Efforts to frontrun tariffs was part of it. But now, there’s more to it.

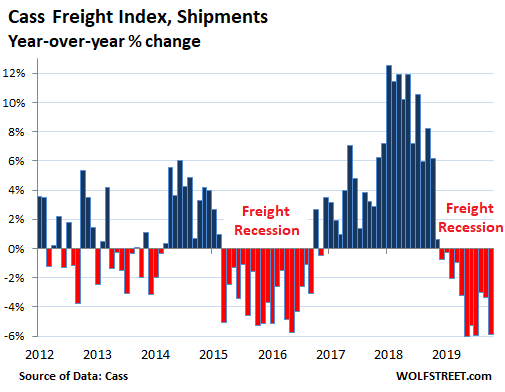

Freight shipments have declined on a year-over-year basis all year. Until today, the declines were from the extraordinary shipment boom that started in late 2017 and lasted into late 2018. It had been stimulated by efforts to frontrun the tariffs, where companies over-ordered to get the merchandise and equipment before the tariffs would hit. With today’s data, this image has changed for the worse. Freight shipment volume fell not only below the October 2018 level, but also below the October 2017 and October 2014 levels, which predate the tariff-frontrun era.

Freight shipment volume in the US by truck, rail, air, and barge fell 5.9% in October 2019, compared to October last year, according to the Cass Freight Index for Shipments. It was the 11th month in a row of year-over-year declines, and the third month out of those 11 when year-over-year declines were around 6%. This chart shows the percentage change per month, compared to the same month a year earlier – and it also shows infamous cyclicality, the boom-and-bust cycles, of the business:

The Cass Freight Index is a measure of the goods-based economy. It tracks shipment volume of consumer goods and industrial goods such as construction materials; products, equipment, and components being shipped to or by manufacturers; and supplies and equipment for oil & gas drilling. But it does not track bulk commodities, such as grains.

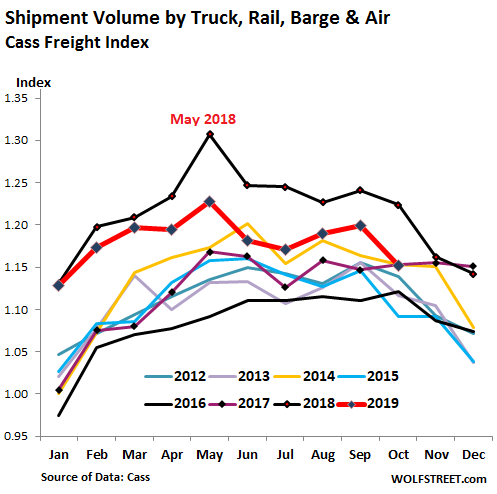

The decline in shipments in October was so steep that the index fell below the level where it had been not only in October 2018 but also in October 2017 and October 2014.

In addition to being infamously cyclical, the business is also very seasonal. The stacked chart below, for the years going back to 2012, shows this seasonality. Note how the index for 2019 (red line) in October dropped more sharply than normal seasonal patterns, and fell below 2017 (purple line) and 2014 (yellow line). Now shipment volume has not only fallen below some record outlier boom figure but below two other years:

Where does this slowdown in transportation come from?

Not the consumer. Retail spending in October, while not red-hot, grew 2.9% from October last year, propped up by the boom in ecommerce, according to the Commerce Department this morning. These goods have to be shipped.

Yes, from the industrial economy. Industrial production surged in late 2017 and 2018 as companies were frontrunning the tariffs, with year-over-year growth rates peaking at 5.5%, the fastest growth since the recovery from the Great Recession. From the peak in December 2018, industrial production has fallen 1.8% as of October 2019, according to Federal Reserve data this morning; and it was down 1.1% year-over-year, the steepest such decline since 2016. Industrial production includes manufacturing, oil & gas drilling, mining activities, and utilities. Transportation plays a big role in that sector.

Yes, from construction. Construction spending all categories combined – residential, non-residential, private and government – in September fell 2% from a year ago and is down 3.1% from the peak in February 2018, according to the Commerce Department two weeks ago. And construction requires a lot of materials and equipment that need to be transported.

Maybe from the agricultural sector. This shipment data here does not include agricultural commodities. So the big dynamics in the ag business – including floods, droughts, or the “trade war” – impact this shipment data only in terms of non-commodity items, such as equipment.

