Orders for heavy trucks re-plunged, after false bounce off the bottom.

By Wolf Richter for WOLF STREET.

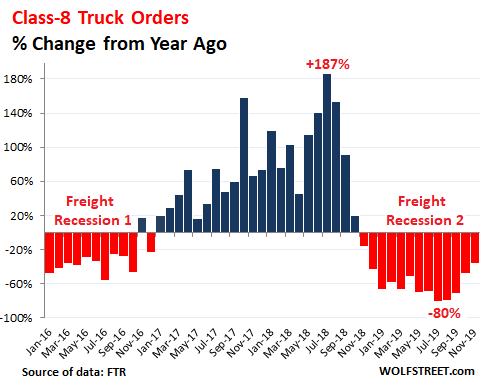

This was not supposed to happen. November was supposed to be the second month in what would be the upturn from the historic collapse in 2019 for orders of heavy trucks. Orders in 2019 had plunged by as much as 80% from a year earlier. That collapse in orders followed a historic boom in orders in 2018. But in October, orders had bounced, and though still down by 48% from a year earlier, it was a big move. So November was supposed to power the second step of the upcycle. And instead, orders plunged again.

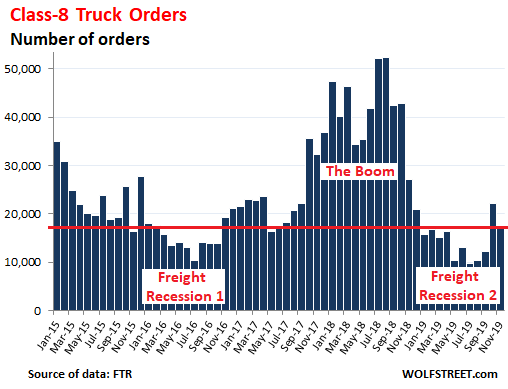

Truck makers in the US received just 17,300 orders for Class-8 trucks in November, according to preliminary estimates by FTR Transportation Intelligence. This was down 21% from October, down 39% from the already swooning levels of November last year, and the lowest November since November 2015:

This brought the cumulative total for the past 12 months down to 180,000 orders, below the prior cycle-low in December 2016, and down 64% from the 12-month total of over 500,000 orders at the peak of the cycle in October 2018.

“Fleets remain extremely cautious heading into 2020, placing small orders and not extending orders much beyond the first quarter,” FTR said in a statement. “A couple OEMs [truck makers] reported decent order activity, but total orders fell below expectations.”

The truck makers are Daimler divisions Freightliner and Western Star; Paccar [PCAR] divisions Peterbilt and Kenworth; Navistar International [NAV]; and Volvo Group divisions Mack Trucks and Volvo Trucks.

By now it has been widely acknowledged that the boom of Class-8 truck orders from late 2017 through most of 2018 was a result of a series of events triggered by companies across the spectrum trying to front-run potential tariffs, which resulted in a shipment boom, which caused carriers to order more trucks to meet this demand. But by late last year, the shipment boom had fizzled. And truckers slashed their orders.

The chart below shows the year-over-year comparison for each month, which eliminates the effects of seasonality and outlines the infamous cyclicality of the business. Note the year-over-year gains in 2018 reaching 180% in July 2018, and then the year-over-year plunges, exceeding 80% in July and August 2019:

“The fall order season has gotten off to a slow start,” Said FTR VP of commercial vehicles Don Ake. “Freight growth has stalled from the high rates of last year. This is causing fleets to be much more measured in their ordering for 2020.”

Trucking companies — they’re part of the services sector, in the category Transportation Services — play a huge role in supporting the goods-based sectors of the US economy, such as retail, manufacturing, construction, and oil-and-gas drilling. But some of those sectors, particularly manufacturing and oil and gas drilling, have encountered some turbulence this year, and shipments for those sectors have declined.

Now loaded up with the new equipment they had ordered during the ordering boom last year, and which by now has mostly been delivered, trucking companies can back off ordering even more new equipment.

Truck makers have been eating into their historic backlogs and were able to keep production levels high. But Freightliner, the largest brand in the US, has already announced layoffs at two of its manufacturing plants, as have some suppliers, including engine maker Cummins [CMI] and Meritor [MTOR].

