Wow, what a day, what a week, what a 15-minute spike at the end!

By Wolf Richter for WOLF STREET.

OK, all kinds of things were going on today. First, in mid-plunge this afternoon, the Fed came out and said it’s going to print antibodies or something. To soothe the rattled nerves of the Wall Street crybabies on TV, as the worst weekly sell-off in stocks since 2008 was heating up, Fed Chair Jerome Powell released a one-paragraph Fed-speak statement Friday afternoon (in full):

“The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity. The Federal Reserve is closely monitoring developments and their implications for the economic outlook. We will use our tools and act as appropriate to support the economy.”

The thing is, interest rate cuts and QE or whatever other shenanigans the Fed concocts aren’t going to solve the problem posed by the appearance of the coronavirus. If you don’t want to get on a plane in order to avoid catching the virus, you’re not going to change your mind because T-bill yields dropped 50 basis points.

The second thing going on: “Nothing goes to heck in a straight line.”

This was predictable, with it only being a question of when. The effect – “Nothing Goes to Heck in a Straight Line” – is also printed on our handsome and hilarious heavy-duty WOLF STREET beer mugs, that are ideal for contemplating days and weeks like these, and for musing about the 15-minutes-before-the-close spike like this.

The thing is, sooner or later, buyers in form of humans and algos always emerge. This is the nature of trading. If there’s blood in the streets….

If this happens shortly before the close on a Friday afternoon after a horrendous week, when all the sellers are done selling and are exhausted in a corner somewhere licking their wounds, when there is no liquidity left in the market, and some human and algo buyers step forward, then stocks bounce and prices explode higher. Hence the WOLF STREET beer mugs.

And this happened beautifully during the last 15 minutes of trading, when the sellers had disappeared, and it took just a little buying pressure to red-line the needle:

- The S&P 500 index skyrocketed 73 points in 15 minutes, from 2,881 to close at 2,954, down “only” 0.8% for the day.

- The Dow skyrocketed 622 points in 15 minutes, from 24,787 to close at 25,409, down “only” 1.4% for the day.

- The Nasdaq spiked 207 points in 15 minutes, from 8,360 to close at 8,567, flat for the day, and “green” because it was up 0.001%.

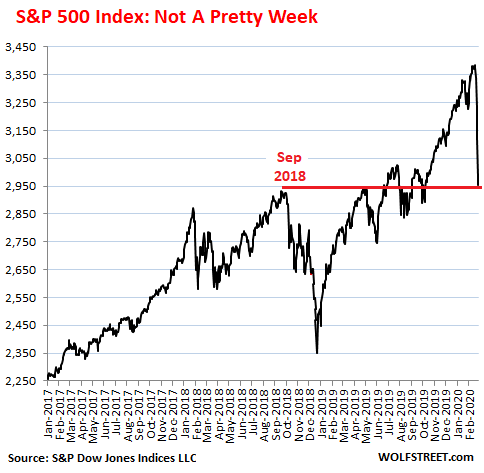

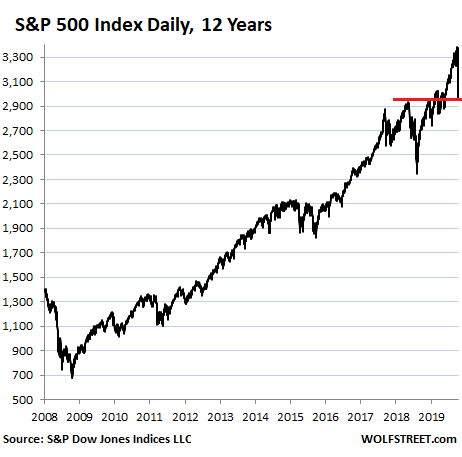

Despite these fireworks over the last 15 minutes of trading, it wasn’t a pretty week. The S&P 500 index had peaked on February 19 at a closing high of 3,386 – after skyrocketing 30% last year despite a slow-growth economy, and after spending the first seven weeks this year blowing off the end of QE-4, lousy corporate earnings, the coronavirus outbreak in China and all the issues this would pose for US corporate supply chains and revenues, and the near-certainty that the virus would make it to the US. But on February 20, it started to sink in.

In the seven trading days since the closing high of February 19 – and really over the past six trading days, because the first trading day in the series was just a mild down-tick – the S&P 500 has plunged 12.8% 2,954, and it is now just about back where it had first been on September 20, 2018, as if the 20% drop in late 2018 and the 30% rally in 2019 had just been an illusion.

No market in my lifetime has ever been more overripe for an implosion than this one, and I have seen three big crashes going back to 1987. I said so on December 30, when I announced that I, Who Vowed to Never-Ever Short Stocks Again, Just Shorted the Entire Market. Because “the setup is just too juicy.”

Over the longer term, the current place on the chart – roughly flat with September 2018 in an economy that grew about 2.5% a year – is nothing to whine about. What did people expect? But this week’s sell-off does stand out in its steepness:

The Nasdaq and the Dow were clustered around the S&P 500 in their recent losses:

- The Nasdaq had peaked on February 19 at 9,817. At today’s close of 8,567, it has plunged 12.7% in seven days.

- The Dow had peaked on February 12 at 29,551. At today’s close of 25,409, it has plunged 14.0% since its peak.

So, in terms of the S&P 500, we’re back to about September 2018. It’s not the end of the world. It’s not the end of anything.

But the crybaby-economists and stock-jockey-mouthpieces of Wall Street have been yammering and wailing for days to get the Fed to bail out their stock positions with big-fat rate cuts now, even before the March meeting. How dare the Fed allow the stock market to drop??? How dare they???

Stocks surged 30% last year, fired up by three rate cuts and $400 billion in QE-4. But QE-4 ended in December. And earlier this year, the Fed tentatively took rate cuts off the table. And suddenly, over the course of seven days, stocks gave up part of the mind-bending gains last year.

And these Wall-Street-crybabies are now relentlessly badgering the Fed to make sure that the market isn’t allowed to do its thing because an actual functioning market where price discovery is allowed to take place would be too much to stomach for these Wall-Street-crybaby-economists and stock jockeys. Instead of a market, they want the well-oiled money-machine of 2019.

Consumer spending accounts for roughly 70% of the economy. When and how will the reaction by consumers to the coronavirus – dollars spent and not spent – become visible in the overall economic data? That’s the question going forward. In January, consumers were still in hunky-dory land. Read... Has the Coronavirus Hit US Consumer Spending Yet?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

But I thought stocks only went up! Surely there is a mistake. Quick!.. Bring the helicopter…

Unfortunately, no one is providing data on race, smoking, pollution, or other such possible factors.

The real number of infected is far higher, this is the number confirmed, according to different countries self created criteria.

It’s also possible far more are infected then thought, so death rate may be lower than thought. Conversely, alot just got it and haven’t survived or died yet, so death rate may be already be higher than 3%.

There is also a possibility that in warmer environments or in warmer seasons the effects are less severe.

Unfortunately, if hospitals become overrun or medical supplies run out, the death rate could jump.

May I suggest Imperial College’s Institute for Disease Emergency Analytics in London.

They’ve been studying infectious disease propagation for years and are the experts experts in prediction of infections, morbidity and have some YOUTUBE videos available giving their look at the coronavirus.

Google Neil Ferguson and Imperial College to find them.

20 cases in the U.S. now so 20 / 360,000000 = 5.555555555555556e-6

Probably around the same odds of getting this virus as you have of winning he U.S. lottery, UK lottery & € millions lottery in the same week

Higher temperatures don’t stop the virus. Look at Singapore.

In the US the number of registered sick people could be lower than in reality, because of the high costs of medical treatment. Going to a hospital to get tested might cost to much for so many people, they will choose to keep walking around, hoping their symptoms will go away by itself. Because of this ‘avoiding (the cost) of healthcare’, the death rate might be higher in the US than in the rest of the world.

Stock up on toilet paper. It’s always the first thing you run out of.

And hand sanitizer. Here in The Netherlands we had our first registered COVID-19 cases just two days ago. Right now, most stores are sold out on hand sanitizers.

