But back to “normal” hurts after a good run.

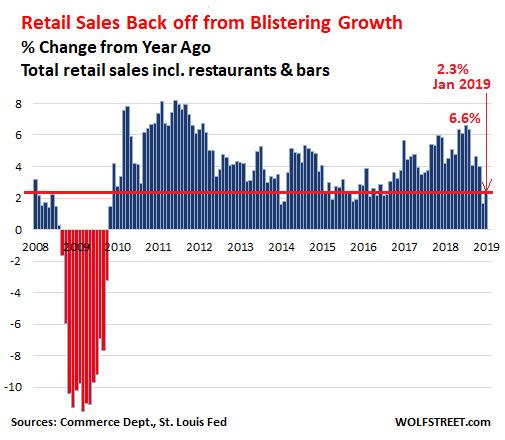

January retail sales confirm the trend seen late last year: Overall retail sales, including at restaurants and bars (“food services and drinking places”), had been running at red-hot growth rates starting in 2017, reaching 6.6% year-over-year last summer; and they’re still growing year-over-year but at a slower rate, with sales at auto dealers and parts stores acting as a drag, and with sales at restaurants and bars acting as a push.

Total retail sales, including at restaurants and watering holes, rose 2.3% year-over-year in January, to $504 billion (seasonally adjusted), according to the Commerce Department this morning. December sales were revised downward to a year-over-year growth of 1.6%. So, growth, but way below the red-hot growth rates last year. This chart shows the percent change in monthly retail sales, compared to the same month a year earlier. Note what a real retail recession looks like (red):

This measure of total retail sales includes e-commerce sales, but today’s data release does not separate them out. The Commerce Department reports e-commerce sales quarterly and will release the data for Q4 in a couple of days. Then we can see what is really going on at brick-and-mortar stores. Preliminary estimates for e-commerce sales in Q4 indicate that they were strong. If the Commerce Department confirms this, it will throw a deep shadow on brick- and-mortar sales.

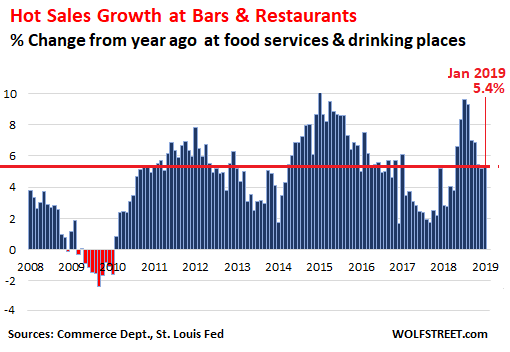

Sales at restaurants and bars grew 5.4% in January compared to January last year. Year-over-year growth rates have been above 5% for most of the past 12 months, reaching nearly 10% in July. So this industry is hopping, after a slowdown in 2017.

The chart shows the year-over-year percent change in sales at “food services and drinking places.” It is on the same scale as the above chart to show how the Great Recession had a much smaller impact on restaurants and bars than on overall retail sales:

Without the push from restaurants and bars: Retail sales excluding sales at food services and drinking places rose 1.9% year-over-year in January after having ticked up 1.2% in December. In November, year-over-year growth was still 3.8%, and last summer it was over 6%.

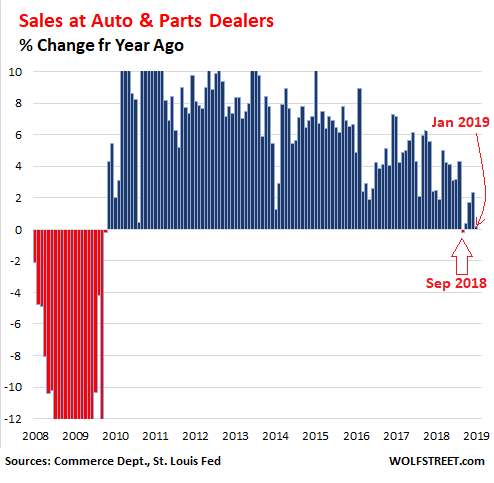

The biggie in retail sales revolves around America’s love for a set of wheels. Sales at new and used vehicle dealers and at parts stores account for over 20% of total retail sales. And here we encounter a problem: New vehicle sales in terms of units delivered peaked in 2016 and have edged down since then. Price increases have caused dollar sales to rise over the period, but this is now too stalling.

