Inventory continues to surge. Potential buyers move on.

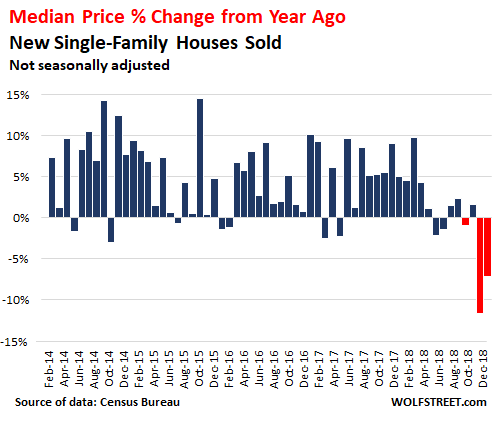

Here is the good news: Lower prices stir sales. Clearly, homebuilders are motivated to move their inventory, and they’re making deals at lower prices. The median price of new single-family houses whose sales closed in December fell 7.2% from a year earlier, to $318,000, according to the Commerce Department this morning.

December’s 7.2% drop and November’s blistering 11.6% drop were the sharpest year-over-year declines since Housing Bust 1:

The new-house sales data, produced jointly by the Census Bureau and the Department of Housing and Urban Development, is very volatile. It is revised in the following months, often quite drastically. But despite the ups-and-downs in the monthly data, trends emerge.

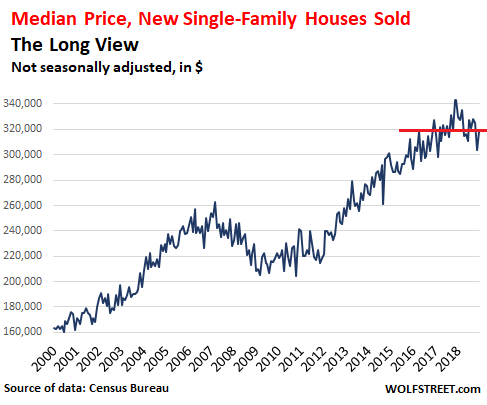

The steep year-over-year price increases in prior years formed a multi-year boom in prices that has now outrun what the market can bear. The median price of new houses ballooned by about 55% from the range in 2011 and 2012 to the peak in November and December 2017 ($343,300), which exceeded by 31% the crazy bubble peak in March 2007, before it all came apart:

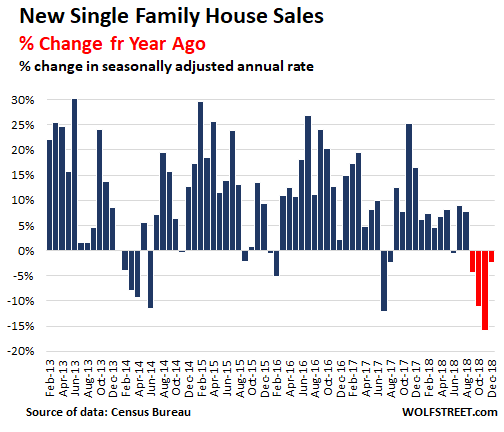

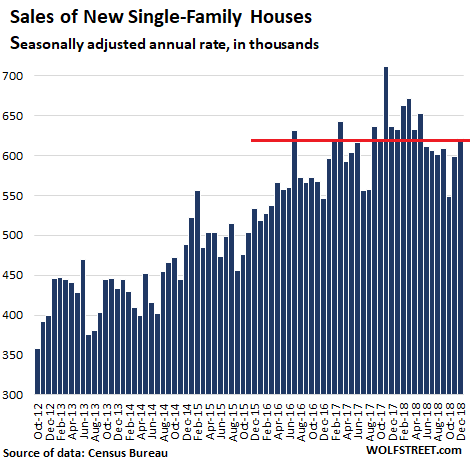

Sales of new houses, in terms of the seasonally adjusted annual rate, had plunged late last year. The year-over-year decline exceeded 15% in November. So in December, this seasonally adjusted annual rate of sales finally responded to lower prices and declined a little, instead of plunging. The year-over-year drop of 2.4%, to an annual rate of sales of 621,000, was the fourth month in a row of year-over-year declines – but a heck of a lot less bad than the double-digit plunges in the prior two months:

In terms of actual sales – not the seasonally adjusted annual rate of sales – homebuilders sold 44,000 houses in December, down 2.2% from December a year earlier. This was in the same range as October (43,000) and November (43,000).

In terms of the seasonally adjusted annual rate of sales — 621,000 in December — the chart below shows the dynamics over the past six years. Lower prices recently have started moving the needle, but not enough:

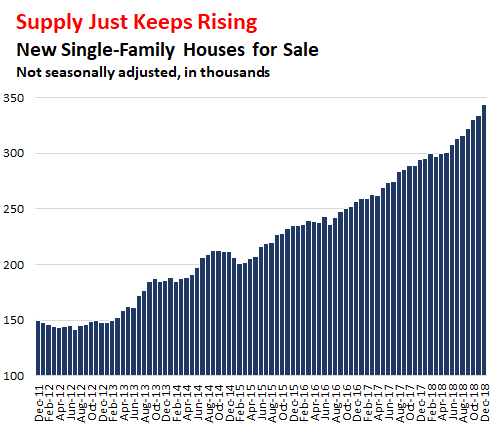

That the price declines have not moved the needle enough also shows up in the inventory of new houses for sale that just keeps on rising. In December, the supply surged 17% year-over-year to 344,000 houses, for a supply of 6.6 months at December’s rate of sales (up from 5.5 months a year earlier):

So it looks like homebuilders will have to sharpen their collective pencil in order to bring prices down to where the buyers are, and where that inventory for sale starts shrinking.

Homebuilders build and sell houses – that’s their business model. They cannot just not build and not sell houses. So they add inducements, such as free upgrades to the kitchen, and when that’s not enough they have to try to hit the price points where potential buyers turn into actual buyers. And they’re trying. But the market is fluid, and buyers move lower. And so there remains a lot of work to be done on the price front.