This is a “novel” virus, you can reinfect, which makes you wonder how can they formulate a vaccine if there is no immune response? Should they find a vaccine how long will it take to produce enough material for 1B innoculations, 2B? What about the other 6B? Even if seasonal dampening occurs what is to keep the virus from ping ponging between the two hemispheres? If we run out of masks and hand wipes remember the people have been exposed need them most, to keep the virus contained in their persons… Which is why detection is the key, to lock down asymptomatic carriers. Drink a glass of kool-aid and call me in November.

The theory about the weather is that warmer environments cause you to have a better chance of survival. The infections rates might also differ. Humidity could also be a factor. No one suggested that it couldn’t spread in warmer environments.

There is some evidence as well, that the human body’s immune system is weaker in the winter, but, why if true, hadn’t been proven.

Sorry. you are wrong about the weather!

The World Health Organization (WHO) Philippines warned on Saturday, Feb. 8, that the 2019 novel coronavirus (2019-nCoV) can survive in both hot and humid climates.

This was one of the rumors and myths the WHO Philippines debunked in its latest Twitter posts.

“2019-nCoV has spread to countries with both hot and humid climates, as well as cold and dry,” WHO Philippines said.

“Wherever you live, whatever the climate is it is important to follow precautions,” it said.

https://news.mb.com.ph/2020/02/08/who-ph-2019-ncov-can-survive-both-hot-humid-climates/

I love the Fed comment: “The fundamentals of the U.S. economy remain strong.” Yes, and for years after it hit the iceberg, the Titanic was technically repairable. It just needed to be raised from the bottom of the sea and have millions of dollars (billions in current money) spent to salvage it.

W Bush kept repeating that right up until the crash

Flop flop flop flop…..

oh man let it dropped.. dropped dropped….

I am assuming you were not around in December 1974 when the Dow dropped below 600 (yes 600, not 6000). For some perspective, read this article: http://www.fiendbear.com/bear1973.htm

You will know things are really bad, when you are called in for a staff meeting and are told that the layoffs are coming. I experienced such an ordeal in late 1974. Fortunately, our area of the company was making money so no one was laid off, but other parts of the company were not so fortunate.

Good pts.

Context and careful analysis is getting to be more rare among commenters here, which is sad.

”

On Oct. 25, 1929, Herbert Hoover declared, “The fundamental business of the country, that is the production and distribution of commodities, is on a sound and prosperous basis.”

“The day before Hoover insisted that the fundamentals were strong was the day that came to be known as Black Thursday, when in heavy trading the Dow Jones Industrial Average lost about 9 percent of its value.”

The “virus” is doing the job of the FED. National politics will do the rest.

We are in uncharted waters now.

Anon1970: I remember the Dow at 600 very well. I also remember that the Dow was at 1000 in 1969, and that it hit an inflation adjusted level of 350 in 1977.

That was pretty much the day I got out of college.

For some reason, there were very few jobs on Wall Street at that time.

Passive investment in SP500 is mandatory for pension investors. $12 billion a day. Thanks to lobbying by Blackrock & co. Fed has to protect it. With the virus decimating the elderly, Wall Street wins.

The only virus the retired suffer from is interest with yields below 2%. It is insidious. 1% of 5,000,000 you can survive on, 1% of 100,000 you cannot. Most have nowhere near 100,000.

Sold quarter of my puts today (all march and half of june), for 600-800% profit. Could not resist, vix went as high as 49.

Keeping Januaries.

Sold tons of covered calls early today when market was down around 24,900…already seeing appreciation as mkt jumped to 25,500.

I feel it’s a reasonable expectation that most of the market will come back as more specific data and experience becomes available for Coronavirus.

America should definitely take note that the Chinese have shared exactly none of the critical information required to understand, manage & develop antivirus; for my money, they can go pleasure themselves.

‘I feel it’s a reasonable expectation that most of the market will come back as more specific data and experience becomes available for Coronavirus.’

When? may be 18 months?They say Vaccine could be ready in 18 months?! Btw still no vaccine for SARS since 2012!

Now reading (not confirmed yet) that Fed & other CBers are planning to announce global wide joint effort to ‘beef’ up the mkts before the Asian mkts open Sunday Is that the reason Fed not decided a declare an emergency cut Friday, late afternoon?

But how? That question is still up in the air! Rate cuts 0.25 basis or more likely 0.50 basis points and more dovish guidance? QE4 light into real one, followed by QE5? ZRP into NIRP? So many possibilities!

What else they have in their tool box,never tried before? may be they will be creative just like they saved the World from GFC since ’09 (but ignore to investigate what and why really 2008, happened?) there were very widely known structural problems throught the global Banking system, not just here in US.

They just covered all those problems with more debt ( insane credit infusion!) Banksters were bailed out! Suspension of Mkt to mkt accting standard made fantasy accounting a reality. NONE objected!

Now the piper, they kicked away is back!

Is corona, a karmic backlash?

Sunny129

You have your dystopian opinion; I believe I’m more realistic. Let’s meet back here in a year and compare notes.

In the mean time, stay away from windows on high floors.

Tell me what kind of puts I should buy.

This has a long way to go south

I bought a few puts on SPDR S&P 500 Trust ETF (SPY), ex date May 2020, but I guess I buy more if the index movse up further next week

I have puts in varying time frames short and long term all the way to Jan ’21 in ‘out of the money’ zone. will double up if it falls up to 40% ( sell at 50%)

I also buy hedges ( calls or long x3 Etfs) since i have surprised by whiplashes by surprise, tweets, whispers and what not since ’09/ This market is surreal in my life time (Been in the mkt since ’82) but corona will bring the mkt way down, not straight.

There will be many spikes along the way. Mr . Mkt entices more investors to climb his band wagon, before plunging again! Study previous BEARs!

I bought puts and made $, on airline, hotels, cruise lines, global logistic transport, trains, +++

More happy days are coming for those trade ‘options’ of course nimble and experienced.

“If you don’t want to get on a plane in order to avoid catching the virus, you’re not going to change your mind because T-bill rates dropped 50 basis points.”: In the Fed’s god-complex-delusion, they believe they have godlike powers to affect anything with their shenanagans. So no matter how “over ripe for implosion” any market is, their delusions will ensure that we all see zero (and below) interest rates and people papering their walls with “extra liquidity”. Perhaps interest rates will even enter the realm of complex numbers. … oops, I shouldn’t have given them any further ludicrous ideas.

Inflation is already in the realm of complex numbers. After all, it has an imaginary value according to CPI as well as a real value.

Where is the inflation( other than already in mkts,education and healthcare) coming from, when wages have been stagnant since late 80s? If Fed prints more, how does it enter economy? Remember velocity! It is like pushing on a string!

Who is going to buy overvalued stocks ( with record levels of global debt, economy in it’s last inning + Tired Bull!) ready to keep sliding, after corona

Painful Deleveraging DEFLATION more likely when the assets value crumble in the post corona world!

I think it’s fair to say Jeremy Grantham called it better than most in his “bracing for melt-up” paper from 2 years ago.

Wow!

Good ole’ Jeremy knew about Coronavirus 2 years ago?

Ehhh…I doubt it.

——————————-

Three super-secrets about the market:

1) Even idiots who forecast the market will crash will be correct…sooner or later

2) Even idiots who forecast the market will rise will be correct…sooner or later

3) Whichever group of drooling idiot’s prediction proves correct, they will be feted as true fortune tellers…for a while

ALL bubbles burst!

Overvaluation in stocks do matters.

So does the humongous debt on debt, unlike any time human history! Corporate BBB 50% or more even at IG grades!

A record extended Economy in it’s last inning with tired Bull do matter!

The same gang who brought us 2 boom bust cycles in this century also created the 3rd largest ‘everything’ bubble, ready burst in 2020. They replaced business cycles with insane ‘credit infusion’ cycles. Supported 15-20% Zombies in S&P!

Can Fed print vaccines, antibodies or re-establish ‘supply channels’ with more rate cuts, zrp/nirp and QEs to infinity?

Corona virus, the Black SWAN (BAT?) turns out to be NEEDED karmic backlash to all the insane actions of CBers including Fed! Stay tuned!

While I am glad your shorts are making some money (you deserve it after all the hard work you put in maintaining this blog), the outcome is due purely to an exogenous event , not some foresight into market dynamics, in other words, you got lucky.