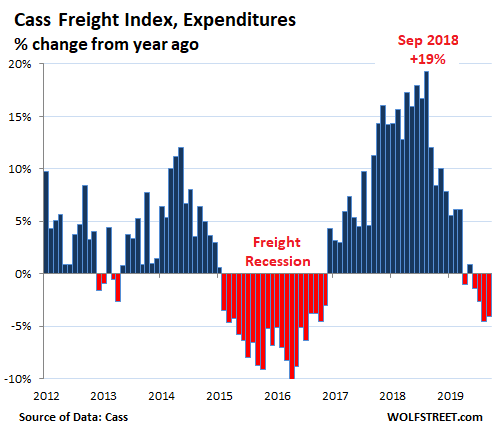

Consequently, freight expenditures decline.

Given the decline in demand for transportation services, freight rates have started to decline, and overall the amount that shippers, such as retailers, wholesalers, and industrial companies, spent on freight, including fuel surcharges, has declined 4.1% in October, according to the Cass Freight Index for Expenditures. It was the fourth month in a row, and the fifth month out of six of year-over-year declines.

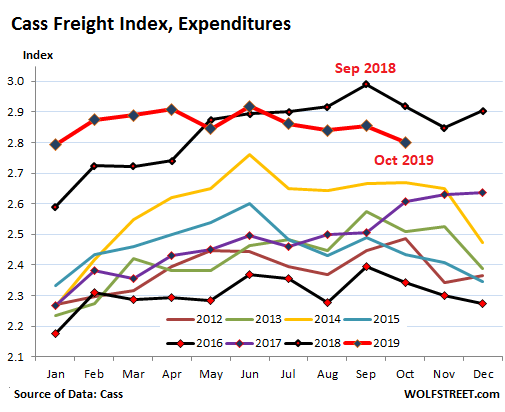

The stacked chart below shows the soaring shipping expenditures in 2018 (top black line) that were totally out of whack with prior years, with double-digit year-over-year increases from October 2017 through December 2018. Then the decline in shipments took the pressure off and now truckers and railroads are facing excess capacity, downward pressure on rates, and lower volume. But spending remains high compared to all prior years except 2018. Note how in late 2017 (purple line) freight expenditures began to soar against seasonal trends:

The transportation sector is notoriously cyclical and linked tightly to the goods-based economy. Services, such as finance, insurance, and health care, dominate the US economy. The goods-based sector is small by comparison. But transportation is also a service, and like some other services, it depends on the goods-based sector, and reflects its weakness. And it’s one of the ways in which weakness in the goods-based sector creeps into the services sector.

It’s even worse than it looks. And this time, there is no jobs crisis. This time, it’s the result of greed by subprime lenders. Read… The Holy-Cow Moment for Subprime Auto Loans; Serious Delinquencies Blow Out.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

May I posit some questions?

1. No mention of pipelines. Gas ( and renewables?) replaces coal for power generation and oil, that once moved by rail and truck ( or even barge?), now moves via pipeline.

2. No major natural disasters ( in terms of population centers). If you lose everything you need everything. Yes, Paradise, California was destroyed as was Mexico Beach, Florida but we aren’t talking Houston, SF Bay Area or Miami. Not even Joplin, Mo. or Moore, OK.

3. The data or models aren’t accurate.

Trade war, tariffs! Where is the inflation? If EVERYTHING comes from China and Trump has put HUGE tariffs on their exports why doesn’t it show up in PPI and CPI?

There were major floods in the farm states a few months ago. Crop volume has to be down. Also heard from a guy who works at a lumber mill, in the northwest, they are closing down all over the place. Those are two industries who ship and are way down.

unit472,

Your question #1 — pipelines?!?! — is totally off topic. Been smoking this new stuff everyone’s talking about? This shipment data in the article EXCLUDES commodities. These are consumer and industrial goods shipped by truck, rail, air, or barge, as explained in the article. Would be helpful if you had actually read the article.

Your question #2: In the US, there are nearly always natural disasters somewhere, they’re part of life and the economy: hurricanes, tornadoes, blizzards, fires, floods, droughts, earthquakes, you name it, we have it… BTW, the huge hurricanes that devastated so much of the Gulf Coast (Harvey and Irma) were in 2017 not 2018, so check the shipment data to see if you can find their impact at the national level.

Your item #3: this data is NOT a model but actual shipment data by Cass, based on $28 billion a year in actual shipment transactions that it processes for its clients, which gives it a good and huge sample of the US freight market.

In terms of your questions about the tariffs not showing up in CPI, read this:

https://wolfstreet.com/2019/08/13/inflation-data-shows-tariffs-are-not-a-tax-on-consumers-but-on-foreign-us-corporations/

This is really funny.

Wolf do you ever consider that these are AI-Bots that are driven by key-words, you know most of the questions were out of context, but you go ahead and address the questions.

