Having become a master of financial engineering instead of aircraft engineering.

By Wolf Richter for WOLF STREET.

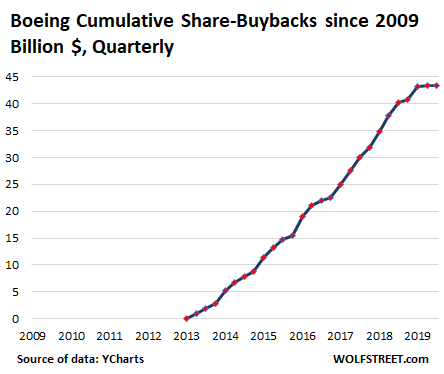

The first thing to know about Boeing’s mad scramble to line up “$10 billion or more” in new funding via a loan from a consortium of banks, on top of the $9.5 billion credit-line it obtained in October last year – efforts to somehow get through its cash-flow nightmare caused by the 737 MAX fiasco – is that the company blew, wasted, and incinerated $43.4 billion to buy back its own shares since June 2013, having become a master of financial engineering instead of aircraft engineering.

If Boeing had focused on its business – such as designing a new plane instead of doctoring an ancient design to save money and time – and if it hadn’t blown $43 billion on share-buybacks but had invested this money in a new design, those two crashes wouldn’t have occurred, and it wouldn’t have to beg for cash now. The chart below shows the cumulative share-buybacks in billions of dollars since Q1 2009. In Q2 2019, it belatedly halted the share buybacks (share buyback data from YCharts):

As is always the case with share buybacks, the idea is to buy high in order to drive shares even higher. This is what you learn on the first day of Financial Engineering 101. So Boeing stopped buying back its shares in Q1 2009 when its shares had plunged into the $35-range, at which point they were a good deal, and then recommenced share-buybacks in Q2 2013 when its shares had already risen to the $100-range.

The second thing to know about Boeing’s mad scramble to borrow another $10 billion is that it already has a huge amount of debt and other liabilities, and that its total liabilities ($136 billion) exceed its total assets ($132 billion) by about $4 billion as of September 2019, meaning that it has negative net equity, that the share buybacks have destroyed its equity, which is what share buybacks do to the balance sheet.

It also means that every dime in “cash” and “cash equivalent” listed on the balance sheet is borrowed. And this is about to get a whole lot worse. In October 2019, Boeing had already obtained a new credit line of $9.5 billion, which about doubled the size of its existing credit line. Credit lines serve as liquidity backup.

And now Boeing is scrambling to pile “$10 billion or more” in new loans on top of it.

This huge amount of cash is needed to fund the cash drain resulting from the fallout of two 737 MAX crashes, the global grounding of the planes now in its 11th month, the inability to deliver the 400 or so already built planes, the current halt in production, the squealing suppliers that have now started layoffs, the settlements with its airline customers over the grounded planes, the settlements and litigation with the families of the victims of the two crashes, the costs of dealing global regulatory issues, the collapsing sales of that plane, the scandal of Boeing’s culture revealed by corporate emails oozing to the surface, and the costs of re-engineering the software of the plane to make the plane safe to fly, amid doubts that this can even be done.

Putting a priority on financial engineering over actual engineering can get very expensive.

Now Boeing is getting closer to a deal with a group of banks, led by Citibank, for new loans of “$10 billion or more,” CNBC reported this morning, citing “people familiar with the matter.” The banks have already agreed to $6 billion of the funding so far, and Boeing is talking to other lenders to obtain more. Commitments are due by the end of this week.

The loans will have a maturity of two years and will have a delayed-draw structure that would allow Boeing to access the funds at a later time, Bloomberg reported this morning.

On January 13, Moody’s finally started stirring in bed, after sleeping through the first 10 months of all this, and announced that it would put Boeing’s debt ratings “on review for downgrade,” fearing “a more costly and protracted recovery for Boeing to restore confidence with its various market constituents, and an ensuing period of heightened operational and financial risk.”

And the upheaval among Boeing’s largest customers is growing.

Speaking today at the Airline Economics aviation finance conference in Dublin, Steven Udvar-Hazy, executive chairman of aircraft leasing company Air Lease, which has 150 of these cursed planes on order, said, according to Reuters, that his company “asked Boeing to get rid of that word MAX. I think that word MAX should go down in the history books as a bad name for an aircraft.”

“The MAX brand is damaged,” he said.

At the same conference, Aengus Kelly, CEO of aircraft leasing company AerCap, which has 100 Boeing 737 MAX planes on order, exhorted owners of these planes to not panic-dump them by leasing them at low rates or sell them cheaply, according to Reuters:

“Discipline and keeping a cool head is vital because if people panic and lease the airplane or sell the airplane at knock-down rates for an extended period of time, it will be harder for the residual value of that asset to recover.” A plunging residual value could be deadly for aircraft lessors. And he exhorted his colleagues to “be absolutely disciplined when it comes to placing the aircraft.”

UPDATE, Jan. 21, 2:50 PM Eastern Time:

Oh Boy…

Boeing stock was halted at around 2:12 pm pending news, after the stock had dropped $15 or 5.5%, to $306.

Now the news is out: Boeing announced that it still doesn’t know when the 737 MAX will be “ungrounded” but it has moved the earliest date out to “mid-2020.” This date depends on the FAA and global regulators. From Boeing’s press release:

We are informing our customers and suppliers that we are currently estimating that the ungrounding of the 737 MAX will begin during mid-2020. This updated estimate is informed by our experience to date with the certification process. It is subject to our ongoing attempts to address known schedule risks and further developments that may arise in connection with the certification process. It also accounts for the rigorous scrutiny that regulatory authorities are rightly applying at every step of their review of the 737 MAX’s flight control system and the Joint Operations Evaluation Board process which determines pilot training requirements.

And it said that it will provide more information with the “quarterly financial disclosures next week.”

The Biggest Share-Buyback Queens: When Will They Run Out of Juice? Read... Four Banks & Three Tech Companies Blow $56 Billion in Q3 to Prop up Their Own Shares

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I wonder how much damage you could cause if you organized a global debt strike…

Sorry, ignore me. Just fantasizing about nationalizing the Fed and ending the financiers’ reign of terror.

“organized a global debt strike…”

Fed would just print more in the name of “stability”.

Fiat money means any gvt can easily convert their debt ruin into your inflation ruin.

But government is smarter than us and here to save us.

“But government is smarter than us and here to save us.”

Certainly smarter than Boeing it appears.

wow – that’s big one

govt smarter than corporations

get out of here!

or boeing is planning end-game

giving back debt to creditors at .50 cents on dollar

rest of military industrial complex salivating

“smarter than Boeing ”

Hmm.

Boeing has screwed up but…

…the Gvt’s power to defraud and threaten people on a global scale isn’t a productive talent.

Or a long term one.

Label me “nuts”, but what person/pilot/crew etc., would want to step foot and fly on another “Max” rehabilitated or not. As I understand the basic design change makes the “Max” inherently unstable in flight (especially during take-off).

A software patch will convince flight crews and the flying public to accept the remedy and flock to fly on this ill fated plane????

With the crash photos up front in so many peoples’ minds?

I think Boeing is smoking some fierce hallucinatory tobacco!

@sierra7

Which is why some of the organizations quoted in the article are requesting a rename.

Aside from that how many people would know that the type designation 737-8200 is the 737 Max (See the rebranding Ryanair has already done from the factory)?

Need to be careful here or you could end up polluting the whole ‘737’ range name

Cas127 I guess he means debtors strike in which case inflation would be rewarding. Sounds like a good idea to me. I am so maxed out on my credit that it is rapidly approaching the bottom. I am ready accept the reality that my credit will never recover. I am eager to go first, but there would have to be a way for cumulative debtstrike action to be known for the strike to catch on. We just need some centralized communication. Who will do it?

Oh well it is also the case that all my income is from Social Security, so the CC bastids couldn’t get their hands on it. I wonder if enough old farts like me would join the strike. I see no reason not to try it though. What can we lose?

