Exports-at-all-costs for economic growth comes home to roost.

Manufacturing in the biggest manufacturing countries, particularly those focused on exports, has hit various levels of malaise, ranging from slowing growth to panic-inducing decline, according to the manufacturing Purchasing Managers Indices for May released on Monday. The PMI data shows that in the US, manufacturing is growing more slowly, but it’s still growing, and so the US continues to be the cleanest dirty shirt in this bunch.

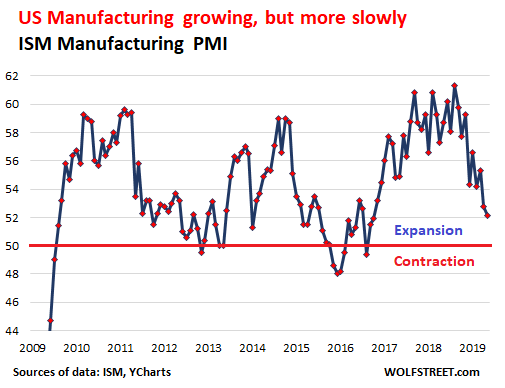

The US Manufacturing PMI released by the Institute of Supply Management for May, released this morning, showed that economic activity in the US manufacturing sector expanded in May, but at a slower rate. As with all these PMIs, a value over 50 indicates expansion, and the more the value is above 50, the faster the pace of expansion. A value below 50 indicates contraction. The ISM Manufacturing PMI for May ticked down to 52.1 (data via YCharts):

“Comments from the panel reflect continued expanding business strength, but at soft levels,” the report says. “Respondents expressed concern with the escalation in the U.S.-China trade standoff, but overall sentiment remained predominantly positive.”

Here are some key points:

- “Demand expansion continued, with the New Orders Index strengthening” to 52.7, but it remained in slow-growth mode of “the low 50s.”

- The Backlog of Orders Index contracted for the first time since January 2017, and it did so rather sharply, falling to 47.2, from 53.9.

- The Production Index expanded but at a slower rate, at 51.3 (down from 52.3 in April).

- The Employment Index expanded at a faster rate, to 53.7 (from April’s 52.4).

Of the 18 manufacturing industries covered by the ISM PMI, 11 reported growth in May:

- Printing & Related Support Activities;

- Furniture & Related Products;

- Plastics & Rubber Products;

- Textile Mills;

- Miscellaneous Manufacturing;

- Electrical Equipment, Appliances & Components;

- Computer & Electronic Products;

- Chemical Products;

- Food, Beverage & Tobacco Products;

- Nonmetallic Mineral Products;

- Machinery.

And six of the 18 industries reported contraction in May:

- Apparel, Leather & Allied Products;

- Primary Metals;

- Petroleum & Coal Products;

- Wood Products;

- Paper Products;

- Fabricated Metal Products.

The US manufacturing sector is also covered by the IHS Markit US Manufacturing PMI, released this morning, for a slightly different point of view. It still showed growth (50.5) but the slowest growth since the Great Recession, “as output growth eased and new orders fell for the first time since August 2009.”

Employment rose, but at the slowest rate since March 2017, “amid tight labor market conditions.”

Production rose only marginally, “often linked to clearing backlogs of previously-placed orders.”

New orders contracted for the first time since August 2009. “Though only fractional, survey respondents stated that weak client demand drove the fall. Some firms also noted that customers were postponing orders due to growing uncertainty about the outlook.” New orders from abroad contracted, “albeit at a marginal rate,” for the first time since July 2018.

German manufacturers, gloomiest-and-doomiest of all.

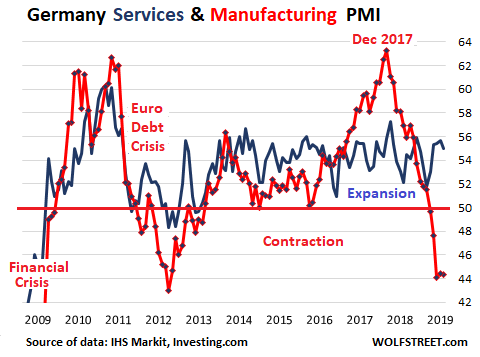

The German economy’s legendary dependence on manufacturing for exports, and in particular its focus on the auto sector, has some drawbacks when the auto sector goes into decline globally, as is the case now, and exports in general deteriorate.

