Nasdaq down 8.7% in May. S&P 500 back to Jan 2018. Russell 2000 down 15.7% from peak, back to Sep 2017. FANGMAN except Microsoft get creamed.

Stocks were already gunning for the worst May since 2010 when, on the evening before the last trading day, Trump tweeted that he would impose tariffs on imports from Mexico, if Mexico doesn’t crack down on migration flows coming through its southern border. Those tariffs would hit the automakers particularly hard because they imported 2.6 million vehicles from Mexico in 2018, up 10% from the prior year. Not even counting the component makers. But the Presidential tweet was just the icing on the cake. May had been crappy for stocks before the tweet went out.

The S&P 500 index, which earlier this week had fallen through 2,800, dropped another 1.3% today to 2,752, down 6.8% from its peak in early May that had exceeded by a hair the prior peak of September 2018. The index is now back where it had first been on January 9, 2018, having spent nearly 17 months going nowhere, despite intoxicating surges and nerve-wracking drops. And the chart is morphing from “not pretty” to something a little uglier (data via S&P Dow Jones Indices):

The Dow Jones Industrial Average fell 1.1% today, unceremoniously plopping through the 25,000 level and closed at 24,815. It’s now 7.9% below its October 2018 peak and right back where it had first been in December 2017, having spent 17 months gyrating to nowhere, including a 19% peak-to-trough plunge in four months followed by a blistering 22% rally in four months.

The Nasdaq composite dropped 1.5% today, to 7,453, the level it first reached in January 2018, also going nowhere in nearly 17 months despite a huge bout of volatility. It fell 8.7% in May.

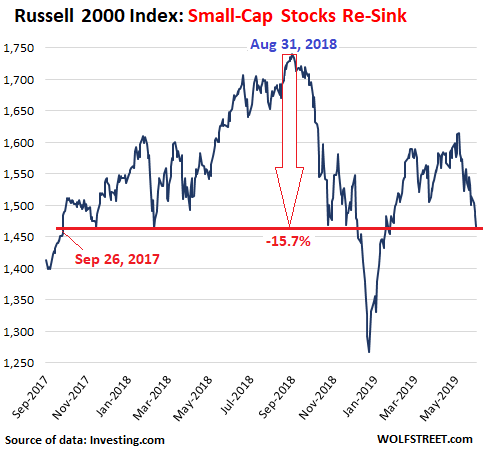

The Russell 2000 index, which covers stocks with smaller market capitalization, fell 1.3% today, to 1,478. It’s down 9.2% in May alone, down 15.7% from its October 2018 peak, and right back where it had first been on September 26, 2017, a very volatile 20 months of going nowhere. Chart looking ugly (data via Investing.com):

In terms of the Mexico debacle: GM’s shares fell 4.2% today, to $33.34. It is the automaker that is the most exposed to Mexico: GM imported 667K vehicles from Mexico in 2018, accounting for 23% of GM’s total US sales that year. In Q1 this year, GM imports from Mexico, Trump or no Trump, surged 28% year-over-year to 182K vehicles.

But don’t just blame the tweet: By Thursday evening, GM shares were already down 10% for the month of May. Friday’s dive took this loss in May to 14%.

My fancy-schmancy FANGMAN index

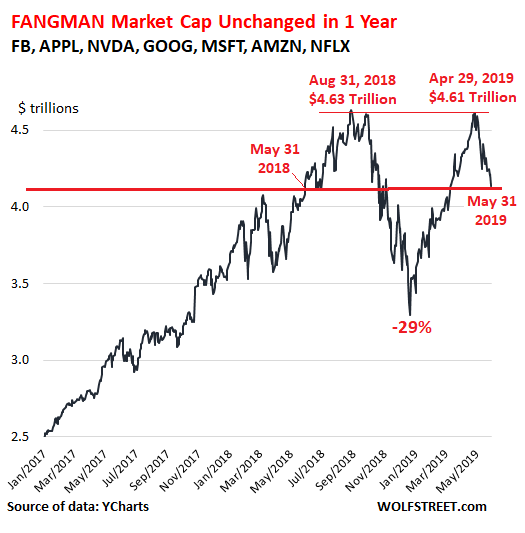

My FANGMAN index – the combined market cap of Facebook, Amazon, Netflix, Google’s parent Alphabet, Microsoft, Apple, and NVIDIA – fell 2.0% today and is down 8.7% in May.

The FANGMAN index had peaked in August 31, 2018, at $4.63 trillion, then plunged 29% to $3.29 trillion by December 24, then skyrocketed 40% to $4.61 trillion by April 29, but ominously failed to take out the August high.

Since April 29, the FANGMAN index has dropped 10.4%, giving up over one third of the blistering post-Christmas rally in just one month. The index is now back where it had first been on May 31, 2018, having gone exactly nowhere in one year despite these brain-twisting surges and plunges (market cap data via YCharts):

Here is how the FANGMAN components did:

Facebook [FB] dropped 3.0% today, and 8% in May, to $177.47. It’s down 18.8% from its all-time high in July 2018 and down 8.5% from May 31, 2018. Its market cap is now down to $507 billion.