“There is still a great deal of uncertainty in the environment which is creating apprehension in the trucking industry,” Ake said. “Manufacturing has receded for four straight months, slowing economic growth. The trade war and tariffs are destabilizing prices and supply chains. And the tumultuous political climate just adds to an uneasy mix. The industry thrives on stability, but we are now on a rocky road.”

In manufacturing, worries abound, weakness persists, but some aspects and sectors tick up. Read... US Manufacturing Stuck in Dour Mood, After the Boom Last Year

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Historically, which has been more accurate in predicting recessions: truck orders, the PPI, the yield curve or tea leaves?

No one is saying that trucking is predicting recessions. Consumer spending predicts recessions because it causes recessions because it’s 70% of the economy, and consumers spend most of their money on services that are not hauled by trucks (health care, rents, insurance, telecommunication services, and the like)

Wolf,

I was asking, not implying, and should have written ‘Transportation Services.’ When shippers, truckers and the railroads cut back I do think it implies they,, at least, think the economy is contracting.

I see what you’re saying. Misread that one.

And that’s why SUSTAINED high oil prices are destructive to the economy.

Oil is involved in EVERYTHING – from extraction of resources used in manufacturing to delivering goods to retailers. There is virtually nothing we consume that oil does not touch.

So it is not surprising that the IMF research indicates that a SUSTAINED $10 increase in the price of oil whallops 0.4% off of GDP.

A $30 SUSTAINED increases punishes GDP by 1.2% and so on.

Shale needs way more than that to break even so work out the hit to GDP.

Oil has been at a SUSTAINED price of $50+ for a long period now.

Look no further than that as to why things are getting shaky.

The consumer has been able to weather the storm by taking on debt and being able to service the debt due to record low interest rates.

But very clearly the consumer is reaching the point where no matter how low the interest rates are, he is unable to consume more. He is simply unable to service any additional debt.

This article details one of the symptoms. Others include increasing rates of default on subprime loans as well as auto loans.

The problem we are facing is that high-priced oil is not good for the machine. The machine NEEDS low-priced oil to operate.

We are NOT finding much if any low-priced oil. We picked all the low hanging fruit.

We can delay the inevitable with wide ranging stimulus, and we have, for nearly two decades.

And we are now starting to push on a string.

The grim reaper is warming up.

good lordy

Bust – boom – bust economy trying to front load China manufacturing and imports. Then the coastal building boom from the wealthy foreigners who are inflating sky high properties here!

Freight trains have already laid off thousands of engineers and parked hundred of locomotives in Arizona desert waiting for failed imports!

Wolf,

Do you have any idea what portion of consumer spending is spent on rents? Or any idea where that information could be found?

Thanks.

About 63% of households own their homes and don’t pay rent. So overall, rent is not a huge factor in consumer spending. But among people who rent, they’re spending a lot on rent. Based on vague memory, about 1/3 of renters’ household incomes is spent on rent. In many expensive cities, this can be far higher, with some people spending over 50% of their household income on rent.

Historically, an inverted yield curve was an excellent predictor of an imminent recession.

But that was before QE to infinity, bailout after bailout, TARP, HARP, HAMP, Operation Twist, ZIRP and adding more to the deficit than all other administrations combined.

I’m with 2banana. I’d answer “none of the above”.

Truck orders are not that closely related to actual transportation services. Actual freight metrics are better if you want to gauge health of the tangible-production side of the economy. But it also depends on the mix of goods being transported. On-shoring and trade battles change the mix. The shift from coal to natural gas for electricity changes the mix. Coal goes by the trainload but gas flows through pipes.

As for the other options – PPI doesn’t correlate well with recessions. Yield Curve used to predict recessions well, but central banks have taken us out of the economic parameter space where it works.

I’m amazed at how few economists have grasped that in the absence of a gold standard or any other constraint on credit supply, most of the macro textbooks and past research are flat out invalid. (“Not even wrong”, as the witty physicist once said…)

Now we have stuff that was never even in the textbooks: Negative rates used to be unthinkable, yet here we are. Zombie corporations were unthinkable. Major reserve currencies continuing to hold value despite previously unthinkable debt/GDP ratios and unsustainable deficit/GDP ratios…

Having a gold standard has zero to do with whether recessions or financial booms or busts occur. The US was still on the gold standard when the 1929 stock market crash occurred, followed by the Great Depression.

