We got another one today, warning about all the right things. And then they do the opposite.

By Wolf Richter for WOLF STREET.

Here is what gets me. It happened again today. These Fed guys and gals are wandering about the land – armed with solid data – flailing their arms to warn about corporate debt that is at historic highs, and about credit spreads between certain types of junk-bond yields and investment-grade yields that are the tightest in history, where investors no longer effectively distinguish between higher and lower risk, and about commercial real estate with “cap rates” that have hit historic lows, indicating out-of-whack prices.

And they’re pointing at all the warning signs of “excesses and imbalances” caused by low interest rates and excess liquidity, and they’re pointing at the risks that these excesses and imbalances can pose to the US economy and financial system.

And then what do they do, these Fed guys and gals? Everything they can to make these excesses and imbalances even more excessive and imbalanced.

They cut rates three times, and bail out the repo market by throwing over $300 billion at these folks since September, rather than allowing some sort of price discovery to take place, and allowing in the process a hedge fund or two and a mortgage REIT or two, that have gotten addicted to borrowing at the ultra-low interest rates in the repo market, to experience withdrawal symptoms.

Today it was Dallas Fed President Robert Kaplan on Bloomberg TV that said all the right things and warned about the “excesses and imbalances,” and even named some of them – despite having been part of the cabal that cut rates three times and bailed out their crybaby cronies in the repo market in order to inflate those very excesses and imbalances even further.

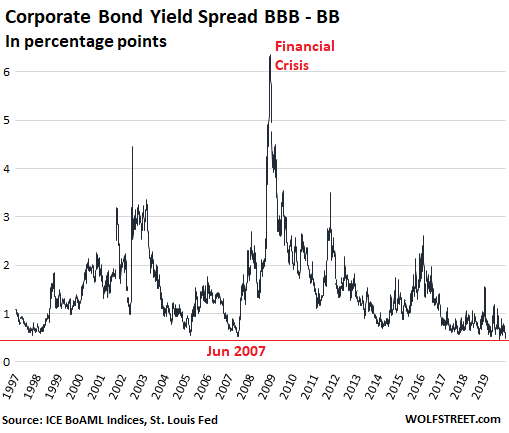

“What gets my attention more is that single-B and double-B credit spreads are so tight, triple-B spread are very tight,” he said.

How tight are they?

The average yield of BBB-rated bonds (with “BBB-” being the very bottom of investment grade) was 3.23% as of Monday at the close. The average yield of BB-rated bonds (BB+ being the top end of “junk”) was 3.72%, according to the ICE BofAML US Effective Yield indices (my cheat sheet of corporate bond ratings by S&P, Moody’s, and Fitch). The difference between the two – the “spread” – was 49 basis points. Spreads in this range of 48 or 49 basis points are “tight” in the sense that until September this year, they’ve never been this tight before.

This means that the markets are only asking for minimal extra compensation to take quite a bit more risk. That’s how a bond bubble is defined, when credit risks don’t matter much anymore – meaning the risk of a company defaulting on its debts isn’t perceived as much of a risk anymore, even at the junk levels, where this risk is substantial.

In the past, the low points in credit spreads was followed by financial upheaval when these companies then did default and yields of riskier bonds spiked, as bond prices plunged, and credit spreads blew out, with bondholders often ending up as creditors in bankruptcy court. The same credit spread Kaplan pointed out:

“If I see evidence that the market is sort of distinguishing between lower quality credits and better credits, I actually think that’s an encouraging sign,” Kaplan said. But the market is no longer doing that, now with spreads between BB and BBB at historic lows.

“My bigger worry is that you’ve got increasing PEs, you’ve got historically low cap rates, you’ve got very tight credit spreads,” he said, referring in one breath to:

- The high P/E ratios in the stock market, a sign of overvaluation.

- The historically low capitalization rates in commercial real estate that have been cropping up in the Fed’s Financial Stability Report because they’re such a worrying phenomenon now, and that indicate that commercial real estate prices are the most overvalued ever in terms of rents.

- And the credit spreads – see chart above – that indicate that in the double and triple-B range, bonds are in the biggest bubble ever.

So that’s his “bigger worry,” and he went about how vigilant he is about these excesses and imbalances:

“I’m just keeping a close eye on excesses and imbalances, particularly when corporate debt is historically high, [the amount outstanding of] triple-B debt has tripled, [the amount of] double-B and single-B debt has increased dramatically, and I’m just cognizant of that and watching it carefully to make sure we’re not creating excesses” – and then he corrected himself – “undue excesses and imbalances that are hard to deal with later.”

This short interview was just so rich. So he is saying that creating “excesses and imbalances” is fine, no problem; but “undue excesses and imbalances” are a problem. Now the excesses and imbalances have reached historic highs, as he himself pointed out, and are therefore by definition “undue.” And in theory, these undue excesses and imbalances would require for the Fed to start scrambling to try to bring them back down to earth, however “gradually” they might want to do this in order to avoid bringing down the whole house of cards all at once.

But what did they do instead? They cut rates three times and printed hundreds of billions of dollars to bail out their crybaby cronies in the repo market, and the “undue excessed and imbalances that are hard to deal with later” are further blowing out, making them even harder to deal with later.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I think you misheard the man, Wolf. He said “I’m just keeping a close ‘I’ on excesses and imbalances”.

… When me and my 1% buddies have completely squeezed the lemon of personal gain and exited these inanely high risk positions, only then will we cast an ‘I’ towards stopping printing and raising rates.

Exactly. And when he mentioned ‘undue’ that really meant that those not in the club were due nothing. All profits from the excesses and imbalances are due only to those in the club.

These spokespeople for the club have done this same sort of spiel for many years, scare the crap out of the little investor while they and those in their club gobble at the trough.

George Carlin was way ahead of his time.

Not exactly, it just shows today’s problems are the same as yesterday’s problems. Same S* Different Day.

Sorry Wolf folks!

No more dips to buy, ever!

They can’t allow withdrawal symptoms, otherwise Mad Max scenario.

Haha! good observation. Those guys sure seem to know how to butter their bread.

Last January I realized the Fed was reversing and the entire “tightening cycle” was yet another lie so I put everything in the S&P 500 – I will never exit the market again now that I know the Fed will never tighten again. I only earn about $16,000/year (less than inflation) in dividends on my life savings but that is all the Fed’s Politburo will allow. At least I don’t have to ever worry about a market correction.

There has never been anything like this in the history of civilization, there will never be another dip. Powell has my back – who has your back?

The Fed is locked into maintaining the ‘wealth effect’ to keep consumer spending (and the economy) alive.

The problem is that the wealth effect for Boomers and GenXers = a poverty effect for Millennials and Zoomers.

At some point, this will translate into political consequences.

Also, the Fed has a habit of allowing a 20% dip every few years. Early 2016, early 2018, etc. If an election goes the wrong way (against Wall Street) they will be inclined to let the whole sucker go down, as they did in 2008 in order to defang the Obama threat (which turned out to be wholly empty).

Other than those considerations, your strategy should be fine.

I have a BA in economics and was very interested in monetary policy during my college days.

I am stunned and speechless about the last several years of unparalleled easy money from Japan, Europe and America. We have central banks who are printing money to buy stocks (Japan), buy corporate bonds (ECB) and prop up insolvent/gambling banks (repo in America).

I know this might sound ridiculous, but can anyone give a reason WHY the central banks are propping up the asset values of the wealthy and pushing us into the ever-greatest-bubble in history?

I always thought that the business/credit cycle was an important part of the economy, and I always thought that free markets allowed zombie companies to get replaced by better actors.

But… Now we live in a world where the Central Banks always arrive to bail out excessively greedy market participants.

Why?????? Is there a better reason than the obvious corruption between Wall Street and the government? Are the central banks scared of something – that they created? Is the debt-bomb going to wipe everyone and everything off the planet? Why has “Don’t let down asset values” become an unstated mandate of the central banks?