I still see this market being driven up past 30k for Dow before the election. As soon as the Fed starts seriously pumping money into it, the return to the upside will be just as brutal.

“Purely due to”? That’s unmitigated BS.

It’s like saying that an avalance is “purely due to” the gunshot that caused it, not the thousands of tons of snow sitting on the precipice.

I should say “the gunshot that started it”, not “the gunshot that caused it”.

Zantetsu

If you stumbled over the meaning of “exogenous”, you appear to have recovered from it.

Z,

Good pt – people don’t seem to view various valuation levels as presenting various levels of risk.

They ignore historical relationships between various metrics and seem to ignore history almost entirely, the concept of regression of a mean seems alien to them.

None of these things make investing/economics an exact science, but they do provide a framework to evaluate events – as opposed to being entirely reactive to short term news.

Memento mori,

The coronavirus scrambled my logic. It caused the market to rally in Jan/Feb based on hopes of central bank stimulus. China did this in a big way. And stocks rallied hugely in China, after a one-day selloff. And they took global markets with them. This was unexpected.

But an overripe market is a sitting duck. Any catalyst can take it down – a change in the direction of the wind.

My logic still holds, but it was overpowered by the rally of the coronavirus and now the selloff. Now the Fed is making noises again. My logic counted on the Fed to see that everything was OK and step away from the market. I’m actually more nervous about my short now than I was before.

I agree about nervous. No way no how can the Fed not act forcefully to make stocks go back up. It will act to make stocks got up, because that is it’s job. The confirmed today – by it’s actions – that making stocks go up is job #1.

Wolf,

honestly, I think this is a problem of perception, in January/February, everyone thought, well, Thank God the Chinese are involved in this, they can contain it. So, no need to be pessimistic, in fact the extra stimulus will keep the party going. The perception was slow to catch up with the reality that “holy crap, this thing isn’t contained.”

Even Apple saying we can’t meet guidance didn’t curb anything. I think the turning point was over the weekend when holy crap, the Korean cases are spiking, and Iran, and Italy. Suddenly, it isn’t a China problem any more that can be contained by those authoritarians (there were some NIMBYs who were doubtlessly relieved by that), it is a world wide problem that no containment is possible.

This is basically to a point where perception caught up with reality, and then promptly ran wild, while the velocity of reality is still constant, the velocity of perception has been accelerating faster and faster in the last week and finally caught up.

Now, people have realized, China’s little sneeze has gotten the world to catch a cold. (but in reality, China is probably slightly better off in managing the problem, where the world would suck at it)

Oh, forgot to add, that newest community infection (what kind of name is that? Communities are infectious?????) in Santa Clara is going to spook people over the weekend. Now, it is in the heart of silicon valley…. OMG OMG OMG.

Never mind that there was already at least one case in the valley almost a month ago.

this was giant setup by GS, Citi and the hedgie squid that they sponsor…they started talking it up weeks ago in the press….complacency was the meme, waiting for opex on Friday, then forced direction Sunday evening via Index weeklies with bank index taking the lead, at the same time they sold everything off to rotate into sectors less at risk from virus, they had about a month to get the plan into action..

too many managers were most likely in sectors exposed to potential demand issues….the big boys don’t rotate into highs

I enjoyed how they saved the CDC, FDA, Calif and press for the week to throw in some fear….

the problem with shorting is waiting, easier to just get in when it happens…..I’m not algo quant…..

I’ve read there are now two community cases in California and one in Oregon. These people had no idea they had the Coronavirus because they haven’t traveled or met anybody with the virus (or so they thought). Unfortunately, they’ve been coughing and sneezing all week, and making hospital visits. Not good news.

Nota Bene: peak flu season is Feb. and the end is May. There are only hypotheses as to why there is a season. One hypothesis is that sunshine kills the virus. So get out of the house and office and take a walk around.

Wise Man! …I mean Wolf.

Yes, it will be interesting to see if the market can get up to new highs again or if this is a multi year Bear market!

It’s my perception that the Fed does a very good job at promoting the mindless buying of stocks in general, however, individual companies still rise and fall on their own good and bad news respectively. Countries reacting to the virus by partially shutting down their economies will continue to halt and seize up supply lines and thereby deprive numerous industries of their ability to produce their products and services. If a company anywhere in the world is not directly effected it may find itself indirectly effected and employees may find themselves told to stay at home or work fewer hours solely for economic reasons. This is potentially an income implosion moment. In so far as individual publicly traded companies don’t lie about their situation then if suddenly a lot of them begin posting bad news… I fail to see how it could not effect the aggregate stock market even with the Fed going back to 0%. Is that going to help a scared junk bond market? People sitting at home instead of working buy a house? VC’s keep the money spigot open? Right now the CDC and FDA are the Fed. To save the stock market they should lie and say they have a vaccine already mass produced.

The Government in general does a job of promoting the stock market through all the tax deferred pension and other programs they allow. 401s, 403s, IRAs, 529s, etc. They should not exist.

Markets are not done yet. Next leg down takes the dow to 22k We got a dead cat bounce first for maybe a few weeks

Sounds about right

CHANCE favors the ONE who is prepared!

You call it LUCK but not those of us anticipating a BEAR long over due ( Been in the mkt since ’82- made $$ not with just luck but with educated and informed analysis and put that into action!)

Many newbies in their mid 40s or younger have never gone thru a secular BEAR in their life time. All they knew just ride with Fed’s put since ’09! Stocks can go up & up! Now comes the other part of that ‘ride’ Enjoy

Corona – What a shocker!

Wolf, did you close out your short yet? I did gin up a bit of courage and bought a few puts on Tesla at $400 on April 17th. That was when Tesla was at $700+ it looked painful last week when Tesla went to $900. Glad it crashed enough to get out of the position.

This is interesting though. The marker is still way overvalued, I am curious when you will do a gold article again.

I still have my short. My time frame is “several months.” I’m not set up to do minute-by-minute trading. I’m busy working :-]

Nice short!

I would think about covering a percentage of it, e.g. half.

We just saw historic moves, with a real black swan (overused phrase- this qualifies in my book).

The other indicators in the market and economy aren’t that bad- or weren’t until the virus event. If the surprises are positive, expect a spectacular snap back rally.

Just my $0.02

3300 at least…3450 for sure….closed all gaps open in all sectors…

the big boys even accelerated thru 27.50 XLF shock and awe call I made a month ago on a market trading blog

Could be really hard to get direction until Wednesday after super tuesday

the virus fear is over done now….if your 70 with previous health issues stay home…

@ CD

‘the virus fear is over done now’

Wow!

What an optimist!

Are you still reading the news about the virus in the USA and around the world?

Will Corona disappear next week or the next?

Will Fed print vaccines or antibodies to the virus or even RE-ESTABLISH supply channels from China? May be QE to infinity along zrp/nirp will do the miracles, right?

More to come! Stay Tuned!

Oh boy! You’ve got big brass ones, I’ll give you that. The Fed does not like market corrections and they have many toys in their toybox.

Jerome let his intentions be known today. For the better part of eleven years I ignored several of these innocent Fed announcements and I paid dearly for it. He has made a not so veiled threat to unleash much more reckless monetary stimulus, and I believe him. It has been a hard lesson but I learned it well. The cure for a pandemic is to inflate assets to unthinkable heights.

The cure for anything that ails you is asset inflation.

@van_down_by_river–

> The cure for anything that ails you is asset inflation.

Put another way, Jerome Powell is stealing the purchasing power of retiree’s savings. QE 1, 2, & 3 has already destroyed the standard of living for most Americans, and Jerome’s likely solution to the Coronavirus crisis will be QE 4.

And hy cdx spreads completely ignored jeromes rub and tug job, and widened even further at the close than their high point in begining of oct ‘19 when rates were 25 bps higher and spx was 100 points lower lol

Unlike JPM, most people dont have access to the discount window, people that think the fed can solve credit risk who have been conditioned to buy EOD short covering rallies on equity indecies or other high risk/crowded trades AND have NO tail risk protection gonna get taken to the cleaners in these frothy-debt-backed-by-junk-collateral riddled markets.

