More and more companies either choose not to invest in other countries or are prevented from doing so.

By Don Quijones, Spain, UK, & Mexico, editor at WOLF STREET.

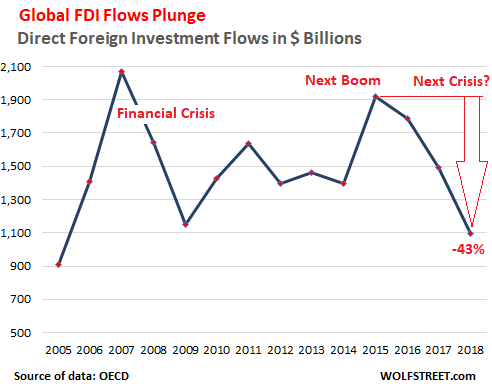

Global foreign direct investment flows plunged by another 27% in 2018 — after having already plunged 16% in 2017 — to just $1.1 trillion, the equivalent of 1.3% of global GDP, the lowest ratio since 1999, according to new data released by the OECD. It was the third consecutive annual plunge in global FDI flows, as more and more companies either choose not to invest in businesses or assets in other countries or are prevented from doing so.

At the peak in 2015, before the trade wars began, before the Brexit vote happened, and before China began cracking down on the capital outflows that had fueled big-ticket purchases of strategic companies across the globe as well as surging asset prices in multiple jurisdictions, global FDI flows totaled $1.92 trillion and represented around 2.5% of global GDP. FDI has since collapsed by 43%.

The OECD apportions much of the blame for the latest fall in FDI flows on the US tax reform in 2017, which prompted many US companies to repatriate large amounts of earnings held with foreign affiliates in countries such as Ireland and Switzerland, which both suffered a massive reduction in inward foreign investment last year.

The U.S. is traditionally the world’s biggest source of FDI, but last year it recorded negative outflows for the first time since 2005, as the movement of funds from U.S. investors into global businesses and assets reversed and flowed back toward the U.S., at least on paper. The total sum of outflows last year was -$48 billion, compared to $316 billion in 2017.

The negative outflows were concentrated in the first half of 2018, due to the immediate impact of the US tax cuts. By the second half of the year, the U.S. had returned to its position as the major source of FDI worldwide.

There were also widespread falls from 21 (out of 36) other OECD countries, in particular the United Kingdom, Luxembourg, Canada, Germany, Belgium, Japan, Korea, Denmark and Austria.

A concurrent sharp decline in FDI outflows from China for the second consecutive year made matters even worse, particularly in Europe and North America where total Chinese investment plummeted by 73%, from $111 billion in 2017 to $30 billion in 2018.

Chinese direct investment in U.S. assets collapsed to $4.8 billion in 2018, the lowest level in seven years and down 90% from the $46 billion invested in 2016. This was a result of a variety of factors including the ongoing trade war, stricter Chinese control over capital outflows, and greater US government scrutiny of Chinese acquisitions of American assets.

The country that received the most Chinese foreign direct investment in 2018 was the UK, though the amount of funds it received — $4.9 billion — was down 71% from the $17 billion it received in 2017. The fall was largely due to the absence of any mega-M&A deals, such as China Investment Corporation’s $14 billion purchase of the London-based warehouse company Logicor in 2017.

Total foreign direct investment into the UK plunged by over a third last year, to $64 billion, down from just over $100 billion in 2017. The latest OECD data provides further evidence of the heavy toll that protracted economic and political uncertainty is having on investment appetite in the UK, both among domestic and overseas investors. Investment fell quarter on quarter all through last year for the first time since the financial crisis of 2008-09, according to the Office for National Statistics. Fresh inward investment in the UK’s all-important automotive sector plunged 47% to just £589 million in 2018.

For the UK economy there was still some good news, as the British government was desperate to point out. Even after the recent drop in inward investment, the UK remains one of the world’s top five recipients of FDI inflows, together with the U.S., China, the Netherlands — which claimed the top spot in Europe with $70 billion of inward FDI — and Brazil.

Many European companies have put all non-essential UK commitments on hold, at least until the thick fog of uncertainty shrouding the UK’s political and regulatory future lifts. The EU’s recent decision, at the UK government’s behest, to extend the Brexit deadline to October 31, rather than providing much-needed clarity, have sown yet more confusion and uncertainty. And that’s the last thing businesses need.

That being said, the UK was not the only European OECD member to suffer a sharp decline in inward foreign investment last year. Germany’s FDI inflows plunged by 67% between 2017 and 2018, from €33 billion to just $11 billion. The German government’s decision to introduce tighter controls on foreign investment at the end of last year may well deepen this trend.

