Asset-price inflation feels good to asset holders – until it doesn’t

I was asked two important questions in this mind-boggling era of QE: The Bank of Japan has monetized 50% of its national debt; so why has there not been a surge of inflation? And why can’t the Fed restart QE and do the same without triggering inflation?

“Inflation” can be a lot of things. Here we’re not talking about “monetary inflation.” We’re talking about price inflation – when the currency loses its purchasing power. There are several types of price inflation that are accounted for separately, including:

- Consumer price inflation

- Wholesale price inflation

- Wage inflation.

- Asset price inflation.

The questions were about consumer price inflation; but the answer lies in asset price inflation.

It’s true that despite QE globally – not just in Japan – there has been relatively little consumer price inflation in the countries whose central banks perpetrated it. But it has caused enormous asset-price inflation. We call it the “Everything Bubble” where practically all asset classes globally have become ludicrously inflated.

Asset price inflation means that the currency loses purchasing power with regards to assets, such as real estate. The house is the same, only a little more run-down, but now it takes twice as many dollars to buy than five years ago.

When asset-price inflation reverses, which it invariably does, it can be deadly for the banks and the financial system overall. There are plenty of examples, including the US housing and mortgage crisis that was part of the Financial Crisis.

Assets are used as collateral by banks and other lenders. When asset prices get inflated, they support larger loans. But inflated asset prices invariably deflate at some point, and suddenly, when the borrower defaults, the collateral is no longer enough to cover the loan. Asset price inflation feels good because it translates into free and easy wealth for asset holders, but when it deflates, it tends to bring down the banks – even or especially the biggest ones – and causes all kinds of other mayhem.

Asset price inflation means risks are building up in the financial system.

So central banks, while they try to stimulate some asset price inflation, are worried when it goes too far. The Fed has expressed this worry in various forms for two years. The ECB is now murmuring about it. And even the Bank of Japan is suddenly fretting about the “sustainability” of its QE program, and its impact on the financial markets.

This is why QE cannot be maintained without setting the stage for another, and much bigger and even more magnificent collapse of the financial system, the Big One if you will, and all the real-economy mayhem it would entail.

Consumer price inflation – defined here as loss of purchasing power of the currency with regards to consumer goods and services, as measured by a consumer price index – is in part a confidence game.

Consumer price inflation results from a mix of market forces, psychology, and other factors. What exactly causes consumer price inflation is still not fully understood, as evidenced by the surprise that economists experienced when QE failed to cause it.

One factor in consumer price inflation is confidence in the currency – often measured as “inflation expectations.” Like so many other factors in economics, it’s psychological!

When the people have confidence that the purchasing power of their currency remains stable, and when businesses therefore cannot raise prices because people and other businesses would refuse to pay these higher prices, then inflation is “well anchored,” as central bankers say. This is expressed in various “inflation expectation” indices. But confidence can vanish, and once gone, it’s devilishly hard to rebuilt.

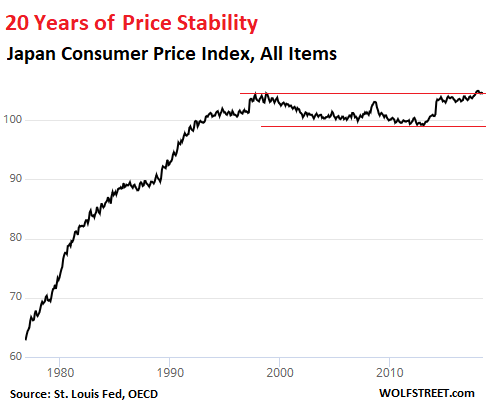

Over the past two decades, the Japanese have learned that there is very little or no inflation in their system:

All economic players have adjusted to it — consumers, government entities, businesses, pension funds, etc. This confidence has made it effectively impossible to raise prices on many goods and services (with some exceptions). When companies tried to raise prices, consumers simply switched to alternatives or cut back, and the price increases didn’t stick.

The Japanese are hoarding cash (via yen deposits and other low-risk yen instruments) because they know it will retain its purchasing power. They trust the yen! This attitude – “inflation expectations” – has helped keep inflation to near zero. It’s a self-reinforcing mechanism.

On the other hand, there’s Argentina: Successive governments have for decades trashed any kind of confidence or trust people might have had in the peso. Argentines get rid of pesos as soon as they can (convert them into dollars or assets). In other words, they constantly sell pesos. The entire economy has adjusted to dealing with a currency that rapidly loses purchasing power. It too is a self-reinforcing mechanism.

During the 1970s, there was a lot of inflation in the US, reaching nearly 15% in 1980. It had to be stopped before it would spiral completely out of control. Fed Chairman Paul Volcker, with the gutsy public backing of President Reagan, went to work with rate increases of a full percentage point per meeting that shocked. This was accompanied by a publicity campaign.

It was radical surgery to rebuild confidence in the dollar, and it caused a nasty “double-dip” recession that threw millions of people out of work. But inflation began dropping. And over many years, it gradually rebuilt confidence that prices might rise by about 2% to 3% a year, not more. In the Fed’s terms, “inflation expectations are well anchored.” As long as that confidence persists, inflation will have a hard time spiraling out of control.

But in the US, this confidence is still fragile. Inflation expectations already ticked up to 3%. Once inflation expectations rise, all bets are off.

This can also crop up in Japan, and when it does, nothing and no one will be prepared for it – after two decades of price stability. If consumer price inflation gets out of hand, the loss of purchasing power of the yen will destroy much of the wealth of the Japanese and the purchasing power of their labor.

That is a risk. And it comes on top of the more immediate risk associated with asset price inflation – what it does to the financial system when the prices of leveraged assets deflate. That’s the mechanism by which QE becomes destructive. That’s why the price of free money can be very costly.

Despite repeated speeches to the contrary, the Bank of Japan is sharply tapering its QE. Read… QE Party Is Drying Up, Even at the Bank of Japan

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf, this is a magnificent piece. Thank you so much for the education.

As Thomas Paine said, “The mind once enlightened cannot again become dark.”

Yes! Best description of inflation I’ve ever read. Shiller would give you an A+ (and he may even want to “borrow” it).

Old Dog… I don’t think Tom Paine had it right. If you listen carefully I think you can hear our founding fathers (particularly the writers of the Federalist Papers), are spinning in their graves.

Yes, I’m definitely saving this article for future reference.

I don’t know why they call it inflation. Its just the invisible hand exposing a dollar bubble.

Too many dollars, the value of the dollar goes down. The rest is just complexity to give folks something to write and talk about. And all these dollars are not created by the fed. Banks all over the world making dollar loans are creating more dollars using the reserve multiplier, and even worse today, the bastardized accounting standards for banks where loans are 100% created money.

Nobody will call it a dollar bubble, because everyone knows what a bubble is and what happens to them. All the rest of this is just obfuscation to keep the public from hanging the bankers and politicians.

I would add some additional pointers, off the top of my head:

1. hedonic quality adjustment, e.g. the prices of smartphones have cross the Rubicon of thousand dollars. Also see product replacement speed. The ipad inflation is well and alive. The same with cars.

2. Outsourcing production to the third world. The inflation there is also well and alive – because they live on basics.

3. Product replacement speed. The quality of product isn’t what it used to be, so you buy more to replace the old broken items in the same space of time. Also applies to “innovation” replacement.

Cars last 200,000 miles now a days.

I can remember when 100,000 miles was when you knew you had to buy a new car before the engine/transmission destroyed itself.

I had two cars built in the late 80’s that lasted well over 200 000 miles.

One was a Porsche 944 one Audi 100 .

The newer cars stuffed with electronics break faster, and the companies save more on parts.My mexican Jetta needed new springs for the suspension after 100 000 kilometers a defect i had not heard of before.