What they did at Boeing was they pinched a penny (1 cent) and lost 10 billion dollars and counting. To save on a hundred dollar software update that they made an optional charge to the airlines instead of throwing it in for free on a hundred million dollar sale price for one 737 Max, and then telling the airlines their pilots didn’t need more training on the 737 Max…they destroyed the company.

Penny wise and pound foolish.

Yep, Boeing is the new GE.

Not for the executives and short-term investors (many of them). The penny saved allowed them to pump the share prices and made tons of money.

Who cares if the company bites the dust? It’s gonna be someone else’s problem.

They may have destroyed the company, but Muilenberg walked away with $63 million.

Apparently Boeing was about to launch another aircraft model that did not require a pilot.

It was going to be mostly computer controlled and self driving (like a Tesla….) however it did require a human to oversee the operation.

Airlines were being pitched as follows ‘prior to take-off you just have the flight attendants make an announcement asking if there are any experienced gamers or digger operators on the flight. If not then you ask for someone who knows the basics of operating a laptop. Then you upgrade them to the cockpit and they sit there and monitor the self driving system. This will save you literally millions per year in salaries’

I am told by someone who works in the C-Suite at Boeing that this initiative has been put on hold — indefinitely.

They might have been experimenting with pilotless planes some time. Remember the plane piloted by Andre Lutz (I think that was his name) which mysteriously crashed into a mountainside and was attributed to the pilot committing suicide? There were whisperings then about Boeing having put a device into the aircraft controls by which the airplane could be controlled externally from the ground. It created something of a furore briefly as witnesses denied that the pilot was in any way suicidal.Boeing management has a lot of explaining to do about how they have been running it (or ruining it).

LB,

Arg, just a quick Google check of your disinformation piece shows that:

1. Lutz was flying a British-made Avro 146-RJ100, a four engine turboprop. NOT a Boeing product

2. While Lutz was an experienced pilot, he had previously made errors with navigation and landing procedure (i.e., he was a terrible and dangerous pilot), and his airline, Crossair (which later became Swiss International Air Lines) had done nothing to correct the situation, either by making him taking corrective training or grounding him

3. The crash was caused by a similar such mistake with navigation and landing procedure. Lutz got confused after being told on approach to landing to switch to a different runway at the Zurich airport. His flight was coming in late and landing at the main runway required going over a populated area late at night, which had been banned by the local authorities because of noise. So he had to make a different approach to an alternate runway which had a different and less accurate landing navigation system.

4. Lutz totally screwed up that change in direction, landing the plane short of the runway and into a hill – a “controlled flight into terrain”.

5. Amazingly 9 people of the 33 onboard survived the crash. Lutz did not

Will this plane crash and burn like Tesla (s) ?

Really wants to make you just jump right on board doesn’t it…(sarc).

LB,

I just realized that you probably confused Andre Lutz with Andreas Lubitz, who did commit suicide and also mass murder by deliberately diving his Germanwings Flight 9525 from the cruising height of 38,000 feet into the French Alps, in 2015, killing a total of 150 people.

But again, this was NOT a Boing aircraft – this was a 24-year-old Airbus A320-211.

Lubitz had well documented psychiatric problems, and had been declared unfit to work by a physician just prior to his death dive. Unfortunately, medical privacy laws in Germany meant that his employers were not notified of his psychiatric problems.

Lubitz was only a co-pilot on the flight. He had tricked the pilot into leaving the cockpit and then locked him out (a legacy of the 9-11 hijackings when lockable unbreakable pilot cabin doors were mandated)

Willy would I get a good view of the ground if I sat in the cockpit, or would I only see the instruments? Does it even have a window? It seems like there would be no need for it.

Would not really blame Boeing. Clearly, they are to be diminished, if not actually disappear.

They played the only game in town…….and lost. Can’t really blame them however. So they won’t make the next super bowl.

You know that some people died, right?

The best way to make the bankers swallow the national debt is to destroy their plans to raise income taxes to pay interest. The way out: pass a new Amendment to rid our families of the tax on income to overthrow the 16th Amendment.

Aside from the usual simplistic wrong solution to a complex problem this won’t work since you only target the income (which will be gotten one way or the other) side of the equation and do nothing about the spending. My suggestion is to start by halving the total expenditure (that is not just the direct but also include the hidden cost in for example the department of energy and healthcare) of the military at that point the US government would run a surplus thus removing the stranglehold the bankers have. Note that that is also a simplistic solution to a complex problem so there will be massive problems with it as well seeing for example the dislocation of industry that will happen.

Boeing did not have to design a whole new airplane, nor should it. It had 5000 orders precisely because it wasn’t a new plane ( they thought) it was the tried and true 737, but with more fuel efficient engines.

Airbus is doing fine with new engines in its 320.

But the 320 had taller landing gear so the engines did not have to be higher.

All Boeing had to do was redesign the landing gear and not move the engines higher.

Commercial airlines exist to make money. They are not operating fighter planes where a slight edge in some aspect of the envelope is worth unlimited money.

The emphasis is on fuel efficiency instead of speed is because this is a mature technology constrained by physics. Passenger supersonic is now half a century behind us, and there is no sign it’s coming back. The reason is simple: the resistance to motion through a fluid varies as the cube of the speed.

This is more apparent in water and is why a modern aircraft carrier is not much faster than a WWII carrier. (Much higher speeds require skimming over the water, i.e, leaving the dense fluid)

In air the resistance becomes prohibitive much later but when it arrives it increases geometrically, so you might have to double the fuel to go 750 instead of 550.

Half the take- off weight of Concord was fuel.

The cruising speed of non- supersonic, or practical airliners hasn’t changed in more than half a century.

There is no reason to redesign the air frame. The customer doesn’t want it.

I think this is interesting because there are many other plateauing technologies. The so- called Moore’s Law predicts endless rapid improvements in computer memory, but this is not happening because memory is constrained by physics.

All Boeing had to do was redesign the landing gear and not move the engines higher.

This would have demanded redesigning the fuselage to accommodate it, moving other systems, etc., essentially the same complexity as designing a new plane. Which is what they should have done, but didn’t do 5-10 years ago because their idiotic “supply chain revolution” for the 787 with years of delays.

Boeing pushed an old design beyond where it could go, under pressure from cheapskate airlines and their own myopic management, and they’re now paying a big price.

They think you can just eliminate the work “MAX” and everything will be OK?

They better think that one through. If they remove the ability of people to track the cursed aircraft, people like me won’t fly any 737s at all. Airlines that fly the good 737s should be fighting the rebranding. There’s no reason to taint all 737s.

Yeah, I thought the same thing: just change the name, and that’ll fix all problems.

Remember something like: no one ever went broke underestimating the intelligence of the public. People just want cheap fares, they don’t even know what plane they are flying in.

I’m sure re-labeling will work. “Oh no, this isn’t a 736 MAX, it’s safe.”

… or they will just stop drinking/ordering Pepsi Max

That was Vonnegut. He said something like no one ever went broke underestimating the vulgarity of the American people.

I mean overestimating

I searched it. Vonnegut was actually paraphrasing Menchin.

P.T. Barnum said it first.

And made tons of money, especially when he hooked up with John Ringling.

“no one ever went broke underestimating the intelligence of the public”

Those are wise words indeed.

It is a sure thing that the renaming will work. Just lower the prices of the planes and the debacle will be forgotten. Boeing will make less money instead of none, airlines will make more money, travellers will pay less. 737 Max what?

New Coke says Hi.

It worked for Donny Osmond when he released his Soldier of Love hit single.

Trump allready twittered that in april 2019:

https://www.reuters.com/article/us-ethiopia-airplane-trump/trump-urges-rebrand-of-737-max-boeing-has-other-ideas-idUSKCN1RR0YS

OT: Couldn’t Boeing gradually sell their shares to get the funds they need? Yes, the shareprive might go down, but they wouldn’t have to lend. Or maybe it is better to have debts, so the risk is with the lenders aka “we are to big to fail”?

Maybe if Boeing renames it the 737 TRUMP, at least 40% of the American people will fervently show their devotion and faith by deliberately seeking these planes out to fly on.

The executive bonus formula depends on share price, not debt/equity. They have a strong interest to buy shares, not sell them.