Lowering rates even further (cause thats gonna bring a “V” recovering in oil consumption and disrupted supply chains overnight… lol) and hurt bank lending even more (ecb/boj style) and let junkies take markets higher only gonna make tail risk protection cheaper/attractive (and markets more fragile) for folks like me who will glady throw pennies in front of credit risk steamroller others can pick up on max leverage.

‘they have many toys in their toybox’

What kind?

Can they print vaccines or anti bodies for corona?

Can they re-establish supply channels from China?

Can they stop spread of virus in China, USA or anywhere else in the world, by printing more money, QES to infinity, ZRP/NIRP and what not

They are terrified, clueless and helpless

Corona is the karmic backlash for their insane credit/debt by printing money out of tin air!

THINK

Jerome can stand on his head and spit wooden nickles. He can’t stop the drumbeat of scary C-virus headlines that will hit every day. The Fed / Jerome isn’t God. Plague panic will only go away with news of a drug remedy or vaccine. Those are at least six months away unless some clown lies about his progress.

I went to my local Costco this morning. The parking lot was over full and cars were lined up all around the neighborhood trying to get in. The place was mayhem. People are standing in line for hours and filling their SUV’s. This looks like panic hoarding to me. That short position of yours is starting to look better and better.

The President’s news conference seemed focused on keeping the enormous stock market bubble inflated, I didn’t get the sense that he had even been briefed on the virus. We may have a problem after all.

I might go to Costco next weekend and will take photos, if they let me :-]

The house always wins.

Casino’s do go bust. It is rare but it does happen.

“Casino’s do go bust. It is rare but it does happen.”

This is true. You have to be very stupid to go bankrupt with a casino.

That’s why if you happen to win, take those winnings off the table. Cause you can’t win what you won’t bet, but you can’t lose either.

Wolf…how long do you give it before it reverts to reverting to the mean?

By “mean”, do you mean a 50% crash from here to get back to historic norms, or a minor grind higher to match the “new normal”?

What’s the mean?

This may shock the commentors, but for a 35 year stretch, the DJI is just slightly above its mean. Well within the standard deviation. Correct me if I’m wrong… If you go beyond a 35 year look, then this may be much different.

Good luck to anyone holding risk assets over the weekend. Two days, who knows what will happen

Good luck to anyone not holding risk assets over the weekend. Who knows how much money printing the Fed will announce over the weekend. Given the recent pullback the market could open with the Dow up over 2000.

I’m sure you’re familiar with the compressed spring analogy, the market spring is massively compressed and after Powell announces an all new, massive, easy-money scheme that spring is going to shoot into the sky. If you’re sitting in cash you should be very nervous – there is about to be a lot more of that stuff.

Everyone likes being popular, printing money makes Fed members very popular. They are put on magazine covers and called heroic, those guys love that stuff. Powell is going to unleash a biblical flood of money, best you start building an arc out of assets or be left behind to drown. Cash is trash.

You know that is exactly what’s going to happen. No question. When the FED goes all in, it’ll be the greatest, but also final salvo before the dollar collapses. The dollar is in peril right now. I don’t know what to make of COVID19 except to say I don’t want to get it, but shocking PMI numbers are out of China today and they blaming it on COVID19.

the FED better aim twice and shoot once cause this is it. I also wonder how long the populace will permit this ongoing printing and printing and buying of assets rendering the emergence of a neo-feudal system of ownership as everything will be privately owned.

Times are. . tense.

You’re exaggerating. Consider the times the Fed came out of the corner making big noises when there was a market collapse: 1987, the Y2K fright just before 2000, the crisis in 2008, and now. It’s what they do. .. deal with freak-outs. It’s all about perception and the crowd. If, as many of you have wet-dreams about, sit on their hands and “let price discovery” (the invisible gland) return to it’s position on the thrown of capitalism, things would get very ugly. Again, all the super-critics of the FED blast at them for wrecking the economy. Don’t look now but they dodged a speeding train in 2008 (regretfully due to their own ignorance of the banking Frankenstein they allowed to grow) but the result has been a record stretch of economic and employment growth since ’08. Yes it’s a mirage, and yes it’s super-fragile, and yes it’s created a gig-economy with no salary growth. The continued spending by the government, starting with Reagan, has made money worthless, not the FED. Stop the ranting and take off your partisan head-set. The FED has kept us from total banking collapse – a collapse they inadvertently caused – but, hell, we are not as bad off as the conspiratorialists who post here bleat about constantly. And YES, I may have created a new word here.

not just “continued spending”… rather, insane deficit spending.

“You’re exaggerating. Consider the times the Fed came out of the corner making big noises when there was a market collapse: 1987, the Y2K fright just before 2000, the crisis in 2008, and now. It’s what they do. .. deal with freak-outs.”

HowNow,

Those times have been considered, and they indict the FED as it is precisely those actions that contributed to and created what we have today.

But keep up the FED cover. They love you for it.

CD,

Can you describe a realistic alternate outcome to, say, the 2008 crisis? What would you have done?

I asked, in a similar rant about government, what CAS 127 would do, and… no answer.

Bank failures were rampant in the late 1800’s and early 1900s. The FED was created to combat that. And it started poorly. The FED’s response to the Depression was also seriously flawed, largely because of politicians who thought that the economic/financial system needed “cleansing”.

I feel there’s a correlation to the blame doled out on “government regulation” – another bogeyman of commenters here. Do you have any concept of what the major food industry producers were putting into foods (canned goods) and the production of meat, to name a few, in the early part of last century? Congress was in the pocket of the powerful food industry and didn’t give a rat’s arse about consumers/citizens. Upton Sinclair laid bare what was going on (although a chemist, Harvey Wiley was well ahead of him and a major reformer) and then the public outcry forced corrupt Congress to do something. But now, government regulation is treated like the original sin.

It would be nice if people could see things in gray, not just black or white.

More cases of community transmission on the west coast. Though risk assets can bounce on Fed action events can overpower it for a while. I am old enough to remember 2008

Does printing money:

Re-establish supply channels?

Prevent further spread in USA or China and world?

Can print vaccines /antibodies?

Are you buy the ‘falling’ knives – stocks?

They are terrified, clueless and helpless with thei PRINTING machines!

THINK!

Cash is hard trash – and equities, options and real estate are dreams.

I like wolfs comment, “were back to sept 2018, its not the end of the world”. In perspective the drop in 2018 on the chart was a bigger drop than this correction. Yet nobody was calling 2018 a black swan event, holy cow history barely remembers it! Maybe the bear needs more time to growl more, or come out of his cave.

…”going to print antibodies or something.” Will this require a prescription?

Will there be another Federal Acronym? FED+FDA= FADED, DEAF, or DEAD?

Pigs get slaughtered, hopefully none of them ate bat poop and give us corona virus with our chops and apple sauce.

Why would the Fed Jump in and say they are going to rate cut before the weekend and news cycle even started? If this thing spreads this weekend what other action could they indicate they will take when more panic sets in. I mean, at least wait until Sunday night to announce rate cuts (as if that’ll do anything to get people on the plane Wolf mentioned)

I’ve been out of this market since 2018. Sold at s&p 2650 when none of it made sense. Started buying small amounts yesterday and again today… going to keep adding SPY and VIG every 1000 points down. Unfortunately I think this is just getting started and when boomers, who are about to retire, start seeing their nest eggs disappear 2-3% every day/week there will be a stampede to the exits.

I hope I’m wrong. I’ve wanted to see this unsustainable run-up come down for a long time, just not on human suffering. Hollow victory after waiting it for so long.

The boomers are already retiring in droves and taking their cash out of the economy with them. What’s worse is the liabilities that belong to the US govt which are not funded; are owing to this huge demographic as it ages. What happens when the govt can’t pay these out anymore, because the US dollar puked and isn’t worth the paper it’s inked on because that’s wheee this is going. It’s a double whammy of some pretty awful doom.

Kassdour,I’m interested in how you think the boomers are taking their cash out of the economy. Do you mean they are no longer receiving a paycheck? Or do you mean that they are liquidating their retirement assets en masse and putting it under the mattress in the bedroom.

They don’t called it boomers for nothing. It’s a huge demographic force on the economy.

A lot of my clients are getting into physical commodities…

Not necessarily just that. One point I saw made is that in a fractional reserve banking system, as the Boomers have paid down their debt, it has taken money “out of the system.” The exact reverse of what occurs when loans are issued. That, it seems, is one of the things that the Fed has been compensating for with their mad liquidity injections into Mr. Market.