So over time, as product design and production efficiencies improve, we have to give all of the benefits to the Fed and the banking system. The consumer is allowed to receive none of the benefits achieved over time as industry learns better ways to build things and improve products? The consumer must always pay more and never reap the benefits of improved production methods? Nonsense.

The Fed insists the price must always go up in tandem with progress, all benefits must always flow through to the finance sector. So the Fed insist the price of an iphone should cost the same now as when it was a consumer commodity product rather than a boutique specialized product.

The finance and medical and defense sectors are all picking our pockets.

van_down_by_river, You said that very well.

where ever you live, enemy is your own government, always.

or to put it differently, enemy are your brothers and sisters, people who work for government.

They are the ones who put laws and regulations which protect their jobs from competition and outsourcing and which unions picking your pockets.

I remember when engines?transmissions didn’t last 100,000 miles.

Correct observations. Consumer inflation, while not being as out-of-control as asset inflation, is still very much noticeable, except in statistics. You can safely double the official CPI to get the sense of real CPI. In the US the CPI index is almost 50% rent. When that item moves, the inflation moves.

Great article. What I find amazing is that consumer prices were stable in Japan, even with massive oil price spikes. Energy is part of all production. Producers, resellers, importers must have reduced their margins or became more productive. Normally, I would guess that some companies would fail to do this and would go bankrupt, causing supply to go down, so that prices can go up. What am I missing?

Most countries do not include ‘oil / fuel’ prices in their basket to calculate CPI

That’s because most countries don’e use “oil/fuel”….very heavy sarcasm here!! “Sleight of hand statistics”

Ask any “consumer” how much a bag of groceries cost today compared to even ten years ago……I don’t buy this “no consumer inflation”. And I do understand the difference between food products and the tinker-toy ones when it comes to utilization and product improvements to overcome “inflation” in price. More bang for the buck.

I certainly understand “asset price inflation”.

Those at the BOJ were experts in managing currencies using option/futures etc. not to mention they had an array of currrencies they could use to buy resources with. That coupled with efficiency and a highly productive work force along with great quality control. In the late 70’s it was the Japanese who produced the most fuel efficient vehicles and started their foothold in the USA while the US automakers restructured.

Bada boom bada bing.

This time it really is difficult in as much I want to believe otherwise.

Let’s say asset classes experience price declines. Up to a certain default rate, banks will absorb the losses beyond which they will become a clear and present ‘systemic’ danger to fiscal integrity.

At that point, what has been oft written on this blog will happen, ‘Privatize your profits and make public your losses’.

So at least in the US, the government will once again bailout the banks. And the US due to a host of reasons can do without an immediate loss of confidence in its currency.

A bank bailout usually means that the bank is propped up by government assistance and that deposits are guaranteed at least up to FDIC limits and more often, unlimited. But stockholders are not bailed out. Take a look at Citigroup’s stock price. Adjusted for its reverse split during the great recession, its common shares are still down about 85% from their 2006 peak. For Citibank employees who were laid off during the recession, then sold their company stock and cashed in much of their 401k plans just to pay bills, the whole experience was hardly a bailout.

Citi has been bailed out so many times….one of the greatest case studies in moral hazard ever.

Yes, and one of the dirtiest still. The Financial Crises Inquiry Commission’s report suggested that Robert Rubin be indicted but, of course, that never happened.

Plenty of other crimes he got away with too, including criminal interference with a Rating Agency downgrade.

Anon, it is a given that the Top leaders who loot their own bank (see Bill Black) skip away scot-free. But plenty of those just below who got burned knew what kind of Character, or lack there-of, was putting money in their pocket. Sleep with dogs…….

Could it be that consumer prices are kept down because of high asset prices and high private debt? If you have to pay large percentage of your income to cover rent or mortgage then you will have less money to spend on consumer goods.

I recall Michael Hudson argued that ordinary people keep having less and less to spent because of the had to spend large sum of their income for debt service: Mortgage, student debt, credit card debt, car loan.

I’m glad someone else mentioned this… The CPI is low because the QE money hasn’t been going to people in the form of wages.

Quite the opposite in fact, as the financiers who get earlier access to QE money use it to purchase scarce resources such as housing, pushing up rents, or land pushing up food costs.

Big corporations are free to cut spending on R&D because they can similarly buy out their competitors with their huge advantage in access to capital. Their market power allows them to reduce staff and keep wages low while consumer spending shifts further toward necessities, like food and energy, which are not in the CPI.

The CPI heavily weighs discretionary spending items, which is where the pinch is felt when consumers are short on cash.

Not just that. The asset price inflation does spill over into consumer prices, in rents and pricy smartphones (weren’t we told they their price can only go down?). But more importantly, most of the money printed went abroad, mostly to China. That is how the US dug itself out of the Great Recession. Fed increased its balance sheet by about 3.5 trillion. The Chinese forex reserves grew by the amount in the same period. Coincidence?

Wolf,

I wasn’t alive during the Volcker rate hike and willing to bet most fellow millennial have no idea who he is. Was the Fed back then also on this “gradual” rate hike path and some event changed its trajectory for the more expedient? Do rate hikes address asset price inflation mostly?

Also wondering if Reagan’s approach to opening China up for business in the late 70’s and could he have used it as a means to address consumer price inflation? In the late 90’s in addition to the Chinese workforce, we had the post USSR collapse and all the European Eastern block join the global markets. That was a lot of new cheap labor, 1.2 billion in china and 55+ million in the Balkans.

Do you think that Trump or future presidents might try to replicate that similar approach with maybe India/Africa and possibly parts of Central/South America?

It worked well for Reagan, might be a way to avoid having to deflate the bubble fully? Just wondering what your thoughts on this topic is?

Great article as always.

lenz,

I’ll give your first question a shot: There was nothing “gradual” about Volcker’s approach. It was purposefully shock-and-awe. 1-percentage point rate hikes per meeting, in-between-meeting rate hikes, and lots of talk about bringing down money supply.

Wolf,

Volker did what needed to be done on the inflation front. Ironically his actions are often linked with Reagan. Jimmy Carter actually was the one who named him to run the Fed. In another ironic situation, Reagan ultimately got tired of Volker and end up bringing in some guy named Greenspan.

Carter gets blamed for the fiscal policies of LBJ, Nixon and Ford and the inflation these policies caused. Seems a dishonest and lazy judgment to me.

When a society decides to shun someone they never relent. Carter did a decent job but most, who know nothing of his time in office, will forever speak unfairly of him.

Wolf, as you are likely aware there are different narratives regarding the Volcker experiment and high interest rates in general.

Post GFC we now know that the FFR is basically pulled from the arses of the FOMC and loanable funds is based on a fable. Both supposed to be primary driving forces behind interest rates.

Heterodox economists, Richard Werner, for example, show that high interest rates are a root cause of broad based price inflation, for things like consumer prices. As a side note, I have also read that the real reason behind the Volcker experiment was political. A tool to break the air traffic controller labour dispute at the time and send a strong message to the working class at the same time.

Any thoughts?

Yeah, I let Richard Werner stew in his own juices ;-]

Connecting the air traffic controller strike, and how Reagan handled it, to Volcker’s efforts at breaking inflation is total unadulterated BS. Anyone can come up with a funny story like that. But that doesn’t make it true.

That is why I put things out there in order to unearth the truth, or at least a given ideologues version of it. Probably not the forum but I will take anything you can offer regarding criticism of Prof. Werner’s perspective. For clarity he was not the one connecting what Volcker was up to with efforts to bust the unions.

I would say Prof Werner’s general thesis is:

1) Banks are special as they create virtually all the money supply (among non banks). He has demonstrated this through changes in a banks balance sheet during the loan process, and how it differs from non-bank financial institutions. Many academics and central banks have since supported this, including the Bank of England.