Where do you think those Central bankers go after they retire from their poorly paid civil servants jobs? hint: bernanke now works at citadel. Do you think these guys want to piss off their future employer’s? $300bil of taxpayers money to ensure $10mil for themselves? Sounds like a pretty good deal to me…

Austin really asked a good question, that I often wonder about. Just what IS in it for them? Ben’s lousy $10M? There are probably posters here worth that much. It’s far short of being able to have a jet/bugout setup in NZ, private missile silo, etc, etc. Seems their service to the wealthy is worth far more than that. What do the whole bunch (the ultra wealthy and their politician and other government goons they can buy, know that we don’t? Surely these folks are all smart enough to know this can’t go on forever. I’m a nobody and I am.

I read somewhere Vienna is a hangout for ex CBrs, with lots of highbrow cultural goings on, but it hardly makes them safe from the pitchforks.

At my age I personally have done plenty existence time and don’t expect any afterlife, so I’m OK with the whole experience and ready to give up my last set of atoms anytime, but what about all the younger folks? (not to mention the end of a pretty interesting species)

I will add that I’m ABSOLUTELY positive they would much rather have some a financial-bean-counting problem to deal with than a planet trashed by stupid short term human greed for “more stuff”.

Maybe we are all just insane, maybe just me.

Well, I doubt Carlin knew, either.

Stunned & speechless about sums it up. However, one must remember that the IMF, World Bank,and major banks (JP Morgan/Chase, Goldman Sachs,ect) are not amateurs at this.

That is, they have a plan. They know only too well what happens when the bough breaks. And if some didn’t, they quickly learned after 2007/2008 financial crisis.

No one can tell at what moment panic begins to set in and Jim Cramer starts to go ballistic as the next crash begins to occur. What I do believe is they are prepared to roll out the “emergency” plan. What would that look like and entail?

First, efforts to prop up the banks. It’s called taking care of number 1. I believe they will seize a portion of savings accounts, to recapitalize the banks, as they did a few years ago in Cypress. This was a trial run to test the method. Possibly after a bank “holiday”. It is my guess they will go after the big accounts, ones with over $100,000.00 and higher, taking between 10 & 15 percent. Again, only a guess.

Next, limits on withdrawals at ATMs as we move towards a cashless society. China has already made the move towards a cashless society and so have some European countries. With no cash sales, no one can hide. Everything is taxed, and can be traced.

Finally, The IMF, the TRUE lender of last resort, will bail out countries with SDR’s (Special Drawing Rights) and basically be at the top of the food chain under a global trading system.

The amount of debt in the USA and worldwide will force a crash & meltdown, but don’t expect this overnight. Our own Great Depression may have started in ’29 but didn’t reach bottom until a few years later. It was WW2 that really pulled us out of it.

Evo Morales said:

“Before, in order to obtain credit from the IMF, we were forced to give up a part of our country, but we have liberated ourselves economically and politically and we are no longer dependent on other countries or institutions.

I didn’t take long for him to be dealt with!

Re: I know this might sound ridiculous, but can anyone give a reason WHY the central banks are propping up the asset values of the wealthy and pushing us into the ever-greatest-bubble in history?

Because Trump is the president and the bankers and head of the Fed do anything he says figuring they’ll get kickbacks. Had Hillary won the presidency the world’s elite were going to implode the entire financial system shortly after her election victory.t

If you noticed, Trump stopped yelling at Powell which means Powell is following Trump’s instructions. What are those instructions? The answer to that question lies inside the next question. Who is benefitting from the current policies?

Much like politicians, watch what they do NOT what they say.

Wolf,

The answer is simple – ass covering.

They can see the piles of politicians’ burning bodies if (when) this thing comes apocalyptically undone and they want to have some excuse on record to point to as they are dragged to the bonfires.

Figuratively.

Of course.

Also, remember the look in Tim Geithner’s eyes during the worst of 2009 – dead men walking.

American leadership knows it has played out the end of its corrupt string and is just looking for the last copter out of Saigon.

and apart from that we know that “when it becomes serious you have to lie”, just as much in the USSA as in the EU ;(

The imbalances, malinvestment, bubbles, and inequality these Fed blowhards have created after incentivizing three decades of debt, debt, and more debt and now trillions in new money printing is criminal. And yet it continues in ever greater quantity and lunacy. When will the average person figure this out? The Fed is as responsible for the sorry state of this country as anyone/anything. Sound money should be their sole concern. Not inflation. How is itfine to inflate away one’s hard earned money on purpose and then have the gaul to say there’s no inflation? How is this not criminal? Intentionally robbing someone is criminal.

Asset prices over all are so disconnected from reality yet it goes on:

Sp500 yield = 1.8%

Sp500 real yield = -0.2%

standard deviation of SP500 = 15%

Nominal growth rate of GDP = 4%

Who would purchase an asset with a real yield of -0.2% and standard deviation of 15% and growth rate of 4%? But it works til it doesnt.

Actually; since the huge debt is a thing that started with the space race, it is more than three decades.

Wow is over 50 years by now…

There is a lot of ruin in a country/currency…until there isn’t any more.

After the fall, I don’t think DC’s Age of Guns will be any more successful in building the American economy than its Age of Fraud has been.

Life Liberty and pursuit of happiness. You still have that. But please don’t extend that into your birth right that what you earn can NOT be inflated away. You work and they print. They set the rules and you obey. This is NOT criminal, this is the way it is. Just obey. If you really get angry, they will tell you to look at the rest of the world. Imagine what will happen to you if you were born in Africa. Just obey.

“just obey”

You are not describing a democracy or liberty – you are describing a dictatorship and totalitarianism.

Speaking of the T word, let’s ask ourselves just how total government control is when it accepted as a matter of course that the gvt has an unconstrained right to manipulate the value of one’s lifetime savings.

savings confiscation is the unquestionable right of the gvt?

I hope you were being sarcastic, JZ.

You are exactly right. It appears to be criminal.

They are destroying the middle class. They are leaving behind a whole generation of young people who cannot work and save fast enough to buy houses or other assets, because the assets keep inflating faster than these hapless people can work.

The Central Banks keep using low consumer inflation as an excuse to induce asset inflation for the wealthy.

Weird!! They have taken it too far.

The reigning global monied class is still deathly afraid of the “communes” to raise their heads above the capitalist muck. This attempt to destroy any “ladder to comfort” or a real middle class has been going on for more than 150 years.

There are only markets that will support speculation; only markets to continue to allow the rotten to the core system to stumble forward. The FED is making this possible along with the “economic intellectuals” who continue to reign over sanity.

“Trust” went out the window in 2008 and has never returned.

The system will continue this way until it gets slapped in the face from a direction now unknown as always.

Bottom line for all investors/savers:

“Do not ‘invest’ or ‘speculate’ with money you are not prepared to lose the moment you place it in harms way.”

I once attended a talk/Q&A with Geithner and Paulsen intending to ask: “Why should the cost of everything double every 36 years?” The ushers would not take my question.

The Feds’ real policy is to impoverish the masses. Just look at the purchasing power of the dollar over the last 100 years. What more evidence do you need? It’s time to awaken from your golden slumber.

Geithner himself was once quoted as saying QE was to “foam the runway”.

One explanation is:

The present Repo orgy, conveniently out of the media’s critique, is ENABLING all the 1% to CASH OUT while maintaining price as the buy side take these positions with repo foam, and then take out put option like insurance.

It’s all very very very devious. The coming crash will only bring austerity to the sheep, not the 1% who will be safe and out to attend inaugural balls and whatnot. LOL.

The repo thing smells like a half trillion $ Cash Out to me as well. It’s either a shadow bailout or financed theft of the usual kind.

This Repo thing is nothing but an excuse to QE more.

Geithner was such a little sleazy punk who cheated on his taxes and then blamed the software…Turbo Tax. As a retired CPA, when I use to attend tax update seminars, Geithner was the butt of the jokes which the instructors would initiate…amazing Giethner got away with it. That tells you exactly where the political system is at – a two teared system of justice. Moreover, when a poor person legitimately claims the earned income tax credit, that return gets held up and audited…yes, there has been fraud in the area, but nothing the likes of the Geithners of the world and his ilk.