**** you.

Never mind Kasadour’s unnecessary comment but clean up your dialogue please. Its just a simple fact that as mankind live longer so will the statistical increase in death at an older age.

One thing both of you hinted at is the possible economic impact of the boomers suffering more at the hands of this illness. If you are going to say something say it. Don’t beat around the bush about it.

Pigs get fat, Hogs get slaughtered.

“Why would the Fed Jump in and say they are going to rate cut before the weekend and news cycle even started?”

Because they don’t want the muppets, lemmings and gerbils to run helter-skelter off the cliff. It’s a prudent thing to do even though FED-HATE is big on this site.

Arghh, that Powell statement is exactly what I was expecting, and it still makes my head boil. I’m sure it will emanate in various ways from many more mouths before this ordeal is over.

They encourage the development of huge fragility and division in our societies and economies, and as soon as some acutal real and unrelated problem turns up they try to piggy-back all the problems they’ve created on top of it.

Salt-check.

A better day to us all.

1) There was never a gap like that.

2) There was never a drop like that.

3) What does it mean.

4) US30 (DOW futures) dropped nonstop from the Buying Climax to today low (to AR), without a bounce ==> 16.5%.

5) Those market makers are amazing. They gave investors hell til 3.59PM.

6) US30 daily show that there was a lot of buying today.

7) SPY daily had the highest volume on the chart.

8) SPY weekly plunged on top of the cloud and bounced back up. If SPY will

be in a trading range, from July it travel under the cloud. Chickou, the lagging price, will still be above the cloud.

9) SPY, after a period of trading range, might enter a new zone.

This time the target for sp500 is 1666.

maybe in a couple years…..this take down was perfect play by GS, have a couple more days to squeeze out both sides more….

know your sector rotation…

“There was a lot of buying today”

For every buyer there was a seller.

Malthus,

What changes is the price at which investors are willing to buy or sell.

Desperate sellers will sell at any price, wherever they can find a willing buyer, and when there are no buyers at $10, the price has to drop, until there is a buyer willing to buy, for example at $9. Then there is a transaction. And when all buyers willing to buy at this price bought their shares and no one else wants to buy at $9, then the price has to drop further, perhaps to $8 for the next buyer to be willing to buy, and so there is another transaction, now at $8.

The reverse happens too, as it happened over the last 15 minutes of trading on Friday. At $9, there were no more sellers. So buyers had to offer $10 to find the first sellers. And once those sellers sold, buyers had to offer $11 to find the next sellers, etc.

Isn’t, “For every buyer there was a seller.” misleading? One buyer buying issues from multiple sellers or one seller selling issues to multiple buyers negates the axiom, no?

But prices did not seem to be in any “free fall”. I had a few buys at as little as 5% below its market price and they didn’t fill. And these were not high volume traded stocks. Maybe they had a number of trading curbs along the way. I dunno, haven’t checked.

“When and how will the reaction by consumers to the coronavirus – dollars spent and not spent – become visible in the overall economic data?”

I for one am stocking up on food. Once the career civil servants at your local school panic, they’ll shut them all down in the blink of an eye.

Then it cascades from there.

With spring just around the corner, that will do much to dampen the spread.

Trump is heading for an election defeat if he continues to bungle this. I find it hard to believe there is still no real testing for the virus. If even a few hundred die from this in the US, the democrats will be running non-stop ads lamenting the fallen.

Not intending to get into a political food fight, but a critical reason for lack of US testing is the Chinese (who have been experiencing Coronavirus & hiding it from the world for months) REFUSE TO SHARE VIRUS DATA TO DIAGNOSE, MANAGE & CREATE ANTIBIOTICS.

Yes. All this talk about multi-lateral/global world without any national accountability is being exposed. Most countries do NOT have freedom of speech/they DO have government censorship.

This is just one of the consequences.

It’s hard to have too deep of a relationship (political, economic, etc.) when your “partners” don’t have the freedoms that we do.

If you haven’t lived anywhere else, it’s hard to recognize until something like this happens.

Just FYI antibiotics don’t treat viruses.

jack flash

You are correct. I should have said “vaccine” (which protect against some viruses like measles & shingles), not “antibiotic”

The Chinese have suppressed information about the virus, but I haven’t seen a single Western country trying to help them. If this was in the middle of the 20th Century, the USA would have been sending over medical staff to help them. Instead you have a nativist president who doesn’t care about anything except himself putting up walls. And if China and South Korea can’t stop this virus, no one can. China built a hospital in less than 2 weeks. Korea has done more than 66,000 tests as of Friday. You had better start praying.

c_heale

The US is a “western country” and China has REFUSED western assistance.

Obviously you’ve missed the rather heavy media coverage over the past few weeks where Trump has directly offered Xi on-site US CDC staff. Offer has been made several times.

The world need data on how the virus infects various species, how it mutates, and what the course of the disease is. China has steadfastly refused to release any of this info.

So much for your political fairy tales regarding this matter.

Retail investors seem to react with less panic than institutions. The so-called “dumb” money isn’t that dumb. The “smart” money sells during downturns ‘cos it is other people’s money. And there are the alogos that are also dealing with OPM.

—————————-

Jason Zweig in the WSJ – Feb 26, 2020

https://www.wsj.com/articles/the-pros-have-to-sell-stocks-now-you-dont-11582722004

“Institutions sell more than individuals when there is a large stock-market drop,” finance professors Patrick Dennis and Deon Strickland found in a 2002 study. They also showed that the more widely a stock is held by big investors, the greater its trading volume during sharp market drops.

A survey of more than 16,000 individual investors by Vanguard Group, the giant asset manager, shows how drastically their attitudes differ from those of big institutions. Vanguard has been repeating this survey every two months since early 2017. The results suggest that individual investors have become a major force for moderation in the financial markets.”

————————-

Vanguard reportedly took in over $3bn just over Tuesday and Wednesday from retail investors.

Of course there are the “pundits” who are now exhorting people to buy solely because the Fed will step in. Don’t tell them that the “dumb money” isn’t as dumb as it is made out to be.

With the market already 12-13% down from the peak, I wonder what the average Vanguard fund holder with an IRA or 401k can do especially if they are a boomer at or nearing retirement?

The timing of this correction will be a tough one for the 60 year old and above cohort. I hope they have enough to retire.

Having experienced the thrill of victory, guys with margin loans are now experiencing the agony of defeat

> a tough one for the 60 year old and above cohort

They should barely be invested in stocks anyway, and have no debt at that age.

A 30-year Treasury or a 60-month CD has an earnings yield that is below inflation after taxes. Real estate is extremely overpriced. Where do you suggest retirees invest if they should be barely invested in stocks?

“They should barely be invested in stocks anyway, and have no debt at that age.”

Good luck with that. I’m retiring in less than 30 days. Thankfully, I don’t have debt and have studiously avoided the market for the past 6-7 years. How many people have done that? I would wager not many. The Fed has killed safe savings to encourage market gambling. Exactly where do you recommend that we go for a safe yield that stays up with inflation?

There really is no such thing, but being glib is not helpful either.

Not as bad as feared at end of market today versus yesterday. You liked Clorox for the virus, you lost around $12 a share today. How about Zoom Video, you lost $9 share today. The institutions and funds are playing the face rip/pump and dump game. I saw it across a range of stocks past two days. Nothing has changed, market might rally a little or go down more. The virus is a little overdone by the media, but it will likely slow Q1, GDP. I hope the FED waits for real economic data in April to make a decision.

Here’s my predictions:

1. COVID-19 is not going to go away magically when warm weather arrives, as per the wishful thinking of Donald Trump.

2. China’s rise in cases has started to taper because of the draconian quarantine of much of the country. That doesn’t mean the virus has disappeared in the country. We know now that a certain percentage of people can be asymptomatic carriers of this virus, and they are still out there, just under quarantine. As soon as China, Inc. reopens its factories for business, I strongly suspect a second wave of the virus will power through the country and shut it down again.

