“Bloodbath” and similar technical terms crop up in the media.

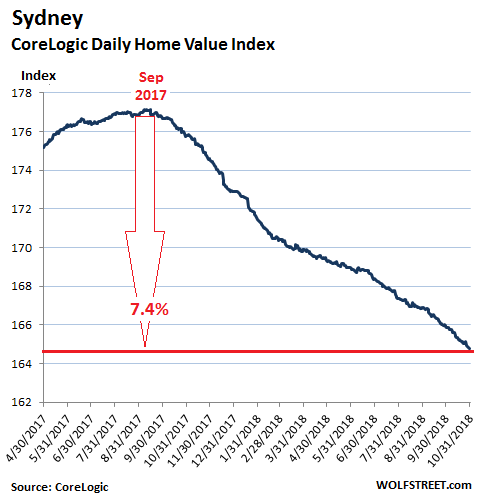

Sales of houses and condos in Greater Sydney, Australia’s largest housing market, plunged 16.7% in October compared to October last year, even as advertised listings surged nearly 20%, to the highest level for this time of the year since 2009, according to CoreLogic. And prices fell in October:

- Prices of single-family houses dropped 8.4% year-over-year

- Prices of condos – “units” in Australian – fell 4.9%;

- Prices of all types of dwellings combined fell 7.4%;

- Prices at the most expensive quarter of the market dropped 8.6%;

- Prices at the least expensive quarter of the market fell 4.6%;

The worst hit regions in Greater Sydney were the suburb of Ryde (-14.4%), Baulkham Hills and Hawkesbury (-10.3%), and Parramatta (-10.3%). CoreLogic’s Daily Home Value Index is now down 7.4% from its peak in September last year:

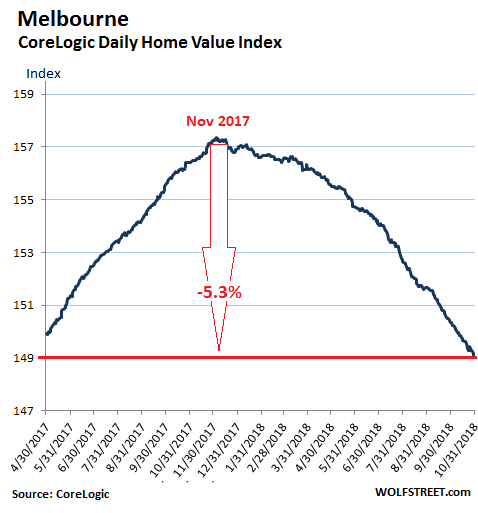

In Melbourne, which has been lagging behind Sydney, a similar scenario is playing out, as sales in October plunged 14.4%, even as advertised listings surged nearly 20%.

- Prices of single-family houses dropped 6.3% year-over-year;

- Prices of “units” fell 1.1%;

- Prices of all types of dwellings combined fell 4.7%,

- Prices at the most expensive quarter of the market dropped 8.9%;

- Prices in Melbourne’s tony Inner East plunged 10.3%;

- But prices at the least expensive quarter of the market, the “more affordable” segment rose 2.9%.

The peak in Melbourne occurred last November, and from this peak, the CoreLogic Daily Home Value Index for all types of dwellings has now dropped 5.3%:

The other capital cities were mixed, with Darwin and Perth in decline since 2014, and Hobart having become the last hotbed of housing speculation. These are the price changes of houses and condos combined in October, compared to a year ago:

- Brisbane, Queensland: +0.3%

- Adelaide, South Australia: +1.8%

- Perth, Western Australia: -3.3% and are down 13.5% from their peak in 2014 following the mining bust.

- Darwin, Northern Territory: -2.9%

- Canberra, Australian Capital Territory: +4.3%

- Hobart, Tasmania: +9.7%

“The weakest conditions continue to be felt across Australia’s two largest cities where investment buyers have been the most concentrated, supply additions have been the highest, and where housing affordability is the most stretched,” CoreLogic notes in its report.

Nationally, sales in October dropped 11% from a year ago. And even in speculative hotbed, Hobart, appetites may be waning. It has been doused in media hype as fortunes were turning in Sydney and Melbourne. But in October, sales in Hobart dropped 11.4%, according to CoreLogic Asia Pacific’s head of research Tim Lawless.

Even as sales dropped across Australia in October, advertised listings rose 10.5% year-over-year.

And CoreLogic’s index for prices of all types of dwellings nationally fell 3.5%, “signaling the weakest macro-housing market conditions since February 2012,” said Tim Lawless in the report.

