The hail of two-notch downgrades doesn’t help.

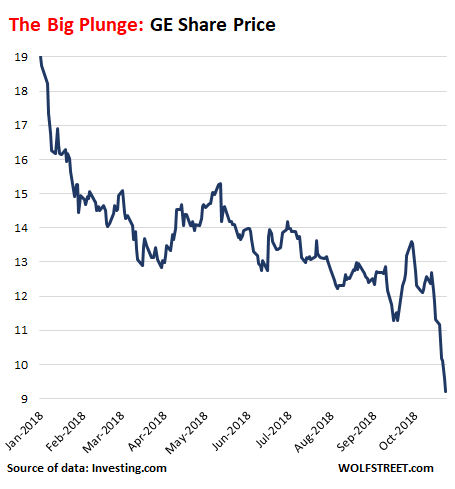

Wolf here: Shares of General Electric [GE] are down over 3% this beautiful Friday morning, trading at $9.20. If they close at this level, they would mark a new nine-year closing low. Shares are down 52% year-to-date:

The lowest close since the 1990s was $6.66 on March 5, 2009, during the Financial Crisis. I remember well: The next morning, then CEO Jeff Inmelt was on CNBC, which was owned by NBC, which was owned by GE at the time. And Inmelt was hyping GE’s shares on GE’s TV station that gave him a huge slot of time to do so, and the share price, displayed prominently onscreen, ticked up with every word he spoke.

Inmelt was also on the Board of Directors of the New York Fed, which at that time was implementing the Fed’s alphabet-soup of bailout programs for banks, industrial companies with financial divisions, money market funds, foreign central banks (dollar swap lines), and the like. This included a bailout package for GE in form of short-term loans, without which GE might have had trouble making payroll because credit had frozen up and GE had been dependent on borrowing in the corporate paper market to meet its needs, and suddenly it couldn’t. Inmelt was involved in those bailout decisions and knew what GE would get, but didn’t mention anything on CNBC.

Now Inmelt is gone from GE (resigned in 2017 “earlier than expected”), and he is gone from the New York Fed (resigned in 2011 “due to increased demands on this time”), and CNBC no longer belongs to GE, and the new CEO is trying furiously to keep the whole charade form spiraling totally out of control hoping to be able to dodge the question: “When fill GE file for bankruptcy?”

Below are some of the things that GE is doing to avoid that fate.

By Leonard Hyman and Bill Tilles for WOLF STREET:

General Electric — at one time the world’s most formidable manufacturing company and now one of the world’s most mismanaged conglomerates — suffered more financial indignities this week: Its bond ratings got hit with back-to-back two-notch downgrades: Today by Fitch Ratings, from A to BBB+ due to the “deterioration at GE Power”; and earlier this week by Moody’s, from A2 to BAA1. This follows a similar move by Standard & Poor’s earlier in October.

The rating agencies also downgraded the company’s commercial paper (CP) program, a form of short-term borrowing. Moody’s cut GE’s CP ratings from P-1 to P-2. The new, lower CP ratings effectively prevents GE from further issuance of CP. However, GE still retains access to other, higher cost bank financed short term funding vehicles. But still, not a good look.

Also this week, GE virtually eliminated its quarterly dividend, slashing it from 12 cents to a penny. A belated Halloween themed headline could read, “Boston Slasher Strikes Again.” A year earlier GE’s board voted to cut its dividend from 24 cents to 12 cents.

In our view the previous dividend reduction was better anticipated than the most recent one. Why the hurried need for a cut last week? Probably for cash conservation reasons. GE badly needs the $3.9 billion in cash saved per year to meet financial needs such as $5 billion required for an underfunded pension fund and $3 billion to shore up the capitalization of GE’s finance arm (or what remains of it).

GE also requires considerable cash to retire existing debt. One of GE’s stated financial goals is to improve ratios of debt-to-EBITDA (earnings before interest, taxes, depreciation and amortization) to 2.5 times by 2020. In the present climate, we might refer to this as virtue signaling. Except here GE’s principal goal is to keep its respectable, investment-grade bond ratings.

The debt burden that GE’s management is presently struggling with stems from a strategy of borrowing heavily for M&A over the past decade. The biggest (and probably worst) was its purchase of French electrical equipment manufacturer Alstom in 2015 in which GE outbid arch rival Siemens. GE paid top dollar just as the market for electrical equipment began a sharp slide. This acquisition was recently written down by $22 billion reflecting the rather subdued prospects for the global power generation. Talk about a winner’s curse.

