In January, consumers carried on in hunky-dory land.

By Wolf Richter for WOLF STREET.

Consumer spending accounts for roughly 70% of the economy as measured by GDP. When and how will the reaction by consumers to the coronavirus – dollars spent and not spent – become visible in the overall economic data? That’s the question we’ll try to find answers to going forward. But according to the Bureau of Economic Analysis today, in January, American consumers in aggregate were still in hunky-dory land.

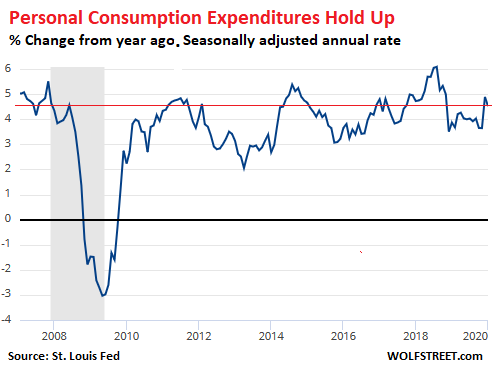

The broadest measure of what consumers spend in the US, Personal Consumption Expenditures, rose 0.2% in January from December (seasonally adjusted) and 4.5% from a year ago to a record annual rate of $14.87 trillion. In the chart, note what happened to consumer spending during the Financial Crisis. If consumer spending holds up, the economy will wobble through the coronavirus. But if consumer spending dives, all bets are off:

Personal consumption expenditures include nearly everything consumers spend in the US for goods and services but also mortgage interest payments which are part of “rent.” But it does not include what they send or spend overseas.

Nearly 70% of consumer spending goes to services. Here are the major categories of spending, with year-over-year growth rates and the dollar amount expressed in “seasonally adjusted annual rate” (meaning that at the current pace of spending, this would be the total amount spent in a year):

- Durable goods such as cars or furniture: +4.8% to $1.56 trillion annual rate.

- Nondurable goods, such as groceries, cosmetics, fuel or paper products: +3.8% to $3.02 trillion annual rate.

- Services, such as rent, mortgage interest, insurance, healthcare, haircuts, dry-cleaning, or education: +4.7% to $10.30 trillion annual rate.

Interest payments on credit cards, auto loans, or student loans, etc. (everything but mortgage interest) are tracked separately from personal consumption expenditures but are part of the overall “Personal Outlays.” They rose +0.7% to $361 billion annual rate.

So, consumers spent liberally in January. A month from now, we’ll find out how they did in February. But given the lag in the data and given that February was nearly over before US consumers in aggregate started to think seriously about how to react to the coronavirus, we may have to wait till the March spending data is released in April to see the first real signs of a hit to consumer spending.

And the moolah was rolling in.

Personal income – the amount of money consumers received from all sources – rose 4.0% in January compared to a year earlier, to a record of $18.98 trillion. By major category, in order of magnitude:

- Compensation of employees, such as wages and employer-contributions to health insurance, pension plans, and government social insurance: +3.7% to $11.63 trillion annual rate.

- Government payments, such as Social Security, Medicare, Medicaid, Unemployment insurance, and VA benefits: +5.7% $3.2 trillion

- Personal receipts on assets, such as interest payments received, but not including capital gains: +2.9% to $3.04 trillion annual rate

- Proprietors’ income, farm and nonfarm: +4.5% to $1.70 trillion annual rate.

- Rental income of individuals: +4.4% to $0.8 trillion annual rate.

And they saved a ton.

Disposable income – personal income minus taxes and contributions to government social insurance – rose 4.0% to a record $16.76 trillion annual rate.

Their disposable income is what consumers spent on goods, services, interest and the like. And the amount of disposable income that they didn’t spend is considered “savings” – though this doesn’t mean it went into savings accounts

This “personal savings” amounted to $1.3 trillion annual rate, or 7.9% of disposable income (the so-called “savings rate”). In other words, at this rate, consumers would “save” – meaning “not spend” – $1.3 trillion of their $16.67 trillion in disposable income in 2020.