So how big is the decline relatively speaking, and is this the end of the decline? The report adds:

The downturn in housing market conditions has been relatively mild to date, with the 3.5% fall in dwellings values over the past twelve months coming on the back of a 34% rise in national dwelling values over the growth cycle. With credit availability remaining tight and rising inventory levels, we are expecting there will be further downwards pressure on housing values…

With total listing numbers likely to push higher over the final quarter of the year, buyers are becoming more empowered and will increasingly find themselves in a stronger position when it comes to negotiating on price.

As housing prices have surged over the past years much faster than rent, gross rental yields declined to record lows. But now, the combination of declining prices and rising rents are slowly lifting gross rental yields from their record lows. Nationally rental yields inched up to 3.9% in October, from 3.7% a year ago. CoreLogic:

Rental yields were compressed more significantly in Sydney and Melbourne, reaching record low readings of 3.04% and 3.07% respectively in 2017. These cities are still recording the lowest yield profiles at 3.24% and 3.34% at the end of October 2018.

If financing costs, maintenance, insurance and other costs are included, rental yields are negative. In other words, at these yields, landlords lose money. The only saving grace is “negative gearing,” as it’s called down-under: the tax write-offs against regular income. But this too has come under attack.

After years of media hoopla about the excitement and profits of speculating in the housing market, the media is now peppered with articles about a bitter reality, with the technical term “bloodbath” being cited regularly. For example, frazzled home sellers had to grapple with a story in the Financial Review about a A$2.2-million or 28% year-over-year plunge in the “value” of a “large house in a prestigious, leafy Melbourne inner suburb,… highlighting a sharp downturn in the Melbourne market” (amounts in Australian dollars):

The four-bedroom, two-bathroom house on a 1210-square meter block, which is close to some of the state’s most prestigious state and private schools, was passed in on Saturday for $5.6 million, having been sold last November for $7.8 million.

The Financial Review noted that “Melbourne’s weekend auction sales slid to record-year lows and Sydney struggled to clear half the properties for sale in another bleak outcome for one of the most important weekends of the spring sales season.” And then the inevitable “bloodbath” quote:

“It’s a bloodbath,” said Emma Bloom, a buyers’ agent for Morrell and Koren. “There’s a big increase in the number of auctions where there is only one bidder, passed in without a bid, or being sold below expectations.”

This is when media frenzy that for years had added fuel to the speculative fires turns in the opposite direction after prices have started to fall, and as speculators abandon the market. It creates the opposite feedback loop, where the mood of potential buyers sours further as lower prices beget lower prices. Boom and bust.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

You can add that many Real Estate Agents no longer advertise the sales price. You must now contact the agent directly to find out what the price of a property is.

The bloodbath is going to cross the Tasman Sea and land in New Zealand if it hasn’t already. As an ex-pat kiwi living in the US I look at the prices homes are selling for back in NZ and shake my head in disbelief. Based on my knowledge of Kiwi incomes (I still have family ands friends back there) and what they are paying for property at 6x income and mortgaged to the hilt with variable rate interest loans. This is all going to end very badly down under.

Ohh yes since we left NZ some 16 years ago homes no longer are listed with an asking price, but rather the “price by negotiation” or at best “buyer enquiry over” (BEO) $$$,$$$

NZ is a destination for rich prepper American expats.

Who all think that when TSHTF they’ll just mozy on down to the airport and stroll on to the next flight to AKL…

Riiiiiight.

…and you do have to have significant assets & income (all numbers USD):

A quick Google check indicates American retirees require a visa (requires frequent renewal); need to invest $600,000+ in NZ, have an additional $350,000 to live off (maintenance money), and have an income over $48,000/yr.

Visas are required; the category visa retirees get depends on if you have family who are citizens of NZ & “sponsor” you.

Probably not going to be a flood of folks moving to NZ to retire because they can’t afford to retire in the US.

@Javert Chip, most citizens of developed countries get 3-6 month visitor visas at the border, with no limit on how many times you can renew these (just have to leave and return). If you have some funds and a return ticket, they’ll let you in.

If you stay in the country for more than 6 months total within a tax year (1 April) then you become an NZ tax resident. So it suits many retirees to not stay in the country for 6 months. Also, the weather through winter/spring is not that great.

Up to this year there were no restrictions on a non-resident buying a house to live in or rent out. UK citizens even get free medical and accident cover on arrival. The Bay of Plenty is stuffed full of British retirees doing this annual visa run. Northland and the deep south have numerous US multi-millionaire holiday homes.

