Amid a shakeout among trucking companies & production cuts and layoffs among truck makers.

By Wolf Richter for WOLF STREET.

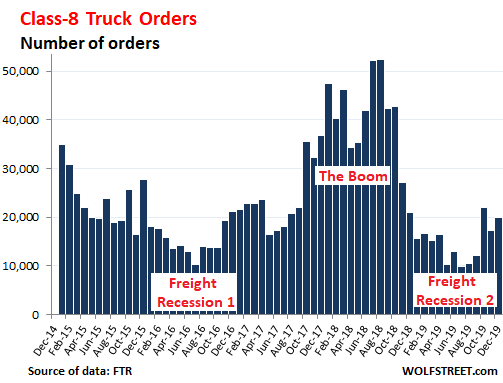

Orders for heavy trucks in December came in at 20,000. In the fourth quarter, they averaged just under 20,000. For the past 12 months, there were 179,000 orders for Class 8 trucks, down 64% from 497,000 orders in 2018, and the lowest annual total since 2010, according to FTR Transportation Intelligence.

“Fleets are being very cautious in this environment, only ordering what they know they need for the next few months,” FTR said in the statement. Stability at low levels, so to speak:

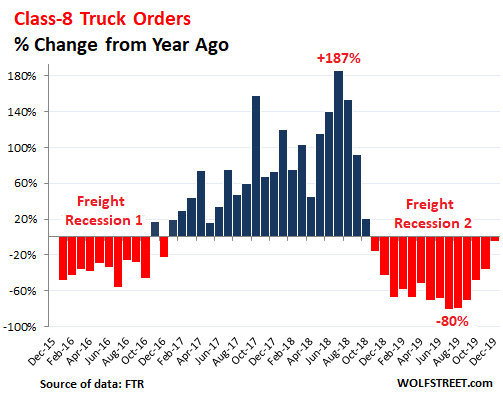

On a year-over-year basis, orders for Class 8 trucks in 2019 had collapsed by as much as 80%, following a historic boom in orders in 2018. The truck makers that receive these orders are Daimler’s divisions Freightliner and Western Star; Paccar’s [PCAR] divisions Peterbilt and Kenworth; Navistar International [NAV]; and Volvo Group’s divisions Mack Trucks and Volvo Trucks.

Truck makers have already begun adjusting to these new market conditions with production cuts and layoffs:

- Navistar cut production by 25% at plants in Springfield, Ohio, and Escobedo, Mexico, in two rounds of layoffs. The first round of layoffs was announced last summer, and the second round in October.

- Volvo Trucks announced in November that it would lay off 700 workers in January.

- Mack Trucks on the other hand got hit by a 12-day strike that idled 3,500 workers late last year and is still trying to catch up from that event.

- Freightliner announced layoffs at the beginning of October for two manufacturing plants.

- Kenworth announced at the end of October, that it would cut production at its Chillicothe, Ohio, plant by about 12% and trim its workforce by about 100 workers.

The chart below shows the year-over-year comparison for each month, which eliminates the effects of seasonality. The historic boom in orders from late 2017 through much of 2018 was triggered as truckers reacted to a boom in demand for transportation services triggered by companies across the spectrum wanting to front-run potential tariffs. By late 2018, the whole thing came unglued. Truckers slashed their orders to low levels, and orders have now stabilized at these low levels:

Last year, trucking company failures more than tripled to reach 800 shutdowns. Most of these were smaller trucking companies. But it also included regional carriers, such as New England Motor Freight which collapsed in February, and car-hauler Jack Cooper which shut down in August. And then in December, Celadon Group, a full-truckload operator with about 3,000 drivers and about 2,700 tractors, was felled by accounting fraud and the freight recession, the largest truckload-carrier bankruptcy in US History.

“The good fleets are making money, the weak fleets are leaving the industry,” is how FTR VP of commercial vehicles Don Ake explained the phenomenon.