So overall, in the data for January, consumers in aggregate held up well, making money and spending money, and saving money too, in hunky-dory land. And the impact of any decisions related to the coronavirus has not shown up yet.

Once we dig deeper and separate “aggregate” consumers into layers, we find that some consumers are doing really well, and others are getting into deep trouble and are becoming delinquent on their credit card loans and auto loans at Financial Crisis rates or worse, in an increasingly steep bifurcation. Read… Subprime Credit Card Delinquencies Spike to Record High, Past Financial-Crisis Peak, as Other Consumers Relish the Good Times. Why?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Consumer spending has been flat since August. Or real final demand. March is going to make the yry look not so good.

Social Nationalist,

“Consumer spending has been flat since August.”

No (see chart above). And not even on an inflation adjusted basis (see chart below): “real” consumer spending grew 2.8% year-over-year in January and grew between 2.4% and 3.3% yoy every month in 2019. This is what the year-over-year growth rate of inflation-adjusted consumer spending looks like:

December 2018 had that huge infamous drop in real personal consumption(along with real final demand falling bigly). That is making the yry look good with the big March and pumped up summer spending on the books for the yry. When March comes off, it will take a big chunk of yry spending with it along with a large disinflation. We already saw January peel back a bit. March will be the black swan.

Social Nationalist,

Yes, there was a huge drop in Dec 2018. But spending has surged since then and has gone far beyond it. The chart below shows “real” consumer spending in billions of 2012 dollars. You can see the big drop in Dec 2018 that you pointed out, but you can also see how spending surged from there even on an inflation-adjusted basis.

I agree that we’re going to see the impact in March.

I go out a little less but when I do I tend

to spend more than normal.

consumer is 70% of GDP?? how

when GOVT SPENDING – fed/state/county/city/agency account for 40% of GDP

guess we’re running on 110% GDP not counting businesses

It can be a challenge to make gvt metrics from different gvt rpts/surveys reconcile…the methodologies often differ significantly.

But it does raise the question of how accurate the Gvt’s info really is and why so little effort is apparently put in by the G to generate internally consistent numbers.

The ability to print money at will may generate a rather cavalier attitude…they will just “fix” all errors with the printing press…

joe saba,

That’s not how GDP is counted. The economy is a flow, and much of it flows in circles. To avoid double-counting, expenditure-based GDP (there is also income-based GDP) is measured at final consumption by consumers, businesses, and governments. When the government pays salaries, that is NOT counted in GDP. But when employees of the government spend this salary on food and rent, then it’s counted in GDP.

January was a different century

Feels that way with all the panic and hysteria. Reminds me of the swine flu, except for the supply disruptions.

Masks, purell, rice, beans, flashlights, batteries, the shopping list goes on.

Me and my friends are stocking up right now. Everyone is acquiring at least a month’s worth of food to have on hand in case of quarantine.

Remember, if you are going to panic, be the first one to panic.

I bought 3 sacks of Japanese “Koshihikari” rice. I might as well eat in style. I hope that’s enough. I am not sure about the canned goods. My freezer is full.

I panicked years ago so I even have gallons of Chlorine bleach, Green Soap and a special wand to spray it (not causing corrosion) using a pressure washer. I have 2 ULV foggers. I believe in the boy scout motto. Always prepared.

I am ready to self quarantine.

We are stocking up on Tums, Bicarbonate of Soda, and Alka Seltzer tabs for our trip to Disney World during the middle of March. No virus would dare to infect anyone that eats Disney World food!

About time I put to use, that year supply for 4 people survival food package that I won five years ago!

I have been pretty good an maintaining those items just as a general course of business, but I am now moving up my TV buying plans, and touching up necessities before the panic begins. It seems people are primed to lose their minds on a regular basis, from the pandemic of the century (Ebola, Swineflu), to elections of the century (seems like every one) to the storms of the century (every single hurricane when I lived on the Gulf Coast. Bad part is the constant hyping numbs people for when the actual cry of wolf is for real. For this, I doubt it, at least for for what Italy’s numbers look like, people sick but very very few deaths. Third world may be another issue, but they always are.

