Homebuilder Toll Brothers just said it out loud.

High-end homebuilder Toll Brothers, when it announced earnings this morning, made some peculiar comments.

Not so peculiar was the plunge in new orders in its fourth quarter, ended October 31: New orders dropped 13.3% from a year ago to 1,715 units. In California, Toll Brothers’ largest market by revenue, new orders plunged 39.4% to just 226 units. Toll Brothers also slashed its guidance for home sales in its fiscal year 2019. This is not so peculiar because I already reported on the drop in new home prices across the US, amid unsold inventory of new homes that has ballooned to 7.4 months supply, the highest since February 2011, toward the end of Housing Bust 1.

Here is the peculiar part in its announcement concerning new orders (emphasis added):

“California has seen the biggest decline. Significant price appreciation over the past few years, fewer foreign buyers in certain communities, and the impact of rising interest rates all contributed to this slowdown.”

High home prices and rising interest rates are a toxic mix. We have been discussing this for a while, and the first signs are visible in Silicon Valley and San Francisco. But Toll Brothers today threw in a new variable that is going to heck: fewer foreign buyers.

This is the greatest fear of the housing industry in the state. Once those foreign buyers dry up, who’s going to buy? Because there is a little bit of an issue here.

At the end of November, the US Census Bureau released its data on state-to-state migration for 2017. So this does not include the new developments in 2018. But it gives us an idea of the magnitude of the problem.

People move to California for jobs and education. People leave California because the cost of living is just too damn high. Many retirees cannot afford to live in the state. Income taxes are another reason – though property taxes are extraordinarily low for people who’ve owned their property for a long time (due to a homeowner revolt that ended in 1978 with Proposition 13).

The data released by the Census Bureau at the end of November confirm the trends in prior years. When it comes to in-migration and out-migration between states, California is losing it.

In-migration: In 2017, a total of 523,000 people moved from other states to California. These are the top states from where people moved to California (data provided by the Census Bureau and real state brokerage Compass) :

- Texas: 41,000

- New York: 34,300

- Washington: 33,100

- Illinois: 27,100

- Arizona: 26,900

- Colorado: 25,000

- Florida: 24,600

- Nevada: 23,800

Out-migration: In 2017, a total of 661,000 moved from California to other states. These are the top destination states for Californians:

- Texas: 63,200

- Arizona: 59,000

- Washington: 52,500

- Oregon: 50,100

- Nevada: 47,500

- Florida: 30,900

- Colorado: 27,000

- New York: 25,000

So, with 523,000 people moving from other states to California, and with 661,000 people moving from California to other states, the state experienced a net domestic out-migration of 138,000 people.

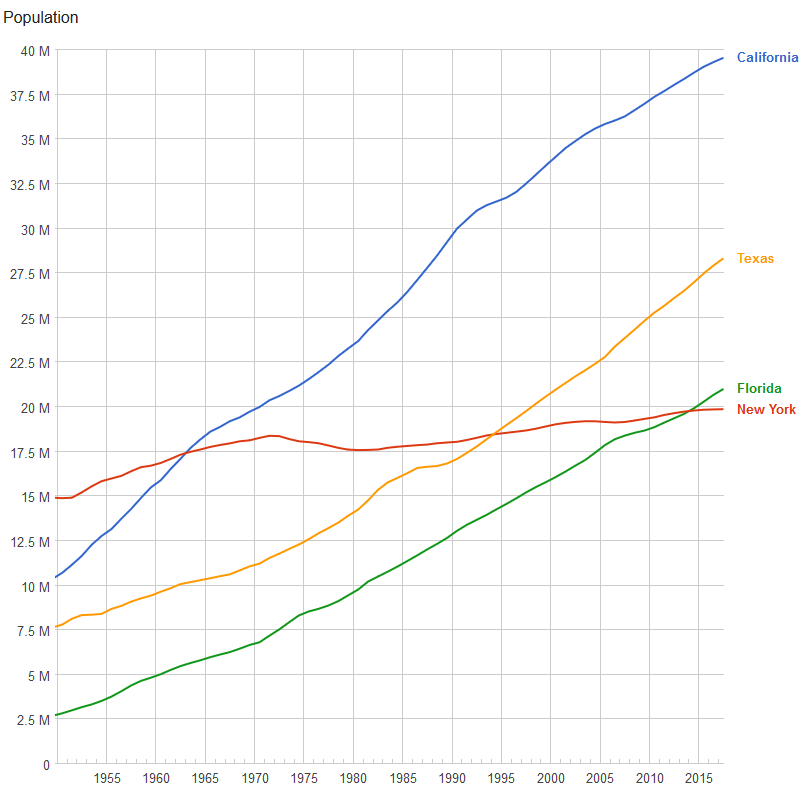

And this is repeated year after year. According to those migration numbers between US states, it would seem that California is gradually emptying out of people. But that’s not the case. In 2000, there were 34 million residents in California. In 2017, there were 39.5 million.

The chart below shows the population trends for California, Texas, New York, and Florida (via Google’s public data visualization; click to enlarge):

In 2017, net out-migration amounted to 138,000 people. But California’s population grew by about 241,000 people over the same period. The difference – around 379,000 people – has to come from somewhere. A small component of it is births minus deaths. And the remainder? Foreign migration.

In California’s case, foreign migration is largely from Asia. These people come for jobs, particularly tech jobs, education, and opportunity, or to get themselves and some of their assets away from the long arm of their government.

And now the greatest fear of the housing industry in California is that this inflow from Asia is going to slow down. Even a small slowdown, with domestic out-migration as large as it is, could create massive demand problems for the housing market.

And suddenly there’s Toll Brothers anecdotally confirming that fear.

The 2017 Census data does not yet include the impact of the Trump administration’s changes to the tax law and the discussions about curtailing H-1B and related tech visa programs, including spousal work visa programs. A crackdown on the tech visa programs would impact immigration from India the most. Revisions of the investor visa programs, such as EB-5 visas, would impact immigration from China the most. These are the people who enter the housing market in the largest urban centers in California. The agricultural workers from south America don’t impact the super-expensive coastal housing markets that much.