“This is as balanced and stable as you are going to see in Class 8 ordering,” he said. “Fleets are ordering trucks according to their standard replacement cycles and also for normal delivery cycles. They are not speculating about the future direction of the freight market because there is too much uncertainty. This is a ‘wait and see’ approach.”

A heavy truck dealer who owns two stores with several franchises, and who has been doing this for a long time, had a less sanguine description: “On our lots, there are no lookers for used sleepers, and we will sell new sleepers at a loss to clear them out, and new orders for sleepers have come to a stop,” he said. Read… Turmoil in the Heavy-Truck Market as Seen by a Truck Dealer

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

This makes sense. If all I’m doing is hauling cheap Amazon crap that pays next to nothing, them I’m going to do that on the cheap, too. I will not deploy capital for that cheap freight. Probably that’s why FedEx pivoted. They cant bulk up for cheap freight of a future competitor. Let them grow by themselves with their own capital.

Amazon uses every supplier and when I see a truck pulling a Amazon trailer I know they are losing money every mile they run. If you look at the lines going into a Amazon DC the trucks wait in line for hours to either get loaded or unloaded! Loosing money like crazy and then when loaded they have to run like hell to get to the next DC and wait again.

Glad Fed Ex told them to go to hell and if you think your so smart go start your own Trucking company and see how much more money you loose Amazon.

When will people wake up and see how Amazon is a time bomb!

I use to sell on Amazon and as shipping cost went up I would never get a increase from their set cheap shipping I would be reimbursed for.

Example: to ship a book the flat price of $3.99 they would credit me bit the real cost to me to ship the book would be over $5.00 or more. Luckily I had enough margin but finally their extreme polices put on is sellers I said screw it!

“On our lots, there are no lookers for used sleepers, and we will sell new sleepers at a loss to clear them out, and new orders for sleepers have come to a stop,”

What’s next?

I read the media stories that the sky is falling on trucking companies, but every time I merge onto the highway there are big trucks EVERYWHERE.

The media tells me about XYZ trucking company having collapsed under a cloud of excessive debt (thanks BErnAnke) — but that says more about excessive leverage at the corporate level than it does about trucking. A lot of industries took on too much debt.

Too much debt allowed every Tom, Dick and Harry to start a trucking company and to under price more experienced truckers. Something tells me this is what is happening with Jeff the debt king Bezos getting into the trucking business, when he already can’t make money in retail.

Zombie companies were conjured into life by a foolish academic playing Fed Chair. The zombies are not economically viable and are guaranteed to fail at some point, but a lot of real companies are getting hurt while they wait.

“Zombie companies were conjured into life ”

Actually ZIRP is way, way more about keeping the huge legacy Dead on (life?) Support than creating new industry entrants.

(Although, as with all instances of the Fed hitting its one big green button – labelled “print money/cut rates” all the multitude of consequences can’t be predicted).

Wolf,

Speaking of ZIRP debt binges, do you know of a good free website that lists all upcoming debt maturities for all public companies?

I’ve sporadically looked and found surprisingly little.

In the ZIRP exit era, debt rollover days will be the most important days in the lives of most public corporations – a zombie might survive paying a 3 pct coupon but go down for good on a 6 pct coupon – if it can find a rollover lender for its engorged debt base at all.

Since these maturity dates are public info – I am surprised that nobody has created a database.

I am sure that a Bloomberg terminal could probably cobble something together but I don’t have 16k lying around.

Maybe you could get your readership to pay for one for you….

Finra now offers a free no-login site to look up US-traded bonds by company.

http://finra-markets.morningstar.com/BondCenter/Default.jsp

Go to the “Search” tab. Enter the ticker or company in the search box. On the results page, it will lists each bond outstanding as a line item, including maturity date. So you can easily look up IBM, and then look at all the maturity dates. Then click on a line to see the details, price and yield chart, etc. I use this all the time.