Gut instinct is Americans keep spending until things get very serious stateside. As long as people are working and making cash, the party continues…yet very glad to see some needed savings in the mix!

Quarantines may be the catalyst for Minimum Basic Income, keep the masses at home but distracted with online shopping and video downloads.

Whatever happened in the past 6 months will not be relevant to the next 6 months with the inevitable disruption of supply chains. The value of the past 6 months will be to show what an economy looks like with ‘normal supply chains’ and tons of liquidity supplied by the Fed and other Central Banks (including ultra low interest, negative rates, stealth QE, etc.). The sins of the Fathers are about to be exposed.

Just to add to your list of why the next 6 months will be different than the last. The fear of going anywhere there are crowds or crowding, like mass transit, airplanes or cruise ships and even restaurants. I can even see stores and restaurants closing not just because of lack of customers, sick employees but even the corporate fear of forcing someone to work and then having them die from this bug.

i went to Costco this morning. The parking lot was 3/4 full. Inside, the checkout lines were four deep and the food court had no empty tables. No one had a breathing/protective mask on.

It’s business as normal around here (north side of Houston…Friday morning).

I imagine that tomorrow Costco will be full up all day.

Everyone sold their losing portfolios for cash and are now shopping.

That’s the real American pastime.

Look at what they are buying. Canned goods, rice, beans, various cleaning/disinfectants, toilet paper, batteries, and other items common to the “Prepper” pantry. You can sense the urgency in the Sacramento area Costco’s. I’m sure Costco is tallying some interesting product purchasing data.

My gf works at Costco. They sold out of water on Wednesday, and like mentioned above everyone is stocking up on ‘prepper supplies’. The mormon church advised its members to stock up. All the local Costco’s actual sales are way above projected sales.

Good thing I own Costco stock

I have at least 30 days of 2000 calories worth of rice, beans, lentils, buckwheat, oatmeal, corn flour, dried fruits, nuts, seeds, canned fish, fresh and frozen vegetables and fruits etc.

I worried about runs on supermarkets when hurricanes approached Florida.

The only thing I cannot store a lot is gasoline for my generator.

Imafan, you should have put in solar w/battery back up. Then you don’t need a generator.

Went to my local Costco here in the DFW area and the place was packed. I usually go between 1PM and 3PM when it’s slightly less crowded but not this time. So yes, I did my part to increase consumer spending in February.

Las Vegas Costco also absolutely full & no one had any masks on.

I was there to stock up – just in case for the inevitable – just saying.

Take care everyone, no money will help if ….. pandemic happens.

There will be local outbreaks across the US, give it another week or two.

I think less time than that. Its been exactly 2 weeks since flights from China stopped. About time for all of those people exposed to start showing symptoms.

As far as I can tell, people are still traveling internationally to infected areas. Think of all the people vacationing in China, Italy and Japan. They come back to the US and go to work or school the very next day, until symptoms show up.

I think that’s why they say spread in inevitable. Unless Trump wants to shut down all international travel, I don’t see how you cut off the virus spread.

It’s kind of silly to shut down a school of business because somebody has the flu, knowing that thousands of people are still entering the country from infected areas.

I wouldn’t be surprised to see Pres Trump issue an order to stop all flights and discretionary travel for a week or two, during this critical stage of the virus. That would cause the S&P to drop another 10%-20%, but it’s also an easy way for Trump to avoid blame for popping the bubble, which was inevitable anyway. Blame the stock market drop on the Coronavirus, then take credit for facing the virus head on.

There is likely a major outbreak in Kirkland Washington in an assisted living facility right now, two confirmed cases and another 50 likely cases. There will likely be 1,000 cases on the west coast in 2 weeks.