There are a dozen names for sugar on boxes of food and drinks, but they all make you fat and contribute to degenerative diseases…

It’s been tried by the think tanks before.

I think we all want a pilot whose life depends on his skill and self preservation.

Wolf:

Boeing may be one of the Poster Children of the Financialization of once great businesses, but I continue to see it everywhere.

My sister was invited to buy a bunch of haul trucks which she would lease to a silver/zinc/lead mine. I told her the deal seem too good to be true. So I went through the basic financials. The Mine lost USD $55million the last 9 months of 2019, and the parent company, after selling $3.6 billion in shares over the last 30 years had an accumulated deficit of $2.6 billion. I told her to go down to the casino where they, at least, would give her free drinks and a breakfast.

Once again, without Central Banks creating money and credit, there would be no way to fund the losses.

4 feet of snow here at least.

should be re branded the 666max.

737 PRO, Tim Cook suggested.

Ba has additional problems!

737 Max “Fix” Causes Entire Computer System to Crash

https://moneymaven.io/mishtalk/economics/737-max-fix-causes-entire-computer-system-to-crash

It’ll only take one more 737 MAX (or whatever else you call it) crash, for the public to wise up.

The problem with the “change the name” approach is that; if the newly renamed 737 Max gets in an accident or even gets enough bad publicity for other reasons like the ongoing repair struggles. The Boeing name overall, can become tainted. Already before the whole fiasco, many websites that compare all the available flights for you; would list next to each available flight, the plane for that particular flight. If the name changes, many people might have to remember about, which models they have to avoid. This leads them to look up which Boeing planes they need to avoid, that could lead to many problems.

One thing Boeing might want to do is rename the 737 “Not Max” to distance it from the 737 Max. After the repairs are done though, Boeing could rename the 737 Max to something like the 737 Max 2020 to distinguish as a revamped plane, but, not taint the brand; this could also help out, with the fact that not everyone is aware that all the 737 Maxes are being repaired.

In my typical snarky manner I suggest a rename to 737-SAFE. After all, perception is everything.

Lisa_Hooker,

That won’t work. That name – SAFE – has already been taken in an even snarkier manner by China’s State Administration of Foreign Exchange (SAFE), the regulator under the State Council that is supposed to regulate foreign exchange market activities and manage the state foreign-exchange reserves, you know, by keeping them safe.

It worked for ValuJet -sorry AirTran…

George Carlin did a masterpiece routine on euphemisms…

He didn’t attribute them to good will trying to dignify anybody.

Corporate turds…as the old Soviets used to joke of their mammoth bureaus: a septic tank where the biggest chunks rise to the top.

“Patient” in a medical sense could be considered a gerund. They are called patients because – well how long did you last sit in a waiting room? “Is a” patient as opposed to “is” patient. It’s a slow morning.

Well, it kinda worked for Windscale, Sellafield and now THORP (The Great White Elephant of Nuclear Power).

Every time a leak to the environment from that plant becomes public knowledge, the name will change.

They better start with changing the “737” name altogether.

Today there is a rumor that a 2009 737-800 crash in Netherlands was caused by similar problems. Boeing and FAA pressured the Dutch investigators not to put too much emphasis on their verdict that the blame was primarily with the Boeing design/training and instead blame the Turkish Airlines pilots. There is discussion about how much influence Boeing and FAA had on the final report (wouldn’t surprise me a bit given the outsize influence of US authorities over here), but it sure looks like the 737 MAX isn’t the only 737 with problems.

Yes, the NYTimes published an article Jan. 20, 2020 titled: “How Boeing’s Responsibility in a Deadly Crash ‘Got Buried’”

A faulty altimeter caused the automated throttle to go to idle while they were trying to land the plane.

I guess Boeing doesn’t believe in having backup sensors for any of its new planes with all the automated flight control sensors.

Tote up more billions in long-term capital destruction to the corrupt ideology of Jack Welch and his GE MBA spreadsheet-jockeys, and the myopic Wall Street creeps who enable them in the name of short-term greed.

Agree. This share holder is very disappointed in the BOD choice of a new leader.

I’m leary of anyone from GE. The 737 Max program launch was approved by McNerney who came from GE. So now they turn to another GE business guy to fix it? Unbelievable….

Boeing stock is going to end up like GE stock.

Boeing stock has some similarities but also some big differences from GE. Boeing is more “utility-like”.

Boeing has an installed base an virtually no domestic competition. It will basically be bailed out some way come hell or high water. The stock hasn’t been hammered yet because people believe this. It still might get hammered.

Boeing must survive somehow.

They still probably have the best technical people. Their management has been stinking it up for about 20 years now.

(by the way, partially due to GE management methods!- check on the former CEO)

Hi Wolf.

Hope this question is not too late on the thread.

f things get really catastrophic for BA:

Do you thing government will do a GM / AIG type bailout?

What will a huge drop of the price of BA stock, if it is allowed to happen, do to the various indices? Can the Dow remove and replace it in the Dow 30 etc. during a halt? What would that do to the indices?

I think it’s too early to think in those terms. When GM went bankrupt, it was a penny stock and it couldn’t raise funds. Boeing can issue $40 billion in new shares at a big discount, no problem, though that would cause its shares to crash. But it would give the company enough equity and cash to get its problems sorted out and return to health. GM waited too long and then didn’t have this option. So as long as shares are this high, or anywhere above $50, Boeing can raise new funds and won’t need a bailout.

It is insanity…

$43 billion in stock buybacks.

Boeing could have designed three entirely new airframes, from the bottom up and fully tested, and be set for the next two generations with an awesome product line with that kind of money.

Instead, they cut corners on a 40 year old design.

All to pump their stock price.

They need to go bankrupt.

The past 10 years of executives need 100% clawback of every bonus and stock option.

Then they need to go to jail.

And only engineers in charge from now on.

“Putting a priority on financial engineering over actual engineering can get very expensive.”

Its just like the “investment banks” rolling the dice each year, pulling out as much money as they can at the end of the year in “bonuses”.

Then, one year, things blow up and they get a government bailout.

Stock buy backs and large partner capital draws should disqualify those entities from any government assistance. IMO.

Some credit to the namers of the plane. It is MAXed out to its limit … and beond.

The 787 has cost Boeing about $35 billion so far, give or take a billion, but many of the technologies piooneered in it had to be developed almost from scratch and some of them have been reused (for example in the 747-8). A completely new narrowbody using similar technologies would have cost them in the $12-15 billion range, but it’s something they could have sold for 30 years with relatively cheap upgrades (re-engining the A320 cost Airbus about €1.5 billion).

In fact Boeing had just that kind of aircraft in the works (codenamed Yellowstone 1) but Boeing executives panicked when they learned Airbus was re-engining the A320 and hence devised a solution nobody really wanted because it felt like the copy of an already far from optimal solution: to get the most out of the present generation of narrowbody engines such as the LEAP-1 both Airbus and Boeing would have needed to either heavily redesign their products or design a completely new aircraft. In particular both aircraft would have benefitted from a completely new wing to increase fuel and maintenance savings, but wing are expensive and time-consuming to design, and even more so to integrate into dated designs.

Please note that at the time everybody knew Airbus was stretched thin: the complete A350 redesign (XWB) was swallowing resources Airbus could barely afford. Even if the Yellowstone 1 had been two/three years late the fuel and maintenance savings alone would have had airlines lined up in front of Boeing’s doors.

Jack Walsh and his chums have much to answer for here, especially to future shareholders: Airbus has already started to design the A320 successor (finally I may add) and Boeing’s response has been slow and clumsy. All they could come up with was buying Embraer’s civil aircraft division: I really hope these idiots’ don’t think they can just “stretch” the E-Jet and call it a 737 replacement.

They have learnt from the banks…they are too big to fail

This is why antitrust law enforcement needs to return with a vengeance.

The system only works if nobody is too big to fail.

“the system only works if nobody is too big to fail”…..yes, and nobody is too big to jail as well.

“And only engineers in charge from now on.”

