be bad, but it doesn’t matter because states are gonna get bailed out. Isn’t that what we were promised?

Capital gains tax is a huge deal for California since so many people here are involved in stocks — entrepreneurs, VCs, employees of startups, employees of the biggies (Fb, GOOG, AAPL, et al) during good years make out like bandits, and California counts on this money. When it doesn’t show up suddenly because the market craps out on everyone, then budgetary mayhem breaks loose.

I will be attempting hubris casserole as we can’t spare the flour for pie crust. Hang in there.

Lisa H

It is a question for everywhere, including Canada. A local greenhouse pepper cuke grower has tried to get a waiver to allow his long-time Mexican workers entry visas during the lockdown. He provides housing and pays $14 per hour. He is trying to fill the gap with locals, but they don’t know what they are doing and are not as productive. This is on Vancouver Island. He said they’ll limp along the best they can.

Ca farmers have been mechanizing for a while. Immigration was in decline before 45 made his signature issue. Farmers are also downsizing. The produce fields moved to Mexico. The issue is imports. Mexico does not have an acute problem yet, but perhaps the Vail virus will spread, some rich Mexicans went skiing in Co. and took the virus home. Short answer, as long as Mexico remains virus free ( and Mexico City would be ground zero due to high density of people) and the border remains open, and field workers are not infected they will supply food. Meat production remains largely domestic, and that might be shut down. The entire meat distribution system is likely affected. I notice that besides paper products meat has been scarce on super shelves. There is plenty of idle man/woman power in Ca. right now, people looking for work. I don’t think they will have trouble getting the crop in.

People who work outdoors in the sunshine are safe from colds and flu…and bone loss.

How I worry about these children who live only indoors with screens.

Deanna: Exposure to too much ultraviolet light outdoors weakens the immune system, increasing the risk of infections. It also increases the risk of skin cancer, particularly in light-skinned people.

Social distancing is a quaint bourgeois concept that the poor canot afford. Here’s how it pertains to the poor in India:

https://foreignpolicy.com/2020/03/28/social-distancing-is-a-privilege/

It’d be tough for India’s poors but the govt there has come up with free food for the poor keeping in mind the plight of poor.

It’s almost as if the elite ( say Bill Gates ) and friends got together and made a wish list.

What would be the perfect place?

1.) No traffic on roads

2.) Not having somebody breathing down your neck at an ATM machine

3.) No homeless on the side-walks

4.) Everything clean ( people are kept indoors )

Sheesh, how could we do this? Ah, lets have a pandemic

Yes, “Social Distancing” is a tool of the rich, because it was an idea of the rich, they know exactly what they’re doing.

Like Bill Gates said this week “Why can’t you all just stay home 10 weeks”, all the while he flys all over the earth on his super-jet.

Not all migrant labor any more. The United Farm Workers Union members do most of the work, at least in the Salinas Valley areas with which I am most familiar. Driving through that Valley a dozen times or so in the last five years, I have been very pleased to see dozens of cars and trucks instead of the buses, along with proper sanitation stations, including hand wash and eye wash facilities, and shade stations accompanying every harvest.

It is very different than it was in the late sixties when I was also driving the 101 a lot to see a friend in SoCal while at Cal.

A TON has change since Cesar Chavez and so many others fought for the rights of the farm workers back in the days when most of us in Berzerkeley were boycotting grapes, etc…

Yes, I see the same thing in the orchards near me.

When its time to harvest you will see dozens of fairly nice car’s parked near the highway. In 1-2 days, they move to another field.

One highly motivated man can do the work of ten ( fact ), they pay buy the crate, not the hour.

Much of the narrative, is from the 1950’s cotton plantation busing, today migrant farm workers can make north of $50/hr

I wonder how many of you commenters on farm labor have done “stoop labor” such as picking strawberries????

Your comments are “amusing” at best.

But it does reflect the ignorance of most Americans of how their food comes to their tables.

(From one who has spent many years in youth in the row crop farming and produce business)

As an aside to the whole subject: How about the massive refugee camps all over the world? How will they cope with the infections????

We will reap what we sow.

Migrant farm laborers don’t have the luxury of being concerned about a flu even if it carries a 1% mortality risk

Wolf,

Thanks again for the insights. Stay safe.

This situation reminds me of what David Oppenheimer said after witnessing the bomb at Trinity. I don’t remember the exact words, but something on the order of opening the gates of hell. The great MDs and Ph.Ds tried to stem a pandemic, but opened another one on the backside.

