But for its still pre-coronavirus quarter, Navistar reported that its Truck revenues collapsed by 31%.

By Wolf Richter for WOLF STREET.

So Navistar International reported Q1 results this morning. It swung to a net loss of $36 million in the quarter ended January 31, as total revenues plunged 24.5%, to $1.84 billion. Net sales in its Truck segment plunged 31% to $1.24 billion.

And new orders for trucks have essentially collapsed, which bodes ill for revenues going forward. These orders may be for units that have been sold to a specific customer, such as a trucking company, or for units built for dealer inventory to be sold eventually to a customer. These are the net orders (new orders minus cancellations) in Q1, and only school buses did well:

- Class 8 trucks: -83% to 2,600 units (14,900 a year ago)

- Class 6 and 7 medium-duty trucks: -72% to 3,200 (11,600 a year ago)

- School buses: +27% to 4,200 (3,300 a year ago)

And Navistar’s order backlog has plunged as well:

- Class 8 trucks: -56% to 13,800 units.

- Class 6 and 7 trucks: -63% to 7,100 units

- School buses: +34% to 4,300 units.

What keeps Navistar’s shares at an elevated level is an unsolicited buyout offer from TRATON Group, that caused NAV to jump 52% at the end of January. TRATON, a subsidiary of Volkswagen Group, is one of the largest truck and bus manufacturers in the world (MAN, Scania, and Volkswagen Caminhões e Ônibus).

Volkswagen Group spun off part of TRATON via an IPO at the end of July, 2019. Shares started trading in Frankfurt at €27 and closed today at €19.02, having plunged 30% in seven months.

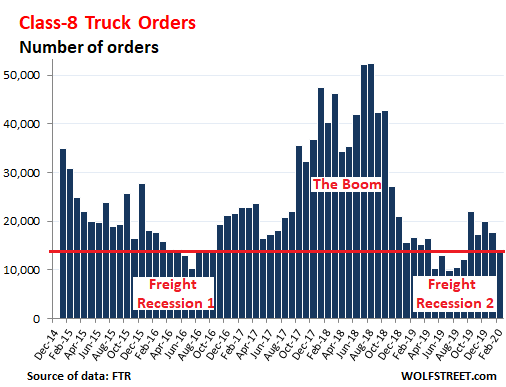

For the US industry overall, orders for Class 8 trucks – the heaviest category of trucks – fell 18% in February from the already low levels a year ago, to 14,100 units, the lowest number of orders for any February since 2010, according to FTR Transportation Intelligence. For the past 12 months, there were 177,000 total orders for Class 8 trucks, down 64% from 497,000 orders in the year 2018.

“Fleets were already being very cautious in equipment purchases due to the flat freight market and slowing economy; now the COVID-19 virus has added to that uncertainty,” FTR said in the statement.

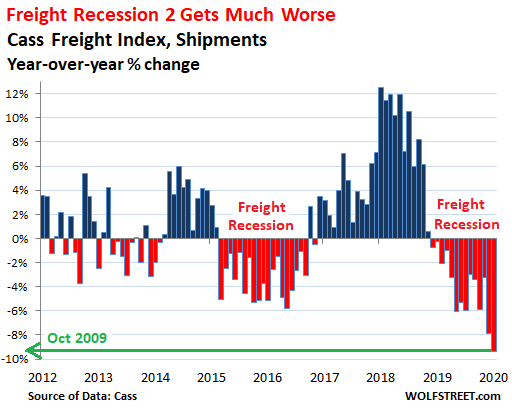

This downturn follows the historic boom in orders from late 2017 through much of 2018, when trucking companies reacted to the surging demand for transportation services that was fueled in part by companies wanting to front-run the new tariffs. But late 2018, shipment volume across all modes of transportation – by truck, rail, air, and barge – began its long decline on a year-over-year basis that has now turned into an ugly swoon.