In order to raise cash and simplify its business, GE has arranged the sale of GE Transportation (locomotives, electric motors and propulsions systems for mining equipment, etc.), plans to dispose of its Baker Hughes oil services business, and intends to spin off (while retaining control) its profitable health services division.

The power division will be split into two businesses: gas turbines and everything else. This last strategic endeavor is probably the one that rankles the most insofar as it’s about two decades too late. A true house that Edison built would have pitted the fossil vs renewables organizations and let the markets sort it out.

How did GE get into the present mess and how did it manage to miss the turning point in a business it used to dominate? Despite recent disparaging comments regarding Harvard’s case studies, we believe this is something business school professors might want to examine. But it is history. For those in the power business, buyers and users of the equipment, what is the message?

First, the manufacture of gas turbines for electric power generation has become an oligopoly. Three suppliers dominate the market: Mitsubishi Hitachi (in clear lead), Siemens, and lastly GE. Oligopolists almost by definition tend to abide one another, meaning that they do not engage in anything resembling robust competition. But with an uncertain business outlook, they may be reluctant to invest more money into their businesses. One almost immediate effect is a reduction in spending on research and development which creates a sort of feedback loop which eventually weakens product positioning against new technology.

The manufacturers may argue that the business will bottom out, that a turnaround will take place. And that revenues from servicing existing equipment will provide a steady stream of business anyway. We do not disagree with these prognostications. Renewables will not provide every new kilowatt of capacity, and gas turbines will be needed anyway to back up renewables.

But we also need to be aware that longer term the competition for gas turbines will come not from renewables but from storage devices such as batteries. In terms of capital allocation, we would wager that there is far more money chasing power storage technologies than there is chasing investment in gas turbine technology.

GE, under its new management and new CEO, Lawrence Culp, may resurrect itself as a well-run manufacturing conglomerate after paying down debt obligations and shoring up its pension obligations. The aviation and health groups (even after disposition of some shares) are large and profitable. And Baker-Hughes, despite its indefinite status, might still surprise to the upside depending on global energy prices.

However, Power, despite its worldwide decline, is still GE’s largest business. New management may succeed in growing the gas turbine business (or maybe better managing its slow decline). But to us the dividend cut symbolizes GE’s fading role in a business that it literally created. By Leonard Hyman and Bill Tilles for WOLF STREET

The financial Crisis was a decade ago. But its consequences still haunt us. Read… I Was Asked: “How & When Will the Next Financial Crisis Happen?”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Not a mention of GE’s new exploding jet airliner engines ? Thailand airline and South West engines recently blew up.

” The plane was powered by CFM56-7B engines, which are made by CFM International Inc., a joint venture between General Electric Co. and France’s Safran SA. CFM, the sole supplier of engines for 737-700 planes, said it has sent technical representatives to examine the plane. ”

“The aircraft was brand new and considered among the most advanced planes in the airline’s fleet, as were the first Boeing 737 MAX 8s that were delivered to Lion Air a little more than a year ago.”

Hi Mark,

Insofar as the incidents you mention are financially adverse they are still rather modest for a conglomerate of GE’s scope. If we wanted to worry ourselves re aviation’s prospects we would focus on engine competition from Pratt&Whitney.

Very very interesting. In March 2009 GE’s stock bottomed at $6.66 and the SP500 bottomed at $666. I have therefor placed a good till cancelled order to buy GE’s stock at $6.65 and I anticipate filling it during heavy tax selling and more bad news by December 31, 2018.

What great timing GE had over the years. They had a knack for buying out companies at the top of their economic cycles just before harrowing plunges during bear markets. They bought into the oil space just before oil plunged from over $100 per barrel to as low as $26 per barrel. And they paid out billions of dollars over the years to the executives who pulled off these impeccably timed capers.

One has to wonder about so many bad deals. Is it truly just incompetence? Or, is it just possible that these are corrupt deals designed to enrich only the individuals involved in making the deals while stripping a once great corporation of its wealth?

Nobody appears surprised anymore to hear that private equity has once again enriched itself by stripping the wealth of a corporation and forcing it into bankruptcy. Why should it be unthinkable that GE’s executives and Board might have surreptitiously unjustly enriched themselves by deliberately overpaying for acquisitions thereby intentionally stripping GE of its wealth? Corruption not incompetence.

