These unsettling tidbits about sudden problems on the demand-side in China.

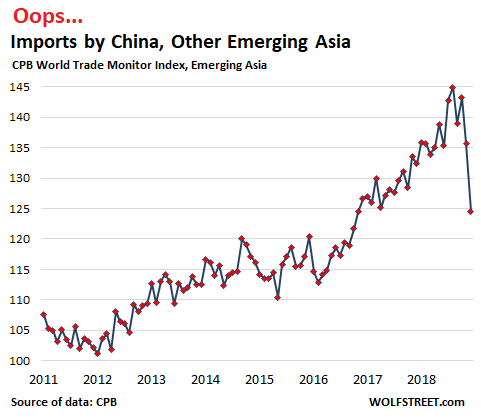

Imports by China and other emerging Asian economies in December plunged to the lowest level in two years, in the steepest one-month plunge since 2008, after having already plunged in November, according to the Merchandise World Trade Monitor, released on Monday by CPB Netherlands Bureau for Economic Policy Analysis, a division of the Ministry of Economic Affairs.

For November and December combined, imports by China and other Emerging Asian Economies plunged 13%, the steepest two-month plunge since November and December 2008 (-18%). In point terms, it was the largest plunge in the data going back to 2000:

“Emerging Asia” includes China, Hong Kong, India, South Korea, Indonesia, Malaysia, Taiwan, Thailand, the Philippines, Pakistan, and Singapore. But China is by far the largest economy in the group, and by far the largest importer in the group.

If the term “plunge” shows up a lot in discussions about certain aspects of the Chinese economy, it’s because that’s the kind of sudden wild moves now cropping up.

The fact that imports into Emerging Asia are plunging is a sign of suddenly and sharply weakening demand in China. This type of abrupt demand-downturn was clearly visible in the double-digit plunge in new-vehicle sales in China over the last four months of 2018, plunging demand in many other sectors in China, and record defaults by Chinese companies. When it comes to China, “plunge is no longer an exaggeration.

So the US trade actions against China – the variously implemented, threatened, or delayed tariffs – was largely geared toward hitting exports by China to the US. But it was imports that plunged!

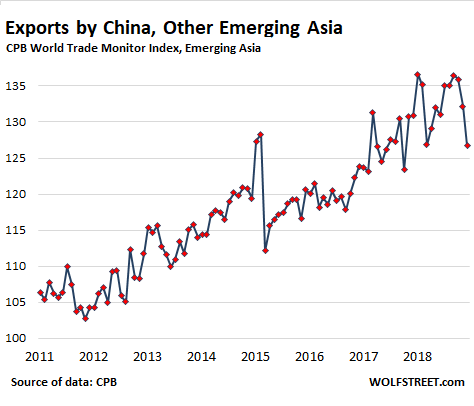

Exports from Emerging Asia too dropped in November and December, but not nearly as brutally as imports, down by 6.7% over the two months combined. And these drops were not all that unusual in the export index:

To compile the data for its World Trade Monitor, the CBP gathers data from official data providers in the individual countries (technical description). Because US import and export data for December was not available due to the partial government shutdown, the CBP estimated the data for December by assuming it was the same as in November.

The overall World Trade Monitor — for trade in all directions by all economies it covers –dropped 1.9% year-over-year in December, largely due to the plunge in imports and exports in Emerging Asia.

In the advanced economies – US, Japan, the Euro Area, and “other” – imports in December were about flat year-over-year, while exports fell 1.2% year-over-year.

In the other emerging economies without Asia, imports inched down and exports rose on a year-over-year basis in December. Imports: Latin America (-1.3%), Eastern Europe and CIS (-1%), and Africa and Middle East (-1%). Exports: Latin America (+8%); Africa and Middle East (+2.2%); Eastern Europe and CIS (+0.6%).

So the global trade situation outside of Emerging Asia is not exactly hunky dory but not totally alarming.

But the situation in Emerging Asia, and mostly China, is alarming. There is something big transpiring on the demand side, for imports to plunge like this.