The IHS Markit/BME Germany Manufacturing PMI contracted further, to 44.3, the sharpest contraction among all manufacturing powerhouses.

However, Germany’s services PMI has been strong, and the divergence between services and manufacturing is stunning. The chart below shows the terrible condition of the manufacturing sector (red line) and strength in the service sector (blue line, IHS Markit Services PMI). Even in Germany, services (including healthcare, finance and insurance, information services such as data processing and telecoms, and professional services such as lawyering and architects) are by far the largest part of the economy.

“Stronger growth in the consumer goods sector” helped ease the decline in manufacturing output for the second month in a row, also helped by “a slower decline at capital goods firms.” The sharpest contraction in production occurred at makers of intermediate goods.

Despite easing, the latest declines were sharp overall, with anecdotal evidence highlighting the effects of the slowdown in the car industry, the US-China trade conflict and customer destocking on sales.

And manufacturing employment is taking a hit. Manufacturers have shed workers for the third month in a row: “having accelerated from the modest rates of decline seen in March and April, the pace of job losses reached the quickest since January 2013.”

The 12-month outlook of these executives remained “downbeat,” on “lingering concerns towards trade conflicts, the auto sector slowdown, and Brexit.”

Eurozone

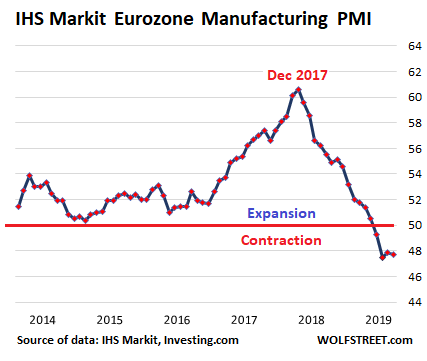

The IHS Markit Eurozone Manufacturing PMI contracted further, to 47.7 in May (from 47.9 in April), the fourth month in a row of contraction, and a six-year low.

But as in Germany, consumer goods makers are still growing while intermediate and investment goods makers are in contraction:

- In the consumer goods sector, “growth was sustained to a modest degree” and has been in expansion mode for five-and-a-half years.

- But “marked” deterioration was “centered on the intermediate and investment goods sectors.”

In terms of the Eurozone countries, some show strength in manufacturing. The weakest are Austria and Germany. Note which country has the fastest expanding manufacturing sector in the Eurozone:

- Greece: 54.5 (three-month low)

- Netherlands: 52.2 (two-month high)

- France: 50.6 (three-month high)

- Spain: 50.2 (three-month low)

- Italy: 49.5 (eight-month high)

- Austria: 47.8 (50-month low)

- Germany: 44.3 (two-month low)

The weakness in manufacturing continues to be “closely linked to deteriorating order books. Latest data showed an eighth successive monthly fall in new work received,” both from domestic and overseas customers, “as highlighted by another solid” contraction in new export orders.

A fourth successive monthly drop in output and further steep decline in new orders underscored how the sector remains in its toughest spell since 2013. Companies are tightening their belts, cutting back on spending and hiring. Input buying, inventories and employment are all now in decline as manufacturers worry about being exposed to a further downturn in demand.

The most commonly cited risks to the outlook were “trade wars, slumping demand in the auto sector, Brexit, and wider geopolitical uncertainty,” and they “all have the potential to derail any stabilization of the manufacturing sector.”

Japan

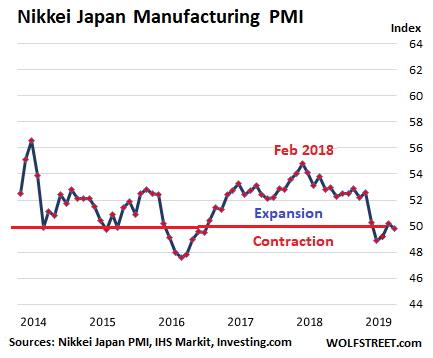

The Nikkei Japan Manufacturing PMI edged into contraction mode, to 49.8 in May (down from 50.2 in April):

Employment increased, but at the slowest rate in two-and-a-half years.