Thirteen other OECD countries, including Norway, Switzerland and Ireland, recorded decreased inflows while economies such as Spain, Belgium, Australia, the Netherlands, Canada and France received higher levels of inward investment. The EU as a whole received 20% less inward foreign direct investment from all other countries in 2018 while the U.S registered 10% less. By Don Quijones.

February was bad for London’s housing market. And the weakness is now spreading out from London. Read… London Home Prices Had Biggest Monthly Drop Since Lehman

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

As long as net net the investment goes somewhere then the global economy should be okay. What is the impact on employment, the US job market is hot, is it heading for a sharp cool down?

the REPATRIATION of foreign funds is funny

Apple held most of its $100,000,000,000 in u.s. treasuries held by foreign company they setup

so they SOLD u.s. treasuries(see spike in rates around time) and ‘brought it home’ to pay HUGE FAT DIVIDENDS to 1% shareholders

“businesses or assets in other countries or are prevented from doing so.”

Hmm, and all this time I was under the impression outsourcing was being taxpayer subsidized in numerous ways…. I recall them informing us of this plan a few decades ago.

BTW, now I’m hearing that importation of fentanyl has been taxpayer funded as well.

Will the real terrorists please stand up! Sure seems like we’ve been under attack from the inside.

‘Zactly! U.S. banks launder cartel drug money and the biggest violator is the Fed. Reserve.

Majority of banks are increasingly hoarding right now… Look in the US at the EFF-IOER debacle going on, Hong Kong Interbank up big, India as well. Everywhere liquidity is tightening, fear has gripped World Banking.

It’s that time of the cycle… You don’t know who is exposed to what due to massive rise in Shadow Banking this past cycle, it’s no longer about Interest rates at this point, it’s about capital preservation. Europe inflow decline, well Europeans can thank the ECB. I don’t understand, everybody clearly knows ECB ruined Euro’s banking sector and entire bond sector, yet they double down on the destruction of their Continent, and aren’t even trying to change course

Other contributors to FDI friction:

o EU is not as capitalist as USA (which also does silly things); EU has always had a meta-believe-in-the-tooth-fairy approach. Look what happened to Greece – GDP down 35% in 8 years (as intense as the US Great Depression), and Italy wants to follow suit…adios muchachos!

o Some companies venturing outside home territory stumble into amazingly obvious bear-traps in foreign lands: VW (diesel-gate), EU banks (huge US fines), tech companies (huge EU fines)

o EU is working overtime to figure out how to tax US tech giants (this is actually funny as the US becomes a moderate tax haven)

o EU labor laws are stunningly restrictive and expensive, especially the closer you you get to the Mediterranean (firings, layoffs, terminations, right-sizing, down-sizing, outsourcing are all 4-letter words in the EU)

o At least the above factors involved “friendly” governments; then you have the long-standing, continued & on-going theft of intellectual property by China

Ricardo’s “comparative advantage” makes compelling reading until you bump into the part where displaced workers are somehow supposed to lateral arabesque into productively working in higher value-add jobs as their legacy jobs sail off to Timbuktoo.

ECB owns around 40-45 % of Europe’s National Debts, which they can’t sell or even stop buying without creating havoc… There’s barely any bids at the rates they set, Europe can’t go back to free markets similar to Japan.

Japan is one country tho and running surpluses, so it can work more or less… Europe has a one size fits all for so many different economies, it doesn’t make sense… On top of that they destroyed free market in their bond markets, what happens going forward for Europe ? Not Pretty, and yet every article hails Draghi as some genius, while reality is far from that. I think at some point when the economic pains becomes too big, banks start failing too often and socialists sweep Elections across Europe, they will fix the debacle they created in Bond Markets. Get rates on deposits in the positives not negatives and get refinance rates at least at 3 %

Just More Fundamentals

Credit card defaults have surged most, since the Great Financial Crises (GFC) of 08. The number of loans 30 days past due, has jumped at all seven of the largest US card issuers.

The IMF has cut it’s global growth outlook to the lowest pace since the GFC of 08.

Citigroup has advised it’s clients to wind down exposure to risky assets and prepare for a storm.

A broad downturn in manufacturing has occurred, which portends higher levels of unemployment and reduced tax receipts.

The non-financial corporate debt of $6.2 trillion is now approaching 50% of the US GDP, which is a new record high.

The producers of our food are coming under increasingly onerous financial pressure, with ever lower commodity prices and related to tariffs/sanctions, higher oil prices, or weather related floods. The nations farmers are experiencing very tough times with no relief in sight.

Mother Hubbard’s Cupboard

The time draws ever nearer when the markets will be searching frantically for physical collateral.

Only to find that paper far exceeds the underlying collateral for actual tangibles.

Insufficient credit creation to sustain inflated paper claims.

Crash.

Ambrose Bierce:

=> As long as net net the investment goes somewhere then the global economy should be okay.

Unless the investment fails, or the money goes into stock buybacks, or the money simply inflates management bonuses, or . . .

