French banks are heavily exposed to Italy.

By Don Quijones, Spain, UK, & Mexico, editor at WOLF STREET.

“Don’t underestimate the impact of the Italian recession.” This was the stark warning from French Economy Minister Bruno Le Marie in an interview with Bloomberg News. “We talk a lot about Brexit, but we don’t talk much about an Italian recession that will have a significant impact on growth in Europe and can impact France because it’s one of our most important trading partners.”

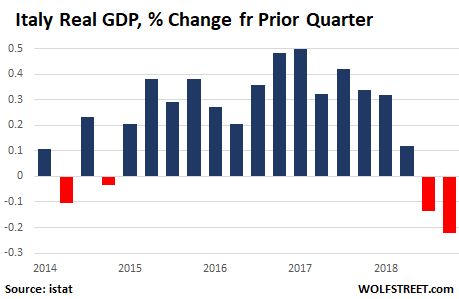

Italy’s economy as measured in real GDP shrank for two quarters in a row, which puts it into a “technical recession”:

It’s the second time in four months that France’s Economy Minister has expressed deep concern about the Italian economy in public. At the end of October he urged the commission to “reach out to Italy” after the EU’s executive had rejected the country’s draft 2019 budget for breaking EU rules on public spending. Le Maire also conceded at the time that while contagion in the Eurozone was definitely contained, the Eurozone “is not sufficiently armed to face a new economic or financial crisis.”

The French government is now openly worried that such a crisis could begin in Italy. The economies of both Italy and France are tightly interwoven, with annual trade flows of around €90 billion. More important still, French banks are, by a long shot, the biggest owners of Italian public and private debt, with total holdings of €311 billion as of the 3rd quarter of 2018, according to the Bank for International Settlements — up €34 billion from the 1st quarter of 2018.

In other words, even as political risks in Italy surged in the Spring and Summer of 2018, causing the yields on Italy’s 10-year bonds to rocket by as much as 50%, French banks increased their holdings of Italian debt by over 10%, once again belying the ECB’s long-held claim that its QE program would help reduce the level of interdependence between European sovereigns and banks.

And the €311 billion figure from Q3-2018 doesn’t even include the French banks’ exposure to derivatives contracts (€11.2 billion), guarantees (€16.2 billion) and credit commitments (€46.3 billion), which add up to an additional €73.7 billion. If you include all that, the total exposure of French banks to the Italian economy is €384.7 billion — the equivalent of 17% of French GDP.

France isn’t the only Eurozone nation with unhealthy levels of exposure to Italian debt, although it is far and away the most exposed. According to the Bank for International Settlements, German lenders have €87 billion worth of exposure to Italian debt — up from 79 billion six months ago — and Spanish lenders, €75 billion — up from €69 billion. If you include derivatives, guarantees and credit commitments, German lenders are exposed to the tune of €126.53 and Spanish lenders, €89 billion.

In other words, taken together, the financial sectors of the largest, second largest and fourth largest economies in the Eurozone — Germany, France and Spain — hold no less than €600 billion of Italian debt, derivatives, credit commitments and guarantees on their balance sheets.

It’s perhaps no wonder Le Marie is worried about Italy’s economy. He’s not the only one.

The European Commission is expected to warn next week that the Italian government’s spending plans will do little for long-term growth, with the proposed lower retirement age and the “citizen’s income” for the poor coming in for particular criticism. The government’s program makes Italy “a factor of contagion risk for the entire euro area,” the Commission’s annual report is expected to conclude.

But there’s not much Brussels, Berlin or Paris can do about it, even as the Italian economy slides into a technical recession for the third time in a decade. Italy’s government is perfectly cognizant that French, German and Spanish banks are now far too exposed to Italian debt for their respective governments to even entertain the idea of pushing Italy to the edge. That knowledge is fueling the coalition government’s bravado, with some lawmakers now even talking about nationalizing Italy’s central bank, the Bank of Italy, for a total sum of €155,000 and taking control of its assets, including Italy’s large pile of gold.