2) Banks are largely responsible for the boom / bust cycle

3) Banks should loan for productive purpose not unproductive. Unproductive being lending against existing assets (read: stocks, bonds & real estate) and/or consumer purchases and productive generally being lending for productivity increases to industry, business and/or production expansion. Where unproductive loans would still be available but through non-bank financial institutions. Probably worth mentioning (and you are likely aware) but close to 100% of current banks loans support unproductive purposes (as defined above).

My only comment on the Volcker scenario is I have no idea, but have certainly seen it referenced more than once. Certainly your not suggesting political BS never interferes in matters of the economy?

Lucky _Lui,

You can believe whatever you want, you can believe the earth is flat, it’s perfectly alright with me, but you CANNOT post this BS on my site.

An article by the Federal Reserve Bank of New York, dated October 15, 2018, on bank liquidity starts out this way:

“Banks traditionally provide loans that are funded mostly by deposits and thereby create liquidity, which benefits the economy. However, since the loans are typically long-term and illiquid, whereas the deposits are short-term and liquid, this creation of liquidity entails risk for the bank because of the possibility that depositors may “run” (that is, withdraw their deposits on short notice).”

http://libertystreeteconomics.newyorkfed.org/2018/10/did-banks-subject-to-lcr-reduce-liquidity-creation.html

It could not be expressed more simply: A bank does NOT create the money it lends out. PERIOD. It has to fund these loans, mostly via deposits, but also bonds, other loans, equity capital, and borrowing from the central bank. Get used to it, and QUIT posting this “Prof Werner” BS on my site.

The BOE paper you mention – which clearly you didn’t read (here it is if you want to read it, all 14 pages of it) — explains the theory that the BANKING SYSTEM AS A WHOLE (all banks combined, interacting with each other) creates money via deposits, and no individual bank can create money.

If Reagan did covertly approve Chinese trade with Hong Kong (illegally, and done outside of WTO which was drafted by Clinton and signed by Bush) that would certainly put him in even lower esteem with Trump and those who want to rollback the trade agreements.

Reagan wasn’t president until 1980

January 20, 1981 to January 20, 1989.

Carter appointed Volcker in August 1979, and Carter suffered the ire of pundits for also decontrolling oil prices gradually over a two year period. Reagan gets all the credit for slaying the inflationary dragon.

No Velocity, simple.

The velocity explanation is interesting; but why is the velocity low?

Perhaps within this nation of savers (Japan), people increase their savings rate when they see the return on savings is lower. This is necessary to maintain a fixed level of earnings. This would be a highly rational response to forced interest rate decreases.

In Japan there has been basically no earnings on funds in a bank for years and years.

Irrelevant post.

Velocity increases when nominal interest rates increase. Obviously, if you can get 1% per month on money, nobody holds physical cash for very long, if they can help it.

In the 1970s, there was another factor: Mini-computer based Cash

Management Systems started showing up all over the place. (Many of these systems did anti-social things like paying on the last possible day using a check from the other end of the country, so as to collect on an extra three days of float.) The Cash Management systems basically reduced corporate checking accounts to the minimum possible level, so that free cash could be put somewhere and get interest income. A side effect of this was to artificially reduce the reported money supply.

Velocity is high when people either expect that the value of money will fall soon (“Buy it now, while you still can!”) , or when they can remove money from the check clearing system and earn interest on it.

Velocity is low when interest rates are low and inflation expectations are low.

The danger is that, if people suddenly change their opinion of near-term inflation, you can get whip-lashed as the velocity suddenly increases.

I am a child of the 1970s. We all learned these things the hard way.

Banks didn’t lend into the system. They parked everything at the FED for 4% in a 0% environment. Not a bad RoR. Paulson’s trillion $$$ ‘bailout’ was supposed to inject liquidity… but it never hit the economy.

Quantity theory of money has no basis in fact/reality.

Velocity will go negative before we are done, people will be taking money out of the economy faster than the Fed prints it.

You need to look into the definition of money velocity.

You have it completely wrong.

MV=PY, Y is real GDP, Y goes negative, by definition

Technically, if there is deflation or real gdp is shrinking, since you’re not talking about the deltas, velocity would have to be negative to balance the equation no?

Here’s my perspective to add to Wolf’s excellent monetary discussion, one that takes into account physics, which economics traditionally ignores.

There is an energy density component to money, that is virtually hidden.

(I’m still trying formulate much of this but it’s important that it is challenged by bigger brains than mine).

It’s very simple;

For any economy to run, it needs energy.

Money represents the storage, transfer and conversion (STC) of energy (labour, fuel etc)

The sum of all money (debt+paper) is a symbolic representation of current and some future energy (STC).

When there is marked inflation, there is often an inverse correlation with energy (STC) (viz Venezuela, Zimbabwe, Weimar Germany, Ancient Rome et al)

This is because the real wealth of any nation (eg its ability for energy STC) is diluted by having too many claims (money+debt) on that underlying resource (which is after all the most important thing in a material sense for an economy).

One way of looking at money and debt is as a medium that helps to shift energy (food, fuel, electricity etc) in order to do some form of work.

We cannot print/digitize energy in the same way that we can money.

When the two become untethered from the reality of finite energy, we get problems.

Perhaps one day we will have an energy backed currency. A way of linking in real time, the total money supply to the variable energy production of an economy.

Vaclav Smil has this covered in his recent book ‘Energy and civilization a history.

Thanks for the tip-will look it up.

The link between energy and money is important, definitely. If you havent, I would suggest reading some of what Gail Tverberg has written on the matter.

You’re right – currency acts as a medium for transferring energy. Because of this, the economy is essentially a dissipative structure with regards to energy – economic growth and energy consumption are linked pretty tightly.

I’ve wondered about an ‘energy’ currency. Being paid in BTU would be fascinating, but the practicals of it are beyond me.

Enron beat you to the “energy currency” . And, unfortunately, as beneficial as cheap energy may appeal to be, it will only add to the immediate issues.

Dissipative-that’s a great word to explain the phenomenon.

Is there a financial entropy at play here?

Murad, afraid I don’t bring any directly useful feedback per se but a couple of finer points did catch my eye:

1) All modern money is debt (either private, corporate or government). What is the “paper” distinction?

2) While I have only studied inflation at the periphery at this point I am aware that in virtually every case there were extenuating circumstances, usually involving paying debt in a foreign currency (i.e. In Weimar the war reparations were bu design to be virtually un-payable, equal to something like 250 trillion in today’s dollars. This was thanks to good old USA, or more specifically the Dulles brothers, who wanted to exploit German companies for their more advanced technology at the time, not to mention other high level interests by the US. In other cases there is rampant political corruption combined with various forms of foreign meddling (almost always stemming from the US).

So from my perspective trying to explain political BS with a formula seems like a monumental task.

The reason why there is a thousand and so dollars smartphones is because there are buyers for it.

When something does not sell well, price tends to drop after a while.

For example:

PS4 game disks are selling so little in Argentina that some places are selling them for half the price they are selling PS3 game disks just to get rid of them.

And no, I am not joking.

Average price of a PS3 game disk today on Argentina: 1500 pesos. You can bargain a bit of a price drop if you pay on cash in some places.

Average price of a PS4 game disk that’s on sale on Argentina: From 900 to 600 pesos. Usually price drop if you pay on cash but might get a small one if you get a lot of games at once.

Thank you for the update on PS game prices in Argentina!

Back in 1990, an early adopter friend of mine bought a clunky cell phone and paid over $1,000 for it. Today, one can purchase a smart phone with far more features for under $200. If you don’t need the latest and greatest technology, there are lots of bargains to be had.

If assets drop in price and consumer prices go up, it will all right if wages also go up, but more……

– Nope. The FED under Volcker DID NOT stop rising inflation (by raising interest rates). It was the corporate sector that did curb (price) inflation.

