“It is their interaction with froth that matters most. How much a housing market adjusts depends on how much froth there is”: Poloz

Across Greater Vancouver, British Columbia, sales of all types of homes so far this year through April plunged to 6,212 homes, the lowest count since 1986, as the market is freezing up.

The condo quagmire.

In the city of Vancouver, condo sales – the largest segment of the market – plunged 30% in April from April last year, to merely 348 condos, the lowest since 2001, even as inventory for sale jumped by 75% to 2,191 condos. At the current rate of sales, supply soared by 168% year-over-year to 6.4 months.

And prices are descending at speeding-ticket velocities:

- Average price: -19% year-over-year to C$786,981

- Median price: -17% year-over-year to C$651,000

- Average price per square foot: -14% yoy to $940.

“Buyers have become increasingly hesitant, particularly for unbuilt product such as pre-sale condo assignments and new unfinished development in general, says Steve Saretsky, a Vancouver Realtor and author behind Vancity Condo Guide, in his April report. “This is prompting condo developers to increase bonuses and incentives as unsold inventory begins to pile up at presale centers across the lower mainland.”

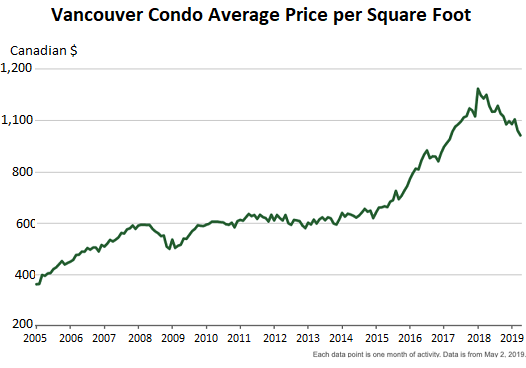

The average price per square foot – historically “a very consistent and reliable price metric with much less volatility,” Saretsky says – has now dropped 16% from the peak in January 2018:

Detached Houses:

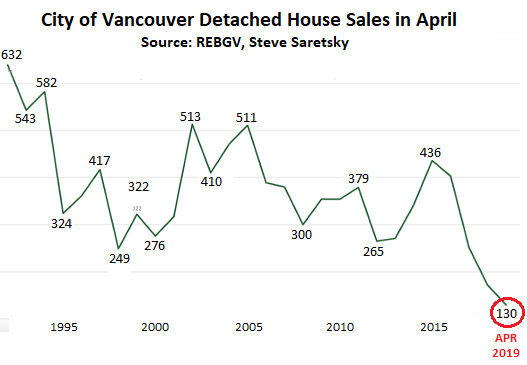

Sales of detached houses in the city of Vancouver dropped to 130 houses, the worst April in decades, down 69% from 2015. The chart below shows the number of sales for each April going back to the 1990s – a sign the market has frozen up, that buyers are unwilling to get anywhere near sellers’ aspirational asking prices, and deals are not happening:

Inventory of detached houses in the city of Vancouver, at 1,616, represents 12.7 months’ supply. But the inventory was down 3% from a year ago, as potential sellers, hoping for a miracle apparently, are trying to out-wait the market.

The year-over-year price declines of detached houses vary by area. To give a broader view: In Greater Vancouver, the Home Price Index of the Real Estate Board of Greater Vancouver has dropped in every one of the 22 areas the REBGV lists, with 12 areas booking double-digit declines. Holding up the best was the lower end, Bowen Island, with a year-over-year decline in the HPI of 0.2% (to C$990,88). In West Vancouver, near the high end, the HPI dropped 15.7% (to C$2.57 million).

So with housing turmoil hitting Vancouver, Bank of Canada Governor Stephen Poloz in a speech today addressed “froth” in the markets, what caused it in the first place, and what is now causing that “froth” finally to come off:

Our research shows that the big rise and fall in housing resale activity in British Columbia and Ontario can mostly be explained by shifts in house price expectations.

When house prices are rising rapidly, people tend to extrapolate that experience and buy houses early to avoid further price increases, or to profit from them if they are speculators. In other words, markets become frothy.

However, when those price expectations are revised down, demand for houses can cool suddenly. And this is what has happened. The trigger could be anything, including new taxes on foreign buyers, stricter mortgage guidelines, rising interest rates, or simply that rising prices create an affordability roadblock for more and more people.