Whatever it is, it must be rattling the nerves of the leadership. The New York Times just reported that President Xi Jinping “abruptly summoned hundreds of officials to Beijing recently, forcing some to reschedule long-planned local assemblies. The meeting seemed orchestrated to convey anxious urgency. The Communist Party, Mr. Xi told the officials, faces major risks on all fronts and must batten down the hatches.”

Whether dealing with foreign policy, trade, unemployment, or property prices, he declared, officials would be held responsible if they slipped up and let dangers spiral into real threats.

“Globally, sources of turmoil and points of risk are multiplying,” he told the gathering in January at the Central Party School. At home, he added, “the party is at risk from indolence, incompetence and of becoming divorced from the public.”

Mr. Xi made clear that the economy was a major concern, telling officials to beware of “black swans” and “gray rhinos” — investor jargon for surprise economic shocks and financial risks hiding in plain sight.

Clearly, something is up in China, and it bubbles to the surface in unsettling bits and pieces on the demand side. The official data on the economy still look blindingly rosy, with the GDP-growth-by-fiat-numbers still at over 6%, copy-and-paste with slight variations to make it look natural. But the relentless accumulation of awful tidbits on the demand side are starting to paint a different picture.

A painful moment of truth for banks and investors, hammered by “uncertainty over the accuracy of the companies’ books and disclosure of pertinent information,” according to Fitch. Read... Record Defaults by Chinese Companies: Fake “Cash” & Fake Accounting

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“Let your plans be dark and impenetrable as night, and when you move, fall like a thunderbolt.”

― Sun Tzu, The Art of War

“Let your ramblings be as cryptic as a fortune cookie, and when your speak, flap your lips assertively.”

— Debt Wazoo

“Everything is fine until it isn’t.”

— China

“In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could.”

–Kenneth Rogoff

“Everybody has a plan, until they get punched in the face.”

– Mike Tyson

In the long run, we’re all dead.

— John Maynard Keynes

“No individual rain drop ever considers itself responsible for the flood.” – John Ruskin

Not a fair retort, IMO.

Don’t see quoting Sun Tzu as “rambling … flapping of lips”.

Wazoo was talking of the FOMC

“Making no mistakes is what establishes the certainty of victory, for it means conquering an enemy that is already defeated.”

Sun Tzu

Ohhhh grasshoppa. You must be patient for the flapping lips. Wipe on, wipe off.

“Daydreaming is for believers, then you wake up”

-My 6th grade teacher

“How did you go bankrupt?”

Two ways. Gradually, then suddenly.”

Earnest Hemingway

THE WHOLE LIVERY LINE BOW LIKE THIS WITH THE BIG MONEY ALL CRUSHED INTO THESE FEET

-SAMO

Except there is little opaque about Dictator Xi’s intent.

“Hide and bide” has become “flaunt and taunt”.

General Sunzi would be disappointed.

– Is there data available for China only and for “Emerging Asia” without China ?

– I know that some analysts keep a close eye on developments in South Korea because the country exports A LOT OF high value stuff to China and the rest of the world. (think: e.g. semi-conductors)

– Another worrying sign is that car sales in China fell for the 1st time in 20 (30 ??) years. Source: Howestreet.com.

– The catalyst was the collapse of the chinese Peer-to-peer lending system. I think it was the final few straws on the back of the camel called chinese economy.

– Some people say that we, here in the US, won’t be affected. But China buys/bought A LOT OF commodities and less demand for commodities will put the squeeze on commodity producers here in N.-America.

The car market in China may be physically saturated, as in there is literally no more room for more cars. Traffic in Shanghai and Beijing is always bumper to bumper. Anyone living there who wants to purchase a car would find it extremely difficult to find a place to park it when at home. In Shanghai (and possibly other cities) you must enter a bidding process for purchase of one of a limited number of licenses for a new car which become available monthly. (Some own new cars they can not afford to drive because they have not negotiated the license process.) Owning an auto in China is not like owning a car in Wilmington, DE. Wolf, you follow cars closely. Can you correct anything I’ve said?