Apple [AAPL] dropped 1.8% today and a juicy 16.8% in May, to $175.07, down 25% from its all-time high in August 2018 and down 8.0% from May 31 last year. Once the most valuable company in the S&P 500, Apple’s market cap is now down to $805 billion, behind Microsoft and Amazon.

It’s not helpful that unit sales of its flagship product line, the iPhone, have been dropping, and that it is now trying to sell more services instead, as iPhone sales are getting battered by cheaper competitors in a stagnating market.

NVIDIA [NVDA] dropped 2.6% today. It’s down 53.7% from its all-time high last October, and it’s not far from taking out its pre-Christmas low ($127.08). If it does succeed in doing this, it would be back where it had first been in May 2017. It’s down 47% from a year ago. Market cap down to $83 billion.

Alphabet [GOOG] dropped 1.3% today to $1,103.63. It had established a new high on April 29, and has plunged 14.2% since. Down 1.4% from a year ago. Market cap at $767 billion.

Microsoft [MSFT] dropped 1.6% today to $123.68. It established a new high on April 30 and has since dropped 5.3%. Up 22.7% from a year ago. Market cap of $948 billion, the most valuable company in the S&P 500.

Amazon [AMZN] dropped 2.3% today to $1,775.07. It’s down 7.9% in May, and down 13% from its all-time high on September 4. But it’s up 8.1% from a year ago. Market cap of $874 billion, behind Microsoft.

Netflix [NFLX] dropped 2.4% today to $343.28 and is down 16.5% from its all-time high last June. And it’s down 4.6% from a year ago. Market cap at $150 billion.

So thankfully that Microsoft is included in my FANGMAN index. Without the “M,” the “FANGAN” index did a lot worse: down 15.5% from its peak on August 31, down 12% from its turnaround point on April 29, and back where it first had been on January 25, 2018. A volatile, but overall orderly unwind.

The economy is in a “very good place,” says Trump’s man at the Fed. And the Fed’s favorite inflation measure ticks up. Read… American Consumers Prop Up the Economy. Wall Street Clamors for Multiple Rate Cuts. Fed Blows Off Wall Street

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Most Chartists would say we need to retest the December 2018 low before the market can advance. That will be uncomfortable for most novice investors–myself included. I never liked those technical analyst types, and tend to think markets cannot be predicted, but human nature does follow certain patterns, so we may be in for a wild ride, ahem, I mean buying opportunity.

Fundamentals don’t matter…until they do.

Wolf – anyway to get published an extensive list of your opinion of “zombie” companies?

We already know a few – Tesla, Uber, etc.

But I am sure there are more than a few surprises.

2banana: I believe Wolf is trying to come up with a Zombie “graft”.

The problem is how do you tell if it is a real Zombie or a fake Zombie?

(Graft is Quebec’s favorite indoor sport!)

Head and Shoulders graph shot : If it stretches upward, it’s the real zombie deal. If it twitches sideways, it just been infected, wrecking havoc with every trader it touches. If it’s plunges down, down, down .. it was never dead to begin with .. only when it hits negative territory, lying in a coffin with the lid adorned with a morgan-chased silver crucifix, do we know it can never rise to manipulate another market day !

See my comment below for a possible zombies starter list:). I am curious though to see Wolf’s too.

Lots of the oil shale drillers. They only survive because the rates on junk are so low they can get by with out actually generating free cash flow. It is a brutal business with wells depleting every two years so you have to drill, drill, drill just to tread water.

Oil bonds are over represented in the junk bond ETFs. If you are correct and I think that you are, then these ETFs will get creamed

I have heard this about shale drillers. Big oil like XOM are into shale bigtime so there must be some value creation there. Haven’t been able to resolve this seeming paradox in my mind. Maybe it’s possible to get your money back and more in two years.

16.5 fwrd pe on Spx says no bubble here

“Forward PE” is the most manipulated fiction number out there. It has zero actual meaning because it is based on forward earnings estimates that always project huge earnings growth, that then, when it gets closer to reporting time, is revised lower and lower until it disappears, so that reported earnings can “beat” those lowered estimates.

“Forward PE” is designed from get-go to pollute your thinking about stock prices.

The fact that anyone is still taking it seriously — despite its totally known fictional and manipulative character — proves that my theory is correct: the market is driven by what I call “consensual hallucination.”

Wolf,

Its a measurement that’s been around forever, much like the libor. so I get it….but its useful…and if you would have followed it over last 6 years you banked cash…..earnings followed the fwdpe really nicely

its just one piece of a very intricate puzzle….

because of an irresponsible SEC, earnings are not comparable to previous periods. Much better is stock price/ sales. A prudent investor should focus on Free Cash Flow and forget about reported earnings

But if corporate profits / GDP ever revert to the level that Warren Buffett has said is the maximum sustainable (40% below current levels) then the earnings won’t be there.

Rcohn,

Very true. I look at only a few metrics when evaluating a stock. Price-to-revenue, revenue growth, and price-to-cash flow. Very few stocks look good on these metrics today.

There are three roads to ruin; women, gambling and technicians. The most pleasant is with women, the quickest is with gambling, but the surest is with technicians.