What we take from this is that it is not higher interest rates and changes to mortgage lending guidelines that have had the greatest effect on housing demand. Rather, it is their interaction with froth that matters most. How much a housing market adjusts depends on how much froth there is.

Supporting this conclusion is the fact that many other markets across the country look quite healthy. Resale activity has been solid in places as diverse as Halifax, Moncton, Montréal, Ottawa and, more recently, right here in Winnipeg.

So the surgical operation of removing that froth from the market appears to be going well. Too bad for the folks that bought into this froth over the past few years, misled by their own “house price expectations” and all the deafening media hype in past years about the forever-surging home prices.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Don’t it always seem to go, that you don’t know* that there’s froth till its gone

They unpaved all the malls, and put up a condo block

* If you work for a central bank at least

Don’t quit your day job my friend.

You win all the internets.

16% loss × (9 x income) or 40:1 leverage = I was the greater fool

But…get on the property ladder or be priced out forever!

Stephen Poloz demonstrates a firm grasp of the obvious with his opening statement”…Our research shows that the big rise and fall in housing resale activity in British Columbia and Ontario can mostly be explained by shifts in house price expectations….”.

One hopes this was not a recent insight for Stephen.

LOL

Central bankers are great when predicting the past. Now, how about some economic forecast when this housing bubble deflates.

Anecdotal evidence is that there is mismatch in price expectations. That will come slowly when the economy is allowed to deflate, and unemployment kicks in.

No one could have seen this coming

/S

“What we take from this is that it is not higher interest rates and changes to mortgage lending guidelines that have had the greatest effect on housing demand.”

I dare Mr Poloz to raise interest rates by, say, 2% overnight and see what happens to real estate transactions in the “frothiest” markets in Canada. I bet a shiny sixpence the froth would evaporate in a couple of months.

Or to see what happened in Australia after the Financial Services Royal Commission uncovered widespread misconduct in mortgage and loan origination procedures and gave all parties involved the mildest slap on the wrist.

I honestly don’t know where we find these modern central bank types but they probably have their offices right next to the Ministry of Silly Walks.

2% overnight, gas light much? The interest rate increases have been in .25% increments spread over many years and have not been touched this year, yet housing still hasn’t leveled off in the “frothy” markets. He answers the core of the issue after that statement, too many people were priced out of the market.

This is about Canada, not the US. Unless of course Vancouver has been invaded and annexed last night. ;-)

Mr Poloz has long warned about “extreme real estate valuations” (I think those were the exact words he used) in several Canadian markets, such as Vancouver, Montreal and Toronto, but in doing so he has looked like the father who sternly warns his children about the evils of smoking while puffing a big cigar.

Without the Bank of Canada (which Mr Polz heads) keeping monetary policies extraordinarily loose and not exactly keeping a sharp eye on the mortgage sector, I am ready to bet my shiny sixpence the surge in real estate valuations would have not become so extreme so quickly. Excessive enthusiasm may provide the matches, but for having a bonfire you need the fuel as well.

At any moment Mr Poloz could have put his foot down, for example by openly recommending banks regulated by the BOC to adopt stricter mortgage origination criteria or raising the issue with the parliament in Ottawa. Had politics got in the way, he could have simply handed in his resignation letter and washed his hands of the matter. That’s what two former Reserve Bank of India chairmen did after clashing with the Modi government.

Instead he chose to talk and do nothing. Now he’ll have to watch all the real estate bubbles he helped inflate burst one by one but, remember, that’s not his fault.

Victory has many fathers, but defeat is always a waif.

After the GFC, the BOC dropped their interest rates lock-step with the US. However, Canada did not have the same housing/banking crisis as the US did. There was no need to drop the rates as low as they did, other than to keep the $CAN low. This drop in interest rates caused housing to soar, as you better believe that banks get their pound of flesh however they can. So instead of a house worth $250k at 6% interest, we have houses worth $700k at 3% interest. It wasn’t housing expectations that caused houses to soar, it was low interest rates, and Poloz is lying if he says anything else.

If markets go up primarily because of all-cash purchasers by foreign buyers and climb well beyond the means of the locals who happen to live and work there, then mortgage rates won’t play much of a role in the market direction once that foreign demand dries up.