Ha, ha, ha. If you recall the ostensibly record fraud settlement that Goldman Sachs agreed to pay to the USG, guess who headed up the bank during that time. Hank Paulson. Guess who representatives from both parties confirmed as US Treasury Secretary after the shyte hit the fan. The very same.

Recall one reason the PTB said they couldn’t bother to prosecute the banksters – too much wealth and ability to hire high-priced lawyers. Not a problem when the PTB decided to go after very wealthy Paul Manafort.

Lastly, recall when everyone thought they finally had the indisputable goods on criminal HBS for money laundering for terrorists and drug dealers, that Eric “Place” Holder said the financial system was just too fragile to endure such a prosecution?

So who runs the USA?

HSBC terrotist / drug money launderers?

Agreed. I saw a documentary on that. FBI underlings had their balls nailed to the table.

But Once again higher ups let the big fish go.

We r Fighting a war on terror and drugs? It’s just theater, At least for those at the top. surely the common criminal get thrown In jail, but no attempts to interrupt money flows to the connected shall be interrupted.

Too much is good, until it’s just a little bit toooo much. Hey well, too big to fail isn’t just a sector anymore, glad to know the Fed is realizing it forced the entire economy to put a gun to its head. Maybe just maybe the trauma will finally get the field of economics to do some soul-searching.

From my article” 29 Nov 19”

the financial and economic world in particular, and the political influences surrounding what may happen in the near future:

The world is going through an unprecedented stage of exceptional financial and economic policy, and we are now on the verge of the collapse of the global capitalist system and the changes it may impose on banking systems and interest and the possibility of the collapse of the global financial system in its usual form. Some will say that these are just speculations for the future and it is difficult to be certain, but if it were not for me to know what is going on in the world in this regard, I would have avoided delving into it. Here are some of the things that are happening now:

1- As everyone knows that the Fed is responsible for pumping money specifically (the US dollar) to all countries of the world with varying interest rates according to the lending mechanism of countries and other factors, the Fed has for the first time in this year reduced interest rates for lending 3 times in a row to the lowest rate It is possible, and as financial experts see it, it does not meet the required profit purpose of the Federal Bank or the global central banks, from what we call the reverse or negative interest of banks, or in short, the loss of banks when lending at these low rates, and the nearness of their bankruptcy in the first case of a global economic recession or inflation as happened to a bank ( Liman Brothers) USA 2008

2- In one of the most important statements of the US Treasury official in the month of September this year: “Digital currencies pose a great threat to American national security.”

3- The current US confusion in global economic policy and the trade war with China is not because China has increased its gross national income gross to high levels in which it has come close to competing with America, but because it has already met with Russia this year to discuss abolishing the hegemony of the US dollar in the world. Trump’s current policies and the prevention of financial supplies to many countries, the most important of which are the countries of the Middle East, are not in a vacuum, which is reflected in the Arab street by the demonstrations due to the lack of the dollar or the lack of it from the market, as some have seen.

4- Bitcoin topped the digital currency by having the largest stocks of the US dollar throughout history, and here are some pictures that bring you closer to what is the meaning of keeping the value in US dollars and how it affects the actual value of the dollar in financial trading

5- In the year 2020 or shortly thereafter, God knows best one of the biggest economic crises in history due to inflation, which I mentioned some of the reasons here, and the beginning of the end of the era of the Federal Bank ….. the crisis that I hope will pass in peace, but I exclude it “

….and also today, Boston fed governor Rosengren suggested the fed pay more attention to asset prices instead of just inflation. The “fireman” and arsonist are one in the same.

Yah what ever, been there, done that. That’s soooooo last year and look where it got us to today.

And the F • I • R • E hosing they weld is of definate ‘liquidity’ .. but it ain’t water .. and it won’t put out nuttin but grief for those gettin clubbed, biggly like !

BEST(!) rip of these cretinous Fed types EVER! Lol! Should be plastered into every E-CON book taught to sheep at high tuition rates!

When a billionaire makes a good investment he gets to keep all the profit

When a billionaire makes a bad investment the FED buys it from him using our taxpayer dollars

In this corrupt system they can’t lose so why not buy everything at any price!

Then when they’ve taken every dollar from us and left the country with Argentina levels of debt and inflation, the billionaires will take “their” money that they stole from us and leave for another country. People need to wake up and elect a Teddy Roosevelt or FDR to smash the corrupt billionaire cabal before it’s too late!

Heckuva plan Sir, but when the mob controls everything and everybody in the total political spectrum, just where are you going to find this Teddy or Franklin Roosevelt?

Bernie Sanders

“…where are you going to find this Teddy or Franklin Roosevelt?…”

You’re not. And it would seem that Americans are too stupid..sorry, law abiding… to do anything except, of course, bitch.

the Roosevelts came from very close to where I live and I can assure you this is ground zero for reckless financial speculation ;(

Yes, the Roosevelt family is Dutch and they have a legacy of being bankers.

In 1792, the first corporate stock to trade on the New York Stock Exchange, was the Bank of New York. It was founded by Alexander Hamilton and Isaac Roosevelt in 1784.

U mean the same Roosevelt who confiscated gold at artificially low prices?

Better plan, Just buy gold and don’t give it to no body- don’t be hoping for a savior from above.

Besides any such sAvior will give the people what they want, and in the short / medium term that is going to mean “lots of free money”.

Eventually we’ll get back to “free market level interest rates”, but first we need to thoroughly test out all the solutions that won’t work.

That seems to be the way of the world.

Right ,

it is losses for the rest of us via financial repression and the debasement of the currencies and immense profits for the few

privatization for them, dispossession for us

they are taking all with the free money they get from the central banks and the minimal taxes to no taxes they pay

It is the cantillon effect

Totaly crony

It cannot last forever.

…although they spend a heck of a lot funding ‘think tanks’ [propaganda outlets] to convince us that there – still – is no other option, the economic and fiscal framework in which we are forced to operate is written in some kind of perpetual natural law, and that to wish for anything else fairer and more equitable is ‘naiive’.

And let’s face it they must be right as they’re rich, hence better than us, and Ayn Rand tells us all so and she was a balanced and rational human being as you can clearly see from her recorded interviews LOL!

It’s not just the 0.1% that profits from this “Heads I Win, Tails You Lose” policy, the same applies to countless small housing speculators in Netherlands and probably many other countries. No risk, no accountability, savers and taxpayers get the bill for reckless speculation.

By allowing some breadcrumbs for the masses the central banks make sure their policy has widespread (tacit) approval.

They can’t take every dollar, the USA is the one that makes them. They can always just print more.

Yes, unfortunately it is called privatizing gains and socializing losses. The FED has been around approx. 105 years and, it has definitely made the masses poorer. The USA started with the greatest of ideals, and gradually (especially since the FED) it is deteriorating and morphing into the greatest of betrayals to the ideals and principles it was supposed to represent.

People can make a difference, because if the people do really start to lead the leaders will follow. I float the idea occasionally in my posts about pulling back personal consumption, deleveraging and such, but seems to go on deaf ears for the most part. In fact many folks post about what great deals they get, etc, etc. Mr. Wolf puts out a great product here and I am grateful to him. Accordingly, I view the folks that post here as being certainly above average for the most part…therefore, it amazes me that more folks don’t embrace a somewhat minimalist approach. That is the only real power we have that can be exercised every day…VOTE WITH YOUR DOLLAR !!! Believe me, in mass it will make a difference. Yes, there will be suffering…that is how we learn and get stronger. Hence, gird your loins because if we don’t do this voluntarily, at some point the way things will play out will simply impose it upon all. Better to get prepared.

If I live minimally I’d save a lot of money

What do think where would I invest that money?

Thanks

Put your money into assets that do something useful, that people need done so they’ll pay you to do it. Works pretty well and keeps your money in the community. And do what you say you will do of course.

Jon:

Who dictates that you have to “invest” your money anyway????

Why can’t you just save what you have, understanding that when you are ready to “invest” you are living decently and within your means.

Who says you have to invest????

I’m practicing what I am ‘preaching’ here.