Oh, dear God, no. As someone who spent a considerable portion of his life working for engineers I cannot think of a worse fate. Engineers are great, but they cannot run a company for any length of time. The best of them are detail oriented, micro-managers, incapable of making a quick decision, and hopeless at selling their product or customer service. They, like artists, need to be allowed to create something other than the chaos of running a business.

On the other hand, anyone (or organization) running a company whose business model requires engineers must be able to work with them and understand them. That’s pretty rare.

I heard Larry Kudlow say the Boeing mess will cost us 1/4 point on our GDP in the first quarter. The fact they already know this is not good for Boeing going forward. I see another bailout/takeover coming.

P,

“see another bailout/takeover coming.”

Considering how very few major defense contractors there are – and how they mainline dope/campaign donations to DC,

they are too-DC-to-fail.

This used to be a country with a future once, not so very long ago.

Govt contracts are no longer awarded on good design, performance, or reputation. They are awarded to the lowest bidder. As long as you are the cheapest, you don’t even have to perform. I’m not kidding.

Lowest bidder. Is that code for highest campaign contributor?

I beg to differ. I guarantee $100 per toilet seat wasn’t the lowest bid.

We now have the worst of both worlds: highest cost producer (thanks to corruption and cost+ contracts), with lowest quality results: ladies and gentlemen, I present the F35, the program that will bankrupt not one, not two, but *three* branches of the military all by itself.

Lowest bidder is how we ended up with $500 hammers.

I have some experience in that. The stuff and services that ‘you and I get’ is indeed lowest bidder, because we don’t deserve better on account on the ‘what have you done for me lately’-rule.

Military contracts, exempt from procurement rules and public scrutiny, following the ‘WHYDFML’ are never ever the lowest bidder.

For those there are millions invested in trials and pre-qualifications in nice locations where vendors can ply the contract evaluation teams with ‘incentives’.

That the selected product doesn’t conform to requirements (or even work) is an added bonus because then the chosen contractor can extract millions extra in change requests and rework over the lifetime of the contract, which can even be extended to ‘solve the issues’.

The F-35 project represents the pinnacle of Defence Procurement Skills. It will be surpassed. Because no consequences other than meaningless numbers in Zurich accounts will be given to those responsible.

Oh – and –

These special skills are leaking into civilian life too and becoming ‘commoditised’. SKANSKA have acquired some ‘good moves’ lately, with f.ex. Nya Karolinska Sjukhuset going from a budgeted 16 Billion SEK to 61 Billion and once it is ‘done’ a.k.a. the money is finally shut off, there will be no staff there because they are sacked to pay for it all!

Different version of ‘Bread & Circuses’ but that’s what it is.

PS –

We should be happy that they are building weapons that don’t work, in wartime one builds weapons that does work! Those rip-off procurements are a sign of Peace :)

ALL the dozens of guv mint contracts that the company I was working for bid in 2016 were based, first on a seriously tight application to be able to bid and second on the low bidder from that select group that had already qualified.

OR, if straight out open bid, without the prequalification process, they were awarded on the basis of “Best Value” to the guv mint…

After over 50 years as an estimator and project manager in the construction and restoration industry, I consider the federal contracting process to be the most open and fair, though many states now have equally good systems in place.

And to be sure, as in any such system, there are bound to be corrupt individuals acting only in their own person short term interest.

So some bad engineering by a couple of people will be the reason for QE 5

It was actually a systemic problem. They broke *several* rules of engineering, such as “Don’t design single points of failure into a safety critical system”. They didn’t even use both of the angle of attack sensors to actually determine the true angle of attack. It’s also a terrible idea to design a system (MCAS) that seizes control of the aircraft from the pilots.

https://www.engineeringforhumans.com/systems-engineering/737-max-a-failure-of-systems-engineering/

I could go on, but it’s not just one or two klutzes who made one or two mistakes, it’s an entire company that forgot what it means to be an engineering firm.

You could just hang a piece of string from the cockpit roof to tell you the attitude. You see the pendulum you are nose down, it goes out your peripheral vision you are nose up, if it is crumpled on the ceiling you are upside down :)

Thank you….I totally agree. The self preservation in the cockpit is vital.

The really big screwup was not including the new MCAS in the MAX flight manual, all to avoid expensive pilot recertification.

If you flew the old 737, you could fly the MAX with an hour king iPad training session.

300 people might be alive if recertification was a requirement.

The punitive damages will or should be severe, but like everyone here says, BA will be bailed out one way or the other.

Hour LONG. Damn autocorrect

re: “You could just hang a piece of string from the cockpit roof to tell you the attitude. You see the pendulum you are nose down, it goes out your peripheral vision you are nose up, if it is crumpled on the ceiling you are upside down :)”

I take it you’re not a pilot:

https://www.youtube.com/watch?v=V9pvG_ZSnCc

MAX and stock buybacks should be outlawed!

Outlaw buybacks and the market will fall at least 50 pct – retail investors have seen too much sh*t in their time – and are too close to retirement – to provide price support at PEs of 25 plus.

Don’t worry, if the market tanks and people lose their retirement savings, the government will bail out the big banks again.

/sarc

The Boeing stock price continues to ride fairly high, trading at 10x the 2009 lows (i.e., 1000% gain). I guess the whole experience reinforces the thought that Boeing is too big to fail and has a guaranteed income stream, no matter how faulty their aircraft is.

Yes the stock is still massively overvalued. I might start looking at BA if the price dropped to $50.

I wouldn’t lend to them below 30% rate.

there’s plenty other attractive investments available today.

My late dad worked at Boeing from the late sixties to mid eighties. He has at least one patent that i know of. Dad worked on the 727,757,767 and also designed an actuator which operates a gravel deflector plate/shield on the nose gear of the 737-100/200 gravel runway landers.

He was an old fashioned german slide rule guy. I think he’s turning in his grave .

He’d be happy to know those gravel landers are still used, chiefly in Canada because there are no real alternatives: the Antonov and Ilyushin that regularly fly overhead here are not really built for Western tastes.

have JP Morgan lend it to Boeing .2 over the Repo rate…

and then have JP go get it from the Fed.

A lock.

Same old story over and over again…….Joe starts a business in his garage……builds it up, his son John runs with it and makes it a multinational, grandson runs it and makes it dominate, then for whatever reason no kids or kids that are not interested………the professional management takes over…….at first with several family members on the board its OK……they get old and the stock is diversified pursuant to financial advisers (who want to trade and create fees) so the financial management better known as thieves take over…..never building any reserves……issue millions and billions of options they say they need to make themselves do a job paying 100 million per year and giving a few to all employees so they keep their mouths shut…….letting labor take whatever since they will be gone before the music starts…….buying stock to drive up the value of the stock and more importantly the options…….bail out……..company goes down the drain…….hahahahahaha. Government stuck with paying the pensions and unemployment….welfare and reeducation.

Executives should have to sign an agreement that if the company has a major issue within twenty years of their time they are personally liable.

In the army if a problem surfaces within a unit of men the commander is responsible no matter what it is…..his career is over. So few problems are found due to commanders spending whatever time and energy it takes to make it work right.

Fred:. Your theory is known by the expression of “ashes to ashes in 3 generations”!

Good description of Motorola from mid-90’s onward.

It seems unlikely that the 737 MAX will ever be as safe as other planes, it’s inherent instability is too great. Possibly with a lot more training.

It came out late this week that the 777-X, their new long distance plane, may have the same inherent instabilities, they took a similar upgrade approach as on 737 MAX.

Rubbish.

Once fixed it will be one of the safest planes in the sky due to the high level of scrutiny it is getting.

Truth is, the airlines need the economy this plane offers.

Remember, several 727s crashed shortly after they were introduced and it became a very successful aircraft in time. Looks like this one will be similar.

I’m more concerned about the new CEO’s ability to fix Boeings other programs like the tanker.