In January, shipment volume of consumer and industrial goods, not including bulk commodities, by truck, rail, air, and barge dropped 9.4% compared to the already weak January a year earlier, according to the Cass Freight Index for Shipments, the 14th month in a row of year-over-year declines, and the steepest decline since October 2009. This chart shows the year-over-year percentage change of the index for shipment volume for each month through January 2020:

And trucking companies reacted to this decline in demand by slashing their orders. Then in February, the coronavirus became part of the decision-making mix.

“This is not good news for the trucking industry or the economy,” said Don Ake, VP commercial vehicles at FTR. “It appears fleets have decided to delay some orders until the health crisis has passed. There is no pressure for fleets to order more trucks since most carriers have enough capacity to handle current freight volumes.”

The Class 8 truck makers – Daimler’s Freightliner and Western Star; Paccar’s [PCAR] Peterbilt and Kenworth; Navistar International [NAV]; and Volvo Group’s Mack Trucks and Volvo Trucks – have responded to this downturn by announcing production cuts, accompanied by layoffs, starting in the second half last year.

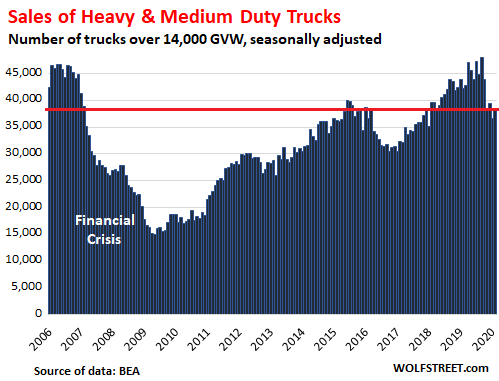

Industry-wide sales to end-users are now plunging too. Sales lag orders by many months. During the ordering boom in 2018, the backlog at truck makers reached historic highs. Then, as orders collapsed by up to 80% year-over-year in 2019, truck makers ate through their backlog, producing trucks at capacity, and as these units were then sold, they generated record sales, even as orders for new trucks had already collapsed.

Sales of Class 8 trucks and of medium-duty Class 6 and 7 trucks (this measures all trucks with a gross vehicle weight over 14,000 pounds) dropped by 9% in February compared to a year ago, seasonally adjusted, to 38,500 trucks, after having plunged 17% year-over-year in January, the Bureau of Economic Analysis reported this morning.

It was only the fourth month in a row of year-over-year sales declines – and is just the beginning of the sales decline that follows with a lag the collapse in orders that began over a year ago:

“The market was already in a wait-and-see mode before the virus spread,” FTR’s Don Ake said, adding, “The current uncertainty has just made more fleets leery of taking on additional risks.”

The freight recession of 2019 – and the collapse in truck orders from the boom year 2018 – was rough enough. But now the very first effects of the coronavirus are being thrown on top of it.

United Airlines: “We are preparing for the possibility of further reductions to our schedules as the virus spreads.” Read… Just How Bad Is It Going to Get for US Airlines?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Market is crushing it

Yeah, isn’t that funny. One day it gets crushed; the next day it’s crushing it.

These last two weeks have sent my financial dread level off the chart.

I am no longer that amused.

Wolf, serious question. How is your snap back theory of interest rates working for you? How about your market short bets? When will you and everybody else figure out that betting against the Fed is like betting against the house in Vegas. The game is rigged, pure and simple. They are never going to let you win. And to put the nice little cherry on top, the current President owned casinos at one point in his illustrious career. Learn the game. It’s called the Fed Owns You.

How many years have we had the fed and how many times has the market crashed in to the ground?

But certainly this time is different, valuations mean nothing, human psychology has been “fixed” and we are certainly at a permanently high plateau.

You are correct, someone needs to learn the game.

The end game of endless stimulus is a collapse of the US $. Happened once already in the 70’s, forcing multiple increases in Fed rate one percent at a time, ending near 20%

Reality,

The 10 year snapped back just fine, about half way to my target level, despite the Fed’s rate cuts last year. And then we got the coronavirus, and all bets are off, as you can tell.

