But 8 markets show double-digit increases.

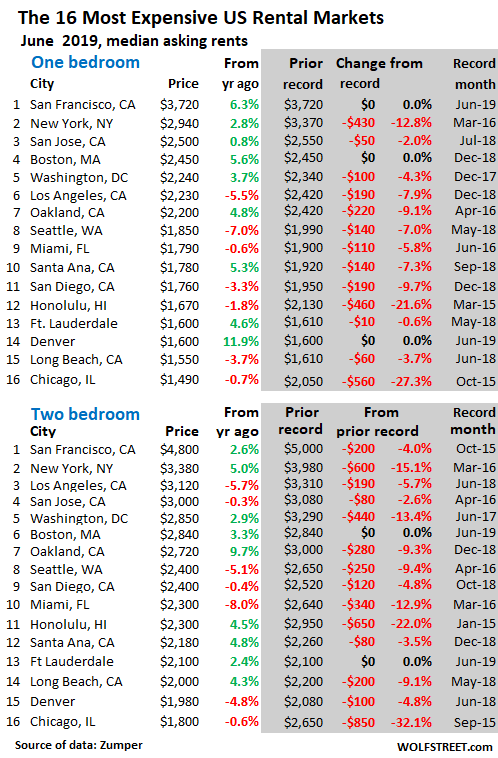

Seattle and Southern California are the big new-comers among the most expensive rental markets whose rents have turned south. In Chicago and Honolulu, apartment rents have plunged since 2015. San Francisco’s rental market had peaked in October 2015, and then rents fell, but in 2018, they started rising again, and now they’re back, or almost back, at their 2015 highs. New Nork City’s rents peaked in May 2016 and are now down by the double digits.

In Seattle, where rents had been soaring for years, the median one-bedroom apartment asking rent in June fell 7% from the peak a year ago, to $1,850. The median asking rent for a two-bedroom apartment fell 5% from a year ago to $2,400, and is down 9.4% from the peak in April 2016. Clearly, the phenomenal apartment and condo construction boom over the past few years is having an impact.

In Southern California, the median asking rent fell in the most expensive cities: In Los Angeles, 1-BR rents fell 7.9% from their peak in December 2018 to $2,230; and 2-BR rents are down 5.7% from their peak in June 2018.

Los Angeles County, with a population of over 10 million, has been experiencing a net outflow of the labor force and employed people. Since the peak in November 2018, the county has lost 103,000 people in its labor force and 68,700 employed people, and California has begun to panic about losing businesses and people to other states.

In San Diego, the median 1-BR asking rent is down 9.7% from its peak in December 2018; and 2-BR rents are down 4.8%. Rents are also down by similar degrees in Santa Ana (Orange County) and Long Beach. More in the table below.

In Chicago, a vast and diverse rental market with its own set of challenges, the median asking rent for 1-BR apartments has plunged 27% from its peak in October 2015, to $1,490; and for 2-BR apartments, it has plunged 32% from its peak to $1,800.

In San Francisco, the median asking rent for 1-BR apartments hit a new high, rising 6.3% from a year ago, to $3,720, barely breaking its old record set in October 2015 of $3,670. But 2-BR rents, at $4,800, remain below their October 2015 peak ($5,000). These dizzying rents give San Francisco the dubious title of being the city with the most ridiculously high median asking rents among large US cities. “Housing Crisis” is the local term for this honor.

In New York City, median asking rents peaked in March 2016. In June, 1-BR rents, at $2,940, were down 12.8% from the peak; and 2-BR rents, at $3,380, were down 15.1% from the peak.

In my handy-dandy table of the 16 most expensive major rental markets in the US, the shaded areas indicate peak rents and the changes since then. Los Angeles had long been the third most expensive rental market in the US, behind San Francisco and New York City. But in 2018, when rents were surging in Los Angeles, its 2-BR rents had briefly moved into second position ahead of New York City. With rents declining in LA, this has now been unwound.

In Denver, the 1-BR market set a new record in June, with rents jumping nearly 12% year-over-year. But the 2-BR market seems to have hit a ceiling last year and is now down 4.8%, as perhaps more renters are priced out of this market and have to tough it out with less space in a 1-BR apartment.

In Honolulu, rents, after spiraling down since 2015, appear to have stabilized this year at about 22% below their peak levels.

The data is collected by Zumper from over 1 million active listings of apartments-for-rent in the 100 largest markets. This includes third-party listings received from Multiple Listings Service (MLS). Zumper releases this data monthly in its National Rent Report.

“Asking rent” is the amount the landlord advertises in the listing. It’s a measure of the current market, for people who are now looking to rent. It is not a measure of the rents that long-time tenants actually pay.

“Median asking rent” means that half of the advertised rents are higher, and half are lower. The data here is based only on apartment buildings and includes new construction, but it excludes single-family houses and condos for rent.

Excluded are rooms, efficiency apartments, and apartments with three or more bedrooms. Also excluded are incentives, such as “one month free” or “free parking for three months,” or whatever.