What you describe has been called Control Fraud by Bill Black, who helped prosecute Savings and Loan crooks in the 80’s and early 90’s.

You know, back in ancient history when systemic financial crimes were still occasionally prosecuted.

GE spent $35B on stock repurchases over the past five years, and now they are so short of cash they have to cut the dividend to zero?

If an iconic company like GE is subject to this degree of financial idiocy, how many other Fortune 500 companies will face the same fate?

It appears IBM is following a same path. Outsourcing, buybacks, financial chicanery, tax gimmicks, speculative acquisitions, write-offs, etc.

Hi Bobber,

Looking simply at its share price, GE ceased being an iconic company about twenty years ago when the stock price peaked at $60.

exactly. jack welch was an ovehyped financial engineer. the writing for ge’s demise has beem on the wall for decades.

Bingo.

1. GE was a bank/financial institution, and not a very good one, which was bailed out with your tax money.

2. They overpaid for acquisitions because they thought they were such management geniuses that they could impose GE systems (e.g. Six Sigma), and make said acquisitions profitable. Wrong.

It’s actually very sad for the US.

How about Jeff Immelt? He was GE’s CEO for almost the past 2 decades. Welch left a generation ago.

In one of the most ironic moves of all time, Immelt was appointed by p44 to provide leadership to the turnaround of the US economy.

Looks like a $35bn losing bet. What was the average purchase price – higher than today….

GE is merely one more in a series of home runs by the “Do as I say, not as I do” crowd. They are the people who devise all manner of disastrous business, social, cultural and political policies yet always manage to thoroughly insulate themselves from any negative consequences. To use Nassim Nicholas Taleb’s terminology, “they have no skin in the game.” Expect many more such bad examples like GE in the years to come.

->If an iconic company like GE is subject to this degree of financial idiocy, how many other Fortune 500 companies will face the same fate?

How many have you got?

And more to the point, how many Starbucks will it take to replace them? Full employment must be maintained at any cost to the economy.

Really, it’s not a problem. Americans can still get rich selling each other multi-million dollar, 600 sq-ft luxury homes on money borrowed from the Chinese. All people have to do is get updated on the latest financial thinking and ignore the fake news about “housing bubbles”. So don’t worry – getting another credit card is easier than ever.

And buy stocks. GE is an outlier, caused by its own inattention to wi-fi availability, unlike superior firms like Starbucks. On the whole, stocks only go up. Official data going back ten years proves it.

It’s all good until J. G. Wentworth starts having problems. Now that would be a sign of the apocalypse.

Wait a minute. You mean we can’t all get rich refinancing each other’s houses?

We’ll know it’s bad when Sears starts making overtures about a takeover.

Sears is a zombie, Chris. It’s been waiting on certain legal obligations, and once those have expired, it too will be gone.

Ich kann nicht so viel fressen, als ich kotzen moechte – I can’t eat enough to puke as much as I would like to.

I think Chris was making a joke

” I can’t eat enough to puke as much as I would like to.”

That’s beautiful !

An all stock deal we hope.

On the bright side, there should be fewer media appearances by Neutron Jack and his spawn. Now it is the share value that is being nuked instead of just factory personnel.

My stint at GE was during the Reginald Jones era, when the company made capital assets instead of playing around with financial assets. I sold my GE shares long ago.

Place turned into one giant tax avoidance platform, with a few Six Sigma projects tossed in.

(Early Immelt years here).

Six Sigma itself is an old Motorola ploy, and look at what happened to them. Statistically it’s only four sigma, which magically becomes six sigma through the notorious and phony ‘sigma shift’.

I can still demonstrate the mathematics after all these years. I do mathematical statistics in addition to chemistry, physics, assorted engineering, and end-time forecasting. We historians have to be ‘agile’, as they say in the world of phony overpriced fault-intolerant software engineering.

Don’t bother telling me jokes. I don’t get jokes. Hence my handle.

One of the most revolting aspects of the US financial media in the 80s-90s was the way they kissed Jack Welch’s hiney with relentless enthusiasm.

Jack Welch then: “You have to be number 1 or 2 in any business”

GE now: “Number 4 isn’t THAT bad”

Hi Lou,

In global power they’re a distant number number three, in a three firm field and fading.