Date Change % Change Close

October 28, 1929 −38.33 −12.82 260.64

October 29, 1929 −30.57 −11.73 230.07

October 30, 1929 +28.40 +12.34 258.47

July 8, 1932 41.22

Amazing that people think a US election can alter a rapidly slowing US and world economy. What’s Biden supposed to: hound the Fed for rate cuts?

On the other hand it is kind of funny to see that the market likes Biden more than the incumbent. Sort of the reverse of normal preference re: party but understandable.

Guess it should be ‘prospect of Biden’….cuz you never know.

The market is expressing a preference for Biden over Sanders. The outcome of the election is to far from now to be part of the daily market calculus. Look in particular at healthcare related stocks that Bernie would have tried to crush with Medicare for all. Up huge today.

Truck sales are probably done, but the freight index should enjoy a tight supply market. These people “move” things around, and in a market where shortages are emblematic they should stay busy.

If there are shortages that is a problem. Freight wants lots of demand and lots of supply.

Sad to hear about those trucks not selling, but this market wants to climb aggessively.

I read an article this morning before market opened from a long standing perma bear and he felt that stocks may rise “violently” because of the Biden turnaround, the Fed’s full blown course reversal towards ZIRP, QE and Japanification.

Now when you notice a worry wart using terms like equities “rising violently” you really should not want to be holding short positions.

No need for Hawk-o-meters, full-on Japanifaction has finally arrived in the USA.

What I remember is that stocks fell “violently.” When? Well yesterday. And all last week. Remember? Or did you already tune it out?

Japanifaction could never last very long in America. Japan has a very overly homogeneous “well-behaved” ,”cannot think of the word I want”, society that makes it possible. Also they didn’t outsource as many of their jobs to the rest of Asia. America’s only real choice is to have a crash and begin to rebuild its industry. There will be a huge fallout from that, almost all 401k and other such retirements funds will be wiped out. Over time social security can be increased, as besides relatives supporting you, social security is the only long term possible retirement option for most people. Healthcare would also have to be fixed. China and India will also likely implode. As they are too large “population wise” to fit into the rest of the global economy and have very little resources of their own. As soon as America brings back jobs from China and India, Europe will likely do the same, because of their young unemployment crisis.

If the bars are monthly, the post for December was an impressive bar down.

Seasonally adjusted.

Re Corona Virus,

3 months ago Wuhan was hit like an Australian bush fire.

Time has passed, and this has not been repeated elsewhere.

Conclusion; Virus has mutated into safer form.

Its being repeated everywhere.

Harrold: Yeah, with the same deadly results.

That’s not how we look at it here at the West Coast. This thing is now taking off. The US policy of “Don’t Test Don’t Tell” has kept the numbers in the fog. But they’re starting to come out.

If you extrapolate the Canadian numbers the US should be sitting at about 400 cases. I don’t see the 49th border all that much of a difference for health concerns. Mind you, (Canadian expression) we actually have a testing regime.

I’ve reports out of China that there might be two different versions of this coronavirus, one more deadly than the other, but both easily spread.

Travis:. I am reading that the coronavirus has mutated from less aggressive “S” type into more aggressive “L” type. (i.e. from bad to worst!).

I do hope you are right and I am wrong.

No.

Wolf- my understanding of freight indices is very poor.

I do note (because my brother bangs on about it) that the “global” Baltic Exchange Dry Index – like the “US-centric” Cass Freight Index – was in free fall in the back end of 2019.

But since it bottomed out in early February, the Baltic has been “up for eight straight sessions”.

Do you have a view of why that unexpected bounce in global shipments of commodities has occurred?

The Baltic Exchange Dry Index is incredibly volatile. It hit 2,500 in September last year, then collapsed to about 400 and has now ticked up to 549. In other words, it’s still down 78% from last September.

But wait… The BDIY hit 11,000 in May 2008, before collapsing to about 600, before resurging to 4,000 in May 2010. And so on. It just jumps up and down violently.

When the index rises or falls, it says nothing about shipment volume, but about spot pricing for shipping dry bulk commodities. It’s a spot-price index of freight rates, not a volume index.