3. The virus has almost certainly hit India already, where Trump and his minions visited last week. The incubation time for the virus can be as long as one month. I am waiting to see if anybody from Trump’s party caught the virus in India and brought it home, as asymptomatic carriers. China and India do over $300 billion in trade annually, via their seaports. India did not shut down travelers from China for well over a month. Surely somebody engaged in that massive trade had brought the virus into India by now. I believe the virus is already in India, and the only reason that it hasn’t been reported in huge numbers there is because jam packed, congested India has so many thousands of other more horrible diseases already (dengue fever, TB, malaria, leishmaniasis, etc.) that people there regularly catch and die from, that COVID-19 wouldn’t even be blip on their radar.

4. The current economic problems caused by China and South Korea, Inc., etc., shutting themselves down in response to COVID-19 are a SUPPLY issue, similar to the 1970s when the Arab Oil Embargo and the Iran Oil Crisis suddenly shut off major supplies of oil to the United States, at a time when US oil production had hit an all time low. This supply side loss of a critical component of the modern US economy caused prices of everything to go up. In response to the first Oil Crisis in 1973, the Fed from 1975-1977 dropped rates drastically to try to stimulate the economy. The result was to send inflation levels skyrocketing even higher, without actually improving the economy. Stagflation, in other words. The moral of the story – the Fed can stimulate the demand side of the economy during DEMAND side implosions, e.g., the GFC of 2008, but if it tries to inflate the money supply with ZIRP or QE during a SUPPLY side implosion, Inflation will skyrocket out the wazoo, as it did in the 1970s

5. If the COVID-19 continues to spread world wide, especially in the US, DEMAND for services, other than healthcare and facemasks, will also drop. Americans will hunker down. The vaunted service and consumer economies will crash.

6. Oh, and that massive world wide corporate debt? Much of it of the Cove-Lite and junk and barely above junk variety? That will blow up as companies discover that that they can’t pay their dividends with cheap debt and can’t service or refi their bonds in this shrinking environment. Can the Fed come to the rescue here with more ZIRP? Maybe, but who is going to want to buy low yielding junk rated corporate debt in this kind of a crashing economic environment? There will be a flight to safety, which is why 10-year Treasury yields have gone downhill into another yield curve inversion. This is where thing will go to heck really fast in a straight line, when all the investors, pension funds, hedge funds, shadow banks, repo debt flippers all of a sudden discover that all the junk corporate debt they own have suddenly become worthless trash.

7. Ahhh, but I have to have a hedge here. It could be that Trump is right, this is all fake news, that COVID-19 will disappear with the warm weather, all will be well again. If so, then …. in the immortal words of Roseanne Roseannadanna ….. never mind…..

I realize that I write in dense prose, so to better explain, here’s the children’s bedtime story version as to why expanding the money supply in a time of a supply side drop will cause hyperinflation:

You are the King of the Land of Purple Marble. You control the amount of Purple Marble produced in the country’s mines. It is an exquisite product, highly prized, and thus used as currency for in the economy and for trade. You keep a control on its production to maintain its high value.

Now, all of a sudden drought and pestilence strikes the land. There is no food, anywhere. The price of food skyrockets. People are dying, and oh, the economy is also crashing. You throw CNN into your dungeons to stop the fake news, but that doesn’t work.

You have to import food to feed your people, but the only thing of value you have to trade with is your Purple Marble as you don’t produce much of anything else anymore.

So, to help buy more food, you order your Purple Marble mines to crank up production 24/7. More Purple Marble! More MONEY!

Not. Your trade partners are now flooded with Purple Marble. Drought and pestilence has hit their lands also. Basic food is now far more valuable to everyone than that stupid Purple Marble, which nobody can eat.

Now, replace the food in this children’s story with all the billions of goodies produced by China, South Korea, and probably soon Japan, which we in the U.S. have come to depend on to keep our cost of living low.

Cranking up our national supply of Green Fed Bucks (which I totally expect Powell and the Fed will do, just like the 1975-1977 Fed) WILL NOT make available those things from China, etc., which simply are not being produced anymore. Inflating the quantity of Green Fed Bucks will only work to increase inflation levels to hyperinflation levels, as EVERYBODY will now have huge, excess amounts of Green Fed Buck with which to bid up the price of increasingly scarce products.

And that’s what happened in the 1970s.

you’ve skirted around an issue that has been worrying me today.

a few years ago where i live, there was a teachers strike. the schools shut down for a few weeks. some of my coworkers had to stay home, as childcare was too expensive for them to make going to work worthwhile. others, the lucky ones that had family/trusted friends that could keep an eye on the kids, came to work and were worried about how they were going to feed the kids since the schools weren’t providing free lunches during the shutdown.

i heard one school in the good ol’ USA closed because of a sick employee, potentially “infected.”

what happens if even 10% of schools close due to risk? who will watch and feed all these kids? what will the unanticipated consequences amount to?

disclaimer: i have no kids. i do, however, pity them, as they are going to most likely have a rough time of it.

Coronavirus now reported in a pet dog confined with its owner in Hong Kong. Yep, you know how dogs love to stick their noses into and lick all sorts of body parts at both ends of the gastrointestinal tract. Another giant pool of hosts and spreaders for COVID-19!

I don’t see this ending soon.

Gandalf, I’m the last to play down the seriousness of Covid-19, as, if anything, I reckon my own health authorities are dragging their feet far too much on this issue. But that dog story probably lacks legs.

John Campbell, hasas I see it, been covering this unfolding pandemic in a superb way on Youtube. He briefly addresses and pretty much discards the dog story. Look from jst a bout 17:40 in today’s video

I’ve acquired 45 days of food and supplies incase I need to self quarantine.

I have no faith that our current administration will do anything different than recite disinformation as happened during the Spanish Influenza over 100 years ago.

But Wall Street has surprised me, they have quickly seen thru the “hoax virus” claims by government officials

Here in China, the government workers went back to work almost two weeks ago. In a socialist country like China, that is a huge amount of people. The average incubation period for the new virus is 3-5 days. There was no spike. Numbers went down. Private industry went back to work last Monday, which was 5 days ago. No spike. Granted, there is only one shift in most places, and attendance is spotty, but hundreds of millions of workers going back to work did not spread the virus. Outside Hubei province, there have been only single digit numbers of new cases in the entire country. The draconian measures of everybody staying home do work. You go outside only if necessary. Everywhere you go, people take your temperature.

If you fly into JFK now, you breeze through, and nobody checks your health. People flying from South Korea, Italy and places with the virus are shocked at the lax attitude in the US.

roddy6667,

You are seriously mistaken if you think that this mass quarantine in China has “cured” the COVID-19 pandemic in China.

The mass quarantine did successfully put a temporary stop to the rapid spread of this virus by isolating infected people from the uninfected population, BUT

1. There is still no cure for the virus

2. Pools of asymptomatic carriers of this virus are still present throughout China, and nobody knows how many of them are there

3. The reservoir of carriers of this virus will likely reappear with the end of the quarantine and start the pandemic again.

Remember, the virus first apparently appeared in Wuhan in November 2019, and it took a month for the growing cluster of infections to become apparent to local doctors, and a full two months before it was acknowledged by the central government.

China’s factories have indeed re-started, but they are not yet fully staffed with workers and not operating at full speed. Once the workers arrive and congregate in large enough numbers, that will present more opportunity for the virus to reappear.

I have also read that the authorities in China have now stopped taking temperatures and have taken down their checkpoints on people traveling back to work in order to expedite getting the factories fully staffed more quickly. So much for your boast about China’s not lax attitude towards this pandemic.

No cures for SARS or the Spanish flu were ever developed. The viruses mysteriously disappeared on their own, which is certainly what the optimists are hoping for will happen again.

It may happen again that way – COVID-19 may just mysteriously disappear in China, perhaps subtly mutated to a benign version that causes no symptoms in 99.9% of people there. And if that happens right now, this month, it will appear that Xi’s mass quarantine measures “cured” the COVID-19 pandemic.

But, if, as in the case of the Spanish flu, it takes TWO YEARS for the virus to mysteriously disappear, making two full cyles of pandemic infection along the way, well, that’s whole different story, with millions of dead people around the world.