Makes sense: the whole capital goods sector went on a verytable spending binge in 2016-2018. I can honestly say I’ve never seen anything like this before. Now the sector has to deal with it: capital goods are not smartphones or even SUV’s: you don’t replace them just because a more fashionable model came out.

Everybody seems to be waiting for massive stimulus programs to bring back the huge order book gains that were so common in 2017, but the problem is we are already in full blown stimulus mode worldwide and if China taught us anything is that stimulus becomes less and less effective the more it’s used. All this “Green New Deal” nonsense has absolutely nothing to do with the environment but a lot to do with more rounds of stimulus of the carrot and stick variety for those who benefited enormously from previous ones. Please note this doesn’t mean there aren’t huge environmental issues but, again, they are irrelevant compared to big thick order books and huge nominal GDP gains.

As I said previously the 2020’s look to be the decade when no stone will be left unturned to keep all the ridiculous bubbles inflated during the previous decade from deflating, exploding, imploding and generally scattering debris all over the world, while at the same time inflating nominal GDP figures as much as possible.

I fully expect the monetary and legislative madness of the 2010’s to be nothing compared to what we are about to see.

Well said, MC (and spot on).

re: ‘All this “Green New Deal” nonsense has absolutely nothing to do with the environment but a lot to do with more rounds of stimulus of the carrot and stick variety for those who benefited enormously from previous ones.’

And if that doesn’t work another war ought to do the trick.

MC01

California Bob

‘All this “Green New Deal” nonsense

So what’s your plan for saving the planet from the ruthless predation of corporatists? Assuming you’re not too late already, which isn’t likely to be a valid assumption.

Surprise me with a constructive proposal. Take your time.

MCO1 – can you tell us what you are doing to save the planet ?

Are you walking, or taking public transit everywhere or do you have a car?

Do you ever fly anywhere?

Do you live in a house with AC and Heating?

Do you grow your own food – or do you buy everything in a grocery store?

Do you ever buy out of season produce (flown in from afar)?

Do you every go skiing? Now if I ever saw a destructive hobby its skiing – up and down a hill like hamsters in a cage running round and round – for no purpose – and burning lots of coal/gas to power the whole lot!

I imagine you have eschewed the use of straws. Congratulations there if you have.

Anything else you are doing to ‘save the planet’ – or are you just like the rest of us — screaming for ‘someone’ to do ‘something’ then jumping in the car to drive down to Walmart to pick up more ‘stuff’

Unamused: you along with MC and Cal Bob all have valid points and I believe you are all coming from the same place. That’s the problem with quick reply posts, things often get misread.

Issue is that we are at the end of some big super cycle. Most folks are feeling something, instinctively know something is wrong, but cannot figure out what is happening let alone identify and put a name/explanation to it.

I’ve said it before on this site that there is an old saying…”from sandals (poverty) back to sandals (poverty) in 3 generations. Each generation is …many say at 25 year intervals. So that would be 75 years for 3. If we count back from the end of the 1930’s that’s over 80 years. If we count back from 1945 then 75 years. Also, there is a book called the 4th Turning which lays out a similar time frame. Something is afoot…here is a list of issues from my vantage point. How to fix them it something entirely different. Personally, I don’t trust government as the self anointed savior to figure a solution to a problem they have had a large role in creating. Here goes (stream of consciousness) :

1. Population of globe – I believe too many folks. Globe not meant more than 5 Billion (we at around 8)- that’s me, can be debated, but not through short blogs.

2. Government will exacerbate the problem and then politics will come before good common sense solutions…end result, too many dishonest people will try and profit only to extend the misery.

3. World debt levels in multiples of world GDP…when you add the actuarial unfunded liabilities, makes your head spin.

4. Pensions, Social Security, Medicare and other programs that have become a serious problem. The younger generation cannot fund this on top of the other debt that has been piled on top of them.