– In the 1960s and 1970s workers still recieved big fat wage increases. Let’s assume that inflation was at 5%, then workers would receive a 5, 6, 7 or sometimes even 10% wage increase.

– If a worker/employee receives a 8% wage increase then producers can increase their prices by 8% as well. Pushing inflation up from 5% towards 8%. (=rising price inflation)

– That started to change from the very early 1980s onwards. With inflation at 5% employers would limit wage growth to say 2%. Every producer that now increases its prices by say 5% is guaranteed to lose (+2% – 5% = -)3% in sales. Producers are now forced to limit the price increase to 2%. This way inflation is pushed lower from 5% in the direction of 2%.

– As a result price inflation came crashing down in the early 1980s.

– The reason US producers started to keep a lid on wage growth was increased competition from abroad (e.g. Japan).

“It was the corporate sector that did curb (price) inflation”

So much wrong with this statement.

I know right? Would love to hear how they did that exactly

US employers could only keep a lid on wage growth as they started to outsource – including China. Before 1980 unions were very powerful, yet outsourcing did the trick. Companies just said: if you want higher wages, we will be closing and buy the product from China. This way many factories closed and Unions became powerless and wages did not go up again – up to today.

J. M. Keynes,

It would more accurate to say that globalization and increased automation, combined with the industrial re-birth of countries that had been devastated by WWII were what brought down both wage AND price inflation- primarily of durable goods and food, in the US.

Consumer goods in the “Make America Great Again” days of the 1950s were all produced in the US, simply because China, Japan, and Europe had all been bombed into rubble (we did the most of that bombing).

And, because we won WWII, our currency became the world’s reserve currency. Everybody wanted dollars. Every country, especially the poorer ones, was willing to take dollars in exchange for whatever their own citizens could produce.

Once the industrial competition with Europe and Japan started again in the late 70s, that was when the offshoring of manufacturing and farming jobs started, to Third and Second World countries to keep wages and prices down.

Illegal immigration increased, especially to provide cheap workers in the US farming and food production industries. Seriously, don’t blame the illegal immigrants for coming here. Blame the (mostly Republican) owners of the farms and processing factories for hiring them instead. Do you think for one second that if we had a death penalty (and carried the sentences out summarily) for hiring an illegal alien in the US that there would be any illegal aliens here in this country at all?

Other industries automated, big time. From giant Frito Lays factories to produce chips to the timber business to coal mining to car manufacturing to cotton farming, the number of expensive workers to make a product has dropped drastically

All of those factors have kept prices and wages down in this country since the 1980s.

As for the offshoring- yes, we are living off the inheritance given to us by the Greatest Generation that won WWII. We are paying for all that offshored product and imported goods with dollars, and year after year building up huge trade deficits.

If we were Argentina or Zimbabwe, the rest of the world would have long ago stopped taking our dollars and we would have indeed seen hyperinflation already

But no, we are the United States, we won WWII, we still dominate the world, you will still take our dollars or we will crush your dirt poor country. And oh you can use those dollars because we will sell you our best companies and our best real estate, again, living off the inheritance of the family jewels.

BTW, I keep repeating this, the costs of the three industries that cannot be easily offshored or automated- healthcare, education, and home building (not the same as the price of a house as an asset) have kept going up at faster than CPI inflation. They have gotten so expensive they now account for about 30% of our GDP (but NOT 30% of the CPI – heh heh, smell something fishy there?).

You said: “I keep repeating this, the costs of the three industries that cannot be easily offshored or automated- healthcare, education, and home building.”

These three industries that cannot be offshored have been reduced to two (at the most). Healthcare is already heavily offshored. This includes “healthcare tourism” where Americans go for cheaper treatments to Mexico, India, etc.; video consultations with doctors in India; pharma products that are made in India and China, medical equipment and supplies that are made overseas, and on and on.

In educations, it’s video and internet classes that are starting to be a thing.

Healthcare tourism makes for great headlines in the business news, but is a TINY FRACTION of the trillions of dollars spent every year. Few if any health insurance plans pay for it, Medicare does not. And, bottom line, you are taking your life and health in your hands – apart from Canada, regulations are substandard to non- existent. It’s really only for that tiny subset of the US population who have enough money to pay out of pocket for healthcare abroad and don’t have a good health insurance plan. Adventurous and ultra cheapskate rich folks, in other words.

Most sane people with money just get a good health insurance plan. I have personally witnessed enough Gross Malpractice committed on Americans who went to Mexico to know that with Health Tourism you get worse than what you pay for.

But, here’s an idea, on the bright side, a Modest Proposal – if we TOTALLY deregulated the Healthcare industry, got rid of all the guild-like licensing and credentialing restrictions, got rid of every malpractice law on the books, let anybody do anything they wanted in healthcare, yes I do think we can reproduce the lower healthcare costs of countries like Mexico.

Online education is quite the thing. I take online medical CME courses all the time. You think grade schoolers will ever go totally online? How about at the other end, a senior college level or first year medical school level Human Anatomy class? Including the lab part, actual dissection of a human body…

Nope, don’t think computers and machines can yet replace skilled, expensive REAL teachers, Professors and labs.

Someday, in the Asimov Future of I, Robot, they will, but not right now

Gandalf, it doesn’t matter what you or I think. Healthcare being off-shored is a big business, and it’s growing in leaps and bounds. Some insurance companies close to the border require it if you want their low rates. Many people don’t have dental insurance, so that’s a no-brainer. Selective surgery that is not covered by insurance is another no-brainer. People with $5,000 deductibles are actively seeking out these clinics…. It’s a very profitable business, it fills a need given our outrageous costs, and so it’s happening.

There was a time when no one thought that components for the automakers would largely be designed and manufactured overseas and imported to be assembled into vehicles in the US, from car-seat assemblies to engines. But that is now standard practice.

For assets, printed money goes to demand.

For goods and services, printed money goes to create supply by founding new companies, keep the dying ones alive, nurture money losing business like Telsla by selling below cost.

With so many unemployed in the early 5 years after 2009, there was NOT a whole lot of wage increase, so consumer demand remains weak while adding lots of supplies. Now labor starts to take profits from capital, and the FED will raise rates to kill it.

There will be NO psychology shift on dollar purchasing power of good services! You hear me? My job is to make sure “CPI” stability while raining the rich with cash by asset inflation.

Wow! What an article Wolf!

I gather there are two types of economies:

1. With the con game of CPI, interest rates are low, QE caused asset prices to rise causing new entrants into the economy to suffer. So only new entrants experience real inflation (students, first time home buyers, first time stock buyers). But since CPI is low, the currency is strong. The only care that needs to be taken is not to go into deflation because that reduces investment and thus jobs.

2. Without the con game of CPI and measuring real inflation, the asset prices would really go down (or not increase as rapidly) at the expense of older population but younger entrants would find more reasonable asset prices to buy into. At 2% real inflation, it’ll still keep some investment but not the great boom happening right now. So this economy is a slower economy. Care should be taken to not let inflation go too high.

So, QT after QE is bursting of asset prices as well as rising inflation (loss of currency value) so a more brutal lose-lose? Everyone loses? Poverty? Stagflation?

I want to know if bankruptcy is counted in GDP numbers. Because then the politicians can still claim economic wins in quarterly numbers.

What about the supply side? If one looks at steel, China has built massive capacity way in excess of sustainable domestic demand, depressing the global price. At the other end of the spectrum might be the availability of housing in markets with strong economic growth, say the SFO area. Since I don’t know what the real number is, posit that home prices there are up 50% from the post financial crisis bottom. If the only asset class a consumer was interested in was buying a new home, and he or she didn’t strike “at the bottom” but kept his or her assets in cash, the value of the cash lost a lot of its value. This loss of currency value = inflation, but if the same person were a buyer of steel, no inflation seen. Weird.

