The once hot asset class of high-end student housing runs into reality.

“Student housing” is no longer the spartan cramped dorm room. It’s a global asset class. Part of this subcategory of multifamily apartment properties has gone up-scale, and the mortgages to fund these properties, just like the mortgages that fund regular apartment buildings, are packaged into commercial mortgage backed securities (CMBS) – including by the Government Sponsored Enterprises, such as Fannie Mae – and sold to investors. But the private sector has carved out a niche in packaging student housing into CMBS. And that’s a good thing for taxpayers, because these “private-label CMBS” are now going delinquent in large numbers.

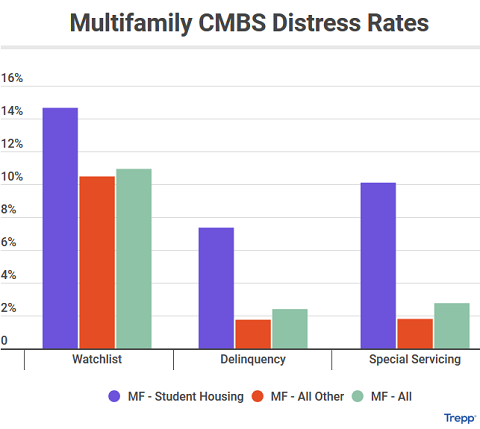

In August, the percentage of student-housing CMBS that were delinquent and have been turned over to a special servicer spiked to 7.3% of total outstanding balances, according to Trepp, which analyzes CMBS. The rate of CMBS that aren’t delinquent yet but have already been turned over to a special servicer rose to 2.8% of the total outstanding. And so, the combined rate of student housing CMBS in special servicing has jumped to 10.1% (purple bar on the right, chart via Trepp):

In addition, another 14.6% of Student-housing CMBS that are not yet delinquent and have not been turned over to special servicing are now on the watchlist (purple bar on the left in the above chart).

In dollar terms: Of the $4.5 billion in private-label student housing CMBS, $331 million are delinquent as of August, and $123 million, while still current, are already in special servicing. In total, $454 million, out of $4.5 billion, are in special servicing.

But for the recent vintages of CMBS, the delinquency rate is a lot higher: $1.5 billion of the $4.5 billion in student housing CMBS are backed by mortgages on properties that were constructed in 2010 or later. According to Trepp, many of these mortgages were securitized into CMBS within two years after construction, “meaning little or no operating history was provided.” The delinquency rate of these CMBS has spiked to 15.3%!

This comes on a backdrop of loose money, low interest rates, and historically low default rates by other multifamily CMBS: With student housing excluded, only 1.8% of the remaining multifamily CMBS are in special servicing (red bar on the right in the chart above).

In broader terms, the Trepp delinquency rate for all CMBS in August fell to another post-Financial Crisis low of 2.5%. Even the battered brick-and-mortar retail CMBS sported a delinquency rate, at 4.1%, that was far lower than the student housing delinquency rate.

But the student housing sector was once red-hot with investors. According to the Green Street Commercial Property Price Index, prices of student housing properties soared 56% from the peak before the Financial Crisis. In fact, the property price index for student housing barely dipped during the Financial Crisis, before it took off gain.

But the sector faces some challenges, including:

Oversupply of luxury student housing units. Not only oversupply, but also the whole notion of “luxury student housing” in the era of crushing student debt. Sure, some students are floating in moolah, but most students are struggling to get by. An insider who has been working in student-housing construction for many years told me:

“I was always shocked by the luxury and presumption of entitlement embedded in the marketing, such as top of the line fitness facilities when there is already a fieldhouse on campus, appliance packages for people who never cook but eat at the cafeteria, etc. All this has added to the cost and to student debt.”

Falling student enrollment. According to the National Center for Education Statistics, total undergraduate student enrollment surged by 37% between 2000 and 2010, from 13.2 million to 18.1 million students — thus whetting the appetite for the student housing industry. But then came the Financial Crisis and other factors such as soaring tuition, and to the greatest surprise of the industry, total enrollment has since declined by 7% through 2017, to 16.8 million students.

Thus, even as supply of high-end student housing is increasing, the supply of students, so to speak, is declining.

The issue with student housing isn’t the low end. There is always demand for affordable student housing. It’s at the high end where things are cracking – and more precisely at a specific corner of high-end. Trepp:

Generally speaking, the student housing market is relatively barbelled in terms of inventory quality.

One end consists of older, lower-end developments with more dated amenity offerings. Since “low end” housing construction is constrained and most campuses have a steady supply of frugal students as well as money-conscious parents, this part of the market usual soldiers on.

On the other end, there is a constant new supply of amenity-rich multifamily units coming onboard – which has triggered – as we like to say – the “student housing amenity race.” The housing options that find it hardest to compete are those complexes that were amenity-rich 10 years ago and remain pricey, but now seem dated.

At these older high-end properties, so the 2010-plus vintages, landlords can’t keep up their occupancy levels, given the already limited number of students who can afford them and the onslaught of new high-end student housing, and given the requirement to charge uncompetitive premium rents to service the debt. Hence, the CMBS delinquency rate on these older vintages that has soared to 15%.

Clearly, many graduates who are now struggling with piles of student loans lived in low-end student housing or outright dumps, trying to get by, in line with the bifurcation among American consumers.

But in the era of relentlessly soaring student debt [The State of the American Debt Slaves, Q2 2019]…

…and in the era of campaign promises (whatever they’re worth) of forgiving part of this student debt at the expense of taxpayers, the whole notion of “luxury student housing” and how it was funded and securitized and sold to investors, and how those involved profited along the way, clarifies the role of the University-Corporate-Financial Complex, and how it has hooked into the government-guaranteed money flow. And students are just the conduit.

Services are Hopping. The #1 Biggie is Hopping the Fastest. It all adds to GDP! Read... The Financialization of the US Economy

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“…clarifies the role of the University-Corporate-Financial Complex, and how it has hooked into the government-guaranteed money flow. And students are just the conduit.”

Brilliant.