Here is a chart. Look at “All” to get the total time span back to 1980:

https://tradingeconomics.com/commodity/baltic

Thanks you Sir.

Now I’m feeling dumber than ever. I thought price would have reflected volume demand. Maybe its a familiar problem with aggregating / averaging i.e. 23 different shipping routes.

Auld Kodjer,

Pricing is impacted by many factors, including demand for transportation, supply of appropriate ships at the appropriate place and time, and market psychology (like stocks) that defies rational explanations.

Some shipping companies (chiefly Maersk) have traditionally tried to suddenly increase spot rates for shipping contracts with no other justification than trying to grab their customers by the ankles and sjake them for pennies. This doesn’t last long, as other companies immediately step in to undercut them, especially if they are heavily subsidized by their respective governments (COSCO, Evergreen etc).

This results in some pretty wild swings.

Also remember the Baltic Dry Index only covers non-liquid commodities transported in bulk, technically “dry bulk cargo”. This means grains, iron ore, coal, granulated sugar… but NOT oil, LNG, containers, cars etc.

Part of the reason for the wild swings you are seeing right now is Chinese ports are clogged by ships waiting to unload iron ore from Brazil, coal from Indonesia, rice from the US etc. Even with the most advanced harbor facilities it takes several day to offload a single Valemax ore carrier. You cannot do it in a few hours.

As long as ships are moored outside Chinese ports they cannot be used to transport other commodities, thus driving spot prices up.

Thanks to you as well MC.

Makes a lot of sense: clogged ships = capacity reduction (at a higher rate than demand reduction) = price increase

I think 2018 was a very good year for vehicle sales. 2019-2020 has seen a downturn in the cycle.

The Chinese reported using the plasma of recovered coronavirus patients to inoculate sick patients. This sped recovery times significantly. Based on two sources.

The Chinese have been collecting data on the efficacy of known antiviral drugs. Gilead started testing remdesivir on coronavirus patients in China and has since expanded the testing to other Asian nations.

That is because by 2018 everybody thought the small bounce that began in the middle of 2016 with the global economy would last. By the 2nd half of 2018, it was clear it would not.

Truck sales were way to high up into 2019 and still aren’t where they need to be for balance. It is probably around 22,000. Lower than the oil bust.

David Hall,

Using plasma and other such methods might be super effective, but, it’s not likely it could be done on a large enough scale in time. It’s good to keep testing it and maybe they could build up some supply for some of the most likely to die this round. But a vaccine is far more promising.

This year could be brutal for some people, and there may be alot of people who die from non coronavirus events “like accidents”, because hospitals may become overwhelmed from coronavirus and possible shortages of pharmaceuticals.

India is already starting to ban exports of some pharmaceuticals, if people in America die, because of pharmaceuticals export bans from non coronavirus events like heart disease. There could be a reckoning for India and China.

There is a big Amazon distribution center near me. I often find myself on the highway next to the big class 8 Amazon distribution trucks pulling the Amazon branded blue trailers. But I have noticed that the tractors are all owned by various subcontractors and most of them are very old and run down. Yesterday the one next to me had the entire fiberglass bumper shroud held on by zip ties. So it does not seem like Amazon is helping with demand for new class 8 trucks.

Amazon in the US owns a large fleet of trailers and leases the rest, but the tractors themselves are all owned and operated by outside contractors: Amazon has cut off the middleman by setting up their own in-house brokerage firm.

For the rest I don’t know how’s the present practice in the US, but traditionally the most modern (and fuel efficient) lorries in a fleet get assigned to long haul routes while the older ones get progressively shifted on shorter range hauls until they break down or they become uneconomical to operate.

I remember back in the first half of the 90’s there were still a few Opel Blitz and OM Tigrotto (both went out of production in 1972) around, chiefly used on very short hops.

These days, with cheap credit and continuous new mandates (most of which have nothing to do with safety) it’s very very rare to see a lorry older than a decade on the road, and most of them are what Americans would call Light Duty or Class 4 at very most: Hino (Toyota) and Isuzu seem to be the only survivors left.

