Who will blink first?

By Don Quijones, Spain, UK, & Mexico, editor at WOLF STREET.

A serious showdown is brewing in the Eurozone as Italy’s anti-establishment coalition government takes on the EU establishment in a struggle that could have major ramifications for Europe’s monetary union. The cause of the discord is the Italian government’s plan to expand Italy’s budget for 2019, in contravention of previous budget agreements with Brussels.

The government has set a public deficit target for next year of 2.4% of GDP, three times higher than the previous government’s pledge. It’s a big ask for a country that already boasts a debt-to-GDP ratio of 131%, the second highest in Europe behind Greece. To justify its ambitious “anti-poverty” spending plans, proposed tax cuts, and pension reforms, the government claims that Italy’s economic growth will outperform EU forecasts.

Brussels is having none of it. EU Commission President Jean Claude Juncker urged Italy’s Economy Minister Giovanni Tria to desist. “After having really been able to cope with the Greek crisis, we’ll end up in the same crisis in Italy,” he said. “One such crisis has been enough… If Italy wants further special treatment, that would mean the end of the euro. So you have to be very strict.”

On Wednesday ECB President Mario Draghi held a private meeting with Italian President Sergio Mattarella in Rome, at which he reportedly raised concerns about Italy’s public finances, the upcoming budget bill, and related stock-exchange and bond-market turbulence.

The meeting evoked memories of the backroom machinations that Draghi, together with his predecessor, Jean Claude Trichet, undertook to engineer the downfall of Italian premier Silvio Berlusconi in 2011 and his replacement with technocrat Mario Monte, after Berlusconi had posited pulling Italy out of the euro during Europe’s sovereign debt crisis.

But such a drastic ploy is unlikely to work this time, since it would mean having to replace an entire democratically elected government. And Italian voters, already disenchanted with the EU, are unlikely to accept having a new technocratic government thrust upon them. But that doesn’t mean the EU doesn’t have aces up its sleeves.

Brussels knows that Italy’s banking sector, despite receiving hundreds of billions of euros of monetary support and virtually free loans from Draghi’s ECB, is extremely fragile. The longer the feud with Rome goes on, the more fragile it will grow. The Achilles’ heel for Italy’s populists is the chronically weak banking sector, whose massive holdings of Italian sovereign bonds make them particularly vulnerable to an economic downturn.

As tensions between Rome and Brussels escalate, and uncertainty grows about Italy’s economic future, investors are dumping Italian debt, causing bond values to fall and yields to rise. That, in turn, is hitting banks’ funding costs and their capital cushions. On average, banks are estimated to already have lost 40 basis points of their core capital in the second quarter and another 8 bps in the third.

As their capital base shrinks, banks are less able to write down bad loans — of which there are still frighteningly many — or issue new loans. According to analysts at Morgan Stanley, Banco BPM SpA, Banca Monte dei Paschi di Siena (MPS) SpA and UBI Banca SpA are the most vulnerable of Italy’s largest lenders due to the size of their holdings of government debt.

It is this outsized exposure of Italian banks to Italian debt that makes any sudden deterioration in the value of Italian bonds so dangerous. The banking sector hold around 18% of all of the nation’s public debt. It’s the reason why, as investors abandon Italian bonds en masse, the shares of Italy’s banks are also nose-diving, with the stock of recently rescued Monte dei Paschi di Siena leading the way down having lost more than half its value year-to-date.

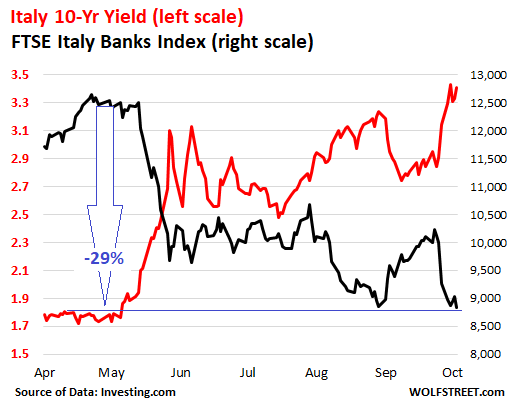

The chart below shows how the FTSE Italy Banks Index has plunged 29% since early May (black line), while the Italian government 10-year yield (red line) has nearly doubled from 1.8% to 3.4%, practically in tandem:

In other words, the dreaded “Doom Loop”– the vicious cycle between over-indebted governments in the Eurozone and the weak banks that funded them, which the ECB’s QE program was supposed to put an end to — is back in full flow.

It’s not just the banks’ shares that are feeling the impact. So, too, is the banks’ ability to raise funds.

Despite the ECB’s NIRP, which still reigns in the Eurozone, yields on Italian bank bonds have soared over the past week. On Thursday, a bond maturing in January 2023 from UniCredit, Italy’s largest bank by assets, yielded 2.67%, over two-and-a-half times the 1% it yielded when issued early this year. But smaller banks are frozen out of the market altogether, unable to issue new unsecured debt at rates they can afford. And that is putting renewed pressure on their liquidity, which, in turn, is restricting the amount of fresh credit reaching the broader economy. In August, total loans to companies and consumers slumped to their lowest level in two years, according to data from the Italian Banking Association.