I’m surprised Universities haven’t tapped yet (to my knowledge) the 65+ cohort. “Come on in folks! How about getting a PhD in English Lit for less than $50k. You’ll get to mingle with the young crowd and you can party with them in a posh apartment. Their youth and your moolah. A marriage made in heaven. Don’t overthink it and call 1-800-OLD-FART for details”.

Can you bundle that with a funeral plan? :-)

If negative interest rates come to America that plan will be shelved indefinitely.

Universities have been courting older people for a long time. But it’s mostly part-time “life long learning.” I like students, but no sane 65 year-old wants to hang out with college students all day, much less go to parties where you get drunk or stoned and stay up all night. Sounds like hell to me.

Guess I’m insane (but it quit bothering me years ago). I took two years of Auto Shop at 62-3, and had a blast. The campus cops never came near the place, so smoking dope was cool. Instructors were all “use your brains and hands” types, so they didn’t care what went on as long as nobody got hurt bad.

I have always wondered how people who made their living in suits and offices had any fun. Golf, I guess.

If you’re a student, frankly, you can live 4 to a room with bunk beds. What do you need? A place to SSS (sh!t, shave, shower) and a place to sleep. The rest of the time you’re in class, in study hall, in the library, the student lounge, cafeteria, etc. You don’t own much more than your clothes, books, etc.

So who needs these posh student quarters? Even when I was in college in the early-mid 80s, student dorms were more expensive than living off campus in a rented room.

Students need some privacy in order to consummate their date/hookup of the night. A room with 4 bunk beds ain’t gonna work.

Around here students rent a place for two and get seven living in it. Since they are most of their time in classes or studying in libraries, or in Cafes with Wifi, they only use them to sleep and maybe breakfast. The apartment may only have two beds but they have no problem using sleeping bags.

Maybe every two or three days; unless us Summer, they use it to take a bath.

That makes sense to me. I was an undergrad back in 1998-2002, and we used the off-campus housing office to find roommates, typically getting 4 people into a 2 bedroom apartment. I always shared a room.

I also had the experience of splitting hotels with a bunch of students with everyone finding a space on the floor to sleep on (you’d enter the hotel separately in groups of 2). Not all that comfortable, but everyone was stoked to go on the trip.

I could easily see 4 students splitting a studio apartment and sleeping on cots. The room is not a hangout, it’s a bed and a shower.

Agreed — I thought my 10×10 concrete block was designed as an incentive to get out in 4 years and start making a living.

I have a nephew who would sooner wait for his inheritance from the old man kicking the bucket.

His preferred profession is video games…

From the ripe age of five onto computer games…

The bad news is that he turned out the way you raised him.

Your mistake was treating him like an expense. If you had treated him as an investment you could have rented him out to do piecework when he learned how to walk.

Children should not be used as a hedge against the future. They’re more like hostages.

“they’re more like hostages”

You sure it’s not the other way around?

*hiding from the tyrants as I type*

You sure it’s not the other way around?

Hardly. There’s a reason employers prefer employees with children. Parents can be persuaded by their employers to do things that would make the non-parent walk out in disgust.

Ha, don’t I know.

(To be clear, my “tyrants” are my young kids. I’m still in the trenches of parenting…learning how to navigate the “disgust” as you so adeptly put it)

@unamused

I ask many ppl who grew up on multi sibling households:

How did ur parents treat u all?

Reply: equally

And How did you turn out? differently

Also

Pls advise what u would have done when the ur kids school required every student to have their own iPad? Btw, all schools pretty much require such these days.

Once ur kid gets an iPad / internet connected, parental mind control is vastly diminished.

Do u have children.

I have two

One with borderline personality disorder

One with mild Aspergers

One has done every drug known to man kind

The other has had maybe a few drinks his whole life.

What ever happened to kids just being shy or eccentric. Are there any “Normal” sane kids anymore? Seems like the “normal” kid would very suspiciously stand out in a crowd of modern mentally impaired children as not conforming to the norm.

@Joe LaLonde and RagnarD: Get the kids involved in sports and a few real-world activities, and they won’t have time for the brain-wasting games. Let them pick the activities and they’ll find something better than the games too. And all screens off an hour before bedtime – they impair sleeping.

Some families have everyone check their devices into a shared centrally-located multi-charging “phone garage” at specified times (1 hour before bedtime, mealtimes). Keeps it fair if parents make same sacrifice as kids. And then everyone sleeps better and has conversations at mealtimes…

Pls advise what u would have done when the ur kids school required every student to have their own iPad

I would have prevented them from being assimiliated by the hive mind by putting them in a real school.

I would also have exercised my vindictive streak by exposing the school board for taking illegal kickbacks from Apple and ensuring they were duly prosecuted and replaced.

Other countries are civilised and don’t have these problems.

@Unamused,

Many school districts have introduced mandatory laptops in middle school and even extending that into elementary schools.

There is no choice. Where the family lives, dictates which school kids go to.

Costs a ton to the school districts to purchase these devices (which get outdated in 3 years), maintain them, have software for those etc. Without adding much value.

One area sorely missed in education is life skills as we age.

How the laws and regulations change so drastically.

Being able to research our laws and rights on the computer really saved my bacon of being so naive on what I thought was my rights to what the laws actually are.

My common law wife passed away of many years together and she gave the impression of having quite a lot of money. No will, but the family vultures swooped in and became executor through a lawyer.

They found no money, just bills which really passed them off.

Needless to say, they tried every trick in the book and the police had to issue them a warning…

Just saying that laws and regulations change over the decades.

Wolf when i look at student debt, post 2008 seems to just be following the trend line no? It seemed like we were already on track to meet the current conditions. Why no sudden spike like in housing?

One area sorely missed in education is life skills as we age.

Life skills are learned from the local culture. Unfortunately the US has no culture because it was replaced with marketing. Marketing teaches people to worship celebrities and become debt slaves to buy crap they don’t need, can’t afford, and have no use for.

Education is about learning, not teaching. People have been carefully taught to get that exactly backwards.