While the draft law stands little chance of being approved, it underscores just how far removed Italian politics currently are from the Brussels-approved status quo. Yet the more the Commission tries to bring Rome into line, the wider the spreads on Italian bonds tend to grow, which in turn forces Italian banks to cut their lending. This risks deepening Italy’s economic slowdown, which would put even further strains on Italy’s fragile banking system. And that’s the last thing that France’s government or its banks want. By Don Quijones.

No one can afford even the smallest hiccup in derivatives. Read… Disorderly Brexit Increasingly Likely, EU Blinks on Derivatives-Clearing in London

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Huge victory for Italy coming. Brexit goes through and the €Euro can begin its rapid devaluation.

…and the dominoes are falling…

“Eurozone is not sufficiently armed to face a new economic or financial crisis” haha

You also forgot the ECB holding @20% of Italy’s sovereign debt, around 365 bn, but no moral hazard there according to EU funded EUCJ in its latest judgement. Remember that sum (and corresponding amounts of other nations) is a mutual liability for all Eurozone citizens, regardless of if they would invest in another country.

Oh, and why not try Target2 imbalances, which actually are NOT the above mentioned debt, as explained in

https://ftalphaville.ft.com/2017/09/14/2193700/guest-post-the-ecbs-story-on-target2-doesnt-add-up/

They are the result of capital flows after ECB monetisation of debt it now holds. Those target2 imbalances are a further liability to creditor nations if the Euro disintegrates without accord.

They also demonstrate how the north is benefiting financially in terms of net position and interest burden , all else being equal, from the southern mayhem, that without mentioning social disorder via debt, and loss of productivity encountered further south due to a fixed rate single currency.

Anyway, at this point

“LONDON/MILAN (Reuters) – The European Central Bank is expected to absorb less than 15 percent of Italy’s bond issuance in 2019, down from around 50 percent in 2017, a new challenge to Rome which will find itself relying on the private sector to fund its borrowing…..

….But while Italy benefited from ECB over-buying in the past, it now stands to lose out as the ECB adjusts its bond holdings to bring them “into closer alignment” with each country’s share in the capital key, which was recently updated.

That would see the ECB reducing holdings of bonds from Italy, France and Spain by nearly 90 billion euros if it were to mirror its shareholder base strictly, according to Reuters calculations based on ECB data.

On the bright side, however, sentiment towards Italy has improved as Rome dodged a damaging budget row with the EU.”

Well dodged, now for securing the nations gold, which is currently integrated into the Eurosystem set of accounts via past unnecessary transfers to private central bank so as to meet EU criteria on national holdings of foreign currency, that so as to join Eurozone. Rules insisted the NCB held these (national) assets.

Haha ECB is Italy’s sugar daddy! ECB can technically buy bonds and hold 10 Trillion Euro on there sheets and it wouldn’t matter, which they will do… Europe has a bunch of zombie countries that need constant money to survive, Italy entered a recession while the ECB was buying there bonds, that’s about as bad as it gets. They are stuck on perma bond buying from ECB or they crash

That too, but there are limits to that… somewhere.

In reality you have many different events turning over at national level for any country, some of them will be very challenging or negative for the EU construct. EU cannot control this, at best it can try to manage any country via the elected leaders, but I don’t think it is really capable of doing more than trying to encourage more integration, more centralisation. When it gets too difficult then there is coerced restructuring, I don’t think Italy or Spain would take that lying down. So the methods used so far are more discreet, they take the populations along. As the results show, they are less effective. Even Spain which is used as poster hasn’t done much more than level off lower, spreading the cost more than finding any new direction. Perma bond buying is not going to be all that permanent because the surplus countries also have a saturation point where they see no improvement but a lot of risk from this approach. At some point one side will start showing its hand and expect the others to do the same. That is when it will all get ” interesting “.

Whenever I hear about the immediate dire fate hanging over Italy (“the poor man of Europe”) I look at the latest comparison of the median wealth of citizens living in various economies.