In addition, any slowdown in hiring in the tech and social media sectors – given that their stocks are now getting battered on a regular basis – would also impact recruits coming from overseas. And the housing market could already be feeling the first signs of this.

The underlying dynamics changed in August and have worsened since. And this is still the tech boom. Read… Bubble Trouble: Silicon Valley & San Francisco Housing Markets Head South

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I’m speculating here, but I think the average foreign buyer is just plain happy to be living here, so they are more willing to take risks on housing than the average person. Like in Vegas, people gamble when they are feeling good. Plus recent immigrants likely don’t fully appreciate the price buildup and history to things, including the earlier bubble.

Some may be thinking their time in the US is limited, and they don’t care if a mortgage goes bad. They can run.

I think the departure of these buyers for whatever reason is a big deal.

“but I think the average foreign buyer is just plain happy to be living here,”

Could be true!

“so they are more willing to take risks on housing than the average person.”

This will be true as long as there is not a precipitous fall in home prices. Losses hurt in general but precipitous losses will see one’s risk appetite vanish faster than one can say loss unless of course the Fed comes up with its bag of tricks to reflate home prices once again!

price those homes in rupees and you will see that they will still be better off than if they had kept their money in india.

Talking with a Chinese college student of mine, it is obvious this neighborhood east of San Diego is radically more pleasant in most every way than her polluted hometown. That would count for an awful lot of trade-offs money-wise, even now. Her home sounds like it has been reduced to a hell-hole.

Just wondering about all the homes destroyed by fires and now mudslides and whatever. Do these former homeowners give up and leave the state? Do they live in FEMA trailers like they did in New Orleans? We do see a lot of California plates here in Arizona.

https://www.sfgate.com/california-wildfires/article/Chico-home-sales-and-prices-soar-after-Camp-13441748.php

The town of Paradise was a relatively low-cost area of the state. There were a lot of retirees because of that. It’s terrible what happened there. Eventually, the plight of these people will disappear from the media, but it will go on because they cannot easily move into more expensive parts of California. They might have to leave the state or rebuild. But when you’re 80, it’s not that easy anymore to leave or to rebuild. And insurance payouts may not be enough to rebuild anyway. Surely, some will try to stick it out and live in FEMA trailers for a while, and others may pack up and leave. But either way, it’s going to be very tough.

Climate change causes more extreme weather conditions. One of the leading, if not the leading cause of climate change (not to mention deforestation, land use, water use, ocean dead zones and more) is animal agriculture. Why is no one talking about this ever or making the necessary changes?

A poorly maintained electrical grid caused the majority of the recent fires.

Climate? You are squinting for the gnat and ignoring the elephant.

People are living in areas that are naturally very prone to fires. The threat can be reduced, but that requires some cutting and clearing which is not acceptable to some. I am a staunch environmentalist, but many reg’s and laws are put in place by people who are so far removed from the actual impact of their policies.

50 years of fire suppression, encroachment of housing to formerly wilderness areas, people who insist on seeimgndemse forests which are a big source of magnifying fires, huge cutbacks in the fire fightimg budgets to the point that CA had at least 25% of its firefighters who werw qctually inmates working for a follar a day, ongoing and long droughts…the amounr of *fuel* sitting on the ground waiting to burn is tremendous. while the catalyst happened to be electrical lines, the propensity for huge fires is due to climate change, mismanagement of forests, cutting of budgets.

Case closed folks! The cows lit the fire, saw them with tiki torches and everything!

Had nothing to do with all the dead fall from an aging forest that should be removed and harvested so new growth can replace it. Nope, old dry wood doesn’t burn. It takes cow farts and matches, and cows have a lot of matches….

No wonder more people leave California after living there.

CA is all semi-arid, fire-adapted forest that, if I remember right, would naturally burn every seven years on average from lightning fires, though the natives used to burn it off every 2-3 years to keep the brush down and prevent the fire from getting into the crowns and killing the mature trees. Once you start building houses there this doesn’t work anymore, and there’s no other really good way to remove all that fuel. The proximate cause might be power lines and tree branches but the ultimate cause is people building houses there in the first place, with climate change as an exacerbating factor.

OK, exactly how is the weather “more extreme” in California compared with, say, 200 years ago? Statistics please, from a non-politicized source please, including all of the weather station data please, from the year 1818. After all, unbiased statistics and facts are the foundation for the “science,” correct? It would not be surprising to me if the exact opposite were true – that before the forests were managed at all, say, 200 years ago, fires were more widespread, in terms of acreage, than they are today.

Sure climate change has impacted forest fires and so does poor maintenance of the power grid but the main cause has been that the forest managers were unable to follow thru on their management plans..

The plan sold to all of us was to clear cut, burn off the brush and limbs, plant, then in 5 years, come back and clear the brush, then in 10 years come in and thin.. then in 20 or so years come in and do a pre-comercial cut.. Then in 40 years cut and start over…

Except Congress and the State Legislatures’ never funded the brush removal or any of the stages beyond that… So we ended up with forests that have fuel from the ground to the tips of the trees.. and these clogged up forests are everywhere as they cut almost all the old growth…

On top of this the government defunded the quick response units that would stop many small fires. There use to be a smoke jump base here in my valley and it has been gone for decades..

People who blame the environmentalists or say we need to just cut more are just blowing smoke and have no real idea what they are talking about. It was Congress that created the problems and it will take Congress to solve them. Either that or we will end up with no forests.

Climate change? Really? I thought it was “global warming”? Either way we should be more worried about deforestation, overfishing, Fukishima, radioactive waste, the fouling of our lakes/rivers/ground water, ie. serious environmental problems that are for more apparent and pressing than global warming/climate change. These are the here and now problems that are already affecting us. Have you even researched the major major problems we have with radioactive waste storage just in the US alone? Oh yeah they turned Yucca Mountain into museum which was supposed to house all of our radioactive waste from around the country safely for the next 1000 years. Instead it’s spread out into dangerous containment systems that are old, in dire need or repair, leaking etc. But yeah keep your eye on the ball of “climate change”. 17 of the wildfires in CA in 2017 were caused by PG&E, look it up!