Thank god we spend the most on education in the world that’s why American kids are the smartest in the world

Bwahhhhhaaaaaahhhaaa

And spend the most on health care in the world that’s why Americans are the healthiest in the world …

Americans are the healthiest in the world? Not even close. The latest rankings place America 35th. Even behind countries like Slovenia. Having private insurance companies as the middleman, siphoning off a significant share of the money spent by consumers for health care services, is a sham and a shame. But the profits generated by these companies does make GDP more impressive and this system does work as an excellent vehicle for further wealth transference from the have nots to the haves.

Right you are. When people from around the world need the best medical, nobody flies to New York or Miami or Los Angeles for treatment.

They all go to…..Slovenia.

Right?

Random- When Jamie Dimon had throat cancer he went to some place in Europe……so yes you are right……and without knowing anything.

Just lucky that time, I guess.

Housing, health care and higher education.

The bigger government gets, the more it gets involved, the more regulations it passes, the more it tries to “make things fair” or to “make things more affordable”…

The more expensive and less efficient these sectors of the economy become.

There is a lesson in there somewhere.

There is a lesson in there somewhere.

Yeah, don’t let corporations take over the government.

Also, criminalise anarcho-capitalism.

Seconded.

Corporations love big government.

I guess you haven’t figured that out yet.

Government loves big corporations.

which is why it quit enforcing antitrust laws.

Rowen,

A good article on the inability to enforce antitrust in today’s environment:

https://www.wired.com/story/tim-wu-says-us-must-enforce-antitrust-laws/

Government is the only thing standing between you and the forces that want to gobble up everything you own and earn. And that is precisely why corporations (the facade of the wealthy super predators) have targeted government for termination. But I guess you haven’t learned that yet.

MarkinSF

I guess you haven’t been paying attention to this election’s crop of Democrats want to impose socialism (as the Bern says: “helping organize your life”).

World-wide, government is about the biggest offender; people seldom actually go to war with the cell phone company, PC maker or car company.

Chip

Recommend you get “war is a Racket” by retired Marine General Smedley Butler. He finally wised up as to who really is behind these wars.

Don’t sweat the socialism Chip, you aren’t worth enough to pay inheritance tax, anyway. They’ll leave economic losers alone.

There is a direct connection between involvement of the state and cost of healthcare & higher education. More involved/taxpayer paid is cheaper.Not surprising with health care’s monopoly position and higher education being a Velben good

Bologna (and others):

I really think you are selling American youth very, very short. Too damned cynical about their abilities to cope with the world we are leaving them. Speaking from experience of we having a large family and watching/guiding them into middle aged adults and now watching the many grandchildren. All hard thinking working individuals…not a (intentional) under-achiever in any of them. Some college others just plain hard workers.

Arguably, nothing is more universal across history and cultures than the plight of the older generations against the “youths”…the old graying man shaking his fists at the good-for-nothing, lazy, entitled kids. LOL. I guess some things never change.

@Sierra7 – I think that short selling is very well deserved when objectively looking at just how entitled so many Millennials actually are. Just look at all the calls for “safe spaces”, demands for trigger warnings, free everything, etc. That is not a generation of strength but rather a generation of weakness.

They built out the high end luxury market and refurbished used condos with stone countertops to try to increase their profit margins, when all people wanted was more affordable housing. I remember seeing a news report about law school grads passing their bar exams and not finding work. Student loan delinquencies are a growing problem. Computers might take the place of some professionals. I read IBM’s Watson supercomputer was better at diagnosing illness than most doctors. They are already trying to replace drivers with artificial intelligence. Perhaps collision avoidance systems might lower auto insurance premiums. People want lower prices.

Luxury student housing should be an oxymoron.

Instead, it is the norm.

Brought to you by bigger and bigger government making higher education more “affordable” and buying votes.

Brought to you by bigger and bigger government making higher education more “affordable” and buying votes.

Government will never be big enough to satisfy the demand for corporate welfare.

Government officials do not buy votes. They sell them to corporations who will get them replaced if they don’t.

I don’t think every democrat candidate running for president got your memo.

“Government officials do not buy votes.”

I don’t think every democrat candidate running for president got your memo.

But some did. Unlike every Republican, most Democrats opposed Citizens United, which codified the corporate purchase of politicians.

The problem is not government, but the corruption of government by wealthy predators, a fact the average sixth-grader should be able to explain to you, if you’re interested.

Unamused

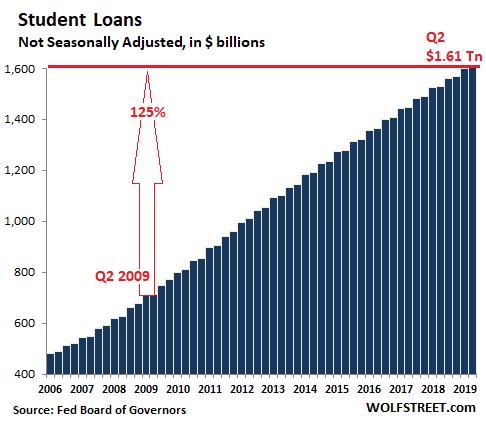

So if politicians write-off $1.6T of student loans (7.6% of 2019 US GDP), just exactly which corporation have they been “sold” to?

I’m sticking with the opinion that politicians buy votes, the country be damned.

So if politicians write-off $1.6T of student loans (7.6% of 2019 US GDP), just exactly which corporation have they been “sold” to?

Like I said, some politicians haven’t sold out your country to corporations. But don’t worry, the ones who have will see to it that it never passes.

Besides, writing off student loans isn’t buying votes or selling out. It’s social justice.

I’m sticking with the opinion that politicians buy votes, the country be damned.

Indeed it has been.

And I’m sticking with the fact that corporations buy politicians, now that corruption has been legalised.

unamused

so, you think: ‘…Besides, writing off student loans isn’t buying votes or selling out. It’s social justice….”.

Compos mention adults freely & knowingly sign legally binding contracts promising to pay taxpayers back debt equalling 7.6% of GDP – what all the rest of us produce while you’re on a 4-year (or more) fell-good experience.