The 2018 Credit Suisse report lists the median wealth in the USA (#21) as $61,667 and in Italy (#15) as $79,239. I guess there is something to be said for owning your own home and passing it down thru generations—-.

If you use averages as a measure, the US is the wealthiest country in the world as one would expect from the most unequal wealth distribution in the hemisphere. Gates and Bezos’ wealth does wonders for the average when their trillions are thrown into the statistical pot—.

Of course everybody in the US knows that Socialism is BAD and leads to starvation and rags. That must be why Iceland has the wealthiest citizenry in the world, with over three times the individual wealth of Americans. ($203,847.) Could it have been because when their banking system collapsed in 2008, throwing the economy into depression, Iceland’s response was to jail the fraudulent banksters, nationalize the banking system, and re-capitalize it with public funding?

In the “free market USA” the policy choice was to allow foreclosure of all the mortgages fraudulently registered under the MERS scam while Justice turned a blind eye, and socialize the bonuses and golden parachutes of the banksters. At least that created new opportunities for hedge funds to buy houses for pennies on the dollar and enlarged the pool of renters to occupy the foreclosed homes.

Some would argue that fiat money itself is a form of socialism, so you would be comparing different forms of social management, as in statist US finance “capitalism” vs national compensation of imbalances from similar in Iceland. It is a reaaaaalllly deep topic that stretches into so many different fields of understanding that I won’t even pretend to be up to debating it here :-l .

As we are talking EU though, and how its imbalances are going to be addressed, or at least how they might be recognised, the Centre of European Policy has underlined the real transfer of wealth that has occured (whether anyone considers that earned or not), in Spanish

https://www.eleconomista.es/economia/noticias/9722451/02/19/El-euro-ha-hecho-a-cada-aleman-23000-euros-mas-rico-y-a-cada-espanol-5000-euros-mas-pobre.html

Which leads to the question of if EU will try or be able to socialise this by mutualising it along with more centralised fiscal (government) management, and if that would actually be seen as taking undue advantage of a previous iterance of purposefully nation corrupting Euro “capitalist” system.

There are so many twists and turns to this all that it is hard to know where to begin. I like to start a few thousand years ago, was much simpler and straightforward then, if also more unforgiving – meaning view is also always partly/fully subjective. I suppose morals are what binds the picture, but even those are variable to a degree…until in hindsight from a story that has already finished playing out = “That’s all she wrote”.

The ECB is suposed to buy less bonds, but they can and will change and do the opposite in a nanosecond.

“They are stuck on perma bond buying from ECB or they crash”

The most succinct summary of the situation!

And some form of EU (read Germany+Benelux+Scandinavia) bail-out this is quite likely also the aim of the – admittely resfreshingly new – posturing of the latest government in Italy.

Gee, without Italy what would Germany do?

Who would buy those BMW, Mercedes, and VW cars?

(Germany also built the latest ferry here in BC, Canada.)

Jess keep on keeping on I guess.

Germany would be perfectly happy to see Italy, Spain and Greece go their way. It doesn’t even share a border with the last two. And everyone wonders how Greece ever got into the euro (Sure. with cookery by Goldy but why was it ever even considered?)

But not France. The original core of the EU project is the only essential part. Essential because two lost wars is enough.

@Nick Kelly

“…Germany would be perfectly happy to see Italy, Spain and Greece go their way. It doesn’t even share a border with the last two…”

Since when does Germany share a border with Italy? News to me.

True. There is a sliver of Austria intervening. So of course they once shared a border. Not that I’m suggesting they should again!

Any thoughts on the main point? On the allegation: ‘They also demonstrate how the north is benefiting financially in terms of net position and interest burden , all else being equal, from the southern mayhem’

This explains to some degree how that has played out

http://archive.fortune.com/2010/06/03/news/international/PIIGS_euro_economy.fortune/index.htm

the short of it being that the disruption in the southern economies just happens to be to the profit of northern industry via competitiveness, and northern finance via debt burden ( assuming it is repaid in something better than toilet paper). The instability of the south and the desire for policy that ensures northern accounts remain whole, means borrowing is near free for northern countries, while the south continues to edge further into debt at their own lowered interest. The idea of that being that southern countries are able to cycle debt via sovereign means into the inflated economy so ensuring that the now pre-existing inflated status is repaid.