New orders contracted for the fifth month in a row, “a reflection of weakness both domestically and overseas.” Export business fell for the sixth month in a row, “which firms attributed to challenging economic conditions at key trading partners such as China, as well as greater competition internationally.”

With appetite for Japanese goods dwindling, firms trimmed their inventory levels and scaled back buying purchasing activity. Stocks of both finished goods and inputs declined in May.

Having shown signs of a slight recovery in April, future output expectations turned pessimistic in May for the first time since November 2012, amid concern towards heightened trade tensions between the US and China, as well as the planned sales tax hike later this year.

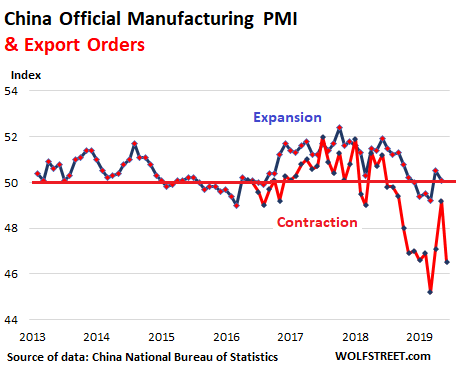

China’s Official and Private Sector PMIs

The official China Manufacturing PMI, released by China’s National Bureau of Statistics, dipped back into contraction mode in May (49.4), after two months in expansion mode. Of particular significance is the sharp multi-month drop in export orders (red line with data going back to 2016):

Some standouts:

- Production index continued expanding (51.7) but at a slow rate.

- New orders contracted marginally (49.8), dragged down by new export orders (46.5)

- Purchasing volume index ticked up (50.5)

- Import index fell deeper into contraction (47.1, down from 49.7 in April)

- Employment index fell sharply (47.0), in contraction mode since at least mid-2017

- But executives remain optimistic, with the Expected Production and Business Activities Index at 54.5.

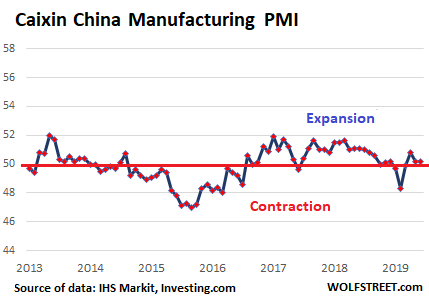

A slightly more upbeat version comes from the private sector Caixin China General Manufacturing PMI, which has been just barely in expansion mode for the third month in a row:

“Chinese manufacturing firms signaled a further slight improvement in overall operating conditions during May,” the report said. “Total new work rose at a faster pace, supported by a renewed increase in export sales, while production was broadly stable.” Some standouts:

- Backlogs of work continued to expand.

- There was a “further increase in total new orders.” It was “supported by a renewed increase in new export sales. According to panelists, new product releases and firmer foreign demand supported the expansion.”

- But there was a “slight decline in staffing levels” for the second month in a row.

- Business confidence fell “to the lowest level since the series began in April 2012,” citing “concerns of an escalating China-US trade war and forecasts of relatively subdued global demand.”

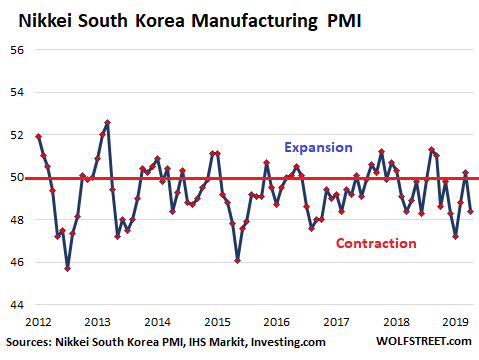

South Korea

The South Korean manufacturing sector is far smaller than the big four: China, the US, Germany, and Japan. But it’s the next largest in line. And these executives are a rather negative bunch, indicating that the manufacturing sector has been in decline for the majority of the time since 2012, according to the Nikkei South Korea Manufacturing PMI, which dipped backed into contraction mode in May (48.4):

“Output was cut back as demand conditions became increasingly challenging, with domestic and export markets remaining fragile,” the report said. Some standouts:

- The “faster decline in new order intakes” was attributed to “fragile conditions in both domestic and major export markets. New export orders fell for the 10th month in a row, and the decline accelerated.