The San Francisco Bay Area and the Seattle metro lead with the biggest multi-month home-price drops since 2012; San Diego, Denver, Portland, Los Angeles all book declines. Prices in other metros have stalled. And a few eke out records. Read… The Most Splendid Housing Bubbles in America Get Pricked

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Do we have a chart for month supply to go past Dec -2011. The 6.6 month of supply is huge and indicate this is a Buyer’s Market. However, like to compare this supply with 2007 and 2008. One thing for sure prices are high as crazy!

Home prices have been driven higher by historic low interest rates. The economy is no as hot as many wish to believe. The cost of debt as a percentage of GDP continues to rise. Democratic Socialists threaten the economy with mind-boggling spending programs. The Chinese housing market is fracturing. Auto sales are stressed. What happens to housing (or the stock market) when rates rise?

“Democratic Socialists threaten the economy with mind-boggling spending programs.”

Hahahahahaha Ha HA HA (catches breath)

thanks for the laugh.

Yeah. Everybody knows it’s the Democratic Socialists’ massive tax cut for corporations and the extremely wealthy that ‘threaten the economy.’

buying a home is no longer a tax deduction for most people. the $24,000 standard deduction is higher than most families schedule A itemizations. A single parent at work with a disabled child, told me she didn’t get any benefit from her home mortgage this year.

renting has become a better choice for many especially since many have to move for work.

ummmmmmm, Its fairly obvious that this new tax bill was passed by people who think $24,000 is not a lot of money for interest on a home.

What happens to Housing and Stock market when the rates goes down which is a real possibility..?

Actually robust govmit social spending is the thing that would massively improve the economy, which hobbled by austerity for working people and low interest rated and QE for the cash hoarding ultra rich. We are sufficient front too little social spending.

“We are sufficient front too little social spending.”

Is this statement a joke? The federal govt spent $4 trillion in 2017. By comparison it was $1 trillion in 1987. We’ve quadrupled spending in 32 years and it’s STILL not enough for you? Jezuz

“Actually robust govmit social spending is the thing that would massively improve the economy”

Surely you jest. The government has no money, It is only taken from the taxpayer. Therefore if the government spends then the taxpayer has less to spend. Do you really think the government knows how to better spend that money?

“cash hoarding ultra rich”

rich always try to invest every penny to make more money.

Gov’t spending has been for the top 10% and the 90% are getting sick of it. This is the stuff of which revolutions are made.

Any money the government spends is taken from the taxpayer. It is not paid back by him, however. It is paid by his children and their children. Intergenerational can-kicking. That’s how America got where it is. The cost of this debt is built into the price of every kind of goods and services. That’s why America is such an expensive place to live and do business.

JSRG – you will find that the nominal amount spent remains roughly the same as percent of gdp over recent years.

There is a profound irony here I think, the nominal increase in spending being permitted by expansionary monetary policy. It is normal maybe that people argue when their resources are forcefully allocated to other people. That would be both you being taxed for social spending and timbers view that monetary expansion creates a forward allocation of resources that although the borrower is left feeling they deserved to benefit from that allocation, in fact is a bias is created in the market which punishes others in terms of access to resources due to price levels created – it is known that expanded monetary supply of easy money can be channelled into society to benefit certain players only.

Maybe this is how it should be, people discussing how publicly controlled wealth is supplied and how access to it is governed, even lenders work under public law although not without a disincentive to see customers compete in price and therefore borrowing levels – especially when any losses from poor allocation of lending are backed by the public but profits remain own.

Or maybe this is all just people being played off against each other policy or commitment-wise to the benefit of a third party, be it political, financial or other .

This is a Keynesian fallacy. Keynes offered not a shred of evidence that savings exceed investment throughout history. This was another one of his hunches.

He was correct that rich societies, like rich individuals, save more. But it does not follow that they produce more “excess” or “unused” savings.

“Democratic Socialists threaten the economy” … not the Republicans hell-bent on wealth concentration? not the crony capitalism crapola that is peddled as American capitalism? … really?!?

You got that right. We are in this mess only because the globalists gutted the middle class with their trickle down theory and tax cuts that favor the wealthy. Their short term wealth grab threatens the long-term viability of the system.

Extreme socialism is not the answer, but when the other option is extreme wealth concentration socialistic options looks better. The top 1% forced the pendulum to swing too far their way, now it will swing back a long way.

Of course, if mature-thinking moderates ruled the day we wouldn’t have the extremes to begin with.

Because the Democrats never voted in favor of any of these policies. Bzzzzzt. Next player, please.

Thomas,

what happens to the housing and the stock market “when interest rates goes up”? Is the following;

First of all sanity starts to prevail in assessing the values of different Assets classes such as stock and housing as it removes the speculative

Factor from the equation.

So the investors start judging the assets on their real merits and financial viability instead of the FAKE inflated values that the low interest rates induce.

Secondly and more importantly it will probably be the only way left( and this is quite debatable now)! To keep what’s left of the trust in the ( VIABILITY of the US economy and the US dollar as a reserve currency).

This however seems to elude both sides of the US senate in the current environment!!!

The clear rationale and an adequate plan to save the “ home of the brave” is a NO SHOW!

In the Agenda of the Messengers of radical Economic management that both sides of politics argue for now will only add to the quagmire that is the current state of the affairs , and as a clear management plan window evaporates slowly and day by day , the citizenry is left to contemplate very ugly scenarios.

Do we have a savior in the corridors of Washington?! I highly doubt it.

So my advice to you is ( move to NZ! ). :-]

Dont bother. the economy is falling apart rapidly in NZ with a big spending left of center 3 party coalition govt.

I thought by now interest rates would have been much higher and a few years ago, I thought they would get pushed to something close to double digits. Given how much federal debt we have and how the equity and housing markets have show they are extremely sensitive to modest rate increases, I think rates may go up a bit (25-50bp) and then level off or drop again and stay low for a long long time. The truth is that the current strong economy is hype driven with low rates, debt and share buybacks. I think the top 5% or so are doing well but even the lower part of this top echelon likely is living comfortably with minimal savings.