Jon,

…Yeah, Animal agriculture…. Do you know that domestic animal respiration accounts for 13 Billion pounds of CO2 a day? Did you know that?

…actually no. That 13 Billion pounds a day is from human respiration…simply breathing at rest.

My Bad.

Until somebody can show that climate change was directly responsible for these forest fires or any of the other things it is being blamed for, and quantify the effect, climate change talk is of no material use.

A few years ago, some church folks went to court to argue that bible is another model and since science is full of models, it should be admitted as one of the competing theories. They lost the case on the grounds that every scientific model can predict and assign probabilities to each of the outcomes. Theory of God cannot predict. It makes claims post facto.

To claim that climate change caused these fires or those hurricanes or anything else, one needs to have predicted beforehand the event and a probability. Geologists do this by predicting earthquakes and assigning a number reflecting their confidence, for example. For climate change to be taken seriously as a factor for forest fires, it should be able to predict where the next fire/s will occur and the degree of belief one has. Right now, all I see are claims made after the event and a degree of belief that is 100%.

To make sense if this, consider this claim: the stock market falls every time a goat falls into a tea cup. Yesterday, the sacred goat fell into a tea cup and that’s why the market fell. For this to be a acceptable hypothesis, I need to be able to say the next time the market is expected to drop by this amount or more and how much my belief is. The important thing is to convince others and this can only be done by predictions.

Since we have the culprit for the fires, people are using Occam’s razor and assigning fault to the electrical sparks.

Sorry. The global warming theory is an old ruse, designed to allow government to increase it’s bureaucratic state, “solve” a problem that it invented, then tax carbon to excess(?!) to develop a funding stream. When I was in college, it was the “population bomb”, ozone hole, acid rain, etc. etc. These are a charade. California gas cost $3.50, in Texan its $1.90. Get it?

The climate is always changing: cooling or warming. The ice sheet thickness and mean pole temperatures are thicker/colder than predicted. Whoops!

The California fire problem has always been bad. It’s worse now due to fuel accumulation from the beetle and disease damages that have accrued, and the lack of much management. “Global warming is a cruel and manipulative hoax.

Well…maybe it’s just climate, not climate change. Multi-decade droughts have been documented by tree ring studies for California all the way back in the 1400’s and 1500’s, with shorter drought periods of 5 to 10 years more common in the modern era.

Severe droughts and severe fire events are related.

Granted, population pressure may make things worse as more people live in fire prone dryland areas today.

Some insurance payouts are in jeopardy:

https://www.latimes.com/sns-bc-us–northern-california-wildfire-insurance-20181201-story.html

Even if people are made whole, if the government is involved it’ll take a while!

Setarcos,

I’m not just talking about this fire. Or only fires. Broaden your perspective. More extreme and occurring natural disasters, rising sea levels, depleting of oceans, toxic runoff into our water, ocean dead zones, the list goes on. Why are we supporting an industry (animal agriculture) that is destroying our planet?

“toxic runoff into our water, ocean dead zones” You mean like the big and getting bigger one in the normally fish and shrimp bountiful Gulf of Mexico? The one caused by agriculture runoff from corn production for government required ethanol production? Nothing at all to do with animal agriculture. The government “solutions” are only making it all worse. Vive les gilets jaunes!!!

“Why are we supporting an industry (animal agriculture) that is destroying our planet?”

Because people love to eat meat.

If the problem was fixed, few could afford to eat the amount of protein we consume. And that is not something any politician wants.. A bunch of angry voters.. Just look at France to see how that worked out for Macron..

CAFOs have nothing to do with animal agriculture. You are throwing out the baby with the bath water which is intellectually ignorant and deceitful. Concentrated animal feeding operations are by nature environmentally destructive. That doesn’t mean we can’t raise cattle, livestock etc. efficiently and responsibly with minimal impact on the environment. Rotational grazing, management intensive grazing can be profitable, efficient, and sustainable. Yes, we might have to curtail some of our ridiculous meat consumption as Americans but that doesn’t we should eliminate meat/dairy etc. like some of the veggie/vegan/peta nazis insist. It has nothing to do with meat. It has to do with corporate profits. The Hormels, Tysons, JBS Swifts of the world could care less about sustainability. But they are no different than Goldman Sachs. If you think so you are clueless about the overall economy and the environment. THE FIRE industries have “destroyed the environment” as much as any actual industry out there. The effects are just so hidden and insidious.

Responding to Nick. You hit the nail on the head. We can absolutely farm responsibly and cut emissions of methane from industrial animal agriculture. Food is so cheap, it’s estimated that 25-40% of our groceries are thrown out, wasted each year. People need to value food. And the only way to get people to value something is to make it more expensive. Going sustainably will be more expensive, at least in the short term, but it’s what we need to do. BigAg will fight but there’s going to be a contraction back to regional food supplies as climate does change and worsen in areas causing localized droughts, water encroachment on farmland (already happening in the Nile River Delta) and unpredictable weather. There’s a resurgence of getting back to the land and people are doing extraordinary things in their communities with growing. And good thing they are because there will be some famines, but like the next Recession, it’s hard to say when exactly that will be. I think it will be in my lifetime and I’ve got a good 40 years left in me.

Rebuild in a fire prone Forrest…?!

There should be an IQ test before people are allowed to live in western forests. And people who build on cliffs.

And people who post on financial blogs. Heh.

Search for ‘paradise houses standing’. There’s nothing wrong with living in that area if you 1)use resistant materials, per current code, and 2)maintain a firebreak. It’s important that coverage of this event include some reality.

For a lot of Asian buyers, mortgaging a house in California is

a good speculative risk. If prices go up, cashing out after

a couple of years leads to a good nest egg. If prices

drop, you head back home knowing you won’t be holding the

bag.

Which Asian buyers are you talking about. Tech drone with visa, then yes, you got a point there. If the economy goes south then they can mail the house keys to the bank, leave their Tesla at OAK/SFO/San Jose airports, in long term parking, and fly back home. If they are from China, well, chances are they bought their place, all cash, at the top of the market. If they walk away, they will be will have lost a lot of money (assuming it is their money). Chances are, they will sell; better too loose 100 or 200K rather than everything.