P.S. China is NOT a socialist country. It is a one-party authoritarian oligarchy that is quickly evolving back into a totalitarian regime under Xi. The word “socialism” has long been greatly abused, misused, and misappropriated by many totalitarian regimes, but the true definition is that the governmental system is designed to provide an economic equality to all people in the society. If you just compare the current levels of income, healthcare, and educational disparities in Chinese society between the rural 30% with the urban masses and against the wealthy Communist party connected elite/oligarchy, seriously, China is no where near being a socialist society, no matter what it claims to be.

The number of active coronaviruses in China has been dropping. They isolated individuals with the disease to protect family members. They have been testing numerous antiviral drugs. Tests with remdesivir are underway in China after two patients in the US responded well.

Your hedge is this;

Virus spread like a bush fire in Wuhan in Dec 2019.

Plenty of time has passed for that to be replicated elsewhere.

Hasn’t happened.

Conclusion; Virus has mutated into a far less dangerous entity.

1) Coronavirus + Burnie BS. They are not the cause. The DOW had a Buying Climax (BCLX) and a sharp drop. That’s the real cause.

2) The media is a system control with positive feedback loop. Bad news

amplified, but the good is blocked. Market makers use the media to accelerate the drop. Coronavirus did not caused it.

1) SPX trend is still up.

2) SPX was up 1,047 pt from Dec 2018 til Feb 2020.

3) SPX dropped in Feb 537 pt. // at this point : 537 : 1047 = 51.3%.

4) Target : easily > 3,700 pt.

I think 2 things can be good:

1.) The President stops the trade war. A moritorium. ZERO tariff.

2.) The Fed declares an IOER for savers – increase rates so that those with savings can earn a little to survive this pandemic.

The Fed has disdain for savers (hoarders). Christine Lagarde has stated savers “must be made to pay” for monetary policy of repression. There will be no IOER for savers, rather savers must be made to pay for the bank IOER via economic repression.

You shouldn’t be saving money in a bank account in any case. Bank accounts are theft.

Been in cash for several years now, and debt free for 15? The Market collapse after the ludicrous gains of the past several years has been fascinating to watch. Regardless, as the economy continues to slow and collapse into itself, (whatever the catalyst), I continue to agree and heed the words of Ben Franklin as opposed to the ‘king of debt’.

I suppose with a predominantly service economy physics can be denied for awhile, but the bottom line is that there cannot be infinite growth, only the appearance of growth. Another entertaining feature of the past few days is the inept stick handling of the boosters; their tongue twisting explanations, particularly Kudlow. I see terror on their faces, actually. Desperation.

Coming soon: Shale collapse, manufacturing stoppages due to supply chain interruptions, restrictions on public gatherings in North American venues, early summer vacation school closures, shortages of consumer goods, and work stoppages. Not this week, but in the next few months. All the boosters will resign and get jobs with the RNC. Pence will be the scapegoat.

“British Columbia has tested more people for COVID-19 than the entire United States, B.C. Premier John Horgan said Friday.

The B.C. Centre for Disease Control (BC CDC) reported that it has tested 1,012 people for the virus as of Feb. 27, 2020. Seven cases of the virus have been confirmed.”

So Wolf, who actually lost money this week? How much of this is just paper?

It’s not even “paper.” It’s just digital :-]

But for people looking at their accounts, it’s all the same.

my gambling account took it in the shorts this week.

an accountant might classify it as an unrealized loss. i, however, prefer to look at it as a yet-to-be-experienced-gain.

Retail investors are getting the whooping of a lifetime: exactly how many jumped into the fray in 2019 and were all over the Internet talking like a yup c.1988?

The ones who took the worst beating are the retail dip buyers who have been crushed time and time again this week. They got in too soon and they lack the sophisticated (and expensive) instruments and especially the know how to carry out high frequency trading (HFT).

Personally I’d go out a limb however and say European, and in the specific, Italian retail investors are those who proportionately took the worst whooping. The dip buyers who bought on Wednesday got a thrashing they (hopefully) won’t forget any time soon.

I’m curious to know who is selling. If it is just flush high-rollers, that’s one thing. If on the other hand it is cash-strapped firms (and investors), that suggests layoffs straight ahead, as well as a potential spiral in stocks and other asset values. And who knows, the 1% buying itself back in, to greater equity stakes (and rentier status), might be a “savior” rather than the Fed. Except of course, the lower half of the masses would thereby be moving ever closer to serfdom or total redundancy. (I saw an LA Times article today on fast food preparing robot costing merely $3 per hour on subscription/lease model.)

It was a very coordinated GS move with the other players taking part….only the big boys can create this rush, weekly index options seemed to be conduit…the banks started the run out the door Sunday evening….I like how they kept FDA, CDC, Potus, Ca case news and fear ammo in check until this week…

been around the block… rotation led to complete rout…these pigmen don’t buy at the top

Miso Robotics, the inventor of the Flippy fast food robot, claims to have brought down the cost of manufacturing one of their units from $100,000 to just $10,000.

The absolutely cheapest handling robot sold by FANUC (the basic LR Mate 200iD) costs $25,000, and that’s without including any bell and whisle such as Ingress Protection, absolutely necessary to protect the robot from environmental elements such as all that grease flying around.

This means one of two things: either Miso is losing money when they manufacture their robots, or these are “disposable” units that will be replaced either at fixed intervals or when they break down.

The former concept is well known, the second would be quite interesting to pull off, as one of the main selling points of modern robots is they can go much longer before needing planned maintenance, let alone repairs.

Miso would also need to put up an extensive sales and support network. With traditional industrial robots you can get away with just covering industrial areas, but Burger King has been spreading like wildfire.

That’s a whole lot of French fries and cheeseburgers. ;-)

Traders first because they are largely wiped out.

Second are the newer class of investors becuase they dont have much “equity”.

I think those who are buy and hold and are holding because they have pre-08 gains are very nervous if they had not sold yet.

As far as I remember : SPX peaked in Sept 1987, dropped a little

and bounced back up to a lower high.

Oct 1987 was not a nonstop drop from the peak.

1929 was the same as 1987.

And 2020 looks very similar

VERY similar I saw a graph of the markets superimposed on one of the late 20s to the 30s and it was an eerie match

Do you have a link?

I don’t see the comparison

If you look at the data the 1930s drop was a relentless month after month decline hitting -60 to -83 percent after 3 years

The 1987 drop was a mainly one day event and a quick recovery followed by the largest and longest bull run in history (if you ignore 1987 drop stocks skyrocketed until 2000)

Jerome Powell released a one-paragraph Fed-speak statement Friday afternoon (in full):

“ We will use our tools and act as appropriate to support the economy.”

No doubt they will consider the “advise”, if not actions of the Plunge protection Team. Perhaps a coordinated effort? Rigged system.

He should have said “to support the equities markets” I would say because that’s what he meant

Congrats Wolf,

Took a little while. I remember day trading the financial crisis volatility. That was insane. A swoosh down early was the biggest spread, otherwise pretty narrow. Corona vol is still here, especially, we start getting more positive coved 19’s. Holden. Thought I would get AMAT cheaper, not yet.

V-bottom, BTFD. That is how I cast my vote.

Everyone’s got an opinion, mine may stink but it’s based on 11 years of central bank bailouts that occur with the regularity of sunrise. I can’t afford not to be long.

Printing money can’t solve a supply shock. Do you think the Fed gives a damn? They are going to open the floodgates and the money will flood into the market – just as always.

The stockmarket is a grotesque farce. Trust me 10 years of false gains ( money printing without growth). Everyone who’s been making money in this joke and gloating I label them the financial zombies, they dont have a mind of their own. Yep keep buying Tesla, Netflix, Amazon etc at 100+ P/E, the zombie master gor your back.

P/E is just one problem stocks have. Another is record margin. Another is record share buy-backs and still another is stocks 135% value relative to GDP.

It’s a huge farce that has about reached its limits and soon everyone will see that play out in real terms.

if i liked popcorn, i would have been stocking up for quite some time, waiting for this current situation.

my roommates have a jar of bacon fat they use to make popcorn. alas, i am a vegetarian, destined to smell the delicious scent of the popcorn that i don’t like, and can’t eat.

i will have to substitute beer for the popcorn. and, despite the fact that the mug says otherwise, the contents of said mug do go down in a straight line. or at least straight-ish :- ]

p coyle,

Try olive oil. does just fine if you tend to it closely.