I tip my hat for your patience, I should say Infinite-Patience to infinity, like our Fiat.

…

I think it should pointed out by your inquisitor that most of the “CRAP” from China is brought in last-mile. From port they have private means of bringing the junk to the regional post offices, and from there the stuff can be delivered by uncle-scam ‘last mile’, that’s why you can ship something from China, for less than say NY to CA.

Lastly, on the Tariff’s. I live in ASIA and since Trumps Tariff’s went into effect I see complete breakdown of the internet-shopping system, I’m seeing +50% shipping of returns, I’m seeing credit card companys refusing to honor charge-backs. The system is breaking down over here.

On the USA side of the pond, I suspect that the shit will hit the fan and soon.

I will say this, over here folks are about ready to back to shopping ‘locally’ cuz the online scam ain’t working.

Thus it could be in the USA, that ma&pa local hw stores return, and certainly Walmart shelves go empty.

You bring up an interesting alternative to local boycotts to regain local control to re-establish some balance to pricing and economy to possibly re-establish real entrepreneur based transactions. Even Franchise operations aren’t doing so great, based on the quickie food outlets like McDonalds, Starbucks, etc. on the urban fringes in Ohio. BUT, what access does any local ma&pa local anything have to any real cost effective supply chain functions? Individual shipping, trucking- small shipments are based on a higher pricing schedule than what Walmart can ship and warehouse. Small outlets have been non-existent for so long, is there even any pricing opportunity based on the initial costs for a small, individual operator? How can small enterprise in the US even get back into any real market activities? Sure there’s some marketing platforms trying to compete for advertising against GOOGLE, etal. But any new businesses that aren’t franchise operations? Who is really buying much of anything from Walmart/Home Depot- other than essentials? Doesn’t look like much building by small contractors, etc. nor consumption from small direct retailers on any stats that I’ve seen on public access data. Sure the so-called consumer is consuming, but looks pretty much down to the basic essentials for goods and services. With the stagnation showing up, do even the offsets for hi-wealth consumption compensate enough? If local artisan based activities increase, who can still afford to purchase the goods produced locally? How many local farmers can really get their food sold even to local neighbors? Maybe there’s some hope for real economy turn around, but I sure don’t see much real entrepreneurial activities that indicate any local real economic growth and transaction based financial increases. Not much spending at any local street fairs/community shindigs, except for food and drink. Who really earns the real take-away when practically every consumable anything, even water is a branded product with money flows skimmed by the real unidentified owners of the brands. Anecdotal personal observation really doesn’t count for much, right, until it does.

The scenario with “charge-backs” on all kinds of levels is probably going to show up as a real indicator of the real entrepreneurial realities. Even the WE co. scenario is basically an example of a charge-back, just on the grand scale, that publicly reveals major corruption efforts. Those “charge-backs” may windup snowballing on the ground in the US.

What about Alibaba sales of $38 Billion in a single day?

Am I supposed to doubt CNBC reporting?

Because not “everything” comes from China. We trade almost as much with Canada as with China. And we trade more with Mexico and Japan combined than with China.

1 China – $636 billion

2 Canada – $582.4 billion

3 Mexico – $557 billion

4 Japan – $204.2 billion

5 Germany – $171.2 billion

6 South Korea – $119.4 billion

7 United Kingdom – $109.4 billion

8 France – $82.5 billion

9 India – $74.3 billion

10 Italy – 68.3 billion

Just Some Random Guy:

The “trade” figures you cite are imports plus exports combined, added together (“bilateral trade”), which is a brainwash-number. Imports subtract from GDP, exports add to GDP. They should never be added together.

The US has a balanced trade relationship with Canada, with imports and exports roughly the same. But the trade relationship with China is totally one-sided, with the US having a huge trade deficit with China. These are the figures for imports and export by country for the full year 2018:

I used to wonder about US policy and trade since we run such large trade deficts. I think I saw that the margins on our exports were much higher than what we imported. In other words the imports were generally very low margin goods. This is probably the strategic battle now as China wants to move up to higher margin items and the US wants to prevent them from doing that.

I also heard someone say about 10 years ago that there was basically no return on capital in China. That seems like strange statement, but I could see it being somewhat true. Take the steel production industry. Isn’t the tendency to completely over supply the market until market prices collapse? Maybe that’s why capital is being ring fenced as the smart money knows that its a ponzi.

The balance between the US/Canada and US/Mexico trade sure shows. Wouldn’t the US just be a whole lot better off just working at balanced traded agreements within this continental block? We don’t need China, China needed us, and sure doesn’t anymore.