You can say that the south signed up to this, unwittingly or imprudently or out of bad faith even, but that is besides the simple mathematical fact that the low rates are benefiting the north to advantage, and theoretically at least, the whole to a slightly lesser degree.

This is what happens when you write all the previous risk (that was a main market indicator and structural framework) into a single currency, a single value . It removes all the boundaries of traditional resolution, it removes the clarity of who is assuming the liability and who should pay for it and how,both should redemption not occur and in terms of general fiscal responsibility.

Absolutely, but the point is that as stands the flow of trade in Eurozone is based on a circuit of finance that is not sustainable. The dynamic of the southern countries tended to high rates and inflation, Italy had low household debt, Spain low household and government debt pre Euro. That dynamic was part of national management, the fx cost kept local industry more competitive. Now that the South is flooded with debt and principally Germany is holding the derivative in the form of credit from that, apart from reinvesting it in the now more disorganised south (which it tends to stick to official routes to do so, also via ECB, in sovereign terms), how is it going to finance the buyers of its produce at the base rate it has set? That is why the construct is crooked, and the writedowns are going to be for the creditors of it, either Germany, or as currently the EU as a whole via ECB to keep Germany whole. Default by the south, in sovereign terms, has no strings attached, except legal fees, loss of goodwill, and face – for the last two the goodwill will have mostly gone by that time, and the loss of face will be directed politically at the usurpers, who ever they are chosen to be made out to be.

So they can keep this turning as is as long as they are able to, use the various crisis as points of influence if they choose, but at a structural level it is pretty much jammed and will bring more upheaval at some point. You are dealing with countries, many countries, and in each there are a large proportion of people ready to turn round and say “who the f are you to dictate any kind of new terms”. I would not want to manage other countries if I were paid to, ergo those involved are not as honest or well intentioned as they make out, and they won’t have people’s sympathy.

Free trade, free movement but with national oversight were fine, it should have stopped there in my opinion. We are not in the same imperial competition since WW2, I don’t see any menace of that extending unless both countries screw up completely, something Euro might help them do.

( assuming it is repaid in something better than toilet paper).

I don’t think many in Germany or anyone else think they are

going to be repaid the Greek portion. It is the populist transformation of Italy into the next bottomless but much larger pit that has them worried.

The thesis seems to be that Germany needs the suffering imposed on the South be having the loan, via the ECB, of Germany’s credit card, which they used run up debt.

Before the euro Germany was muddling along alright. Yes the D-Mark was uncomfortably high.

No such problem with the lira which was becoming a second- tier currency inside Italy, with real estate often priced in dollars. The project of devaluing the lira was well underway with the introduction in 1997 of the 500,000 lira note.

The idea of returning to the lira, and Greek drachma, has little support in either country, and none with their overpaid bloated bureaucracies.

Switzerland lies between Germany and Italy.

Regarding not buying much fancy stuff from Germany, China and the world in general is the main problem.

That reason for having the EU, no more wars and peaceful cooperation is still a valid idea. They can still do it if they stop making the USSE.

Southern Germany is bordered on the east by Switzerland and a longer border with Austria on the west.

PS: When this border was erased for a few years by the union of Germany with Austria, one could drive directly from Germany to the Italian border. without passing through a border on the way.

Nick

Time to drop the geography clarifications.

“Southern Germany is bordered on the east by Switzerland and a longer border with Austria on the west.”

Austria lies to the east of Switzerland.

You end with a geo clarification. And your clarification is correct. I got west and east mixed up while pointing out that, obviously, Switzerland does NOT lie between Germany and Italy. Germany has a long border with Austria. You do not have to pass through Switzerland to go from Germany to Italy. You can drive through Austria.