The floodgates have been open for quite a while, at least since 2016: Beijing and Frankfurt have been particularly enthusiastic in not merely opening the floodgates but dismantling them so they cannot be closed ever again.

This weekend somebody will most likely do something very very stupid: my money is on Jerome Powell for no other reason the Batphone at the Eccles Building must have been ringing non-stop since Monday and so far Powell has proven to be completely unable to resist any demand originating from the White House, no matter how patently ridiculous.

Stock markets skyrocket for a few days, then the first death from Covid-19 comes to US shores, the lockdown in Italy continues, Chinese authorities are found to have lied out of their teeth, US authorities are caught trying to cover up news of extra cases… even I known how these things work.

No problem speculating on this stuff, just remember to get out of the way as see the steamroller appear.

“And this happened beautifully during the last 15 minutes of trading, when the sellers had disappeared, and it took just a little buying pressure to red-line the needle:”

Not to nitpick, but it’s statements like this that confuses us less sophisticated students. How could sellers have disappeared, if transactions were made. There were still willing sellers at a price a buyer was willing to take, or a market maker was willing to make. Many of these sellers might consider themselves lucky to obtain the price they did. What happens in the case where numerous sellers and numerous buyers put in market bid prices?

(I recognize that your point was probably that desperate sellers had disappeared.)

Congrats on your short.

This week many were investing in “virus safe stocks”–Teladoc had a good quarter, Clorox rising, Zoom Video rising. The big funds bought pushed up the prices and then sold–down goes TDOC, CLX, ZM. Where to go next–the obvious Apple, Microsoft, Nvidia, Shopify. The institutions will sell those again before the market opens on Monday, or might carry it a little bit into the market open. Summary, if you are a sophisticated trade you can play this a little. If you are just wanting to jump in to invest on FOMO, likely going to take a big hit again this week. The old standbys are not working right now–oil, gold, even utilities, consumer staples taking a hit. I have been a bull, I have time to trade, but I moved from 10% cash to 85% cash this week. I am about 12% ahead right now making that move. I watched too many people just watch it fall in 2000/2001.

I should have said “sellers at these prices.” There are always sellers if the price is right, so the prices rise until they meet the sellers. That’s what I meant. Sloppy writing :-]

Wolf,

You are as competent a writer as I have ever read, and prolific by my standards. A real gift to us readers.

When I buy or sell, I use limit orders. I usually bid under the “last sold” price when I try to buy and over when trying to sell, hoping for a hit.

Is it plausible that some group at the end of Friday put in rising limit orders to buy, pushing the market up?

Unless this pandemic ends really soon or turns out to be far less scary than it’s been so far, what rationale is there for an already overpriced market to turn around? The epidemic is just getting started in the US and the markets are already crashing hard. What happens to the market when widespread infections start being reported in the US? I don’t see how that won’t happen at this point. People aren’t going to want to travel, eat out, go to big events, etc. Streets in many American cities could be virtually empty like they are in major Chinese cities right now.

Trump and the Fed can talk things up and stimulate all they want, but if people don’t want to associate with each other, the economy is going to take a major hit.

I’m not as sophisticated an investor/trader as many of you here, but I only see stock market downside for the foreseeable future. That assessment could always change if the virus is brought under control soon, a vaccine is discovered, or the virus isn’t as nasty in the US as it was in China. But, I don’t see any indications of that yet.

I went short the market in January once it became evident the outbreak in China was bad. I don’t foresee changing that positioning for a while.

P.S. Note that this isn’t investment advice. You don’t want my investment advice…:)

I can’t even begin to imagine the chaos and desperation if and when this thing shows up in the massive homeless populations on the West coast primarily Will be an ugly scene no doubt Are officials in California handing out free dust masks to the homeless like they do free syringes? They should be if they’re not already

What if it hits Mexico and Central America really hard? We could have hundreds of thousands (maybe millions?) trying to escape north into the US. How many of those will bring the virus with them?

if, and this is a big if, trump were to give the best possible advice to america regarding the coronavirus, roughly half of america would disregard the advice because TDS. the, roughly, other half would disregard it because “freedoms.”

to summarize: we are doomed.

Of course, the working lower class will be destroyed first when the streets go bare. Waitresses, cooks, and all the paycheck to paycheck lower wage earners we take for granted. Will 1% loans from the FED be available to them? No, but our darling banks and corporations (working with 1% money) will step in with 30% credit cards to save the day. But hey, those grubbing out a living (mostly because they love their kids), are just underlings, right?

– A matter of “Short covering” ??

Cruise lines were up from opening bell. Coordinated head-fake?

Alot of gold was sold (collateral) for the EOM tape paint job across equity and HY trash… and JPM is using the discount window to remove the “stigma”… damage is done lol

weather its as simple as an attempt to stampede the fed w/ underlings padding resumes when they should be spritzing door knobs .. or taking advantage of the steaming you know what by committing some sleight of hand .. no doubt the glue is getting soft and theres only three shopping days until Tuesday. so its Friday/hunky dory nice! and ive got a variety pack cooling so on that first issue, I don’t think jp takes the head fake and makes them throw, I think he’s busy w/ the window, we’ll see cheers.

I wondered during this market down cycle if the fallout might impact the 65+ investors who have been all in this market but in talking to various friends 65+ it seems this is but a blip on the screen. They are convinced that going to cash or moving away from their financial service advisor is a negative and the idea that they could be wiped out financially by a market downturn is not on the table so they keep their money in the market.

Aren’t they way too old to be on stocks?

“Financial advisers'” can’t get rich from people being in cash.

That category of savers is historically heavy in stocks: in the days of yore these folks usually had a mixture of investment-grade bonds (not necessarily US Treasuries alone) and blue chip stocks. These were considered conservative portfolios, for no other reason this stuff has always been extremely liquid. You could sell it with a phone call to your bank even in those days.

When my grandfather died in 2002 he had a lot investment-grade stocks: I remember Roche and Daimler but there were more, all big name companies. He had been holding that kind of stuff since at least the late 80’s and he was typical of his generation. Nothing strange.

Financial advisors however are another thing. Some know their trade, but the rest seem either comically incompetent at Lionel Hutz levels or are snake oil salesmen. Perfectly suited to peddle Tesla, Netflix, Delivery Hero, NAS and Netflix stocks.

Doesn’t matter if you ‘need’ yield. Gotta play the market, or take a 1 percent return…Age doesn’t matter here. I keep seeing ‘seniors should not be…’ Tough, it is the only way they get to eat what they are used to eating, etc…

Plenty of boomers heavy in the market, and not getting out. They can’t. No choice.

I invested in a mug, and it has the highest return. Thanks Wolf for all you do.

“..the Fed came out and said it’s going to print antibodies or something.” Classic.

I stole that from a commenter here. With appologies :-]

China’s official February manufacturing PMI has been released, and it’s an all time low of 35.7. barring some other highly positive news to offset this i have to think the market is gonna continue getting hammered come Monday.

Damn this is getting interesting.

sell the rumor buy the news…..it was most likely known a week or 2 ago if your a big house…

My understanding is this is a worse decline than at any time in the great recession.

Could be in for something as bad? Or a depression?

“It’s not 100% clear that having interest rates 25 basis points lower is likely to have a direct impact on the ability to manufacture goods or to get people back to work. And that’s one of the questions the Fed has to think about.” Former Fed Roger Ferguson.

I live about about 25 miles from the corona virus patient in Northern Ca. I could see that people are already in “panic “mode.

I had to wait only 20minutes vs 30 minutes for a table at a local oriental restaurant .

And traffic on 24 East was backed up only 40 minutes vs the normal 50 minutes.

I talked to a friend whose family still lives in Beijing. She stated that everyone is going about their business normally , except that they can not travel to the affected provinces and they wear masks whenever they are outside.

It’s clear from the cases emerging Friday (non-traveling school employee in a 425 student school with symptoms on Feb 19–one of them!) that the days of “containment” in the US are over.

But it’s a hoax!!!

Then factor in the disturbing trend that some “recovered” people become symptomatically ill a couple weeks later. Use you brains to try and figure out how to end quarantine when people who should be over it can infect people again. That’s more like tuberculosis than the flu.