But it’s curing a housing crisis where middle-class households are priced out of a market, inflated by rampant international speculation and large-scale money laundering, says BC’s Finance Minister.

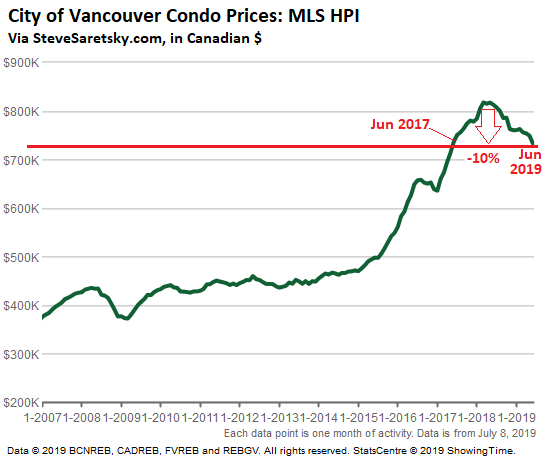

In the City of Vancouver, BC, Canada, condo sales in June plunged 28% from the already weak June last year to just 343 units. Inventory for sale jumped 32%. Prices – however you slice them – follow volume and supply: The median price fell 10% to C$656,000. The average price-per-square-foot fell 10% to C$933. And the MLS Home Price Index for condos, which calculates a “benchmark price” based on a “typical” condo, fell 10% to C$733,300. This took the MLS HPI below the level of June 2017 (red marks added):

In Greater Vancouver, condo sales – the largest segment in the market ahead of detached houses and town houses – plunged 24% from June last year to just 976 units, the lowest number of sales since 2002.

“This is particularly concerning, given this doesn’t account for the increase in population growth and new condo stock during that time period, says Vancouver Realtor Steve Saretsky, in his June report on the Vancouver housing market.

Inventory of condos for sale in Greater Vancouver rose 48% from June last year to 5,887 units, for over six months’ supply. The median price fell 7.4% year-over-year to C$565,000. The MLS Home Price Index for condos, fell 8.9% to $C654,700.

And it gets a lot worse: detached houses.

In the City of Vancouver, sales plunged 16% to 151 houses. Inventory ticked down to 1,614 houses, as dispirited sellers pulled their houses from the market, leaving the market with about 11 months supply.

Prices inevitably follow volume and supply: The median price dropped 12% year-over-year to C$1.78 million. The average price fell 14% year-over-year and has now plunged 28% from the twin peaks in April 2016 and in October 2017 (each at $3.08 million), representing a decline of C$876,000. This is starting to be real money.

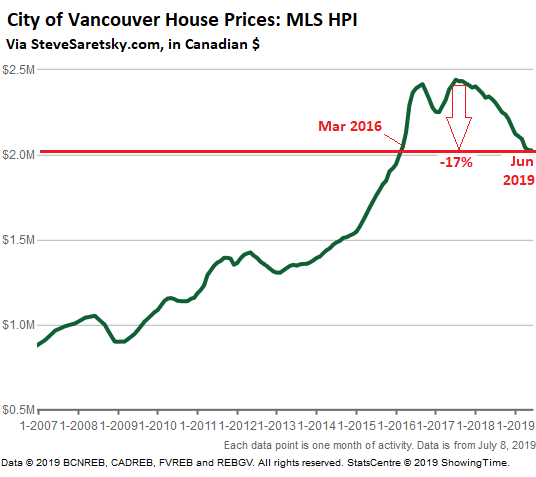

The MLS HPI for detached houses in the City of Vancouver has dropped 17% from the peak in July 2017, to C$2.025 million, the lowest “benchmark” price since March 2016:

In Greater Vancouver, detached houses, the second largest segment behind condos, is confronted with a market where buyers and sellers are too far apart to make deals. Sales in June plunged 61% from the peak in 2015, to just 761 units, the fewest transactions in the data going back to 1991 (when there had been 1,931 sales). Inventory for sale in Greater Vancouver rose to 7,025 houses.

The median house price in Greater Vancouver fell 9.4% year-over-year to C$1.284 million. The average price fell 14% to C$1.51 million.