Or you can just be like Peter Thiel: spend 2 weeks in the country, put up a loan to some NZ startup underwritten by the NZ government, and get your passport a few months later. NZ immigration will even come to see you in SF to do the ceremony.

“they are paying for property at 6x income”

Around my parts it’s closer to 10X incomes……..but it’s not a bubble if you ask a realtor. I visit some other RE sites and the delusion is strong. Every bull has the belief that the last crash will never happen again because it’s “different this time”

My take is, once this current bubble pops were going to see all kinds of shady details that was going on.

Blood bath hasent even started in either Country.

All you are seeing at the moment, is some over-leveraged speculators getting stung. They know the rules. SELL, or have financier issues, which will make it hard to buy at the bottom again.

When the local urban region weekly property handout, has over a 100 Forced sales listed in it (Yes we have seen this before ) you will know you are getting somewhere with this long overdue correction.

Dont be surprised if it does not get that far.

The is a huge amount of demand for “AFFORDABLE” listing’s, for Wage Earners.

Sellers simply have to meet what buyers can afford, or the financiers will do it for them.

Wolf, clicking through to the Financial Review piece indicates your dollar figures in this article are in Aussie $ – probably more editorial trouble to edit all those ‘$’ to ‘A$’ than it’s worth, but just a heads-up to fellow non-Oz readers that while Aussie RE may be bubble-priced, it’s not quite *that* bubble priced. E.g. the 4br/2ba Down-under McMansion cited sold last November for US$5.5M, and is currently valued at US$4.0M. Bargain time, mate!

In the article, it says: “(amounts in Australian dollars)” for the quoted paragraph with most of the dollar amounts.

However above it, there is a dollar-figure that I didn’t quote but calculated, and upon your recommendation, I just now added an A in front the the $2.2.

You should also say that A$ is 13.6% down to US$ from its peak in January 2018. That adds to the catastrophe. A falling asset class, returning negative yield, and denominated in a falling currency. What a bargain!

Lots of foreign investors who own inner city apartments wont be happy.

There are tens of thousands of empty apartments in Australia – allegedly Land Banking by Asians.

Les Francis, what I hear from friends in Melbourne is that a lot of these land-bank city apartments may not be very saleable — many of them are too small or were built with weird layouts to maximize developer profitability, while planning authorities looked the other way.

They were sold off to Asians not intending to either live there or rent them out, who may not have even seen them. When they come on the market, their limited desirability as actual dwellings is going to slam pricing down hard.

Mike G, don’t count on those apartments being too hard to sell.

The weirdly shaped/way too small apartment has been the main fuel of Italy’s Housing Bubble 1.2. They have been building them everywhere, especially in places with plenty of empty houses and/or lots of room, precisely to get the most out of small lots.

Differently from Australia they haven’t got Asian cash buyers there and plainly put even 2.9% 30-years mortgages cannot get the market to move.

Do you think any of this matter? Of course it doesn’t.

Prices remain sky high and the escavators are hard at work. Banks keep on lending money to developers with complete abandon and regulators keep on looking the other way.

Plainly put when real estate becomes “too big to fail” liquidation is not an option, no matter what are the costs for the whole country.

On top of this Australia has a depressingly common problem, meaning a neurotic immigration policy, which has contributed a lot to inflating that real estate bubble. Like Italians and Spaniards living in Germany and Switzerland tend to lose their taste for homeownership, immigrants to Australia tend to acquire a taste for it. A Rome, fais comme les romaines.

No country across the world is immune to locals demanding tighter control on immigration, and Australia won’t be different: apart from Switzerland (and even there only due to one of those pesky binding popular consultations) so far “restricting immigration” has basically been a joke on the electors who voted for it. But, again, how long will it last?

Everything is hunky-dory in USA per Robert Schiller: https://www.cnbc.com/2018/10/26/robert-shiller-i-dont-expect-a-sharp-turn-in-the-housing-market.html

Wolf, I had a question for you.

It’s not totally related to the blog post but housing in general.

I’m seeing lots of articles about the Bay Area housing saying, “supply is surging, but prices keep rising”.

Econ 101 would tell you this doesn’t make sense. Prices should fall when the supply curve shifts out. Is their manipulation in the Bay Area market, what’s causing this bizarre behavior?