Nothing that Politburo can’t plan away. Chinese stock market was up almost 6% today. In one day.

I agree with you.

They have every means to stimulate the economy that western countries can’t image or copy.

The rise in stock, the economy condition was very similar to my memory in May 2014.

Best wishes to the Chinese in 2020.

Dead red panda bounce. :D

“Chinese stock market was up almost 6% today. In one day.”

Well known Chinese Communist Party strategy. Just a soon as they know what is being watched, that thing gets manipulated.

A “free” market, China is not.

That’s because much of the “Asian’ mindset is that of being good emulators….tough to argue that the have learned quickly and been taught well….! lololol

“A “free” market, China is not.”

Nor is the US, or any other major markets for that matter. Free markey is a myth.

The most obvious answer is that their true situation is unknowable as the data being reported up the various lines of communication is fabricated to some unknown extent. That’s the reason for the threatened accountability as there exists no effective other policy actions left in the party tool bag.

Soviet Union redux which explains the Gorbachev reference in the NYT piece.

When China sneezes, the world catches a cold. If the US, EU and China sneeze together it’s not going to end well.

Perhaps a long overdue flu?

9 out of the top 10 least affordable Price To Income Ratio in 2019 are in Asia…

1-Hong Kong 49.42

2-China 29.98

51-Japan 11.25

81-Canada 7.66

92-United States 3.58

Mortgage as Percentage Income in China is somewhere around 230-240 %. Rule of thumb is to never have more than 28 % of your gross income going to your mortgage. 230 % is equivalent to someone making 5K Gross a Month and having a mortgage of 11.5K

That doesn’t even make sense in Theory. I know macro well, this is beyond crazy, there is no way one can lead a healthy life having to live that much beyond your means to due excessive Inflation in your society. This is very real and it’s a coming crash at 1000 %, either through inflation crisis or deleverage, there is no other way around… jinping taps out and deleverages or Hyper Inflation within 2-3 years at this rate of printing. They have been on a dangerous Inflation path since 2011, it got really bad in early 2017 with super charged QE… People in China are running just to stand still, juggling loans and it will only keep on getting worst.

This isn’t Pakistan or Venezuela with 150-200 Billion debt, there banks have anywhere between 40-45 Trillion in Assets in 2019 and less then 10 % Equity. One can argue when there cycle crashes this year they will need 25 % of GDP to fix Banking System, that means print print print, and higher higher higher Inflation. Unbelievable

They will be forced to have a Regime Change, completely reform there economical system to structure it around accommodating offshore inflow of investments/money , like other successful Countries do

The fact that you are talking about Price-to-income ratio and China in the same sentence shows you don’t understand Chinese real estate at all. 82% of Chinese own their homes outright. Most home sales are cash, not mortgage. They save for 30 years and buy a house cash, rather than taking possession and paying interest for 30 years. It is tradition for a family to buy their son home when he gets married, at about age 30. They have thirty years to save up for this. The kids live at home until they get married, and they also save money. They do so for 8-12 years. They can help with the purchase. Also, the grandparents live in the same house and contribute cash. Debt is avoided at all cost. Even the people who get mortgages exhaust all options before borrowing money. Often the mortgage is just a 5 year bridge loan to put the deal together. In China, blue collar families purchase homes for their kids day in and day out. With cash. They never heard of the strange 28/36% ratios, down payments, price-to-income rations, and all that Western mumbo jumbo.

There is a small percentage of young Chinese who try to operate out of the Chinese system when buying a house. The results are as predictable as somebody who decides to drive on the right in the UK.

Funny, Way you presented as if the billions of Chinese are all on the same wave length, thinking, ability or is this a new communist doctrine for the population.

roddy667,

In the US too, about one third of homeowners own their homes outright without mortgage. And many others have very little mortgage debt. It’s the most indebted 10% or 20% who are at risk, and that’s who got in trouble in 2006-2011 and triggered the mortgage crisis.