We’ve stopped spending here in LA. The current stock rout will give cover for a rate cut. Hope not, but looks probable.

February consumer spending will be much more interesting. Even though the virus will not have hit the US mainland in force yet, the losses in folks 401K’s, the reductions in tourism spending, especially those who depend on tips and renting out their basement on Air-Bnb to make mortgage payments will hit hard.

March will be more interesting. That’s when we see the effects of 3.18 thousand billion dollars (3.18 T) disappearing from stocks. This just happened in the last week of Feb and Feb stats will show little change compared to March and beyond.

Well after taking a bath the last few days in the market, my wife and I will cut back. I was eyeing a new Indian motorcycle but that is on the back burner now. I would imagine there are a lot more out there making some of the same decisions.

Yes, I believe the big purchases will be delayed. My wife and I were sort of looking at houses, but now we will wait it out some more to see what happens. RE prices will likely be declining after this latest stock market route. Young folks that were saving for a down payment just lost 10-20% of it in the stock market. Something tells me this market won’t bounce back like it did the last few drops. With all the debt out there, as well as the Coronavirus, the news cycle looks bad for many months, if not years.

Plus, I sense people are sensing that the “Fed put” never did exist in substance. The Fed is really powerless. QE only works in peoples’ minds, and then they change their minds.

I think the markets will rebound significantly perhaps after an expected FED intervention however I feel the second leg down will come shortly thereafter when everyone realizes how fuked up everything is

As far as housing, my advice would be to be patient and you will most likely save some money, possibly a lot of money if things get chaotic I’m waiting for a deal on RE myself

Look it will take a while for people to get the supply chain disruption. Meanwhile, meh. I am bringing forward two new computer purchases to this weekend, plus six weeks of food.

Otherwise, meh

February consumer spending +10% yoy?

Kidding aside, if we get front-loading of the type you describe in the February/March data, then the April and May data are going to suck bigly.

Front loading is exactly what might happen. The local Costco is no busier than usual. But, thanks to the news cycle and the general lack of good reporting, or better yet, good use of judgement, just wait until the other shoe drops.

It seems like the velocity of perception and the velocity of reality are at a larger than normal mismatch. And all that does is generate FUD.

I heard from KQED this morning talking about local schools preparing plans just in case, after that entire segment, the only thing I got was people are worried, but still going to school, and there is some planning going on somewhere in the local school districts. In other words, it was empty air, no information, just opportunity to create more FUD in the name of good journalism. I suppose though these guys are still heads and shoulders above the rest of the media if nothing else because they have a smaller reach. But the cumulative effect here is going to be noticeable. Front loading indeed

My wife was at Costco in Minneapolis today and said it has never been busier, even during the holidays. Also, saw a story yesterday about a Costco in Hawaii that actually ran out of some basic goods items. Seems like we’re all preppers now!

@Bob

Yep, FUD. Our media helps to perpetuate it when the information is not clear. (why, cause no one wants to look stupid by saying, we don’t know the necessary information regarding this virus) The unknown is the biggest killer right now, there is no scientific understanding of the virus beyond theories and conjecture. No idea how long a person can be infectious, how the virus is transmitted, how it is actually operating.

And the media doesn’t help with vague comments about plans, and statistics and other items that are essentially useless, not much in the way of real scientific information at all. The only known thing is that close proximity to others who are sick will increase the rate of transmission. (Thank you Diamond Princess) Then our wonderful governor of CA is blabbing about how its monitoring 8500 individual… but hey, no location info, no names, no idea where they are, are they all quarantined. Could they be your neighbor, that person coughing on the train, nobody has a clue.

When you add together how little people actually know about the actual virus and its operation modality, well, Welcome to FUD. And thank you free press for spreading FUD.

Don’t have a clue what the right balance is, or not even what the right solution is, but right now, people have no idea, and so they are responding only in the only reasonable way possible. PANIC.

We are doing the same. Front loading a bit.