Um, I knew a lot of Asian (Chinese, Indian, Philipino, etc.) in my 35 years in the tech business. They were all here because they WANTED to be here (sure, some probably brought suitcases full of cash). Though some expressed missing their homeland and culture, not one wanted to leave California. I suspect the speculators stay in Asia, and have a local proxy buy properties to be rented or just sat on.

I think it was on this site a few days ago where an Indian expatriate lamented all the Indians coming to town: “I left India to GET AWAY from Indians!”

Working in tech in SV, I can tell first hand that sentiment is low with dropping stock prices and immigrants feeling unsafe in in investing in this country.

For many years, california has reaped the benefits of immigrants bringing money/producing goods (especially tech) and investing in this state. Not any more.

Think about it. Would you invest in a house/business in UK if the govt can eject you at any time? Would companies invest in a country where they can’t hire the best and can have their best ejected any time?

Obviously with less stability comes less business.

Somewhere along the line somebody thought it was good to eliminate all loyalty from the employer-employee relationship. Companies often hire easily because they can fire easily. The primary beneficiary of this is the corporation. The individual becomes another just-in-time resource with no job security.

I’m surprised anybody wants to buy a house given the current work environment and how specialized things have become. People may have to take a job across town or across the country on short notice, to find a decent job in their technical area.

This instability is why so many tech companies and employees stay in Silicon Valley despite excruciating costs. Employee gets laid off or company folds, there are dozens of alternative places to work in your tech specialty within commuting distance. Company wants to hire, there’s plenty of talent in town for the same reason. Also the lifestyle desirability of being around a concentration of other tech people with similar interests.

Even if you did find a tech job in a cow town in Wisconsin where you could buy a giant house and land with your six-figure salary, you have no alternatives when you want/need to move on.

re: “… Would companies invest in a country where they can’t hire the best and can have their best ejected any time?”

Retired SV tech worker here. The H1B program, as noted here and elsewhere, did not achieve the stated goal of bringing the ‘best and brightest’ to the US. Large labor brokers–Tata, etc.–gamed the system and made thousands of (alleged) tech workers available, largely by stuffing the lottery for visas. In my 35 years in the valley I can attest the ‘brightness’ of the imported workers followed a more-or-less normal distribution; i.e. there were a few geniuses, some really poor workers and the vast majority were somewhere in the middle. The imports would, however, work longer hours for less pay and not complain about anything (including the hateful glares of the locals they were displacing).

About 20 years ago, just prior to the 2000 dot.com crash, the valley was flush and the imports were feeling their oats. They started a movement to, well, for lack of a better term, unionize. Then the dot.com crash hit and they went back to their cubicles.

Some grain of truth but you can’t deny that the vast majority of SV companies are from first-second gen immigrants who probably were H-1B at some point in their lives. Did you know that international researchers and students from Stanford have to get an H-1B to work at Apple and design those IPhones? If they don’t do it here, they’ll do it in a Chinese and Indian company and there goes our chance at making a phone company.

Without the stability of living in a country, smart immigrants won’t get the grooming or confidence to take risks.

It’s a simple equation: Every “budding” Nobel Prize winner was a normal human being for the vast majority of their life. Some traits made them smart, take risks, innovate and then become a Nobel prize in the future.

I see these people as wealth. Are 100% of these people going to be amazing? No. But even 10% of the best around the world create the best technology and companies that give us our leg up. Stop this funnel and you will never get that 10% that creates vast majority of our fortune 500 companies and thus our 401ks.

No budding nobel prize winner would ever try to move to an unstable country.

On the flip side to your argument, competition with foreign students and imported labor has made the pursuit of a career in STEM a bad deal for many Americans. Things are bad when more young people choose a career in law or investment banking over engineering. You have major economic problems when the majority of your population is engaged in some form of rent-seeking, and not producing new wealth through technology.

re: “Some grain of truth but you can’t deny that the vast majority of SV companies are from first-second gen immigrants who probably were H-1B at some point in their lives.”

Some grain of truth there, but you’re talking about a few dozen, maybe a couple of hundred, of the tens or hundreds of thousands of imports care of Tata, Infosys, etc. (that’s the normal distribution I mentioned). Some of whom got post-grad education at American institutions.

We’re talking simple probability here, now that tech is–I’ll make a SWAG here–about 80% Indian it’s not surprising upper management will reflect that. I worked at several companies that were representative of the overall workforce at the time and diverse–maybe 60% white, 30% Asian with a few Indians and other nationalities (yes, I know India is in Asia). As soon as an Indian was brought in or promoted to management, within a couple years the tech workforce at that company was 80% Indian. I got along with them fine–India is perhaps a better democracy than ours now, and they usually have a good sense of humor–but I was the odd man out, and the writing was on the wall. It’s been an under-the-radar takeover, and it’s hardly surprising management reflects the prevailing nationality of the workforce.

https://www.mercurynews.com/2018/01/17/h-1b-foreign-citizens-make-up-nearly-three-quarters-of-silicon-valley-tech-workforce-report-says/

https://www.nytimes.com/2017/02/05/business/h-1b-visa-tech-cheers-for-foreign-workers.html

https://www.theguardian.com/us-news/2014/oct/28/-sp-jobs-brokers-entrap-indian-tech-workers

Shall I go on?

Anyway, back to the original subject; the H1B Indian tech workers–many of whom I called friends–did not buy houses until they managed to get permanent residency (aka ‘green cards’).

The US’s inability to produce more local STEM students is probably more a cultural phenomenon than a recoiling from foreign competition.

Our primary school education and parental focuses just doesn’t push hard enough on engineering and medicine.

But good luck finding a foreign student who isn’t looked at as a failure by their families if they don’t become doctors or engineers when immigrating to the US. At least from Indian and Asian backgrounds.

The reality is that all Indians hire Indians and NOT any Indians but those from their village or caste or state where they grew up. They are a pain in the ass about it. All they want are yes men (or women) even if it means hiring idiots instead of American STEM people. I have no time for these guys as most are just as big a pricks as everyone else so don’t pretend otherwise.

James – Really?

The vast majority of H-Bs are NOT FROM STANFORD.