- Sales were hit by “slowdowns in automobile- and semiconductor-related industries.”

- Panelists cited “difficult trading with foreign clients in Japan, China and other parts of Asia.”

- Production contracted in May, following declines in orders.

- Staffing levels were reduced for the sixth month in a seven-month period. “According to panelists, fewer workloads led some workers to voluntarily resign.”

- Backlogs declined for the ninth month in a row.

In comparison with the travails experienced in the manufacturing powerhouses of Germany, China, Japan, and South Korea, that are all focused on exports, the US manufacturing sector for now remains the cleanest dirty shirt — still expanding, but with growth slowing.

The economy is in a “very good place,” says Trump’s man at the Fed. And the Fed’s favorite inflation measure ticks up. Read... American Consumers Prop Up the Economy. Wall Street Clamors for Multiple Rate Cuts. Fed Blows Off Wall Street

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

First of all, you must be willing to buy and sell without tariffs. That will be upbeat.

does US have manufacturing industry left ? Isnt everything outsourced to other countries already ….

Yes. The US has the second largest manufacturing industry in the world, behind China.

There are two large forces at play in the overall dwindling of US manufacturing employment (now down to just 8.5% of total private sector employment): automation (more output with fewer people) and offshoring.

Manufacturing production has increased over the years, driven by automation, and despite offshoring; but it would have soared if manufacturing had not been offshored to such a large extent.

We could be undergoing a full-blown reversal of the popular received wisdom around manufacturing. Offshoring hit its stride in the 1990’s once Walmart capitulated and reversed its Buy American ideology.

Now that labor costs are rising in “emerging” economies, offshoring could very likely be hitting the diminishing returns wall. Who wants long supply chains that are vulnerable to political/diplomatic conditions, when there’s a robot for almost any task you can imagine?

For industrial planners, adjusting an IRR a few basis points to compensate for inflated (but known) costs at home is far easier than trying to come up with a risk model that can accurately mitigate for the vicissitudes of international politics. I guess the big guys use derivatives for this sort of thing, but who saw tariffs coming 5 years ago when all those joint ventures were signed? Did they account for this in their models? I hope so.

I heard US has only 12% manufacturing of what it used to manufacture. I would not count offshoring. Offshoring uses foreign labor not people on the continent of United States of America.

Automating what? Flipping burgers? Just Kidding!

Not true. Us manufacturing is at its highest. Employment is only 40% of what it used to be in 1979.

Maybe Wolf has data on this. My understanding is that manufacturing employment includes anyone who is employed at a manufacturing company. This includes bookkeepers, order trackers, accountants and paper shufflers of all kinds. Many of these jobs no longer exist at manufacturing firm for two reasons. One is computerization and digitization of nearly every aspect of the paper shuffling work, thereby drastically reducing total employment and/ or many firms have outsourced these jobs to accounting firms, whose employees are counted as service jobs. My point is that automation, offshoring and job reclassification all have contributed to reduced manufacturing employment.

PS,

As figurehead of my WOLF STREET media mogul empire (a corporation), I had to participate in the survey on which the jobs data is based. This is a huge survey the Census Bureau does constantly, and participation is compulsory. As a company, you don’t get to not participate. This keeps it fairly representative.

This survey goes by job site. So the survey asks something like: At site x with this address, how many…

So for example, an Amazon fulfillment center has warehouse workers, and they will be classified as warehouse workers. An Amazon office building is stuffed to the rafters with coders, and those people will be classified as coders. And none of these workers count as “retail” workers.

Industries (such as my media mogul empire) and jobs in them are classified by NAICS codes. You can check them out here:

https://www.naics.com/search-naics-codes-by-industry/

Don’t forget the US military-industrial complex – an enormous amount of high end US manufacting there.

Does the Caixin China Manufacturing PMI include armaments?

Does the American PMI include armaments? Armaments are of course the massive $1 trillion dollar taxpayer subsidy into the economy.