Mean Chicken:

=> Hmm, and all this time I was under the impression outsourcing was being taxpayer subsidized in numerous ways

Every president has supported outsourcing since it started ramping up all those many years ago, for example, tax subsidies and economic development grants, in return for ‘campaign contributions’ and a draft pick to be named later. Search keywords: ‘outsourcing subsidized’.

Lemko:

=> Majority of banks are increasingly hoarding right now… it’s about capital preservation

Unfortunately for banks, hoarding is not a successful capital preservation strategy, but it is better than making bad loans.

=> Everywhere liquidity is tightening, fear has gripped World Banking.

They should have realised that screwing people would make it harder for them to qualify for loans.

OutLookingIn:

=> Citigroup has advised it’s clients to wind down exposure to risky assets and prepare for a storm.

Their clients should take that as a signal to sell Citigroup. Also to be prepared to spend a lot of time on the phone cancelling Citi credit cards that they never signed up for.

=> that paper far exceeds the underlying collateral for actual tangibles.

The ratings agencies said it was okay, but you know how they are.

Not sure I understand what the OECD is actually measuring and whether the metric tracks the rhetoric here.

What really is “FDI” or “Foreign Direct Investment”?

Is it really “investment”? Someone spending money to buy an existing company isn’t actually “investing”. That’s just a change of ownership. If Chinese company buys US company, US company spends money to buy UK company, and UK company spends the money to buy a Chinese company, that would appear to generate a lot of “FDI” but really it’s just shell games.

Is it really “Foreign”? Suppose a Chinese-owned US enterprise invests in a US factory. Can the OECD tell that it’s not US domestic investment but actually Chinese FDI? Conversely, suppose that a US-listed Chinese company makes a secondary stock offering and then builds a bunch of factories in China. Can the OECD tell that it’s not FDI but actually Chinese domestic investment? (To know that, don’t they need to know who bought the shares?)

Is it really “Direct”? Presumably there’s also “Indirect” – could changes in one be offset by changes in the other? What difference does it make?

Not gonna buy a doomsday scenario without more details…

Choose where to list company, choose law of contracts, choose where to pay tax, choose PFI to share cost/risk with taxpayers, choose when to implement strategy of “going into administration”, choose when to sell even before set up, global business ethics and morality completely disconnected from “business meets a community need at local level”, choose which corrupt revolving door figure heads to pupiteer your company and bonus them to silence. Just so inspiring for the kids – next generation copying existing leadership – has toxified the future business community. Foreign investment always has an agenda – such as China in Africa derisking primary resource sources. Foreign investment – build a phianthropic school or hospital – is a cheap way to buy political influence. It is not about one partner with ‘money’ or access to large loans forming a partnership for the betterment of the lanscape or quality of life for species spectrum, just inane repetitive taking from the many to give to the few.

Purely academic definitions are infinitely more precise, but practically speaking, FDI coming from outside into a country is differentiated by how it is invested:

1) Indirect: bunch of money washes into a country as stock (or other like financial) investments thru the institutions (stock market) of that country. Indirect investment is sometimes called “hot money” because it’s relatively liquid & can quickly & easily be repatriated. This type investment represents a more tentative commitment.

2) Direct: investment is used to buy/build buildings & facilities and furnish with various machinery & equipment. Direct investment is much less liquid. This type investment represents a more stronger, longer term commitment. Given a choice, most countries prefer “direct” FDI.

This is not a trivial topic and my 25-words-or-less doesn’t do it justice. However, under given circumstances, either type FDI can cause havoc in a country.

Quite. If, like the UK for instance, one is ‘living on the kindness of strangers’ to make things seem just fine, it’s a poor strategy as strangers are never, ever, kind……

Given those definitions, how is either one actually measurable with any accuracy?

Does an Asian real estate firm buying up Canadian houses count as direct or indirect? Sounds like direct but IANAL…). But if it’s individual Asian buyers, as opposed to firms working with pooled capital, how can that even be tracked?

Anyway it sounds like real estate investment flows might be part of the FDI picture and a reduction in some of the insanity there is probably healthy, rather than a harbinger of crisis as DQ slanted it.

Fair question and I have absolutely no idea how it’s done or how accurate the measurement is.

Physics has an uncertainty principle (most common: even theoretically, cannot exactly measure the position & velocity of a particle).

Additionally, I suspect there is a FDI uncertainty principle: cannot exactly measure small investments at a specific location (eg: Chineses lady shows up with a bar of gold wanting to buy your house).

=> Global Foreign Direct Investment Flows Collapse

That doesn’t have to be a problem.

It is perfectly feasible to organise a steady-state economic order which is equitable and sustainable, one which does not depend on open-ended economic growth. It would mean giving up capitalism and encouraging the parasites get honest jobs, though.