The biggest fear is a return of the credit crunch that throttled Italy’s recovery after the euro debt crisis seven years ago, says Nicola Nobile, a Milan-based economist. Before that happens, Brussels hopes that Rome will do the decent thing and back down. The Italian government did offer a compromise of sorts on Wednesday by promising slightly smaller deficits in the medium term. But both coalition partners — the anti-establishment Five Star Movement and the nativist League — have dug in their heels on the 2019 budget.

Sooner or later, one side is going to have to blink, for the longer this uncertainty lasts, the greater the risk that Italy’s systemically vital banking system slips over the edge, taking Italy’s economy with it and potentially doing serious damage to the Eurozone economy. By Don Quijones.

Turkey’s “economic miracle” was fueled by foreign-currency debt. Now there’s a price to pay. Read… Loans Sour in Turkey, Inflation Hits 25%, Interest Rates Spike, Fears of Contagion Rise

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

When talking Clubmed banking, you repeatedly leave out 1 massively important point.

The sector would be nowhere near as weak as it is, if it had not been forced to absorb the losses on GREEK DEBT.

The greek crisis is vaguely over in greece but the chickens from it have still yet to completely come home to roost in the rest of Cubmed apart from Cyprus, which was a ECB hit job on the russians and living proof that bail in would be used.

Italy had to leave the EU for God’s sake. The EU and all its system is absorbing all our money and even so we are in debt. They have ruined Greece and now they want to ruin us. And as if everything were not enough, they still crushed us, leaving us sinking with the African misery. Undoubtedly the EU does not work for us,

I do not know why, but it seems that other countries of the union, for example France and Germany are getting richer, Italy is sinking in debt. We tried hard every time, but it is definitely not working for any one of us. Sad.

Italians love the euro. They finally have a currency that doesn’t get constantly devalued, like the lira did. Makes life a lot easier — and borrowing a lot cheaper :-]

Quite right.

Above all, very rich Europeans just love it.

So it stays, until……

When I collected stamps as a youngster, some 60 years ago, the Italian tenants upstairs used to give me the stamps from their letters mailed from Italy. The denomination was usually 600 lire, which was probably the exchange rate to the US$, as well as the cost of an Italian airmail stamp to North America. By 1990, the exchange rate was around 1100L to the US$. When the lire was replaced by the Euro, the exchange rate was almost 1700L to the US$.

The US $ isn’t what it used to be but neither are a lot of other currencies.

I not sure the Italians love the Euro. I’m sure some do, but I doubt it’s absolute. The EU is slippy into an Abyss.

A currency that rapidly loses its value, like the lira did, is a form of theft from the people, and people spend a lot of energy trying to protect themselves against this form of theft. A hard currency like the euro that loses relatively small amounts of its purchasing power gives people peace of mind, and they can focus on other things.

Wolf, though I agree with the initial priniciple there, I do not think linking the Euro to price stability is correct. I am looking at ceicdata for Italy household debt for example at max range, and you will find similar for Spain et al. What you have is enormous increases in private debt since euro, then national debt as counter-cyclical balance after the bust. This is due to low rates and EU transfer system of investment without fx risks. That is to say you have a huge misallocation of capital going on, purposeful as far as I understand. However Italian productivity and share of exports for example, have followed their secular decline ( or worse) , and yet you have no extreme inflation during that period.

How can that be? The reason it can be is because cheaper stable producers such as Germany mixed into the basket of Euro offset the inflation that would have occured, winning market share in the process and financial share via recirculation of earnings into the south. Obviously the south thought they had succeeded somehow, based on whatever sideline bubbles were used to support this expansionary credit flow. Then they found out they hadn’t. The ECB/EU/Investment have now laid their claim, their further management, over populations that are both resentful and destabilised, not least because of the debt overhang and misdirected/valued economy.

So with rates negative in EU, with income/debt volatile, with employment and economic and political structure trashed over a large area , you are not going to tell anyone who has seen this that the Euro is stable, because the price of a BMW remains the same or because there are more unofficial workers harvesting food . Sorry, but it just does not work like this unless you only have a single macro economic project and all else be damned, in which case further serious instability is also very likely to follow. No exit is just the ultimate folly – you really do not want populations of tens of millions feeling they are trapped, at least if you ever want to relate to them again in a normal way.

????

until interest rates move 700% in a year or two?

> They have ruined Greece and now they want to ruin us.

Oh no, that’s totally not true. PIGS ruins themselves perfectly, they don’t need any EU help.

> We tried hard every time, but it is definitely not working for any one of us. Sad.

And it will, probably, be even worse when you leave.

Good… then they should leave. And, of course, Brussels will ‘allow’ that?

There’s a very important Centenary coming up that all Italians – and especially Matteo Salvini and League supporters will be well aware of – and perhaps even preparing to mark.

March 23, 2019.