Sales at auto and parts dealers fell in September year-over-year for the first time since 2009, then ticked up a tiny bit in October, and rose around 2% in November and December. But in January, sales were essentially flat year-over-year (+0.2%).

The plunge in vehicle sales during the Great Recession peaked at -27.6% in November 2008, after the Lehman bankruptcy, when big-ticket sales practically came to a halt. And during the recovery, growth rates off those low levels were also huge, peaking at 20.5% in February 2011. In the chart below (same scale as the charts above), those extremes blew past the limits of the chart. But note the recent malaise in the industry:

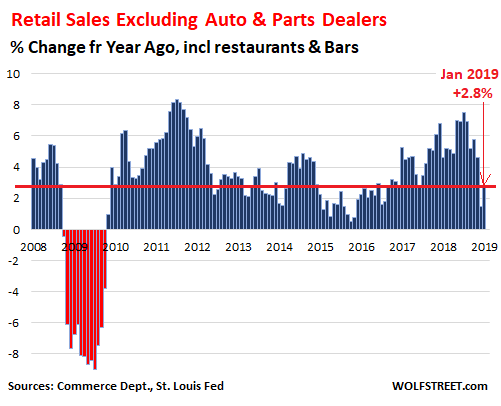

Retail sales, including at restaurants and bars, but excluding the drag of auto and parts dealers, rose 2.8% in January year-over-year after ticking up 1.5% in December. This was down from growth rates peaking at 7.5% in July last year (chart on same scale as above). That 2.8% year-over-year growth rate was right in the middle of the range since 2010:

So clearly, auto sales are suffering from malaise, which I have extensively vivisected over the past three years under the tongue-in-cheek moniker Carmageddon because “car” sales have been getting totally crushed, while sales of “trucks” — pickups, SUVs, and crossovers — have been thriving but not enough to make up for the plunge in car sales. Restaurants are doing well. And the remaining retailers are back in the middle of the range of growth where they had been.

When we get Q4 e-commerce data in a couple of days, we will likely see continued powerful growth in e-commerce, at the expense of the brick-and-mortar divisions of the same retailers.

Nordstrom’s online sales, now one-third of its total sales, eat up its brick & mortar sales. But it’s a matter of survival. Read… The Biggest Retailers Are Too Scared to Disclose this Data. But Nordstrom Just Did

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

What happened in September 2018? Is eird it ent down for just a month like that and then the next month was low but back on positive.

The Tee Vee lady said strong sales are supported by strong wage gains. On to DOW 30K we at Da FED don’t see no bubbles.

Lol. Since when is 3.5% strong when the prices of everything is up across the board?

In NYC, prices predictably jumped since beginning of year with the$15 minimum wage.

Having a job does not mean having thousands of dollars in extra disposable income every month to go shopping for clothes and electronics. Many people in the bottom 80% are just getting by at best

But the Tee Vee Lady says wages growth is strong. Didn’t you read my post?

And that is the problem with part of America. They just take what the Tee Vee Person said at word.

They said, “The economy is doing fine.”

They said, “Trump is a big fat idiot.”

They said, “Saddam has weapons of Mass Destruction.”

They said, “Buy this company because it can only go higher.”

The truth is that the economy isn’t doing fine, it is doing just okay when you account Amazon’s role and the store closings that are currently taking place. The second and third ones aren’t true at all, and the very last one is in reference to Jim Cramer’s call to buy Bear Stearns right before it collapsed.

This time last year I was spending my tax refund. This year there’s no refund, payment instead. I think between the lower to no refunds and the government shutdown, people got spooked.

Perhaps compare taxes paid last year to taxes paid this year for an apples-to-apples comparison? Or compare effective tax rates?

Comparing tax refund amounts doesn’t tell you if you paid more or less in taxes.

Also, withholding has been changed on a lot of people. Petunia and others that had to pay in this year instead of getting a refund, you might want to check with your employer to see if your withholding has been changed. The more you withhold, the more you have a shot at a possible tax refund.