There is nothing in the Cosmic Rules which requires such ‘growth’ as a categorical imperative, but there is something in them about ‘inherently finite capacity’. The key word here is ‘sustainable’. The opposite of ‘sustainable’ is ‘doomed’.

Nevertheless the modern order is characterised by such growth, but as you know, just because you can do something doesn’t necessarily mean that you should, and it certainly doesn’t mean that you will always be able to do so.

This could be a good occasion to clarify one of my positions, where I suggested that TPTB are leading human civilization into disaster because they do not care, which isn’t exactly true. In fact, they do care, if only for themselves, but strangely, they do not care enough. For all their wealth and power, they don’t believe they can affect the future, and certainly not without sacrificing their privilege. They want to have it both ways, and that’s simply not possible. They could hire me to work it out for them, but they’ve already messed up right field so bad nobody can play it, and it’s not my job to be the Earth’s supervisor anyway. That’s Karellen’s job, and he’s not available, because he’s a fictional creation of Arthur C. Clarke, as played by the estimable Charles Dance.

The issue with what you call “steady state” is human nature almost demands differentiation (wanting bigger house, better food, better medical care, control over people, more money, run faster, jump higher, score more goals, get better grades, etc, etc, etc). Enforcing this on a large & diverse population (say >10M) inevitably requires “coercion” (ref: Venezuela). I’m not aware of any sizable country having survived this type regime for a substantial period of time (hundred years?) since the end of the Middle Ages (my prior historical knowledge is incomplete).

Napoleon (keen observer & manipulator of human nature) once observed (paraphrasing here) “…society cannot exist without differentiation; differentiation cannot exist with morals; morals cannot exist without religion…”.

Napoleon (who killed more than his fair share of Europeans) was aware you couldn’t successfully control a large population for long term simply by using force. Hitler & Hirohito/Tojo went the “pure force” route and killed roughly 3% of the global population demonstrating Napoleon’s point.

Factoid: Geogre Orwell observed: “All animals are equal but some animals are more equal than others”. Generally speaking, people implementing “steady state” societies will (literally) kill to ensure they’re in the tiny group of “more equal than others” who get to tell the other 97% how to live their lives.

Sadly I have come to the conclusion that everything is now controlled such that there is no marketplace anywhere in world.

If this is true, then all data is fake. Data can mean whatever you want it to mean.

Tesla’s books are an example.

As such it becomes hard to get too excited.

AOC’s 12 years left means … don’t wake me up … I must be dead already!

We are quickly reaching the point in the election cycle where I wouldn’t believe a word the US gov puts out for the next two years. 2% inflation, yeah right!

Given that the US gov has gone completely rogue with constant threats to seize assets of anyone Trump doesn’t like under the guise of sanctions, it is no surprise at all that China stopped investing money overhere. And arresting the Huewei executive hasn’t helped either.

American lawyers are replacing the old “iron curtain” with a new “paper curtain”, the paper being produced by lawyers. Tell you what, if I was young and had to pick a side of that paper curtain to be on, being with 1 billion Chinese consumers and the fast growing economy seems like the place for a young man to make his fortune.

cpp account

Rockefeller

Well, if you have no morals or ethics, are totally corrupt, are comfortable subjugating hundreds of millions of your fellow citizens, are willing to imprison a million or or more muslims (plus others as required), China is indeed your golden opportunity.

I only see three issues:

1) You probably are not Chinese, or at least not a “connected” Chinese

2) In every totalitarian regime that’s ever existed, EVERYBODY wants to be in the top 3% that gets to steal from every one else

3) Even if you are “successful”, you need to get yourself and your loot away from China before the state police arrive – corrupt Chinese have a bad habit of eating their own kind.

The Chinese have discovered the technology of capitalism and now the are the future and we are the past. The CIA should have not spent the last 50 years undermining communism – if the Russians and Chinese still believed in Marx then we would still be top dog!

More & More comments are blocked for telling the Truth.

Go figure, who would censor Truth?

BilboSF,

You’re welcome to comment here, but this is not a free-for-all and it’s not a place for throwing around insults and hateful terms. Perhaps it would be helpful to know the guidelines:

https://wolfstreet.com/2017/10/07/finally-my-guidelines-for-commenting/

Communism as concocted by Marx and Engels, was an academic curiosity, but as purportedly practiced in the USSR and China, it was just a mask for a dictatorship of the few over the many.

China is another historical curiosity, growing with the ingredients of competition at the micro level but iron fist always at the ready to control those whose competition threatened the Communist Party.

I think the top has stopped spinning and dynamic balance is over.

BilboSF –

“telling the Truth”.

A “Truth” teller does not use insults or insulting language involving hateful terms of speech to tell the “Truth”.

Truth stands on it’s own without embellishment.

Read and abide by this sites guidelines.