The only thing lower mortgage rates could do is to increase the amount that ordinary folks can lever up to pay for these things … prices still need to drop before the most highly levered median workers can purchase anything.

I wish our central banker could be open enough to say that falling home prices isn’t necessarily a bad thing. That would scare the investors too much though :-)

“When house prices are rising rapidly,”

I guess analyzing the reasons for that rapid rise are beyond the scope of his thinking.

“…beyond the scope of his thinking”

No. His speech was a prelude to a study the BOC will release shortly that looks into what caused the “froth” — he already said froth is caused by rising “house price expectations” — in other words, the hype that drives markets up, which is true. Once that type of hype sets in, it is self-propagating until it implodes. But that study will dive deeper into it.

He is on record, including on my site, of having warned people, back when home prices were still spiking, about deflating home prices and losing money on speculative housing bets. He has been trying to tamp down on this bubble for a while, and it’s working.

I think everyone including Poloz gets that lowering interest rates and leaving them there would create a bubble in housing prices. Human psychology follows the trend until it ends. Clearly without his dovish policies the bubble would never have happened.

We’ll see what happens when all of those condos being built start to close:

* Can investors find/qualify for mortgages?

* What mortgage rates do they pay? (if second or third home, rates can be over 10%)

* How many investors are locals or Canadians with assets in Canada that can be seized to pay for expensive condos?

* How many investors are foreigners or Canadians with very little assets in Canada? How easy is it for Canada to get those assets to pay for newly built condo?

* How many resale buyers are left in the Vancouver housing market?

* How long can investors keep condos empty before vacancy tax eats away at potential profit?

* How low will rent go when the new supply of condos hits the market?

* How many months does it take for novice landlords to say they’ve had enough and can’t stand the negative cash flow anymore and are willing to sell their investment condos at a loss?

So many questions, to be answered over the next 24 months.

You forgot the black swan event, the Canadian government or Chinese government can simply take possession all the houses bought with laundered money in Canada.

The Canadian government doesn’t care about money laundering or fraud until after markets have imploded. In the last financial crash, they didn’t work on the Asset Back Commercial Paper reforms until a couple of years after investors lost most of their money.

https://business.financialpost.com/news/fp-street/abcp-investors-to-get-settlement-money-this-month-osc

The bigger problem for banks and regulators is the ripple effect from defaulting mortgages, many speculative properties have several mortgages on them from novice syndicated mortgage investors.

If one mortgage defaults then all mortgages are in default as shown with the following court decision from the Greater Toronto Area:

https://twitter.com/ExtraGuac4Me/status/1096230682190176256

Creditors may not be able to sell the home for the value of the mortgages as was the case for 1153 Eyremount Drive in Vancouver:

https://twitter.com/mortimer_1/status/1122222916748210176

It starts with froth. Will get down to bone soon enough. The key to bubbles is to stop them before its too late.

My boss at work put his house on the market in Taunton, Ma. Sold first day on market am much higher price he paid for it 3 years ago. He’s got his first child and family is near New Bedford area. Since they do all the child care during the when he and his wife works, he wants to relocate closer to them.

If CS’s data is right, it’s old data. Maybe the Fed U-turn changed it all and CS is looking at stale treads in some areas, but I see no indication of real estate priced decline in my neck of the woods in the Boston area.

It’s still the first innings of the bust. The east coast is a year behind…do t worry it’s coming. Save your commissions lol

It might be coming, but I doubt with the current super duper easy Fed policies.

Remember by the Fed’s own statements, it is currently in substantial easing mode (below 3%) and is this massive monetary expansion as we speak it’s record shattering massive monetary expansion.

Ergo, assets are rising. They will probably continue to rise unless the Fed changes it’s easing stance.

Yes, your one anecdote discounts all of the other data coming out to the contrary. Boston is hanging on… for now. Every region will get hit at different times.

If you got the timing right you could buy in Vancouver in 2016 and sell for a huge profit. One bought for 2.1 M sold in 2017 for 3.1.

Then the crash hit in late 2018.