The Cities with the biggest percent rent increases:

Rents are still surging in some of the 100 major rental markets, with eight markets booking double-digit increases in median asking rents for 1-BR apartments compared to June last year:

- Chandler, AZ: $1,210 (+15.2%)

- Fresno, CA: $1,000 (+12.4%)

- Glendale, AZ: $840 (+12.0%)

- Denver, CO: $1,600 (+11.9%)

- Reno, NV: $910 (+11.0%)

- Spokane, WA: $810 (+11.0%)

- Scottsdale, AZ : $1,380 (+10.4%)

- Gilbert, AZ: $1,200 (+10.1%)

And the Cities with the biggest percent rent declines:

In some cities the pendulum swung the other way. Here are the eight cities that in June booked the largest year-over-year declines in median asking rents for 1-BR apartments:

- Philadelphia, PA: $1,310 (-12.7%)

- Baltimore, MD: $1,180 (-11.3%)

- Columbus, OH: $700 (-9.1%)

- Akron, OH, already the cheapest rental market among the top 100: $550 (-8.3%)

- Madison, WI: $1,180 (-7.8%)

- Nashville, TN, unwinding last year’s surge: $1,230 (-7.5%); and 2-BR rents: $1,350 ( -8.2%)

- Seattle, WA: $1,850 (-7.0%)

- Des Moines, IA: $810 (-6.9%)

- Portland, OR: $1,360 (-6.8%)

All this gets thrown into the same bucket and averaged out, and so nationally, the median asking rent for 1-BR apartments ticked up just 0.9% year-over-year; and for 2-BR apartments, it rose 1.9% to $1,220. There were the slowest year-over year increases since June 2017, and among the slowest increases in years.

Below is Zumper’s list of the top 100 most expensive major rental markets, in order of 1-BR asking rents in June, with year-over-year percent changes. You can use your browser’s search function to find a city. If you’re reading this on a smartphone, and it clips the right side of the table, hold your device in landscape position:

| Pos. | City | 1 BR | Y/Y % | 2 BR | Y/Y % |

| 1 | San Francisco, CA | $3,720 | 6.3% | $4,800 | 2.6% |

| 2 | New York, NY | $2,940 | 2.8% | $3,380 | 5.0% |

| 3 | San Jose, CA | $2,500 | 0.8% | $3,000 | -0.3% |

| 4 | Boston, MA | $2,450 | 5.6% | $2,840 | 3.3% |

| 5 | Washington, DC | $2,240 | 3.7% | $2,850 | 2.9% |

| 6 | Los Angeles, CA | $2,230 | -5.5% | $3,120 | -5.7% |

| 7 | Oakland, CA | $2,200 | 4.8% | $2,720 | 9.7% |

| 8 | Seattle, WA | $1,850 | -7.0% | $2,400 | -5.1% |

| 9 | Miami, FL | $1,790 | -0.6% | $2,300 | -8.0% |

| 10 | Santa Ana, CA | $1,780 | 5.3% | $2,180 | 4.8% |

| 11 | San Diego, CA | $1,760 | -3.3% | $2,400 | -0.4% |

| 12 | Anaheim, CA | $1,700 | 4.9% | $2,120 | 1.0% |

| 13 | Honolulu, HI | $1,670 | -1.8% | $2,300 | 4.5% |

| 14 | Fort Lauderdale, FL | $1,600 | 4.6% | $2,100 | 2.4% |

| 14 | Denver, CO | $1,600 | 11.9% | $1,980 | -4.8% |

| 16 | Long Beach, CA | $1,550 | -3.7% | $2,000 | -4.3% |

| 17 | Chicago, IL | $1,490 | -0.7% | $1,800 | -0.6% |

| 18 | Providence, RI | $1,430 | -0.7% | $1,580 | 3.9% |

| 18 | New Orleans, LA | $1,430 | 2.1% | $1,530 | -3.8% |

| 20 | Minneapolis, MN | $1,400 | -1.4% | $1,830 | 1.1% |

| 21 | Scottsdale, AZ | $1,380 | 10.4% | $1,910 | 1.6% |

| 22 | Atlanta, GA | $1,370 | -4.9% | $1,740 | -3.9% |

| 23 | Portland, OR | $1,360 | -6.8% | $1,730 | -3.4% |

| 24 | Philadelphia, PA | $1,310 | -12.7% | $1,700 | 0.0% |

| 24 | Orlando, FL | $1,310 | 5.6% | $1,500 | 2.0% |

| 26 | Charlotte, NC | $1,260 | 1.6% | $1,370 | 0.7% |

| 26 | Sacramento, CA | $1,260 | 2.4% | $1,470 | 2.1% |

| 28 | Dallas, TX | $1,250 | -6.0% | $1,710 | -3.9% |

| 29 | Nashville, TN | $1,230 | -7.5% | $1,350 | -8.2% |

| 30 | Houston, TX | $1,210 | -5.5% | $1,400 | -15.2% |

| 30 | Chandler, AZ | $1,210 | 15.2% | $1,450 | 16.0% |

| 32 | Gilbert, AZ | $1,200 | 10.1% | $1,430 | 5.1% |

| 33 | Austin, TX | $1,190 | 0.0% | $1,510 | 2.7% |

| 33 | Irving, TX | $1,190 | 1.7% | $1,550 | -4.3% |

| 33 | Aurora, CO | $1,190 | 3.5% | $1,490 | 1.4% |

| 36 | Baltimore, MD | $1,180 | -11.3% | $1,390 | -13.7% |

| 36 | Madison, WI | $1,180 | -7.8% | $1,380 | -2.1% |

| 36 | Tampa, FL | $1,180 | 1.7% | $1,330 | -3.6% |

| 39 | Plano, TX | $1,160 | 0.9% | $1,550 | 0.6% |

| 40 | Newark, NJ | $1,150 | 3.6% | $1,470 | 5.8% |

| 40 | Fort Worth, TX | $1,150 | 9.5% | $1,340 | 5.5% |

| 42 | Henderson, NV | $1,130 | 5.6% | $1,350 | 8.0% |

| 43 | Durham, NC | $1,110 | -0.9% | $1,270 | -1.6% |

| 44 | St Petersburg, FL | $1,100 | 2.8% | $1,540 | 0.0% |

| 45 | Richmond, VA | $1,080 | 1.9% | $1,230 | -3.9% |

| 46 | Salt Lake City, UT | $1,070 | 2.9% | $1,370 | -0.7% |

| 47 | Pittsburgh, PA | $1,060 | -3.6% | $1,300 | -3.7% |

| 48 | Virginia Beach, VA | $1,050 | 2.9% | $1,230 | 2.5% |

| 49 | Raleigh, NC | $1,040 | 3.0% | $1,200 | 0.0% |

| 50 | Phoenix, AZ | $1,000 | 2.0% | $1,250 | 4.2% |

| 50 | Fresno, CA | $1,000 | 12.4% | $1,140 | 5.6% |

| 52 | Buffalo, NY | $990 | -6.6% | $1,180 | -11.3% |

| 52 | Chesapeake, VA | $990 | -4.8% | $1,200 | 0.0% |

| 52 | Las Vegas, NV | $990 | 7.6% | $1,150 | 4.5% |

| 55 | Milwaukee, WI | $970 | 5.4% | $1,020 | -8.9% |

| 55 | Syracuse, NY | $970 | 6.6% | $1,050 | -1.9% |

| 57 | Kansas City, MO | $960 | 1.1% | $1,110 | 0.9% |

| 57 | Boise, ID | $960 | 5.5% | $1,100 | 13.4% |

| 59 | Jacksonville, FL | $950 | 0.0% | $1,080 | -1.8% |

| 60 | Mesa, AZ | $920 | 1.1% | $1,150 | 6.5% |

| 60 | Colorado Springs, CO | $920 | 2.2% | $1,160 | 5.5% |

| 62 | Anchorage, AK | $910 | 5.8% | $1,150 | 7.5% |

| 62 | Reno, NV | $910 | 11.0% | $1,310 | 9.2% |

| 64 | San Antonio, TX | $900 | 0.0% | $1,120 | -4.3% |

| 65 | Louisville, KY | $880 | 3.5% | $950 | -1.0% |

| 66 | Corpus Christi, TX | $850 | -1.2% | $1,060 | -2.8% |

| 67 | Omaha, NE | $840 | -1.2% | $1,050 | -0.9% |

| 67 | Rochester, NY | $840 | 0.0% | $980 | -2.0% |

| 67 | Glendale, AZ | $840 | 12.0% | $1,070 | 7.0% |

| 70 | Baton Rouge, LA | $830 | -4.6% | $930 | -1.1% |

| 70 | Laredo, TX | $830 | -3.5% | $890 | -8.2% |

| 72 | Arlington, TX | $820 | 5.1% | $1,090 | 3.8% |

| 73 | Des Moines, IA | $810 | -6.9% | $860 | -5.5% |

| 73 | Cleveland, OH | $810 | 3.8% | $870 | -2.2% |

| 73 | Spokane, WA | $810 | 11.0% | $1,000 | 11.1% |

| 76 | Norfolk, VA | $800 | -3.6% | $1,050 | 5.0% |

| 76 | Knoxville, TN | $800 | -2.4% | $900 | -3.2% |

| 78 | St Louis, MO | $790 | -2.5% | $1,150 | 0.9% |

| 79 | Cincinnati, OH | $780 | -4.9% | $1,120 | 5.7% |

| 79 | Chattanooga, TN | $780 | 2.6% | $890 | 9.9% |

| 81 | Winston Salem, NC | $770 | -1.3% | $830 | 1.2% |

| 82 | Tallahassee, FL | $760 | 4.1% | $880 | 3.5% |

| 83 | Lexington, KY | $750 | -6.3% | $980 | 3.2% |

| 83 | Augusta, GA | $750 | 0.0% | $810 | -4.7% |

| 83 | Indianapolis, IN | $750 | 8.7% | $810 | -1.2% |

| 86 | Bakersfield, CA | $740 | -3.9% | $930 | 3.3% |

| 87 | Memphis, TN | $730 | 0.0% | $770 | 0.0% |

| 88 | Oklahoma City, OK | $720 | 2.9% | $880 | 7.3% |

| 89 | Greensboro, NC | $710 | -4.1% | $830 | -1.2% |

| 90 | Columbus, OH | $700 | -9.1% | $1,070 | 0.0% |