It seems to me that 30+ years ago, the percentile of homes that drove the consumer economy was a much larger portion than todays population so said differently, back in the 70s, it was the top 50% of households that drove things and now, its a much much smaller group of households that drive consumer spending for the country. My numbers are for example but hopefully you all get the idea. Much less margin for error and wages are still not growing for most or growing well below inflation. I’m actually surprised we have not seen things slow down yet but I suspect the second half of 2019 won’t be pretty. Wolf, am I allowed to ask your readers if they have seen the deadcanary website? If not, feel free to delete this post and accept my apologies.

NZ is more socialist than US. It’s current PM is a Kiwi version of AOC.

“….Democratic Socialists threaten the economy with mind-boggling spending programs.”

Very very funny.

Don’t even need rates to rise

Yeah, the Endless War & Security State doesn’t cost much either T.M.

All you crackheads vexing about socialist spending mania should consider that

everything Berniecrats are proposing has literally been standard practice in Germany, France, The Netherlands, etc. Not just in the last 70 years but going back to late 19th c. This, while Germany is the epitome of austerity run mostly by conservatives! And these are not some fringe weeny economies. The UK is cut out of a different softer browner stinkier material lacking in social intelligence and the US is just a rehash of that freakshow.

Those mushbrains vexing about the dangers of large gov, gov irresponsibility, gov ruining the economy etc. should consider who comes to the rescue and washes the diapers every freaking time when the private sector cronies and buffoons inevitably make a mess of everything and themselves. Who saves the economy at what cost with what funds? The hillbillionaires? Didn’t think so.

Zing! Good one.

The Trump personal tax INCREASE is what killed the market in the Northeast.

qt,

There is irrelevance and there is also a risk.

Comparing everything to a once-in-a-time event 10 years ago that may not reappear again in our lifetime gives us a twisted perspective. We think, oh, it’s just 6.6 months supply when in was 12 months supply in January 2009.

But in January 2009, the financial world was collapsing and the economy was grinding to a halt as credit had frozen up. Those are not normal events. I’ve only seen this once in my life. We’re talking about a normal housing downturn here, not the collapse of the global financial system.

And if you discuss the shares of IBM today, it doesn’t matter where they were 30 years ago or 20 years ago or even 10 years ago. It is irrelevant unless you want to show some specific thing about IBM’s long-term history.

Anything that happened when I was a kid or even a younger man is now being taught in history class and as no business being on a current-events site like this. However, you’re always free to dig into history on your own. So have fun…

https://fred.stlouisfed.org/series/MSACSR

Also to consider – as I believe you pointed out a few months ago – is that the “months supply” metric has shifted. Closing times are faster now with the increase in internet/automated listing, sales, mortgage and escrow processes.

This “castle” in my neighbourhood went for sale in 2016 for 3.5mn. Now it’s listing at 2.5 mn.

People are sure weird in what they think is classy. Who would have thought there would be Royalty in Boisie? :-) Idaho, I would have thought some nice timber framing, a few logs for posts, maybe some granite walls and facing, even a stone driveway?

Nice State to live in for sure. I was hoping Canada would have taken the offer for Montana last month. I like Montana, too. :-)

Thanks for the link.

The “castle” is less than a decade old – built by a crypto entrepreneur. It is heated with underground geo-thermal energy. Tacky, but interesting.

bloody hell. what a tacky chav’s nest dis one. do you really want to live nearby?

you sure neighbors didn’t shorten the owner’s agony with some pitchforks action?

speaking as a property related consultant

:-)

Where I live the average price of a new detached 1,200 square foot bungalow on a 30 foot lot is about 2.5 million dollars. New home prices have fallen a lot since the Chinese stopped buying.

Blue state top end home prices have declined in response to the $10,000 cap on mortgage interest deduction. It doesn’t have as much effect on lower priced homes in red states. POTUS DJT knows how to punish his enemies, as do all successful politicians.

The asset bubble brought excess supply to the market, and since personal income did not rise as fast as supply, and prices, (interesting that supply and price go up together) these people are stretched too thin, and are about to go under water on their mortgage. If we don’t destroy the dollar (outright) we are all doomed.

No, asset holders are doomed for their bad decisions. Make them go through reorganization rather than punishing those who have saved responsibly and we will be just fine.

I wouldnt plan on it working out that way, fair and just as it may seem. When ‘asset holders’ lose money they cry and demand rule changes. The thought of TrojanMan or bungee being right, and them being wrong, is too much to bear. to them a wrong decision means the board has to be flipped over. In SF there were people who got in trouble with TICs during the financial crisis. It was valuable for them to rezone to condos but totally against the rules. Id watch them cry on public access tv. Rolling up their sleeves and tightening their belts and pulling themselves up by their own bootstraps? f@%# that! Change the rules! They all shut up when prices started their new epic climb. But the same sort of pain and the same sort of desperate legal wrangling are part of this show, but this time should be weirder cause everyone is prepping for it.

I hear you and do not necessarily disagree. I should have said they “should” feel the pain. My real disagreement was with the conclusion that we are all doomed if we don’t destroy the dollar. No, asset holders would be doomed but savers would finally get to reap the rewards of their savings. Granted the banking sector would have to be reformed, which should have happened in the last crisis anyways and left us in a much better position today.

“stretched too thin”

The government sponsored enterprises (GSE’s) Fannie Mae & Freddie Mac, do not lend money directly to the public. Instead they provide guarantees and low cost credit that allow housing loans. By buying loans from banks, packaging them into securities and making guarantees to investors, in case borrowers default. In other words, residential mortgage backed securities (RMBS) derivative generators.

A full 25% of the overall US non-agency (RMBS) are seriously delinquent by more than 5 years! Roughly $160-$200 billion of these delinquent loans are on properties that are likely still underwater after more than 10 years!

Guess who is the ultimate holder of these stinking piles of manure?

YOU – the taxpayer.

Out looking in: Actually the 25% who are 5 years behind on their mortgage payments are the really smart ones!

They have figured out that the government won’t let the mortgage lenders evicted them for not paying their mortgages!