“Buyers remain very cautious, and low-ball offers have become commonplace,” said Saretsky, who is also the author behind Vancity Condo Guide. He added: “When priced right, there is still adequate demand willing to provide liquidity.”

“Priced right” – that’s what the market is currently trying to figure out. And sellers are grappling with what that price means for them.

Townhouses galore, suddenly.

Townhouses confront a similar fate. In Greater Vancouver, sales in June fell 8% year-over-year to 341 units, as inventory for sale jumped 42% to 2,017 units. And the median price fell 10% to C$735,000.

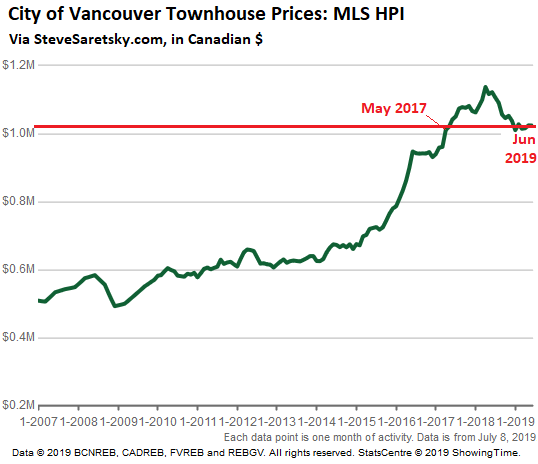

In the City of Vancouver, the median price of townhouses fell 13% to C$955,000. And the “benchmark” price of the MLS HPI for townhouses, at C$1.024 million, is now down 10% from the peak in April 2018:

“Prior to the start of the year, many market watchers and industry pundits alike rightfully noted the importance of the spring market, suggesting it would dictate what to expect for the year ahead,” said Saretsky. “After a sluggish finish to 2018 and an equally weak start to 2019, there were hopes the historically resilient Vancouver housing market could shrug it off. However, month after month that proved not to be the case.”

Now come the fruits of the building boom…

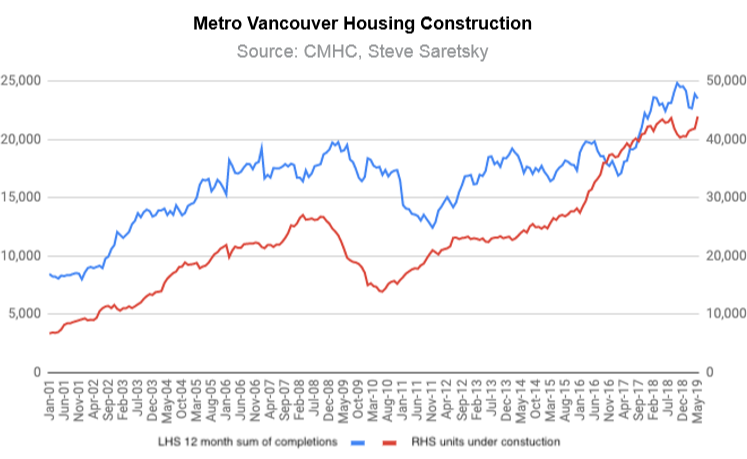

After years of a blistering building boom, a record number of new housing units are or will be coming on the market in Greater Vancouver. Saretsky, citing data from the Canada Mortgage and Housing Corporation (an entity of the Canadian government), points out that an all-time record of 43,000 units are under construction (red line, right scale) and an additional 23,000 units have been completed (blue line, left scale) over the past 12 months:

But it’s working…

Carole James, British Columbia’s Minister of Finance and Deputy Premier, expressed her approval with these developments, as a cure to the housing crisis in Vancouver, where local households with middle-class incomes are still priced out of the market that has been inflated by rampant international speculation and large amounts of money laundering, into one of the world’s craziest housing bubbles that is now, apparently satisfactorily, deflating.

She tweeted: “Through measures like the Speculation and Vacancy Tax and our world-leading work to end hidden ownership, we’re tackling the housing crisis and money laundering head-on to build a more sustainable economy that works for everyone.”

And she tweeted: “We’re leading the country in our work to ensure that housing is used for people, rather than a haven for speculation or worse, money laundering. I’ll continue to watch the housing trends closely but am cautiously optimistic that the housing market is returning to balance.”