And, I live decently, within my means; have a paid for modest home in the mountains, some small savings and sleep well at night.

“Wall Street” wants you to invest. The sheep are fleeced 24 hours a day.

Have there been opportunities to jump into the “markets” over the past 60-70 years? Of course.

But remember. The line from the movie “Wall Street” (the original). “Somebody’s gonna pay and it ain’t gonna be me!” You want to be that person.

‘But what did they do instead? They cut rates three times and printed hundreds of billions of dollars to bail out their crybaby cronies…’

But is the Commander happy? Hell no! He wants rates cut to zero or negative. ‘Then we could refinance the national debt.’ He wants to get rid of ‘bone head’ Powell, already arguably the weakest Fed chair in prosperous times.

No doubt some will say the US $ can’t be threatened as long as it has the most H-bombs or something. (Russia has as many and the ruble isn’t money outside Russia. It’s not a convertible currency)

The US $ almost collapsed in 1978. To shore it up the US had to issue bonds denominated in Swiss francs.

Remember what happened to the Taj.

Was watching in fascination BA (Boeing) stock ramping up for a few hours despite the horrendous news of stopping production of their most important airliner. same with AAPL hitting alltime highs despite news of a 30% drop in their china sales. i think what’s going on here is these are massively owned issues globally by pension funds,central banks (the swiss CB has been loading up on AAPL) and everybody and their cousin. these companies can not be allowed to falter without causing significant risk to the global financial system IMO,the train is going downhill with no brakes but they keep shoveling coal into the engine.

I read they snuck export-import bank into defense 738 billion bill. I have heard that is just a financing give away for Boeing. Nothing like rewarding failure.

In reality it seems like government is determined to cause inflation. Spend, spend, spend. 12 weeks parental leave. Could be wrong but I think you can use carry over paid sick leave days already for time off.

That’s not coal they’re shovelin, it’s dung !

Daniel weise is correct, Boeing is the “smoking gun” for equity manipulation IMHO.

BA has a float of about 563 million shares

Easy to manipulate that. Plus Boeing is the most heavily weighted issue in the DOW. They have to keep that doomed plane flying for now

Boeing has the rare distinction of having negative book value. They have literally given away more than they have ever made.

So busy with financial hijinks that they forgot how to design airworthy planes…

everybody is trapped

knowing and speaking of the risks of everything bubble

and keeping on blowing into the bubbles that is what they are doing all the time

they cannot deflate such a ponzi without imploding the system

They let it growing even bigger hopping for ?

nobody knows exactly for what,

may be for more time “kick the can down the road” until they think there will be able to resset -change the financial system hoping for a kind of soft landing

they are either dreamers or cynicals may be both.

Central Bankers have decided natural free market cycles, the type that occasionally flush excesses, are inconvenient and a nuisance.

So they took the 2008 debacle as an opportunity to self author and expand their powers and mandates. They then proceeded to use these new powers, completely unmonitored, to iron out these cycles through a new supervision of markets.

In so doing, excesses are no longer naturally purged, but instead build and are pent up. They will eventually be flushed, but the events will be cataclysmic and systemic in nature. Then the supervisors (central bankers) will again move to new territory in expanding their powers and carving new mandates.

The result will be globalization and socialistic economic directives and control by ever more powerful central bankers. This will all begin to take the form of an Orwellian exercise. And just as the EU began as an economic arrangement that morphed to political and social control, so will the constant central banking manipulations. The central bankers are already speaking of climate change policies. They are the deliverers of Globalization and Socialism

“Then the supervisors (central bankers) will again move to new territory in expanding their powers and carving new mandates.”

Like the Green Deal in Europe nowadays … with two big thumbs up from the new ECB president. If they completely wrecked the EU economy, we can trust them to wreck the climate too (or more likely, do nothing for the climate/nature but wreck the social fabric even more). I’m curious how they plan to have both boundless expanding consumption (faster than ever, we need at least 4% inflation?), better energy efficiency and improving climate at the same time, it really makes no sense unless the plan is something like the Matrix, with consumption for the masses going almost entirely virtual.

“they cannot deflate such a ponzi without imploding the system”

This is often repeated. Paulson and crew used this line for TARP approval. To make these statements is to advance Bankster propaganda. Just like referring to creating money as Quanitative Easing is to advance Bankster propoganda.

The FED is antithetical to free markets, intentionally.

The FED has proven to be quite the scam. Greenspan, Paulson, Geithner, Bernanke, Buffet, Cramer, Goldman and accomplices are scum within the scam.

@cb,

“The FED is antithetical to free markets, intentionally.”

The purpose of a central bank is to fund the Kings wars. The Fed was created in 1913 and we have been at war ever since – WWI, WWII, Korean war, Vietnam, Middle East and SW Asia. And these are just the hot wars. The wars will stop when we end the Fed.

When there is too much corruption, too many lies, at some point, a system, a society is not able to function anymore as confidence in the government & the bankers are lost

It is only about confidence you cannot abuse it permanently on such a scale

and now confidence is starting to run thin.

The Fed is a wealth transfer agency, to extract wealth from the general population and move it to Wall Street and Washington. Inflation is the mechanism. There is a deflationary risk, however, in that the inflationary mechanism is springy … it involves the creation of debt. Debt wants to be repaid, so the buildup of debt itself is a deflationary force. In the act of inflating the Fed sows the seeds of deflation. So it becomes a vicious circle. Unfortunately for the past two or three decades at every opportunity for gradual withdrawal from the cycle the Fed has elected to further exacerbate it.

Yes, operators and countries are trapped. However, individuals have room and methods to contingency plan. (Did I say operators instead of investors?) Oh my.

Contingency #1, get rid of personal debt. #2, Buy what you need for a time of adjustment depending on where you live and your individual circumstances. #3 Maintain your personal health. #4 Obtain useful skills and training as a past time. (Learning is fun)

One personal example: A few years ago I saw an add that our local Regional District (think county) was looking for Amateur radio operators to help with their emergency preparedness plan. They paid for the license/training. I took the course then upgraded with another one to obtain the Advanced certification which allows me to build and maintain site equipment and operate on all HF bands. Not only did the local Govt. pay for all the training, they bought me a radio. I built a small emergency comm centre for the Regional District on our property, and our renter is the watchman. Finally, I bought some used HF gear to use at home, built some antennas, and have found this a very fun pastime. Our local Emergency Plan communicates with HF groups in western Canada, and in the western States. I noticed a US net that has a regular contact sched with control in Hawaii, and connects with all US Pacific Ocean states. Tsunami and NK preps I expect.

After just 2 years the local radio operator ratio in our remote valley is 1:100. In any emergency where we might lose communications (cell phones don’t work very well here at the best of times), we have operators able to run the comm shack and/or report out by radio the needs of their immediate neighbourhoods. Folks that had trouble studying course material obtained the training and now feel pretty good about being part of a community plan.

Think of this radio stuff as an analogy. WS is another one. Most of us posting here sense something is wrong. Certainly, we often preach to the converted, but many many comments are worth following up and always make me think and consider other points of view.

As for real emergencies? I live in subduction zone earthquake country, as do many of you. Did I mention my nephew in Novato CA lost cell coverage and electricity for a few days this summer courtesy of fires and PG&E? SH** happens and there is absolutely no reason to blithely believe this debt fueled binge can continue indefinitely. IMHO. regards

God will punish the money changers

after 2000 years it seems he hasn’t even started with punishment, they are thriving like never before.

As for the Fed,well,it’s owned by the banks but i bet if you would hold a survey 80 % of Americans would say it’s some form of government institution working for the common good. a truly masterful Charade.

Might be a good time to be stacking…

You mean like stacking plywood predicting a Florida hurricane? It may be a while coming but you know it’s going to happen. Same with precious metals.

Wow can’t you see. The plan is to inflate everything. All the while, those with access to cash will keep buying assets. In the end, all those debts will be forgiven through inflation. Your mortgage will be too. It is not ideal from their perspective but acceptable. They gain much more.