Stability is important in aviation. The classic 727, like a Cessna 150, could fly itself when trimmed ( small adjustments made by hand )

The 737-max is unstable because of the forward engines, in order to use an auto-pilot, constant pressure is required at the tail to keep the nose up, so they added a flap up front just one for the negative feedback-loop, and that ‘MCAS” failed. The problem is since 2007 self-flying aka BUAP ( boeing un-interruptible autopilot ) is/was more important than making money, as civil aviation had become a weapon in the hands of GOV. Class auto-pilots worked, because the planes flew themselves as they were ‘stable’. Then this non-stable airplane arrives, but they push the auto-pilot into control; Where no auto-pilot was designed to control a non-stable aircraft, which led to a ‘hack’ of feedback surfaces with no redundancy.

But I agree with ‘old eng’ planes that fly, are ‘stable’ that is basic aviation engineering, they should have redesigned a new super-efficient plane from scratch, they didn’t they cut corners, they didn’t listen to the engineers. The GOV should go public with BUAP let them know that it was CIA that caused the planes to fail, because of their obsession with “Return to Home” BUAP top-secret control.

Much of this happened during time Boeing was moved from Seattle to Chicago, once in Chicago the bean-counters could do as they wished, the engineers just wrote condescending emails that are now coming out.

Boeing relocated to Chicago. In Illinois. The epitome of financial “engineering.” Never pay today what you can put off until tomorrow. Don’t fix it unless it’s falling apart.

I am Boeing, and I approved this message!

“Once fixed it”

If you believe it can truly be fixed at an economically reasonable cost for Boeing.

I wonder if it’s like trying to fly a bucking bronco?

I can picture the pilot and co-pilot crashing about in the cockpit trying to hold onto the throttle fighting to steer it while flicking levers and pushing buttons.

More tiller Scotty — MORE TILLER!!! Reduce speed, no no – more speed she’s stalling, now she’s climbing too steeply!!! Reboot that new software!!! I can’t my hands are full. Call the purser to help.

Ka-dunk.

I have devised a solution to the Boeing funding problem:

1). Fed creates a special Repo Desk for Boeing. It will be called The Boeing Repo Window.

2). The Fed will provede complete and total unlimited Repo Credit on the condition the Repo Credit use is only for: A: Stock Buy Backs. B: CEO Bonuses and Stock Options. C: Management Bonuses and Stock Options. D: Additional mandatory requirements of wage and benefit reductions, and employee layoffs, to be implemented immediately.

Because this time really IS different…

The Fed has discovered a way to print money that mostly only goes to the rich, thus sterilizing inflation….and so allowing it to pursue such policy for much, much longer time than previously experineced….because….THIS TIME REALLY IS DIFFERENT.

It must be nice to have a gilded central bank window you can get 0% loans from no matter how many people you kill in plane crashes.

Not for us middle class people, though.

If it was for everyone it wouldn’t be profitable. The times when you could grow your economy ‘organically’ by exploiting ‘externalities’ (ie destroying the environment) are long gone. At the macro (global) level, the economy is always a zero sum game. The only time when all boats were lifted was when exploiting and consuming the environment was cheap and easy. (all human actors profited for a while)

Now it’s.. wolf eat dog (?) time. (or something like that)

it’s not the 737 max that Boeing only problem. They are also almost ten years behind on the replacement for the usaf Kc 135 refueling plane. the military higher ups have grown tired of the delays and have threatened Boeing

In the meantime Italy and Japan are perfectly happy with their tanker conversions of the old 767… developed by Boeing!

The KC-46 is the kind of “FRED” (Fantastically Ridiculous Economic Disaster) defense program one would read about in a satyrical magazine: just think about the cargo locks coming unlocked in flight. This isn’t exactly new technology: it dates back to the 50’s. But somehow they got it wrong. Contractor with zero experience in the sector? An attempt to reinvent the wheel? I’ll let the GAO decide.

In the meantime the penalties slapped on Boeing have already passed $2 billion and keep on ticking forward…

Financial and equipment Engineering is as old as the books.

I once worked for a multinational multi billion dollar engineering company.

The CFO told us :

(a) wars are great – we get to sell the same equipment for than once to the same customer.

(b) don’t ever think we are in business as an engineering company – we don’t make much money out of the equipment itself. It’s the setting up finance, share of interest rates, extortionate maintenance rates, lease back and share of operating profit we make the real money.

Year of discussion? 1973

Great story!

But… was that philosophy sustainable? Are they still in business today?

Seriously, Boeing’s income statement requires a PhD to understand all the actuarial assumptions. It’s a joke.

It is not hard to see how a financial engineering firm can quickly forget how to engineer!

GM did the same thing, I think by 1980’s they were making 3% ROI making cars, and 15% selling credit cards to plebes. (GMAC – I think I remember one of my credit cards back in the day covered by them )

Then by late 1990’s GM was toast, not a finance company, but not an auto company either.

Same today with Boeing, not a designer of quality aircraft, but not trusted fiduciary either.

Too bad really, well not bad, just bad for all those people in Renton that lost their jobs.

Correct.

If old fashioned engineering companies hadn’t turned into marketing and financial engineering companies years ago I doubt whether they would be still in existence – German Luxury car market as an example.

In the old days the engineers would design a product, perfect it and then go to the marketing department and tell them to sell it.

Now the marketing department go to the engineers and tell them to design something by a set date. Product is released to market ready or not.

PS. You should write “no pun intended” after the word “fallout”!

Boeing’s government/military contracts. Is there any way those sources can keep Boeing afloat? I foresee the creeping carnage spreading right through Boeing’s supplier chain to accelerate and turn out to be too big to prevail. Watch out below, Chicken Little, you just might be right this time!

Excellent article and some illuminating comments, especially from KSFO. However, there are a few points left out. The pride of past generations of Pacific NW Boeing employees was discounted as Boeing also played one assembly location against others, all in an effort to break the Machinist Union. From Wiki:

“In 2011, the National Labor Relations Board filed a federal complaint against Boeing stating that the company broke the law retaliating against Boeing workers in Washington for exercising the right to strike. South Carolina’s low unionisation rates, the lowest in the country at 2.7%, were stated by Boeing management as a reason to transfer production to there.[8]

Since then, Boeing has continued to challenge the rights of unions to organise at the plant,[9] [10] and is alleged to have fired workers for their attempts to unionise”

A profitable manufacturing enterprise is never enough for the money grubbing bonus class (called senior management), they have to grind out ever more. And when this wasn’t enough, they played loose with both the design and certification process knowing full well their design was unsafe before releasing the aircraft onto the flying public (and their families).

And then, going even beyond union busting and share manipulation/buybacks, they enlisted the US Govt to impose 300% (292%) tariffs against the 737 main competitor, namely, Bombardier’s Class C. Bombardier spiked the lawsuit by selling 50.1% to Airbus, where much of the aircraft would be assembled in Alabama while the lawsuits were pending and continued Boeing manipulation would restrict sales. (The C Series is also still produced and assembled in Canada.) Bombardier Class C is now called the Airbus 220, and customers seem a tad more pleased than the buyers of the 737 Max.

In the end, the International Trade Commission struck down the biased and protective tariffs.

From a CBC article:

“Delta Air Lines said it was pleased with the ruling and called the Boeing complaint an “attempt to deny U.S. airlines and the U.S. travelling public” access to the Bombardier C Series.”

Boeing forgot it was in the plane building business, and acted like it was in Private Equity firm with government connections and clout. Apparently, the new 777 has some of the same problems as the Max. You know a company is in trouble when it takes tariffs to help it survive. It’s something both Boeing and Wisconsin dairy have in common. And…US steel, aluminum, wine, auto manufacturing…..

regards

I have had the pleasure of flying the C-series (A220) on several occasions, direct service on Delta between Seattle and Houston, the plane was quiet, comfortable and thoroughly modern with large windows and comfortable coach seating. Boeing’s attempt to have this plane program derailed was a disgrace, really a sad chapter. The shocker is Air Canada is still a Boeing customer, I guess there is a really long line outside the Airbus sales office these days.

Boeing is GOV, when it was moved from Seattle to Chicago, the GOV-MOB took over the company.

The CIA forced in the Boeing-BUAP program (2007), and the pilots went nuts.

A large reason for 737-Max was to make the pilots think that nothing had changed, even the changes weren’t documented as we now know.