Sounds like a con-job, not social justice.

Just wondering what role government is playing in the build out of luxury student housing. to my knowledge these projects are entirely private enterprises. Please explain exactly what you’re talking about. And how in the world can you possibly come to the conclusion that higher education costs are driven by government? Are you saying that tuition rates at universities are determined by government dictates. Your entire statement seems entirely baseless. I wish you could provide at least some semblance of logic to these off the wall comments.

Federally insured student loans are paying for these luxury apartments.

You think if college students were borrowing directly from the university or a bank with no government guarantees and if these debts could be discharged in bankruptcy there would be any kind of luxury student housing?

Student housing would be what it was from 1950-1985. Cinder block room with metal bunk beds. And a bathroom down the hall.

Corporations love big government. Destroy the smaller competition, grossly distort market forces, socialize the losses and keep all the profits.

And no worries about going to jail for fraud.

The only thing corporations love more than big government are politicians promising even bigger government.

MarkinSF

What 2banana said pretty much nailed it.

18-year old kids have no concept of how crushing $30K of student debt can be; they literally cannot make an informed decision on that proposition.

Student-debt funds more-or less of the increase in anything student-debt pays for. The more exclusive the product or service is for students (eg: college tuition, text books) the more pronounced the effect.

2 Banana & Chip

I don’t he nailed anything. Of course some of these luxury apartments are ultimately paid for via student loans. And yes those loans are guaranteed by the US Government. But pinning the blame on “Big Government” is just inane logic. The system has been corrupted by the super predator wealthy (just like the military industrial complex). And people continue to vote in politicians who maintain & accelerate the entire process mainly because they are uninformed and remain uneducated (the irony) about who they vote in. It’s a popularity contest.

As i spelled out in a previous post the primary culprits who gamed this student loan program are the scam “universities” such as University of Phoenix who managed to get accreditation and worked their way into the pockets of Congressmen who opened the Red Sea for these scam artists. A large portion of loans that will never be repaid are from these institutions. Check out the political affiliations of the owners of these entities. I don’t think you find they are liberals or Democrats. They most definitely are not progressives.

The constant rant against the big G is a Republican driven slogan but this group of politicians represent the super wealthy whose ultimate goal is to get their hands on every revenue stream currently in Government’s hands (and I am by no means suggesting that Democrats are not complicit in this scheme). When this comes to fruition them the corporate state will become a reality.

The point is that this country is founded on the principle that the people are the Government meaning we need to protect each other’s interests. 2 Banana’s constant rant about Government being the problem is just him opting out of the system and by doing so acquiescing to this sick intrusion into the well being of the general populace.

Debts that cannot be repaid, will not be repaid. Let’s end the misery of the desperate & nearly impoverished people who got duped into this scam by voting in leaders who want to find a moral way out this mess.

MarkinSF

Nice try, but you’re wrong.

I think you’re being willfully ignorant.

Cuba, Venezuela, China (only 20% of whom are middle class), Russia, India (among others) are current & perfect examples of big government, as Bern says, “helping organize your life”. Problem is, your life will be organized to serve the government, not you.

Chip

The US inflicts an economic war on Cuba and Venezuela but in higher education and health care they are top of their pears. China had not even 1% middle class 30 years ago so they are doing fantastic except health care, but that is more private than state run. You also did not mention any of the other first world countries, almost all have more state interference in health and higher education and better result.

It is obvious that heavy state interference/control in Higher education and healthcare leads to better results. In other fields this is less obvious or even the opposite is true but you can’t admit this for ideological reasons.

2banana I’m wondering if you have any familiarity with the actual mix of student housing in the real world. I work at a state college with the highest family income demographics in my state, which also has a lot of affluent foreign students driving European luxury cars. Off campus there are a handful of “luxury” student apartment buildings, but over 95% are high-density basic old apartments; the on-campus dorms are basic to intermediate-level at best.

Don’t read too much into the Watson story. IBM is a smoke and mirrors show, very controlled environments, very specific and narrow cases. At best, it will augment the field for the foreseeable future.

to sc7: The knowledge base of Watson can be transferred to other computers. So if Watson can diagnose the medical illnesses better than most doctors, this knowledge base can be copied to any number of other computers in an instant. This is one of the fundamental advantages that computers have over humans: their knowledge can be designed to be endlessly accumulative. This is why, sooner or later, self-driving motor vehicles are going to replace many transportation workers. In order to transfer knowledge from one person to another, you have to start at ground zero and spend months or years training each individual, which is far more expensive and time-consuming.

BUT I thought it was impossible to get out of student loan debt I feel pretty stupid for paying nearly 200k dollars for my son at Georgetown Can we say “ moral hazard” to this story?

Amazing Polly does a great job exposing the Maxwell connection to the Epstein debacle by the way on YT

You should. I got a Georgetown education for 90k (45k a year when I went) and then a masters in math for free in a PhD program which is worth its weight in gold.

One year at my state college and transferred to Georgetown and graduated in two years. I also worked at Georgetown and made about 25k during those years and paid my room and board. Frugal for life. Everything can be done frugally.

4 years for undergraduate is two much. I think that they should make Bachelors a three year degree.

“Two much.” PHDs ain’t what they used to be or you get what you pay for (free)… Just joking – its the internut :)

I left with a masters from a top institution in math. It was absolutely worth at least 150k a year in compensation.

Maybe feeling grateful that you actually had $200,000 to pay for your child’s education. Unless you had to borrow that money, you are living in a world of privilege 90% of the world dreams about.

Maybe soon an article: “The Total Financialization of every aspect of People’s Lives From Birth to Death”?

There ya go: cradle-to-grave debt slavery.

If people really loved their children they’d have themselves sterilised.