— George Pompidou

Just going to fill the open gap at 2718 with possible overshoot to 2650 and its over…..still only down 200 points from all time high…

big deal…equities are now priced for buying as bonds are done, SP 500 divi is better buy than bonds…so rotation to commence after a little down move to shake out the weak hands

Bonds are a terrible buy and so are most stocks.

People seem to forget that over the long term bond prices and stock prices move together

NOT if they enter ‘Earning recession’

Can US mkts (still over valued!) can go and succeed against the head winds of global slowing down, tariff wars and political upheaval in Europe including Brexit?

Also remember, unlike any time human history, the levels of DEBT (public/private) in all and any kind is on record,just unprecedented!

Even rate cuts, ZRP, NRP and QE 4 (+ what not!) may post pone for days/weeks but will NOT reverse this slide to the reversion to the mean. Fed/Trump will try any way, but the fundamentals do matter in the end! The great reset is long over due!

Good Luck!

Actually, short term treasuries still have a much better yield then SPY (SPY dividend yield equals a dismal, pathetic 1.78%). The days of earning a positive, real rate of return are long gone – Uncle Ben put an end to it. You might still win some capital appreciation but if you play that game you are just buying Trump-twitter lottery tickets – might as go to vegas and bet it all on roulette.

Anyone saving anything in this environment is just a sucker. Spend everything you make today because there is nothing to invest in and the longer you wait the less your money will buy. My suggestion: Sienna Italy is particularly pleasant this time of year, take every cent you have saved and spend it now (preferably overseas).

After having my life savings cut in half, by Ben (Inflation) Bernanke, I finally came to my senses and quit my engineering job – no sense and working hard and saving if the financial system (and the government, and sick care industry…) will lay claim to anything you save. If you think you will be allowed to work, save and achieve financial independence I will warn you: the people running the show have other plans for your hard earned money.

There are plenty of people (suckers) working and doing what needs to be done – I’m done being used, done being a sucker, I’m enjoying what’s left of my life.

This market is driven by money, not sentiment or speculation. TA is no longer valid. The dollar loses purchasing power which causes asset inflation, and so it takes X times the number of 2019 dollars to buy the same share of the S&P you could buy several decades ago at par. There are ways to gauge the flow of new money. In a closed system the competition for earnings and fundamentals drives the market, and bull markets are not based on financial engineering but real economic prospects.

Mkts and the ‘productive’ segment of the economy (not the bubble created by financialization!) are completely distorted by Fed/CBers by their insane credit explosion policies.

The factors (artificially) responsible for this extra ordinary UP cycle has come to an end.

Not many insurance viable there against the DOWN cycle!

To quote Michael Douglas, “The illusion is real”. The price of a stock is what George Condo would call Artificial Realism. Andy Warhol would call the stock market a Genuine Fake. Much like the price of a Condo or Warhol painting, the price of a stock can be whatever we want it to be, as long as the right people are willing to buy it.

Bingo. The “artificial” prices can stay that way just as long as the right people want them there. Up the thread, someone said “I’m waiting to see these fake markets return to reality level”. It’s pretty simple to squeeze the peasants indefinitely via sky-high asset prices compared to wages plus cheap money and risk-free profit arrangements for banks. What’s not to like? Japan has shown us the way.

You notice Trump isn’t blabbering anymore about the economy. They read him the riot act.

Here is a slogan for his 2020 campaign:

Buy American.

What’s there to buy?

If the correction was back down to 2350 S&P, then we would have come within a hair’s breadth of a traditional bear market twice within a couple of years (and have done since 2008 a time or two also). That would be about 2.5 years without any capital gains, and about 3 years without any inflation adjusted capital gains.

There would be a real battle between the bulls and bears there.

Right now the stock market risk has risen higher than any time in past 3-5 years. That doesn’t mean there couldn’t be another leg up after the correction/near bear.

Some of the best cyclical bull markets are during secular bear markets.

Luck to all.

All the recessions in the past have started with in 3 months of Fed’s rate cutting! Every one and his uncle are counting on that! QE4 won’t be long!

Fed cut the rate from 5.25% to almost ZERO from 2007 through early 2009!

S&P still lost BIG – 57%!

Will it be different this time?

Think about those in retirement or close to retirement (5-10 yrs!)

I am already over 10 yrs ago and have seen the severe damage a BEAR mkt can do one’s portfolio!

FORE WARNED is FORE ARMED

To each his/her own!

People can be predicted and people affects markets. That the trade war would cause stocks to do down was know, more so in the tech sector.

The Fed must be happy since stocks are going down.

Nvidia was a classic “story” stock with a smaller more volatile float. All the stories are no longer being told. Crypto mining chips, AI , driverless cars. I have seen this movie before. 2000. 2007. Nividia is likely to head back to 70. I find it too funny ceo’s Are crying over the tariffs, wanting to sue the whitehouse. Big biz got their tax cuts to spend on the buybacks. Now … too much winning. Since 2016 the indexes have been on a relentless upward unsustainable

Trajectory. Time to pay the piper. What goes up hard and fast comes down harder and faster. Wallstreet has taught me that

Funny they always seem to forget their own lessons. Go figure

Nvidia, lipstick on a pig.

EFF is at 2.39 %… The 10 Year is yielding 2.14 %, from the 20 year on it’s either on par or below the EFF.