Flippers don’t have 3 year time lines. The market turns on dime when this full of froth. If you can sell for the price of three years ago yr market isn’t frothy OR the market hasn’t turned yet. But in Van houses were trading like stocks. You might as well talk about ten years ago as three.

Speaking of froth, I’m going to defend Poloz. For a banker, he’s telling it like it is: and he uses the word too.

Why are prices crashing? Because they were over priced.

I wonder how big the effect will be when flippers leave the market. They have to be out quick when prices start falling because when they start losing money they are out of business pronto

Good news story. Hopefully, these ‘frothy’ markets will join the real world. It is just a year or two ago that I watched boo hoo stories on Global news (YVR) about new buyers rushing ‘to get in’ to the market, removing inspection riders from sales agreements in order to jump the line, then having the gall to whine for all the public to see about how they were hoodwinked by the sellers and RE agents. They were paying plus 1 million for crap shacks, including dangerous electrical service, rot, etc. Really?

The price and sales drops aren’t hitting the Island, yet. Although, a few properties have dropped in asking price where I live. Prices are still too high, and so are expectations, imho. These lowered prices simply reflect the desire of sellers to leave and move on, and not because they have to. They own their places free and clear and are retired.

What I have been seeing is the stark divide between those who are okay and established in RE, and those who rent and can’t even afford that. And this situation, is in an affordable area. Rents for rural shacks are often $1,000+. We have a neighbour who has little income/money and cannot afford their rent anymore. They have just bought a used travel trailer and are happy to relocate to my son’s property who will make an rv pad up for them including service hookups. They will be another set of eyes around the place which will offset the worry of tool theft, etc. (large tool storage building). The price for pads around here? $500 per month. If you look carefully you will see RVs everywhere these days; behind stores, houses, in trailer courts, etc. It is a new reality. Winter? Just buy a few more ceramic heaters and watch the meter spin.

What really chokes me are some of the new RE agents. I see kids, who have never held a real job, working with their RE dad and advertise with their Personal RE Corporation moniker. Criminal, imho. Criminal. They’ll lead some of these new buyers right into the slaughterhouse and think they’re doing God’s work.

Thanks Paulo – Great Incisive Post!

I agree – multiple markets.

Established Owners (Mah and Pawh, bought the house 38 years ago.. or similar..)

They have massive equity, no immediacy and time time time, on their hands ( for now).

Those with Equity take a very different view to the marketplace

Newer Money. First time Buyers, late cycle Buyers – they can be under a lot of pressure…

As for Speckers, churn and burners, flippers, whashers..

Well.. whole different ball game. An operator who is using RE to launder money and has big backers, may be able to sit it out for a while

Jimmy, who borrowed Mom and Dad’s Retirement money to make some “smart money” mmmm Not So Much…

I too, hate it, when I see people who end up having to pay for poor personal or business decisions, start whining for Bail Outs, or start the finger pointing..

In all – It’s called a Marketplace for a reason children..

Many offers, many sellers or buyers, and choices with consequences attached.

Let the games begin.

From the Doobie Brothers: “what a fool believes he sees, no wise man has the power to reason away”. When “facts , logic and good sense ultimately prevail, it will be tough to watch the aftermath. Incredible what a speculative appetite has been unleashed all over this world. Then we have the apparent disaster in the making that Wolf has been diligently reporting about Australia. I have a feeling others, including the good ole US of A will follow to some extent. Prices here in Portland, OR are nuts. The “greater fool theory” can only go so far. We will stay tuned.

There’s nothing subtle about this data. The transactions have ground to a halt – in April no less.

Today’s buyer would be like the inattentive wildebeast eating grass alone after the pack has moved on.

The trigger could be the carbon tax in both British Columbia and in Ontario or if the crooks and criminals finally let the U.S. stock market crash. As they say it looks like the Chinaman has left the building so to speak in Vancouver. Local salaries are only $39,000 Canadian a year. If they get rid of the stress test southern Ontario (the golden horseshoe) will rapidly rise in price while the greater Vancouver area will continue to fall.

B.C. Carbon tax was implemented in 2008. It caused the last global recession. Not this one.

Start of a 15+ year downtrend, now all the speculators have disappeared and it’s back to ‘normal’ buyers whose ‘FOMO’ has subsided?

The Japanese precedent certainly suggests so.