I suggest we divide analysis into BC and AC. Before Crash and After Crash. As much as two trillion dollars has evaporated from US financial assets. What consumers did BC has little relevance to their behavior AC.

BC, it was possible to extrapolate from the past to the near future with a high degree of confidence. This was based on the expectation that the near future would resemble the near past, which it almost always does.

Most Februaries resemble the preceding January. Not this one. This February might as well be twelve years ago, in 2008.

Some will maintain that technically it more closely resembles October 1929, which was the last time the Dow fell so fast in one week. Hopefully the first date is a better guide to the likely future, but even that will not be good.

Yes, prepping is going to give a major short-term boost to spending, though as Wolf notes, the backside of that, hunker-down mode, is gonna be a cliff dive.

I’m not buying huge amounts of stuff, just making sure I got plenty of pasta and beans and PB&J and wine laid by, alas no room for a chest freezer, but got a big case of canned tuna and box of beef jerky. Thanks to our local corrupt utility, PG&E, and their 3-day shutdown of my area last Fall, have a little portable solar-charger unit which can power small appliances and recharge portable devices. But just ordered a rugged little Coleman dual-fuel camp stove in case the gas gets cut at some point.

In “shameless market shill” news, just did a check of a handful of my favorite unicorns, and saw that some flack was hyping the likely benefits to Peloton Interactive (PTON) because what better way to stay both safe and fit during the Zombievirus apocalypse than running on your web-connected human-sized indoor hamster wheel? Similar for gaming stocks.

Shares of ZOOM Technologies (ZOOM) jumped more than 50% on the belief that its video-conferencing technology would benefit from the coronavirus.

The actual company that makes Zoom is Zoom Video Communications (ZM).

ZOOM Technologies (ZOOM) that went up over 50% is no longer in business.

Hmm at the right time scale this looks like things are going to check in a straight line.

Panic is a hell of a straight line.

…but Panic is a straight line to Hell! Sounds like a good supplement to Wolf’s mug!

Until the last 15 minutes…

https://wolfstreet.com/2020/02/28/nothing-goes-to-heck-in-a-straight-line-not-even-stocks-today/

I’ve been waiting for it today and Fed finally said something to the effect that they stand ready if the economy falters. I am not much of a Fed interpreter, but I know bullshit when I hear it. They know damn well even the most robust perfect economy in the universe would survive a major hit with a pandemic.

So, unless they change course this weekend they are going to let it slide. Then after 30%+ down on the S&P 500 they’ll start making rate cuts and chase it all the way down just like last time. At the bottom money will be dirt cheap, and those of us with access to this cheap credit will be able to buy assets at 30-50% off regular price. Just like last time The financially illiterate will take a bath, just like last time.

“not survive” that is, unscathed anyway

‘buy assets at 30-50% off regular price. Just like last time’

During the bear mkt of GFC ( 2008) the S&P lost nearly 60% and the NASDAQ over 80% in 18 months.

This coming ‘down cycle’ accelerated with corona effects on the global commerce will make 2008, look like walk in the park!

How can Fed counter act the ill effects of corona? With more easy-peasy money. more rate cuts and or more QEs?

Can they restore supply channels from China? would they prevent further deterioration in China or out side? Can they print anti-bodies or the vaccines?

They are clueless and helpless this time!

I agree I’m looking for a DOW/ Gold ratio of 1.0 sooner or later 3 to 5 thousand is my prediction or could be 100k knowing how central banks love to inflate

Once the virus arrives, consumer spending will be hard hit here in Portland. Maybe it wasn’t such a good idea to base your economy on Hot Yoga studios, Spin Cycle Classes and Coffee Shops. OOPs.

Never in my life have I spent so much shopping as I did the last several weeks. Hopefully this should do it for a long time.

Prepping is called for?

Well, better get Trader Joe’s and get me a few MORE boxes of Cocoban and Apothic red wines.

Absolutely essential (now you know we I haven’t ordered a beer mug). Red wine just goes better with horror movies.