Ambrose – NYC metro and SF Bay are going to pull back significantly for a variety of reasons, but the housing markets in the rest of the country are fine. If the national average home price goes negative, the Fed will just cut rates again until the 30 year fixed hits 3.0%.

Problem solved. We will seem some massively overpriced big cities get hit by a few percentage points and the rest of the country’s apprecation flattens at worst.

First, it was “days on the market”, then “unsold inventory”, and now it’s price adjustments.

Good, but not good enough. If the prices come down to the 2010 levels we can start talking about the beginning of a return to sanity. Until then, I’m watching from the sidelines.

Exactly; “watching from the side lines”.

As housing prices continue to erode in an attempt to attract buyers, prospective buyers will hold off, hoping for even lower prices. Recently purchased houses at the market high, will increasingly see their mortgage holders become jittery of going underwater and will sell at a price point ensuring still lower market prices.

This then becomes a self reinforcing deflationary loop.

Is it possible to correlate the drop in price with the decline in supply and determine some abstract value where prices would need to go in order to return sales to a median level?

I forget who said it –

‘The cure for low prices, is lower prices’.

OutLookingIn – You are forgetting that the Fed has unlimited power to cut interest rates whenever they want. If the national housing index goes negative at any point, the Fed will slash rates and drive mortgage rates down to a new low.

The Fed can easily double the value of housing again through monetary easing. Don’t bet against inflation in America. You will LOSE EVERY TIME.

Anybody who buys now and thinks he got a deal is going to get shafted. Wait until the selling price drops to the amount of his mortgage. He has lost his down payment. From there on it is a ride through Upside Down Mortgage Hell. You can’t sell your house or move. Bigger, nicer houses in better neighborhoods are now selling for what you owe. The house is not an asset anymore, it has become the proverbial millstone around your neck.

When is this movie coming out?

This happened twice in my lifetime. It will happen again.

roddy6667 – The Fed will prevent his from happening by cutting rates again. Betting against long term inflation in housing and the stock market is a terrible idea. You will get killed.

Cut rates to what? They already were at 3.5% for 30 yr and 2.5% for ARMs. You think it’s possible to have a 1% 30 yr mortgage?

The more depressing (and difficult) read on existing home sales at

https://seekingalpha.com/article/4244629-fate-real-estate

helps paint a wider picture when combined with the series you are using. To me that leaves the question of where the true demand actually sits, are there are plethora of eager potential buyers waiting on the sidelines, or is that demand overshadowed by other uncertainties that lower prices will not overcome ?

I don’t know the answer, I imagine it is an unpredictable combination of those, and by a half educated guess think lowered housing activity slowing the economy might depress any existing demand to some extent also.

Bankers – We have plenty of cash and a solid income but there is too much uncertainty in the market right now for us. NYC, SF Bay Area, and Seattle are in an absolute free fall and it looks like the contagion is starting to spread to other major markets.

Our tentative plan right now is to relocate to a cheaper 2nd tier city to be closer to family and capitalize on lower rental rates and child care costs. If some of the higher quality of life cities (Denver, San Diego, Phoenix) go down by more than 25%-40% we would consider going bargain hunting.

We will continue to rent outside of the superstar cities until it’s clear what direction real estate is heading. We will buy after a major correction and will continue to rent if prices remain stable or continue to go up.

That sounds very wise to me. From the busts I have seen usually they occur after they have caught every eligible buyer and then some. People who have the sense to stay out don’t usually step in while there is uncertainty, those who really could not afford are likely to be more cautious than we imagine in an uncertain market as well, and those that needed to buy somewhere beyond anything else will have likely found a way to already. The last bust was not so long ago for people to have forgotten its lessons, those that choose ignore them are likely to already be as deeply invested as they are going to be. No one knows really though, the uncertainty is when not knowing is well to the forefront of it all and with a bit of experience you recognise when that is so and avoid it. It often takes a bit of self discipline to do that, but that is what we are given our senses for.

Banker. A cracking post sir, whoever you are.

I don’t know if the SFBA is ‘in absolute free fall, ‘ but prices do seem to be coming down. Here’s the house in SJ I sold last April:

https://www.zillow.com/homes/1070-keltner-ave-san-jose-ca_rb/

Xome has it lower, Redfin has it higher–it is, after all, an RE company–but it’s been coming down.

Isn’t Zillow in the works of trying to replace RE firms by selling directly instead of just a directory service?

I’ve noticed houses on Zillow listed lower then other competitor sites.

I’m sorry. The SF Bay area real estate market is hardly in a free fall. Even over here in Oakland, for sale signs turn into pending within a week. Not that I would recommend buying at this time

Same here in Marin. Anything decent and priced within reason under $1M is gone in about 10 days.

Heard that Oaktown was gentrifying pretty rapidly the past few years, is this true?

MarkinSF – Roughly half of zip codes in that region have sales and median prices down more than 10% YoY on redfin. Inventory is way up. Anything below $1M is considered affordable in SF Bay and is not a good barometer for how the overall market is doing.

Compared to every other market in the country outside of NYC metro, SF Bay is a total disaster right now. Not sure how everyone can see this besides the people that actually live there.

MarkinSF – Mountain View median price is down 24% YoY in February. Inventory is up 70%.

Palo Alto – Median price down 7.8% YoY, sales down 25%.

I can go on and on, but the story is the same. Investors are running for the exits in the Bay Area before the economy implodes at the end of 2019/2020.

Ed,

We are in a similar boat waiting for prices to drop and close to spitting distance of retirement. 2nd tier as well and renting until the price is right. Me thinks within 18 months it will look a lot different and maybe sooner if the declaration of housing accelerates :)

I meant deceleration

Wolf has a way of identifying key information. These are some great housing data points that don’t require much interpretation. With builder inventory rising, they have to cut prices and there really is no other way to look at it. Holding houses in inventory is too costly.

Common sense says new house prices are correlated with existing house prices, given buyers compare the two before making a purchase decision. This means house prices are very likely to continue heading lower this year, and perhaps several years to come.

It would be interesting to see where the bulk of the inventory is located, as those states will be hit hardest with price declines.