5. The debt levels wants to crash this charade as we saw in Jan. 2016 and a year ago, only to see “stick saves” by the central banks….only putting off a worse crash at some point in the future. Will they sacrifice the currency at some point? Gotta believe so.

6. This is the worse game of chicken ever seen and folks are betting on how long it can go on in order to profit. Meanwhile, the system creates more homeless, etc. and more and more people drop off/out. At some point, the proverbial pitchforks will come out and we all lose.

7. You have people in positions of authority wanting to preserve the old and close to the FED spigot, effectively loading up the patient with financial antibiotics…patient will die.

8. You have people wanting a green new deal – I also believe patient will die.

9. just look at the nonsense that our colleges push and they look like country clubs/gyms….unbelievable at huge expense/debt to the student/family.

So, how to manage this societal change that is upon us due to reasons above and many not listed, in an orderly and equitable fashion is the question. I believe neither side is capable as neither side is truly objective, nor have we had statesmen or stateswomen for a very long time.

What is afoot is HUGE !!! It will be a painful transition to wherever we are going because the greed and vanity that inhabits the powers that be is beyond comprehension. So, the hits will just keep on coming (as with the trucking example above, the malls and theaters earlier, etc etc etc) and where/when she stops, nobody knows…until the final massive blow is delivered. We have been too cavalier with debt, spending, hedonistic ways, etc etc etc. Really, Really gird your loins!!!

You’re right, Trinacria. I don’t blame MC01 or California Bob for not having a plan to save the world from ruthless corporatists. Hardly anybody does, and none of them may actually be feasible. It’s just that their deprecation of the so-called Green New Deal is absurd, insofar as they themselves have no plan at all. I could do it, but I’d need the cooperation of ruthless corporatists. It’s awfully hard to force them to do the right thing, and I’m just not up to it.

My perspective is a bit different from yours in that I can quite rightfully blame malicious tycoons for having dragged the world into its present parlous state merely to serve their own ambition and greed. Unlike the rest of us, they’re in a position to solve the world’s great problems, but instead they’d rather cultivate them and exploit them: war, poverty, overpopulation, pollution, environmental destruction, overconsumption, and more can quite rightfully be laid at their feet. They really do not care.

Where I live we’ve managed to sustainably retain most of the benefits of the modern world while mostly avoiding the disadvantages and disasters, although global catastrophes like famine, war, and ecological collapse would roll right over us. Mostly we’re just hoping we’re not as fucked as the rest of you are going to be.

I happen to like skiing, but we don’t have a ski lift because we thought a kiln and a glass refractory would be more practical, so we either climb the hills or do cross-country.

It’s late, and really don’t have time for this.

Also known as the Roaring Twenties. I hope it ends better this time. I am not holding my breath.

A newspaper in the UK has that headline a few weeks back: demonstrating a sublime ignorance of history!

I believe the author was entirely unaware of what came after the ‘Roaring’….

I agree and I’m not holding my breath either. I also agree with “unamused” who blames malicious tycoons as they have had a huge hand in this as well along with the gov’t they own. Remember that after 2008 nobody went to jail except maybe one low level sap who was made a fall guy if I recall.

Overcapacity meets tariffs and weak economy.

Pause. Waiting for Fed put. Hey it’s an election year.

Class 8 truck engines historically would last about two million miles. Now they recommend that we rebuild them every four to five hundred thousand miles at an average cost of twenty five thousand bucks. All of the new pollution controls don’t work and are very expensive to maintain.

Kenworth and Peterbilt build around sixty thousand gliders every year. New trucks with no engine or transmission. We find twenty year old engines, rebuild them and put them in the new trucks.

It’s not hard to find one year old trucks that the engine has already blown up in it. Buy it and put a rebuilt engine in it. Then you have a useable truck.

It’s what happens when the feds start telling people how to build engines.

Thanks for the post.

Have a friend with a small trucking

Company.