So you see, there will be no crash. Only dollar collapse around 2025. Why then? Its right after Trumps second term.

Think about it. Didn’t candidate Trump talk about default on Treasuries? Guess what? He was actually being honest.

Increased debt has its risks. Nothing is free. Lowering interest rates just allows higher debt accumulations. It also tends to drive up the value of all leveragable assets.

The problem is that banks make their income on the spread. So when interest gets really low, the banks have to lend more. Lending more and more wouldn’t be a problem except that the real economy isn’t really expanding so the banks lend on riskier and riskier propositions. Higher and higher asset valuation. Same building, just leveraged higher and higher.

None of this matters until some of those riskier propositions start having problems servicing their debts OR when the demand for debt rises not for investment purposes but mostly to fund consumption (as in Zombie Corps and National Debt). At a peak, when more money is burned in consumption than is produced by actual business activity, servicing the existing debts starts getting rather dicey. In any case the problems arise when interest rates rise. That causes the asset valuation to decline. Opposite of lower rates.

This is when things can come apart. Not enough real income to service the debts, to high of asset valuations and service costs rising.. End of cycle..

Are we there yet?

Good question. Answer, we’re closer since there are signs of stress. Debt can’t keep prosperity forever.

2024 is when the interest on the national debt is set to exceed all US debt issuance so figure that’s the beginning of the end pretty much. Lines up well with a post second term Trump crash.

Nate,

Nah… Interest payment is now less than $600 billion a year. It’s just another budget item. If you add up all defense and intelligence spending (Defense Dept, Energy Dept which runs the nuclear weapons program, Homeland Security which includes the Coast Guard and numerous intelligence agencies, the VA, the other agencies that are part of the Intelligence Community, etc. etc.), you come up with a lot more than interest payments, and no one in Congress or the White House is trying to cut defense and intelligence spending. On the contrary. They just raised it by a whole bunch. Interest is just another line item in this bloated budget.

Central planning always end up in misery.

END FED

What can one expect from academics and bureaucrats?

Most of them are cowards.

Not a problem caused by academics or bureaucrats.

Problem caused by naked greed and the out-of-control finance sector, and the massively disproportionate power and influence it wields.

A situation that has arisen out of political cowardice – and our own fascination and obsession with fast, easy money which results from speculation rather than the slower but sustainable growth which results from design and production.

It has the feel of a story where a comet will soon hit the earth and blast us back to the stone ages, but only certain people either know about it or can comprehend it. My friends are busy living flat out to make ends meet and their eyes glaze when the words “bond bubbles” hit the airwaves. They have other things to do and wouldn’t likely believe it if you told them what Wolf has related in this post. I think I know who is getting hurt when this thing falls into the street.

Don’t get me wrong, but I am beginning to suspect we are seeing some sort of rift opening up between central banks and governments.

So far this had mostly been the preserve of developing countries: see the past public spats between the Indian government and the Reserve Bank of India. But in 2019 something changed: when was the last time we heard people for central banks bemoan their own handywork and so publicly? Where have all the pats on the back for saving the world gone?

It’s beyond doubt politicians and the people voting for them absolutely love the present monetary climate. Not only that but they want more, more and more: see how the White House farcically keep on calling for rate cuts at a time when rate hikes would be eminently desirable or how the Japanese government and their corporate pals fully expect the Bank of Japan to bankroll more trillions of yen in stimulus (read: corporate welfare and white elephants) just after bankrolling the usual Olympic pork barrel. These guys remind me of Mr Creosote, every single one of them.

Central banks lack the ability and, dare I say, the spine to stand up to these horrible folks. But lately Mr Creosote’s demands have become so absurd and downright grotesque even these usually meek creatures are starting to show a tiny hint of rebellion.

Last week Mr Visco the President of Bankitalia, Italy’s central bank, voiced his thoughts on NIRP and QE, calling the former “a mistake”, suggesting interest rates should never go below 1% even during a financial crisis, and the latter”in need of deep reform”. He also did his job for once and ordered the effectively insolvent Banca Popolare di Bari (BPB) to enter administration to prepare the bail-in procedure.

Needless to say politicians are furious and have already overruled him to bail out BPB. €900 million are already gone and many many more will follow. Cue in Trent Reznor’s “March of the Pigs”.

Mr Visco is not a hero, far from it, but he probably reached saturation point after increasingly ridiculous demands on the monetary and financial side. Every man with a shred of self-respect has a breaking point after which he’ll break: some may go on a crime spree, other may self-destruct with drink and others still may make their irritation known through other means, as absurd and ridiculous as these may be.

I don’t think this is new at all, we have heard the same warnings from ECB figureheads and (former) EU national bank presidents for at least five years, yet they keep cutting rates and pouring oil on the fire.

Yes, without admitting so much EU governments love what the ECB is doing: many of them have totally free money or they even get paid for going deeper into debt (and despite this, taxes are rising). In my country incomes of large numbers of government workers (e.g. teachers, healthcare) are now rising at WAY above inflation with probably more to come – got to keep the troops happy ;)

All these warnings are nothing more than a way to cover their a**. These guys all have a contract that states they and their whole family have the right to political asylum in Switzerland, probably including elite lifestyle forever, when SHTF. I guess the same goes for the FED mob. I see no sign of self-respect with these people, they are far worse than the Italian maffia.

The ECB operates at the pleasure of the EU countries, not the supposed separation and independence of the Fed.

The ECB dictates the rates at which the failed Socialist countries of the EU will borrow, or paid to borrow (NIRP).

As these central bankers promote inflation, do not forget…

They, the unelected, promote inflation upon us as they all have inflation protected pensions awaiting them. They are immune from the effects they ply upon us. France 1792

MC01

The great beneficiaries of low rates are the governments that empower the central bankers.

I see no rift, but rather a partnership on how to handle massive government borrowings. NIRP

Governments have been spending more than they take in since the days of Marius and Sulla if not before: they were able to get by well enough before the idea of a central bank was conceived. Sometimes a government would default on debt payments and a few banking families would be ruined but civilization was hardly imperiled.

The great beneficiaries of this most recent scheme have been corporate and private debtors. Paying a 0.125% coupon on corporate bonds, well below even the mildest official CPI figures, has no precedent in human history, just like present mortgage rates. Companies bankrupt both financially and morally (see Toshiba) can do business as usual without a care in the world and people like Jeff Immelt would have been revealed for what they were and kicked out after a couple of years instead of being able to devastate some of the best engineering companies in the world.

MC01:

We “crossed the Rubicon” in 2008-09.

There is no going back…….

And, history will “repeat”……….to what????

central banks spine? Christine Lagarde wants to codify FISCAL policy into monetary policy! (it’s called the green bond/green new deal buzzword). Even More power to central banks!

She’s merely jawboning financial markets, just like she was doing at the IMF. That’s part of the reason she got the job.

The whole “green” economic nonsense has absolutely nothing to do saving the environment. Please note this doesn’t mean there isn’t a huge environmental problem.

What’s important is that European conglomerates and especially automakers get a big boost to their sagging business after killing and devouring every single golden egg-laying goose that was handed to them. The “green economy” thing has zero to do with the environment but has a lot to do with Volkswagen, FCA, PSA and the rest of the gang.

If Mlle Lagarde wants to do something for the environment she could start by hiking rates to 5% overnight. It would instantly kill real estate speculation, zombie airlines and a ton of other dead wood economic activity. It would do a whole lot more good than any corporate welfare scheme.

MC01,

“Mlle Lagarde”? … Mme Lagarde, no?

(She was married and has kids.)

There’s a very good reason why I refuse to look into the family details of these politicians: now I have this mental image of half a dozen little Lagarde dancing and singing songs about monetary gloom and doom like a currency-debasing Von Trapp family.

The stuff of nightmare for short. ;-)

Fully agree. I’m not really on top of developments in the EU auto sector but I do sense some real panic there, the big German auto companies seem pretty desperate about their future and they need help from big government and ECB to survive without really innovating.

I’m very much in favor of a green economy, but when bankers and the average politician start arguing for this you know it is a boondoggle and all kinds of bad things will happen.