Have a chat with YNGSO as well.

Let’s not forget those banks also hold large amounts of Turkish debt. No one seems to care that Turkey is also in recession, and their national bank is being propped up by funds they can’t determine the source of. (Seriously, how can a bank not know where $21 Billion in funds came from? How can anyone trust anything they report?)

DQ

I’m genuinely confused. exactly what does La Maire mean by his statement “contagion in the Eurozone was definitely contained…”, and how credible is the evidence for that statement?

The EU is already financially fudged beyond any reasonable limits by the always popular bank bailouts (Monte dei Paschii, anybody?). Other than shoving more Trak II debt onto Germany, what resource does it have to respond to recession?

Maybe the EU should just pass a law saying the economy must improve next year…or else!

“contagion in the Eurozone was definitely contained…”

This is classic DQ sarcasm.

Classic polspeak meaning the opposite, that he’s scared as hell indeed.

Wolf, I must keep on beating the interactivity drum. You can figure out how to do it, and then your beer mug will be full with nice foam on top. If you need more money, improving your excellent product is the way to go.

This Article and the comments are a continuation of the previous “Brexit” article a few days ago. Posts made by the same contributors.

Once again I admire Banker for his accurate assessment of the problems the EU faces not directly connected to Brexit. But of course these inter EU Country debt problems are one of the reasons the UK needs more of a ‘clean break’ deal and not the 585 page paper ‘handcuffs’.

I hope there are people with views similar to Banker and J.Chip who can whisper in Mrs May’s ear.

PS. Wolf , I tried to donate the promised £50 by pressing the donate button but gave up after 3 attempt yesterday. I’ll keep tryiny with another or another bank until it gets to you.

HMG,

Thank you for your efforts to donate. I’m not sure what problem you have run into. If donating in GBP is the problem, you might try USD and let your credit card convert this into GBP.

So let me review as far as I can. The sequence of Step 3 is important. People have stumbled over it:

1. Go to https://wolfstreet.com/how-to-donate-to-wolf-street/

2. Click the “Donate” button. This opens a new page.

3. Into the space that says “$0.00,” fill in the amount you wish to donate — you must fill in the amount first or the next step won’t work.

Since you’re in the UK, I’m not sure if the system shows you, or allows you to choose, GBP as the currency. Here in the US, the only option is USD. If you can’t use GBP, use USD and let your credit card do the conversion on your billing statement.

4. Click the “Donate with a Debit or Credit Card” Button — this opens the box where you enter all your credit card info. And it should work from there.

I hope this is helpful. Thanks again!

Wolf , thanks

I’ll keep trying until it works.

The amount did come up in U.S.$ and I entered 50.00 assuming somehow it would get converted.

You’ll get it soon I promise. Or come to UK or South of France and pick it up personally !

Typical, bankers are happy to profit from the high interest rates they can charge on bonds until things go wrong. Then they start pleading that they need a bailout should bad times ever emerge. They claim all the profits in the good times, then the public picks up the tab for the losses. Same scam, different decade.

The article notes that French banks have increased their buying of Italian bonds. But it doesn’t explain why? Is there a wicked troll under the bridge that’s holding the princess hostage and forcing them to buy bonds which will eventually fail?

The system needs to be either capitalistic, meaning the bankers have to eat their own losses on their bad investments. Or it needs to be socialistic, which means nationalizing the banks. But the bankers want capitalism when they keep the profits and socialism when they push all their losses off onto the people who don’t get to share in the profits.

Excluding basket cases such as Greece (whose bond issuances are however always heavily oversubscribed), Italian bonds are the only euro-denominated sovereign bonds with a scrap of yield: the 5-years BOT (fixed yield) issued last Fall have a real-world yield slightly over 2%, which in the EMU is basically unheard of, especially for such short-term maturities. For all regulatory purposes these bonds are as good as French or German ones, and pay a whole lot more. And if there are troubles on the horizon they can always be sold for a profit to the “buyer of last resort”: Italian sovereign bonds have already gained 3-5% over last Fall depending on maturity, with fixed yield gaining the most.