At any rate, time to update your knowledge. By now, there is over $4 trillion in mortgage debt in China. The chart below goes through Sep 2018. Look how mortgage debt DOUBLED in four years. Via CAIXIN (click on the chart to enlarge):

Hiding In Plain Sight

The US mortgage disaster waiting to happen.

A full 25% of the overall US non-agency RMBS loans, are seriously delinquent by more than 5 years!

In 2012, just 2% of all these delinquent borrowers had not paid in more than 5 years. By 2014, just 2 years later, that number has skyrocketed to 21%. Why?

Because mortgage servicers around the US had discontinued foreclosing on millions of delinquent properties. Homeowners got wind of this and realized they could stop making payments without any consequences!

By 2015 62% of the balances of all outstanding securitized sub-prime loans had been modified. A “modified” loan is no longer considered to be delinquent! Now 4 years later these borrowers with modified loans are more than 40% re-delinquent. That big 2008 real estate lump in the snake, is slowly passing through.

The ability to carry debt depends on a few factors. The most important is how much other debt. Chinese people are remarkably low in that area. Also, the average person saves 36% of his pay. It’s not just the rich. The blue collar guy does this too. As a percentage of the homeowners, the people with low down payment mortgages is low. If property values drop 20%, very few will be upside down. In America it would be banking Armageddon.

4 trillion in mortgage debt (yuan) is 570 billion in USD. China has 1.5 billion people. This amounts to $380 USD per capita. Not a huge deal.

roddy6667,

You misread this. It’s 24.88 trillion yuan (on the chart), which I converted to USD 4 trillion.

Best Korea (as a target) is North Korea (as a target)!

To compare price to income ratio between China and US directly is apples to oranges, because of property tax. China doesn’t tax residential property annually like US does, therefore ownership cost for Chinese real estate is almost zero (no ownership tax, and minimal maintenance cost due to concrete structure and cheap labor) .

Apples to apples comparison would be to take US property tax and maintenance into account. With 2% property tax rate, 0.5% annual maintenance cost, and 5% interest rate (all made up numbers), the value of all future cash flow would be 2.5/5=50% of property price. So real cost of house in US would be ~1.5 times of the transaction price. I usually double the US house price when I want to compare it with Chinese property.

With this said, the property tax adjusted Chinese price to income ratio would still be around 20, which is insane. However, I have to agree with Roddy6667 that the percentage of Chinese people buying houses with such high ratio is very small, with the number growing. Majority of people got into properties long time ago before price has inflated to such an extreme level.

There are a couple of factors that Chinese are willing to spend all savings on house: 1. perceived value appreciation: in past 20 years real estate price has only gone one way. This perception could change as market softens; 2. other essential benefits tied to properties, i.e. citizenship registration, public schools, retirement income, etc. ; 3. High savings rate due to low cost of living, food, health care, insurance are way cheaper than US.

Can these support the ~20 price/income ratio in the long run? Nobody knows.

On the other hand, real estate (selling land, or leasing) has been the single largest fiscal income source for Chinese government. They will be hit hard if real estate no longer produces revenue. This is probably why all past policies have been ‘control price increase’ but ‘don’t cause price drop’ type of things.

I personally hope there would be a crash (either in China or in US) so I can get onto the bus at lower price points. Have no idea when/whether that would happen, though. This is part of the reasons why I visit this site. I enjoy seeing Wolf shorting real estate.

China and much of the EM crashed badly last year. That wasn’t about the “looming trade war”, but fundamentals.

Hmmm, China or Europe to blow up first? The latter is maybe a little ahead because of Italian debt affecting France?

No blowup. This time is different because we are sailing through oceans never seen so it’s impossible to say what will happen.

China seems to have run into some serious problem we have serious troubles diagnosing. All I can say is that the vicious cycle of huge liquidity injections around the Lunar New Year that has become the “new normal” for the Chinese economy seems only able to stimulate shorter and shorter term demand. I have no doubt the present flood of yuan will create it again, but the question is how long will it last? Last year it had run its course after just two quarters.