Anecdotally, in my area I’ve seen sign spinners out promoting new developments every weekend for a few months. This is unusual, because for as long as I’ve lived here when anyone builds houses people will hunt them down to buy them. Prices still haven’t budged much though.

Really enjoy your articles and videos. I am wondering if you have looked at some of these same graphs with standardized dollars, especially the longer term ones.

Thanks

Umm. What’s the point of these charts. A few weeks ago was all about housing crash. Now more sales…

By late spring and summer housing will be going up again. There’s no crash in sight. So buy now, or pay more later.

Well, if you look at the first chart, it looks like it’s “buy now or pay LESS later”

:-]

Not exactly. Those who were patient looking for a new home were rewarded during the last few months with better deals. Here in the DFW area average new home prices are still softening. Will there be a seasonal bump? Probably so, but the trend toward more stagnation still appears to be intact despite the recent sales uptick courtesy of the lower rates.

Many buyers who are sacrificing square footage just to stay under a certain price point could end up with serious buyers’ remorse when they see what the could have purchased with just a little more patience or a little more cash. If you are still paying record high price per square foot, that’s not exactly a great move in a stagnating market.

Hey my fellow commentators, if you talk about your area, it would be helpful as a good reference point for us if you say where. City, or county or at least state/Provence ?

Cheers!

Ridgetop – Amazon HQ2 has dramatically increased speculation in Northern Virginia and prices are up and inventory is down.

Downtown DC seems to have stalled for a variety of reasons. The economy in the rest of the country is now very strong and there are more desirable places to live, millennials that currently live here are starting to have families and are fleeing for lower cost of living areas. DC is very expensive and is greatly impacted by the tax reform act.

My guess is that DC and Maryland will be losers in net migration over the next five years and NoVa will be prompted by Amazon.

Philadelphia area seems strong because of still affordable prices. My guess is that we aren’t the only home equity locusts / affordability refugees moving from NYC and DC for cheap houses and nationally ranked schools.

Thanks Ed.

Another anecdotal point: I have a friend that moved from Dayton Ohio to Charlotte N.C area, (around Lake Norman), a few years back. Now two other friends, in the S.F. Bay Area, and completely independent of each other, are now thinking of retiring in the same area. Hmm?

You can get a nice newer home for $275K. Lots of young families there.

Ridgetop, you may want to suggest that your friends look at Upstate South Carolina instead of NC — taxes are much better and home prices are even more reasonable.

Ridgetop – Major cities and high quality of living areas are insanely expensive right now. I love the big city, but if it comes to buying a solid home all cash and cutting a decade or two off my retirement age I’m on board for flyover country.

Everyone has their price, and mine is about 15 years of not grinding it out in an office.

I find it rather odd that supply has increased steadily, almost a perfect 1:1 slope, yet house prices have sharply risen. How on earth is this possible? Macro-econ 101 tells us that more supply means lower prices (given that demand is constant).

Is this because the “supply” of homes is in the high-end market and they are not building “affordable” homes, thus skewing median price data?

Or are home builders unable to build “affordable” homes that are profitable, so they build houses and charge high price – sq foot ratios?

Or is there still way too much demand?

Interested to hear your take on this.

– The key here is credit. As long as credit is readily available and households/builders are willing to borrow (for buying/building) credit will flow and prices will rise.

– But when ALL costs (taxes, cost of living, etc, etc.) are going up faster than wages/income then somewhere in the (near ??) future real estate prices will (start to) come down (again). Then ultimately gravity will win (again) and prices will come down (again).

– People who earn their keep with real estate will do everything to hide the ugly truth that real prices are falling. Because when buyers see that prices are falling then those buyers are not too eager anymore to buy a house. Those people will wait for prices to fall even lower.

Remember, these are NEW homes. The overall dynamics of the housing market however is driven by EXISTING homes, which are a much larger market.

Semi-long time reader here. I’ve followed housing closely for years and am always interested in getting various opinions, both bearish and bullish.

My story for those interested:

My wife and I bought in 2010 at the bottom, or near bottom. Bought a foreclosure for 40-50% off what that house was going for at the peak in 2006/7. And on top of it, got a 30 year fixed rate at 3.25% through Fannie Mae who held the foreclosure. Paying off a mortgage at such a low rate builds equity fast. We’re well on the positive side of a mortgage payment, when more principal is paid than interest every month. The timing was just about perfect. It was a newish area of town with not much around. Since then it has grown all around with tons of stuff around, restaurants, shopping, etc. It’s become a cool place to be. So the risk of it becoming a ghost town again is quite low.

9 years later and the the house has more than doubled in value again in Bubble 2.0. My wife and I were debating whether to cash out. After much going back and forth we decided to stay put. After calculating all the costs associated with selling (about 8% given realtor fees and a variety of state/county selling fees/taxes), moving costs (twice) and then all the costs to buy again in a few years, we decided it wasn’t worth it. We could potentially be giving up well into six figures of net gain, even accounting for costs.

But life isn’t all about money. The house is exactly what we need/want, great location, neighbors, the works. Plus renting a similar house to ours would cost significantly more than the ridiculously low fixed mortgage payment we have. And moving is such a giant pain in the a**, the thought of doing it twice….ugh.

So, we’re hunkering down, waiting for Crash 2.0 to happen and go from there. Ideally we’ll ride it out and then at Bubble 3.0 peak in another 10 years from now, the kids will be off to college, the mortgage will have another 10 years of principal paid off, the time will be right to sell and downsize permanently.

I see a lot of comments here and else where about FB this and FB that. And I get it. But remember, not everyone is as F’ed as you might think owning a home.

There wont be a housing bubble 3.0 anytime soon….government debts and FED balance sheet will need to double or triple. At some point, its diminishing returns. Like NOW

You brought at a decent time. Just hang on. Make sure you have paid off debts and keep a nice reserve in case of layoff.

Just Some Random Guy – You’re doing it right.