The common understanding of why the Great Depression happened nowadays is that almost everything was done after the Crash of 1929 in the reverse of what we know now will stimulate the economy – the Fed initially tightened rates, and taxes were increased to balance the deficit, and later to pay for the New Deal. The idea of deficit spending and cheap money was frowned upon then

The Great Depression was merely the last and most severe of a series of financial panics that occurred at roughly 20 year intervals in the United States ever since its founding. All were caused by private financial speculators who built up excess debt that blew up, causing contagion to associated financial institutions that also blew up.

The original purpose of the Federal Reserve was to help smooth out these financial panics. The Great Depression showed that it didn’t really know what it was doing, and that other financial regulation was needed.

And so a vast array of Federal laws were passed that strictly locked down the financial institutions of the time. Glass Steagall, which prevented banks from providing loans for speculative instruments, was merely just one of those laws.

Marginal tax rates were as high as 90%, which further discouraged the idea of speculating with money in order to become a fabulously rich Master of the Universe. Making more money just meant you gave more taxes to the guvmint

This was true the “Great” period of the “Make America Great Again” slogan of Trump, a socialist paradise where unions were strong and protected by law, financial speculators and capitalists making money off the sweat of the common worker were dirty words and tightly clamped down by Federal law and taxed to the max.

What made it all work and “Great” for America was that the rest of the world had been bombed to dust or bankrupted by WWII. It was hardly a great period for the rest of the world. Great Britain, the other putative victor of WWII, was so poor it had food rationing until 1955. Germany, Japan, and China were completely devastated by the war

This was the 50 year period between 1930 and 1980 where “normal” and mild business recessions in the US occurred, the kind seen with the cyclical transportation industry data, instead of the every 20 year mass financial panics that had previously characterized the poorly regulated free wheeling United States prior to 1930.

As the rest of the world recovered, the socialist ideology that financial speculators were a dirty word changed. America now needed to compete financially with the rest of the world. Suddenly the idea that capitalism was Good, that Greed was Good, that daring entrepreneurs should be given all the money they needed and not be hampered by pesky guvmint laws and regulations and taxes came into vogue. This was the Reagan Revolution of the 1980s. And it worked. Clinton more or less continued this policy with Greenspan as his chief crony, now using the Fed to open up the floodgates of money. Glass Steagall was repealed during the Clinton era.

And so what we have now, with all the financial deregulation that has occurred is a return to the freewheeling anything goes speculation of the pre-1930s, now hugely amplified by a complicit Federal Reserve.

The deregulation and easy money that made possible the irrational debt and stock market speculation that brought us Amazon, Google, Netflix, and Tesla are also going to bring back the regular cycles of financial crisis.

This is the true ying and yang of finance and guvmint regulation and taxes. Strict regulation and high taxation does prevent the spectacular crashes, but also clamps down on the potential booms. This is what’s known in engineering terms as a low gain system.

Get rid of the regulations and taxes, crank up the amplification power with cheap money from the Fed, and you get our current wildly speculative boom period, a super high gain system. As engineers know, super high gain systems are unstable, and are probe to oscillate wildly, i.e., crash just as spectacularly as the high gain boom periods.

Gold is just another commodity today. In the old days of a world gold standard, it almost certainly caused the hyperinflation that occurred in some developed countries like Weimar Republic Germany which over printed money while other countries did not.

The gold standard thus did severely restrict the ability of countries to over expand their money supply, a good thing you might say, except that this also severely restricted the ability to expand the money supply during the deflationary period of the financial collapses that regularly occurred.

The Fed and world central banks did rescue the world from falling into another Great Depression by rapidly expanding the money supply. The problem now is that this money spigot hasn’t been turned off, and combined with the loosened financial regulations and lower taxes, is only going to increase speculative debt, which will blow up, sooner or later

Gandalf, I appreciate the detailed history, but I fear you completely missed my point, which is that any macroeconomic theory developed during a time of constrained credit, and any policy prescriptions tested by history during a time of constrained credit (i.e., prior to about 1990), are invalidated by the regime change which has taken place since then.