Hi Mike,

If you spent that much money on Wall St. M&A they’d kiss you too. Plus for a time they actually owned a broadcast network.

->they kissed Jack Welch’s hiney with relentless enthusiasm.

To which I said at the time: “Dear Brown Noses, you’re looking for love in all the wrong places.”

Immelt’s (not Inmelt) performance at GE was abysmal. At the ten year mark of Immelt’s tenure at GE, its stock price had dropped 61% from its levels when he took over, while the SP 500 doubled in the same period. That’s what happens when the big kahuna only listens to his or her PE buddies and ignores the scientists and engineers who actually built the company.

It’s safer to have a decent marketing guy run things than a hot-shot finance guy with delusions of adequacy. Product guys always get outmaneuvered in corporate politics, smeared as mere technicians who “just don’t understand modern business”, and almost never get to the top.

Good to see someone call out I-melt. He was a charter member of the brown nose club. He probably thought cronism with P44 was his only shot. Rand must have dreamed about I-melt in the 40s as his kind were featured in her writings.

I sold my stock when they announced a 10 % preferred stock to be sold to W. Buffet to raise cash. What an expensive way to raise money. I think they cut the dividend just after that too. If they were so stupid managing money then there was no reason for me to own the stock. I think that was around $24 a share.

Ask yourself why they did it. Immelt was bad but not tha stupid.

Immelt’s greatest contribution was finagling that NYFRB seat because it allowed them to grab the coattails of the TBTF stampede, and get access to TALF. Without that, they were cooked.

Is Welch going to give back any of the book royalties lauding him as the genius of the business world? He started the steroid regimen where Capital juiced the entire earnings profile, but was conveniently kept just below the threshold that would have forced a Moody’s reclassification of GE from an ‘industrial company’ to a ‘financial’ company and lose the AAA rating.

Flannery got sent to the glue factory before the ink was dry on his contract. Ironic, seeing that they let Immelt sit there as long as he wanted while the stock did nothing for years amid a raging bull market.

Flannery actually seemed competent to me. He ran the medical unit and did a good job before the CEO stint. I want to know how Inmelt walked with $200mm. Some of the problems were created before Jeff and he was left to deal with them but he did have what, 15+ years to do so.

Agree.

->In terms of capital allocation, we would wager that there is far more money chasing power storage technologies than there is chasing investment in gas turbine technology.

And I believe you would be exactly correct.

Hydrogen: generation from solar and several other sources, storage on any scale, and usage in fuel cells on any scale, appears to be extremely promising and presently depending almost only on adoption. The Germans, who have always dominated the world’s chemical industries by a wide margin, appear to be well ahead of the competition. The US is years behind and still falling back, and US policy aims at a comeback for fossil fuels besides, which can only be described as suicidal.

There are absolute limitations in the physical chemistry of battery technologies, and hydrogen lacks those limitations. The Nernst equation cannot lie, and you can only get so much energy into or out of a chemical system.

I am not sure if you are referring to hydrogen production through electrolysis by solar panel electricity, or some other means? That’s a rather expensive way of producing hydrogen.

As far as I know, lithium production also involves electrolysis, and that will always be expensive for mass use.

Direct catalytic photolysis. Electrolysis with dedicated or excess solar panel output is cost-effective but unlikely to eventually dominate without overinvestment. In either case, prototype and pilot operating budgets are almost negligible compared to fossil-fuel generation, so costs are almost entirely for installation, product handling, utilization, and other downstream activities.

Hydrogen generation has a long and distinguished industrial history going back before Michael Faraday, Humphrey Davies’ greatest scientific discovery. With a few exceptions, it is usually collected as a by-product of other industrial processes on relatively small scales, but that is likely to change. Fuel-cell utilization of hydrogen is mature and not rate-limiting.

Hydrogen technologies were foreseen by Tesla (played by Jonathon Young of the Electric Company) over a hundred years ago, the guy who single-handedly invented alternating current, nearly all AC devices, and the electrical generation and provision industry, which is no doubt why he was assassinated.

The bad news is that emission-free energy technologies will not save civilization from greenhouse ecocide. None regret more than I.

“…The bad news is that emission-free energy technologies will not save civilization from greenhouse ecocide…”

Excuse me, but you lost me there.