Many people directly associated with the financial cartel syndicate don’t like the idea of a bail out of student loans, but saw the bank bailout as necessary.. Rather hypocritical. Of course there shouldn’t have been bank and auto company bailouts to begin with, but there was, and criticism of students and parents with overly burdensome school loan debts will fall on deaf ears come election time, it is a fact that people vote for what will be best for them financially, not for some rich financial types phony moral disgust. For example, on the same decision making realm, the government created the welfare system. and If your a poor mother with a couple of kids without an education, of course your going to get 60 grand of welfare a year through housing, food stamps and other supportive living funds, rather than get a menial paying job, and try to pay for day care and housing on your own.Let’s not talk about what should have been done in the past. Let’s discuss what will probably happen in the the reality of the future, and how the majority of people will vote whom are affected by debt slavery and/or poverty . The rich bankers didn’t want to suffer did they? It will all bring the system that is presently in place to it’s knees a little quicker, and say a reflective prayer while down there. Save our nation, but always save yourself and your family. Please don’t preach about the morals of the situation just the probable reality.

Save yourself FIRST before saving the nation. Agree 100%. But this does NOT justify all the choices one make under the name of saving him/herself. There are things one should NOT do in PRINCIPLE, such as one does NOT hurt other people or take their properties by force or violence. If this principle is violated, the things people do under the name to save themselves will corrupt and erode the society to the point of there no future for future generation but revolution, death and chaos. To save themselves, people naturally want to transfer other people’s wealth into their hands, and they know individuals can NOT use violence force to do it. So here comes in the .GOV. The organization of wealth transfer by TAX, policy, money printing, enforced by police, military and the best part, it can be voted! So we can VOTE to save ourselves! Yeh! Mean time, people forget about .GOV can be bought as well, by a few people called .00001%. In the end, if the nation’s principle and morale is corrupted, the voters will NOT get what they want, they get what they deserve. To save yourselves, vote for principle, NOT wealth transfer.

Thanks for the discussion JZ.

It’s probably too late for those commendable moral principles to be in play. They need to be in place with a work ethic when one is being bought up. What people think as survival and /or entitlement are blurred. This isn’t a ethical or moral thought out judgement, it is a survival flight or flight instinct for people.

Many have made bets on this categorical imperative as the primary force that causes the collapse of the system- the 2020 elections. Talk about volataility

Is it morally wrong to try and profit from it? Or is it just negative bear thinking that helps an inevitable collapse move along?

I’d argue there are two moral evils we need to fight. One is people trying to get things without work. We know there is a lot of that. The other is people attempting to accumulate vast amounts of wealth, often through corrupt practices and favoratism, in excess of what Michael Jackson could spend in a lifetime. We all know there is even more of that going on. That’s why interest rates are nothing these days.

Wealth transfer IS an economic principle. Wealth concentration is a demand killer.

Wealth transfer shouldn’t be viewed as some money grab. In reality, it’s a way to keep demand flowing and the economy running smoothly.

That said, only extreme wealth should be redistributed so there is always a strong capitalist growth incentive.

I think Warren’s idea to tax accumulations of wealth above a high threshold, at a reasonable rate, is actually a strong idea. An alternative is to enforce a strong estate tax. I always like the idea of a “death tax”. Is there a better time to pay tax than when you are dead?

Funny how wealth transference is viewed as some kind of sin against the laws of a free market God and marketed as a scheme to give money from the makers to the takers. Yet wealth transference in the US is an ongoing process that has been redistributing the workers share of production to the folks sitting on there a$$e$ and accumulating great wealth from the actual efforts of the middle class and the working poor. It even makes life more stressful for the upper rungs of the middle class (the professional class). How is this accomplished? How about a 15% capital gains tax, a tax structure that ensures companies like Amazon pay zero tax, a tax table that increasingly lowers the maximum tax rate on the wealthy, that taxes Social Security, etc,etc. Time for a tax revolution. Where is FDR when you need him?

MarkinSF

You appear to think Social Security is excluded from Federal income tax.

85% of Social Security payments are included in every recipient’s Federal taxable income (individual states may handle differently). Federal income taxes are calculated using the same graduated tax tables as all tax-paying citizens.

The untaxed 15% represents some highly inaccurate bureaucratic estimate of what the recipient actually paid into Social Security during their roughly 40 years of working life (additionally, employers “contribute” an additional and slightly higher amount for each employee).

Further, during an employee’s roughly 40-year working life, Federal income tax is collected on the amount they pay into Social Security every working year.

MarkinSF, people can do wealth transfer all they want as long as they are willing to. I help you when you need and you help me when I need it. But wealth transfer accomplished by using force, such as TAX or money printing can only bring the worst out of people. The anger you have towards Amazon and want to TAX the shit out of that corporation is exactly due to the A$$et inflation by money printing that make the 0.0001% rich while the middle class squeezed. Why can they print money but you can NOT? because if you do, you will have guns at your head and you go to jail. This will erode and corrupt the society until there is NO return and it will bring the worst out of everybody. Where is FDR when you need him? He has been bought by Jeff Bezo. I am sorry, the moment you think you will get help by empowering the .GOV, the 0.0001% will make a deal with the governor in a closed door while you are listening to what they say on TV and keep your hope up. I understand everything has a life span even for a country founded with good principles like US. But just to see it gets eroded by these corruptions still make me sick.

I am NOT saying we should change anything. Everybody pick their own fight. What I am saying is simply it is a sad fact for people to discuss how to use government force to transfer other people’s wealth. It sickens me when they print to enrich the 0.0001%, it sickens me when they do spending and everything for everybody for free.

What will happen in the future is enrollment will drop drastically when the students finally figure out a degree won’t get them a job, not even a minimum wage job.

An education in modern finance would teach them to get rich by starting up cash-burning ventures funded by gullible investors.

No college needed. Just pick through the archives here for promising examples.

Incorrect. Degrees still have a vastly positive RoI, especially if you smartly minimize your cost by way of public schools and scholarships.

Good luck “self teaching” your way into a STEM career. The people that love to say this have no idea what degree fields really do.

Degrees still have a vastly positive RoI

That’s debatable, but you’re unlikely to concede so I’m not going to bother.

And yet, New York magazine is running a piece on “How to Major in Unicorn: Many of the freshmen now arriving in Palo Alto came to raise capital and drop out. A cynic’s guide to killing it at Stanford.”