So when you write “And so what we have now… is a return to the freewheeling anything goes speculation of the pre-1930s” that’s exactly wrong. It’s not simply “hugely amplified by a complicit Federal Reserve,” it’s an entirely different system altogether.

We agree that constrained credit leads to busts after booms – because it enforces financial discipline at all levels. And I think we both suspect the modern “debt up the wazoo” approach (to borrow Wolf’s phrase) will lead to even worse consequences, due to the speculative excess and the consequences of that – associated zombie currencies and corporations, wealth inequality, and rampant corruption based on proximity to the credit spigots.

Wisdom Seeker,

I think you totally misunderstood my little history lesson.

My point was the 50-year period of 1930-1980 was the ABNORMAL period of American economic history.

The US has always had speculative booms that went wildly bust (usually because of a business recession) and caused mass financial suffering.

The thing that is really missing from all this constant whining here on this forum about the Fed and the need to go back to the gold standard and all that is that the MAJOR FACTORS that prevented a mass financial panic and stock market crash during those fifty years were the highly restrictive federal laws regulating the financial industry and corporations, as well as high tax rates on highly compensated individuals.

This had the effect of hugely suppressing any sort of speculation, and it also probably suppressed the ability of entrepreneurs with crazy ideas to do start ups. The term “start up” was an unknown during that time.

No massive runups like the dot-com boom happened during that period! No massive dot-com crashes! No massive subprime mortgage lending happened with sleazy credit default swaps, funded through non-existent money from huge financial institutions like Lehman! Corporations did NOT buy back their own stock to keep prices high! Junk bonds did not exist!

Why? Because nearly all of that was either outright banned by Federal law or regulations or considered to be dangerous financial speculation under the ethos of that time.

Financial shenanigans were clamped down to the max, and if people did them anyway, they had to pay a 90% tax to the government for their efforts.

(Yes, tax shelters were quite the thing then too, but, in a way, they were Federally regulated tax shelters also – you could dodge some of those taxes and set up corporate ownership of all sorts of perks like airplanes and yachts – which were really good for the American airplane and yacht industries and forced the rich to divert their wealth into useful things to avoid paying taxes)

The Fed is just another humongous private bank, funded at taxpayer’s expense. In the Gilded Age, there were immensely powerful financiers like JP Morgan who built their fortunes off of legal monopolies that functioned in much the same capacity (legal monopolies are essentially a tax on the the American people who get to pay the extra cost of whatever they are selling because they are monopolies, so I don’t really see much of a difference here either).

So, you guys need to stop focusing on the Fed, and realize that what really created the stable 50-year period of no boom, no bust 1930-1980 was the strict Federal financial regulation of that period.

The Fed pumping money into this deregulated system is just a return to the pre-1930s cycle of regular financial crises every 20 years, except now the financial crises are likely to occur at MORE FREQUENT INTERVALS, more like every TEN YEARS or so.

The only way to stop this from happening is to return to that tight financial regulation. No more credit default swaps. No more Covenant-Lite bonds. No more junk bonds, period. No more corporate buy back of stock. No more security back loans of ANY kind. Loans should be loans, with collateral available, period.

The yield curve inversion

I believe that the yield curve inversion is still the most accurate predictor of an upcoming recession. I don’t know why Wolf and others keep downplaying it.

There are loads of papers written by the Fed itself that document this phenomenon and its predictive power.

Yes, there are a lot of weird manipulation of the bond markets and lots of weird stuff going on with bonds right now that affect long term and short term yields.

But think about it – why would ANY investor want to buy a 10 year Treasury Bond at a LOWER YIELD than a 3-month or 2-year Treasury?

The ONLY reason is if they think that the lower yielding 10-year Treasury will be worth more at a future date than what the short term yielding Treasuries will be yielding. And that means that they think the Fed will be LOWERING short term rates shortly, and this only happens if the Fed starts to see a threat to the economy.

I am unable to think of a way that the Fed or anybody else can manipulate the long 10 year Treasuries to give up a lower yield than short term Treasuries. The ONLY way to do it is if there are a LOT MORE buyers of the 10 year Treasuries than the short term Treasuries.

Why would the Fed deliberately manipulate a yield curve inversion to happen this past July? Everybody knows this is a recession signal, why would the Fed WANT to trigger a recession signal?