| 90 | Albuquerque, NM | $700 | 6.1% | $840 | -1.2% |

| 92 | Lincoln, NE | $670 | -4.3% | $890 | -4.3% |

| 93 | El Paso, TX | $650 | 1.6% | $800 | 3.9% |

| 93 | Shreveport, LA | $650 | 1.6% | $700 | -5.4% |

| 93 | Tulsa, OK | $650 | 6.6% | $800 | 3.9% |

| 96 | Tucson, AZ | $640 | 1.6% | $880 | 3.5% |

| 97 | Lubbock, TX | $630 | 5.0% | $780 | -1.3% |

| 98 | Wichita, KS | $610 | -1.6% | $750 | 0.0% |

| 98 | Detroit, MI | $610 | 0.0% | $690 | 1.5% |

| 100 | Akron, OH | $550 | -8.3% | $730 | -3.9% |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Anecdotally my boss’s daughter rents in the Biltmore area in Phoenix and her rental rate dropped $200/mo between her rental search a few months back and time of signing the lease.

Real estate is still on the way up here in general. Areas that were pushing $500k to $600k and up are starting to stagnate and I’ve seen several homes on the market that sold before just two to four years ago. People trying to capture equity with the market so high?? People are now paying $400 to 500k in crummier neighborhoods. Definitely left with the feeling that the housing market is starting to get to a breaking point but then I’m surprised yet again. The bar keeps moving higher and flippers/investors are buying more expensive properties they generally didn’t touch before… probably because that’s all there is at this point.

The real question is do rents cover the P/I, taxes, maintenance, fees and insurance of the rental properties?

If it is not cash flow positive – it is speculation for future appreciation.

Investments don’t cost you cash every month.

Future greater fool gambling speculation does that.

A sure way to tell if your area is a bubble area.

It’s peak market behavior… things will remain stagnant as long as unemployment is low and wages are still growing with or above inflation. If and when the economy turns, markets like that will get obliterated.

The crummy areas around Arcadia are a great example of these crazy prices. Flippers buying up little 60’s ranches for $200K+, gutting them, adding on, then relisting them for $400K+. Some of those houses were worth maybe $50K during the previous downturn. There’s one on my old street that’s been on the market for over a year now bouncing down from $460K to $395 then up again a bit. Right across the street from a run down row home complex. I’m sure someone who can afford a house that much really wants to live across the street from that.

I recently watched a dead mall video from the Phoenix/Scottsdale area. I only watched it because I thought this was considered a very upscale area and a dead mall there seemed unusual. It was a nice mall, but empty.

Who wants to live in greater Phoenix area in midst of global warming and pay for outrageous air conditioning?

You must be a Californian. Electricity is 1/3 the cost of California. And the income tax is 5% vs. 13%.

13% is top rate. You have to make a lot of money to pay that rate… And when you make that kind of money, you can afford a nice house in the expensive parts of the Bay Area and life is pretty good with enjoyable outdoor life year round.

In the cities where a million dollars gets you a crack shack in a crime infested neighborhood…

9.3 percent on taxable income between $56,086 and $286,492

10.3 percent on taxable income between $286,493 and $343,788

11.3 percent on taxable income

between $343,789 and $572,980

12.3 percent on taxable income of $572,981 and above

Yes, and 4.54% is the top rate in AZ. You have to make a lot of money to pay that rate…and when you make that kind of money, you can afford another house in another state, where you can escape the summer heat.

I am in SoCal for last 14 years and only reason I am here because of my cushy job ..

I am looking for flee asap I can

Socal is not for middle class…

It sucks

As a retiree with a modest pension/SS I pay no Ca income taxes for years, and i live well.

Other living expenses have increased; insurances, car registrations, property taxes etc…yes.

Just thinking out loud I wonder what was the socio-economic rank of the 103,000 total that left L.A county and how does it compound with the building frenzy.

Middle class are fleeing CA.

Rich can afford to stay.

Poor can not afford to leave.

And bringing the policies they dislike to the states they move to

During the previous housing bubble people moved out of rental units to try to get rich through home ownership – price appreciation. The national rental vacancy rate rose to levels much higher than today’s nationwide rental vacancy rates.

Some retirees were free to travel to lower cost of living areas. They escaped from high cost areas. Some low rent areas are high crime areas, but not all.

Expat American communities sprouted in Latin America.

The “uber” gentrification around Universities are phenomenal. They are catering to a lot of Chinese students. I guess they pay rent, too. And when they leave and are not replaced by other Chinese, guess what? We folks cannot afford that rent.