Jessy-my understanding is that withholding was automatically reduced to generate the ‘tax break’, but this was not broadcast by the gov’t. to any great extent-thus surprising those who didn’t realize their W-4 needed review, and/or those who use their refunds to hedge against any potential bank bail-in on savings accounts. May we all have a better day.

Well the economy keeps chugging right along. People are flush with money and have plenty to spend at restaurants – Goldilocks! Last night, on 60 minutes, Powell assured investors that there is no economic weakness, much less a recession, on the horizon. So now that we know the economy is going great guns and world central bank monetary policy will remain ultra accommodative it’s clear assets will continue to inflate.

Looks like I assessed that entire situation all wrong. I had believed Bernanke was a coward who took the easy path but it looks like he was courageous after all, saved the economy and found a way to prevent recessions from occurring in the future. As the Fed has stated, there has been no inflation so the reward to the country comes without cost.

I refused to believe and I missed the entire quadrupling of asset prices. Now, though there has been no inflation, the $900k I worked and sacrificed to save is all but worthless – if I put it all in SPY now it would yield a meager $16k/year (below poverty).

America rewards optimists and badly punishes pessimists. My punishment for being a pessimists was to have my hard earned life savings wiped out by the inflation that doesn’t even exist – I got what I deserved I guess.

Cheers to the courageous Ben Bernanke, his act of courage saved you all and you can enjoy the fruits of unearned wealth. I was wrong, Ben was correct – invest accordingly (I would join in but I now have too little left to buy a seat at the table). Some gotta win and some gotta lose and Guillermo’s got the blues – good luck to you all.

Dont despair. You have $900k in savings. Not exactly an end of the world scenario.

I can sell you one of my rentals in Pacific, WA for $280k and hence you will still have $620k in savings. Plus, you no will no longer have to live in your van down by the river.

I have a rental in Tucson to sell him for $150K. The cost was $36.5K at 9.5% interest brand new (1420 sq ft.) Of course, he’ll have to live in a barrio instead of by-the-river.

900k X 8% a year (so far 11%) is more like 72K. If SPY pulls back 20% then resumes 8% YOY you only make 57600. This sounds vaguely like the discontent in France, which probably falls under the politics of resentment, though I do know some people who have lost everything at a very inopportune time in their lives. I know many others who are worse off than their parents. For that kind of seed money you could probably buy a couple duplexes and make the same return. Assuming you don’t quit your day job you could do pretty well.

Don’t forget taxes:

25% Income tax: 72K – .25(72K) = 54K

10% State tax: 54K – .1(54K) = 48.6K

8% Sales tax: 48.6 – .08(48.6) = 46.12K

Of course, the govt probably feels bad that they didn’t work as hard for their share of the money as Van did, so they will give him a standard deduction(tax discount) off the top. There has to be some reward for being a cash saver who retired by the river and doesn’t own a house.

post script: Isn’t the income tax rate in France around 40% and everyone required to carry a yellow vest in their vehicle?

So, lessons learned:

o DO NOT live in a state with 10% income tax

o DO NOT live in a state with 8% sales tax

Lesson in the process of being learned:

o money (cash) is not a store of value, it is a transaction medium

o If you’re crying about being poor with$900k, look somewhere else for sympathy

No, he got money but is not happy – is sad. He want to put the money to right way cause he got will to make good with it, cause he don’t want to feed from pig trough, but he got no road but to wait and lose, even if he can be luxury. Vanman, you find something good for your money one day for sure, then you find you much better off than you think.

At the very least, upgrade to a used Winnebago.

Van: I am in the same boat as you too! You are probably too old to work and maybe not in the best of health like me (deaf and blind) so going back to work isn’t an option at all!

Most of the people replying to your comment are still working and still have their health plus energy, so they think you are rich. Well I can tell you they are actually pretty stupid compared to you and me! We have already proven over our lifetime that we were smarter, harder working, and more disciplined than most of the joker’s replying to your comments so far!

What these joker’s don’t get is that you need to eat up your capital just to live because central banker’s “financial repression” has robbed you of the ability to “safely” earn a return on your saved capital! These central banker’s are trying to push you to take more “risk” at the very time in your life when you can not afford to take the degree of risk they want/demand/force you too!