Allow me here a personal excursion but over the past three months I’ve started having some serious problems with Chinese suppliers.

I am not talking about the much abused “Chinese junk”: in fact quality of the latest shipment of polycarbonate moldings I received was absolutely excellent, passed QC with top grade. It’s the same thing as happened with fiddles: their top stuff is at the same level as our top stuff, perhaps a tad bit better, and often cheaper.

I am talking about continuous “snags” in the delivery process. Parts that get shipped but disappear from tracking when reaching a hub, shipped parts vanishing into thin air, repeated delays in shipping… the puzzling fact is that every request is met promptly with a “we are working on it” and refund requests are handled quickly and efficiently. These are not fly-by-night outfits out for a quick cash grab, but serious firms with some serious problems. You clearly see they want to keep foreign customers happy but there’s “something” beyond their control happening.

What this “something” is I have no idea but I’ve never seen something like this before, not even back in 2009.

Through oceans never seen/through fog as thick as night.

We have been seing “snags” on the chemical raw materials side for about a year out of China. Muliple unconfirmed “plant fires” and shorted orders. Prices also spiked 100’s of percent. It has been scary at times.

Quality control not one of their finer points.

This confirms what my colleagues have been saying… I’ve seen price hikes from China up to Q2 2018, then a plateau during Summer and Fall and finally prices started to be rolled back during the Winter.

This seems to extend to the rest of Asia as this morning I got a quote from a Japanese vendor I’ve used in the past for other polycarbonate moldings: it’s about 15% lower than his quote last November, and shipping is about 30% cheaper as well. I am really tempted to bite because every time I’ve bought from him I’ve been extremely satisfied but things here are deteriorating at a pace I’ve never seen in my life. This is not like one of the previous crises: it’s like watching a racehorse slowly running out of breath despite being flogged without mercy.

PS: regarding quality control… the problem is not with Chinese firms. The problem is when their customers want cheap: to quote Jeremy Clarkson “There’s no such thing as cheap and cheerful”.

If you want the lowest possible price you have to be ready to put up with a lot of nasty things, including spotty quality control, and that has no nationality.

MCO1, Yours is the kind of info it’s hard to come by and quite illuminating. Thanks!

I drove into town to get a replacement block heater for a Cat diesel engine. Worked in the cold and dark so the machine would start in the morning.

The new block heater was installed November last year. Now burned out in 4 months.

A once good U.S. brand. Clearly printed on the box was “made in the USA.” That is, the box was made in the USA. The actual heater element “made in China”.

Yup, China. It costs more to transport and replace their defective stuff than what the stuff costs at 2 or 3 time the price if it was “made in the USA”.

This “Walmartization” of American standards is a national cancer.

Well ‘unWalmartization’ of them would require the rollback of 45 years of neoliberal dogma.

Good luck with that one – don’t forget, we don’t do industrial planning for the manufacturing industry any more – only for the finance industry, which apparently must be afforded protections and favors that were never extended to the productive portions of the economy.

“A once good U.S. brand. Clearly printed on the box was “made in the USA.” That is, the box was made in the USA. The actual heater element “made in China”. “

You’ve got to be kidding!?

I sell Temro block heaters and have some Cat ones on the shelf, the boxes say USA and one of the 3 I have shows Made in USA on the block heater. Might depend on the brand you bought as to why the box is not labeled correctly. I am pretty sure there are laws about labels of origin but I am foggy on what they do or really mean.

MC01,

Corruption and theft or faked delivery of goods has always been a problem in China. “It fell off a truck” magnified a million tines.

I suspect that with the obvious increased signs of economic stress in China that economic crime is increasing as well.

And to those of you fantasizing about regime change in China, please do a little reading on this topic. Massive surveillance of the populace is the order of the day, increasingly amplified with all sorts of high tech. Google and Facebook in the US are nothing compared to China.