…

On the rest of the following text, if you don’t think it’s relevant, on this topic as you have on your blog, I am primarily including it as a topic you may want to develop further. I sure can’t do that as well as you can. No other way to contact you directly. If need be, just edit it all out.

Thanks.

……..

I think the following is extremely relevant. Your article is really touching onto the deep dark subject of economic warfare, based on and promoted by internal supply-chain destruction actions by ??? We are not just being confronted by tariff imbalance trade issues, with freight indicators revealing the imbalance.

We are also being confronted with a real local freight/transportation and local production based problem with many negative far-reaching ownership, and economic effects.

The most basic products that any local citizen can sell to another is based on locally produced food. One of the most basic food products is milk, as a farm product.

RE: US/Canada- presently there is a real fight going on within the US over milk. Superficially, it may not seems like it. Canada protects milk, cheese production for local farmers. It really shows up in the 2% milk and cheese contract agreements. For US production:the loss of US farmer Dean contracts, take-over by Walmart of milk processing is slamming an entire section of agriculture in the US. There really isn’t a loss in milk consumption. Even if consumers have broadened their taste for other types of milks. It’s the fact that milk is processed into other food commodity products. The processing plants have been bought out essentially by Walmart, and sold out by Dean. Farmers in Pennsylvania especially cannot get the milk to the processing plant etc. This is really a family warfare of a few entitled that are looking out for a real land grab. It may not show yet. But, this is not a superficial marketing issue. The real fight is over some of the absolute best land in the US that is owned by families of American citizens for generations. The big take-away will be the loss of that ownership if it is allowed to happen. Unfortunately, I think there is critical maneuvering occurring that is concealing the real battle. The real take-away is the big take-away of all the regional land owned by many individuals, and getting transferred into ownership of a few multinational corporations. This is a regional land grab across the fertile land across the United States. This could be on the level of the last round up of US indigenous, but not totally indigent population in the 21st century.

You may want to check out who actually owns a lot of US agricultural land presently across the US, that is owned by a few extremely large and wealthy international corporations. The ownership is NOT small, individual local US citizens based families.

There are a lot of protective agreements that Canada and Mexico use to protect the milk commodity type products that are used in an expansive amount of general food processed products that use milk product.

While the US is conned into reactive response and debate over external US/China maneuvering and game-man-ship, there is a real serious battle occurring on the home-front, involving real US land and ownership, and real permanent loss.

So, we need a few more Canadas and fewer China’s… heheh.

Too bad all of the manufacturing are in Asia.

I was looking at the list of Apple suppliers the other day, and it is literally amazing how much money the US or Apple is pumping into China. Oh sure, Apple makes a hefty margin, and technically that is the US side of things, but at least 60% of the Apple BOM ends up in Asia somewhere, meaning it’s sourced out of Asia, whether it is components or services.

I live in CDN softwood lumber country. Right now the entire logging and sawmilling industry in BC is in a virtual collapse. Provincial experts say it hasn’t been this bad in 40 years. The collapse started about 6 months ago.

This is why (from the article): “Construction spending all categories combined – residential, non-residential, private and government – in September fell 2% from a year ago and is down 3.1% from the peak in February 2018, according to the Commerce Department two weeks ago. And construction requires a lot of materials and equipment that need to be transported.

We trade almost nothing with Canada,we do labor arbitrage. Sendind raw goods to be finished and bringing them back for less than their cost is not trade. We trade more with Mexico to get even cheaper labor and a salad full of illegal pesticides and E.Coli(Montezumas’ Revenge)

CN Rail to cut 1600 jobs

Headline Globe and Mail, Sat. Nov 16

Canada’s largest railroad says slowdown partly due to trade war. Currently employs 24, 000

I listen to a podcast out of Canada who has a regular caller to the show who works for the railroad. According to him the layoffs have been occurring every Friday for months. A few weeks ago, they forced people to take any vacation time they had accrued, many weeks for him.

The most interesting thing he said was that the trains are all automated now. He is only there for show and he doesn’t think this will last long. He can’t wait to make retirement.

I think I read in the US the freight railroads wanted to be able to operate with 1 person instead of 2 when the automated train control got completed. Regulators wouldnt allow it.

Also if I am not mistaken the railroads own the rails and the locomotives, but not the cars. Railroads are based on a lot of old engineering that still works and have been improved. A lot of basic engineering challenges like getting the whole thing started without the locomotive wheel spinning.

Despite the continued twitching of the SPX, I think it’s now pretty clear to any rational observer that any “deal” with China going forward is going to be inconsequential. Living in Canada, it’s easier to keep in mind that China will make no substantial concessions while Meng Wanzhou is wearing an ankle bracelet in Vancouver. It’s difficult to imagine the goods-based economy recovering under the present circumstances. Perhaps the everything bubble is also not that far away from its best-before date. Thanks for your continuing high quality work, Wolf!