Can the totally disparate Treasury buyers of this world with all their different agendas all get together and decide to buy lower yielding 10 year Treasuries en masse to drive the yield down? Highly doubtful

The Fed itself is obviously a believer in the predictive power of the yield inversion because as soon as it happens, it does everything it can to reverse the yield inversion. And this is easy for the Fed to do because all it has to do is to lower the Fed Fund rate and the short term yields will drop to whatever lower value is needed to correct the yield inversion.

The result, if you look at the yield curve charts for the 3 month/10 year and 2 year/10 year Treasuries is that the yield curve inversions have become smaller and shorter than ever in previous history, ever since the Alan Greenspan started the Fed on its mission of “Prosperity Forever” with cheap money and responding to economic crises by lowering rates and opening the floodgates of money expansion.

As we have seen, Greenspan’s efforts to suppress the yield curve inversions had its own consequences in the two big blowouts attributable to the Greenspan era of the dot com bust and the subprime mortgage bust leading to the GFC.

Re: Housing as a predictor of recessions – it has some predictive power, as new home start numbers generally drop before a recession hits. However, there have been times when the number of housing starts has dropped sharply, but no recession followed, and once during the 2001 dot com bust, where the housing starts barely changed.

And…. current housing start numbers are hardly robust or signs of boom times. They are in the historical middle range between bust and boom times, nothing to brag about. There’s just too much going on with housing – demographic changes, population, cultural and societal changes, etc., for this to be a reliable indicator.

Finally, back to the yield inversion – stock markets usually hit a new high shortly after the yield inversion, usually in response to the Fed dropping rates again trying to stave off the recession. That’s what we are seeing now.

What I’m seeing are too many commentators who seem to have thrown in the towel that there will be a bust coming, and are starting to believe in this “Prosperity Forever” nonsense, rational investors tired of missing out on this irrationally rising stock market and finally jumping in. Like Joe Kennedy’s shoeshine boy investing in the stock market, that’s a good sign also of the coming recession.

I’m thinking the next recession will start in 2020, the only question being whether it will be before or after the election.

Gandolf,

>I am unable to think of a way that the Fed or anybody >else can manipulate ..

Step 1: Fed directly lowers short-term rates.

Step 2: Fed reduces its buying of e.g. 10 year Treasuries,

indirectly causing sellers to increase interest rates

to generate other buyers.

Presto: Yield curve inversion is undone!

Question: Is the coming yield-curve-inversion-predicted

recession also undone?

Yor thots?

Gandalf,

4 responses above, you wrote a very thought provoking piece. There was no reply button So I am responding here. You stated:

“The Fed and world central banks did rescue the world from falling into another Great Depression by rapidly expanding the money supply.”

You are obviously a smart guy, so I have very curious about your reasoning for this. If you would share your thoughts and support for this position, I would appreciate it.

I have read much from Paulson, Bernanke, Geithner, Buffet, etc. who seem to think the actions taken saved the world. I think they are just speaking their book.

I think the actions taken damaged Capitalism and free markets. These actions have contributed to the rise of views represented by AOC (Alexandria Occasion Cortez) and others clamoring for MMT. And why not clamor for MMT? If welfare is good enough for Wall Street and Buffet, why is it not good enough for little people?

I read Geithner’s book. He’s a hero in his mind. But he didn’t support, with cause and effect, why his actions were necessary …….. other than to save insiders. To favor one class of people and business over another.

AIG and Goldman Sachs should have gone under. But Bush, sucker that he was, and Obama, sellout that he was, gave cover to massive undeserved bail-outs that benefitted the profligate and corrupt, and was detrimental to fairness and the prudent.

In the middle of a LTL bid and rates are very competitive and some rates have actually dropped to secure our business. Lots of cold calls from Truckload carriers than normal and they are not 3PL, they are the asset carriers looking for more capacity. NEMF, LME, and a host of TL carriers have gone out of business in 2019…. Ecommerce changes (NEMF) and regulatory fines (LME). Dimensionalizer are now common to see the PCF of everyone’s freight metrics in real time, which will have an effect on shippers pricing moving forward. All the carriers have gotten smarter on making money and the new pricing models of using DIM weight is coming.