I’ve long been prepped on extra organic black bean, rice, and California olive oil because of course the inevitable coming Zombie Apocalypse.

Just non prepped up on wine.

Wine is essential. My motto is Buy Low, Be High.

Definitely. I bought 3 cases of wine at Costco. I barely was able to l load them in the car. I unloaded half of the bottles from the box first.

If I go it might as well be good.

Pyewacket scared me and I don’t scare easily. That movie freaked me out for two days.

Black bean? Well at least you won’t have a shortage of methane to power your generator lol

Emergency Food and Water Supplies companies having strong sales for the past several months…shows the underlying level of fear that has existed before the market downturn.

Don’t forget about Census jobs being eliminated the 2nd half of the year, that always causes some “weakness”.

What Powell told us by his actions in making a statement only after markets tanked:

“It’s only important if makes markets go down.”

The entire known and unknown universe could vaporized this second. But is markets aren’t impact negatively, the Fed could care less. It wouldn’t even notice.

How can Fed counter act the ill effects of corona? With more easy-peasy money. more rate cuts and or more QEs?

Can they restore supply channels from China? would they prevent further deterioration in China or out side? Can they print anti-bodies or the vaccines?

They are clueless and helpless this time!

Anyone who has been watching already knew that but thanks for reminding us END THE FED

actually, the spending figures for Jan 2020, were not so good. they when up .2 % of a per cent. However, they went up only .1% if you take into account a .1 increase in he PCE deflator.

The consumer is strong! Plenty of money to spend and save – a 4% increase in income, life is good.

Well done on your short call btw (hope you covered by today).

BTFD!

The three big HFT firms used the coronavirus narrative to take out retail investor stop losses like a pro bowler knocking down pins (or so I assume). and now that they have loaded up at a 14% discount from last week we can no doubt expect the usual V-bottom. Monday should be up well over 1000 on the Dow and new all time highs by the end of the week (IMHO).

The CNBC crowd is howling for Fed interventions, they get what they want.

Plenty of money to spend and save – a 4% increase in income

How much did the bottom 90% get? Or did most of the increase go to the top 1% again?

How much did household debt increase over the same period?

Some of the numbers seem contradictory. Spending is up in all categories, but household debt is also up to yet another record, which isn’t what you may expect since saving is also up.

And yet, the debt to income ratio is down to where it was in the 1980s. Still, an inordinate proportion of low-wage jobs have been created in the last several years. Auto loan deliquencies have been rising.

I’m not so sure about the numbers, and they can be subject to a great deal of qualification and interpretation in any case. It’s a fuzzy picture. Maybe if I say something stupid I can get WR to provide some additional explanation.

Some of the numbers seem contradictory. Spending is up in all categories, but household debt is also up to yet another record, which isn’t what you may expect since saving is also up.

And yet, the debt to income ratio is down to where it was in the 1980s. Still, an inordinate proportion of low-wage jobs have been created in the last several years. Auto loan deliquencies have been rising.

I suppose the good things are happening to the higher-income demographics while the bad things are happening to the lower-income ones. In aggregate things are looking good even though half or more of the country is sinking or stagnating. And that’s okay for the politicians.

Unamused,

“Some of the numbers seem contradictory. Spending is up in all categories, but household debt is also up to yet another record, which isn’t what you may expect since saving is also up.”

Doesn’t sound contradictory to me. Because these are not the same people.

1. Some consumers live from paycheck to paycheck and don’t save anything. These consumers borrow and spend. With these consumers, increased spending is supported by increased borrowing and debt. Those are the consumers that drive consumer debt data.

2. Many other consumers are flush with cash, and have no outstanding debts, including about 1/3 of homeowners who own their homes free and clear. These people can spend money without borrowing. And they make more than they spend, and they “save” – don’t spend – the rest.

I get that. It’s demographics. The well-off are doing better because their incomes are rising faster than the cost of living, while a majority, or even most, are doing worse because their incomes aren’t keeping up with the cost of living.