100 % QT stops at end June meeting, calling it now… Was my prediction been 2 months or so, but it’s official now

You know, this makes sense, but something is going on with Fed comments. They are still consistently upbeat. To me, this says they feel that, no matter how bad the situation, the Fed can’t really do a 180 without a causing a panic. I mean, look at these ridiculous statements by Clarida. These people will look ridiculous if suddenly rates have to go down and QT has to end.

I think the Fed has given up. EFF is over IOER and will always be. It will never be below. Think about that.

Middle class, shoot yourself in the head. Your life is over.

I think we need an explanation here.

Banks have more than $1.4 Trillion of Excess Reserves at the Fed.

The REQUIRED Reserves today is less than $195 billion.

This means that banks have at least seven times more reserves than they are REQUIRED to have.

No wonder the Effective Fed Funds Market – lending and borrowing Reserves at the Fed – is a low $60B a day. Many Banks do not need to borrow reserves because they have too much more that what is REQUIRED.

Ergo, the EFFR does not mean much because it measures reserves that are traded. Yawn.

IOER is the interest paid on excess reserves. It currently stands at 2.35%.

This is the interest rate the Fed pays tha banks to hold reserves at the Fed. Excess Reserves were caused by QE. The Fed paid the banks reserves in exchange for sercurities the bought during their large asstet purchases, Decmeber 2008 to October 2014.

The theory behind IOER is to pay the banks interest (at a high enough level) so they won’t think of figuring out to use it (lend) to create hyperinflation.

Therefore to compare IOER to EFFR is like comparing apples to oranges.

One wants to make banks KEEP their reserves as is, while the other measures the rate they are lending it. Of course EFFR will be higher that IOER, or else why bother to lend below IOER?

Remember that Fed Funds is about RESERVES and not Treasuries.

Treasuries are a whole different ball of wax. Treasuries are REPOed, currently reported by SOFR. I would think T bills are better for REPO because they hold little term risk.

I doubt many individuals buy 10Ys (except maybe the Japanese). I don’t think we can forsee that long. Maybe institutions can.

I am not certain why the 10Y yield HAS to be above or below the EFFR. I guess that’s why we have an inverted yield curve. But folks are still buying the 10Y auction. Although, last May 8th. the the 10Y bid to cover was a low 2.17. It had the largest ever SOMA roll-over at nearly 9.2 bil.

The only thing I can say about rates today is that they are historically LOW. As a saver, I don’t like it. But for the borrowers, they are like in an opioid high.

When was the last time, we had a (robust?0 recovering Economy when 10y yield is 2.17%?.

Historically Bond mkt has been more accurate then the equity mkt in foreseeing the recession! Been in the mkt since ’82. I won’t surprised to see yield go below 1.6% at the end of the year.

Once the Fed reversed their intended ‘rate increase- charade’ following near bear mkt slide of indexes in the last Dec, I knew rate increase is history for the time being (unless tariffs cause in inflation?!)

My calls on TLT proved me right!

Well I’m not sure what you mean by a “recovery”, and definitely I don’t know for whom?

According to FRED the 10Y (GS10) was lowest in July 2016 at 1.5%. The August 10, 2016 auction had a coupon of 1.5% at a high rate of 1.503%. If you think the level of the S&P is a great barometer, then there you go; its (price) has been up more than 30% since then.

I don’t think that after QE rates are saying much of anything anymore. They are so distorted.

As far as the TLT etf is concerned, I almost bought some but I chickened out. The yield is about 2.47% but it had a price gain of almost 8% for the last year. It’s too late now, as I think it’s overbought already.

TO

Imafan

‘Well I’m not sure what you mean by a “recovery”, and definitely I don’t know for whom?’

Just read FOMC minutes of the last 2 yrs, it will be apparent!

That’s the UP BEAT narrative, repeated’ all along until this January, when Powell hit the ‘neutral; button! Once he start rate cutting, late this year TLT will zoom again!

Now, they are trapped of their own making! Trying to ban the ‘business’ cycles with their ‘insane’ CREDIT cycles!

Since they abandoned the good ole genuine American Capitalism – Market driven Economy’ all their INPUT data and the feed back numbers & facts are distorted and inconsistent to the reality of bottom 80-90% on the ground!

This was preordained when DEBT on DEBT spending became a panacea and adopted by CBers, for all the financial problems (public/private) all over the World!

No wonder where we are heading NOW!

Wolf,

The going is getting weirder by the day.

2-month T-bills yielding 2.38%. Take on an additional 19 years and 10 months of duration risk and the reward is….a single basis point.

U.S. Treasury looks like the big winner here. Last year, lots of criticism for funding the government via sales of short-term paper. Very shrewd move. Now it must be time to pump up the issuance of 2-year, 3-year and 5-year paper since they’re all yielding less than 2%.

And of course, LQD closed out this ugly week at a new all-time high. When that ETF blows up, will be breathtaking.

Astute observation. The FED is in a fight for the 1st time in its century long existence.

it would be nice for this to be written about, but virtually everyone is now stuck in confirmation bias mode anyway so it would only reach a few.