I would also add:

“Yes , from Auto Manufacturers”

Mirrors our ebb & flows this year.

Nov. has been a strong month so far.

Real retail sales, even after the huge spurt in the spring/summer is not actually awesome y/y https://fred.stlouisfed.org/graph/?g=pwDN

“US Freight Shipments Skid Below 2014 Level, Hit by the Slowdown in Industrial, Manufacturing & Construction” ……. And yet notice Wall Street couldn’t care less aside for this being good news for low rates & QE? Asset bubbles are peculating and assets holders couldn’t care less what’s happening in the real economy except to hope for more bad news because the only reason the real economy exists is to be a useful tool and flog for the Fed to make up excuses to blow asset bubbles to benefit the assets owners and ruling class.

They care but its like our ruling political, teachers, cop, and firemen.

When your getting a huge guaranteed check every month, with all the benefits like 100% paid premium health-care then ‘life is good’

The problem is we have say 20% that has it nice, and then the people who fill content for MSM and internet have good story’s, and pretty much censor the bad story’s.

So it comes down to the point of the 80% are not pitied, but their ignored.

Well they’re ignored until they snap like the spoiled-brats in HK, and then the lone-wolves come out and burn it all down ala “The Joker”

Happy Holidays.

Why do you call HK protestors ‘spoiled brats’?

I think it’s the Gucci sneakers and Burberry umbrellas.

It will be interesting if the DOW transport index diverges differently from the roaring stock market.

Services, such as finance, insurance, and health care, dominate the US economy.

Profound.

Yes I noticed that too. Those are near monopolies protected by regulation and cronyism. That does not bode well for the future of this country or the average citizen.

Dow crossed 28K today. Doesn’t look like Wall St cares too much about freight. As they say in NOLA,Laissez les bons temps rouler.

The DOW doesn’t care about anything. At this point, you could have a depression, with companies going bankrupt left and right, and the DOW would hit new highs.

Someone smarter than me posted an interesting graph showing the 4 big stock market areas. The markets have popped and not recovered starting with Japan, then Europe, then emerging markets. The implication was the US was the last man standing, but when the US pops it would be like the other 3 and flatline for a long time with an economy weighed down with too much debt.

Well, that one went out of the park! Glad I am not the one that threw you that ugly pitch. Head down, walking away mumbling.

Just read over the long haul sp500 returns 10% per year. To get back to where trend 10% returns are possible SP500 would have to be about 1000. Fed has used elastic fiat to keep pulling the future forward. I guess the thinking is to deal with today’s problems and leave to someone else to deal with tomorrow.

The Mises thinking I believe is correct on this that it just keeps oscillating to bigger and bigger debt bubble til it cracks up. We don’t like it but we have to live and invest in this environment. That’s probably the downfall that people invest running it through the filter of what they think the Fed is going to do.

Just like they say the highest return on investment is paying someone to lobby in DC. The next highest is having insight into what the Fed is going to do.

Translated that French…..”Leave the present fat rulers alone”.

Summer of 2018, I couldn’t get a heavy-hauler for any price.

Unavailable.

By Spring of 2019 things were back to normal, then Trump’s Tariff’s went into action.

Since fall of 2019 shipments plummeted.

Now we come into 2019 xmas, merry christmas truckers.

I don’t feel for these guys sorry Wolf in summer of 2018 they were quoting $50/mile, and now $5/mile and they want my pity? Sorry, the industry are just highway robbers, and that’s largely the reason for the boom&bust cycles shown in your graph. When the can rob shippers they do, until they kill the golden goose. Then the cycle repeats. I suspect this goes back to the old wagon-train days where haulers would dump stuff out in the desert 1/2 way, unless the settlers ponied up more money. Nothing new under the sun here.

Perhaps they should remove Trump from DC and have him drive flatbeds around Fresno?

The political class is out of touch with the working class, in fact much of the working class can’t find a job.

People here like to argue “When will there be a recession?”

When over 50% of the people worry about paying their bills,, you ought to know we’re in a depression.

If you go to the mall, the best department stores have light traffic and not much buying. T J Max still busy but everything else is slow.

Consumers are not buying anything except the staples like Costco, Walmart for basic needs!

Everything seems dead with no traffic and the FED are lying about shipping and retails.

New homes are still too expensive and young people are not buying so no wonder all the lumber mills are shutting down. Housing supplies shipments dropping like a stone. Shale oil drilling’s dropping off a Clift.