One may expect to see the rich get richer, the poor get poorer, and the middle class continue to decline. The aggregate numbers don’t show that, which seems to be a long-standing feature of US government statistics.

The numbers which would show that won’t come out until some independent group crunches the numbers in a year or two, which means that criticism of increasing inequality will always be well out-of-date relative to political boasting about the supposedly wonderful state of the economy. Even though it’s not wonderful for the majority that gets keeps getting left further behind.

I’m just looking for information that’s outside the scope of the article.

Thanks.

Yup and gold will outperform stocks So in “ real” money you will be poorer This whole BTFD stuff will end really badly for a lot of people Sadly

Re: ‘all time highs next week’

Too bad we couldn’t get WR to hold the money or I would fire him a thou right now AND I’d give you 2:1 odds.

This removal of about 2 trillion in US wealth JUST happened. There has been almost no time to react in the real economy. Every supply line connected to China (i.e. most of them) from auto makers to drugs have just begun to run out. Several auto makers have already shut down assembly lines.

There are also a few industries walking around with their heads cut off that just needed to look down.

It’s a bit of a mystery how Shale survived this long. One answer is that there was nothing for the banks to foreclose on. They lent against reserves that at these prices hit this week are worthless.

Anecdote: a friend just told me that out of the blue his wife has signed them up for a 60 day cruise at 10 K apiece. This boggles my mind. But maybe I’m prejudice because I wouldn’t go for free even before this virus thing. But now?

In the last day or so a cruise ship in the Caribbean had one crew member feel flu-ish and two of the islands on the route wouldn’t let it dock!

Correction in reply and comment: loss in US stocks (alone) was 3.18 trillion. So somebody is feeling poorer.

I’m not seeing any news on leveraged loan impairments. Maybe they want it to be a surprise.

If the information is being withheld to avoid a stampede the tactic doesn’t seem to be succeeding.

I have tickets for April in San Diego for the BattleBots competition. Does it appear safe to go?

Nope Or you could always go in a hazmat suite

If we begin to see an outbreak here in the US the service sector which is 70% of the economy will take a huge hit. The retail sector will initially get a pop as panic buying will set in and people will clear store shelves of groceries, and other necessities, to be followed by a lull as people try to consume what they have bought. Entertainment, travel, restaurants, and non essentials will all take a huge hit. If you begin seeing new cases in new cities springing up, this will morph into the worst recession / depression any of us have ever seen. The fact that both consumers and business are over their heads in debt will finally become a huge issue, and the result will be really ugly…

They just gave everybody in Hong-Kong 10,000 HKD, that’s $1300, which buys much the same in USA, a good weekend, or a month if your frugal.

They can & will hand out ‘free money’ in the USA, many ways to feed the ATM card’s universally

I’m more concerned with the pipelines, the stocks in Walmart/Costco haven’t been replenished, we should be wrapping up december by now, and there were not Jan/Feb shipments to USA; So all that ‘shopping’ should become real boring in the near future when there is nothing to buy, that’s right about the time the GOV throws free-fiat to the ‘cargo-cult’

IMHO drug use alcohol will sky-rocket, hell if people have to stay home might as well make bath-tub gin, so the next big thing to go missing at the store will be sugar & yeast

…

In two months USA will be locked down, China will be back in biz, ships will start flowing again, stuff will arrive on USA shore, but the fiat will have become worthless; Like Rome long ago, eventually the Chinese will stop sending their stuff to USA, when they realize they get nothing of value in return.

How can the USA return to normal? That is manufacture? No investments in infrastructure since the 1950’s, no factorys, and now drug-addicted, feces covered city-zombies. Prison labor is the only solution in the USA, where hygiene, and working-hours can be controlled.

Lastly for those that think the Chinese will care, let’s remember that never was “USA exports” from China over 15% of their GDP, it just doesn’t matter what happens to the ‘leper colony’ that was USA.

I just spent almost $800 on cat and dog food to stock up. That should get the economy back on track a little. (3dogs/3 cats)