Hiking rates back to at least the average of the last few decades, and eliminating all the huge subsidies and exemptions for fossil fuels (the biggest users/polluters pay by far the lowest price) would be the easiest solution and sure way to bring consumption and energy use back to more sustainable levels. But I guess instead we will see even more government and central bank interventions to make things worse.

Now I have to get rid of that nightmare of Lagarde dynasty offspring waiting in the wings to wreck any future the EU could have after the ECB, EC and Euro-parliarment have been eliminated ;(

I prefer “convicted financial criminal Lagarde”.

And why exactly is a convicted financial criminal the best choice for the head of a major CB?

It speaks for itself.

Yeah, Lagarde a convicted criminal is the most powerful woman in thte EU. For normal people, being convicted for a petty crime pretty much will doom your career prospects , yet this woman was promoted to the highest job. She said it, its better to have a job than savings so she will make sure savers will be punished to the end.

first they will come for the savers and then they will eliminate most of the jobs; resistance is futile.

You wanna read something striking .. read Corey Morningstar’s series ‘The Manufacturing of Greta Thunberg’ for a view of the drubbing the lowly plebians, world-wide will receive, should the ever-grifting peter-principled global elite have their way regarding deals green …

Very eye-opening !

Sweden’s central bank ended NIRP…

https://www.ft.com/content/0cb65c7a-223a-11ea-92da-f0c92e957a96

Paulo Zoio,

If you’re going to post a link, at least use the one from a reliable source :-]

https://wolfstreet.com/2019/12/19/despite-slowdown-sweden-exits-negative-interest-rates-first-central-bank-ever-to-do-so/

I want Jerome Powell and the Fed to create a Timbers Bimbers Repo desk just for ME! I will borrow billions & trillions at almost no cost whenever I want! I’ll buy Apple and Boeing and become part of the 1% and give lectures on cutting Social Security & Medicare because they are cause of all our deficits but never mention wars or tax cuts for the rich and I’ll sanctimoniously snear at all you irresponsible Little People who aren’t rich like me.

Get in line.

Hey Wolf, I hear ya! Regulations on banks they say about keeping reserves, there fore no liquidity. They are getting rid of libor too. They are keeping an eye on it though. Scary! Low rates forever? They will continue cutting but not a fan of negative rates? Unreal! Tech deflation and no pricing power? Seems all yield to me in this market. Single bonds and stocks with yields and buybacks. Holding even if they’re levered.

When the imbalances and malinvestments and misallocations of resources comes to fruition, it will be one more excuse to

CUT RATES

They use the same tool for all instances. The QE in 2009 (Dow 8000) is now used in 2019 (Dow 28000)

When things improve, they don’t raise. When things worsen they cut.

A ratchet to NIRP.

Why do we keep on listening to these folks? I have had enough already.

“they cannot deflate such a ponzi without imploding the system”

This is often repeated. Paulson and crew used this line for TARP approval. To make these statements is to advance Bankster propaganda. Just like referring to creating money as Quanitative Easing is to advance Bankster propoganda.

The FED is antithetical to free markets, intentionally.

The FED has proven to be quite the scam. Greenspan, Paulson, Geithner, Bernanke, Buffet, Cramer, Goldman and accomplices are scum within the scam.

of course, that’s only an opinion of a interest rate oppressed saver …..

What have we found out so far?

That so-called “Excess” Reserves of about $1.5 trillion is really what is left of all the house money conjured before, during, and after the 2008 crisis which has taken the “fidence” away for confidence. The rest of the money or debt has been spent a long time ago and cannot be paid back. And now even that “excess” is not enough to prop up the shop anymore, so the magicians have to create another crisis for an excuse to create more excesses. QE led to undue excesses, which led to QT, which led to Repo failures, which lead to more QE. Why don’t you think this wasn’t planned?

It’s like watching paint get wet again.

Stock prices going higher. Dividend yields going lower. Home building surging. Home prices going higher. M2 rising. Price of palladium not falling.

Another possible interpretation of these types of statements is that the members of the FOMC are essentially saying they know what the better policy choices are, but they’re unable to implement those policies for unstated reasons. So what might those reasons be? Couple of possibilities, and I suspect there are others:

1.) Monetary policy is actually being set elsewhere. If so, who are those opaque policymakers and what is the source of their power or policy leverage to do so? Who benefits from the continued infusions of central bank liquidity and historically low interest rates? To what extent is trading in speculative derivatives booked in FDIC-insured depository institutions placing the payments system at risk absent low asset price volatility? Is a reported shortage of US dollars globally with the dollar as the primary global reserve currency playing a dominant policy role; and if so, why?

2.) It’s too late. The Fed is trapped, but is unable to publicly acknowledge this. In the wake of the GFC, the Fed ran QE and negative real interest rates for too long a time period. The maladjustments reached such magnitude that reversion to the mean is now politically and economically unacceptable. The Fed can’t reduce liquidity or financial markets will drop. Stock market indexes, bond prices and real estate collateral values have primacy in a debt-driven economy.

What cannot be sustained, won’t be. But why can’t it be sustained, and why can’t domestic fiscal policy initiatives that benefit the American people be undertaken?

Fed is trapped.. not because of what they did since the GFC but even before the GFC. That is why the bail out was just the same ole thing on steroids. More debt, lower rates.. Just look at a chart of interest rates.. AND Velocity of Money charts. They can’t admit or quit because that brings down the entire US Ponzi scheme.. So they go until gravity collapses the entire house of cards. There is no way out for them or anyone else. Just like the game of Monopoly, once it is over, it is over and the game has to start from the beginning again.

When it comes crashing down, the public will scream to the Federal government for someone to held accountable. But the no will be held accountable because the Federal government never holds itself accountable. End of story.

That’s why God invented pitchforks and torches. Sometimes the peasants just have to storm the castle.

I read today that some of the protesters in France cut the power to the homes of the elites. People like “let them eat cake” Lagarde may have homes with their own generators etc. just in case, but these protesters may be onto something ;-)

Cutting the natural gas supply to the generators will be very dangerous. Perhaps it can’t be helped. Then again they will eventually run out of diesel.

the governments are bankrupt too!!??

Do you know what happens with the bailouts of the Chinese government to five of its banks?

Talk about DEFLECTION. I had Bloom TV on and quickly disposed of Kaplan’s interview.

Instead of criticizing highly indebted companies who are in the business of trying to MAKE money, look instead at the government who’s only goal is to SPEND money by borrowing and taxing.

One of the easiest and most understandable way to make sense of all this econ blab is to simply look at how the government borrows money by selling marketable treasuries — to mostly repay debt that has matured and to make net new money. The ratio is 9:1. We get less than 10% net new money from the treasuries we auction. About 90% of issuance is to repay maturing debt!

Term (the length) of the debt matters a lot.

T-bills mature within a year or less and have to repaid within 52 weeks, so you tend to recycle through T bills quickly. They decay fast and they also grow very fast. To give you a sense of where we are with T bills, here’s the last 4 years. (In Billions USD)

2016: Retire 5,197.9 Issue 5,556.9 New Money 359.0

2017: Retire 5,920.9 Issue 6,114.9 New Money 194.0

2018: Retire 6,872.9 Issue 7,246.0 New Money 373.1

2019 est: Retire 8,232.9 Issue 8,408.0 New Money 175.1

So you can see the repayment snowballing effect with raising money on T bills. No wonder the Fed is doing $60b a month purchases. We have to auction 8.5 trillion a year to get $175 billion spending money! And, it will only get WORSE.

Therefore we raise money also be selling Notes and bonds. 2019 est.

2 to 10 year Notes: Retire 1,731.5 Issue 2,341.4 New Money 609.9

30 year bonds: Retire 32.0 Issue 236.0 New Money 203.9

So, you can see we are trying hard to kick the can down the road as far as possible. It will we interesting to see how foreigners react. Some are desperately seeking a substitute.

>>We get less than 10% net new money from the treasuries we auction”.

That’s actually a GOOD thing. Ideally it would be 0%.