QE has also caused a misallocation of capital, and in this manner has created oversupply in some commodities, which brought their prices down. This happened in US oil and gas.

China is in a category of its own since these decisions are made by corrupt government officials at all levels. This is unrelated to the effects of QE. China created overcapacity in steel production for other reasons than QE, and yes, the price of steel collapsed.

Wolf,

Without trying to get technical isn’t QE simply an asset swap between the Fed and the banks ie reserves for bonds? As I understand it reserves can’t be used outside of the interbank market but, depending on details of the swap, it may strengthen bank balance sheets which can permit them to create more credit. If so, the segments receive the new bank credit will be effected. This would line up well with stocks, bonds and real estate prices. Any thoughts? And are reserves ever just “given” to banks without some asset swap? If so, how is this distinguished and accounted for?

Wolf, per my above post. Instead of bonds I should of indicated MBS (likely all the toxic ones) for the asset swap between the Fed and banks during QE.

Wolf, I think you are missing the wage inflation piece. You noted in a previous article that prices are what the market will bear, they’re always at the highest price that won’t cause sales to collapse. Without appreciable wage inflation, prices can’t increase.

I think that dovetails nicely with asset price inflation. QE was meant to put money in the hands of the asset holding class, not the wage-earning class. The idea being that the asset holding class would now have the confidence to invest the money in businesses and create jobs.

And it worked! Though it took a decade and caused the immiseration of tens of millions of Americans. However, first and foremost is the need to maintain the illusion that all wealth is created by an entrepreneurial class that deserve their wealth. QE, in that regard, is the best solution available.

Kent – I have had similar thoughts before, but I think adding one more aspect to your comments would make them even clearer.

That aspect is “Chained CPI”!

When the price of one thing goes up, people buy less of it and more of something else.

Well, for the majority that save nothing, that happens by definition as they are spending everything they make!

Thus, for those people, which is actually most people, CPI is nearly zero by definition, simply because of how it is calculated.

Why not just give it to people directly to spend on what they need and inject the money into the economy? Wouldn’t this have more of a direct impact since the avg person spends more of their income? People spending is what drives the economy. What you are describing is grift since it really just allows those closest to the source of money creation to buy the assets before a jump in price is reflected as the money spreads throught the economy.

Free market… what a joke…

I seem to recall President Bush doing just that back in 2003 by sending out $300 checks to everyone.

I think that was an advance on Federal Income Tax. That $300 would have decreased your tax refund as I recall

That is/was the idea behind “welfare” that so many denigrated over the decades…..give those that really need money to live and they will turn right around and return that money to the economy. I’s not like they would run to their local (mostly no local banks where they live anyway) bank and deposit into a fat savings account.

The real price should be the “cost per use”. Used to buy shirts that would last 10 years or more (I still have some). Now they last maybe 10 washes. Hot water heater used to last 20 years, now maybe 5. 20 years shingles on a house used to last 20 years, now maybe 7. So no “inflation” on the list price, but on the “cost per use” prices are way up.

In my view, cpi did happen. It’s hsppening right now.

But it’s measured using metrics that don’t capture quality.

I’m tending to buy pre 2008 stuff now if I can because it seems built like a tank compared to stuff I’ve bought since.

Just looking underneath my ~ 2012 designed bmw and my ~ 2002 one and the differences in expenses spared is significant.

And it seems cpi has finally started to get quite significant with cars… reaching the end of cost cutting that’s not so noticeable?

I just bought a small 1997 RV – built on the chassis of a Chevy 2500 with almost 200k miles. It was well cared for, and the mechanics (I had several check it over) all said the engine looks like it has 50k miles on it. I had a compression test done that says the same thing. I’ve put a few grand into it and am still under 20k on cost.

My good friend who has a lot more money than I do just bought a new RV, similar size, for 120k and things are already falling apart. He’s trying to sell it.

The RV industry is starting to hurt, partially from the high costs, but also from the junk they’re pumping out. Don’t believe me? Check out this pubic FB group:

https://www.facebook.com/groups/RVHorrorStories

This just underscores the comment that it’s not just prices that are going up, but everyone’s cutting corners and producing more junk, even in the more expensive arenas like RVs.

Wolf has it right. The monetary expansion went mostly into asset prices and increased leverage.

The thing to remember in this context is that the return generated by those assets HAS NOT kept up with the rise in the underlying asset price. This is evident when looking at non-gamable metrics (i.e., ones not affected much by financial engineering) like the inverse of price/sales and price/free cash flow, and rent CAP rates – all of which fallen substantially while asset prices moved higher. That’s the reason why the other types of inflation have not budged much.

Yeah, it feels great as those asset prices go up but that feeling also numbs investors to risks. The crash comes as a Wile E. Coyote moment when it finally dawns on investors that the long term returns generated by those assets are going to be pitiful at best. This epiphany is usually precipitated by a rise in interest rates as more and more investors start shifting into fixed income as credit becomes more and more attractive compared to those pitifully low cash returns from other assets. That begins a snowball effect which removes support from the equity markets that eventually becomes an avalanche. It has happened many times before and it will happen again.

Missing a critical point: almost all of the money created in the US and the Eurozone went to the 1%, who invest and/or horde and therefore do not drive up the velocity of money. The money was “sterilized” in the hands of the rich, the corporations, and the banks. It didn’t drive the kind of inflation we saw in the 1970s because it never “trickled down” to the vast majority of people but made the rich, first whole, then richer.

You are 100% correct. It is simply grift by the banking class and is disguised with big words and lots of academic credentials. Theft, plain and simple. See my above comment.

Grammar Police:

“Hoard” is when you stockpile something you don’t need.

“Horde” is a large mob, aka the Mongol Hordes when Genghis Khan’s troops conquered most of Asia.

P.S. Pass it along to Wolf, he made the same typo in the OP.

And “whored” is what the FED did to the economy

I agree with that James. If money went to the lower 3 or 4 quintiles, thru a Basic Universal Income, we would see inflation almost immediately.

Less wealthy household will likely spend any new income.

All that QE in the past 10 years did not go to the more average household, so we did not get wage inflation. Without increased earnings not much consumer price or wholesale inflation either.

I think inflation in the 70s had a lot to do with the huge Boomer population hitting the job market. We increased spending a lot.

I don’t remember much about interest rates, until they went high, but if they were low when we were all first getting jobs, that would be inflationary.

Inflation in the ’70’s had to do with labor unions. Folks back then used to get “COLAs” Cost of Living Adjustments for you youngsters. Since most folks were unionized, most folks got COLAs. And if you weren’t union, you got one anyway so that you wouldn’t join one.

And that set a floor for inflation. If it was 3% everyone automatically got a 3% raise. Then oil prices went up and inflation jumped to 6% and bam, everyone got a 6% raise, and on and on. I recall my father’s pay almost doubling in 5 years with no change in position.

Your explanation goes a long way to explaining the off-shoring of manufacturing that really took off during that period.

How can anyone read this great article, and not be eternally grateful to our unelected masters- the private banking Fed.

I’m sure they always have the best interests of the common citizen at heart….. right ? ( the banker’s jackboot on your throat).

But it was NO answer why priceinflation has not shoot up

My guess would be globalisation…

I agree. It was a non answer.

If you look at disposable income for most of the population, it has not increased for a long time. So they will not pay higher prices. Producers pass this limit on to their suppliers and so on, or even more look for ways to reduce prices on everyday goods, so that they win market share. Simply put, prices of non assets could not go up because no one could afford them if they did. It always surprises me how so many people use food stamps in the US… it says a lot. I think most people would not use them if they were not stressed?