Are you delusional? or are you just a troll?

i just finished a number of tours of the nyc specialized high school system. it’s one of several public school initiatives that are funded to promote STEM here. incredible schools. bronx science has many nobel lauriate alumni. a freshman at staten island tech demo-ed their solar race cars for me after the principal showed off footage from the gopro that they had launched into the stratosphere.

the program gets a lot of pushback for it’s lack of diversity. by diverse, they mean black or hispanic. i would say 75% of the parents on the tours are immigrants mostly east and south asian. nobody seems to know how to fix this…

Cut the H1-B program, and many American STEM graduates will move back to California to work those jobs. Despite the propaganda in the media, American universities produce far more STEM graduates than the number of available entry level jobs, due in no small part to H1-B. A STEM degree is not a meal ticket.

I’m afraid you are correct. Tech was a wild and fun ride for me, but I can’t recommend it to any young people unless they really love it. It’s not a guaranteed meal ticket/career path anymore.

California Bob is right on. I worked in software development for a large bank for many years and while I liked the Indians and have many Indian friends, the H1B was definitely gamed by Tata et als. A STEM degree is still a good option but it depends where you are situated. A couple of my kids in the Austin, Texas area have done very well.

It’s not hard to see who the abusers are —

Top H1-B employers:

1 Infosys Technologies 20,587

2 Tata Consultancy Services 13,536

3 IBM 11,286

4 Capgemini 9,715

5 Tech Mahindra (Americas) 8,548

6 Deloitte & Touche 7,472

7 Accenture 6,690

8 Ernst & Young 6,130

9 Wipro 5,812

10 Google 5,288

11 Microsoft 5,005

12 Amazon 4,286

Think about it. Would you invest in a house/business in UK if the govt can eject you at any time? Would companies invest in a country where they can’t hire the best and can have their best ejected any time?

If the current tensions between the US and China end up erupting into a major conflict, which I fully expect them to given China’s aggressive power play in the South China Sea, the Chinese population on the West Coast could end up being viewed as a 5th column, just as Japanese-Americans were (unfairly) after Pearl Harbor. In that scenario, there would be politicians agitating to expropriate their property and march them into internment camps in the same of “security,” Constitutional protections be damned. So I can understand why Chinese “investors” might be pulling back from West Coast real estate.

James, your repeated use of the words “the best” is quite funny.

I have worked in the tech industry for over 30 years, and I can assure you that H1-B workers are far, far away from being “the best”. In fact, there are good reasons we used to call them “Bulk Engineers”, or “Half-Priced Half-Wits”,

Are you an immigration lawyer or a lobbyist?

It’s a white collar sweat shop now with H1-B workers. Problem is, they use them to stamp down everyone’s wages. Get too uppity, you’ll be training your replacement in no time.

Wolf, a bit of a correction – according to Federal data, the majority of California population growth comes from births-deaths.

Most recent data (Federal reports):

California Births (in 2016): 488,827

California Deaths (in 2016): 262,240

—————————————————-

Net Growth (Births – Deaths): 226,587/year

The picture I get is that overall population growth is comparable to Births-Deaths, so domestic out-migration is balanced by overseas immigration.

A drop in overseas immigration would still be of concern for the housing market since it still reduces demand.

Birth Data here: https://www.cdc.gov/nchs/data/nvsr/nvsr67/nvsr67_01.pdf

Death Stats here: https://www.cdc.gov/nchs/data/nvsr/nvsr67/nvsr67_05.pdf

P.S. There’s a newer CDC report for 2017 births (471,658, very similar to 2016). The 2017 deaths report is not out yet.

Wolf, I’ve read several reports that suggest many of those leaving CA are lower income younger people with a high school education in lower skilled jobs or retirees on fixed incomes. Both groups are reported to find CA too expensive for their incomes.

Those moving to CA are reported to largely be college graduates with professional jobs that are well paid.

My point in mentioning this is that while it’s unfortunate that anyone should have to leave CA because of affordability, those migrating into CA would seems to offset much of the loss from an income perspective.

I’ve seen some of those surveys too. But they don’t correspond with what I’m seeing among my acquaintances. To be honest, my sample is small and skewed. But so far, everyone I know who left had a pretty good income, from what I can tell. Several moved to Seattle — not exactly a cheap place, but less horribly expensive than the Bay Area. A couple of them moved because their jobs were moved (corporate decisions!), which is starting to be more common. The one exception, possibly, is a young chemist moved because he was let go and couldn’t find another job in SF. After he ran out of money, he moved back home to Ohio. The latter is going to happen a lot when tech companies start laying off. It’s always this way.

Another anecdotal: I’ve met a number of older people in the entertainment biz leaving CA to live in Vegas purely for cost of living and tax reasons. Some still work, one is retiring, but all are looking for somewhere relatively close to LA yet where they can stretch their dollar.

And these aren’t people living paycheck to paycheck. One is very successful and the others do well. They’re buying nice homes in nice neighborhoods and looking forward to enjoying their money instead of flushing it all away as rapidly as they would in LA.

re: “I’ve met a number of older people in the entertainment biz leaving CA to live in Vegas purely for cost of living and tax reasons.”

Well, you sure as hell don’t move to Vegas for the scenery and the climate.

If you can stomach Vegas-like weather, there are places closer to LA with similar costs of living.

Further one data point sample: I’m a reasonably intelligent tech worker who moved from Santa Barbara to the Seattle area a couple years back because of expense, the headlong rush into one sided politics within CA, and better mix of schooling options in WA. I lean left but my opinion is that a single dominant political party (from either side) is not good news for that jurisdiction. Also, no state income tax in WA.

@LessonIsNeverTry-

>”…moved from Santa Barbara to the Seattle area…”

What a shock that must have been especially the climate.

It’s not just California. Prices have been distorted on a grand scale all over the place with central bank credit markers (QE). It will be interesting to see how the luxury home segment in Dallas-Fort Worth performs since the slowdown is just getting started. The Highland Park/University Park area could see some steep declines when this latest bubble comes unwound destroying a lot of that paper “wealth”.