No-one in their right mind buys at these ludicrous valuations when they know they’ll be able to save a whole chunk by waiting 6 months…12 months…18 months…

Thus is the nature of all bursting asset bubbles.

It’s nowhere near a crash when prices have tripled in the last 15 years. Median price of C$651,000 for a condo is still ridiculous. Wake me up when this lunacy tumbles another 30%.

As the housing market contracts they will be raising real estate and other taxes to make up the shortfalls. This will further depress prices. It’s a race to the bottom until people can afford to buy again. Or maybe Warren Buffet will save the day and buy up all the empty homes.

Indeed. Is it a coincidence Vancouver now has new taxes attached to R/E? Or howabout Vancouver’s gas price, roughly 40% of which is taxes, is the highest in North America.

Yes, surely these and more are just a coincidence.

so froth may be the result of supply, demand and perhaps a bit of futures guess work running inside a financialized system, (you knew it was your fault) that could be addressed by lengthening mortgages and sharing the risk of ‘our’ bad loan decisions with your pensions. tune in next week when we learn from a chamber of commerce somewhere that irrational exuberance can simply be replaced with a strong economy.

So I’m doing my lunchtime interest reading…Yahoo Finance doesn’t list anything stock prices or indexes, just lines showing nothing.

Did the powers that be declare an emergency because stocks aren’t allowed to go down? Like they do in China sometimes?

The Fed better do something. Cut interest rates or QE, whatever. And buy stocks and corporate bonds like other governments. Suspending trading because stocks go down fits perfectly into their liquidity standard, no?

Everyone know the markets are the economy and the nation and world.

Dosomethingdosometingdosomething, Mr Fed.

With all the tools that any central bank has but doesn’t use properly it is so ironic that they pontificate about froth and expectations and exuberance etc. All they had to do was enforce the rule of a 25% deposit in cash (not a borrowing from another bank), an income coverage rule of 30% max on mortgage payments, and an amortization period of max 20 years. Surprise suprise surprise… just remember when mortgage banking really was mortgage banking in the mid 50’s. Not that long ago.

I’ve never been to Vancouver so I guess I’m missing the scale. 3700 condos+SFR seems really low for a mid-sized city? I’m assuming these numbers are for the city proper, so once the metro area is included, things will probably make more sense. But it still seems really low for a population of 675K?

It’s not the size of population, it’s the income level of the population. There aren’t enough top tier wage earners in that city to keep that market flowing.

‘By the end of the second world war Canada had the world’s fourth largest air force, and fifth largest navy.’

To me this is a pretty good metric how significant the Canadian housing market will play out in the years to come.

Come on guys, socaljim is SEEING something different. His anecdotes > data.

Where is the real analysis of how money laundering in Canada is rampant, and how successive governments have ignored it.

This article does an excellent job of explaining how even a small amount of money laundering can have an exponential effect on real estate prices:

https://wolfstreet.com/2019/04/24/how-a-little-money-laundering-can-have-a-big-impact-on-real-estate-prices/

Then go google “money laundering Vancouver” and see all of the articles about the information that is being dug up on how there has been a ridiculous amount of laundering from drug money, money from gang related activities, and money from China (attempting to get currency out of the country). It’s unbelievable….except it’s true.

Bankers, real estate agents, developers, government officials- none of them want to talk about this. But that’s because they were all complicit.

It’s the biggest scandal in B.C.’s recent history, and yet only the journalists seem to want to discuss this. All those who’ve been complicit want to deflect and blame it on a bunch of other things.

It’s criminal.

Vancouver sat on a wall, Vancouver had a great fall:

Average price: -19% year-over-year to C$786,981

Median price: -17% year-over-year to C$651,000

Average price per square foot: -14% yoy to $940.

All the bitcoin, casino and laundered money coming into the city couldn’t put Vancouver’s housing bubble together again.

I would love to rehash the hundreds of posts of all the people who have defended, propagated and worshiped this particular housing bubble over the last decade.

Just a question for Wolf about a topic that just came to my attention this week. Mortgage foreclosures and auto loan delinquency numbers have been going up over the last 6 months in the lower priced markets. At which % did the market turn south of the border? The number is less than 1% in Canada which seems small but it hasn’t been this high since 1992, not sure if it should be a concern or not.