Hyperinflation is something different, it is not too much money in the system ( though that goes on at the same time) , but a loss of faith in that money…not people spending it because they have too much but people getting rid of it because it is becoming worthless.

Inflation is when people want more and more money for their goods and services.

Hyper-inflation is when people don’t want the money at all.

“Inflation is when people want more and more money for their goods and services.”

Has to be paid though, they almost always would like more :-/. So it works out at some kind of balance which people accept, if everyone is flush then prices might climb, if they are short then prices might go down. There are limits also, for example manufacturing costs, supply shortages, alternatives, and the whole equation feeds into itself in many ways.

To put it differently, prices cannot rise and exist when there is no longer a market, inflation is what might happen till then.

Hyperinflation, well if no one wants the money then it is no longer on the chart and is worth only a trip to the bin . So hyperinflation happens while there is still some kind of demand somewhere.

Because labor has no power. The unions are busted, our industrial jobs have been sent overseas to locations where labor is cheap and easily controlled. This has resulted in many goods being cheaper so what purchasing power we have goes further, but the gains are nothing like the losses. Those losses have been made up with debt, $21Tn now, $50Tn in 15 years, is that sustainable? You tell me.

Layman’s Terms translation: Quantitative easing was/is a fraud. Debt is deflationary. Debt has increased exponentially due to quantitative easing and the misallocation of capital.

They kept filling a balloon that was losing air. Same as we did here. Balloon looks the same (asset prices) but at what cost. It’s as fake as a 3 dollar bill

Great post Wolfe.

Even though America has low unemployment rate.she ha

a large pool of workers available. The low hanging fruit has

been hired but the fruit at the top of the tree is much more

expensive to harvest.These are the long term unemployed ,the

addicts of various types and older workers.When those workers are

productive again and if the doors at the borders are still locked

then wage inflation will move up nicely . likely pushing consumer

inflation along with it.

Unless you have a powerful labour union behind you (as in 1970’s UK), or you have a government that raises wages for public sector workers (as in 1970’s UK) – or both (as in 1970’s UK) consumer price inflation does not lead to corresponding wage inflation, workers just consume less. I am not sure about the USA. But I think weak labour unions prevent wage rises which keeps the lid on inflation.

So keep going with this. The natural outgrowth of this is populism as people(average,median etc) understand they have gone nowhere in most of the “recovery.” If people want to complain about politics, ie Trump, they should point the finger at the Fed printing and at Obama for not bringing anyone to justice after the financial crisis. Three card Monty is not fun to watch but when you are the victim of it, you don’t forget it.

Asset inflation –

Borrow $4T because ’emergency’, put it on the backs of the taxpayer, loan it to your buddies at 0% then blow giant asset bubbles in the stock market and housing sector to take the two best ways to build a future out of range of purchase for the little guy , meanwhile promising trickle-down, which never happens.

It’s how you create a debt slave – renter class.

Watch for asset stripping of the public/government assets now because $1T interest payments by 2028 according to the CBO. (meanwhile tax breaks of $5T defund the government and make it worse…)

+1

As others have commented, this narrative conveniently ignores the fact that the QE money was directed to the banks, the companies and the rich, i.e. the asset holders. How could it be any different when QE works so that the central-bank buys assets? Hence asset price inflation is no surprise.

The other thing that this narrative misses is that, thanks to the financial crisis and globalization, the so-called “trickle down” effect doesn’t really work anymore. The reasons for that are primarily two: 1) wage earners make unreliable debtors (how could it be otherwise when their wages don’t correspond to asset prices, or when they’re already mired in debt) 2) wages are increasingly seen as a means to gain competitiveness in the global markets (i.e. through keeping them low, in other words as an internal devaluation of sorts).

Guess my comments along similar veins didn’t sit well as I used the phrase “How to create a debt slave – renter class” and got nixed. Adding another $5T defunding of the government won’t help either with the next set of tax cuts.

Nate,

It didn’t get “nixed.” It got temporarily hung up in a tripwire. That’s all :-]

Thanks Wolf! Couldn’t tell what was up. ;-)

Jimbo,

Your first paragraph says “asset price inflation” which is the topic of the first half of the article, but it seems you didn’t bother to read the article. Just because you didn’t read it doesn’t mean it isn’t there.

I am looking at it is a similar way but with a slightly different emphasis.

Asset price inflation does feed extra cash into the economy. That is an upward pressure.

Consumer prices experience a natural downward pressure ( productivity, competition, outsourcing)

The two meet at price stability. This process of QE puts wealth into the hands of the already wealthy, that is asset holders, first ( including government) . That is the proverbial trickle down economics.

Inflation expectations are a market and business force. If rates rise for example, they know the flow of money will reduce and its price increase, which they must calculate into their own production model for own costs. That will therefore eventually, when all slack is taken up, transfer to shelf prices. Raw commodity prices, for example oil, will also affect inflation expectation.

After that you have consumer expectations, and they react as they do to what shelf prices do. That adds another feedback into the confidence in the currency, and the way money is handled.

There should be significant rotation into the short end of the T bond market to preserve capital in this tightening environment. However someone has to be holding all the long dated paper whether it be equity or bonds. That someone is probably not to hard to identify. The institutions that have to show competitive returns every quarter and do so by chasing yield or maintaining high equity exposure are the very likely candidates. I guess it’s OK to lose money when everyone gets the same haircut.

An impairment of bank capital however is a different matter. This implies credit contraction and counterpartys failing. This is not going to be allowed to happen to core financial institutions. The last time around it took the Fed by surprise. If the regulators and politicians allow it to happen twice in a generation there will be serious repercussions. At least the US banks marked everything to market, paid their fines and rebuilt their capital. Europe may be a different story.

The yen will eventually implode given the monetizing of debt, but in the

meantime Japan has large investments abroad so that sale and repatriation bouts keep the yen up. Remember Pebble Beach, Rockefeller Center?

Are Central Banks a cartel?

The yen will never implode because the Japanese people will always accept it as payment for their labor. The cultural aspects of the Japanese economy are largely unknown in the west. Japan will be just fine no matter how bad things get, they proved it with their accommodation to their catastrophic loss in WWII. Institutional power was transferred from govt to business and preserved. I think it will be unleashed someday, to China’s great surprise.

P.S.

Yes, central banks are cartels and on multiple levels, internal and external to their political foundation.

Wolf, President Jimmie Carter originally appointed Paul Volcker to the Fed chair position after William G Miller resigned. When Ronald Reagan had the opportunity he appointed Alan Greenspan. Paul Volcker was the only non-Keynesian fed chairman in modern history. If you want to read a little history on that time period, read William Greider’s “Temple of the Gods”. Greider quotes Paul Volcker receiving two by fours and bricks being mailed to the Fed office by home builders etc. I’m going by memory but I think the 30 year treasury peaked around 14%. That would have been a great time to load up on them. Being around 1980 those 30 year bonds would have matured in 2010. Just think of what the premium on the principal would have been.

If you had the balls in 1980 to buy 30-year T-bonds, when inflation was 14% and apparently heading higher — which could wipe out the purchasing power of the bond, as 30 years is a long time for things to go wrong — you would have bought the investment of a century, earning 14% a year without credit risk for 30 years.

Wolf, read the book. One individual in the book did buy them and/or options/futures. He named the new wing he built on his house the Volcker wing. I would go back and check the book but I gave it to a friend.

…but can’t the Fed redeem the bonds and “roll over” the principle at a lower rate?

Actually, I’m not sure. I would have to do some research if the Treasury Dept (not the Fed) could have called those 30-year T-bonds. The Treasury Dept stopped issuing “callable” bonds in 1985. So all bonds issued after that were non-callable.

And I think many bonds issued before then were also non-callable.

With non-callable bonds, the government is forced to pay that interest for the entire term of the bond, in this case for 30 years. That’s one of the reasons why interest payment on government debt stayed relatively high for long time though rates came down.