2020 should be a chaotic year of changes from IMO 2020 (low sulfur fuels) impact on all modes of logistics, tariffs, and general unrest in the markets (Repo crisis; pension crisis; student loan crisis; demographic shift (older populace); auto subprime; cost push inflation; housing question?; All forms of taxes ever increasing on everything….. looks to be a hell of a year to live through all in an election year! Good luck.

I live in California’s Central Valley, the main artery of which is Highway 99 (I5 runs from Canada to Mexico but most of the small-medium-sized cities and towns lie along ‘The 99’). My ‘unofficial indicator’ of the economy’s energy level is the number of trucks congregating on 99; when the economy is booming the ‘slow’ lane is clogged with trucks, when it slows you can actually get somewhere on 99 in a reasonable time. A few months ago, WS mentioned one of our local produce haulers was liquidating, but as of lately 99 is still pretty well clogged most days. So, my guess is the economy–at least, California’s– is hanging in there (for now).

So what is the state of Central Valley AG? US grown produce is rare in the low end supers. Seemed to me last time I was up there that the suburbs were reaching south along the 101, Morgan Hill? AG land is perfect for developers.

A lot of ‘US grown produce’ is seasonal, and most are harvested in the fall. If you’re buying seasonal produce–tomatoes, etc.–in the winter/spring it is probably coming from Mexico. Most of the tomatoes grown in my area–Modesto, dead center of the CV–are sent to canners for paste and sauce. If you buy any almond products they most likely came from the California CV; the entire valley is planting almond trees by the millions (I’m planting 9 acres this fall; I’m ‘farming’ 18 acres since my father died last year). It would be distressing except our grower’s co-op, Blue Diamond, is building markets worldwide (and almond milk-based products seem to be gaining popularity). I’ve heard the $/lb for almonds may be up a bit this year. Farmers are paid in allotments, since the sellers cannot determine supply/demand for the whole year (or so they say ;). Water is/will become a massive issue (as it always has been in CA).

My aunt and uncle grow citrus, oranges and lemons near Fresno, and they are doing well. Florida citrus growers are having a hard time:

https://www.universityofcalifornia.edu/news/75-percent-floridas-oranges-have-been-lost-disease-can-science-save-citrus

This could conceivably help CA prices, but I wish no ill to any farmers (and the ‘bugs’ have a tendency to migrate). My neighbor grows walnuts, and they are wealthy anyway but not in good health so I haven’t heard from them in a while.

I just moved from the SF Bay Area and, yes, the ‘101 Corridor’ from San Jose to Gilroy is growing acres and acres of housing tracts, as is the ‘580/205 Corridor’ from Livermore to Manteca (traffic patterns confirm this). In Modesto, housing construction may well have overtaken farming as the largest job market. Farmers are bemoaning the cost of labor; aggressive anti-immigration measures hurt them, but they still don’t like ‘immigrants.’ Go figure.

Lots of US produce is in low end supers—only it is found in a can.

Trucking as a whole has been horrible this year. I run a stepdeck trailer, last year the wife and I grossed 335k. This year I’m currently at only 245k, with only 3 soft (because of holidays) weeks left in the year. Companies are going out of business because of low rates, and owner operators like myself atte having a hard time because both big companies, and a lot of foreigners (that get tax free business loans), are happy with lower rates, and only serve to exacerbate the problem by working for peanuts. It’s not going to get better until those monkeys go outta business, and the only ones left are us drivers that understand what we are worth and what it cost to run a business. Hopefully things improve soon.

How does the shift to online shopping change the trucking fleet? Not as much junk on the shelves at WMT. May just be a gap between one set of buyers (bricks and mortar) and another. Or they use different shipping methods.

Some observations on Xmas shipping:

Spent around ~$100 online at a department store, with free shipping, the 4 items came in 4 different Fedex packages. There’s no way that could be profitable.

A very large sized item ordered from Amazon was handed off to the post office even though my neighborhood is overrun with Amazon trucks. It seems Amazon has a new deal to have the USPS deliver for them again. And of course we had a problem with the delivery because the box was too big.

The small Amazon item was delivered by Amazon truck.

Yes.- many items and service prices are distorted due to lots of reasons- currency manipulation (+ others) from imported goods; Shipping distortions due mainly to Amazon being able to distort based on stock market/stock price appreciation (+ others).

These aren’t good for an economy: no price information/discovery.