The commies control the armed forces, and only they have guns, and since the world wide embarrassment of Tianaman Square, they’ve avoided such public scenes by doing thousands of smaller roundups and executions of dissidents and protesters ….. EVERY YEAR. That’s right, hundreds if not thousands of these smaller protests happen every year in China, the people get arrested and shot/imprisoned, and nobody in the West hears about it.

“Don’t bring a knife to a gunfight”

-Gandalf (and others)

“The existence of a hunting culture and a large home grown gun industry were the key reasons that the thirteen colonies were the ONLY part of the British Empire to ever successfully break free by a violent revolution”

-Gandalf

“So the US trade actions against China – the variously implemented, threatened, or delayed tariffs – was largely geared toward hitting exports by China to the US. But it was imports that plunged!”

Gee, who would have expected that if China lost the income from exports it would result in a reduction in imports. And coming at a time when the great Chinese Bubble is already under stress.

This is reminiscent of NAFTA, which, by allowing the mass importation of cheap US corn into Mexico deprived millions of small subsistence farmers of their source of income. Who would have ever thought this would have resulted in the displaced Mexicans trying to find jobs in the US. Clearly not a US financial wizard.

Do those imports relate to “raw” materials?

To make sense of these wild moves, one might take a look at the demographic break down in China, if that data is available, and determine if there is a cut off point or range where the older, larger generation consumes less. If that’s the case, it could also account for record defaults of Chinese businesses.

A similar demographic time-bomb exists in America, where you have retirees leaving the work force at a higher rate than those entering it for the first time, resulting in less income reflation, less consumption and an expanding FED balance sheet to compensate. The question is, how big can the central bank balance sheet get before maintaining economic status quo is lost?

Yes, but demographics play out over decades, not from October through December.

Oh. Yeah, that’s true. Lol.

I actually got a laugh out of this. You mean you actually got a number from China you can believe in?

How many of the US numbers do you believe?

Aren’t most rhinos gray?

some are white some are black, some are extinct because the Chinese hunt them for their horns

My suggested ad line for Viagra: ‘Still working to save the rhino’

Trying to pin the drop in imports. The only two recent figures that were clear and available (e.g. via Reuters etc.) I found for main imports were for oil which is still at highs, and iron ore which dipped 1% last year and up again start of this year. So looking at China’s main imports

http://www.worldstopexports.com/chinas-top-10-imports/

other main imports are electrical integrated circuits/microassemblies electrical machinery… the rest are small in comparison. Those are 2017 figures which seem the latest offerred on the web. So if anyone wants to search further they might start looking at exporter data of those to China to get an idea.

Sort of related and quite informative is the state of the global corporate bond market which sits at 13 trillion. In recent downturns about 3% gets defaulted on, quite a lot of money especially if you consider maybe 2008 did not play out to its full effect. China has an increasing share in that market.

http://www.oecd.org/corporate/Corporate-Bond-Markets-in-a-Time-of-Unconventional-Monetary-Policy.pdf

So, is their reduction in imports due to reduced demand in the production of their exports, or mostly due to internal consumption?

I don’t know, but I imagine it will be largely due to reduced (or predictions of reduction in) demand for their exports.

?

Good add Bankers +100

The stars moove stil, time runs, the clocke wil strike,

The devil wil come, and Faustus must be damnd…Yet will I call on him: O, spare me Lucifer!

— Christopher Marlowe

I am getting push that a trade deal with China would be hugely bullish for the markets (like this isn’t bullish?) It might be “sell the news”. Two takeaways: US econ policy is run by an absentee landlord, has morphed into a monetary drug house and is therefore a hot money destination. The adults in the room are quietly taking charge, and a return to business as usual might involve some overshoot on the downside. The notion that you can make wholesale changes in policy and reverse the same does not square with the deliberate nature of business planning. Even IF there is a trade deal, the turd is already in the punch bowl.

If you go back to 1929, automobile sales peaked at roughly 5 million automobiles in the United States. The capacity of all large and small automobile firms in the United States was approximately 8 million cars. By 1932, automobile sales fell to 1.2 million, and the bankruptcies resulted in massive layoffs and a significant consolidation of the firms in the auto industry.