@unamused

Show me concrete data and I’m willing to concede to other points. Fact is, college gradates might not have it as good as they did years ago, but they have it much, much better than high school graduates.

Some N.Y. Magazine article about a very specific subset of the population looking to raise VC funds has nothing to do with the topic at hand.

sc7

For years, several credible national publications have analyzed college expense vs returned benefit. This is not new.

Generally speaking, whole classes of degrees fare poorly (eg: gender studies, French lit), while STEM degrees perform better.

If all degrees were (your words) “…vastly positive…”. we wouldn’t be having a student debt crisis.

The post-WWII GI Bill was a huge accelerator for the US economy while most of the rest of the world struggled to rebuild and feed themselves. In the intervening 75 years (3+ generations), parts of the rest of the world are catching up. A generic “college degree” is no longer sufficient for a lucrative post-college life.

The probably reality is that the US economy is dying of a thousand cuts. As a senior with almost 15 years of retirement and even well off enough to visit the dentist regularly, I feel like an observer to the decline and fall of the American empire. If the country had been allowed to vote in a special referendum, perhaps it would have let GM go bankrupt and let AIG default on its credit default swaps. Of course such an outcome would have been catastrophic for southeast Michigan. If an AIG default had dragged Goldman Sachs into bankruptcy, a lot of Americans would have cheered but who knows what effect it would have had on the overall US financial system.

Most bank employees are not well paid.

One major difference in the banks’ and auto companies’ bailouts, they all had to pay it back with interest and they did. The student loan bailouts are just blank checks paid by the taxpayers.

to Scott: There’s a double standard in how student loan debt is handled versus almost all other kinds of debt: Namely, you can’t discharge student loan debt by filing for bankruptcy. We can thank Joe Biden in part for this debacle.

Private individuals and corporations file for bankruptcy all of the time in the United States in large numbers. You are in effect arguing that it’s okay to discharge the debts of badly run businesses and individuals who carelessly spend more borrowed money than they can ever pay back, but we mustn’t dare discharge student loan debt. This argument is completely ridiculous.

Maxine Waters is the House Financial Services chairwoman. At a hearing a few months ago with the big bank CEOs, Maxine Waters read all the alarming figures on student loan debt and in a grilling style asked, “What are you guys doing to help us with this student loan debt?” The first couple of CEOs simply said their banks had exited student loans many years earlier. Finally, Dimon said Chase exited when the government took over student lending in 2010. If was a humiliating moment for Waters who quickly changed the subject.

Why that exchange was almost beyond belief, in 2010 the govt takeover of student lending was projected to save taxpayers tens of billions of dollars by “cutting out the middleman”. Now, in less that a decade, sticking taxpayers with the resulting $1.6 trillion problem is actually a campaign promise.

Setarcos,

Wait a minute…. These student loans were ALWAYS guaranteed by the government. Back in the 1980s, I got my student loan from a bank, but the government guaranteed it. So the bank made a profit issuing and servicing the student loan, and the government took the risk of loss. In 2010, the middleman (bank) was cut out, and the profiteering by the bank was stopped, but the risk to the government has not changed.

Thank you.

The federal government began guaranteeing student loans provided by banks and non-profit lenders in 1965, creating the program that is now called the Federal Family Education Loan (FFEL) program.

IdahoPotato,

A couple of days ago, I read a story in the WSJ about people leaving coastal areas and flooding into mid-tier cities such as Austin, Boise, etc. It used the example of a women in tech and her family who moved from Los Angeles to Boise, where she is working remotely… was that you in the story?

No Wolf. I moved to Boise from the Bay Area in 2004. And I “retired” in my 40s. I do freelance stuff now and then. Mainly for non-profits.

@wolf, idaho When private lenders were still in the business of making federally insured student loans, they were still underwriting the risk of the loans. That went away and delinquency & defaults have increased significantly even through unemployment is at a 50 year low. What the CBO said would save taxpayers $5-10B/ is now projected to cost taxpayers $30-40 billion a year. Maxine isn’t happy with the new crisis. So forgiveness is the new plan. When that happens, the destruction will be complete.

So is it correct to say the GSEs are not backing this CMBS after it was packaged as sold as investments?

Yes, correct. These CMBS discussed here are “private-label,” meaning that the GSEs have nothing to do with them and are off the hook.

Unless you were in dental or the medical profession tuition and books were affordable by working a summer job back then.

The narrative sure has changed. It is now “why should the government profit off of the backs of poor students, let’s forgive all loans”. I believe you have commented in the past on the unfairness of student loan forgiveness.

Adding a bit more detail:

it all started with good intent. Without a government guarantee, bank would have charged high interest rates to cover this high risk loan category. Government guarantee reduced the risk, and let the banks charge lower interest rate.

College became affordable since monthly payments weren’t formidable. Government was happy, students were happy; but none happier than the colleges who now could now charge much higher tuition. See how the tuition rates have gone up without any regard to inflation? Because wages or inflation are not the deciding factor here – cheap student loans are.

Looks like the ‘profiteering’ banks are all out of the picture since 2010. So who do we blame on being the blood sucker? The very program that started to help out needy students get affordable loans.

Good points but it should be noted that legislation enacted to provide access to student loans became a big industry for colleges & universities with the advent of the University of Phoenix and other sham “institutions of education”. Basically an abuse of these programs intended to give access to meaningful education to it’s citizens. This scheme was so profitable (schools get the goodies – tuition, taxpayers take the risk) that real institutions of learning would be foolish not to take advantage of. In addition to disqualifying institutions that are of dubious merit from having access to student loans, universities should be on the hook for at least some portion of these loans. Student loan forgiveness will cost taxpayers but that can easily be offset by cutting the grossly wasteful defense budget, establishing a small transaction tax on stock market transactions (and here we’re talking algorithm trades) etc. Is it fair to write down student debt? Is it fair to allow predatory institutions (supported by our Secretary of Education Betty DeVoss – who never had to work a day in her life) to take advantage of desperate, uneducated young people (our citizenry) whose only hope of making it in today’s world is getting one of these pieces of paper?