Fair enough retort. Gooses and ganders.

But I assume the US spend on armaments is (large and) steady, while the China spend on armaments is escalating rapidly. These differences would affect relative PMIs if armaments are included.

If so, the non-armaments component of PMI for China would really be in the toilet.

… and the cleanest dirty shirt will get cleaner, as manufacturing returns to the U.S.

Among others, Stanley tools, longtime manufacturer of hand tools and buyer of the Craftsman brand, is to be congratulated IMO for establishing new U.S. manufacturing facilities.

Good news. Good tape measures, etc. :-)

HF gives them away for free, Pittsburgh, made in China

Yes Stanley is a great manufacturer here is the states. Nice stock to own too.

agreed and we also need to keep our technology and innovation / invention which China has been forcibly taking from us. That is the one big item the news deliberately wont put out there because it would justify the Trump administration actions. They hate him so much they will crater our country to get rid of him. Invention and innovation is our bread and butter if we lose that were are toast.

Discrepancy between China’s “official” PMI and export orders is interesting. Without knowing the breakdown of export & domestic consumption, it’s hard the draw objective conclusions, but exports appear to have underperformed PMI sentiment for almost 3 years.

I assume the Caixin index only shows PMI (not exports). Hard to evaluate this without knowing what % of total mfg this represents.

Given China’s demonstrated propensity for politically-manipulated numbers, could the “official” PMI be signaling a sharp adjustment in mfg activity may be in order?

BA dwindling new orders and cancellations are the cause of industrial troubles.

FANG bad news day moved the NDX, but the DOW and the SPX

didn’t care.

NYA, RUT, XLI and XLE are up, on bad news day..

That a sign that BA will move up to close the big gaps.

We are tired of lifting all boats. Perhaps DDay remembrance can remind the world where they would be without the US. Perhaps.

The rise of China is not all bad. The US is at its best as a beacon of freedom in a multipolar world, rather than as imperialist globocop.

The US can actually lift all boats too, just not so much and more in a mutually-beneficial way rather than at our own expense.

Not likely; there were only 20 years between the end of WWI and the European start of WWII (Nov 1918 – Sep 199).

Most people under 40-ish can’t accurately name the belligerents, much less identify the side they fought on at the end of the war, and much much less identify the 3 major powers that fought on both sides at some point in WWII.

(Nov 1918 – Sep 1939)

Why do you not have much info on cannabis stocks? Just wondering if there is a reason, such as you think they are a scam?

Cannabis is an ag product that, when legal in the US under federal law, will become an ag commodity, sold by the bushel or whatever. We don’t write a lot about individual ag commodities. But here is a piece on cannabis:

https://wolfstreet.com/2018/09/27/pot-stocks-soar-as-pot-prices-plummet/

Looking forward to the day when cannabis and hemp are traded on the futures exchange; under “Foods and Fiber” ie. Cotton, Lumber, Coffee

The writing is on the wall for a recession in the not-too-distant future. It was a really bad time to be implementing Tarrif’s. China, Europe & the rest of the world have been taking advantage of the U.S., but this is hurting the American consumer at at the worst possible time. A time of deteriorating global growth & a continuing seismic shift in demographics.

Cash is taking ove & precious metals are appreciating as the safe haven assets that they are. I believe the U.S. will always be the cleanest dirty sheet. As long as the USD remains the world’s reserve currency that will reamain constant. If that dynamic ever changes, the world will be dominated by real assets of value.

Double D, in which universe are precious metals appreciating? I mean other than just in the past couple of days/weeks/months.

Also, cash can’t be taking over, because it’s never created or destroyed in a transaction – except at the Fed or whenever a bank creates money by lending before collecting reserves – to anyone except Wolf that is.

Cash just IS. I think what you’re trying to say is that other assets’ prices will be dropping, making cash more valuable to investors?

P.S. Here’s the contrary scenario to your recessionary fear: The US strengthens its manufacturing, pulling the remaining slack out of the domestic economy. Rising output and increased pay to workers increases standards of living through increasing workforce participation, working hours and, due to low unemployment, a modest but long-overdue boost in wage income as a share of GDP. With higher living standards and purchasing power, and through level-playing-field trade agreements, US consumer spending provides the kick needed to pull the other nations out of their downturns… (The world will always have problems, but that hasn’t stopped us yet…)

You live in a different universe.