And she tweeted: “After years of skyrocketing prices we’re finally starting to see more balance in the housing market. We’re seeing moderation in the cost of condos, townhomes and detached homes, while housing supply is at a five-year high.”

Let her rip – that’s the message. And kudos. It’s not common that governments express support for the deflation of these kinds of destructive housing bubbles. What we’re used to seeing instead are desperate governments calling for an immediate reflation and bailout, whatever the real costs to society may be.

This, despite still ultra-low interest rates and the highest disposable income ever. Read… The State of the Canadian Debt Slaves, and How They Compare to the American Debt Slaves

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Quote:

“We’re leading the country in our work to ensure that housing is used for people, rather than a haven for speculation or worse, money laundering.

End of Quote.

Names. We want names. Who are the speculators/launderers? How much have they invested/laundered? How can Carole James prove the money was laundered?

I wonder if the ~20% RE appreciation in the last two years in Bellingham, 50 miles south of Vancouver, has anything to do with Vancouver’s decline.

Old Dog,

Money laundering in Vancouver real estate has been a huge scandal in BC that is now in the open. We’ve reported a couple of morsels of it right here:

https://wolfstreet.com/2019/05/10/money-laundering-provided-1-in-20-dollars-for-real-estate-in-b-c-canada/

Thanks Wolf. I was aware of your article. It’s just that a big part of a politician’s job is spinning news and giving himself credit (or blaming his opponent) for things that he’s not responsible for. A percentage of all-cash deals can be ascribed to laundering but there’s no doubt that some aren’t. That’s why we citizens would be better served if we could see proof of crime.

Anyway, here’s Bellingham’s RE trend from Trulia, showing a steep incline.

https://www.trulia.com/real_estate/Bellingham-Washington/market-trends/

Thanks for the info on Belllingham- looks like the number of sales are definitely declining tho-

RE in Lower Mainland ( Van, Burnaby, Richmond, ect ) is worse then advertised… Foreign buyers have houdini’d, literally. Only locals now from what I have been told

Richmond which is 80 % + chinese are having fireee sales on condo’s, but with commercial RE being obliterated and stores closing on a monthly basis now it seems, evaluations will have to be re-adjusted before it can start picking up… Price per sq foot in commercial doesn’t make sense, for lease signs creeping everywhere and no bidders. I think reality has not sunk in for some RE owners, or just flat out refusing to lower com RE prices ?

Excellent article Wolf, as a resident of Van I have to say commercial retail is in worst shape then residential, as bad as residential is in.

I have a few questions if you will indulge me.

What kind of retailers are we talking here? Have they ever appeared to be remotely financially viable? If these are grocers (read: selling food and drink) what’s the density?

It seems to me that lately brick and mortar retailers are back in full expansion mode and instead of looking for ways to survive in this new environment and avoid ending up like Sears and Toys R Us they are doing the same old mistakes: selling the same stuff Amazon sells at twice the price. Grocers may be safe from Amazon, but they are weaving the rope that will be used to hang them: oversupply means rice paper thin margins are turning into selling at cost just to stay open.

I’ve never seen anything like this before.

@MC01 Small-Medium Retail… Go down Cambie Street from King ed towards Broadway, for lease signs piling up and staying it’s been at least 6 months if not more, Granville street is the same. Commercial RE is just way too expensive, small businesses are slowly getting drilled and I do not see it getting better unless a deflation wave hits RE to re-adjust lease terms, property taxes.

I am guessing the majority of them are deep in debt, their is a minority that hits profits in bull markets for sure, or hot spots in downtown… But those little sushi shops paying 8k ( all included ) a month for rent in Kits, I see a flood of bankruptcies coming in retail around here… Wages going up, taxes going up, rent sky rocketing, cost going up, where is the profit in certain stores ?

Thanks for the reply.

Ah yes the ubiquitous sushi shop, typical of all backward areas that want to appear more sophisticated and fashionable than they are. Another case study in economic suicide: way too many of them and all offering the same goods/services.

PERSPECTIVE IS IMPORTANT WOLFEY!