100% of the demise of Boeing is the move to Chicago, the Machinists had been doing what they do since the 1960’s ( unionizing/striking/getting more-money). There were still some of the most respected team of machinists in the world. Made everybody in Renton middle-class post ww2

DAL stock has been doing well. They don’t fly Boeings.

Correction: Boeing is about 50% of Delta’s fleet, but they haven’t bought any Boeings in the past few years.

These 400 parked planes were to bring in about $135 million EACH to Boeing? Either Boeing has to fully convince the world these planes will be safe and problem fixed (good luck with that anytime soon) or the value will drop to scrap. There is no in-between. I’m glad I don’t have to fly anymore.

Convert the Maxs to freighters, give the two men crew ejection seats, and like fighter jocks they can eject, when and if needed.

No passenger’s lifes are endangered. Snark?

Boeing reportedly dropped the price down to $22 million an aircraft, for Southwest – I think. No way those max’s are selling for $135 million.

How can an airplane you are not allowed to fly be worth more than $0?

Scrap value lol Let’s da boys go to work with pliers and a blowtorch

The only place these planes will be in use is in South America.

The total number of grounded 737MAX at last count (18 december 2019) stood at 717, including both delivered an undelivered aircraft.

Aircraft are rarely, if ever, sold for full price but both airlines and manufacturers tend to keep the real unit cost close to their chest: that’s another way to help inflate share price. Stock market jockeys love aspirational full prices.

Ryanair has already stated they are “ready” to order more 737MAX over the existing order for 175 but they are bidding their time. Why? Because they are grabbing Boeing by the ankles and shaking them for pennies, not just with the aircraft themselves but with contracts for parts and training. And that’s on top of the penalties Boeing is already negotiating with customers such as American Airlines and Turkish Airlines.

When all is said and done Boeing will be lucky to break even on these large MAX orders placed post-groundings. Very lucky.

Some companies, like Ryanair, will make a lot of money out of all this once this fiasco is “fixed” (with a low cost BS fix such as renaming the plane). Investment opportunities?

Doesn’t Ryanair own a lot of young 737 which they sell after a few years. It is not that they would lie to increase the price of second hand 737

Jeopardy two part question

What do BA and some of the great retailers have in common.

Part 2

How do they differ?

Both had chief executives who did not realize that the barrel of the gun of stock buybacks was pointing back at themselves

BA is a major defense contractor whose management fudged the books to hide their incompetency,while some of the great retailers were just incompetent

The perfect example of buying back stocks in an overvalued company, will eventually be exposed by its weaknesses. The emperor wears no clothes.

We can blame cuts to government programs as a partial cause for Boeing cash flow problems, in more ways than one.

One reason Boeing is having a cash flow crunch, is because America has a Small Government. We’ve spent to many years cutting government that works for us to the bone, and so many government workers and regulators, we don’t have anyone to handle inspections for Boeing is a timeframe to help Boeing:

“Some Wall Street analysts believe Boeing can deliver 25 of the stored airplanes a month. Analysts typically gain some guidance from Boeing’s Investor Relations office before publishing a note. However, a person with direct knowledge of the plans says the FAA has only 10 inspectors, who will work Monday-Friday from 8am to 4pm. LNA has one report that the FAA now has arranged for 50 inspectors, but the person with direct knowledge can’t confirm this.

The planes each will have to go through detailed inspection after months of storage. Test flights by Boeing and the customer are routine. Squawks identified have to be resolved and, if necessary, an additional test flight performed. The entire process, called flow, normally takes about eight days, LNA is told. With the FAA assuming control on its own workday/weekday schedule and with only 10 inspectors, the flow could increase to 13-14 days per airplane.

“It will take well into 2022 to clear the inventory,” LNA is told. “The process will really be slow. Boeing’s reputation with the FAA is damaged.”

“because America has a Small Government”

The US does not have a small government. It has a huge government – over 2 million federal civilian employees and then add the military, intelligence agencies, legislature staffs, and all the contractors. And throw in state and local for good measure.

What the government does not have is job performance accountability. As is obvious from the Boeing situation both from the engineering inspection viewpoint as well as the criminal financial enforcement viewpoint.

More an issue of the Priorities of the government workers, than the number of workers. A leadership failure.

Joe,

I wrote:

“America has a Small Government. We’ve spent to many years cutting government that works for us to the bone…”

I should have clearer the part of Government that works for us, IS SMALL.

The military, spying on American citizens, war industry…is the HUGE part.

The part of government that works for us? Small….small….small.

Gotcha.

A great book about government agencies and public services is The Fifth Risk by Michael Lewis.

Among the sectors where cuts will impact public safety and national security are in the Department of Energy (keeping track of nuclear threats around the world is only by one example) and Department of Commerce (weather services, i.e. tornado alerts, navigation, air traffic, agriculture).

Brace yourselves.

I’ve read the book and as always goodwork by MLewis. Remember… You don’t know what you don’t know.

To be fair to Boeing, they didn’t do a cleansheet design because their customers didn’t want it. Southwest’s entire business strategy revolves around their pilots having the flexibility to fly any plane they have, thereby minimizing training costs. Which is why they only buy 737s. Reportedly, Southwest told them in no uncertain terms that they wouldn’t buy a cleansheet design as it would break that commonality in type rating and pilot training.

Even in the current MAX contract, Boeing agreed to pay Southwest a penalty if the FAA ended up mandating simulator training for 737 pilots to qualify to fly the MAX.

Of course Boeing should have had the integrity to tell their customers the truth: that the 737 design was stretched to the limit and stretching it further would increase risks and drawn a line in the sand.

But there’s plenty of blame to go around to all those pearl-clutching airlines who were very aware of the 737 design limits but pushed Boeing to do another stretch anyway in the pursuit of cost efficiencies.

Not quite – Boeing didn’t have an answer for the A320 Neo, so when US carriers started ordering it, they rolled out a band-aid.

Boeing didn’t want to lose a sale. Plain and simple. Fits right in with the financial engineering culture.

Call me old fashioned, but I blame the regulators for not doing their job, and Americans who don’t support vigorous government regulation and full and generous government funding to achieve that safety. Oh, and the CEO should be in jail right now awaiting his trial for manslaughter like other non VIP Americans are.

I happen to agree with you. FAA regulators have been asleep for decades, outsourcing most of the task of certifying a new aircraft to the manufacturers themselves. They should have seen the 787 as a warning: if you’ll recall, the entire global fleet was grounded within a year of EIS because of faulty batteries that were catching fire. Fortunately, they weren’t critical batteries, there was no crash or lives lost, and the batteries were switched out for an older, safer (albeit heavier) design. That was God warning Boeing and the FAA. They never heeded it. And now we’re at the MAX mess…

With that said, there is also evidence that Boeing hid critical information and perhaps outright lied to the FAA about certain things. (I recall initial reports saying that the FAA allowed the certification because Boeing said the MCAS software was only allowed to change the pitch by X degrees, but in reality, they had programmed it to allow a much higher change, or something like that. They never notified the FAA of the change to the software. This wasn’t a bug. It was a deliberate design change that was never communicated to the regulator).

Good points, Lune.

What got me, is when the CEO phone called POTUS and asked him to lift the grounding of the 737. At that point, there is no way the CEO could not have known of the issues and flying 737 risked casualties.

About the same time Boeing CEO made that call, a Regular Joe like you & me, was sentenced to prison because his reckless driving of his car killed 4 people.

He was charged with manslaughter which is not murder, but unintentionally causing death/harm thru recklessness, I think.

Southwest is in bad shape. They will have to start flying other aircraft types as the MAX is the end of the 737 family.

They’ll get over it.

Even now Boing is talking of only a re written software fix of Maneuvering Characteristics Augmentation System (MCAS) + possibly multiple sensors instead of a single sensor for activating MCAS.

Boieng not addressing vital un airworthy physical design engineering issues!

Atleast Why can not Boeing spend their money to train all 737 pilots of all 737 Max purchaser airlines at Boeing HQ at Boeing expenses ? (before re launch)

No sir it will cost a lost of money.

They are rather willing to drop the price of sitting unsold inventory. So many airlines went with max only fleet or many max aircrafts & incurring millions of $ in cut schedules & temp leasing of aircrafts from other firms. Those pending loss claims have been accounted for ?