Central bankers are the very evil enemy of all savers! Their money printing has driven interest rates permanently into negative return territory such that your savings have no value! Yes, when money is free loaning your savings out for others to rent/use has no value!

Yes, you could earn more money but then you would have to go further out on the risk limb and risk losing all your savings and end up with nothing! I have tried that and suffered multiple 100% losses to the point that I no longer have sufficient savings left to live on!

Van if it is any consolation to you, all of these joker’s replying to your comments will sooner or later get to go through the central banker’s “financial repression” hell that you and I are currently living!

These joker’s will of course ignore the warnings from people like you and I who tried to do the right thing, consume less than we made and save sufficiently for our “golden years”.

What all of these joker’s don’t understand is right now they are working, have good health, and plenty of energy. They think this will always be the case and nothing will change! So they think they will always have unlimited options available! O.K. can’t do this then simple just do this! See no problem!

Maybe they should think ahead and say O.K. what will happen “when”, not if, my current levels of energy and health diminishes such that I can no longer do all the things I currently take for granted. Like work!

Simple things in life! Like being able to drive! Like being able to walk! Like being able to see or hear! Being as mentally sharpe or not forgetting things! Stiff joints! Breathing problems! Cancer! Stroke! Heart attack! I could go on and on! This is what really happens when you grow old! You start falling apart bit by bit!

This is what really happens in your so called “golden years”! Whomever coined this wonderful phrase should be shot! There is nothing wonderful about growing old! I have yet to meet a single person who thinks growing old is wonderful! Not one person!

Van, I can tell that you remain an optomistic person and are much more likely to suffer in silence than complain! All we can do is soldier on as best we can!

As for the younger ones, …… well …. good luck!

A WSJ feature article published about a third of a century ago quoted a retirement “home” nurse: “They aren’t the golden years. They are the rust years.”

I’ve been lucky: my health at 87 allows me to enjoy life thoroughly at an appropriate pace.

I’ve been lucky another way, too: I came to maturity in the generation I believe to have been at the apex of U.S. culture: 1945 -1975.

That allowed my most enduring piece of “luck”: starting at the beginning of that generation, building a life as divorced as possible from the vagaries of the contemporary financial system.

RD: Thanks for your comments! Hope your money and health last to the end!

You should see what happens after I have finished cutting the lawn!

My reply to missed sections of grass is “What do you expect when you make a blind person cut the grass”!

One Size doesn’t Fit All

Van and Wes, I can sympathize. $900,000 seems like a really big number to many / most. But one thing I’ve learned about America is, you do not want to run out of funds and rely on the government for support. I am retired but have a wife and children (most people my age have grandchildren, I have children who are now nearing college age. They are fun but not really a great investment, yet). That $900,000 will need to last my wife about 30 years (yes she could work, but at her age, at what cost?). Due to health I may make it another 10.

Remember the famous quote at the end of this video.

https://www.youtube.com/watch?v=fUKO_Y6RqEk

So, the challenge is: how to make the nest egg last. Unfortunately that will likely require risk. When I was younger (under 55) I enjoyed teaching mountain climbing. I learned to manage risks and was lucky. I’ve also been lucky with a couple investments so my family should be financially OK. But my investments are no longer in the market. My point is; if you have $900k and need it to last 20 to 30 years and your risk tolerance is at a Treasury bond level, it’s not as huge as some may believe. Unforeseen Health issues with family members can cut that down in a hurry.

I also wish those of younger generations best of luck with their financial wellbeing. Keep reading Wolf, at least you won’t be far behind the information curve.

Retail sales :

January 2009 >> $336,929B

January 2019 >> $504,440B

Growth over 10 years ? 49.7%. Not too shabby.

Is that number adjusted for inflation?

… and serving size?

And change in population?

Just think how much of that was the INCREASED Price of I-Phones..and the ‘younger-kids’ in 09 buying ‘techy’ stuff now,plus population growth and Immigration (both kinds)…..lolol

Forgot…INCREASED Car-Truck-SUV Prices too…

Not to mention that the growth in auto sales was caused by the “Cash for Clunkers” program.