Don’t worry. That bias will end when people get their 401 statements. But this time, no panic. Why? Because middle class people know they have been coconspirators in the world Ponzi for ten years. Our middle class scum can’t plead innocence anymore, and they know it.

There will be no more Chuck Schumer saying, Mr. Chairman, get to work. It’s over for suburbia.

I say we put a fire-hardened stake through it’s blackened heart, once and for all. Put everything back under the influence of the Treasury Dept. and not allow BIG BANKSTER to run the show !

Yeah, noticed that in the brokered CDs as well 6 month and a year are almost the same. Although the sources are not your big banks typically.

Before that ETF, junk bond etfs including JNK and HYG have to blow up!

With Corporate DEBT( leveraged, covenant lite++) most of whom are rated BB are lower, will Fed allow this ‘ the sub-prime’ of 2019 to bust? Doubt it! They will go nuclear to zrp or even NRP!

Interesting days ahead.

Holding LQD with some puts for protection while making money will calls on HYG (+some puts for insurance!)

I want to know how Wolf writes 1-2k intelligible words per day. That’s what I want to know. What kind of drugs … can we expect pharmaceuticals to outperform nexts quarter?

Zero: Aren’t drug stocks a lot like airline stocks?

He’s da Bomb!

Well on the sunny side, my badly beaten up zombie gold stocks are up about 8% in May.

At this point, i’m hoping Larry Kudlow gets replaced by Cramer.

LOL.

Haha. Ultimate idea.

At this point, I’d settle for Kramer.

They should have cramer’s List of sound effects too in the process, especially during any press conferences.

Genius! Love the sound effect idea, I’m certain this could happen – Trump is a man of action.

What the press conferences could really use is a guitar army to play after each applause line. Terry Cruz should replace Pence as his running mate in 2020.

Poor Fangman. But what great diversion therapy every time the Russia news hits big. See? Mueller’s off the front page in less than 24 hours and all it took was new tariff threats, China trade war escalation, and another mass shooting. Time for golf!!

The administration = volatility

wall street volatility is mm’s not admins…..

backwardation on vix says this is no big deal…

Correct me if I’m wrong, but didn’t a wise man once say something like “nothing goes to hell in a straight line”?

Once the SP500 peaked again, I dumped it all and paid off my primary home. I’m a young guy but I see where this is heading….

Main St. couldn’t be any busier though if you’re a contractor….maybe other’s did the same, my company might set a sales record this year, we can’t even take on any more work!

Your main street. Construction is very localized, though the data is volatile and prone to updates it looks to have peaked in May 2018 https://fred.stlouisfed.org/graph/?g=o3TE These data are not adjusted for inflation so it is probably flatter.

You could be right. But here in MA things are booming, and will continue for a bit. Painters already not accepting new houses to be painted, plumbers booked a month out, landscapers not taking on new clients. Things are good here….FOR NOW

Sounds just like 2006

Construction is still booming here in LA as well. Lots of highrise apartments, senior centers, etc. A lot of buildings breaking ground this year, and a lot of plans developing on projects further out.

One set of apartments in bidding tile on has units attaching 4 studio apartments (bedroom, shower, toilet) to a shared kitchen. New middle class housing.

The rope connecting the market to the economy got replaced by Bernanke’s rubber band. In all the states where I travel business investment has been strong and construction is brisk. But if the market can lift the economy per Bernanke, then it can hurt the economy also. The wealth effect drug the FED was giving the markets year after year, e.g. ZIRP and QE, has been taken away the past 2 years. That has consequences.

I hear ya. Same here.

The US is the greatest economy in the world, so says the stable genius. The economy is in a good place, so says the man appointed to steer the ship. Question: what kind of genius is he?

Wile E. Coyote – Super Genius ;)

All of economies have been phony for a long time. Thank the CBs and deficit spending for that. But on a relative basis, the US economy is strong. Anyone spending any time examining the job market and wages knows this quite well.

Bernanke’s experiment was to try to make the market lift the economy. The market was lifted with asset inflation while all the free money and QE failed to help the economy, year after year. The FED was actually feeding the dog red meat while the central planners were busy beating the dog and wondering why the dog would not wag his tail. Europe has been stuck in this mode for years.

All economies have been phony for a long time. Thank the CBs for that. But on a relative basis, the US economy is strong. Anyone examining the job market and wages knows this quite well.

Bernanke’s experiment was to try to help the market lift the economy. The market was lifted with asset inflation while all the free money and QE failed to help the economy … year after year. The FED was actually feeding the dog red meat while the central planners were busy beating the dog and wondering why the dog would not wag his tail. Europe has been stuck in this mode for years.

Trump causing some market jitters with the tariff theatre to force the Fed’s hand. QE4 is around the corner – MBS is old news, this one will be USTs and bonds all the way to new Fed balance sheet peaks. Need to be ready for China “weaponising” UST sales, right? $1.2trn can’t scare today’s well-oiled printing presses.

The everything bubble has a lot further to go, certainly till 2020 reelection time..

What “Oops…”?!

I’m waiting (without any skin in the game) to see these fake markets return to reality level, for this one it means bellow 10,000.