>>Instead of criticizing highly indebted companies who are in the business of trying to MAKE money,

This is one of the first times I have a fundamental disagreement with you. There is nothing intrinsically good about private debt and something intrinsically bad about public debt. Unproductive debt is unproductive debt. Private corporations have gone into massive debt for the extremely unproductive purpose of buying back their own shares. Government has gone into debt for bankrolling endless and immoral wars and also bankrolling horribly unproductive tax breaks for the wealthy.

ALL unproductive debt is bad.

All unproductive debt is bad, I agree, but it’s very popular. What should companies do when there’s over production and over supply while debts are so cheap? I am not the moral in moral hazard. Who is to prevent management from doing something stupid? The happy shareholders?

NarMAGEDDON:

We already know how to market productive debt.

The last GFC taught us how to “market” unproductive debt.

No debt is an longer, “unproductive”; all debt now is marketable. Therefore all debt is “productive”.

I’m just a little old man living in the mountains and continue to be fascinated by this site and the commenters who have taught me so much.

It is quite a verbal feat to on the one hand talk up the greatest financial bubble of all time, and at the same time warn of (others) excess. Double talk, talking out of both sides of their mouth, blah-blah, yadda-yadda-ya….In the twilight struggle between talkers and doers, the carnival barkers have won. The Fed are nothing but a distraction, circus clowns mimicking reality, while the three ring circus of markets, liquidity and debt play on.

The FED is in an all out effort to prevent Trump’s re-election. They will sabotage the economy for political gain. This is just the start of the campaign.

Well, the Fed cut rates three times this year and threw $300+ billion at Wall Street via the repo market and T-bill purchases. It doesn’t look like that they will raise rates next year even if inflation goes over target because they already said that they will let inflation overshoot. And they will continue to throw money at Wall Street. So for now that goes in the opposite direction of your suspicion.

The FED raised rates 7 times in 2 years after Trump got elected vs once in all of Obama’s 8 years.

Care to explain how that goes against my “suspicion”?

Bush handed Obama the Financial Crisis. The Fed acted when things started blowing up, which was at the end of the Bush era. Obama inherited that fiasco — and the Fed policies that came along with it. This is the same discussion we’ve been having forever. You keep forgetting about that Bush part. It’s really annoying that I have to remind you every time.

Fed’s target range is now 1.5%-1.75% and the balance sheet is ballooning at the fastest rate since the Financial Crisis. But this time, there is no crisis. These expansionary policies are NUTS in the current economy and inflated asset prices. And you’re telling me that the Fed is doing this crazy expansionary monetary policy to take down the economy so that Trump will lose? There is something twisted in your logic.

You might have a point if just before the 2020 elections the Dow tops at 35000 or so and crashes back to below its 2008 value and takes the everything bubble and the reputation of Trump with it (many Americans seem to be fine with him as long as the stock market and home values keep rising).

Unfortunately there is zero chance of that happening. One could even suspect that the FED initially raised rates in order to enable Trump to tweet the market up even more right into the 2020 elections ;)

Wolf, it’s all about “situational awareness’, and it has been for all animals with nervous systems for millions of years.

I know exactly where his logic leads. That the Fed is obviously a “Trump Hater”….(whether T has taken over the GOP by virtue of their need for votes remains to be seen, I guess)…along with coastal elites and many other groups….all added as needed.

Not that the DNC is much better, being to the right of Eisenhower, IMHO.

In USA culture/history most of it traces back to Calvinistic Protestantism (see Max Weber). Just my take.

You have to watch Fox at least a little bit, and maybe some Duck Dynasty, too.

Anyway, thanks again for good data, insights, and mostly for collecting current notions from intelligent people. It’s definitely a part of my quest for situational awareness.

95.6% investor consensus of a 1/4 point rate cut end of January 2020. I keep visualizing a WWII fighter trailing smoke as it heads for earth in a vertical dive. Unfortunately I can’t judge the altitude.

Lisa_Hooker,

Either you left out the “no” or you misread something. Currently the market sees a 95.6% probability of NO change in January. The current target range = 1.5% to 1.75%. And the market sees a 95.6% probability that this will be the target range also after the January meeting, meaning no change, no rate cut, no rate hike:

Duh!

Mea culpa — squared.

Misread the 4.4% chance of an increase to 1.75-2%

Thanks Wolf.

JSRG, you’ve got it almost exactly upside-down (as Wolf has patiently explained).

My theory is the opposite of yours: the Fed has been kicking the can down the road, hoping to stave off a crash just long enough to ensure a GOP win in 2020. I don’t really think TPTB really LIKE Trump – he so uncouth, even worse than most New Money! – but he’s delivered on what they most want (lower taxes at the top end, de-regulation, lax enforcement, Federalist SCOTUS, etc).

If it works – no crash until Nov 2020, Trump wins – they will use the extra time to buy islands & build private Navies. The rest of us are screwed.

If it doesn’t work – bubble pops soon, a Democrat (or even “worse”, Bernie) wins the White House – then Republican Senators will stifle any recovery, just as they did under Obama. They will use the extra time to buy islands & build private Navies. The rest of us are screwed.

My advice: if you can’t afford to buy an island, get a job building warships.

Space Force warships maybe?

Maybe Elon should pitch the “Elysium” concept to them ;(

The Fed is owned and operated by the bankers for the benefit of the bankers. Anyone who thinks any thing else is delusional. The Fed does not exist nor act for the good of the American economy, nor for the good of the American people. The Fed is owned by the bankers and operates solely on what’s best for the bankers.

That’s reality. If you think otherwise, then vote for someone different as a “Fed Governor”. You don’t get a vote. Surprise, surprise, surprise.

There was the chance to vote for Ron Paul, but not enough supporters. People who I thought were rational, dismissed him as a crank. I know this might be construed as political, but how can a thread such as this not mention and early and arduous critic of the FED.

They had Williams on CNBC. I fell asleep.

Rosengren also spoke yesterday. Evans today.

What’s up? Why are they all talking?

Why are they all talking ?

They’re all jabbering crows .. who have swiped the only source of Dragon Glass daggers & Valerian Steel swords, that are the only protection from the Whitewalker threat of inflation invasion.

Winter is coming, for all of us who dwell in the likes of Flea Bottom !

polecat:

“Winter is Coming” like in, “Game of Thrones”!

Meanwhile Congress did sign off on the spending bill, with some dissent. Hard to understand how they can impeach a president for bribing a foreign leader with taxpayer funded aid and then write him a blank check? No political axe to grind just know that Treasuries are even more toxic, and if JP starts putting them on his balance sheet (stocking stuffers for Congress to monetize, or QE4, or both?) the dollar is going to suffer creating a death spiral, and corporates will ride above the storm. Someone said La Garde wants to pump money into the climate change industry? booyah

well, La Garde does make sense … ECB could force EU governments to burn euro currency notes in their “biofuel” power plants instead of burning trees from non-sustainable sources. Plenty of ECB toilet paper around nowadays to keep the power plants humming along ;(

LOL!

I can’t recall Wolf getting this mad about anything. In the mind’s eye one can see Wolf jumping up and down. Is he going to throw the chair through the window? It’ll cost $500 to fix the window …

Meanwhile, the Fed is throwing TRILLION$ at the repo- and short term markets like it’s QE or something. What do we need that for? I thought everything was going swimmingly.

Oh well, if there is a crash, interest rates will fall to zero and there will be QE for real. Otherwise, rates somewhere important (like China) will rise regardless of central bank efforts and ‘waste products’ will hit the fan. It will be interesting to see who gets mad at that point …

I want all you bankers to get up from your chairs, go to the REPO window, open it and yell, “I am mad as hell and I am not going to borrow this money any more..” https://www.wsj.com/articles/fed-sees-diminishing-demand-for-liquidity-operation-11576681199?mod=searchresults&page=1&pos=2 I think its likely that Fed will have to go to QE to get their attention.

The decreasing overnight repo numbers seem to suggest that. But there are at least two kinds of term repo plus multiple T bill Fed purchases (about 7.501 billion a shot).