Don’t try to understand it, that’s a sure way to drive yourself crazy.

Sort of a “it’s not illegal so that makes it the alright thing to do” mentality.

Jim Chanos recently explained by food delivery businesses would never be profitable https://youtu.be/I7jeqBdXAfk

The of course this is this article https://wolfstreet.com/2019/11/16/meals-on-broken-wheels-uber-eats-grubhub-doordash-postmates/

It is my understanding that Amazon’s goods delivery business does not make money and that it is their tech services that are driving profits. (correct me if I am wrong)

Does Amazon and others not face the exact same issues as the food delivery business?

At the end of the day, bricks and mortar need to pay rent — but at least the customer handles the delivery.

With online shopping there still needs to be a warehouse – yet you add on delivery costs.

Presently, just as with food delivery, the costs are being subsidized by investors who accept the losses in order to gain market share.

BUT if the delivery costs rose to a level where online shopping businesses became profitable

How many people would be willing to pay those costs?

Might a large number of them just revert to picking up ____ on the way home from work?

Amazon recently lost a big DOD contract to Microsoft. There is now a big lawsuit over it. They will take a hit on both the lost contract and the legal fees.

As a asset based specialized carrier I think many companies are going to go out in 2020, the rates are very low and below operating cost.

Here in California it is really going to be interesting to see what happens come Jan 1st with our new law that everyone must be an employee, many companies are cutting all ties with owner operators based in Calif, Swift and Landstar just to name a few. Fedex is another company that uses owner operators based in Calif along with all of the containers in and out of the harbors, its going to be interesting!

Drop shipping (shipping from vendor/manufacturer) direct to customer has been a shift from holding large quantities of inventory at our locations and removing SKU counts that are not ordered frequently (MTO- made to order now). Ecommerce with Build.com and others is how most drop shipping occurs and removes the multiple touches of a carrier (less handling is less damage = less claims/loss $). Parcel 100cwt shipping has gained traction as well for many shipper are seeing smaller orders from customer (frequency has increased Ex: 100 smaller orders a year vs. 50 larger shipments a year) and UPS parcel 100cwt has gained traction vs. LTL or TL. The carry cost of inventory for most manufacturers must be managed well and a fast ramp up must be possible (demand surge/storm orders).

Ecommerce is drop shipping delight and many people worldwide are in the business of selling (margin % markup) and becoming online retailers whom constantly shift from hot sellers by season/hot products.

I own odfl which is.ltl trucking and the stock has been a monster.

Riby,

Yes, on declining revenues and declining net income, shares reach new high. What else is new in this market?

Kenworth and Peterbilt have also had layoffs. The Chillicothe Ohio (their larget plant) reduced the build rate from 180 a day to around 160. I think Peterbilt was down even more. As of April 2019 the Kenworth Chillicothe plant no longer builds the T800 or W900. Instead they have converted completely over to the newer wide cab models-T680, 880 and 990. The W900L with that long hood all decked out in polished chrome was a real cowboy’s truck. You knew when one of those was in your rearview mirror. I think the first year for the 900 was 1961. The T800, a real workhorse of a truck, has been built since 1986.

After the first of the year, expect another drop in build rate. Customers want there trucks by yearend for tax reasons, and 1st quarter is always slow.

one thing with ODFL…. they along with R&L will only haul shipments that meet a metric that ensures Operating Ratios to profitability. Other carriers do the same, but not as well. Though freight volumes might be lower, the type of freight ODFL carriers is excellent freight.

They won’t handle Lighting product. The carriers are much smarter now to how claims, OS&D, dim factor, dwell time at a shippers location, etc…. they have it down to a science. If PCF is under 8…. better call Roadrunner or Central Freight.

Housing starts and permits up strong……airlines doing ok……..what recession. Housing is the #1 leading indicator.

Housing is the last indicator. Freight volume is #1.

No one said anything about a recession, BTW: housing is picking up as the prices go down, so much less effect on GDP https://fred.stlouisfed.org/graph/fredgraph.png?g=pFff

Have no fear. Trailers will max again.

For now check ltl freight.

This is not truckload on the road.

Ltl is freight right now being delivered to the doors of 327mil. USA Citizens.

A “Dead Truck Bounce?”