The main problems with a general expansion of prosperity are demographics, existing debt servicing, inflationary pressures from increased wages for the workforce, human nature and a finite planet.

First off we have a huge generation of retirement age which are no longer interested in buying new things. Inflation would crush these people.

Secondly, debts have to be serviced or repudiated. There is just to much debt in the system to service, much less pay down or off. Meaning more debt is a negative force and massive change would require more debt.

In a zero sum game, increased wages have to either come from profits or increased sales. Increased sales do not seem to be on the table with the world’s demographics, the amount of consumer debt or dwindling resources to exploit (meaning each ounce or gallon or bushel costs more to extract or create).

Then you have human nature. How much is any of those who now have assets or income streams be willing to give up large chunks to others so that general prosperity can be raised.

Of course then there is the 800# gorilla, the finite planet’s ability to absorb the impact of increasing human interaction and pollution.

Nothing is simple. Everything is overly complex. Nothing good happens quickly or without cost to some group.

Re “The main problems with a general expansion of prosperity are demographics, existing debt servicing, inflationary pressures from increased wages for the workforce, human nature and a finite planet.”

Demographics: The boomer retirement wave is peaking. The future is young people and babies.

Debt servicing: Non-issue for personal prosperity provided personal income growth exceeds personal debt growth.

Increased wages: that’s not inflation, that’s the definition of prosperity. You WANT that to happen. This is also what makes the debt servicing a non-issue.

Finite Planet: yes, but there can be increased happiness and prosperity for a finite population on that planet, without resource depletion, if the people build the technologies for sustainable lifestyles.

Re “In a zero sum game, increased wages have to either come from profits or increased sales.” – this is entirely wrong. First, it’s not a zero-sum game. Second, wages don’t come from profits, they come at the expense of profits. Increased competition lowers profits and increases wages as a share of economic activity. This is a good thing. Third, and finally, increased sales come from increased wages* not the other way round. (* or borrowing, but we already agreed debts have to be serviced)

Finally re Human Nature: people don’t have to give up anything. The rich will get richer if the poor have more income, because the companies owned by the rich will have more sales. Profits can rise even as profits/GDP fall, when GDP is rising. The alternative is a world of only princes and paupers, and in such a world even the princes will be poor because the paupers have no income for the princes to skim.

The contrary to your contrary: Jobs return but not at a living wage. Government cuts back on benefits and subsidies. Early retirees return to work after their pension fund blows up along with the dollar. Additional purchasing power is sucked up by payroll taxes, increased health care, cost of durable goods. US workers spend spend spend their way to poverty. Cheap US exports, including energy, enrich former third world consumers.

A tariff is simply a national sales tax on an import.

Leveling a playing field or punitive against some nation or product for some reason.

They are revenue that otherwise would come from income or other federal taxes.

If you read the US constitution they not personal income taxes are how federal revenue is supposed to be raised.

Republicans and democrats all like the idea of a national sales tax but none of them will actually do it, as it will cost votes.

Globalisation requires a level playing field since ccp chian entered the global trade environment, then the WTO the playing field has been anything but level.

A globalised economy cannot work when 1 major player, in this case ccp china uses a different rule book.

Tariffs are not the answer but they may help ccp chian change its evil ways.

If you dont want to pay the tax/tarrif dont buy the products that attract them.

Isn’t this also the largest state run (aka:subsidized) global rail equipment manufacturer?

China play dirty in 1994 by pegging US$1=8.8 Yuan.

In 1991 US$1=4.1 Yuan.

This weaponising the Yuan make China workers the cheapest in the world and make South East Asia nations , Taiwan and Japan lose their competitive edge immediately.

As a result, the electronics supply chain all move to China after 1994, and caused the Asia Financial crisis.

The American consumer needs should come

second to the needs of American workers .

Use tariffs to provide healthcare for the American citizen and the cost savings to business will encourage companies to locate

in the US.

You know a country has gone completely mad when they act like “consumers” and “workers” are two different and separate groups.