That’s all they can do. The 737 is such an outdated design, if you actually start making physical changes to the plane, you’ll end up with a rat’s nest of cascading problems. It’s like an old car held together by duct tape. Take one piece off and the whole thing can fall apart.

When (not if) they decide to throw in the towel and decide to address the design deficiencies that made the MCAS software necessary in the first place, they’ll start with a cleansheet design, because that will be far cheaper than compensating for all the deficiencies of the 737 design.

boeing could ditch the low earth orbit pony rides and recycling ventures, toss the complementary design software that came w/the program/mers package, and design aircraft that doesn’t require a fix of any kind to make the first statement true. now that the faa has publically taken charge of the approval process, should they allow the plane to fly/crash again, what would the statement read like? like to hear about any approval/testing process for remote programming allowed, a la that new Chinese car co.

Boeing has “belatedly halted the share buybacks”. Turn those machines back on, Mortimer!!!!!!

Boeing thought that they covered all the bases when they designed the MAX 8. Software making critical flight control decisions in the cockpit? Yes, really.

Captain Sully spoke out about planes that want “kill you“ when referencing the SAS flight 751 incident. Just like Sully and Skiles, the SAS pilots were able to land their MD-81 in a field, and all on board survived. An “in flight” control system that was totally unknown by SAS piloting crew called Auto Thrust Restoration (ATR) kept overriding the pilots manual inputs causing damage to both engines causing them to flame out and disintegrate.

In its effort to save money and automate flying, Boeing designed yet another flight control system wresting evermore control from human pilots and turning said control over to an imperfect machine for critical decision making. This will be why driverless cars won’t scale up considerably.

Not sure it was Boeing, I really think it was Serco ( RCA-UK ) that designed the Boeing-BUAP with Honeywell that pushed for the automated flight control.

Their goal was to eliminate the pilot all together. I think the joke around was the 19 year old MIT engineers were better pilots than guys who have 100,000 hours on their belt.

Build stable airplanes that can fly themselves and a moron can write the auto-pilot code, but when you have non-stable aircraft, you need a human at the controls.

Like AI, they still don’t have the ‘human hand’ mastered, it will be decades before robots can have the dexterity of a human hand.

…

Yes, the people who died in the 737-max cases was because the pilots didn’t know how to turn the auto-pilot off, nobody had told them and Boeing hadn’t even documented it, they had told everybody “Its just like flying a classic 737”. In the USA the pilots by grapevine had told each other how to disable the auto-pilot (MCAS), but in the foreign country’s this topic is national-security, even the mention of MCAS or BUAP you could lose your pilots license, which is why so many foreign pilots didn’t know, but most western pilots did know. Had the foreign pilots known, they might have refused to fly.

The military will continue to push for self-driving vehicles and self-flying planes because they have BOLO envy (see the classic sci fi stories by Keith Laumer) and want something that can inflict human casualties without sustaining any.

Unfortunately, the next step in AI isn’t artificial intelligence, it’s artificial insanity. Faulty or unexpected inputs + faulty logic –> fatally flawed AI decisions. Just ask whoever got crisped in the latest TESLA “autopilot” accident… if they survived.

I have a better idea.

Instead of borrowing more money, just call the Fed and ask them to print off 10 billion — no make that 20 billion as it’s not worth getting out of bed for less than 20.

The Fed will pass that along at 0% interest with no repayment requirement (cuz the Fed doesn’t want Boeing to collapse…) so essentially it would be a gift.

I got this idea from the WeWork fiasco. When faced with huge loss of face, and possible implosion of their main fund, because WeWork was running out of cash to throw on the massive bonfire, Softbank gave Adam a billion + dollars to cede control and ride off into the sunset.

I am confident that a similar strategy would work for Boeing if they just rang up the Fed and explained the big picture.

Phone Number: 1-202-452-3000.

Or since Boeing is in such dire straits, here’s Toll Free option : 1-888-851-1920.

I’ll send the bill for my consulting fee shortly.

Oh, and removing the word MAX – is not going to solve the problem. Most people will avoid buying tickets on that aircraft now, no matter what the name.

Imagine if they do get this thing off the ground again – and there is another crash. Heaven forbid.

Yep. Just print. Wait till the tax payer is no longer needed. Things get interesting, then.

Dear Jack (Welch),

Thank you for the blessings that your management style has bestowed upon the great corporations of America. The latest one to fall victim to your proteges is now apparent to all. Jimmy McNerny has done a great job in his effort to fell two companies in a roll, I think in this effort, he has even managed to surpass your immediate successor, Jeffy Immelt.

In all seriousness, may be Boeing need to split itself up again, after all, the defense business is more crucial to the country than the commercial airlines business. Right now, it is nothing but a drain on resources, and thanks to the mismanagement of McNerny, Boeing might no longer have what it takes to right itself.

If Calhoun has any guts, his first step is to cut the dividends, the second step is to cut the salary of himself and the board down to $1, the third step is to beg the unions to help management make sure Boeing doesn’t go down in flames. Then he better hope the Feds will bail him out with enough defense contracts to keep Boeing afloat, cause it’ll be 5 to 10 years before the next new commercial airplane comes out of the company. Hopefully it’ll be a clean sheet, and not the 787-11.

Here’s a chilling thought:

Boeing right now is only producing *1* plane: the 787. The 737s have ground to a halt, and the 777X is delayed by at least a year. The last passenger 747 was delivered a few years ago. Literally the only plane Boeing is selling right now is the 787. And even there, quality control issues have surfaced at their South Carolina plant…

Meanwhile, Airbus, supposedly on its deathbed due to the A380 fiasco, which was never supposed to compete because, you know, European socialism is never supposed to beat rugged American capitalism (with large defense subsidies sprinkled in), is selling every A320/1, A220, and A350 it can produce. Plus it recently announced the A321XLR which is putting a nail in the coffin of Boeing’s so-called NMA, a project to replace all those aging 767s that airlines have been begging for while Boeing delayed and focused its capital on share buybacks.

It is entirely possible that Boeing, now hamstrung and unable to start the NMA in a timely manner while dealing with the 737 crisis, may lose the mid-market for this generation. No one with a fleet of aging 757s/767s in their right mind will wait for Boeing to do a cleansheet design when Airbus has decent replacements ready. And once they’re replaced, they’ll be good for another 20 years. Additionally, the 777X, while smaller than the A380, may *still* be bigger than what most airlines want, and will likely be far less successful than the original 777.

IOW, Boeing’s strategic decisions in the past 5-10 years would have put Boeing on a downward path regardless of the MAX fiasco. So much for management. How much you wanna bet though, that when we stand over the wreckage of another American icon, mgmt will try to blame those greedy unions?

(And on the defense side: just look at the KC-46 tanker fiasco, which landed one defense dept. official in prison on corruption charges, and is years behind schedule. And that’s just a freaking modification of their ancient 767 platform. But Boeing’s incompetence spreads beyond its aircraft. They were the lead contractor for the NRO’s next-generation constellation of spy satellites. The entire program had to be scrapped thanks to Boeing’s inability to deliver. That program has been called one of the largest failures of government acquisition programs in history. A cursory analysis of what constitutes “typical” program failures shows just how big a distinction that is.

With all that said though, in a few months, I’ll probably buy some Boeing stock. Hell will freeze over before the government lets Boeing face the “creative destruction” side of capitalism. No major defense contractor has ever gone bankrupt, even when their systems don’t work, their prices ripoff the American taxpayer, and their corruption lands officials in jail. Just ask Lockheed.

Defense work isn’t about defending this country, or else the WTC would still be standing. It’s a jobs and pork barrel program. And every district with a Boeing or supplier factory in its district will ensure they have access to as much taxpayer money as needed to continue to limp along, building planes that fall out of the sky, spy satellites that can’t see, and other make-work programs so inane that it would make a socialist blush.