The FEDs are about confidence. Nothing else. When they tell you things are great you should be like a squirrel hording nuts.

Absolutely correct. The Fed ain’t cutting rates and doing QE because they are confident. The price of having a system built on confidence is you can’t say a recession is around the corner.

Or perhaps consumers have finally wised to the fact shopping malls are a complete ripoff and you can get exactly the same goods online or from a non-mall retailer for less?

The whole mall business model is built on the premise that high retail prices will allow high rents which in turn will allow high returns for mall-oriented REIT, especially those specializing in far-off markets: those hicks and rednecks were supposed to pay premium money to buy stuff from a mall. Guess what? Now even hicks and rednecks are buying online.

On top of this the whole mall business model has been overdone to death: malls are everywhere, and they are cannibalizing each other just as their sales are being eroded. This puts the REIT behind them in an awkward position: they need to slash rents to fill floor space, but cutting rents would undermine the huge coupons that attract investors. Decisions decisions.

Correct. Why would I opt for the garbage selection in malls when I can get anything I want from anywhere in the world online?

Brings new meaning to the term “stripped-mall.” ;-)

Careful, with that user name somebody may take it the wrong way. ;-)

Cyclops. This is what I’m seeing here in CT as well. When the local malls close down there’s no longer a place to go hang out and spend your hard earned cash.

Also the FIRE movement and younger ones seem to be more frugal than in my day as well.

“Consumers are not buying anything except the staples like Costco, Walmart for basic needs!”

Who was that guy that said men are from mars and women are from Venus? I feel the same s true in the comments section. Some of us live in reality, live in a perpetual 1933.

Or maybe you’re stuck in 1993 and haven’t heard about this fan-dangled new thing called the internet, where you can buy all sorts of things without ever leaving the home.

Year on year comparisons for rail shipments of coal, grain, chemicals but not intermodal are down from the last three years. We see it in the ag sector.

https://www.aar.org/data-center/rail-traffic-data/

Nothing matters to the market……it is no longer an economic predictor…….multiple expansion is well underway based on fed printing.

or…….. It could be an indication of severe inflation coming…..which would cause nominal earnings to rise substantially while real earnings stay static.

Inflation based on a reduction in the US trade deficit coming from the Trump negotiations with lots of nations, dollar drop based on dollar denial by oil countries and boomers needing lots of service while producing nothing in retirement.

I wonder…….opinions welcome.

That is why Buffett sees no allure in bonds. The traditional 60/40 portfolio is a bad idea.

With $9 Trillion in US Government debt yielding less than the CPI rate, perhaps wholesalers are hording receivables, knowing there is no place to hide their cash in a negative rate environment. Now would that not be poetic?

As far as the consumer being strong via consumption as of now, why is the consumer increasing their savings rate since the end of the last recession, instead of the savings rate dropping from recession to recession, as has been the case since the 1970s?

https://fred.stlouisfed.org/series/PSAVERT

U.S. consumers are saving more and more each year due to the negative rate environment regime, the high “real” inflation rates for healthcare, college, housing, etc, and all the uncertainties due to the tariff wars. And we are not alone as Europe now has a nearly 13% savings rate, a five year high. The last time Americans hit a 13% savings rate was in 1975. Euro NIRP is failing in real time, and Japan NIRP provides a history of failure. Why does the US want to follow failed policies, as the NIRP experiement been failing in the past, and present, for a very, very, very long time.

Low (CPI negative) rates have failed, and Americans are now in hoarde savings mode. How can the Fed look at their own savings chart, and not be in panic mode (remember the Fed/politician “Savings Glut” comments not long ago)? Perhaps the Fed thinks the best way to crush those silly savers in more QE/Zirp? Will it work? That is literally the trillion dollar question that nobody knows…

Congress keeps giving the Fed more mandates but in my opinion it is all b.s. their mandates are all utopian fluff. A real mandate would be a hard number the currency will be devalued no more than 2% per year maximum and let the economy and politicians deal with it. We know that most if not all central banks end up printing too much.

I don’t think congress has any jurisdiction over the Fed.

They created it 3 times over history and can do anything they want with it. Day to day activities the Fed is supposed to be independent but Congress delegated powers to them

At the risk of violating one of Wolf’s commenting rules, here is the story of Congress and the Federal Reserve Act.

Initially, the Fed was created in 1913 with a twenty year charter. This was the same as the twenty year charters given to the First Bank of the United States in 1791, and the Second Bank of the United States in 1816. When these charters expired, Congress did not renew them. The War of 1812 was a direct result of the Rothschilds and City of London banking cartel losing control over the issuance of the dollar when the First Bank’s charter was allowed to expire.