We all wear different hats at different times. Putting consumption ahead of

production is what has gotten us into this mess.

one thing that i think is overlooked when looking at manufacturing is transportation costs. one of the reasons that so much manufacturing has been off-shored from the u.s. is the low cost of shipping from asia. a lot of this is accomplished by the shipping industry using heavy “bunker c” fuel oil. bunker fuel is essentially the tar that’s left over from petroleum refining. it’s super cheap and super polluting.

https://www.dailymail.co.uk/sciencetech/article-1229857/How-16-ships-create-pollution-cars-world.html

i’m amazed bunker fuel hasn’t come under more scrutiny. i’ve read estimates that, international shipping has a carbon footprint that is exponentially greater than all land based vehicular traffic. i think people are starting to pay attention, if bunker fuel gets outlawed, shipping costs will go up and even more manufacturing will become domestic.

“i’m amazed bunker fuel hasn’t come under more scrutiny.”

Your knowledge is outdated by many years. Please update your knowledge on the new bunker rules, including the 2020 IMO fuel sulfur regulation. This has been a huge deal for carriers. The world has changed, and you missed it :-]

Also your math is wrong: it’s NOT cheaper to send something from China by ship to LA and then by train to Chicago, than it is to ship something by train from Cleveland to Chicago. Shipping ADDS to costs, and that is one of the drawbacks for companies, not a benefit.

√

Beat me.

Shipping costs and labour rates are rising, international supply-chains are under more and more threat, subject to constant rising costs, robots are cheap and US enegy is more reliable. Expect more robot manufacturing with a few tech jobs in the US not a big employment surge.

Low sulfur regs are LONG LONG overdue, they are going to force another generation of cheap to run vessels to the scrap yards.

ccp china will flaunt these regulations, just as they flaunted the CFC regs/treatys, until they no longer can.

State-owned China COSCO Shipping (hence COSCO), which is slowly absorbing the shipping companies of both Mainland China and Hong Kong, actually has a very modern and “clean” fleet. Their plans to expand their container capacity to at least 2.5 million TEU to overtake CMA-CGM imply a whole lot of very big and expensive but also very clean ships. Money’s no problem, at least for now: the company is directly bankrolled by the State-owned Assets Supervision and Administration Commission (SASAC), meaning the State Council.

The big problem facing China are the vessels owned and operated by private groups often hiding behind shady PO companies in Belize, Nauru and similar places, which are mostly operative in the dry bulk freight and fishing sectors.

Plenty of these ships are 80’s vintage Japanese-built tankers converted into bulk carriers or factory ships and are now over 35 years old, often in poor mechanical conditions.

These ships get busted for all sorts of environmental crimes, from environmental pollution to illegal fishing: the infamous Damanzaihao, a late 70’s relic converted in a factory ship, racked up several million dollars in fines all around the Pacific Rim before Peruvian authorities finally lost their patience and confiscated the whole rusty lot late last year.

Getting the owners of these ships to pay up their due is almost impossible: the PO companies will simply be allowed to go bust and nobody wants those piles of junk. Having them towed to the scrapyard costs more than they are worth.

So the cycle goes on and on.

fine, obviously i’m behind on my info. however, it doesn’t negate my point. the regulation take effect NEXT YEAR. so we have not seen the impact yet.

also, i’m skeptical that the new rules will be strictly adhered to because enforcement is a big question, for example, the chinese are still manufacturing large quantities of ozone layer depleting cfc’s decades after they were outlawed.

still, overall good news as thing seem to be moving in the right direction.

Australia home prices continued to drop. Other econ numbers turned negative there too.

Canadian housing bubble embarrassingly bad.

Zombie company bankruptcy risks have not been fixed.

With interest rates dropping, some stocks seem to have attractive valuations and dividends.

What is lost in all this is productivity. Is what we are making going to move economic production forward or is it just a bunch of tulip bulbs?

I believe this site has covered it, but the US appears to be IN a transport recession now. Unlike manufacturing or consumer sentiment/PMI stuff, the change in the flow of goods is a very interesting barometer of what is going on in the US economy. I see trucking rates decreasing, and the bid/load ratio is also declining . . .