At what point do folk say no? When rent reaches 90% of take home pay? The man has won, if you don’t pay the market rent there’s always the gutter, make your choice.

Yet, in the absence of meaningful regulation, at some point folks have to “just say no”. There are various alternatives: get roommates, share with another family, move out to lower-priced areas.

There has not in the last 50 years been a true housing shortage (nationally, obviously local conditions can be very different). The number of houses per capita has increased by 25% in that period. What has happened is that folks decided to have smaller households, and in some cases fake shortages have arisen due to housing being held off the sales and rental markets.

In the vein of regulation, I think a 5% per annum tax on the value of *vacant* housing would go a long way. Along with removal of all government guarantees on loans and government assistance on housing / rent payments.

Agree. Rent everywhere is too high as a reflection of stagnant wages going to corporate profits from Reagan days, onward. In areas where rent is lower there’s no work. I would suspect it all balances out…no work= cheap rent vrs opportunities = gouge time.

It is very very hard to move up and get ahead in this environment.

Paulo – That is a ridiculous blanket statement. Rent is too high for SOME people in highly desirable areas. Rent is very reasonable in most parts of the country.

We recently moved from high rent DC to comparatively low rent Philly mainline burbs. Rent is so cheap here people apparently have enough money to spend on frivolous things like Tesla’s and nice clothes.

How do we convince all the renters to go on rent strike?

There aren’t enough refrigerator boxes (after sales) to accommodate a nation-wide rent strike !

… or wooden pallets, for that matter.

Another solid gold post from Paulo; you are a treasure here.

People get offended because you speak the truth, not NAR-speak.

The need for rent control has been building for years now and it will come. It needs to happen on the national level because of all the mega landlords accumulating homes in the hundreds of thousands. These mega landlords need to be kept from buying foreclosures, en masse, at the courthouse steps. Their behavior is locking out first time buyers in major markets.

The way I see it is like the game of baseball. The teams play, we, the crowd, cheer for our team and fave players, jeer the other guys/other players, one wins, one loses, but everyone goes home. We don’t put the losing pitcher on a gibbet, or go to his house and burn it down with his family inside.

People like to win, to win you have to lose sometimes, it’s a game that keeps everyone on their toes and happy. Not life and death. Capitalism needs to be made this way. This is not the Dark Ages. People do not need to be punished by starvation, death by preventable disease, die of a tooth abscess or not being able to afford their insulin, etc.

Regulations can make it from life-and-death into a game in which there’s still the thrill of a win and the “down” of a loss, but we are a wealthy enough society that we can live a life of baseball, not the misery of gladiator-ism.

In ca proposition for rent control was defeated recently as corporations spent 100s of millions to defeat this..

Jordan Morris Seattle Sounders, – no longer on its roster, – is Seattle greatest asset.

The rest cannibalized themselves in unstoppable 10Y buyback.

1) BA :

Total Assets : 120,209

Total Liability : 120,084

Total Equities : 000,125, or 0.001 of Total Assets.

2) AMZN :

Total Assets : 178,102

Total Liabilities : 129,692

Total Equities : 48,410, or 27.2%.

3) MSFT :

Total Assets : 263,281

Total Liabilities : 168,417

Total Equities : 94,864, or 36%.

NKE is next at 39%.

Source : Investing.com

In the next recession big size change of character :

Seattle premier tent city #1.

Seattle Alta #13.

If u bought a house in Palos Verdes, Ca. in the 1960’s

for mid $60K’s, the ground under your feet move, but u don’t.

1) Great place to live, at old age, for the rest of your life, far away from the ugly and the dangerous sides.

2) Infinitesimal RE taxes, zero mortgage.

3) great social and medical benefits.

4) RR Pro #13 markets constriction can only increase the value of your house.

5) Forced selling, u pay capital gains on $millions of current value minus $60K, not adjusted to 50Y inflation.

The rest must rent.

Those who cannot afford the high rent will be evicted to the streets, move away and get out of sight.

When homeless clogging prime RE locations become intolerable, rent fall and vacancies are on the rise.

Extrapolate the social malaise ==> NYC 1975 : drop dead, that’s Seattle, SF and LA what u will get. !

As per Michael’s comment: I still think the best situation is to get into any housing market during sanity…not the bubble.

Even recently, in this market, my kids work as an example. My daughter and husband 1st bought a run down townhouse 15 years ago. After lots of sweat equity they sold it and realized a good down payment for a small house on a great lot; by a park, walking trails, dead end street, etc. I just returned from visiting them (daughter 40/husband 42) and they will have this place paid for within 5 years. They both informed me they are NOT upgrading and/or buying up. Instead, they will just fix and maintain what they have and are making plans to retire between 55-60. Son is 35 and working full time plus owns a small business on the side. He is also working at paying off his place and his mortgage is less than rent. His place is a very nice 3 acres on high/hard bank riverfront. Both homes are on affordable Vancouver Island and not in Vancouver. Young people cannot get ahead in big cities or unaffordable locations as mentioned in this article. As Michael said, the time to have moved there was the ’60s.