Here is Garth Turner, ex finance Minister – Smart, independant, worth reading (sometimes) at http://www.greaterfool.ca here is a snip

The escalation in house prices has been a theme here for a decade. So have been the club-footed responses of politicians. On balance, governments made it worse. They blindly incentivized first-time buyers. Allowed mortgage rates to fall into the ditch. Green-lit Airbnb to ghost-hotel thousands of units, jacking rents and prices. Then, panicked and pressured by house-horny Mills, they taxed investors and stress-tested the kids. The result is a mess. The market is dismal. Prices are still too high. Affordability’s awful. Public policy has been a failure. And it could soon get worse.

For example, this autumn a push begins to allow all municipalities in BC to tax people for ‘empty houses.’ Of course, that doesn’t really mean empty. They could be cottages, chalets, seasonal residences, hobby farms, secondary homes for students or business pieds-à-terre. It’s really just a new excuse to tax, with the socially-acceptable by-products of funding affordable housing and shafting ‘rich’ property owners.

Meanwhile Vancouver, the only city daft enough to already tax people for owning second properties they don’t want to rent out, is being sued by those it wrongly ensnared. Turns out the tax applies to just 1.3% of the 183,000 properties in Vancouver. Only one-tenth of the 25,000 ‘vacant’ homes that were supposedly dark.. The total number of properties forced back into the rental market by the new tax last year is estimated by the city to be (wait for it)… 80.

And yet for that piteous result, local government sucked $38 million from 2,500 owners. Not hard to see why White Rock wants an empty-houses tax, or that other towns will follow. Even Toronto’s bureaucrats have been studying a tax of their own for more than a year.

Alas, this is but the tip of the berg. Just a small reminder Canadians have no legal right to own property, and are therefore powerless to repel political assaults.

Did you notice the new research done by StatsCan? Last week the federal agency breathlessly reported almost 40% of Toronto condos are not owner-occupied. So what? Isn’t this where rental housing now comes from – the loins of investors?

Here was the media/political spin:

The new statistics offer further evidence that people now view housing as an investment, and not necessarily as a place to live, said Andy Yan, of Simon Fraser University in Vancouver. Yan said the data shows that housing prices have “decoupled” from income, and are instead driven by access to capital – giving investors a clear advantage over average Canadians. “It’s not about supply or demand any more,” said Yan. “It’s: who are we building for?” In Toronto, Canada’s most populous city, investor-owned properties are contributing to rising condo prices and a crunch on affordable rental housing.

Guess where that’s headed? Just wait for the next gen of rental legislation or suite of taxes on real estate wealth designed to ‘curb speculation’ and penalize those risking their capital to provide tenant accommodation while reaping a return. Now that moisters are the largest voting bloc – and they want what the wrinklies have – it’s war.

Yes, evil rentiers, there are better places for your money. They’re coming for you.

Looks like they are trying to push RE investors/landlords into more stocks/bonds investment. rentals are the last oasis for your money besides wall street. Thanks for the warning, I’ll look at forming an LLC.

Morty – do you mean the same Garth Turner who over and over again blasted anyone who dared say there was rampant Chinese speculation in Vancouver, anyone who mentioned money laundering? His response was always: “PROVE IT!” or “YOU’RE A RACIST!”

When evidence emerged that there was outrageous flipping of assignments (which didn’t get registered in the Land Titles Office, thereby getting around the paying of taxes), his response was, “Oh, look, the Millenials are jealous!” Do you mean that guy?

The same Garth Turner who for years implored people not to buy into this mess, but who now is fighting tooth and nail to prevent the artificially-made bubble from bursting?

The day I found out that he too had been speculating all along is the day I stopped reading that mouthpiece.

The Deceiver, the Dorothy and the dog.

Garth always blames the huge increase in home prices in Vancouver to the locals and gives zero blame to the Chinese (both local Chinese and foreign Chinese). The locals make less than $40,000 a year.

Garth is not an ex-finance minister, he’s an ex-revenue minister (a junior Ministry), and he has always dismissed foreign buying and money-laundering as the driving force behind Vancouver RE. He is also quick to shut down discussion of the subject by labelling anyone who brings it up to”xenophobic”. While the NDP’s efforts have no doubt been heavy-handed and ham-fisted and worse, they are the first government to ever make a serious attempt at dealing with the problems that were left to fester for 3 decades by previous governments.