Closer to my age. When maintenance

On existing fleet gets to high he will close the doors.

New trucks shorter life span, and more maintenance. It will be the big boys only club.

I think that’s the plan.

I don’t know much about the trucking industry but if you looked at societal trends you could predict the trend of the industry was down. With car use down, people downsizing, and wages being stagnant, the trend was/is less money, less stuff, less space, which doesn’t bode well for the moving stuff around industry. It makes sense this was going to happen based on what was already happening in the economy.

If you want to see the future of the trucking industry look at what millennials own, what they buy, and how they live. They are very mobile and travel light, out of necessity.

I believe they are quite fond of houseplants,as they can take them from one crappy rental apartment to another -or so one explained to me. r them

Consumer spending is at all-time highs though, as is the % of goods ordered online. New truck orders have always been cyclical. Orders will ramp back up once the overcapacity shakes itself out, which will take a while.

I saw the chart. Truck orders hit a trough during the summer. They have almost doubled since then. Who is ordering them?

Year end clearance sales are normal at vehicle dealerships. They may want a 2020 Peterbilt rather than a 2019 model.

How on earth can there be any more stimulus? What’s next, Aladdin’s lamp and three wishes? Nuts. Too much borrowed money chasing unnecessary goods is not the sign of a healthy economy whether the trucks are brand new or last years model. Sensible interest rates would shake this tree PDQ.

I forgot to add this point. I used to build for a living. When I would see a sub contractor, delivery freight truck, or RE agent driving too new of a vehicle I would always go elsewhere. It is a solid indicator someone is charging too much. Same with aircraft. You don’t want to use junk, but serviceable well maintained equipment speaks volumes to who you are dealing with.

Paulo, stimulus will come from QE forever.

That is the point of putting a shell on an existing frame. It also keeps the scale officers off your back. When I was a kid hotrodding, you always had to look out for the guy driving a sleeper, piece of junk all tricked out underneath. As for truckers, nothing wrong with a little honest dirt under the fingernails. Give me a work truck over a show truck and chrome diamond plate any time.

Except, of course, that guy who just replaced his twenty year old truck with “too new of a vehicle.” It’s hard to find good rules of thumb that are fair and work all the time.

Not exactly.

The frugal option is a 5 yr old used vehicle which gets you a chance at the best bang for your buck. Buying new means you can afford to lose $20,000 in a month or in a year even. People buying/leasing new are too young and naive to realize they might not be able to afford that new vehicle in 2 years or they have money to burn and want to be better than the neighbours.

A dentist owns the most expensive house in my town. Never going to that dental clinic.

Come on… be fair. He has his yacht payments just like everybody else!

Peterbilt has had two rounds of layoffs in the last couple of months too….curious to see how deep this rabbit hole goes.

I understand that these rigs run upwards of a million miles with good upkeep. Wonder what the average yearly mileage for these “big rigs” is?

Are all those trucks sold in 2018 just hitting their prime productive years now, limiting new orders?

Wonder if there is a chart showing the “fleet age” by month? That might tell us something.

But then, I know very little about the trucking industry except they have been in dire need of drivers for the past several years.

Average yearly mileage for a long-haul truck is is approx. 125,000.

Keep in mind there is a difference between orders and deliveries. A fleet can order a group of trucks and stagger deliveries over a multi-month period. Most fleets run trucks 3-5 years old.

BTW: car hauler Jack Cooper emerged from bankruptcy last November w/ new financing as lenders swapped debt for stock.

https://www.ttnews.com/articles/jack-cooper-exits-bankruptcy

“The good fleets are making money, the weak fleets are leaving the industry,” this seems a lot like a quote on the airline industry. What exactly is a weak fleet? One with a lot of debt, or maybe some unprofitable routes? Old equipment? Too many safety violations? One which cannot hedge their fuel costs? I love the sound of this slowdown overall, sounds like inflation will return when the economy recovers, (finally,maybe)..