The real estate “editor” for our largest paper thinks 6 months of inventory would be average for our market. I guess it hasn’t dawned on him that with the current warped/flipped/manipulated market, 6 months of inventory would put us knee deep in a recession.

It’s funny you should mention the “luxury home segment”, when I drive around the east bay area that is 90% of the condos/apartments/houses I see being built. At least that’s what the billboards say, “luxury”.

The luxury segment cannot be affordable to 90% of the population, but that’s what they’re building.

Highland Park is old money.

Southlake is new money and where you would see a collapse of prices.

The majority of the foreign buyers you hear about have been buying these properties cash. Real estate doesn’t all of a sudden vanish if the market slips. Many of the Chinese buyers in particular have been renting out their properties and if they don’t sell the properties won’t lose money. All they have to do is wait for the fed to reinflate the bubble and in the mean time colle

\\\

Does anyone know does one need to be a permanent resident or citizen to own or purchase realestate in the USA, specifically California?

\\\

You don’t need neither citizenship nor a long-term (H1B, EB5 etc) visa. All you need is an Individual Tax Identification Number (ITIN) which is issued directly by the IRS or by a Professional Accountant approved by the IRS to do so: the latter are very numerous in areas favored by foreign buyers such as Miami-Dade or the Bay Area.

No, residency or citizenship isn’t required to purchase real property – land or a home – in IOUSA.

\\\

I was completely unaware of this practice. Thanks for the info.

\\\

and you can buy property through a limited liability corp in most places which can be used to hide the true owner.

The NAR has made sure you don’t need to explain where the money comes from either. As long as you are a foreigner, they don’t care. Me, on the other hand, I get probed and examined like I’m Osama Bin Laden if I want to withdraw $5,000 from my checking account to buy a 2000 4-runner. If you’re from out of the country, you can literally walk in the open house with a suitcase full of cash and buy the house on the spot.

What a country!! We have to be the dumbest rubes on the planet.

As always CA biggest problem is its politics. The writing is on the wall.

I presume you prefer Wisconson’s politics?

https://www.cnn.com/2018/12/05/politics/wisconsin-2018-state-legislature-tony-evers-scott-walker/index.html

I disagree with this viewpoint. The problem is the media has poisoned the minds of potential buyers with the constant drumbeat of a pending housing market crash. Since the economy is strong, these potential buyers are in the rental market, and rents are climbing again ( LA/OC ). I just watch an unremarkable 3/2 1700 sqft rent for $5500 per month quickly. Just a block away in Newport Beach, I see another worn 3/2, this one for $6500 per month, and people are kicking the tires. This is a symptom of a very strong economy and it won’t be long before these renters jump back into bidding on homes. As long as the job market stays strong, there will be no housing price collapse. More likely, we are headed into a period of slower growth with inflation … smells like stagflation. I am staying invested in real estate.

There is always strong demand for rental properties in Coastal OC, SD and parts of LA that are in good shape. Supply is limited and zoning precludes densification, thankfully, that would see FL-style high rises.

That said, sales on single-family and condo homes in OC has slowed considerably from early 2018 and there is now ~ a 4.5 month supply across OC, according to Jonathan Lansner in the OC Register.

Perhaps I am old fashioned, but 4.5 months used to be considered a sellers market, and 8+ months supply was considered a slow market. What happened?

The world changed. Technology arrived. Transactions can now be done in days. Here’s where I discuss this phenomenon:

https://wolfstreet.com/2018/10/19/us-housing-turns-into-buyers-market/

You’be been watching a “different” media than I have, evidently

The problem is the media has poisoned the minds of potential buyers with the constant drumbeat of a pending housing market crash.

BWHAHAHAAAA! If anything, the media, which derives much of its advertising revenue from the RE industry, has consistently downplayed the prospect of a bursting housing bubble, even though the data clearly indicates this is the case. Ten years of Bernanke-Yellen QE has inflated the biggest asset bubbles in human history, and now those bubbles are bursting as true price discovery, long deferred by the Fed’s deranged money-printing, reasserts itself with a vengeance.

This is a symptom of a very strong economy and it won’t be long before these renters jump back into bidding on homes.

Wow…just wow. Your “very strong economy” is a chimera and a fraud, floating on a sea of debt, credit, and QE funny money. Meanwhile, the productive economy, where most people have to earning their living, is floundering, even while Wall Street’s rigged casino is flashing danger signals of a full-blown market crash.

As a renter myself, who is sitting out the madness, I can tell you I won’t be “jumping back into” the housing markets until after Housing Bubble 2.0 implodes in all its terrible glory, and millions of people who overpaid walk away from their underwater houses, causing true price discovery to reassert itself at last after ten years of distortion and malinvestment due to the Fed’s trillions in conjured-out-of-thin-air “stimulus”.

“I disagree with this viewpoint”…

Well of course you do – a (wo)man’s view of the future is generally very dependent on the amount of debt he has.

A bubble is a bubble, and they never have soft landings. They don’t stay inflated on wishes, either.

Whoa! You are talking heresy now. Careful, you’ll be burned at the stake for disparaging indebtedness, we had a slight blip in the growth of debt in 2008 and it nearly wrecked the entire world’s economy.

Similar situation in SF. A house across the street from me was just sold for $3.25M (asking price was $2.99M) in about 2 weeks. Although last Sunday it looked like there’s an open house on every block. I’m in Glen Park / Noe Valley area.

SoCaJim,

“The problem is the media has poisoned the minds of potential buyers with the constant drumbeat of a pending housing market crash.”

This is so hilarious, and it seems you don’t even see how hilarious it is. So has the media “poisoned the minds of potential buyers with the constant drumbeat of” buy-buy-buy for the past 7 years, as it was spreading the hype emanating from the industry? This was the process by which California’s housing crisis was created.

Look, the media is reporting the data. And for years the data was: You can’t lose money in RE. Buy,buy,buy. Now the market has turned. The numbers are clearly indicating it. And the media would be lying not discussing it.

The guys who wrote “Freakonomics” called the real estate business “an industry of dissemblers.” So true. Any time the media quotes a so-called real estate analyst, it’s always some RE tout or shill whose paycheck from the real estate industry depends on him or her denying the existence of a bubble, much less a bursting bubble, and parroting some variant of the NAR “now is the best time to buy!” line.