This is great for you and I don’t begrudge you your success. We would all love to be there. However, for those of us who graduated right before the crisis with large student debt, this seems incredibly unfair. You were lucky enough to have the $ to purchase a home during that time when I was just getting out of graduate school without any nest egg and a big student loan bill. 11 years later I’ve paid off all that debt and saved more than should ever be necessary for a down payment on a two bedroom condo, but it’s not enough in SF. The government supported people like you at my expense, so it’s a combination of luck and policy. Good for you, but for those of us who came into our cash during this period, it seems fundamentally unfair that the government won’t allow even a modest correction and people in my position have to either invest in an obviously inflated market or just keep waiting forever for sanity to return.

TrojanMan,

Your reply to “ some random guy” is eloquent but unfortunately displays lack of learning from ( either observation or experiences) !

Had you observed what has happened in the period during the last big financial crises and the way the policy maker reacted to it you’d understood by now that ( people like yourself who do the responsible thing by paying their dues and deal in a honest fashion with their peers and society in general) come to regret that sooner rather than later( this is what you’re suffering from now) !

So paying your student loan quickly doesn’t entitle you to demand any concessions from the government or society for that matter, further more as you’d know by now from reading through this informative site and elsewhere where information is available the number of unpaid or delinquent student loans are spectacularly high upwards of 600Billlion !

The take home lesson is when it comes to financial decisions that we make daily in an environment of Total dishonesty by most economic commentators or media or the government/s for that matter is to play your cards carefully, and good luck in the futur.

Please don’t take this comment harshly it’s just another perspective that you might ponder when making your decisions in the future.

Also don’t take the comment as an encouragement NOT to pay your future dues !! :)

I don’t take it harshly, just totally off base and missing the point. I am not the one who received an accommodation. That would be asset holders who made really bad decisions. Even with zero debt you still need a down payment. Like I said, if you had cash to buy last time good for you. I don’t begrudge your luck in the timing but what the government has done here is deeply distorting and there will be a reckoning.

Trojan Man, just know your not the only one. Wife and I are in the same boat. We’re savers and now I’m struggling with what to do. We’re at that stage in life where one starts really settling down, but do I really want to but now even if we intend to stay for a long time. It’s frustrating that the government seems to support and encourage higher levels of risk taking. Especially when we all know the charade and mountains of debt, both public and private, can’t continue forever. I feel anyway about the whole thing myself and fortunately my wife has been able to temper my desire to move out of our rental and into or own place. I think we’ll be waiting at least thru early summer.

But please stay in CA as your former neighbors that are coming here are just making it harder for us “natives.”

It is a shame. But I truly believe your day will come. Just hang in a bit.

dear trojan man: the government has never supported people like me or like some random guy. during the 80’s i had to pay 20% down and 10 % interest when i bought the home that i still own. Then when i can finally put some money into savings i am getting nothing for rates unlike what was earned by money in the 80’s when cd’s were easily 6-8%. there isn’t anything for free (it may be included in the price), and there isn’t any luck, its all hard work for most of us.

i believe home prices will decrease further and this will be an advantage for both of us. Homes are no longer the tax deduction they used to be for the majority of americans. The new tax law increased the standard deduction so that there is no need to purchase a home for a couple to benefit from the $24,000 standard deduction. It becomes financially more beneficial to invest money in other ways until you are at a stage where you buy your forever (have grandkids over for christmas) home.

Well in a sense the choice of ever lower rates since then has meant the market has not had a shakeout, the reason for that is you would have seen 2008 earlier, i.e. a large part of the population of more recent purchasers underwater and with a recessionary environment thrown in. So it is to a degree good fortune to boomers, not that anyone should personally begrudge that generation – policy is set and they still have to work their own way through it.

However the result is that it looks like rent seeking off the younger generation has become a pastime. It is not funny when you have a generation unable to even start to afford a home.

https://www.jchs.harvard.edu/home-price-income-ratios

Government policy has blatantly supported asset holders over wage earners/savers. That doesn’t mean you didn’t work hard but it also doesn’t mean you weren’t lucky to be positioned with cash to buy when the market came back down to where it should be. You paid higher interest interest rates on MUCH lower principal before monetary policy created the bubble cycle we have now. Home affordability has never been lower and we have never had a generation closed out of hosing this way. The younger generations have been screwed by the numerous policies to support boomers and it needs to stop.

My job was going downhill during the dead cat bounce and I ended up moving to a better job market, but housing has recovered. Tons of foreigners that can bail to home country if things go south again. Neighborhood is full of people subletting rooms and AirBNB to make the monthly nut after paying $80K over the prior buyer. Some town houses held off market until market returned, sold for $150K less than prior buyer.

I rent via craigslist deal, I keep landlord happy. I think purchase price with small down payment would put monthly nut at around $1000/mo more than I pay in rent.

I am planning to get runs of bumper stickers with Overpriced! and Bubble! printed on them, and get them in hands of younger people that are tired of high house pricing. Let them fix up the signs everywhere and work to change sentiment.

Trojan, you are right on pretty much every level. Do not expect people here to tell you that because survivorship bias is so strong. I’m a little older than you and was able to buy in 2011. I was lucky. I realize it. The government absolutely chose winners and losers with their policies. TARP etc. It was artificial as hell and frankly we’ll see how it all ends up. To me we haven’t had a normal functioning economy since the 1990s and I mean it. Boom bust, money printing bullshit as far as the eye can see….But again, I hear you and you are right but life surely isn’t fair. It’d be better if people could recognize when they get a break but instead many just think they hit a home run b/c they were born on home plate.

Trojan,

I disagree that the govt did anything special for me. I got a cheap mortgage, fine I guess the govt did that “for me”. But the rest was nothing from the govt. I took a calculated risk to buy a house when everyone else was saying buying is a bad idea. I did the math and buying was a better option than renting. Nobody did that for me.

I didn’t do anything special or get any favors. And I won’t apologize for my decisions or be guilt tripped into it.

And you live in SF. T hat is your decision. If you want cheaper housing there are 100 cities you could move to where you could easily afford to buy something. SF and NYC have always been absurdly expensive, nothing new about it.