Canada is know the world over as a major money-laundering hub. Investigators as far away as Australia refer to the “Vancouver model” when talking about money laundering via foreign real estate purchases. Garth simply refuses to admit that his position on this issue has been proved dead wrong.

Regardless of what one thinks of the NDP or their policies so far, denying that money laundering and foreign real estate speculation require a policy response from government is beyond ridiculous, and he damages his credibility further with every denial.

“Yes, evil rentiers, there are better places for your money. They’re coming for you.”

And a damn good thing too! About time.

Take speculation out of housing and we might see reasonable prices.

When I bought a CAR with my savings, the auto dealer checked if I was in some Treasury or FINCEN database. How can anyone sell a house without the bank making a rudimentary AML check with a database. Even in the event one sells their house for HARD CASH (printed currency), that person still will take that CASH to a bank and will be questioned.

Selling land requires some registration (transfer) of the deed. Simply require an AML check at that point as see what happens. Municipalities can simply refuse to record without AML checks.

Iamafan,

In the US, after heavy lobbying by the real estate industry, real estate has been exempted from regular money-laundering safeguards. You could walk up with a suitcase full of cash and buy real estate. It was legal, and there were no reporting requirements for real estate transactions. The registered buyer can be a straw-man or a shell company. This is still legal, but reporting requirements are now changing in some big areas (including San Francisco), as FinCEN is starting to require some reporting by real estate brokers about the buyer.

My understanding is that the main loop hole in Canada used by launderers is the iron-clad right to lawyer-client confidentiality. There are a few ways to effectively shut down debate in Canada. One is to make an accusation of xenophobia. The other is to cite some Charter right, because the Canadian Charter of Rights and Freedoms has been elevated to a status in Canada that only religious scripture ever came close to enjoying. Hiring a lawyer to represent your Canadian RE purchase automatically exempts the transaction from reporting to FINTRAC due to the sacrosanct Charter right to lawyer-client privilege. There are almost certainly ways to deal with this without trampling anyone’s rights, but it will require a less rigid, less absolutist interpretation of the Charter, and that’s considered sacrelige up here by our political class.

I know money laundering exist but its hard to speculate the percentage of influence since most are investments from other countries that see vancouver as a haven for real estate investment that time n time again has escalated . Im hoping someone can explain or shed some light on this.

There are names being listed, I would suspect some names can’t be released during legal proceedings but I could be wrong. You can look up “shadow mortgage broker” and find one story where a name is atleast being published.

Our TV news media has actually been reporting a 32% decline in YVR condo sales, not 24%. I’m wondering if this article’s data source is trying to sugarcoat the decline?

https://globalnews.ca/news/5418388/as-sales-stall-metro-vancouver-caught-between-a-buyers-and-sellers-market/

Yes, the NDP is doing a good job helping to force the drop in sales and price, and it has been amusing listening to the knashing of teeth from the right wing RE supporters along with deafening silence regarding the money laundering.

Gotta pull that bandaid off and let the sun disinfect the wounds that greed and corruption has bestowed upon us.

Meanwhile, in coastal flyby NE Vancouver Island, aka Paradise, both homes and properties are still briskly selling. (There’s like 10 listings) One just sold yesterday down the street from me…located in a Valley with 1100 population. My friends sold just last month, priced their place to sell…and there was a bidding war!!! Every day we give thanks for the agricultural land reserve legislation that does not permit the residential development of ag land, and for the crown owned working forest, licensed to companies for forestry and related industries and not for RE development, either.

Here’s the capper. Population of Sayward Valley 1100. No RE agents live here. Some Victoria wealth has been buying up places the past 2 years, and one lady has even been telling us residents what we should be doing to make the Valley a better place (for her, I presume). I expect to see their property up for sale by next year. :-) There are a few exceptions, but most urban transplants last about 2 years before they move back to the city.