When I was young a 8088 Tandy computer with a hard drive was $3000, that would easily be $6000+ today. Land line phone service is probably not too far off cost wise (after inflation) as a normal cellular service with unlimited data/texting. I know my parents 25″ Zenith television was cheaper than the modern UHD 70″ flat panel TVs found for sale at the grocery store. We have more tech now but capability wise I don’t think it’s that expensive.

Especially when compared to housing.

I went to the Social Security Office this afternoon, and our’s is beside a mall. The mall was empty. Hard to think they are selling anything out there.

And talking about the SSA office, you’d be happy enough to know it’s there.

Last time I went to the SS office, I was the only “old person” (65) in the room of 20+ people waiting in line. I thought you had to be mid-60’s to collect. Did I miss something?

Young-looking fit boomers?

SS Disability?

More seriously – I know people who have had to visit SS offices in person to resolve identity-theft problems. The hacked data is getting out there, and criminals are trying to snarf things like unemployment insurance benefits using genuine social security numbers. To fight back, the victims are being forced to spend days in bureaucratic purgatory proving that they “own” the social security number in question.

Well many of us were hard of hearing and missed our names or numbers being announced. But I can tell you there were also many new and younger Americans from their looks. I am not a racist, ok.

Possibly disability. Mental health. Lots of people get certified when they hit their late forties.

For those who buy Treasuries. Shorter term note (2Y-3Y) yield’s are back to last year’s April 2018 yields. That’s a different kind of “sales”. Only 4-week T Bills are kind of rising. Something’s not good. Q.T. is going on but rates are dropping.

It’s a different ball game now that it was a few months ago. Thats why stocks cheerfully bubbling up again.

And the name of that new game is called “Mr Market commands, Powell Obeys.”

Mr Market learned something recently: Powell is it’s eager servant.

It learned this when Mr Market thru a 10% hissy fit and Powell responded by halting interest increases, dramatically increased the target balance sheet normalization, talked of ending QT, emphasized 0% interest are in the tool kit and much larger QE are on the table as tools to fight recessions.

Not financial crises – just plain recessions.

To use 0% rates and QE to fight a recession is….extreme dovishness.

Powell is an extreme dove.

And now, Mr Market knows it. That’s what changed.

One might say Powell has learned nothing. Or he was always the way he is.

Powell’s seeming cave left me wondering if the personal attacks Trump dishes out on Twitter really do frighten these guys.

Maybe, the recession is being delayed by the powers to be until after the election, which is about 2 years out.

Restaurants are what confuse the heck out of me. These days they are expensive … and NOT good. Yet they seem to be full and each month lots of new waiter jobs are created. One has to think that if tougher times come the first thing to go will be eating out – as eating in is radically cheaper. If this happens (assuming people know how to cook) the knock on effects will be huge … very quickly.

You took the words out of my keyboard. A third of the US food budget is restaurant food.

Related: much of the car sales are to leasing companies, that lease i.e, rent the car. Then there is manufacturer financing.

A lot of these cars called ‘sold’ aren’t really in the sense that the money hasn’t been received. It is promised.

And what if something happens and people start defaulting on their credit cards at beyond a record pace?

A lot of young’uns and urbanites have never had to clean a chicken before they ate it or had to plan a meal besides a Big Mac or Whopper. They would starve in place if the fast food and grocery stores closed for a week.

True, but they’ve watched a lot of apocylptic zombie movies and TV series so they know how shoot a zombie to kill it and survival skills.

My neighbors are so lazy they have Uber deliver their meals now. Unreal.

james-it seems to me to be yet another extension of a growing majority of the population now living in a technourban/appliance mentality culture that is easily swayed by constant marketing of whored-out brands. I.E., throw a switch, push a button, and something happens. It must be good because it’s as seen on a national advertising platform.

Long term, this reduces the inclination to at least occasionally skin one’s knuckles or get one’s hands dirty in order to understand, appreciate, and work with the mundane physical processes that drive civilization and the natural environment that our civilization must exist in. Any understanding of what is really happening when the button is pushed? Is all of what’s supposed to be happening, actually happening? Does one realize when it isn’t? Given your excellent restaurant example, maybe not.