Bay Area Girl,

Prices have started to tick down in some spots. Here are some examples:

https://wolfstreet.com/2018/10/08/sonoma-bay-area-housing-bubble-price-declines/

https://wolfstreet.com/2018/10/05/san-francisco-house-price-condo-price-bubble-trump-bump-peak/

But there is a sequence to events: 1. More supply as sellers get eager 2. Sales drop as buyers get leery and choosy. 3. Asking prices get cut for deals to happen. 4. Overall prices begin to edge down.

Unlike stock markets, real estate markets move slowly. It took four years for the last housing bust to play out, and it was so lightening FAST that it was a crisis!

What about these new online RE agents and 24 hour escrows?

As Mr. Richter has said before, the Bay area has its own highly local dynamics.

Many buyers are flush with cash from their stock and bonuses (still worth a lot, even after the recent drop in FANGMAN prices) and are willing to pay top dollar for fairly mediocre and small housing.

Unless the NASDAQ were to crater, Silicon Valley house prices could stay buoyant (even if they stop rising due to higher interest rates) for longer than the rest of the US.

I have come to understand – begrudgingly as an armchair economist – that fear and greed, rather than supply and demand, are the primary drivers of real estate

As with all these nifty, neat indexes, they are massaged, managed, fluffed, revised, and “hedonistically” calculated so that you really don’t know what is going on.

Corelogic states:

“Rather than relying solely on transacted sale prices to provide a measure of housing market conditions, the CoreLogic Daily Home Value Index is based on a ‘hedonic’ methodology which includes the attributes of properties that are transacting as part of the analysis. Understanding factors such as the number of bedrooms and bathrooms, the land area and the geographic context of the property allows for a much more accurate analysis of true value movements across specific housing markets. This method also allows for compositional change in consumer buying patterns when measuring capital gains.”

Read that again:

“Rather than relying solely on transacted sale prices to provide a measure of housing market conditions”

I only know of one measure of sales pairs similar to that of the Case-Schiller in the USA and I wonder what that is saying?

Also could you put up a longer time frame chart for price moves in Sydney and Melbourne over say a period of ten years like you do for the various cities in the USA?

“Also could you put up a longer time frame chart for price moves in Sydney and Melbourne over say a period of ten years like you do for the various cities in the USA?”

Yes, I would like that too. But CoreLogic is very particular about using its data. In other words, you’re not allowed to use it unless you get their permission. I finally got permission to use this data, but they would not let me have the data going back further.

They sell this data, so they’re pretty stingy about letting media outlets use it.

The way the banks are dealing with the falling equity is what I find interesting. They have new guidelines for refinancing mortgages that include looking at all expenses, like haircuts and grocery shopping. They get the data directly from bank debits. Between the falling equity and the new guidelines, many can’t get refinancing, and are forced to sell. Propelling the spiral downward.

I understand they are applying tighter standards to property investors as well. If you own multiple properties, they won’t lend to you anymore.

Australia doesn’t even manufacture its own toasters. All because of the real estate bubble. No one wants to make anything because these people are used to just sit and do nothing, waiting for a Chinese immigrant to come and buy or rent their property. Now it’s about time for the real estate market to blow and for Australia to start making its own living.

Absolutely spot on Rodney. Aussies are addicted to generating wealth from rising house prices. Too many people think the gravy train will never end. But as Rene Rivkin said every boom has a bust. And this one could be a doozy. I remember last year reading an article on people under 40 and how so many could end up with mental illness or worse commit suicide if interest rates head towards the 18% mark of the late eighties, as they were never around back then. It won’t be easy to watch.

Rodney, you are being too unkind.

Australia suffers from the usual issue of having had an overprotected domestic manufacturing capabilities for decades: plainly put many local firms have not been able to compete with foreigners.

Australian farmers used to cut down trees with Danarm chainsaws… who even remember those but oldtimers? Now all farmers use Shindaiwa (Japan) and Stihl (Germany) chainsaws. What happened to Danarm? Despite government subsidies it just wasn’t able to compete and disappeared.

On top of this Australia has fantastically expensive labor, I think only New Zealand is worse in that respect: why should Toyota manufacture cars there when they can do it in Thailand and sell them for cheaper in Australia than they would locally, including import duties?

An Australian reader here on Wolf Street once commented “We have evolved into an economy built around digging rocks out of the ground and flipping houses”.

The problem is digging those rocks out of the ground takes less and less jobs as the machines take over: Rio Tinto even has the first revenue-generating autonomous freight train in service to service their mines: the locomotives were built in the US by EMD, the electronics in Japan by Hitachi and the software was written in Italy by a Hitachi subsidiary.

Not many good high paying blue collar jobs left there…

Speaking to my local Bank liaison man a couple of weeks ago.