In 1811, Rothschild warned, “Either the application for renewal of this charter is granted, or the United States will find itself involved in a most disastrous war.” Congress did not back down; to which Rothschild issued another threat: “Teach those impudent Americans a lesson. Bring them back to colonial status.”

In 1933, the Fed’s charter was scheduled to either expire or be renewed by Congress, but on 25 February 1927, the 69th Congress amended the national banking laws and the Federal Reserve Act. This is known as the McFadden Act.

Page 11 of this Act: “Second. To have succession after the approval of this Act until dissolved by Act of Congress or until forfeiture of franchise for violation of law.” In other words, the Fed will live forever unless Congress closes it down or unless Congress deems it has committed a “violation of law.”

The final piece to the Act states that, “The Federal Reserve Board may at any time require any Federal Reserve Bank to discontinue any branch of such Federal Reserve Bank established under this section.” In other words, the Fed’s Board has complete control over the (twelve) Regional Banks. Of course, the Regional Banks are owned by the Member Banks that keep reserves in them.

The Federal Reserve Bank of New York, which is printing billions and billions of dollars to lend out at 1.55% in the overnight Repo Market is owned by the investment banks on Wall Street.

Old-school you are correct. The Federal Reserve can be dissolved by an act of congress. I do not think that would ever happen however.

‘Excess’ savings = Financial Terrorism.

Double plus no good.

Exterminate. :)

Consumers are changing their habits due to environmental concerns. We’re seeing this with food now (less milk consumption, more plant based meats and such). Just thinking out loud but what if this starts to bleed over into general retail? Imagine what that would do to manufacturing and shipping.

You can buy almost anything you need second hand and these stores are thriving — less going to the landfill, costs much less and benefits people living in your local community (unlike buying online).

Have you shopped second hand stores? The second hand stores today are nothing like what was around when I was younger. We fully furnished my daughters apartment for $200 by shopping at thrifts — bed, desk, side table and bookcase all solid wood and in perfection condition. Of course the mattress we bought new ;)

Yes, TJ-Maxx was ok, but my wife didn’t go wild there on our last visit to ‘usa’, we found a belt that was acceptable, but it was like her #1 outlet she wanted to hit

But oh my gawd, when we went to good-will we bought new REI, New columbia, we bought new hiso REI baby clothes new that would cost 100X

My best guess as we all know that street-people can sell their, IMHO what’s happening is new stolen stuff is getting sold, and re-sold at thrift shops

no other possible explanation, we bought brand new gortex jackets for my wifes family all sizes for less than $15 each, think about this these jacks cost $200 or more at the outlet stores, and they appeared to have been never used

Lot’s of downtown places now have ‘new to you’ shops, where you can sell stuff and buy stuff, its pretty clear that drug addicts are stealing good stuff in Seattle, then walking next door and getting $5 for a $200 jacket, and then store sells the jack for $50

Welcome to ameriKKKA

…

What the heck does this have to do with Freight Shipments, well back in the day, hauling was the easiest way for a guy without an education to make some sure money, so long as he showed up, and wasn’t a drunk or idiot. Now those jobs are going to robot drivers. So where do the un-employed no education people end up? On the street stealing stuff

There are companies that handle and resell returned goods from stores.

It it estimated that 8% of stuff in brick and mortar stores and 25-30% of goods online are returned. Many find their way into these small stores that have an unpredictable inventory and a mish-mash of everything – including thrift stores. You can also find these goods on ebay and craigslist.

“its pretty clear that drug addicts are stealing good stuff in Seattle”

is it? I don’t know that addicts in Seattle act more criminally than anywhere else in the US. And I’m not seeing reams of new and expensive items being sold for pennies on the dollar in 2nd hand stores. But I would theorize that the wealthy has so much sh*t in their closets that donating items with the tags still on them is more probable in this age of excess. It is just an odd premise to assume crime and theft is the reason for a discount.

There is a very popular show online about getting rid of stuff in your closet.

In one of my previous purges I got rid of everything (clothing) I haven’t touched in a year. Some items were new or worn 1 or 3x. They went to the thrift store.

The new stuff in the thrift stores are donations from stores going out of business, moving, or remodeling. I have purchased new socks, new plastic containers, new umbrellas, and have seen brand new jeans with tags going for $4. The donors can probably deduct the full price on the tags.

Agree, my last robot-driver kept rebooting and going in circles.

I talked to homeless person asking for money. She said one thing she did was buy clothes at the thrift store instead of washing clothes. Didn’t seem right to me, but I guess it’s an option if you are on the street.