My best friend’s daughter lives in Vancouver. She is married, and with both working they can just maintain, renting. He told them that if they remained in Vancouver, they would never be able to purchase a home despite both having degrees in physio-therapy.

I believe decisions as to where to work, move, live, buy, or rent are basic life skills. Every phone has a calculator or you can buy one for $2. Young folks spend a pile of money training for and choosing a career that only exists in unaffordable locations. Why housing and future prospects aren’t considered suggests, to me, their parents are either in the same situation, or lacking the same common sense critical thinking ability. And please, don’t blame this on the schools. This is a life skill to be learned from mom and pop.

You not only have to go where the jobs are, you have to crunch the numbers before commiting. regards

Paulo, your second to last paragraph hits the nail on the head and goes into my file of quotables.

Paulo as usual I’m with you 100%.

I was cursed with ambition. I went to college – HUGE mistake. In the US, college costing the insane amount it does, it makes sense only if you come from enough wealth that it doesn’t matter if you go to college. (I’ll make an exception – be career military, at least 20 years and preferably 30-40, they’ll pay for education at least trade school level).

I went to the mainland and did all the things one is supposed to do. End result: I’m officially homeless, and my only hope now is some trade and I don’t mean something that would make sense in the 1950s, but more like something that made sense in the 1550. My pal Gabriel The Violinist makes an OK living and doesn’t depend on a boss for it.

I’d have been faaaaaaaaaaaaaaaaar ahead of the game staying in Hawaii as a HS dropout, and getting into something that can’t be offshored and is Unionized. I’d own a house now no problem.

But I’d not have the perspective I have now. It takes soaking in it, living in its misery, to realize just how bad the Anglosphere is for those trapped within it. I’m too old to bugger off to Mexico like Morris Berman, or Belize like Joe Bageant, or off to Japan like “Abroad In Japan”, a YouTuber I follow. But I can retreat to one of the few “less American” parts of the US, in my case not Acadia or an Indian reservations but the less “American” parts of Hawaii and I may be going back there sooner than I’ve been talking about, as war with Iran looms and travel restrictions start in little over a year.

—“I went to the mainland and did all the things one is supposed to do. End result: I’m officially homeless, and my only hope now is some trade and I don’t mean something that would make sense in the 1950s, but more like something that made sense in the 1550.”

that was brilliantly genius and TRUE and so was all this…

—“But I’d not have the perspective I have now. It takes soaking in it, living in its misery, to realize just how bad the Anglosphere is for those trapped within it.”

so true soooo true.

College only makes sense if you don’t need to go? Talk about delusional. Well past time to quit making excuses and blaming others. News flash, you won’t last 5 minutes in the Hawaii of today – the only ones here that whine as much as you are multimillionaires (via inheritance or from a housing bubble) and those Bernie devotees wouldn’t be caught dead rubbing elbows with homeless – but they insist on taxing others to keep the problem out of sight.

I was in NYC in 1975, it was harder to get a job and pay was low, but there was no homeless problem. A studio in Gramercy Park, an extremely nice area, was $250 and rent stabilized.

In the 70’s and 80’s NYC was nearly bankrupt. Now it’s the centre of the universe.

These numbers are a bit deceptive in that they are median”asking” prices and do not reflect the rent of those covered under rent control. The number of rent controlled apartments in NYC and SF are sizable.

I’ve been saying this for a year. It’s a total buyers market for renters right now. On top of the beautiful tax reform act, there is an absolute glut of new construction inventory all over the country. The sales offices are aggressive and are giving away huge incentives to lease up buildings.

Anyone who ever wanted to test out living in a new area has a ton of options right now. Houses are overvalued in my opinion and there is a large supply of high quality rental units everywhere I look. Can’t imagine even considering buying a house within the next five years with rent actually DROPPING in most highly desirable areas across the country.

LoL funny. The crappily new built “luxury” townhouses near me are $600K+. The immigrants will snatch them up, then another family moves into one floor living in the ground floor bedroom/bathroom. Or some do AirBnB. I’ve seen some listings for other older ones where they’ve added a sink and two burner stove to a counter on the ground floor “basement” room to make a kitchen, calling it a wet bar or something. It’s not a bar it’s for subletting.

Meanwhile the neighborhood guest parking is non-existent.

If the market goes down, they can default on their loans (maybe HELOC first) then roll back to whatever country recourse free.

I think rents in SF are so high because real estate prices are so high and the vast majority cannot afford to buy, or they are not willing to buy something so expensive that isn’t much better than the apartment they are renting, so they keep renting. We could afford the monthly mortgage payment on an above average SF home (assuming 15 – 20% down), but saving that much cash for a down payment is the problem, especially while paying high rent and the overall high cost of living in SF with the commensurate lifestyle. $4K for rent in SF is way cheaper than $8K – 10K of monthly mortgage eating up disposable income, and less risky than gambling $350K – $500K of down payment in this market, basically leaving retirement accounts as the reserve.