Globalists need to move things and people around.

Obviously transportation growth is slowing down.

I can’t think of any transportation industry that has been spared. For sure, cars and trucks, ships, airplanes, trains and subways.

Running shoes?

WES,

Running shoes may be worst of all. Take Nike for example. Sales in its highest growth market (asia) wiped out. Supply chains, are falling apart, as these were one of the first products outsourced to asian factories. And soon up to the plate will be the cancelation of spectator sports events which will hammer the promotional side of the business.

Seneca:. You are probably correct!

Maybe they have lost their “souls”?

I guess if enough people get quarantined, people will be walking and running less too!

Well, at least it looks things are back to normal-ish.

Navistar fell just .48% on that 31% in earning, though of course it should have soared higher if Mr Market wasn’t being so irrational, I suppose.

Bring on the bad earnings, to Mr Market can soar in approval and things can as they once were: normal.

timbers,

Please read the article before posting fake ghost stories here. This is what I said, about 4th paragraph from the top:

“What keeps Navistar’s shares at an elevated level is an unsolicited buyout offer from TRATON Group, that caused NAV to jump 52% at the end of January. TRATON, a subsidiary of Volkswagen Group, is one of the largest truck and bus manufacturers in the world (MAN, Scania, and Volkswagen Caminhões e Ônibus).

“Volkswagen Group spun off part of TRATON via an IPO at the end of July, 2019. Shares started trading in Frankfurt at €27 and closed today at €19.02, having plunged 30% in seven months.”

1) The Fed cut rates. $SOFR – $$FEDRATE is up.

2) Online orders are rising. Demand for vans and Ivanka

pickers in the aisles will benefit from people staying home.

3) People will try to avoid public transportation if they can. Somebody

coughing in the subway near u is a real nightmare.

4) For every infected person in US, 100,000 people will become better

and healthier by avoiding the SAD diet.

5) Mandelbrot is off for the next few days off.

120 billion USD for new not-qe and 8.3 billion to fight the virus. Shows the priorities that Trump has.

Questions questions.

Does the decline in truck orders signal a decline in consumer spending?

Has it ever in the past?

Is the decline in truck orders related to the decline of B&M retail?

Is there a relationship between the sandworms and the spice melange?

I’m told that he who controls the spice controls the universe. That’s what the sign says on the inside of the door to my spice cabinet. Doesn’t seem to be working, though.

So heavy trucks run up to 2 million miles and more before they “retire”. Those big sales numbers in 2018 must still be out there hauling stuff. I see the roads crowded with them and many many older models still going strong.

Isn’t in natural for the trucking system to take time to “digest” an influx of new vehicles? The auto boom bust seems to do the same, but with shorter wavelengths.

I’ll take that as a ‘no’. Truck orders seem to go up when more are needed, not necessarily when replacing retired trucks, since those can be replaced with newer used trucks.

Truck orders and consumer spending are not correlated. Fleets replace trucks on a 3-5 year cycle, because that’s how the cost/benefit pencils out best. There are small to medium adjustments in number of trucks purchased depending on economic conditions and external considerations like tax incentives, but the 3-5 year cycle is basically the beginning and end of factors influencing class 8 fleet orders.

On a related note to your airline story a couple days ago:

https://www.marketwatch.com/story/united-airlines-reduces-us-flights-asks-workers-to-take-unpaid-leave-amid-coronavirus-outbreak-2020-03-04?mod=home-page

This will have an impact, but for now, there are winners in all of this right? Every company that some how supports working from home or delivery to home is going to see some degree of benefit. Netflix for example…. although I suppose delivery from home might suffer from concern about transmission.

As for this crazy market, the only thing I can be sure of is that no one knows how this thing is going to move from one day to the next. Imagine all the weirdos on TV saying Biden is the cause of today’s rally. So, one would assume if he tripped and broke his leg, then the market would fall by a lot all of a sudden.