Every time truck orders plunge once again, PCAR stock legs up. Reminds me of the railroad train-wreck stories of a couple years ago.

More than a decade, daily I’ve been hearing this doom and gloom story.

Mean Chicken,

Yes, we may go into a depression and stocks reach a record high. As far as stocks are concerned, reality just doesn’t matter anymore. Someday it might. But not now. So don’t try to connect reality to stocks. It just makes you look silly :-]

Perhaps we’re coming out of a depression. A good portion of my adult life there’s been a huge effort to export opportunity, replaced (temporarily, IMO) with financial engineering.

Fed policy is to reflate against deflation. If this Fed were in place in the 30’s there would have never been a shortage of money. Inflation policy offsets deflation in a cash economy, however in a cashless society adding money to the system during a contraction (like right now) results in accelerating devaluation. Logically money velocity should go negative, as money leaves the system faster than they can shovel new money. At some point no one wants that money (see REPO spike). (It’s still a collateral problem for bonds) The Fed is creating a dystopian outcome, the question is will they see the error of their ways.

The Federal Reserve was established in 1913.

When the stock market crashed in 1929, its response was to tighten the money supply, as it was believed that a too easy money supply has contributed to the over speculation that led to the crash

This had the effect of worsening the financial crisis caused by banks lending money to speculate on stocks. What might have been a very bad recession turned into the Great Depression.

That’s why Bernanke said in a speech “Yes we did it, and we’re sorry” in reference to the Great Depression

Other things that were done that we now know tend to not help the economy included a tax INCREASE by the Republican Congress and President in order to keep the Federal budget balanced in anticipation of a downturn in federal revenue (wow, have things changed!)

And the infamous Smoot Hawley Act, a tariff on imports done to protect American jobs and industries. This set off a wirkd wide trade war and glibal trade dropped by two thirds

Mean Chicken:

I’m wondering – are you implying that one stock (Paccar) effectively benchmarks the sum total of the entire U.S. economy, doom and gloom notwithstanding? I was hoping you could kindly expound on that.

Here’s my understanding and please correct me where I’m wrong: As you know, central banks implemented policies to restore the financial system after the crisis of ‘07-‘08 hit. Presently, these policies/programs isolate risk components and time value of money by way of QE, ZIRP et al. That, coupled with massive stock repurchase programs – so massive that when JPMorgan withdrew funding the repo market to implement stock repurchases, it destabilized necessitating a FED intervention of hundreds of billions of dollars corresponding to amount JPMorgan withdrew. This illustrates the scale of stock repurchase programs. My question is this: how is it possible for a single stock or a stock index to be a true benchmark for the overall economy when FED rescue policies and programs such as these are implemented?

And they are losing their eye like in the first movie…

Things might get better in a year or so… maybe?

Mike…..you are living in the past……most of the economy is services. Housing makes up a huge demand, about 40% of consumer demand and creates freight volume.

Fred, here is the latest construction spending report https://www.census.gov/construction/c30/pdf/release.pdf spoiler alert, its not good. Private spending peaked in Feb and has been headed downhill since.

Whats lost in this article is the mention of tech fatigue by all small trucking outfits and owner/operators. Everyone has had it. When a sensor can fail and leave your truck, out of production and in the dealer’s shop for a week while they try to debug the thing , they all ask themselves – is it really worth it? The obvious answer is no. So..they bought glider kits until they were phased out and now a lot of guys I know are buying older, pre emission used rigs that have been refurbished from the ground up. They are not purchasing new anymore. The exhorbitant price relative to risk – due to tech failures ..is just not worth it.

Wolf… do you have any data on actual Class 8 total builds (Kenwoth, Peterbilt, Mack, Volvo, Freightliner, Western Star and Navistar) based on year after year over the past 5 years as well as forecasting into 2020?

Total Class 8 truck builds in 2006 reached (I am told) an industry high of approximately 335,000 units.

The BEA publishes “sales” data (when delivered to end-user, not “build” or “order” data) on heavy and medium-duty trucks combined (over 14,000 pounds), not Class 8 by itself. This number is far higher obviously. FTR and ACT I believe track class 8 and medium duty “sales” data separately.

In terms of “build” data for class 8, I don’t have a source. The difference between orders and sales is the combination of timing and order cancellations. The difference between build and sales is just timing.