Every pundit is assuring me that I only need to stop producing CO2 pronto for the planet and the human race to live happily ever after.

Could you please enlighten me?

Search for runaway global warming or hot-house earth climate. The temperature increase already locked in by the current emissions may be enough to set off natural processes which take over even in the case of humans reducing their emissions to near zero. Vanishing ice in the Arctic, thawing permafrost in Siberia, Canada and Alaska and acidifying oceans could all be early indicators of such a scenario.

In this case humans would have to not only achieve zero emissions but significant negative emissions or in other words remove greenhouse gases from the atmosphere in huge quantities.

And the planet will be able to breath again without the destructive human hordes?

Come sing with me…

“GEeee, , we bring good things to lightttt”

“Geeeee” ( in amazement).

“No, GE” ( friendly announcer voice).

I believe that commercial was for GTE.

I know a high-level person that worked for GE five years ago. This person said they spent way to much time worrying about the quarterly numbers. Every business was required to make detailed projections and they were constantly updated the estimates during the quarter.

Getting anything through the purchasing system took all day. Every little penny spent was subject to layers of approval, and vendors wouldn’t get paid for three months at the earliest. The vendors were constantly complaining. It was a huge ball of red tape.

I think the company got to be so big it was ultimately strangled by all the red tape. Put another way, greedy morons at the headquarters and a sea of overhead drowned the business units.

Hi Bobber,

Reading your comments reminded me of Peter Lynch’s snarky comment re the supposed need for corporate diversification. He referred to it as “deworse-ification.” I think to borrow a phrase from Rabbi Hillel, all else is commentary.

With hindsight, GE should have bought a rating agency instead of a media company…

The second problem is that the Chinese are no longer on the prowl to buy the last bit of industrial America at bloated premiums.

China would love to get her hands on a major engine manufacturer, as their domestic programs are really struggling.

Problem is not even perpetually cash-strapped Russians are so desperate to sell a company to them. They prefer cutting them excellent deals and (allegedly) selling at cost than transferring the technology outright.

You see, Chinese aircraft manufacturers have mostly closed the gap with Russian and Western designs. Priority was obviously given to military designs, but now they are starting to get serious in the commercial sector as well. They have bought and stolen whatever they could, and put some truly smart people at work as well.

The big problem are the engines: they are having all sorts of issues, so much the ACAE engine, which was supposed to power the much hyped COMAC C919 airliner, is at least five years behind schedule. The Party’s Central Disciplinary Commission has already been set in motion.

One would say: “why they don’t just take an engine off an Air China Dreamliner or A330 and clone it?”. The reasons are two.

First, the Chinese government wants this to be a wholly indigenous design. There are some similarities between the ACAE and the latest Rolls-Royce designs, but that’s about it.

Second, they have already tried. China has been trying for years to clone the Russian Saturn AL-31 engines used by their latest jet fighters. They managed to clone most components but are still struggling with the turbine blades. As the technology to manufacture them is considered “strategic” and hence subject to all sort of restriction, there’s little hope of just buying it outright from the US, Japan or Russia. China has to develop the capability herself, and is getting through the same nasty learning curve everybody else did.

Hi Max,

Agree, just like Buffett did. Now those are some wide moat, high margin businesses.

I am amazed at the (round numbers) $22B write-off of goodwill attributed to the $12B Alstom purchase (3 years ago).

Sounds like the baby, the bath water & the bath tub got shoved down the accounting hole.

That is why the SEC and The DOJ have open investigations.

Hi Javert,

The goodwill write offs speak to a high level of M&A which turned out to be poor investments. But also it is in new mgmts interest to clean house in this fashion.

what happens with GE Health Division? and collaborations?

Hi Steve,

The health division is being spun off as separate entity to based in Chicago since many of their facilities are in SE Wisconsin.

– This is not the first conglomerate that has come “unwind”. I can mention several companies that have “spun off” large parts of their business or went under as a result of a lack of focus.

– Another (technology) conglomerate is the german company Siemens. It also wants to spin off more (large) parts of its current company. The company is active in too many parts of the “technology space”. And then a company has to divert too much money and attention to too many different subsidiaries. Leading to a loss in competitiveness.

– Remember Toshiba ? A company that became “unglued” when it bought Westinghouse’s nuclear plant contruction unit.

– GE should have trimmed its activities much earlier. I assume there was too much opposition for such plans.