Lt. Yip seeing the same here in CT. My son and his girlfriend have become frugal and often go to this op shops for goods and Walmart and Costco to buy there grocery basics.

There is much truth in what you say.

I have long though that there is enough surplus stuff in basements, barns , storage units and garages to keep us going for quite a while.

However the generation that shops yard sales , estate sales etc is getting older.

eBay and Etsy have replaced yard/garage sales. Nobody has time to hold one of those anymore. Nobody has time to drive around looking for those

Apparently no one asked the question: “If everyone buys what they need with easy credit, or uses what they already have instead of buying new, will sales go down next year?

You can credit-move consumption from the future to now, but creating new consumption in the future is not working out so well. Perhaps they can convince enough folks to buy electric cars.

Eliminate free over-the-air advertising-supported television and sell us streaming subscriptions. The streaming providers and internet communications companies are going to do very, very well. OTA television transport was free. Streaming subscriptions have you paying for your programming plus your internet transport. Oh, and you get the advertising on your dime.

The second hand world is online full force. From eBay to The Real Real everything is being resold online. The implications for retail are huge. The range is from fast fashion to luxury goods. It’s a new shopping world, it’s also a young shopping world, and it’s not just the broke buying and selling.

Saving rate up, inflation low, consumer confidence pretty good, people working more and markets robust if not ebbulent, as DOW above 28,000 and S&P way above 3,000 — wow!!! President leveling the playing field for world trade. What’s wrong with this picture??? ask Wolf every day???… PJS

And that comment is the stuff that makes excellent gardens. Pack it tight around cabbages and they will be the size of basketballs.

Just think how he’ll level things if he can bully the Fed into his latest wish: negative rates. ” I want some of that money! ”

Maybe the $ US will end up leveled like the Taj.

People just make a lot of different choices. My daughter and her husband saved up and paid cash for their first home ($300,000) by 38. It was tough but now it’s done.

My son lives in Net York. He shares a 3 bedroom with a couple of guys $6000 per month total.

Cass data, due to secular noise and other factors are indicative of recessions much like deer tracks are to hunting. Exciting to look at but you can’t hang’em in the barn.

I worked for about 30 years. It was interesting to see the ebb and flow of how labor was treated. There was a couple of times when the labor market was tight all employees got told how great they were at a free lunch each month as sales went higher and higher.

The best time was when we were bought

The cfo had been squirrelng away nuts under warranty claim bucket. We had a block buster year and we all got huge bonuses. I think he knew we were going to get treated like sheet under new management. The new company brought in their own CFO and demoted the guy that gave us the bonuses and eventually fired him.

The pisser is they buy you with debt and then they put the debt burden on you. So now you have to swim up stream to make a profit.

The cass freight recession (6%) was larger than the boom ahead of it (6%), so far the resulting boom (12%) is larger than the recession (6%) . That could be bullish, also the red line monthly against other years is second only to last year, also bullish. It will take a pretty serious recession to dampen those numbers, and so far thanks to prescient Fed, and rate cuts into the teeth of possible economic decline (so what if historically that never works) we may motor through. The stock market could be saying something here about the expansion of multiples, (okay it is self reinforcing loop, they count their gains as justification for a higher market PE) Printing all this money must have some effect? Services and labor recover slowly or not at all, which reduces labor costs, and inflation is low. Corporate America will find some pricing power in that, they can afford to bring back jobs at China’s wages. Ultimately we cannot afford a 2T stimulus package, MMT would bring down the private sector, and despite all these trade wars the same trade situation which was beneficial to everyone continues? What’s not to like?

Hussman does a good job explaining the economy. Base economic growth right now is a little under 2%. Population growth plus productivity.

You get a pickup as the unemployment rate drops from high to low level maybe of another 2% or so. Once you are at full employment you drop back to under 2% and if you go into recession the tide goes the other way as unemployment heads back up. It’s a little seductive when unemployment gets very low and retail sales are high you are probably close to the end of the cycle. You always have to remember employment is a lagging indicator. Stock market can be leading indicator as it moves quickly on fear.

Consumption is falling as excess debt is limiting the ability to make new purchases. That is what shipping is showing. Inflation numbers are skewing the purchasing numbers to make it seem as if the economy is stronger than it is. In addition, business is cutting inventory in anticipation of the coming recession.

A friend has worked at the same plant making lawn mowers for 31 years. He has taken voluntary leave for the first time ever. Another friend is using up his vacation days that were renewed in October. He feels they will all be gone in January. Every other year in the last 5 they have been working overtime at this time of year. I asked if it was a parts supply problem. He said there were no orders.