It was J Robert Oppenheimer, head of the atomic bomb project. The full quote

“We knew the world would not be the same. A few people laughed, a few people cried. Most people were silent. I remembered the line from the Hindu scripture, the Bhagavad-Gita; Vishnu is trying to persuade the Prince that he should do his duty, and to impress him, takes on his multi-armed form and says, ‘Now I am become Death, the destroyer of worlds.’ I suppose we all thought that, one way or another.”

1) BKX, the bank index, trading range : BC @ 93.34 on July 1998 //

AR @ 54.57 on Oct 1998.

2) Mar 2020(L) is a spring @ 55.40

3) If no major changes, good luck !!

Hey, based on recent market action the S&P will be back above 3,000 in no time, so why worry about such minor economics irrelevancies as employment and industrial production?

/s

Exactly.

The Fed and Mr Market don’t need those ancient relics of the past – economies, employment, production, output.

They got each other. That’s all the need.

Oh what bliss. To no one else except each other.

Oh what bliss. To no one else except each other.

The ultimate in profit maximisation: no cost of goods or services sold.

Since the idea has always been to give you as little as possible for the highest possible price, taking that to its logical conclusion they simply take your money and give you nothing at all.

You knew they’d manage it someday.

If the stock market continues to soar during a deep recession rife with high unemployment and wage cuts, that’ll be a first.

There are estimates that the unemployment rate may top out at 30%.

Shouldn’t the government simply print money and give it to the industries in need or suffering a slowdown? I thought that’s what’s supposed to happen in our bailout-based economy, which is superior to both capitalism and socialism.

Shouldn’t the government simply print money and give it to the industries in need or suffering a slowdown?

I thought that was what they were doing.

IMO, I think there will be shortages and sharp inflation in certain areas.

Supply chain interruptions from over seas, empty shelves….

“we get all our light bulbs from where?” kind of shortages.

Oil certainly the exception.

There me a complete lack of certain items at any price..

“no spark plugs? I thought we made spark plugs in the US.”

“no spark plugs? I thought we made spark plugs in the US.”

The only thing Made in the USA anymore is plausible deniability. A major Beltway industry that gets bailed out continuously.

Historicus:

Yes. We will find that exporting our productive forces will be realized in the fictitious “cheap” prices we will be paying for necessary products.

Nothing is as it seems.

It looks like it went to heck in a sraight line.

But it also looks like it’s over

Someone please convince me otherwise

Is this debt even repayable ?

Nobody bothers repaying debt anymore. You roll it over now. If you can’t then you give the middle finger and default, walk away wherever you feel like. And then some creditors get a bailout.

1) During Iran/ Iraq war WTI spiked Nov 2001(L) @ 16.70.

9) If BKX is a spring, WTI will popup like a rocket.

Yes sir !!

https://www.stlouisfed.org/on-the-economy/2020/march/back-envelope-estimates-next-quarters-unemployment-rate

How many people, on net, will be laid off during Q2?

“For this reason, we simply took the average of those two numbers as a point estimate for the total number of workers who will be laid off during the second quarter. This resulted in 47.05 million people being laid off during this period.”

Yikes!! A 30% unemployment rate along with horrifying earnings reports certainly isn’t good (and let’s try to forget abound the bond market). No worries though, it should be a “V” shaped recovery (though that curve could a little flat).

Makruger:

An “inverted” V shaped recover will be more like it!

People got hammered in the sudden crash and are now trying desperately to recover something via day trading (since many are at home any way). Hence the market seesaw,

I’d love to hear if Wolf has a new short position or target that he is focused on. What you say Wolf? What’s your bottom? Where does the “ugly” begin to show it’s true colors?

No short position. I made that clear when I covered the last one on March 12. But I’m getting increasingly tempted… though I will try very hard to restrain myself. This is one heck of a crazy market. Well, market is the wrong word, now that the Fed is in every corner of it.

The current lockdown has one nice silver lining for me!

My wife and her credit card are not allowed to leave the house!

For once, my ZIRP income verses living expenses may not be so far apart!

WES,

Has your wife not discovered ecommerce????

shhh… Amazon is just a river in South America.

My spouse is still online shopping. Of course so am I…

Wolf…l posted a comment about an hour ago and used the word snow…..

My comment went to moderation and then disappeared. Is that a verbotten word??

Yes, it’s used as a pejorative code word to describe a group of people. And that’s how you used it too.

Got it….thank you.

Meant to use it for a group. Neihter pos or neg.

Also thanks for running such a great site….