Paulo,

The article you linked and whose “32%” decline you cited to accuse my data of “sugarcoating” actually said this:

“And it’s slowed to a snail’s pace in Greater Vancouver. Sales dropped 32 per cent from 2017 to 2018 to a nearly two-decade low over a 12-month period.”

Do you see the years? From 2017 to 2018. My data was for June 2019, a year later. Plus, that 32% wasn’t for condo sales but for total sales.

You need to READ this shit before you post the link, the entire shitty article, carefully. And if it’s a waste of time reading a shitty article whose link you want to post, then don’t post the link here and make me read this shitty article.

This is the second time in a row that you posted a link to an article that you didn’t read or just skimmed, and then drew BS conclusions from it to dispute my data: “I’m wondering if this article’s data source is trying to sugarcoat the decline?”

So Paulo, next time you link anything at all, I’m going delete the link and what you say about it, without reading it. I don’t have time to chase down this stuff.

Wolf, thank you for your effort. I opened the individuals link and read through part of the article, found the same issues and was honestly a little annoyed!! It would have been one thing if the individual had accidentally misread the article and linked it with the purpose of encouraging dialog. However, the smug remarks in his comment seem engineered to bate and unnecessary. Once again Thanks for your good work.

He has been doing this for a while. I am frankly amazed with mods patience here.

He does the same shit on James Howard Kunstler’s blog too. Sad how many people think common courtesy goes out the window on the net. Then everyone else gets to deal with heavily modded, low comment pages as a backlash.

Lol you’ve been climbing around on Mt Shasta again? You seem energized

Well said.

Dankeschoen Wolf!

Wolf:

Aw….give Paulo a bit of leeway- you’d be a little sloppy too, if you were held captive on Vancouver Island. The Union Shop B.C. Navy charges C$90 one-way just to escape.

If you plan to live on Vancouver Island, don’t forget to turn your clock back.

K

British Columbia is more dependent on R/E as an industry than Alberta is on oil, and lemme tell you, Alberta is TOTALLY dependent on oil.

So…..BC will be seeing job losses, business failures and public sector cutbacks like that province has never known before.

If she was serious.

Ban non Canadians from buying anything but apartments

20% downpayments

No taxpayer guarantees of any mortgages

Banks eat their bad loans

Vigorously enforce GAAP and fraud laws and put banker CEOs in jail for violations

They are not serious…

#####

“We’re leading the country in our work to ensure that housing is used for people, rather than a haven for speculation or worse, money laundering.”

Ahhhh!!!! The vaunted middle class and their pursuit of housing.. To the government and the fed they are known as CICU’s , Chinese Import Consumption Units. The CICU’s are expendable and replaceable with cheaper (labor cost ) and much less troublesome (politically speaking) Southern Hemisphere units. The so-called middle class can live under a rock from their insular perspective , it is nothing but a trifle you see. Plus the so-called middle class drones on and on with tiresome Polemic arguments about their so called rights as an American .

It’s summer here, Wolf, so alternative living arrangements are easier to accommodate. Check back when the weather gets hairier, or external disruptions forces decisions. Stay focused on core competencies, and everyone have a safe summer.

The only reason the US didn’t flop this spring was from the Powell 180. That will extract the last bits of knife catchers for another year thanks to ultra low rates before the US sees the same thing.

Socaljim, the time of endless Yellen Bucks is nearing its end.

Thanks to Trump. He is manipulating the markets in broad daylight. The stock market in particular will do nothing but yo-yo its way upward until the next election. “Investors” love it.

Powell, so far, has done nothing except talk.

After raising interest rates eight times in three years.

Not a Powell 180. More like a Powell Pause.

SC7, cnbc.com is running a front page story right now … they claim the housing market appears to be headed back into the red hot zone. The title:

“The Housing Market Is About To Shift In A Bad Way For Buyers”

Yup, read that article, more garbage journalism by Diana Olick. The quote from Danielle Hale says it all: “So far there’s been a lackluster response to low mortgage rates, but if they do spark fresh buyer interest later in the year, U.S. inventory could set new record lows this winter.”

So low rates haven’t done anything to revive demand, but if they magically do what they didn’t do and pull some demand that’s not there forward, things will take off again… No $h!t That’s like saying, I climbed on the roof but haven’t killed myself, however, if I decide to jump off, then I will. There’s zero reason to think that if low rates haven’t stimulated demand in the hottest time of the year, they suddenly will start to later in the year.