Now there are only six people in a SoCa 2 bdrm instead of eight.

I live in a nice new apartment building ( wife and I waiting for the next trough in the RE market to buy) near all the big Intel Fabs in Hillsboro OR. A majority of the other tenants are H1B employees from India, Russia, and Eastern Europe. The place is 95% full but it takes a full time sales staff of 2 plus 2 months free rent to keep it that way. If the semiconductor sales trends that Wolf has highlighted in recent articles keep progressing and we see significant layoffs in the H1B workforce it will be a bloodbath in rental rates and occupancy in this area.

I live in Brooklyn, not “hipster Brooklyn” (northwest Brooklyn closest to Manhattan) but in one of the unfashionable neighborhoods. The cost of housing in Unfashionable Brooklyn has gone crazy. In my neighborhood in 2013 you could rent a 1-bedroom apt for $800 and buy a 1-bedroom apt for $225k to $250k. Today it’s $1800 to rent and $325k to $400k to buy (to buy an apartment that still requires kitchen and bathroom reno). Single family houses were ~$600k in 2013, now ~$1 million. There’s plenty of new housing in Brooklyn, but it’s either luxury condos or slum-inducing “affordable housing.” There is an inexhaustible supply of housing for the filthy rich and the dirt poor. And there’s an inexhaustible number of filthy rich and dirt poor moving in. There is no housing for people in the middle, no incentive for middle-earners to move here or stay here. Shopping streets/business districts cater to either the filthy rich or the dirt poor. It’s sad to see Brooklyn turning into Rio de Janeiro.

Do you think it’s a result of population expansion? People relocating from somewhere else (equity locusts)? Salary increases? High salaried people forming relationships and or families? Investment purchases?

Or first time buyers armed with large loans overpaying for low end and the sellers now able to move up to mid-tier?

I suppose one way to combat housing price increases is just to make more money.

Real estate is overvalued. Brooklyn rent is driven by the world’s billionare class buying plots of land in the USA since land rights in America are safer than any bank to store wealth. The land we stand on is just currency being traded by the billionares and the people living on top of it are just a nuisance to be tolerated (until they can figure out a way to do away with us).

Bingo! Real estate is the latest “safe” investment which just coincidentally is killing off all those silly people that need a place to live and work.

Wow. I never considered the situation in that light. I am sure you are right.

Thinking of moving to the US – are Akron & Detroit nice places to live?

They were … once.

Downtown Detroit is not bad.

Oakland county, northwest of Detroit is the place to be.

Detroit downtown has been revitalized and has lots of cool. But it’s not that cheap anymore.

I continue to wonder what will pop the rent bubble. The possibility of Stealth QE, with lower interest rates will expand the bubbles and widen the income inequality gap … and meanwhile, property taxes shoot up to help support mid-level employees who all need more money to maintain their dreams to retire with more pay …

So to recap:

Rents have doubled in the past 10 years

And now rents are down 5% in some cities.

And this is proof that renting is better than owning.

Whatever.

My favorite is when 26 year olds post on blogs about how hard life is, while using a $2500 mac, sipping an $8 cup of coffee, decked out in $200 jeans and $300 shoes, while thinking about their weekend plans which involve $14 pints of craft beer and $17 organic vegan tofu sandwiches.

The poor things. We need Bernie and Kamala to do something!!!!

I don’t know any millennials like this, I don’t even know parents of millennials like this.

My favorite is an old fart with a stale avocado toast trope.

So here’s an actual millennial profile for you, though I certainly won’t claim it’s representative. My wife and I are medium and old millennials, respectively.

I haven’t bought a computer for myself in 12 years as I just use my work-issued one at home (which they allow). After much debate and research, we “splurged” on a $200 Chromebook for my wife last year. I only just finally convinced my wife last winter that paying the extra $3/mo for HD vs. standard definition on Netflix was worth it on our 8 y.o. cheapo plasma TV. She’s still skeptical.

I hate paying more than $4 for coffee (which happens about every two weeks) so I just make it at home. Bought my first new jeans in over 2 years last week; two pairs on sale for under 50 bucks each. Foot problems necessitate specific, well-padded running shoes which I wear until they have holes and reek. Bought two pairs in January on sale $90/each, down from a ridiculous $150.

I love an occasional craft beer, but buying bottles is far cheaper than $14. I did go out to an open mic this weekend for the first time ever and splurged $14 on beer, for two pints. No thanks on the tofu sandwich.

It’s the SFBA and we pay a stupid $4200 in rent (we’ve never owned) for a nice 1960s duplex on the Peninsula that’s “only” 16 miles and 1h15m in rush hour from my job. Our landlord lives in HK and bought the place sight-unseen, of course. Day care for our 3 year old is $2100/mo and we both work full-time. When #2 arrives this winter our monthly childcare costs will exceed our rent.