===> Dear Readers, do you know if any of those 30-year T-bonds issued in ca. 1980 were callable, and if they were actually called? I’d love to know :-]

The Treasury was thinking about calling them in the 1990s, when interest rates dropped, and I remember mentioning this during lunchtime once at work. Another, older doctor, who usually rarely said anything spoke up, quite incensed- “They can’t do that! That would ruin a lot of people’s retirement plans!”

He had bought a lot of those T-bonds, and was now counting on them for his retirement.

He retired not long afterward – he was not in the best of health, he had diabetic neuropathy and his feet were in bad shape from Charcot joints.

The Treasury never did call in those bonds, they first slowed and then stopped issuing the 30 year bonds in 2002, restarting again in 2006. I remember keeping track for a while- financial pressure from big institutions who were the biggest holders of the bonds kept the Treasury from calling them

Thanks, Gandalf. That makes sense.

Very few people had the balls. My father lost half of his savings by selling his 30 year bonds early for fear that interest rates were going waaay past 14%. There was true panic and capitulation then. He never invested in long bonds again.

I believe you could have also bought the S&P500 at a ridiculously low PE and a dividend yield of something like 7 or 8% in 1981.

That year and 1932 were the “best buys” of the century.

a lot of the analysis of consumer prices focuses on the money supply but that is only part of the equation. the other factor is the velocity of money. when people are nervous about their financial outlook, they spend less. that lowers the velocity. you can print as much money as you want as long as no one spends it, there will be no inflation. so when wolf writes about confidence that directly effects velocity. check out this velocity chart from the fed:

https://fred.stlouisfed.org/series/M2V

Wolf. It’s still not clear to me. Are you saying the main reason inflation in JPN is low because people have low inflation expectations? I think there’s more too it than that.

No, that’s not what I’m saying. What I’m saying is that QQE in Japan (which started in 2012) didn’t CAUSE a large increase in inflation because inflation expectation are solidly anchored at around 0%.

This article was about why QE (or QQE in Japan) hasn’t caused a large increase in consumer price inflation. It was not about what causes inflation in general.

Too many retirees earning nothing in interest on their money pushed inflation down to zero. Now known as ” The Bernanke Effect”. Japan is an aging population with a very low birth rate.

The Bernanke-Yellen War on Savers was a vast swindle against pensioners and the financially prudent. How many yield-seekers trying to keep up with real inflation (not the fake CPI kind) are going to get financially devastated as the Fed’s Everything Bubble implodes?

Part of the reason why inflation has not spiked as much as feared is cheap imports.

As long as the US dollar keeps being the World Currency and other currencies keep losing value against the dollar, the fact getting foreign goods and having vacations in foreign countries can be done on the cheap means there is belief on the US dollar being strong and so people are not as willing as going for the pricier options that aren’t luxury goods.

Another part is that cheap credit on dollars means foreign countries borrowing dollars and that helps to get dollars out the US so there is less currency flow and so in theory less inflation. That one been drying up with the Fed rate hikes.

Since it is not how much currency there is that affects inflation but how much of it actually is used on the market.

Yet another reason is dollars being keep out of being directly invested on goods by those dollars going on dollars and bonds.

With QE Unwind and the FED glacial slow rate hikes the idea is both virtual fake money disappearing and the money going from the riskier bonds and stocks to US treasuries.

Yet for some reason people are still investing on Junk Bond Stars like Tesla.

Part of it is the fear that getting out means the stock price sinks meaning the Junk Star goes Nova.

There are other factors too but Wolf is likely to know those better.

Once again, the children of the 70s expect huge consumer price inflation. Look at Japan for your lesson.

An aging economy does not grow asset prices or consumer prices, only medical costs.

Get it?

Boy, dining out has sure exhibited inflation. When a decent hamburger pushes $15 it takes all the fun out of it. When I have business in town I will often make a nice lunch and just stop and eat it at the beach. It’s pretty enjoyable, actually. An expensive meal out should be a treat.

Electronics? Smartphones were discussed above. Yesterday my 35 year old son remarked he needed a new laptop and the new_______ chip ensured it would be $1400+. He uses my laptop and printer these days (he lives close by) for documents, etc…but apparently the $400 laptop I use, that I bought 8 years ago? is a dinosaur. It works just fine, why would I upgrade?

I liked the explanation of Japanese consumers just doing without when prices rise. They speak my language! :-)

We don’t need no stinkin’ Esperanto. Let’s all just speak common sense and hope for understanding.

I guess people are always the wrench in any economic policy. You can really rely on us to behave rationally. And it’s hard to tell where the tipping points are that can lead to loss of confidence or manias.

I believe there are multiple causes for inflation, and they cause different types of inflation.

For example, I offer the following anecdote:

In the last election in Thailand, in 2011, one party promised to increase the minimum working wage by about 65%, and the minimum wage is what most employed people make in Thailand.

For the other half of the population that farms, they promised that the government would buy all the rice produced at twice the international price for which it could be sold.

With such promises being made to a predominately uneducated population, how could they lose?

They couldn’t, and won the election and kept their promises.

The higher wages and rice prices obviously did not make chickens grow faster or consume less food in the process.

They also did not increase the rice yield, reduce the cost of fertilizer, or change anything else.

Within 6 months the prices of most foods doubled, and people with typical income levels there spend most of what they make on food.

Prices on most everything else increased comparably.

I don’t know anybody claiming to be better off today than in 2010.

Further, the nonsense prompted the military to pitch that government out, as they had done her older brother’s government prior to that, and now both of them are criminals on the run.

Something to chew on when contemplating the subject of inflation.

Maybe also something to chew on when contemplating how good an idea democracy is if every DF is allowed to vote.

Inflation can also be looked at in 2 ways; cost push and demand pull. Since QE was effectuated by increasing the loanable funds of banks, it went toward demand for assets not consumer goods. What’s lying in wait are energy prices which have been held down by shale that is fast depleting. Additionally because of unprofitable energy investments the level of replacement capital investment in the sector has been low resulting in some forecasts calling for an energy supply crunch as early as 2020. Since energy is the master resource it can cause massive cost push inflation. When that genie exits the bottle watch out! Further QE will only fuel the fire of consumer inflation. Japan is a large importer of oil; therefore its highly vulnerable to energy cost push inflation and it’s monetary adventurism will have no power over this phenomenon. The result global stagflation.

Actually, most of the US QE went into excess reserves of a few large institutions which were then deposited at the FED.

Most of it never entered the economy, and therefore did nothing.

If that was entirely the case there wouldn’t be asset price inflation either.

I thought it was interesting you didn’t even mention the velocity of money. By some definitions, inflation equals money supply times velocity and, as you know, the velocity of money has plummeted.

jeff harbaugh,

The measures of “velocity” (M1, M2, M3) are based on our classic payment and deposit measures, such as checks, checking accounts, traveler checks, etc. They do not cover modern electronic payments methods, including credit cards — which is a biggie because people spend money they do not have in their checking accounts. Think about it! And as modern payment methods have become dominant, these classic money supply measures have become irrelevant (M3 has already been discontinued, the others have fallen out of use). I write about 3 checks a year. So almost nothing of what I spend gets tracked by M1 and M2. Here is a definition:

“Consider M1, the narrowest component. M1 is the money supply of currency in circulation (notes and coins, traveler’s checks [non-bank issuers], demand deposits, and checkable deposits). A decreasing velocity of M1 might indicate fewer short- term consumption transactions are taking place. We can think of shorter- term transactions as consumption we might make on an everyday basis.