Inventory gains are still up, the YoY percentages are declining because now we are lapping the point last year where inventory had begun to spike up. And as the article states: “…while much pricier markets like San Jose, California, Seattle and Boston were still seeing inventory gains.” Substantiates what I’ve said all along. Nationally, there’s no bubble, most of the country has seen sustainable growth. A correction is coming in the overheated markets from that pulled-forward demand. Lowered rates pulled out another round of knife catchers for one last tepid round of bidding wars this year. Unless rates drop to 2.5% next year, 2020 is going to be the worst RE market these areas have seen in a decade.

The article is pure speculation, fueled by desperate housing perma-bulls because the trend has slightly eased up (once again, on the background of a 100bp YoY drop in rates, it’s pathetic). It’s no better than the doomsday articles on ZeroHedge when unemployment ticks up 0.1%.

There’s no balanced analysis at all in the article, either, when the quotes are from Realtor.com and Redfin.

Per RedFin:

Boston area homes with bidding wars:

June 2018: 72.3%

June 2019: 17.2%

72.3% homes in a bidding war? That number is just plain wrong. It was never that high. Not even close to that. From what I see, about 1/3rd of the homes are in a bidding war, and that number has not changed much over the last few years. However, it was lower in the spring when rates were higher. But, this is just from what I saw.

Hong Kong, Australia, Vancouver and Toronto were identified as housing bubbles by real estate analysts. In America San Francisco and Manhattan have been described as bubble areas. House flipping drove prices up and affordability down, I checked Las Vegas and found rising unsold home inventory there. That is a bearish indicator. In my part of Florida unsold inventory fell with falling interest rates and home prices rose.

In a free country, private owners of land and houses should be FREE TO SELL their assets to ANYONE. A dollar is a dollar. If you want to prevent crime then don’t give the criminals dollars. Otherwise someone is probably just being a hypocrite.

I have old (grade school) classmates who moved to Vancouver way back when because they fell in love with the place. They made a lot money selling their houses to whoever wanted to buy them. Enough to buy a condo and invest the rest. Are you telling me, they SHOULD only sell their homes (cheap) to young Canadians who will borrow money from the banks. In my book, CASH is CASH. I don’t need anyone telling me to how to and to whom I should sell my house to. Last time I checked, your house is your castle. Or maybe the bank’s castle. Politicians drive you nuts?

You have a very shallow understanding how global finance works and how foreigners obtain wealth. There is a jurisdiction with the system you are looking for though. Check out Russia. Great place to do whatever you want if you are already wealthy, of course ?

For the rest of us, we will keep working with half broken government to at least pretend that we care about the rule of law and well being of OUR citizens.

Cheers mate.

The ultimate in f**k you I got mine boomer-ism right here.

Legally the government has told people what they can and cannot spend cash on since the beginning of governing. Want to buy illegal drugs, get caught and go to jail. Buy from the local pharmacy and you are free and clear. No different with housing, use fraudulent credit applications or false identities on the titles and get fined or rejected. Pay cash with an honest title and they won’t bother you.

Kind of like the student in Vancouver that owns a $31 million dollar mansion. Your real world scenario is what honest actors are trying to accomplish, but there is a yin to that yang and it is not creating a healthy market for living or for investing.

“In my book, CASH is CASH.”

LOL Even mobsters know this is not true — the origin of the money is crucial if they don’t want to end up at the bottom of the river.

Your book must have been from the kids section of the library.

1) Whistler Blackcomb is mud.

2) 3M is the DOW worst.

3) BA:SPY was in a trading range for one year, had a breakout,

early in Jan and became the leader of the pack.

BA is back in the trading range, park in a comatose terminal.

An inverse bubble will drag the DOW down.

4) The FANG ETF is FDN. FDN:SPX in a lower high. For two years Ca is under a spell. Ca earthquakes spread to the tech sector and

the FANG are flat on their face.