But as long as the PONZI SCHEME FUEL (ZIRP/NIRP/QQE) remain availabe, this scoundrel market will keep doing this up’s and down’s just for fun…

Umm…much of this might have everything to do with Powell’s U-turn err, excuse me, L-turn.

By it’s own statements, the Fed is still is monetary easing mode. The Fed has never not been in easing mode for 10 some years.

Why? That should have ended long long ago.

The solution is simple: Someone should tell the Fed fiscal stimulus it the solution. The Fed should sing a single song: Congress and the President should enact robust spending programs that benefit the common folk working people of the U.S.

Agree….. Only they are not, sadly, in place to serve the CWM. They do a Great job for the 1%. Axe told me…

There are no common working people. Grow up. Every cent is Ponzi money, and everyone knows it, and everyone takes it. Dream on.

Really? I suggest you move to a place where people actually work. Who do you think grows your food, or provides the energy resources that you use on a daily basis? Who educates your children?

The Northeast (just guessing, here, at to your location) has stolen the natural wealth of other areas of the country for well over a century, and people there consider themselves ‘smart’ for being able to do it. If you want to prove how great you are at ‘productivity’, I suggest you grow your own food, or wood. Try mining and smelting your own ore. Provide your own water (if you happen to be in California, stop stealing it from the Colorado river). Perhaps you, personally, could do a little work and provide your own means of survival without sucking off the production of others.

Somebody does all that for you, don’t they? And you reward them with scorn.

I dread to see the so-called infrastructure bill coming up. Structured most likely to start at the TOP (you know, those fat government contracts). Another money grab for the rich which has to trickle downward.

Fiscal stimulus? Sure, why not? The nation is sitting on huge surpluses (as is corporate America) the national balance sheet is flush with cash. We should spend some of this bountiful surplus, why be so cautious when we clearly live in an age of boundless prosperity and surplus.

It seems like the the huge stimulus provided by federal, state level etc deficit spending does not help.

History will look back upon this period and ask what were people thinking.Negative interest rates, government bonds yielding throughout the world very low levels despite record deficit and the prospect of huge deficits in the future,stocks priced at levels that implied irrational growth rates and real estate selling at levels that are many multiples of median income.

Stocks,bonds and real estate are priced to yield negative returns for the next 25 years .Those stocks with little Free Cash Flow will go down the most . Look for stocks like NFLX , TSLA and of course UBER ,LYft to go down %90 or more and P/e s on tech stocks to be killed.

Agreed on real estate. It’s so overvalued right now, I would not be surprised to see decades of malaise and find that 20 years from now, prices are back where we are at present in nominal dollars.

I agree with that conclusion if the Fed acts rationally and allows a recession to take hold. That said, there’s a chance the short-sighted Fed would print money to stoke inflation, which would possibly result in hyperinflation. In that event, our overpriced assets could get a lot more overpriced in nominal terms.

A lot depends on how irrational the Fed will be. Ten years ago, who would have thunk the Fed would do three rounds of QE and suppress rates to zero long after the financial crisis ended. Apparently, the Fed is now convinced that any potential recession is a financial crisis. They also believe they have the ability to avoid recession by suppressing rates and printing money. This is complete wreckless policy, of course. The policy is far beyond “risky”, because the term risky implies that results may vary. In the case of money printing, however, there can be only one result in the long run.

To: Bobber

‘if the Fed rationally’

?1

LOL!

When was the last time Fed acted rationally after Volcker?

Fed has been always REACTIVE and never pro active. Fed’s POLICY errors are known legend!

The Sydney Morning Herald reported on June 1: “Carmakers see $25 billion wiped out in a day by Trump’s Mexico threat”

Many autos and auto parts that were sold in the US were manufactured in Mexico. Investors sold global automaker stocks yesterday causing billions in portfolio losses.

Trump’s tariffs on Canadian steel and aluminum were lifted in May after it was learned they hurt US automakers who used these raw materials to produce their products.

Auto production-sales was goosed at cash for clunkers and rescue of GMAC-Ally in 2009-10, it was the quickest way out while the treasury, fed and govt. setup their fix on housing. Ally starting buying deep and forced secondary and captive to do the same helped by rates….

we have sold 130 million plus cars since then….auto sector is long overdue for pullback, actually an excellent time for tariffs…

there are 10000+ trades a day…..why all the doom over a 200 pt drop?

has anyone looked at a chart of U.S. Steel lately? A disaster! But but Trump says we have the greatest economy in the world! Interest rates and basic materials say we’re headed for recession if not already in one.

I have very fond memories of Republic Steel. Working on a ‘general labor’ crew in the summers paid my tuition to one of the most expensive colleges in the nation. But, even more valuable was the opportunity to interact with my workmates (mostly Black) as a person ‘almost’ an equal.

I probably learned at least as much at Republic Steel as I did in a college classroom. Perhaps, more.

Stay the course. China has far more to lose in a trade war than we do. They count on us blinking first.

China will be in chaos if they hold out….if yuan busts down thru .14, trouble they be….

The nature of a selloff is crucial to estimating the duration and depth. Usually a few days of cascading selling culminate in capitulation. However the famous 2000 Nasdaq bear market, driven by Fed policy (the Fed was raising rates at the start, and they started dropping rates early. Sound familiar?) It was the mirror image of a monetary induced bull market, such as the one we have had since December. Money leaked out of the market with no crash in confidence, or fear. This is salient to the problems of Tesla, the SPY is up 100% relative to TSLA since the lows, and various IPOs have gotten hammered.