That’s not the point I made. The government didn’t do anything JUST for you, but their policies have supported people in your class (asset holders) at the expense of wage earners/savers. I don’t begrudge you, but you were lucky to have cash during that time and then ride the wave of government welfare for asset holders in general (who tend to be people with cash further in their careers). I also could care less about guilt tripping you, but I think it’s important to remember that, when you say not all homeowners are in a bad position, we understand why that is the case and the role of government in favoring one economic caste over the other and the moral hazard involved. Your guilt or lack thereof does not concern me.

SF and LA are home to my family. My whole life. I is also where I have my career, and it is not immune to the policies I we have been discussing. SF property values have not always been this way, not even close. The massive run up started after the GFC, and has been driven by a government supported stock market and all the other liquidity that flows into housing.

If you want to come here and brag for everyone how well your investments are paying off, at least have the impartiality to admit that you benefited from timing (luck) and government welfare at the expense of others in different economic positions.

Trojanman,

you should go SF fed and take a loss or dump at their building. Make you feel better.

I got my shack in 2010, 3/2 but functional. My opinion is same as your regarding what FED has done and will be doing.

I am pissed and scared. I know corruption when I see it. It is NOT house prices. It is the entire nation believes in working and wealth creation is for suckers and wealth transfer is the way to go. So they vote to do wealth transfers, politicians get more and more power and common people lose more and more power and till the end, US degrade into a nation of corrupted population and seeking wars around the world, to further do wealth transfer as opposed to leading the world to do wealth creation.

JZ – good post. I appreciate the suggestion regarding the SF Fed, but as you know in SF they probably already have plenty of dumps sitting on the sidewalk in front of their building.

regarding: “But life isn’t all about money. The house is exactly what we need/want, great location, neighbors, the works. Plus renting a similar house to ours would cost significantly more than the ridiculously low fixed mortgage payment we have. And moving is such a giant pain in the a**, the thought of doing it twice….ugh. ”

A wise comment from a careful buyer. My 2 cents to add? A house is a home, plus you have to live somewhere for those that are against home ownership.

Anyway, great comment.

Gonna be hard to cut prices.All the low cost

labor is in hiding right now.

Trust me ,the herd will panic. Wait…….wait……..& wait some more. The fiat wheel of fortune may be pointing to deflation not inflation. Contestant #1,come on up.

It is potentially very good, not bad, that construction of new houses is finally keeping up with demand, and that higher supply is leading to reduced prices but reasonably stable sales volumes.

6.6 months of supply is high but not outrageous by historical standards.

Too many have waited too long for a decent, affordable place to live, so as long as employment holds up there will be pent-up demand to work off.

The builder stocks are not getting trashed by the new-house sales reports, so the market doesn’t think that profits are going to be a disaster. And rates have stopped trending up so mortgage payment issues won’t drag on prices as much.

Of course, the market could be wrong. But I think it would be a mistake to get ahead of the market just now.

“6.6 months of supply is high but not outrageous by historical standards.”

Real estate websites (Zillow, Trulia, Streeteasy, etc.) are about 14-15 years old. Does their presence shorten the “selling cycle” by making viewing by buyers easier? Given this change in the buying/selling of real estate, what is a healthy level of inventory as expressed in months?

“Real estate websites (Zillow, Trulia, Streeteasy, etc.) are about 14-15 years old. Does their presence shorten the “selling cycle” by making viewing by buyers easier?”

Savvy would-be buyers–i.e. the young and tech-savvy–set up search parameters on Zillow, etc. then, when something comes up, they are on it. My realtor had one offer in a day, and that one fell through had another a day later. He handled both sides of the sale, and charged 3%.

>>6.6 months of supply is high but not outrageous by historical standards.

4 weeks of active inventory is a balanced market. Anything more than that means that product is piling up and going unsold because it is overpriced relative to the value it provides. Basically, all that is needed from inventory is that what goes pending gets replenished with new inventory.

Keep in mind that pending sales are not counted as active inventory. If there is 4 weeks worth of active inventory then there is another 4 weeks worth pending inventory marching along towards closing.

The REIC does not want buyers to understand that 4 weeks is a balanced market. They want buyers to believe the old propaganda that it takes 4 or even 6 months worth of inventory to create a balanced market. Those numbers ( 4 to 6) were never true, but they are even more false now that every new listing gets instant exposure on the internet.

To get back to the 6.6 months quoted number. Must of the US is now a raging buyers market. But the sellers are overpricing and the buyers are striking because of the overpricing. And as a result, prices keep dropping as the reality starts to sink on among sellers.

JustMe, I think you’re talking your book. Show some data. Find ONE market where there’s 4 weeks of new-house inventory and prices are remaining stable.

Keep in mind that we are talking about new houses here, not resales. Buyers know the development is in progress; the new houses get advertised before they get built. They can see the construction happening just by driving over to take a look.

Pre-internet, there were many ways by which those looking for homes found out about houses coming up for sale. The realtors had the same incentives to connect buyers with sellers, only the tools were different. The difference the internet makes is maybe 1-2 weeks on the cycle, not more.

Finally, any buyer making an offer within 1 day on a place that just came on the market is probably not doing their homework properly, nor taking the time needed to stay emotionally balanced about the largest purchase of their life, and could very well suffer some extreme regrets.

Price have been rising at 4wk inventory because sellers and buyers alike have been *believing* the realtor propaganda that 4-6 months worth is required for balance. If most of the people BELIEVE it is a sellers market, then there is a sellers market.

In 2018 in Seattle area the spell of the inventory propaganda was broken. The buyers just stopped buying, inventory be damned. And then the inventory doubled by the end of the year. Buyers then bought just half as much as before! The inventory was not the limitation. Overpricing was the limitation.

Maybe 3 months could have had some validity in the old days **IF** at that time the stats did **not distinguish** between active and pending inventory. With the glacial pace of old-fashioned paper shuffling and no web listings, it could take 1 month to get an offer and 2 months to close. Hence need 3 months of active+pending for balance. But these days, actives and pendings are counted separately, getting an offer takes 1wk if listing priced correctly , and max 4wk to close, typically.

Yes, I fight the propaganda.

Probably happy they aren’t the Americans who are going to have to eat all their bad debt when they walk away.

Most of those Chinese bought all cash anyways, what is this debt you are referring to then?