This has been the giant elephant in the room all along. And in the local (SF) media, vastly underreported as a cause of the bubble because it’s better to just blame the ‘tech bogeyman’ and the Google bus for everything, especially when 35% of the city is of Chinese descent. No politician in CA is going to go near this third rail as a result, but nonresident foreign ownership of property needs to be addressed, like it was in Australia, NZ, BC – we’re in the same bubble they are.

Every open house I attended in the Bay Area between 2013-2017 had at least one offshore broker involved who was ready to pay all cash, over asking on the spot. They bought them as an escape hatch. Literally getting their money away from the CCP and in the process getting their now young kids a foothold in the UC/Stanford education system and some clean air if/when the house of cards in China collapses. Every RE company in SF has a Chinese website and they were running homebuying bus shuttles directly from SFO so people could land and go to see properties over the course of a weekend.

The Bay Area is littered with properties now owned by mainland Chinese and either sitting empty or being rented out.

That will be the wild card; if the domestic situation gets bad enough that they need to unload en masse like the Japanese did years ago, prices will go off a cliff.

The difference is these are (formerly) middle class starter homes, not Pebble Beach, Rockefeller Center and not commercial RE like the Japanese bought and took a bath on. First time resident buyers were shut out of their own market, and that adds to the distortion.

FWIW, I sold my house in SJ–owned for over 20 years–in March. I really didn’t care who bought it, as long as the funds cleared escrow. I figured if a Chinese showed up with a suitcase full of cash, as long as s/he had the biggest suitcase, it was a sale.

The Zillow ‘z-value’ was about $100K below what I sold it for, then rose to the selling price, then dropped to about $100K below again, and is now just below the selling price.

Nailed it. Congrats!

“Trump administration’s changes to the tax law and the discussions about curtailing H-1B and related tech visa programs, including spousal work visa programs.”

Boo hoo. US companies might have to hire Americans at a higher wage. The whole point of the H1-B program was to suppress wages and create an underclass of dependent workers who can’t switch employers. I assure you there are many degreed Americans who will fill those positions if given the opportunity. Particularly those beyond the ancient age of 35.

You are implying there are no workers to take the place of those h1-bs. Just like with the trucker shortage the ‘shortage of tech workers’ you are alluding to is actually a shortage of workers who will work for peanuts and can be treated like cattle.

I know a couple of big tech and semiconductor companies who are now setting up big operations overseas – after getting a lot of local tax incentives in the U.S. Someone I know is out in another country today hiring people for one of these companies as they plan to pare down their American workforce to address this visa “problem”.

They will be laying off more American workers soon. You can change the rules. They will find ways around it. They need to buy back shares. How will they do it if they actually pay their American employees a decent wage?

re: “They need to buy back shares. How will they do it if they actually pay their American employees a decent wage?”

Borrow the money, then lay off the employees.

Gee, I didn’t know my parents were visionary trendsetters. They left MN for CA in 1954, and bailed in ’68 for Canada. It was shortly after the Hunters Point riots and this angry leader was interviewed on the news and stated, “We’re not going to burn our neighbourhoods down anymore, we’re coming out into the Valley and burn your houses”. That was in ’66. My folks spent a year prepping to move and the moving truck came that August.

Exploiting migrant workers is nothing new to California, whether it’s an apple box or a keyboard the person toils at.

Imagine that. And as for H1B1 visas it reminds me of Steinbeck’s, Grapes of Wrath. ”Gonna get me a whole big bunch of grapes off a bush, or whatever, an’ I’m gonna squash ’em on my face an’ let ’em run offen my chin.”

“Muscles aching to work, minds aching to create – this is man.”

“Why don’t you go on west to California? There’s work there, and it never gets cold. Why, you can reach out anywhere and pick an orange. Why, there’s always some kind of crop to work in. Why don’t you go there?”

and: “The great owners, striking at the immediate thing, the widening government, the growing labor unity; striking at new taxes, at plans; not knowing these things are results, not causes.”

― John Steinbeck, The Grapes of Wrath

And when housing collapses the blaming will begin.

The only projects getting done in my hood in lower SoCa are high rise low to middle class/ affordable housing. These are probably not high margin projects for the builders. Some of it is demographics, environmental, and a lack of infrastructure. While China and visa issues affect existing housing (in specific locations) the problem statewide is fire, freeways, and jobs. PBS was covering the jobs market in San Berdoo, where automation requires retraining every 17 months. The largely hispanic workforce lacks the education to satisfy the requirements of business automation processes, (blue collar jobs) incl 3 Amazon fulfillment centers. These people will struggle to find their place in the housing market.

Are you saying that one can be too stupid to work in an Amazon centre, or simply illiterate (which of course is not the same thing)?

“PBS was covering the jobs market in San Berdoo, where automation requires retraining every 17 months.”

I saw the same show, but had a different interpretation: The technology changes roughly every 17 months, but the only people requiring retraining were those maintaining and repairing the machinery. Putting items in boxes or boxes on pallets doesn’t require frequent retraining.

Those fulfillment jobs aren’t living wage jobs for the most part, they are talking about the people who will get an education, or training, want to marry and start a family, and who will buy a house.

Amazon jobs are mostly seasonal and low-paid. They have a program “Amazon CamperForce” to actively recruit people who roam the country in RVs —

http://www.amazondelivers.jobs/about/camperforce/

CamperForce. Yay, a nomadic workforce roaming the country in search of work. And of course, all the locations are full.

So depressing.

Wonder if the ‘CamperForce’ will be staying in WalMart parking lots?

Maybe The Powers that Be should start paying attention to what happens when the proles can no longer afford decent housing or to pay their bills, while their corporate overlords use their bought-and-paid-for politicians to stack the deck even further against the 99%.

I have been going to France for the last 20 years. I must admit, the French complain by nature. But I have never seen them as angry as I have seen them this time. People can’t pay their bills anymore. They can’t afford the rent. They can’t support their families. What happened to the “socialist” system that is supposed to provide a decent living to everybody? The person making 2,000 euros a month, who was middle class 10 years ago, is now considered poor.