So all in all, the Fed accommodation is actually increasing instead of decreasing. The Fed just wants the short interest rate at 1.55% period.

I am assuming Fed is only doing repo with commercial bank members. But the funding is needed by securities firms and hedge funds. Fed is thinking that if you overflood the commercial banks with reserves from repo that will make them more interested in lending to securities funds and hedge funds. If they were not doing this in September, as rates approached 10%, why should they do it now?

A better explanation would be that big banks are simply front running the Fed in anticipation of another QE As they have gorged on Duration in US Treasuries, with Treasury and Agency holdings of just commercial Banks increasing by $ 400 Bn over the last 12 months.

This has reduced their surplus cash level materially and is a concerted play on recession/multiple additional Fed rate cuts/QE4, which has resulted in all the smart boys being loaded to their gills with term USTs and sitting on the same side of the boat, destabilizing it materially. Great minds indeed think alike, as the saying goes. Plus their GSIB scores will be computed at year-end so they would probably be reluctant to take this additional repo liquidity from the Fed and distribute it in the market, whatever the rate arbitrage available. The fact that the Fed has ramped-up its repo market intervention to an amazing shock-and-awe $ 500 Bn across the year-end probably speaks of the extent of their fear/concern about some potentially big blow-up in the market over the coming weeks, especially the year-end. But the big bank holders of USTs will get their pay-day only when the Fed throws-in the towel and starts buying longer-dated USTs in size on outright basis, transforming the current quaint “not-QE” to full-blooded QE4. And the big banks have the Balance sheet capacity and capital to keep sitting on their tankerloads of term USTs, Guess who is going to be the winner of this battle ?

https://fred.stlouisfed.org/series/USGSEC (Click the 1Y tab in the chart)

“Funding” == the enablement of issuing more debt.

Wall St loves to talk about the repo crisis as a “funding problem”. That’s just a smoke screen. What it really means is that we have reached the limit of how much debt can be created, without “creating” more reserves and thereby pumping more asset inflation.

And don’t forget, asset inflation equals labor devaluation.

Re: I am assuming Fed is only doing repo with commercial bank members. But the funding is needed by securities firms and hedge funds.

No to the first sentence. The Fed Repo is with primary dealers. Not the banks themselves.

Yes to the second sentence. The broker dealers and hedge funds do not have excess reserves at the Fed, so they are net borowers. About 4 large banks own these reserves, with JPM having the largest share. But JPM exchanged a big part of their reserves for Treasuries. So there’s less cash available for repo.

“It’ll cost $500 to fix the window …”

“Stimulus!!!!” cry the Krugmanites…

DC “improves” the “sub optimal” US economy by having the other 320 million of us dig and then fill in their (latrine) holes.

Wolf is a genius. Hopefully he has been mad about this for decades, though it took a little while to figure Greenspan out for the misdirector he was.

If only we could ply the Fed members with alcohol and get them to tell us what they really thought. So how close are we to our very own version of Weimar’s currency collapse in 1923?

For best results, send them all to Belmarsh for a little r-n-r …polecat

Here’s the real reason why the Fed keeps pumping up the debt-fueled everything-bubble: The Fed CANNOT be the first central bank that bursts or deflates its own domestic bubble. Somebody else (meaning essentially, China or Europe) has to burst first.

Said in another way: Our oligarchs do not want their (US) assets to go on a deeply discounted fire-sale to the foreign oligarchs. Rather, our oligarchs want to buy the cheap assets of the rest of the world after THAT bubble bursts first.

This is the real reason why the Fed keeps the music playing. It’s all about who gets to win what is in effect a global financial war.

Good theory, if scary. Thanks.

If right, it implies that we (here in USA at least) will have a bit of a warning as other countries implode first. That’s enough to fill the tank & bug out, I guess.

Bug out to where ?? There ain’t many safe havens left to hide in .. short of some undiscovered cave … for most, it be down to 80% luck, and 20% skill

Helm tip : Learn to chain mail

It’s all about who gets to win what is in effect a global financial war.

It won’t be the general population, which is to say, you. TPTB hold all the cards.

Let us be frank. When will US long term securities (Treasuries, Agencies, Corprate bonds and equity) be labeled toxic? Notice, I didn’t even include munis.

When? Now would be a good time.

I don’t want to be frank. Especially if he’s toxic …

Shirley you jest about Frank.

And don’t call me Shirley.

We are in an economics arms race with China, and so we will match their unsound behavior with ours. Bring it on.

John Dizard at the FT in his Dec 12 column wrote:

“there has been a prolonged infantilisation of the capital markets and sector-by-sector over-leveraging. If private markets fail to finance new debt, the Fed will almost instantly take their place.”

That is the perfect phrasing of what has happened since 2008.

Link to Dizard’s column:

https://www.ft.com/content/7d4b2159-915f-4be4-a947-f77e1b019314

Its a bit like Michael Jackson’s ( or any other big celebrity’s ) personal doctor. They know their ‘patient’ doesn’t need anymore pain killers, sedatives or stimulants. In fact, it could kill them but if they don’t give it to them they’ll be fired and return to some crummy clinic or hospital to practice medicine.

Running a Central Bank is the apex of an academic or finance career but your client is the state and its political establishment. Hike interest rates and the politicians have to cut spending and you’ll be held responsible and lose your position.

What is relationship between FED monetary policy and the amount of “BBB” bonds?

Low interest rates creates more BBB bonds and more downgrade bonds ? How?

“How?”

If cash flow negative companies are enabled to project an illusion of stability and normalcy in employment due to ever snowballing debt accumulation (made viable – temporarily – by historically low interest rates, created by a federal gvt with the power to create money supply out of thin air) then more and more companies will see worse and worse credit ratings.

Historically bad Corp debt ratios/collateral value instability is tracked by the rating agencies – thus more and more BBB debt (actually worse, but the agencies are scared of triggering a panic with honest downgrades into junk ratings – which would force huge sales of bonds by institutional investors).

Basically, the US has become a delusional empire with foundations of bullshit.

Low interest rates create an investor phenomenon, called “yield chasing,” where investors take ever higher risks to maintain some level of yield. So companies find that there is a huge appetite for riskier debt with relatively low costs to them, and so companies can issue more debt to fund acquisitions, etc. Many companies that have done that have gotten downgraded to BBB because of all this new issuance. Others that were already BBB have been able to issue more debt at low rates, and quite a few have already been downgraded to junk, without seeing much of a penalty on yields. See the BBB-BB spread chart in the article above.

Low interest rates blind investors to risks and encourage companies to issue debt, even companies at have less than stellar credit ratings because there is strong demand for this debt by blinded investors. This has been going on for years, hence the pileup of BBB debt, and the pileup of junk-rated debt.

A non-political FED would have rates at 0% to compete with European rates. And even against this headwind, the economy is doing well. But, imagine where we’d be with a neutral FED….5, 6% GDP growth easily.

If Americans understood what was being done to them, they’d be livid. But a) the MSM doesn’t report any of this and b) most Americans have no clue how any of it works, thanks to the dumbing down of the education system over the past 50 years.

A nonpolitical Fed wouldn’t have buckled under Trump’s threats, and its policy rate would now be 3.5% where it should be, given the current economy, including unemployment and inflation, and asset prices. You yourself have pointed out how fantastic this economy is. It needs higher rates, not lower rates.

Olé!

Central banks should be answerable to the people, if anyone, and not to banks, TBTF banks, and certainly not to terminally ambitious and self-serving politicians with delusions of adequacy.

Were today’s economy truly better than ever,

central banks would be raising rates,

cooling things down; but our statistics are off.

Old age, disability, and professional scofflaws

are on the rise, and no one has a decent solution.

In China, traditional family values help, and

the government covertly “re-educates undesirables”;

in the Philippines, the slaughter is more overt.

In New York, jail costs 1,000$/day/person;

the cheaper alternative is to just let everyone

“steal, trespass, assault, etc.” with impunity.

Apparently, central banks think negative interest rates

will alleviate the pain, like heroin ( and/or religion ).

Pain relief is the focus of all religions,