In short this is a “cannot-lose” scenario for French (and Italian) banks: whatever happens they’ll make some money out of it.

Oh, and don’t worry: Italy won’t default on her bonds. The problem is not that.

The problem is the “good cop, bad cop” routine of so-called European institutions has grown so old and stale even the easily manipulated amateurs ruling Italy now have no problem calling the bluff.

People like Jean-Claude Juncker and Mario Draghi look increasingly like Mao Zedong’s counter-revolutionaries: paper tigers. They may sound terrifying, with their threats of sanctions, fines and assorted punishments but have they done so far? Enabled the very sins they proclaim to hate.

Levels of default, from generous to severe:

Monetisation by increased borrowing.

Monetisation by central bank easing.

Direct monetisation by overt printing of currency.

“Voluntary” restructuring.

“Selective” default.

Default.

“Odious debt” default.

It’s your fault we default, plus you owe us for the inconvenience, signed with my shoe :

https://mobile.twitter.com/AngeloCiocca/status/1054749403150475265

The two kinds of debt I’d worry about in Italy right now are construction and commercial real estate in that order. More details on request. ;-)

Hopefully banks learned from their past mistakes and packaged these loans into asset-backed securities to make them somebody else’s problem, because the idea of more bailouts is, how can I put this?, rather disgusting.

Manufacturing is another sector to keep an eye on: too many firms with zero experience jumped overeagerly onto the automotive component bandwagon, and many of those are in for a rough awakening. This is a sector with rice-paper-thin margins and, to make matters worse, many of these newcomers signed unreasonably large contracts which will now have to be considerably downsized because they were signed at the peak of the mini-bubble insanity. Making up for those minuscule margins with volume won’t be possible anymore.

I may not wax as lyrically as others but I have experience on the ground. Sadly.

I’d like to request more details MCO1

My thoughts exactly. Why do the French, and the Germans continue to buy Italian bonds when they are fully aware that Italy is in recession. I can only surmise that they are receiving a slighty higher rate of return. They have probably correctly projected that win the Italian bonds do blow up, the ECB will bail them out.

Thanks for writing this… addresses some things I was wondering about. DQ, there was a recent Reuters article on Italy and the bad debt – quoted below – and I wonder if you have insight as to who are the walking dead?

Rising risk premiums on Italian assets have made the “GACS” scheme more costly, but renewal remains important for the country’s banks which still hold 100 billion euros ($113 billion) in bad debts, a legacy of the financial crisis of 2007-2009 which had a major negative impact on Italy’s economy.

Link below. Time for a rethink.

The ECB bond buying may have had zero positive impact to date and the benefit could well have been a pure correlation to improved conditions post crisis.

So, if that is the case, not only would bond buying to support Italy be necessary but the narrative of its benefit is being questioned at the same time. Stuck doing something you know deep down is not improving the situation, just keeping the patient alive whist increasing the ECB balance sheet until something breaks.

https://www.hellenicshippingnews.com/no-evidence-ecb-bond-buying-helped-euro-economy/

Underneath all of this there are fundamental questions.

If the current situation is all the centralized elite have managed to achieve why do people listen to them at all, or allow them any power, or go along with it?

When will the masses wake-up and stick a finger up to the ECB, Brussells etc.

The central powers may be hoping the pain forces compliance and a melding into one, not caring for the impacted population. That is a type of war without bullets. Resistance futile but no blood shed.

The masses did wake up in UK, its called Brexit.

Pretty much proving that the masses should not be deciding economic policy. There is no doubt a second referendum would be a ‘NO’ by a far wider margin than the first. The difference: now SOME of the consequences are known.

These range from the Iris border issue to looming disaster for the auto sector. Actually, ‘looming’ might be the wrong word given Honda’s exit.