Interest rates had little to do with the Nasdaq bear market.

The Nasdaq was at 2344 on 12/11/98 and traded at 4914 3/3/2000. During 9/2000 the Nasdaq traded above 4,000 again.

Fed funds traded in a range of %4.75 to %6.00 from late 1994-11/99. They did break slightly above this level when the Fed raised them to top out at %6.5 in 5/2000. From this level Fed Funds were steadily lowered to 1%

Except for the speculative spike in late the fall of ‘99 thru the winter of ‘2000, the vast majority of the Nasdaq decline happened with lower interest rates

I tell my grandson the DOW will be coming back up to the 20,000 mark when he’s my age.

When I look at the S&P, DOW or Nasdaq charts I like to use the 10 year time frame. It really puts the current situation into perspective. Kind of reminds me of a momentum play that goes off the rails — that point was last December and its not over yet.

Shirley Bassey best is not Goldfinger its “never, never, never”, love u NASDAQ, hate u, but can’t live without u :

The COMPQ weekly chart have landed on the March 12/19 2018 gap, and stopped on Mar 11 2019 large green bar, that started the previous thrust. .

COMPQ retraced only 36.6% of the move up from Dec 2018 low to the

new all time high, but that was enough. A new tweet easily created a panic, the panicking mom & pop.

Panic is the best wall street have to accumulate stocks.

The current weekly candle was a big red on tiny volume : anomaly

Panic sent TLT up in a vertical move, and the WTIC in an inverse vertical.

So, the DoJ supposedly opening an antitrust investigation on GOOG should be good for FANGMAN?

Microsoft is trading at 28x free cash flow. That’s a nice premium (perhaps too nice) for a company that may be too big to grow. Also, politicians and the DOJ are starting to scrutinize big tech through an anti-trust lense. Some politicians have sponsored bills that would prevent large companies from making acquisitions, which have allowed big tech to grow.

Some politicians may sponsor a few bills, but banks and corporations are HANDS OFF in DC. Politicians also blubber about tech abusing people’s personal info, but as you can see, nothing has been done. It will always be paid-off blubber.

SOOO, will politicians get a head start on upcoming Artificial Intelligence application into our lives?? What do you think? Look out.

The FED should do this, the FED should do that, ditto BoE, BoJ, ECB etc. None of it makes any real difference in the long run, other than inflating fiat to oblivion. If you think that it’s all going to come right in the near, or far, future then think again – it isn’t. The real economy, the one that counts, is the 99% – not the 1%, not the stock markets. Further more, most of the 99% are beginning to realise this simple truth. As I’ve said before – the revolution will not be centralised.

I see so much anxieties, hopium and wishful thinking, here! Wonder how many of you have under gone, with your personal money at risk ,during 1987, 1998, 2000 and 2008? Been in the mkt since ’82.

I read recently that about nearly 15 Million advisers, money mangers/hedge funds and investors have NEVER gone through a prolonged secular mkt like in 1964 to 1982. The bear mkt of 2009 was short about 18 months )peal to trough).

Fed had NEVER bought MBSs in their entire history! QEs have no back ground research or record. Neither the economy under ZRP/NRP by history!

Fed/CBers employed both of these in creating insane credit infusion since March of ’09! Besides there was twist.stimulus and suspension of Mkt to Mkt accounting std! The Fed’s balance sheet went under 1 trillion to nearly 5 trillions. National debt now is close to 22T and growing! The levels of DEBT (private/public) of any and all kinds are at record, GLOBALLY, unlike in 2008. This level of DEBT is unprecedented in human history!

After all the above unusual measures and after 10 yrs, we are back looking at the ‘weak’ recovery! Some think GREAT recession never ended!

Their experiment to ban the ‘business’ cycles with CREDIT cycles has FAILED, miserably! Remember these are the very folks who brought already 2 boom-bust cycles in this century. The fate of this largest, 3rd everything bubble will meet the same fate!

‘Those who cannot remember the past are condemned to repeat it’

George Santayana

1) China, in the last 30Y, exported deflation, destroying our middle class.

A trade war will lead to devaluation, the $USDRMB will jump and we will cont to benefit from cheaper goods, the gift of deflation.

Tweets, in pulse modulation, are everybody nightmares. They scare mfg, force them to produce goods in US & PR, few other countries nearby, even by those who hate us the most, if there will be a change of character.

2) Equities traders are using standard tools like osc and moving averages They are victims of market makers who ignite the wrong signals, forcing them to go the wrong way. .

3) Bond traders go nuts after drinking poisonous saltwater.

Equipped with an outdated knowledge, they come to the wrong conclusions about the modern economy.

4) Energy ETF : SPX ratio is at nadir, at the lowest point in the last 20 years. That will trigger an alarm bell to billions of people in China, India, ASEAN region and Africa, ==> resources are limited, the path to prosperity is closing in and a stealthy inflation will deprive most of them, denying them of their dreams.

I like your analysis, Michael….