Irrational, that’s the only thing I think everyone can agree on about the state of the stock market these days.

As for this crazy market, the only thing I can be sure of is that no one knows how this thing is going to move from one day to the next.

I’ll never tell. If I did, people would pile on to exploit the foreknowledge and then it won’t happen. Then the time line will be corrupted, and I’m in for it with Temporal Investigations as it is.

Irrational, that’s the only thing I think everyone can agree on about the state of the stock market these days.

Mr. Market is but mad north by north west. When the wind is southerly he knows a hawk from a handsaw. Mr. Market has his reasons for doing what he does but God only knows what that might be. And He’s not telling either.

Just saw in my local Bolton, Ontario (just north of Toronto) paper, a report that Ritchie Bros is auctioning off 1700 tractors and trailers from Hyndman Trucking whose parents company is recently bankrupt Celadon Group.

Ritchie Bros will hold 19 auctions over the next 3 months in Canada and the US.

I never thought reading the Celadon trucking bankruptcy on Wolfe Street, that the fallout from such a sad event would ripple into my own backyard!

WES,

You should go to the auction (if you can get in). They’re interesting. It’s amazing how fast these big pieces of equipment go through the auction and sell.

I just can’t wait until these class 8 trucks come down into my range. That red one is sick! But not with Covid.

The Coronavirus (and others to possibly follow) will increase demand for autonomous vehicles to transport needed food and other supplies without fear of human drivers either getting sick (and so can’t work) or transmitting the disease. This could also accelerate demand for home delivery of food, either out of safety or because the customer is too sick to shop.

Thanks Wolf, its nice to see real analysis rather than data picking narratives. Of course, any time in the last couple of years any local economy got in trouble it was the global economy that was key, and it was good. Now that the global economy is sputtering over this virus, its “we will weather the storm, because we different”. Although this narrative is dying fast as this virus spreads, like so much other nonsense our barkers bark. Lets hope one thing that comes out of this is that in the future rather than talking head narratives we go back to real analysis.

Wolf,

At the risk of being repetitive, I will say again, after much ratiocination, there is nothing about the truck market that doesn’t redound to the overall vehicle markets.

Who the heck cares if it takes 50% of the value of a vehicle to repair it?

Fix the dang thing and get it back on the road.

Anecdotally, I have two cars and a pickup, all built in 1999.

All were bought used.

The Acura had 80k, the STS had almost 90k, and the GMC pickup had

95k miles when I bought them.

I change the oil, replace little items like alternators, transaxles, entire braking systems, etcetera, when needed.

The oil changes are done between 7,000 and 10,000 miles.

I think this country is filled with whiny little clowns who couldn’t change a wiper blade without a community meeting.

Our little Acura 3.5 RL has more than 300,000 miles on it.

The Cadillac STS has only 180,000 miles on it, as I am a retired airline pilot, and didn’t drive too much.

The GMC pickup just turned 100,000 miles.

I can’t believe you people agonize over new cars (and trucks), all the time.

In 1968, I bought a brand new Chevy pickup for exactly $2,300. I would have it still if the government hadn’t asked me to leave the country to help kill people I never met.

The problem with a class 8 truck is once it reaches 7-8 years old, repairs or even just a major overhaul can represent 100%+ of the truck’s value.

Great comments, all, thx; and Wolf, as usual for the post.

Humor, well-written comments, and info from personal observations are especially appreciated. Hawks and handsaws, yeah. Seems like the Fed still believes that the VLIRPs and XIRPs are the magic bullet. Pixie dust has never failed…..

Note to self: see latest remarks re current Market vis a vis longterm trend line at Advisor Perspectives. I may have to reinvoke my tea leaves reading which goes way way back; I am on the record here for declaring it, in the last 6 mos. or so, as having failed………

So far, aside from my standard practice of avoiding the SAD, I resolve to abstain from fear. Sure, I intend to do some stocking up. Hearsay has it that a Walmart in my region has run low on toilet paper. Wouldn’t want that. My grandmother used to stay stocked-up on soap. Weather the storm, friends.