I have heard that the long arm of the Chinese government has found these people and forced them to sell and repatriate their cash?

Untrue. They are mortgaged.

From 2017:

https://www.google.com/url?sa=i&source=web&cd=&ved=2ahUKEwiXmpiZ6PLgAhUMEHwKHYKBAHcQzPwBegQIARAC&url=https%3A%2F%2Ftherealdeal.com%2F2017%2F03%2F27%2Fthe-death-of-the-all-cash-chinese-buyer%2F&psig=AOvVaw3ZHah7pDSZqSfAqVvfFsXw&ust=1552143752206952&cshid=1552057350657

Out looking in: Actually the 25% who are 5 years behind on their mortgage payments are the really smart ones!

They have figured out that the government won’t let the mortgage lenders evicted them for not paying their mortgages!

My friend who works at a community bank says they won’t foreclose on delinquent properties that have high HOA/COAs unless there’s a HUGE equity cushion because they’d rather have the unpaid fees accrue to the borrower.

DFW (north) area is seeing buyers traffic increase. Inventory is high but moving. Meaning is not getting worse and it may “get better” if the trend continues.

I’m waiting for prices to come back down to Earth. It’s not happening, not yet anyway. Not near me.

At some point, renting won’t make sense any longer in my case. I have Land/Lot ready to build, so I am paying property tax, landscaping maintenance + HOA, plus rent.

Lumber is down, but still too high. So is concrete etc. Supply demand pushed labor cost up around here.

I do see so many Apartments/rentals being built everywhere. That being said, the ones I see are almost completed or just completed and I see none being framed or just started. From 2016 to 2018 they were popping up everywhere, now, nothing new coming up.

– I wouldn’t touch real estate with a ten foot pole before I have seen what the impact of the new US tax code is going to be on (the price of) housing.

– There are some preliminary signs on what the impact of those tax code changes are going to be and those are “not encouraging”. People who regularly are receiving a refund tell me that that refund is going to shrink/has shrunk or no refund at all. Ouch.

dear j.m. keynes : my third comment on the new tax law. sorry to repeat but you are right. its about the increased standard deduction. The deduction is so high that most middle class americans do not pay that much in their home interest, so therefore they are not seeing a tax benefit to purchasing a home.

That’s just 1 variable in the tax law change. Some are not seeing a refund as expected bc their pay check with-holdings were lower throughout the year and therefore they already paid less in taxes.

The hit to high SALT states does hurt.

I am in socal and after putting in my mortgage interest, property tax in tubotax.. ouch I didn’t see my federal tax go down.. It was depressing for sure.. and a hit to my wallet

J.M Keynes – The US tax code is only impacting 1st tier properties in high tax states right now. Inventory is starting to build for homes priced over $1.2M. The trickle down effect is going to be two fold over the next two years.

1) A Houses priced over $1.2M will lose 20%-30% of their value and compress pricing all of the way to the low end of the market.

2) Builders have been focusing on luxury homes throughout the country. Sales of these have stalled, so construction workers and others involved in the real estate industry will see incomes dry up. This will kill the low end of the market by 2021.

The Fed has plenty of ammo to reduce rates again so I’m guessing 2021 will be a good time to take out a 3% down 5-1 ARM to ride equity gains and a lower refinance rate going into 2026.

Wolf, any advice on SF bay area’s housing market? We keep hearing that there is always demand in the silicon valley regardless of how the rest of the country’s housing market is faring. I saw this realtor’s blog who is talking about the recent sales data (ignoring March 2019):

https://sanjoserealestatelosgatoshomes.com/santa-clara-county-real-estate-market/

Market has softened here but homes are still selling.

Santa Clara County median prices are down year-over-year by about 15% in Feb, according to this broker’s own numbers, which match mine. Inventory is up about 40% in Feb. Average days to sell doubled. Etc. Santa Clara County is probably the hardest-hit Bay Area county right now. The data the broker supplies is pretty chilling.

Yes, homes are selling fairly briskly because prices have dropped sharply. Once those buyers are in their homes, a new wave of buyers will need to be recruited, probably at even lower prices. Prices are still incredibly high, with the median selling price in Feb at $1.175 million (down by $206K from Feb a year ago), so a 20% drop as in 2018 (according to the broker) doesn’t get you very far.

The small local builders drop prices the quickest. I witnessed that first hand. Back in 2007, I looked at a house but told the builder I would have to think about it. Within a week he heard I was looking at another property nearby, so he called to drop the price on his property by an additional 15% (after an original 15% drop) without any prompting on my part. Deal done.

I heard later he was worried about making payroll. Once a builder stiffs his employees and contractors, it’s game over for that builder. These guys like cash and they need it now.

Classic bubble popping action. Most of the recent “buyers” will end up locked in place with underwater mortgages or the new shacks will be seized by banks in foreclosure.

The gas cylinder valve has closed on the housing baloon. Doesn’t mean the baloon is going to pop. It will likely hold it’s form and slowly lose some gas.

That said, the economic slowdown across the world will eventually prompt the US to stimulate more than the recent $1 Trillion per year. It will take the form of “infrastructure” as that is the most saleable cause. That will push deficits higher but the economy will pick up some steam.

The rest of the world will also try stimulus (QE, deficit spending, etc.) with various results.

The world is in an economic war of attrition….best described as who will be the cleanest dirty shirt (according to recently retired Bill Gross of ex-PIMCO fame).

However, the wild card is social stability (or lack thereof). This is where all this economic gamesmanship will end.

Well if most of them were laundering unearned profits or buying into the USA with one of those “bring $2M in assets and you get a green card” programs, they are still feeling good.

SF & Silicon Valley, any indicators of a tech bust on the horizon and if the equity market dropped say 15%, would that not slow down RE for a bit? Uber & Lyft IPOs should be a big tell (after lock ups expire). How are other tech companies doing in terms of exits, M&A w lower valuations? 2001

> They cannot just not build and not sell houses.

Well technically they can go out of business.

Otherwise this would be an “irresistible force meets immovable object” situation.

But yeah, I’m picking nits here.