MarkinSF,

Student loan forgiveness is a moral hazard.

Firstly, who are we asking to pay the tab? People who have already paid off their own loans, people who chose not to go to college and not take on debt, etc. They pay twice over and might not even have the degree for which they are now paying?

Secondly, if the loan is forgiven is it still called a loan? Appropriate term would be handout. No sane lender would give out a loan if it guaranteed to be defaulted (aka forgiven) in future.

Thirdly, loan forgiveness won’t be a one time thing. It’ll be every year. That’s a grossly inefficient and roundabout way of achieving free college for everyone.

Transaction taxes won’t pay for even a tiny fraction of this cost. Trimming defense budget might make a tiny dent (total current student loan around 1.5T. Defense budget around 750B) but nowhere close to cover it.

Wolf,

I remember the days of the Stafford loans. Now, I don’t remember the details, but I do know that I never actually saw a penny of those loans in my bank account, they went straight to the college.

Are the college loans today actually going to subsidizing education, or something else? More specifically, where does the money go once it leaves the hands of the Federal government? Does it go straight into the universities in question, or does it go elsewhere first, like the student’s bank account or an escrow, or something else like it? I ask since I’m ignorant of these processes now.

The biggest parties on any campus happen on Disbursement Day. You figure it out.

The risk to taxpayers has not changed? Take a look at debt levels, repayment rates, delinquency rates, default rates …and all the steps taken by govt to mask those metrics. The risk has not changed. Be serious.

This high end housing was built in the state school my son attended in Florida. I remember looking at the brochure they sent us. The high end unit was two bedrooms with a living area in between, no kitchen because they had a cafeteria with a dining plan. The cost was about $1K a month, more than the cost of a one bedroom apartment in town.

I don’t understand how these units are defaulting because the cost of in school housing was included in the prepaid cost for the semester. If a student chose in school housing, it was added to the cost for the semester. These costs had to be covered before school started.

The only thing I can think of is that if the units aren’t rented, the schools assume the cost. If so, these schools are on their way to bankruptcy.

This high-end student housing is not university-owned (as a dorm would be). They’re privately-owned off-campus properties.

Greystar and American Campus Communities (ACC) are two of the REITs in this space. They have being buying up a lot of properties near campuses around the country.

In Florida they built this high end housing on campus.

This is another example of just the lack of education on all parties. The students who go into these places, and the guys who held on to the property and are now in trouble. Let them fail. The very idea of high end student housing is an oxymoron. People with no income living it up based on loans.

I said it before, and I’ll say it again. The educational system in this country does no one any favors. It wastes time preaching equality, sexual education, gender rights, etc, all of which are important in their own unique way, but functionally irrelevant in most situation relating to day to day living. Public education does not even bother with things like budgeting and basic finance. So, we have kids who has no idea of balancing a budget, much less a checkbook. Then parents, who do not know how to teach their kids the same, it is at best a sad state of affairs.

My assessment is that any students who even attempt to go into these high end residences should be immediately kicked out of the school. The reasoning is obvious, they are either too stupid to make sound financial decisions, in which case they won’t have any chance of becoming a donor. Or they are too rich to give a crap about their education, and probably won’t be a donor no matter what honors are heaped on them. Simply because college would’ve been a trophy to be collected, not a place of learning.

“It wastes time preaching equality, sexual education, gender rights, etc, all of which are important in their own unique way, but functionally irrelevant in most situation relating to day to day living.”

Probably relevant if you are gay, trans, or POC, and unable to find jobs due to prejudices from an uneducated employer. Living in an unequal society impacts every aspect of life for LGBTQ and POC, including financial life. You don’t have to throw out the baby with the bathwater if there are lacking qualities in the University/education system. I agree wholeheartedly a requirement for basic financial skills class would go a long way.

Then there is this trend:

“71 new “nano suites” or micro apartments will open in 2019 at UBC as part of an innovative new residence building combining student housing and a transit exchange.

The nano suites measure 140 sq ft. and contain everything a student might need: a pull-down bed/desk, kitchen with mini fridge and a bathroom with stand-up shower. The nano suites are fully furnished and will rent for between $675-$695 per month when the building opens in 2019 — a bargain on Vancouver’s pricey west side.”

Okay, 140 square feet. A room. My aunt used to rent a similar sized basement room to UBC students in the West End (4th and Sasamat) for $60 per month in the early 70s. She bought the house for $27,000 in ’69, and the lot sold not too long ago….just the lot…for well over 1 million. So, $700 a month for a nano (which seems insane to me) is probably realistic these days.

You want swimming and rec centres? leave the building and walk to one on campus. A UBC degree is an excellent degree by the way for all science degrees; medicine, nursing, forestry, engineering, etc. Political connections and networking for DC? Not so much. I don’t know, when I went to uni and BCIT I didn’t have much time for amenities and having fun. The showers and bathrooms were shared down the hall and the first one out of the showers dried their a** on their buddies towel. I always thought schooling was about education? Silly me.

A degree in Canada just puts you into a years long queue for a minimum wage job. All the emigration to Canada from the third world destroyed the job market. The only wage growth is from the minimum wage laws coming into affect.

My 2 kids graduated from York and both have excellent jobs and no debt.

It’s called working at a real job in the summer (cutting grass) and part time job during school

Work ethic is something not taught at school but at home.

Thank you, Wolf

Local market and macro forces will continue to put pressure on these poorly planned campus projects. No negative pro formas are considered as realistic during development or are 6 point footnotes. It is all blue sky.

I wonder, after default and the bondholders get their haircut will the State Regents adjust rents on certain projects? There are many dorm housing projects all completed in different years on my Division 1 campus (typical) so they are in different tranches.

It is not like the bond holders can get a receiver appointed, take possession of the project and manage it like a business after default so value resets to market. It is on state property – taxpayers are brought in as needed. State regents, college administrators are absolved – the economy did it. Now the circle is complete.