A year ago this branch was writing up 8 – 10 mortgages a day. Now they are lucky to write up 5 a week.

Core logic are getting their figures from the “Vested Interests”. You can take it that the real figures are actually a couple of percentage points worse.

My next door neighbour bought an apartment in a very desirable area – (next to a shopping centre and Rail station). The block of apartments is due to be completed in December. The apartment owners had their first owners meeting last week. My neighbour tells me there are few owners who have paid their deposits but will not be able to complete the sale due to lack of available finance from the banks. The apartment block developer is trying to find these people Funds from “shadow Lenders”.

Suffice to say that the price paid for the apartments is no longer there saleable value.

Concerning the apts, there are lots of stories like that coming out of Canada and China. Developers dropping prices in China, destroying the equity of previous buyers. Buyers walking away in Canada because they are better off losing the deposit than buying a devalued property or can’t finance.

I did hear a shadow banking story out of Canada that was very scary. Retirees are using Helocs to finance properties for buyers that don’t qualify. Nuts.

Looks like San Diego is feeling the heat: http://www.sandiegouniontribune.com/business/real-estate/sd-fi-home-prices-20181030-story.html

Yes it’s a frenzied feedback loop on the way up (fear of missing out and greed driving buyers) and a feedback loop on the way down (fear of losing money driving sellers). This is the nature of all asset bubbles and those who are willfully blind to this historical and contemporary fact and who invent all kinds of reasons to delude themselves their vested bubble is different are fools.

It’s all good until credit dries up. Your monthly, is all that

matters. Depreciating currency most places has lead to

overpaying.

Hi Wolf, you need to do a blog with Martin North from Australia. This guy is the expert on housing in Australia. He predicted what were now seeing months ago.

We were on top of this two years ago, mortgage fraud and all. And we were pooh-poohed for it at the time :-]

√

and we were onto of what became the us 08 event in 1998, and you all told us, to go blow smoke.

I have been doing a lot of work lately for some local “Chinese” landlords, who are bailing, on their tenanted properties.

They see interest rates rising where they get their money CHINA and Japan, its becoming EXPENSIVE to hedge/fx forward cover, those loans..

Satyajit Das (several clips on youtube) also provides some very intriguing views on challenges to both Australian housing and the Chinese economy. Worth a look

A lot of articles and media commentaries about the housing downturn in recent months, everyday in fact. It is getting too much and is not helping sentiments in the market. Perhaps all these damning reports are done for a reason. More so than necessary.

About time to tone down. Thanks

After two decades of deafening hype and lies by the media about the housing market’s endless and stupendous gains, realty is suddenly painful, isn’t it? Deal with it.

√

Hold that bag, Lee. Hold that bag.

When in doubt, blame the messenger!

“It is getting too much and is not helping sentiments in the market.” – You are a market maker Wolf!

Hi Wolf

Do you have any suggestion as how an individual investor in USA could profit from this housing bobble burst? any shorting suggestions?

Thanks

Hard money loans, brokering them (Better) or making them.

The basics are simple, an 18 month term at the longest, no more than 60% CLTV, a TIGHT appraisal by someone intimately familiar with the local market, a prepayment penalty if the loan is paid off within the first 6 months.

Between 2% and 5% of potential borrowers will make the cut if you do your due diligence…

And a 60% CLTV should be considered only for a property you can turn over very quickly.

At worst you make 10% and a few points, if you end up foreclosing you make at least twice that return.

And if you get sloppy you will lose money.

There’s no free lunch Tom. The company I work for got in the game late ’08. Hundreds, after a few thousand short-term or bridge loans later we have acquired some experience. Properties are hard to sell even at 50% of their market value can take months or even years to sell. What is the true market value of a property?

Agree. You have to be very picky, however.

I hear sheep sounds…

If you’re asking “how to” on a conversational blog, don’t even think of trying this at home. If you’re George Soros…well, ok.

Easy, buy low from desperate owners. Then watch the market plummet another 40% further and become that desperate owner.

Ouch.

Investors from overseas who have purchased mainly condos that sit empty to park their $ have never turned utilities on. Mold occurs due to high humidity levels, a possible water leak can soon have major issues. I hope HOA’s state that HVAC systems must always be turned on & if vacant Apt must be inspected & charge sent to homeowner. So many Chinese keep HVAC off even on their mainland rentals.

Many Euros want to move to the USA, if not

this is the second best for them.

NZ, Aussie,less crime , less gangs, less pollution better for the kids.

25 years ago, maybe.