I am dual UK / Canada citizen and find it sad that the UK was a big fish in the EU and a much smaller fish on its own.

One time in Africa I flew Democratic Air: just before descent

the PA asked: ‘Do you want fifteen degrees of flap or twenty?’

Makes as much sense as asking lads in pub about trade policy.

Seriously,there is no mechanism for expulsion from the EU. If the UK could not live with some of the entry rights it could have just refused them. Do you see Hungary being expelled because it illegally ignores EU refugee laws?

Seriously,there is no mechanism for expulsion from the EU. If the UK could not live with some of the entry rights it could have just refused them. Do you see Hungary being expelled because it illegally ignores EU refugee laws?

Brexing will be delayed indefinitely.

Ahh….And the Yellow vest protests too.

I doubt the masses will win though…against machine guns, grenades and the armored vehicles of the militarized police.

The euro is killing european countries 1 by 1.

It makes the globalized elites wealthy while destroying the poor, the middle class and society as a whole.

Ultraexpensive glamorous housing for them and homelessness for everyone else.

In the end the People will have to save themselves by ditching what has become a soulless bankers’ dictatorship run from Bruxelles, via the City , Wall Street and unnamed Temples.

This is nothing but the rehashed model of all tyrannies before. C warned us of the moneychangers before.

Culture eventually wins over money. Which is a good thing. That’s coming.

When there are no animals left to kill and eat, even the great predators starve.

so, is anyone outside of the eu buying italian gov’t bonds? i feel sorry for all the regular people with their life savings in any european bank. this is not going to end well.

The central banks exist for one purpose: to serve as the oligarchy’s chief instrument of plunder against the 99%. The ECB has been especially pernicious, with Draghi’s “whatever it takes” pauperizing the former middle and working classes and transferring their wealth and property to a corrupt and venal .1% of international financiers. But now the rise of populism and nationalism among the screwed-over proles could pose the first serious check to the globalist oligarchs’ plans to turn Europe into a Goldman Sachs looting colony. However, it also means that Draghi, et al are running out of road to kick the can and forestall the long-deferred financial reckoning day – which, when it arrives, is going to be cataclysmic for the central bankers’ house of cards global financial system.

I was so keen to see the UK Brexit on the 29 March 2019 with “No Deal”.

“No Deal” would have meant the UK no longer paying the EC 9bn Euros per annum.

“No Deal” would have meant the UK not paying the EC 39bn “divorce settlement”.

The EC zone is in recession in reality and this is going to get worse over the next two years especially from Germany.

It would have been satisfying to have watched the UK leave and then the EC crash, EC banks go bust and watch other countries in the EC want to leave.

Unfortunately, the UK government are a bunch of wimps and have no bottle.

The UK should have looked at leaving the EC as a war against Europe without weapons.

The Euro will fall against the US Dollar dramatically over the next three years in any case and making the US Dollar stronger as a reserve currency.

Is this the beginning of the Iceland moment, and France Bear Stearns, and DB and Germany Lehmans, sump’n like dat?

Don Quijones,

Wasn’t there an issue during the PIIGS debt crisis regarding debt contracted under English law versus European law?

(I think English law provided more protections for creditors and maybe faster resolution.)

Is the preferred jurisdiction part of the reason why the City of London has such a large proportion of the derivatives market?

I’d love to hear your remarks on this issue.

I am ignoring the Italian recession, like I ignored the Turkey debt problem, (and I am currently ignoring Brexit) I continue to ignore the Yellow Vests, (and all middle class protesters). I ignored the debt crisis in Greece, the financial crisis of 2008, LTCM, and all the way back to the Cuban Missile Crisis! Ignored em all. It’s when the crisis is over you have to pay attention

Agree. For the most part, you don’t get to choose when you’re alive so it’s a good idea to just take what comes while you are–like the weather. I assume you’re old too.

I had money in Espiritu Santo but it was spirited away.

Amen.

Benedicat vos.

Thanks, Don! I’ll check out those links.