‘the social democratic system that “provide[d] a decent living to everybody” was preventing the banksters from acquiring all the assets and all the gains to productivity of the nations with that system of political economy (i.e. most of western Europe). Along comes the bankster-engineered eurozone to enforce monetary dependency and fiscal austerity on previously sovereign social democratic nations — et voila! — no more social democracy.

Macron is a textbook bankster.

“People move to California for jobs and education. People leave California because the cost of living is just too damn high.”

That’s pretty much true. The thing that matters to the housing market is the fact that the people who are leaving are US citizens and the people who are arriving are not.

It is also important that many of those educated immigrants are what we call “not economically motivated”:

In the case of Chinese people, there is a certain perception that buying a house in Canada/US/Australia is a form of Life Insurance. If some political disaster happens, and you have to run for your life, having a house in LA (or at least Surrey, BC) could mean not having to live in a tent in a refugee camp.

In the case of Indian tech workers, a disproportionate number of them are homosexuals. They really, really do not want to go back, because of the, um, prehistoric attitudes Indian society has towards this sort of thing. They really, really want to stay in San Francisco.

In both cases, minor changes in the housing prices or the tax situation will not change their high level of motivation.

re: “In the case of Indian tech workers, a disproportionate number of them are homosexuals.”

Source?

That is just nutty to claim that Indian tech workers are gay. Lordy!

“In the case of Indian tech workers, a disproportionate number of them are homosexuals.”

Where the heck do you get this stuff?

Trump among other so called ‘like smart’ types LOL

30 years of working in the tech industry.

I have worked with many H1-Bs, also TN-1 and L1- visa holders.

Once you get to know them, you start to see that they are also victims of the system.

H1-Bs are offered 3years plus another 3years so long as they’re sponsored.

Anyone know if they stay longer than 6yeaers? Or do they typically return home? On avg…

I would think they’d miss home after a few years..

And then when a recession hits it could send them fleeing

Congress changes the rules every few years, but. . .

AFAIK, the rule is that H1-B visas can be extended indefinitely in cases where a “Change of Status” has been filed. That is to say, if the employer has formally sponsored the H1-B for a Green Card, then the H1-B can “stay in status” for as long as it takes.

That is why you have some H1-Bs who have been here for 11 or 12 years. They are still waiting for their Green Card to come through.

Just went to Zillow to check the ongoing valuation of my house (mid peninsula). For the first time in 8 years I saw a price decline. For most of the past year my house saw the biggest monthly increases ever, and today its in the red. Copied and pasted:

LAST 30 DAY CHANGE (-0.4%)

Seems climbing prices in my neighborhood stopped and made a U-turn in just the past few weeks. I’ll bet in a month it’ll be down significantly more. I have a sense this crash is going to go a heck of a lot faster than the last one.

That said, I do hope CA will be significantly depopulating as we crash, especially my area. It is much too crowded around here!

My wife and I (and our son) are three of the “domestic-out” people who left in 2017 for Washington. Our sole reason for leaving was housing prices, which seemed to us to be absolutely crazy.

We did not get into the market when it was “affordable” in 2011 mostly because even then it would’ve taken basically all of our savings to get into a small house – and we were far from confident the market was going to go recover (obviously in retrospect we should’ve purchased then).

Here’s the thing – we scouted Washington prices in 2014/2015 and found them to be much more reasonable, and we didn’t need to live in Seattle where the prices are just the same as California. But we didn’t actually move until mid 2017.

The irony – by the time we moved, the prices in the town we moved to had gone up so much that the median price was the same as in California when we left! So here we are, paying a smidgen less in rent, and finding prices sky high.

We both miss California a lot and will likely come back. I have a suspicion as the housing market turns there will be others like us who didn’t buy when things were low, then left as things got really high, who are now at the point when prices to come down will consider coming back.

Another factor is the treasury department stepping up it’s scrutiny of all cash purchases through LLCs and lowering the threshold to $300k. This has curtailed cash purchases all over the US.

When I toured California in 2013 I drove from Yosemite to Morgan Hill just south of San Franisco through the middle of the state. I said to my wife, now I know why California is called the Golden State, because everywhere we looked was golden brown. I also said all this was a tinder box just waiting to catch fire. I have one picture where one green tree sits in a vast land of brown to capture the Golden Browness of California.

Little did I know then how many would lose their homes from future fires.

But I did know then that I would not want to live anywhere near that vast browness.

Laughing Eagle, CA has a Mediterranean climate with little or no rain between April and late October. Our climate is usually dry to very dry, other than the northern third of the state, which is more akin the OR and WA in terms of rainfall. Here in Orange Co, we’ve recently had days when the humidity was 8 (eight) percent, or drier than the Sahara. So while it’s dry, anyone who’s lived here for more than a year should have the good sense to clear brush near one’s home, avoid shake roofs and have an escape plan, especially in remote areas. And maybe reconsidering living in a forest, as did the poor souls in Paradise.

That said, between Dec-Mar we frequently get a lot of rain, and this year appears to be an El Nino, which means more rain the usual. One of the nicest times of the year is March-May, when the hills are green and full of poppies and other wildflowers. It’s a sight worth seeing.

I grew up in the East (DC) and remember the heat, humidity, pollen and other physical conditions that made being outdoors insufferable (along with the twisted politics) for much of the year. As Wolf has said of living in the Bay Area and I’ll say of living in Coastal Orange County, there are millions of reasons why I’d want to live here. If you can’t think of any, then it’s not for you.

The foreign buyers are the bulk buyers. Even back in the 90s the word from agents at Shapell was about bulk buyers from Asia. They buy with cash. Interest rates are not an issue.

Toll Bros is building this huge condo complex in Fremont for $1M each. No young family can start out with these things. No senior will downsize to these and will move to AZ instead. The price point is perfect for bulk buyers.

The change now are the tariffs. The $600B per year in balance of payments outflow returns as asset purchases, often property. The tariffs cut margins and are altering the BoP. Also trade tensions are making cash incursions come under scrutiny. There are many human trafficking businesses in the Bay area that may get squeezed.