Based on sketchy data, automobile sales in China peaked in 2017 at a little more than 20-24 million cars ( electric vs. internal combustion engine cars make estimates very unreliable), but the capacity of the auto industry in China has been pegged at 30 to 40 million. Over capacity is problematic at the peak, but if auto sales fell dramatically as they did in the Great Depression, then massive bankruptcies will force a consolidation of automobile firms in China and perhaps around the world. Hold on if this industry goes south over the next few years as the internal combustion engine is phased out. Schumpeterian creative destruction will be the ruin of many marginal producers of automobiles.

I am a believer that humans have figured out how to avoid depressions. The problem with China is they think they have figured out how to avoid recessions altogether, and that’s exactly why they will have a big nasty one.

I think this was invented in the US by Greenspan and continues as Fed policy now.

Recessions used to be part of the normal economic cycle and were also usually short.

Then they became something that had to be avoided at all cost. Even at the mere hint of a recession (Y2K) Greenspan would cut rates.

When 2008 hit, there wasn’t enough left to cut, so QE.

We just saw the latest sequel: in December Powell announced the obvious: that rates were still not normal and the FAANGS caught a cold.

So he backtracked and they recovered.

(BTW: apart from Amazon, per billion of their market cap, these tech stocks employ very few people in the US and buy next to nothing in materials. Winnebago has over 40 times Apple’s head count per billion of cap. Ad outfits Facebook and Google have the Fed in thrall to their stock price and cap )

As the Fed searches for a ‘soft landing’, maybe an old saying from

aviation is apt: ‘A good landing is any you walk away from’

They are not going to land this puppy at Airport Normal without

some bumps, and they are running out of runway.

Yes, a Fed retreat or “patience” is just going to build up a bigger bad debt bomb, which will blow up sooner or later, possibly via bond ETFs this time. Exploding bad debt bombs have been the root cause of every major financial crisis in the US since 1800. The tight financial regulations and high tax rates from 1932 to 1982 were what prevented major financial crises from happening. That’s all been done away with. Continuous Fed intervention since 1987 has meant that the asset bubbles of this country, especially the stock market, have still not been fully deflated to their historic levels

Off-topic:

Did I hear Jerome Powell indicate that patience does not mean an END to interest rate increases, but just longer time to evaluate the data?

Did I likewise hear Jerome Powell indicate that patience also means waiting longer before any potential REDUCTION in interest rate (FFR, “policy rate”)?

Powell’s testimony did not actually say the abovein plain language, but could it be inferred from his clarification of what “patience” means? This was toward the end of today’s congressional testimony, Q/A session, maybe in the last 10 minutes or so?? Sorry I do not have the exact time.

In a speech with Bernanke and Yellen, Powell praised Yellen’s handling of the 2016 mini-recession, so continuity seems to be the template.

China exports a lot of building materials and tools most Americans are not aware of. For example, they export ceramic tile that’s labeled under Aurora ceramics. I can’t believe something as heavy as tile is exported.

They also export all houseware items, closet accessories, rugs, curtain rods, the list goes on seemingly forever.

I used to do inventory for lowes. Virtiually ALL of their Christmas seasonal was from China. Almost all power tools, nails, screws, and all electrical fixtures. Almost all appliances, lawn tractors, tools and chemicals.

A drop in US home construction would really hurt their exports.

Having shopped for tile many times, it appears that this is another manufacturing industry that no longer exists in the US.

The cheapest tile comes from Mexico or Brazil. The high end tile comes from Italy. Tile from China tends to be geared to compete with the high end Italian tile, great looking, much cheaper. This middle to high end pricing justifies the long distance shipping costs. Most granite and marble tile and countertops are now from China, which has gianormous quantities of stone quarries.

Engineered quartz is from Israel, Spain, etc. We can’t compete with Israel and Spain?

Making tile and stonework is one of those old fashioned trades that has gotten lost in America. Very unsexy, not high enough profits for the high flying financiers and junk bond kings of America