“The broader M2 component includes M1 in addition to saving deposits, certificates of deposit (less than $100,000), and money market deposits for individuals. Comparing the velocities of M1 and M2 provides some insight into how quickly the economy is spending and how quickly it is saving.”

wolf, doesn’t “checkable deposits” include debit cards and electronic transfers from checking accounts? doesn’t it also include the money that is used to make credit card payments?

safe as milk,

If you have a $20,000 balance on your CC, this is money you already spent. But you’re only making minimum payments from your checking out. Only the minimum payments are being tracked.

If you bought a car for $35,000 and financed it, this is money you spent on the day you bought it, but since you’re making payments on a loan, your checking account will only track the monthly payments, spread out over the period of the loan.

These are just examples. To get a feel for how much money consumers are spending and how much the spending grew, check out…

consumer spending: up 35% since Jan 2011;

or retail spending, a subcategory of consumer spending, up 37% since Jan 2011.

Americans are spending money — and part is borrowed money. Businesses are spending money too. Money is circulating alright.

“consumer spending: up 35% since Jan 2011; or retail spending, a subcategory of consumer spending, up 37% since Jan 2011. Americans are spending money — and part is borrowed money. Businesses are spending money too. Money is circulating alright.”

i guess a lot of people aren’t keeping money in checking accounts anymore. if this were all borrowed money, i would assume that debt service payments have gone up but they haven’t:

https://fred.stlouisfed.org/graph/?g=lxP5

color me confused.

safe as milk,

Yes, a little confused :-)

The link you provided is “Household Debt Service Payments as a Percent of Disposable Personal Income.” This is a function of three national numbers: amount of debt owed, interest rate on this debt, and disposable income. Disposable income itself is the disposable income of people in the US. More people, more disposable income. Disposable income has increased sharply because people make a little more money and pay a little less in taxes (tax cuts), and because more people have incomes and because there are more people.

Low interest rates and higher disposable income reduce the “Household Debt Service Payments as a Percent of Disposable Personal Income.”

Your link says nothing about checking accounts. But it says a lot about disposable income. This also supports the data I linked on rising retail sales and consumer spending.

wolf, thanks for the detailed answers. your explanations are more coherent than most of what i heard from my economics professors in college.

Thank you Wolf. Great information. I’m off to research velocity and its calculation a little my for own edification. Any new velocity calculations using the previously unincluded factors out there? I don’t write many checks either.

J.

Take look at who got all the money that was printed or materialized out of thin air. It went to the bankers and big financiers on wall street. Thus, as Wolf points out, its the things that they buy that had a massive round of inflation. The printed money went to ordinary Americans, otherwise known as ‘consumers’. Thus, the consumer price index did not show a large bout of inflation.

And, of course there’s the question of whether you believe government statistics. Since the CPI is tied to automatic inflation adjustments, the government has been cheating on those numbers since Reagan. After all, we can’t have money going to ordinary old people. Not when the Bankers and the Merchants of Death also want the money. The government lies on CPI to make sure they don’t have to follow the rules on adjusting payments properly for inflation.

The false CPI also fleeces everyone on their personal income tax each and every year.

Take look at who got all the money that was printed or materialized out of thin air. It went to the bankers and big financiers on wall street.

The plutocrats in this country were the sole beneficiaries of the deranged QE money-printing by Bernanke and Yellen. Everyone else has seen their purchasing power debased even as real wages have stayed stagnant since the ’70s.

Never commented here, but have a question I’ve never seen written about anywhere: namely, regarding consumer inflation, has anyone thought to consider what is happening to discretionary spending with the rise of asset prices and others? The worker who’s rent has gone up 30% in five years (here in San Diego)? Or the mortgage payment? The cost health insurance? Paying for your kid’s schools. The rise in car prices, both new and used. All of these take money out of the discretionary pile. Thus, the hairstylist does less hair-dos. The restaurant sells less dinners, the bartender makes less tips, the food vendor sell less steak and vegetables. The rise of asset prices, health care, energy costs, taxes and every fee possible here in Cali, all take money out of the general economy. What is the effect of all this ‘nibbling’ on jobs? People make less, they spend less, a company here and there has to cut a position. What is the effect of the rent being too damn high on the general economy? Thanks for any input.

I have first hand experience with this question. Two years ago I left Florida because my rent went up slightly more than $100 a month. We could not afford to pay even one more dollar. We left the state and settled in another southern state with a lower cost of living. The number of financial refugees is increasing all across the country. Some are not as lucky as we were and land up homeless on the street. You would be surprised how many homeless people have jobs. A transient population and political instability is the result of a housing crisis.

A transient population and political instability is the result of a housing crisis.

Well said. Even the dullest of the sheeple are beginning to sense they have no future under our current oligarchy and the Wall Street-Federal Reserve Looting Syndicate’s rapacious swindles against the productive economy and Main Street. When the 99% grow tired of being shafted by the oligarchy and corporations and their captured Republicrat duopoly, we might finally start seeing the populists and nationalists arising to take back our country from our corrupt and venal political and financial elites.

The productive economy was outsourced long ago thus one could say the US government subsidized China’s industry and transfer of IP.

People have short/selective memories.

This is the primer on Inflation, and you did this without mentioning the word Deflation? Kudos

Most of the Japanese went broke from zero interest rates (the Bernanke affect) in a country with an aging population. It follows there could be negligible inflation because of this.

This is not true. “Most” Japanese are not broke. The original post says “Japanese are hoarding cash”. If the Japanese are hoarding cash, and consumer inflation rate is zero, or close to it, the Japanese cannot be going broke.

Dear Wolf,

First congratulations on the high quality of this blog.

In my opinion two things also matter.

1. Rising real estate prices translate directly into higher rents because the ROI required by investors. This is a major expense for renters but is normally not reflected in the CPI.

2. Food inflation is staggering. I am from Europe but in 10 years time prices of food have risen enormously like 200/300 %. For some reason this is almost not counted/ Hedonics ?

Combine these two and that is why real purchase power has only come down.

Real-world inflation bears no relation to our Soviet-style fake CPI data. The stealth tax of inflation, caused by the Fed’s debasement of the currency, is relentlessly robbing the 99% of their purchasing power while the Bernanke-Yellen trillions in fake-money “stimulus” benefited only the super-wealthy at the expense of everyone else.

“Over the past two decades, the Japanese have learned that there is very little or no inflation in their system:”

Note how this miracle of deflation occured with the entry of hundreds of millions of workers in China/ Asia and India in the late 1990s. Note China entered the World trade Organization in 2001. This was a massive deflationary force that was in part powered by China supporting its own industries internally.

Yet somehow I read everywhere that the lack of inflation is a mystery and consumers somehow ‘willed it to be so”.

No, mystery about it. That cheap junk sold at Walmart was subsidized by the Chinese government!

I agree that that the trillions that went into QE went primarily into assets such as real estate, but this is a completely different issue than why there has been no consumer goods inflation in many countries.

In the USA we’re going to see massive consumer inflation in the next two years due to the China trade war and demands for higher wages due to the simple point that current wages do not support the majority of the population.

What I think we will see is a lower standard of

living. Wage deflation is coming. Can the essentials fall faster than wages ?

Sporkfed,

Wage deflation haa been with us since the 1980s. Social Security has not kept up with real inflation since 1983 when the CPI started being tweaked, specifically to reduce the COLA increases built into Social Security.

The upshot? Steadily increasing percentages of Americans on SNAP (aka Food Stamps), steadily increasing numbers of the elderly who are homeless. And….. measurable DECREASES in the lifespans of the white male population aged 50 abd above.

These are not Happy Days for ordinary Americans, despute the propaganda about the booming economy

Hear! Hear! +1000!

From an (real old) old retired individual on fixed income (not complaining) that has watched the “monied classes” with their political partners literally rape this country. I’ve said this before we live increasingly in a criminal enterprise economy. There will be a reckoning and it will be something no CB will be able to “control”.