Looking at Class 8 Truck Orders; it was more of a boom in orders from October 2017 to October 2018 as opposed to now having a crash in orders now.

Maybe a lot of transport companies got on the band wagon of ordering because they were told that there was such a large demand that they would have to wait a long time for delivery, henced placed an order.

Order date isn’t necessarily related to the date they will take delivery especially if (which was the case) there is a limited manufacture supply.

Unfortunately it would appear that some of the manufacturers took on more staff and now probably have to lay them off.

New demand for very old farm tractors specifically because they’re low tech

https://boingboing.net/2020/01/06/new-demand-for-very-old-farm-t.html

There’s a similar trend in trucks and passenger vehicles but reporting on it has been systematically suppressed, for obvious reasons.

http://www.startribune.com/for-tech-weary-midwest-farmers-40-year-old-tractors-now-a-hot-commodity/566737082/

I used a 1967 Cub Cadet for planting experimental nurseries and small seed stock increases when my family ran a wheat seed genetics business. Small, simple and quite effective. Only needed a new alternator in 18 years of service!

A decade ago when we got bought by Limagrain, they had a GPS controlled planter which was a pain in the ass to set up, and a new Austrian combine that went for $100,000.

My combine was bought used, made in Germany and cost $4,000.

The cost of new tractors, spray rigs and combines is mind boggling. And there’s quite a lot of frustration with computer controlled machines that a farmer can’t work on & repair as the Star Tribune article reports.

My son farms very well with a ford 1000 4WD tractor I sold him years ago, for $4000.

He priced a new Toyota with extensive mandated bullshitgreenie equipment and was advised “Buy now. Next year’s model has $8,000 dollars of additional bsg equipment on it.

He maintains the Ford very well, but ‘”farmer maintenance” is impossible with the bsg tractors..

PS: The Ford 1000 is vintage mid-1970s. Quite a few local farmers are still using a Ford 8N tractor, vintage 1950.

I my youth, I worked on the assembly line building the 8N:

https://lenpenzo.com/blog/id44261-grandfather-says-a-lesson-on-the-benefits-of-working-smartly.html

Nebraska Farmers Lead on Right to Repair

https://www.nakedcapitalism.com/2019/12/nebraska-farmers-lead-on-right-to-repair.html

Ford 8N

Great tractor. Just a backhoe guy now. But I spent alot of time on the 8n when I was a youngster.

I vouch for that.

I have some of both old and new John Deere (JD6430P, JD4240, JD4400). Comfort and sound better in “new tractor” but “old but good tractor” as my 3 year old grandson calls them are easy to farmer service and reliable.

When row crop farming in the 1950’s we purchased one of the first Ford 4WD on the West Coast. It was a beast! But still couldn’t do the work that a Cat D2 we had could.

Looking at new “hi-tech” equipment today just makes me dizzy at cost and amount of technology. And I guess that some you are forbidden to work on yourselves.

What a world!

I totally get that I have a near perfect kw class 6 might have 1.5 million miles on that 07 and I really take care of it dealer said I’d love to sell you a new one but this thing has no def etc ok I just wanted new I’m so thankful he talked me out of trade

What passenger vehicles are low tech that you would recommend? Vehicles that are actually available

The trucking industry seems to be a perfect example of central planning as practiced by the all knowing central bankers.

By manipulating interest rates too low they sent everyone in the trucking industry the wrong market signal.

Now the trucking industry has a bad hangover, but hardly unexpected.

So who is next?

The new truck order boom was driven less by low interest rates than by tax incentives (100% depreciation), pull-ahead materials buildup (in advance of new tariffs), and failure to recognize the 2018 tax breaks were only a short-term stimulant. The industry is always cyclical, the only question is whether external factors will exacerbate and/or alter the timing of each cycle.

the “tax tail” always seems to wag the “business dog” aided by ridiculously low interest of course…