Basic understanding of a process gives one the ability to assess the quality of the result of that process and thus the ability to intelligently assess value. Restaurants are just one outlier of this-pay money, get food unit (push button). But if one doesn’t know the basics of preparing meals, then one’s money is paying someone who does-yes? And of course it must be good, yes? Because when one pushes a button (i.e.-spends money) one always gets the expected result, as in food value BECAUSE money has been spent. This type of value analysis doesn’t appear to be a strength at this point in our history. An ‘eating-in’ and DIY knock-on effect would only be a good one going forward, perhaps tugging us slightly back towards a ‘nation of mechanics’ culture.

But,like Paulo and Mr. Blakeslee, I’m north of 60 and fortunate enough to be living on a decent patch of paid-off rural land. The trade off of having to work on it every day is that the continuing practical education is invaluable and keeps my mind a bit younger, as well as reasonably honing my slowly declining physical skills. Though never a player in this casino economy of ours, Wolf’s articles and the great commenters are great at letting me see the make, model, color, and license numbers of the endless stream of careening financial trucks bearing down upon us. May we all have a better day.

My understanding is that the retail sales data are not adjusted for either inflation or population growth. So anything under about 3% growth represents a decline on a per-person basis. That implies stagnation or even outright decline in the average standard of living.

Yes, that has been the case on average for years… it’s the “normal.”

But it’s not quite that straightforward: CPI is not only inflation on products sold at retailers. It also includes services (rents, healthcare, education, etc.), and services inflation has been higher than goods inflation. For example, as you know, there has been 0% inflation on new vehicles for over two decades, as per CPI:

https://wolfstreet.com/2019/02/13/sticker-shock-prices-of-new-cars-trucks-flat-for-22-years-says-cpi-even-as-the-price-of-a-taurus-jumps-55/

The New Normal!

Nobody is buying in upscale Uptown of Albuquerque but at least it’s easier for me to park the SUV!

America feels like a dead zone or what?

“You should see what happens after I have finished cutting the lawn!

“‘My reply to missed sections of grass is “What do you expect when you make a blind person cut the grass’”! – Wes

Where I live, there’s nobody around to tuit-tut if the grass grows too tall.

Years ago, I used to write snide little vignettes for the local newspaper under the nom de plume “Uncle Luke”.

One of them: “Uncle Luke says he don’t never shovel anything’s gonna melt, don’t rake nothing’s gonna blow away and don’t mow nothing that’s gonna fall down in the fall and rot over winter.”

Wolf what are your thoughts in the recent articles coming out about the TECH IPO’s that will be coming out?

https://www.nytimes.com/2019/03/07/style/uber-ipo-san-francisco-rich.html

Will this put the SF housing stock through the roof even further? Is the SF/Bay Area the only place that will yet again experince another crazy climb higher in prices? Are these compaines seeing potential recession in the air and cashing out now? IS this the last place before everythig pops?

I’ll just repost my comment I posted yesterday under another article:

The real estate hype going around on this is breath-taking. These people are already millionaires and billionaires because they already own the shares or options, and they have value attached to them. They can be sold, and they can be used as collateral. There are special departments at banks here that issue huge mortgages to these people years before the IPO. This money flow and home-buying has already happened.

The Uber founders, early investors, and early employees are already filthy rich and situated in expensive homes, based on their Uber shares. Do they have to wait till the IPO before they can buy an expensive house or more likely several of them? Nope. That’s not how it works. They already spent some of this money they’re going to get when they can sell those shares after the lockup period. In other words, they already bought those homes – years ago.

Wolf,

For these pre IPO companies, there used to be a service or market that would buy pre IPO shares (not options) from individuals. Is this still done today? If not, these banks specializing in home loans to people with options at pre IPO companies; are the employees turning over these options to the bank contractually or how does the mechanism work to achieve this? From a risk mitigation standpoint, how does the bank manage the risk should the IPO not happen, shares tank after the IPO or if the tech market experiences another 2001 after the techie buys the house but before the lender sells the shares?

Egregious retail sales numbers that will put Q4 GDP into the porcelain fixture and yet the S&P pops.

Real sales for Jan 2019 were zero! nominal .2 less a CPI of .23= 0.00; not good.