One open question, however, involves your definition of ‘prosperity’.

Go re-read Shakespear’s ‘Tempest’. Was Prosper actually happy? In the end, of course, it ‘worked out all right’, but only after a rather unlikely ‘Deus ex Machina’ twist.

Remember Andrew Carnegie? He said, ‘The man who dies…rich, dies disgraced”.

Considerable overlooked downside risk for FANGMAN

Here is a possible considerable downside risk to FANGMANs that I don’t think is being discussed enough: A large part of FANGMAN revenues comes from cloud software businesses that became public in the last 2-3 years – some examples of big $s that these companies spend: w/ Google and Facebook (ad revenue), w/ Microsoft/Azure and Amazon/AWS (cloud infrastructure), w/ Apple and Nvidia (hardware).

The big problem with these cloud software businesses is that most are losing money and have sky high valuations. The main reason for these valuations is the blind belief of growth investors that as long as revenues keep growing there are no downside risks for the these companies’ stock prices, regardless if these companies are profitable or not.

Let’s take as an example OKTA which reported Q1 earnings this week: revenue for the most recent quarter increased by about 8% from 115M to 125M. The company already trades at more than 30 times annual revenues but investors still rewarded that performance handsomely by a nice pop in the stock price of +6% on Friday. The problem is that this revenue increase came with an even higher increase in losses: 67% from 31M to 52M. Ok, let’s still say that OKTA deserves the valuation because its revenues are still growing. But let’s do the following projections using this latest growth trend:

– say the company eventually becomes profitable and once it becomes a mature company (where most of its growth will be behind it) it will be valued at a still generous 25 PE ratio. At the current 12.7B valuation, this would mean a quarterly net income of 127M

– assume that once it reaches this level of net income it does it with a net profit margin of 20% (a pretty generous assumption too) – that means a quarterly revenue of 5 x 127M = 635M.

At a 8% Quarter-over-Quarter revenue increase it would take over 20 quarters to increase the revenue from 127M to 635M. So an investor buying the stock @ today’s price could potentially see no profit for over 5 YEARS (these growth companies usually pay no dividends either) just to get to a some more normal valuation level! And this assumes there will be no recessions for 5 years (when these best of times 8% growth rates will likely not be there) and that the company could actually become as profitable as reflected in these assumptions. Very very high hopes!

Here is a list of just some other companies in a similar situation (roughly the same industry, money losing and price-to-sales from 5 to 60): NOW, WDAY, SHOP, MDB, ESTC, PD, ZM, SMAR, PINS, JMIA, PVTL, SWI, Z, CLDR. With an investment window target of 1-2 years, it is entirely possible that one would just need to randomly pick from this list any stock and he/she could make a very nice profit if opening a short position.

I actually happen to work with/use the services/products of many of these companies and I think they are wonderful. That still does not justify in my mind their company valuations. Unless Trump manages to force the FED’s hand into significant rate cuts/new large rounds of QE, soon, the upcoming liquidity constraints will leave these stocks very vulnerable. Some would likely suffer big losses while others will merge with other companies or might be acquired.

The total market cap for just the companies in the list is >150B. Add to that the UBER, LYFT, TLRY, BYND of the world, the upcoming new large IPOs (WeWork, AirBnb, Slack) and scores of other money-losing startups and you have a considerable chunk of customers for FANGMANs. Any considerable slowdown in these businesses will spell BIG trouble for FANGMANs and the larger market in general.

ON the SPOT!

Wonderful Products/services of these companies but valuations are beyond realistic and susceptible for big slides! Thanks for the list for potential shorts!

Very well written. Dave Kranzler has many of these stocks on his radar. Thanks…

This is a temporary dip isn’t it? I am sure the powers that be will drive it back up so it should be a good time to buy because that’s been my tactic so far

It’s already in crazy mode so everything doesn’t have to make sense

You’re right: I thought that a 6% pop for a $1 in new revenue earned /w $2 of new losses was crazy (OKTA’s example). It can get even crazier though.

If I was to short individual stocks like these I would make sure I have enough staying power to get through potentially even more episodes of craziness. At this point though, I don’t think they will last much longer.

I would watch for the first earnings report where revenues significantly miss growth estimates or stagnate/decline. You could see then large drops, fast.

A miss in forward guidance is equally enough of a catalyst for large price decreases: today, after a 3% drop during trading hours BOX shed another 11% in after-hours trading due to missed expectations on forward guidance, although analysts thought it did OK on the revenue increase for the quarter. Forgot to add it together with DBX to the list above.

On 5/4 PVTL gave poor guidance after closing: next day, stock price opened >40% lower and stayed like that. Today CLDR missed estimates on revenue and forward guidance – price knocked down in after-hours trading: 31%.

One does not even have a chance to catch a breath and sell before the deluge.

Hilarious today that Facebook, Amazon, Google stocks were all totally whacked 4-7% today (so far) by reports of possible DOJ antitrust probe. Must be some fire under the smoke for the stocks to react that hard on no real news??

Apple also in that basket but stock response much more sanguine. The Ns in FANGMAN only down 1%. MSFT off 2.5% on no real news – are they in antitrust limbo now too? Or is the dual-screen Surface such a dud?