– “Unfunded pension liabilities”. Where did we hear that before, right ?

Authors of a report that carries this: “…But we also need to be aware that longer term the competition for gas turbines will come……….from storage devices such as batteries…” are, in as kind a way as I can say it, divorced from reality.

Also: “…The manufacturers may argue that the business will bottom out, that a turnaround will take place…” Well, Duhhh! Energy demand up by between 2X and 3X by 2050, or else. Yes, more gas turbines and GE-H BWRX-300 SMRs at $2,000/kW, will definitely be needed in volume.

Commissioned gas turbine PR guy? Or salesman?

Hi Wolf,

It’s far worse. A new nuclear power plant advocate. His claim, mirroring that of the industry, is that the new GE-Hitachi 300 MW small modular reactors will “soon” be cost competitive with fas fired power generating plants. To be fair, these designs are cheaper than other SMRs. Whether they are commercially viable is another story.

Thanks. I should have googled that :-]

Most of the future demand will come from places with cheap gas, like Russia, Iran, Bolivia, etc. or countries they supply. With the current US policies this leaves most of the market outside of the North America to GE competitors, making GE overdependant on the already oversupplied US market.

In Russia, in particular, GE used to be a preferred supplier. Not any more.

Moreover, if someone counts on chareging more for servicing, this is a big mistake. If it is going to be more costly to run existing plants, the only option is going to be their shut-down.

I remember IBM buying Reliance electric some years back. A bust. The GE Board should never have let Immelt walk away with any wealth. To show some degree of accountability, they should hire a mad-dog lawfirm to sue Immelt and Welch for breach of fiduciary duties and seek a clawback. Even if it drags on, at least make Immelt hire lawyers and have his reputation further damaged. He should end up like Jon Corzine, shunned.

As for the Board, dump the diversity appointees, and put Icahn and Ackmann both on the Board.

Hi Bruce,

Just pay CEOs with the avg annual price of their stock in the decade after they retire. That might engender more long term thinking.

I actually sent a letter to a large US corporation ~20 years ago advocating this. They asked for such input. I said something like all of their variable pay (bonuses, etc.), should be tied items like stock price and be available no sooner than five years after they were given to the executive as pay.

I got a form letter response that their pay practices were in line with other similar firms. Imagine my shock. (sarc)

It happens every time.

Some joker is hailed as the man with his finger on the pulse of happening.

Hallelujah & hooray for mankind at the top of the hill.

And he tell it like it was

And he tells it like it is

And he tells it like it will be

Ever after

Amen.

Right up until the earth moves beneath him.

Where was his crystal ball in all that time ??

Surely it warranted a glance or two every now & then.

RIP Jeff Inmelt.

Will the next hot shot contestant

COME ON DOWN !!!

Things change & today things change ever better.

How many old guys have been rendered infirm & shown the door ??

The new man in town, the younger & wet behind the ears guy with radical ideas will remake the world as we know it.

Ever thus.

Jeff Immelt is 62 years old.

Some men are dead at that age.

As far as I understand systems theory, economic systems (in fact, probably all open systems) need to grow or die on the vine. In completion of the evident, it is a bit satisfyingly entertaining to observe that as they sooner or later grow unsustainably large, systems are never “too big to fail”; rather, they inevitably fail eventually.

A sad day was when GE was knocked out of the DOW 30. It was the only company that lasted in the DOW for soooo long, longer than any company in history. The beadrock of American IRA investment. The dying of America with Sears, ToysRUs and others. For many many years it has been said if GE goes, so does America.

I worked at GE for a couple of years, and in my opinion, the seeds of GE’s death were planting during the Jack Welsh years: He’s the one who installed stack ranking. (For those who don’t know the term, every year, the members of each “team” are ranked against each other. Top 20% get a raise, bottom 10% get fired and the rest get to keep their jobs.) The problem with this was that it created vicious politicking where you would have people sabotaging each other (and incidentally the project) in order to come out on top in the rankings.

By the time I started, stack ranking had been abolished by Immelt, but the poison was deeply embedded in the company culture.

The other problem was that there was no more serious crime than to miss the quarterly numbers that had been handed down from on high. As a result, products with serious known problems got shoved out the door anyway.

I will no longer buy a GE-designed or manufactured product of any kind. I cringe when I encounter one of their products in a hospital setting.