5) Entitlements cancellation is a sign of inflation. Mcdonalds x1 Quarter Pounder with American cheese, instead of x2 for $5, senior coffee with a lot of cream and large fries, great dinner for $8.50, sent MCD to the top of the 30.

6) Milk to beef up my old bones. There is more phosphorus in milk than calcium. The process to remove phosphorus require calcium, depleting the teeth, bones and muscles.

I spent $100K on dentists, using Visa & AXP, the DOW best of the best.

I also do gravity to prevent osteoporosis.

When government exists to grow fiefdoms and not represent the citizen then were in trouble. Laundered Chinese money doesn’t make anyone in Canada rich when it destroys communities.

My relatives living in – now, multi-million dollar homes in Victoria BC would disagree.

Interesting how you equate being rich with the price of your house but not the quality of the community you live in. Governments are suppose to represent the best interest of the community NOT be vehicles for people to get rich at the expense of the community.

Vancouver Island, and Victoria in particular are about as Blue Blood as Western Canada gets. Full of retired millionaire farmers and such. Garden capital of Canada.

yerfej – to many people the word “community” does not compute; it’s a totally foreign concept to them.

Parasitic, perhaps even psychopathic, they chase only the yield and destroy everything that gets in the way. If you’ve never experienced “community”, you don’t recognize it, care about it, least of all mourn its passing.

And all for a buck.

The Canadian government has been taken over by vested interests who have allowed the destruction of Canada. Shame on them.

Unless the Chinese come back to the housing market the exact same fate awaits Victoria and the entire rest of British Columbia housing even Merritt B.C. Your relatives will need cry towels for not selling while they had the chance. Take a good look at what the locals earn in Victoria. If the Chinese aren’t there to buy that only leaves the locals and on the locals income. So you’re looking at a greater than 50 percent drop in home values even as mortgage rates collapse.

“Laundered Chinese Money”

Don’t you think we need to make a distinction between TAX EVASION and Criminal Source of Money?

Laundering as far as I know is real criminal money (like drugs, extortion, and the like) being cleaned up so it can enter the banking system.

Tax Evasion is simply evading tax. Unexplained Wealth can come from legitimate sources whose taxes have not been paid. They don’t necessarily always come with bribery and corruption. Simply report these so-called sales to Chinese people to Chinese authorities and let them handle it.

Iamafan – lots of Fentanyl money entering the housing market.

Money launderers are remarkably sophisticated… hence why it’s so hard to track.

Nicko2 – “Money launderers are remarkably sophisticated.” Oh, please.

Don’t you mean getting away with it because the powers that be purposely looked the other way?

The Canadian government owns in full every piece of real estate that was bought with laundered money in Canada. Since the Chinese are 100 percent responsible this is more bad news for China along with Trump’s trade war on China.

Holy cow. -10% for condos and -17% for detaches houses in Vancouver. A lot of money launders are getting burned. Where are all the Canuck and overseas speculators that have been poopooing this crash for years?? Finally how do we get Carole James to come down and talk to our illustrious SF city councilors, our Superman of a governor Gavin Newsom and his minions in Sacramento on our own problems with housing speculation?

Laundered Chinese money has to go somewhere, might as well go to BC lower mainland. Don’t hate the player, hate the game.

The Canadian government will simply take possession of all the real estate bought in B.C. with laundered money. As well criminal procedures can follow even chasing the Chinese as they flee Canada to avoid criminal prosecution.

backwardsevolution, you are completely right about Garth Turner. He also has a nasty habit of censoring anyone who tries to leave a comment that nuances his claims that a diversified investment portfolio is pretty much guaranteed to give you 7 plus percent return on investment year over year. His blog is nothing more than a way to lure people to his investment advise company. While he has been claiming for years now that real estate is in a bubble, he refuses to admit the same for stocks and bonds.

Usually when someone promises you a 7 percent return on your money every year that’s when you’ll end up losing most of your money. When the hucksters show up that’s the time to run as fast as you can. If anyone could actually earn a 7 percent return each year everyone on planet Earth would be wealthy today. In reality just beating the inflation rate is a miracle and no one is going to earn a spread of 5 percent consistently with each coming year.

US stock market averages 9 to 10% since start of the great depression.

Wolf do you have a prediction for the city of Vancouver market?