America has a Small Government

c,mon, man. do you REALLY believe that? that is guano crazy imo.

compared to whom? China?

there are negatives that come along for the ride, you know. we know too well what an organized government can do. we are a country that prides itself on limited government. even a scattered and incoherent government! we believe in the individual, and the problems it promises.

i’m no aeronautical engineer, but when i look at the little foils used to indicate position (pitch?) on those planes i’m calling bs. Those passed PLENTY of government regulations. it’s a crime and a failure and a tragedy. and a horrific part part of our human experience that we must, in some way, deal with.

don’t pretend bureaucracy will solve it…

here, look at this “sensor”:

https://res.cloudinary.com/engineering-com/image/upload/w_1600,c_fit,q_auto,f_auto/2019-03-15_11-06-24_j7qnz9.jpg

that is what tells the pilot what his/her “pitch” is (if i’m not mistaken).

I wouldn’t install that on a kite.

i’ve seen too much of it lately.

bureaucracy is NOT useless.

but it sure as f#%k isn’t underfunded or underdeveloped in the US.

if anything, a good purge to teach a lesson to the leaches would be in order.

the people who designed these airplane systems were our “best and brightest ” in terms of engineers. so what are you saying? the best and brightest are really in government regulatory offices?

bullshit.

they’re pushing paper like everyone else.

the problem lies in the heart of our worldwide monetary system where bottom lines DON’T matter. where industries are subsidized to perform at a loss. where lobbyists and governments work hand in hand. where stock prices matter more than profits. where the mainstream media is an editorial for the markets.

what i’m wondering, at the ripe old age of 39, is has it always been this way?

Bungee,

Joe,

I wrote:

“America has a Small Government. We’ve spent to many years cutting government that works for us to the bone…”

I should have clearer. Our govt is large. The part of Government that works for us is small.

The military, spying on American citizens, war industry, etc is the huge part.

gotcha. i was triggered anyways… smh. happens to the best of us.

I don’t know where you got that image, but that is not a ‘stall sensor.’ It is an angle-of-attack (AOA) sensor, and it tells the pilot and/or the automation software that is flying the plane what the angle of the wing’s chord line–a line from the front to the rear of the wing–is to the relative wind. Yes, when the AOA exceeds a certain limit, in degrees, a stall can be induced, but it continuously reports AOA, not just when a stall is sensed.

America- Home of the brave and land of the free turning into home of the corrupt and land of the inept.

How the f… are companies allowed shared buyback just to make C-suite rich while squandering the products and simultaneously screwing employees and customers?

At some point this will lead to socialism in the mistaken belief that it is better.

But we already have socialism. It’s just constrained to the rich and giant corporations. They seem to be doing alright off it…

The buybacks are warping the markets and wagging the dog.this increases systematic risk. Apple alone at $18 billion in buybacks a quarter spends $300million every trading day. This is about five times the budget of nasa. AAPL is regularly 10-12 percent of the weighting of QQQ.

Apple trades around 1 in 20 trades every day based on current volume.

I mean they buy 1 in 20 trades that take place on any given day by dividing average volume in dollars by $300 million.

Boeing is a huge component of the Dow and doing the same thing. Wagging the dog.

Membership in the DOW is conditional. They will rotate at least one slot into a gold mining company in the near future. Boeing could be the company to take an exit.

I searched it. At $22b the nasa buget is around three times the expenditures of AAPL currently buying its own shares.

They are running a bucket shop.

I think I’m dyslexic, Kill me. APPL is bUyInG over three times the budget of NASA in value of its own shares every trading day, not the NASA budget being 3x the expenditures of AAPL. There, I fixed it. Goodnight.

It seems to work for now, unlike with Boeing – AAPL stock hasn’t crashed yet despite spending ever more money on pushing their stock higher instead of doing some real innovation ;)

Fortunately crashing iPhones do usually not cause mass casualties (but maybe they do in the matrix?).

So the stock price went from 35 to 338? I thought this would sell off months ago. I would guess some in the company can’t sell yet. I still don’t get why the stock price is still up here. What’s wrong with profits?

Eli from Montzi might not like the buy back chart. The chart expose the whole market contamination.

Boeing is going the same way as Comet (UK) in the 1950s. Comet was the world’s no.1 commercial airplane maker at the time. Poor design caused crashes, which in turn damaged the brand, and the company went bust in the 1960s. Boeing will be overtaken by Airbus (EU) and Comac (China) by the 2030s. If it’s Boeing, I ain’t going.

re: “Comet was the world’s no.1 commercial airplane maker at the time. Poor design caused crashes”

Not entirely true. The DeHavilland Comet was a pioneer, the first commercial jet aircraft. It was pressurized–one of, if not the first, commercial aircraft–to have cabin pressurization (some military aircraft, notably the B-29, were pressurized). It was the first passenger aircraft to fly regularly in the flight levels–above 18,000 feet MSL–and, of course, flew faster than any piston/prop plane of the time. Because of the repeated de/compression of the fuselage–most humans won’t stay conscious above 12,000 feet for long–the fuselage experienced metal fatigue not seen before (starting at the sharp corners of the passenger windows).

“… a phenomenon not fully understood at the time …”

https://en.wikipedia.org/wiki/De_Havilland_Comet

The Brits, perhaps, got a bit ahead of themselves trying to dig out of WWII debt with exports; in a way, BA and others have gotten a bit ahead of themselves with AI and automation.

“–most humans won’t stay conscious above 12,000 feet for long”

I take it you’ve never been skiing in the Arapahoe Basin at 13,050 ft (3,978 m).

But I get your point about the Comet. Sir Geoffrey de Havilland was a great designer.

The company was de Havilland and it did not go bust, it became part of Hawker Siddeley then BAC, now BAe.

The damage to the British jet airliner industry however was immense and the four years it took to get the Comet back into service in modified form (plus the cancellation of the Vickers VC7) handed the lead to the USA in the form of the 707 and DC8.

AAPL buy 1 in 20. Somebody big must be selling, taking profit. AAPL price in mid 2009 = 175 : 7 = 25. 7 for the split.

BA 43B in buyback for 6Y. Buying from whom.

Mostly from market makers, to keep share afloat, or move price higher.

1) BBD was stomped by BA in 2018. BBD management panic.

2) Micron sold Macron BBD gem, the Cseries, 51% ownership for nothing.

3) BBD might write down their 49% ownership of Airbus A220, due to

additional cash infusion needed to keep the program alive, cash BBD

don’t have.

4) S&P rating is sell. BDRBF, Bombardier share price gap down between

Jan 15/16, on high volume and yesterday close @ $0.85 USD.

5) BDRBF share lost 38.5% this week.

6) China will be the biggest winner from BA & BBD current demise.

7) One day they will own Ilan the “rocket man”.

Black Swan. NO ONE…learns.

Wall St. likes it. They have every major company in the US doing it, because if they don’t they can manipulate the markets and damage the company. It’s easy enough for them to coerce corporate officers and to disable regulatory mechanisms as enabling tactics. The interests of the firm, of shareholders, employees, the public, and any others are irrelevant, although it is useful to maintain pretences.

The goal is to maximise rentier returns, unearned profit, by directly or indirectly liquidating certain company assets, like brand value, engineering expertise, and financial position. Their strategies work, and they’re not intended to be sustainable. In the long run these strategies are self-destructive, but their perpetrators aren’t interested in the long run.

Like so many other companies, Boeing may continue to be useful as a corrupted version of its former self, or it may be bankrupted, leaving everybody else holding the bag. And it’s not just Boeing. It’s most of the national and global economy. All the lurid details clearly support this interpretation.

I suppose it’s possible for people who aren’t in on the racket to come out ahead, but that looks like it depends too much on luck and on more effort than it’s worth.

Yup. As I tell my broker – I’m more comfortable putting money on a horse. And I have a nice pleasant afternoon with kindred spirits.

The sad thing with the Trump administration and the stock market is they are more concerned about Boeing’s weak stock price and effect upon the overall economy rather than two planeloads of dead victims. This says a lot about American business and government where potential legal liability and associated costs are more important than producing a plane that can actually stay in the air. Kind of more important than money.

Once everything is commoditized, it can be rendered worthless. It’s just a number on a balance sheet.

Do a search for Ford and Pinto gas tank.