I drive a 9 y.o. hatchback that I bought with the only loan I’ve ever had in my life (0.9% APR), which I only took for the credit score karma (@820+). Every credit card I’ve ever had in my life was paid in full the end of the month, save once when I forgot while on vacation. Last year we replaced my wife’s 15-year-old car with the something kid-friendly and paid in cash.

We’re finally planning to buy our first house next year. Years of spending way too much time on this site (waiting for the next downturn), combined with the PTSD from seeing my parents’ retirement funds slaughtered during the last crash has left me gun-shy. It’s driving my wife crazy. But that’s ok. Finally started making good money (for SFBA) about 6 years ago. We’ve maxed out our 401Ks every year since and thus far have put $45K into our 3 y.o.’s 529. We are saving over $250K/year as of late. By January we’ll have about $1.4M saved. Financial paranoia = all cash. Dumb, I know. We missed the entire Trump-bump. But we knew we’d be buying soon, and have minimized inflation loss via high-yield savings/CDs. No risk, no reward, but I sleep really, really well at night.

They say 40 is your peak salary, which will be true for me. Planning to drop the high stress job and either leave my native CA for my wife’s Midwest. Pay cash for a nice house (or three), invest the rest and likely both go part-time. Or stay in the Bay Area I once loved so much and eek out an expensive existence in East Bay.

#trueconfessions

BTW, people don’t blog anymore.

Millennials and yolo is also fake news now?

Every other report shows Southern California rents rising sharply. Also, on the west side of LA, which is massive, 1 bedrooms are in the 3s. The low 2s are reserved for the ghetto side of LA.

Anthony8 minutes ago

Tax the greed out of investment properties. You own more than 2 houses you get 70 % tax on profit. You try to eliminate investors from entering the market and allow first time buyers a chance to own a home. Home ownership on top of bringing Americans pride it helps them save for retirement via home equity. Also investors can instead put money into creating long lasting jobs opening small business’. Cap apartment rent. Move the money. Create business’. More jobs.

American home ownership rates are at a 20 year low….but at 65% if anything, TOO many people still own homes. Capping rent is obviously a nonstarter. However, that isn’t to say government built low income housing doesn’t have a place. Using modern, 21st century design principles, it’s possible to build complete communities, not ghettos.

Yes, provided you overpay for everything and dish-out pork to your political contributors and union contacts. Gov’t-sponsored housing – I talked to a guy who developed them for the City for a fee and he laughed at how much they cost. Now cities are in panic mode. Look at SD and LA – they are allowing massive bonus densities and greatly reduced, or completely eliminating parking requirements for projects near muni transit. LA is going vertical. Look at how the “affordable” housing is financed. Forgivable loans from the same BK municipalities. Its your life energy transferred to others; sometimes with the political agenda of “social engineering” neighborhoods. There was large SFRs built in a coastal community back during the RTC days when you could buy MFD units for under $20k a door. They were spending $1MM to build a few large “affordable” SFRs west of I-5 at a time when they could have bought a 40-unit project in Barrio Logan area of SD or other less expensive districts. So the answers above are tax investment and let the gubbermint fix it. Good luck with that!

It’s not private investor house flippers doing 3-10 units a year that are driving the price inflation. It’s large private equity firms that bought up every house they could find in desirable areas back around 2008. Black Rock is one of the largest owners of residential homes in the United States – if not the largest. At one point I recall hearing that they had a $10+B US residential portfolio and $20+B is overall real estate holdings. Black Rock is not the only firm in the space. Heck, there’s even a residential realestate ETF. Corporate flippers are also driving prices higher – like webuyuglyhouses.com. They’ll buy up pretty much anything dump some granite counter tops in it, slap a coat of white paint on it, and try and sell it for double what they paid. Who cares that a bunch of poor millennials don’t want or need granite counter tops? Much like millennials, nearly everyone in Germany rents rather than owns. For the Germans it was a result of the destruction caused by the world wars (and government programs that rebuilt residential property after). For the millennials, unfortunately, it is a matter of poor governance and unregulated subsidized mega-capitalism.

it ain’t capitalism.

the price of real estate is escalating for only one fundamental reason:

the value of money itself is tanking, and (WAY) more of it is needed in most places to purchase the same dwelling.

this is the DIRECT result of (quasi) government officials drastically inflating the money supply.

Sold the company I started 25yrs ago and am now happily retired in fabulous Las Vegas with my lovely wife of 30yrs at age 53. I could not turn down the offer and looking back now am very happy to simply sit back, pursue my passion and observe.

No state income taxes, very low property taxes, endless dinning and entertainment options and nearly 300 days of sunshine per year. 40k people per year are moving here from all over the country.

Because this city was ground zero during the last housing bubble I believe that many of the mistakes that were made will unlikely be repeated. The banks are simply far too strict with their lending guidelines to allow this to happen again.

I love your website Wolf along with those of all of your

devotees. I will begin to participate/ contribute my perspective in the future . Happy 4th of July to everyone and GOD BLESS AMERICA !

Also want to relocate to Vegas! Love the Summerlin area. I’m 29, single, from California. Looking for good jobs at the moment.