We’ll see if a new generation of college administrators saddled with student debt change the campus housing model.

On the other side of the coin, it will be interesting to see the ripple effect in this sub-set after the first bond default.

I just saw your response to Petunia, this makes sense. (I wish I could type faster, ha) Many on-campus developments will just be serviced by tuition increases and shortfalls made by taxpayers. The apartments near campus for the most part have rates below campus housing.

Not student housing, but definitely related to the RE bubble:

For years now I’ve been monitoring some new apartment complexes in the Phoenix area. After 2 years of sub 20% inhabitance, one complex — in a very affluent area– recently dropped its prices by 1/3. Its retail (storefront) properties are still sub 5% and no signs that there are more renters in the apartments above them.

In the second set, there are many hundreds of apartments. They haven’t yet reduced rates and still stand at 10% occupancy.

This after 2 years.

This feat of malinvestment made possible by your Federal Reserve.

Eugene near the U of O, new high rise with two years student renting experience. All summer “we reduced rents, no deposit or application fees”. Eugene vastly over supplied with up scale units, all amenities, stuff build in last 5 years. Friend in civil engineering who has his own company and has done work on many of these projects would agree big bust is coming if not here already.

Side note for some reason U of O attracted foreign Chinese student from families with lots $$$. Drive new BMW’s, live in the best locations, ect., but this year number of Chinese student took a big drop, not sure why, but many speculations. Result some of the upscale units they rented ( apparently like to rent in same location ) show really increased vacancy rates.

Some of this might be the slowdown in the flow of celebrity parents who pony up millions to get their C student into college

Like the minority tennis star who got admitted on an affirmative action program, even though she wasn’t black and didn’t play tennis.

What the heck: let’s go for the trifecta – “she” may not have been a female, either.

may not have been a “he” either.

Another problem with this off campus student housing is that they are at the mercy of the policies of the University that they are clinging too. I went to an Ivy that had historically been short of university owned housing. After freshman year most students moved to fraternities, sororities or apartments shoe horned in to old houses in the college town area surrounding the university. In the late 80’s the big commercial landlords bought up chunks of college town and put in fancy ( for the time) multi-story housing. In the following decades the university went on a residential dorm building binge where they created massive amounts of new dorm buildings on campus and tore down and replaced the old cinder block “barracks” style dorm rooms from before. I visited a few years ago and the once fancy privately owned student apartments in the college town were looking run down and were peppered with for rent signs. The university giveth and the university taketh away.

My son protected himself from the university co-opting his rental housing business for their students by restoring some old and building some new free-standing houses.

They can be sold or rented, independently of the student market

Student housing today is a 4 or 5 star luxury resort. Which is part of why I don’t have much sympathy for people who graduate with $100K in debt. If I lived in a luxury resort for 4 years for $100K, it would actually be a pretty good deal.

Get out of the luxury dorms, rent a crappy apartment with 3 or 4 or 5 roommates and your debt will be cut in 1/2 easily. My junior year I lived with 2 other guys in a 1 bedroom apartment in a building that was slowly but surely deteriorating. The bedroom had bunk beds, the living room had a pull out couch. The heater sorta worked in winter. There was no A/C in spring or fall (and you needed it many days). No cable, we had a 20″ TV and we got 3 or 4 channels using rabbit years. We each paid something like $125/mo for rent. It wasn’t ideal, we often got on each others’ nerves, but it was cheap and so we dealt with it and made the best of the situation. We also tried to avoid being home as much as possible. And it’s not like I or my roommates were poor, we were all middle to upper middle class, but that’s how most college students lived up until sometime in the mid 2000s.

Then things started changing. Today’s entitled generation has to have marble countertops, and 70″ TVs with surround sound and rock climbing walls and olympic sized swimming pools (that nobody ever uses) available. Along with gluten free, GMO free, organic, free range meals. Raman? Not for today’s special flowers.

Fine, have at it. Just don’t expect me (the tax payer) to pay for all that nonsense.

You’re describing a different era in US cities.

Sure, I can likewise try to impress people by telling them how I was a full-time student at an excellent, tuition-free public college, supported by a part-time job that paid for my $100.00 per month apartment. In NYC. In Manhattan. My wife and her siblings likewise graduated from effectively free California state college and university system…

Sweet deal for us, but of no relevance to young people and families facing high tuition, expenses and debt in the current era of wealth extraction, when Everything Is A Racket.

I was in college in the late 90s, it wasn’t THAT much of a different era.

I agree with the sentiment, but like it or not, most of the democratic candidates are promising to pay off student loans at everyone else’s expense and sooner or later a democrat will take the presidency. I think the culture has driven off a cliff and society is just flailing about, waiting for impact.

Why do I sense a lot of “grumpy old man” rhetoric on this thread. I’m sure nearly all of us who went to college back in the day saved all our money we hustled mowing lawns during the summer ended up shacking in a run down slum lord apartment building infested with rats and roaches only to walk five miles to campus in our bare feet in two feet of snow and ice uphill (both ways, BTW) while also having to fight off the occasional wolf or grizzly bear with our backpack containing our textbooks. Yes, there are young college aged people I know of who appear to come off as entitled, but most of them are actually well grounded, and even those who are “entitled” didn’t get that way by themselves. They had plenty of help from their parents coddling them instead of teaching them life skills in or adjust to adulthood.

I live near a college campus and work with a lot of students. Those who talk of marble counters and Olympic pools either live in rarefied zones, or are just making shyte up.

I have four degrees, and never took out a loan despite being self-supporting the entire time, but I’m thinking about getting a $200K school loan. There is no accountability in terms of what that loan buys, and it likely will be forgiven. So why not?

When otherwise decent people start looking around like “the system is so rotten that I have to smash-and-grab too just to keep things even”, we’ve got serious problems.

I agree completely. (No, I’m not *really* planning to take out a student loan!)

The moral hazard is destroying the integrity that holds a society together.

Investing money, even indirectly, in a demographic that is poor, irresponsible and not yet learned how to handle money is not where I want to be. This after spending 30 years in higher ed.