On 23 March 1919 Mussolini re-formed the Milan fascio as the Fasci Italiani di Combattimento (Italian Combat Squad), consisting of 200 members.

The Centenary of the beginning of Mussolini’s rise to power is in just over 5 months – and in the middle of campaigning for the EU Elections.

One would be a fool to discount the symbolism.

The EU will lose a fight with Italy. If they were smart they would recognise this before it happens.

Salvini, or Di Maio, are not multi-millionaires (billionaires?) With anything to lose like Berlusconi. They can’t be bribed or scared or threatened in the same way at all.

They have nothing to lose – and everything to gain at the 2019 EU Elections.

Salvini & Di Maio will turn any anger at pain and suffering in Italy against Brussels. LePen will do the same in France, Orban the same in Hungary, Kurz the same in Austria, AFD in Germany etc.

Oh, ‘they’. The evil EU is ruining Italy, not corruption, wasteful finance and reluctance to proper financial housekeeping and wise use of budget resources. We tried hard eh?… really?

Oh, the EU is soooo ‘virtuous’

Italexit.

Sounds like Italy is going to stumble down the same path to prosperity as the US.

“To justify its ambitious “anti-poverty” spending plans, proposed tax cuts, and pension reforms, the government claims that Italy’s economic growth will outperform EU forecasts.”

Europe is all about “outperforming EU forecasts”. Some people liken it to a Soviet-style planned economy but in reality it’s more akin to when we were 15 years old and bragged about our mopeds. Mine is faster than yours and I am a better rider than you are. ;-)

Italy has an enormous number of so called “zombie companies”, especially in the construction, manufacturing and real estate sectors, albeit the recent brick and mortar retail boom is creating a whole new category of zombie companies. You need to sell a whole lot of €2 toys to cover a €15,000/month rent.

Nobody knows this better than the government which has access to all tax filings and knows exactly how fragile these companies are: the end game of this charade is to muscle the European Commission, which has always given the European Central Bank their marching orders, into postponing the end of Quantitative Easing indefinetely and to take interest rate hikes off the table for good.

In short this is yet another Taper Tantrum, with both France and Spain, two other countries filled with zombie companies such as our old friends Orano (ex-Areva) and Abengoa, partecipating in more stealthy fashion.

It remains to be seen if the European Commission, which ultimately holds power over the European Central Bank, will just cave in like everybody expects or will finally show something akin to a backbone and tell the Italian government the taps will be closed at 22:00 and the lights turned off half an hour later and that’s final.

Yes, it never ceases to amaze me how many people keep falling for the, “let’s spend our way to prosperity” BS. I guess too many of us are hard-wired to be short-termist.

It may work out great if you’re a hard working entrepreneur with a great business plan, no so likely if you’re a government.

At least the US government increases its debt in a currency it has pretty much (through appointing the Fed’s president) complete control over and is furthermore also the global reserve currency. Italy is not so ‘lucky’.

The Euro zone covers a collection of very different countries in terms of culture, language etc. It should never have been attempted without a uniform fiscal policy throughout the zone.

As the Grandfathers of the Euro Said

“Financial union, without Fiscal union, is an unworkable insanity”.

They Also said

“The waring tribes of Europe, will never unite, without a gun pointed to their heads, even then, some of them, will force the trigger to be pulled.”

The Grandfathers of the Euro. Were also the Grandfathers of “Ever closer union” With the intended result of 1 supreme authority in Europe

The EUR, is that gun.

France has to decide weather it will go to EU south.

Or EU north, which will keep the Eur, and attain Fiscal union, which requires 1 Sovereign/Federal authority.

The Eu will divide, or implode.

Italy is probably about to do to its peopel. What Greece has done financially to its.

All in the name of protecting “Socialist wealth redistribution ideology’s”, that simply do not, and can never, work.

Zactly

Learned helplessness strikes again, but I don’t think an Ita/reek job is possible. US funds are probably already too stretched to cosy up asset allocation from a bad bank bailout also, Greece already getting slapped down a bit over its own new proposal…and anyway Constantinople is not playing Byzantine these days and the western empire is getting overun . The Italians would not stand for the sort of humiliation Greece accepted .

What is funny to me is that between them EU and Italy talk up yields to doom over a measly 0.4%, and that either hints at that the figures are doomed anyway,or that political differences are now critical, or that it is a complicit political manoeuvre to set a stage for “The great EU redemption” and a European super-format. I won’t even guess, but I don’t see the last occuring without a lot of red in the streets, which would ruin the possibility before it even started – a lot of society in Europe is just waiting for these people to show their faces and pin an own badge as target, for now national politicians and b.eurocrats hide behind each other in some feudal ballrooms in Brussels or Frankfurt and onlookers only get to guess how great from the faint sound of music that seeps from the walls, and the occasional drunken proclamation taken from an opened window.

(You guessed, EU is not my favs)

> The Italians would not stand for the sort of humiliation Greece accepted.

Framing it as humiliation is a typical Trumpesque way of putting it, designed to try to sow seeds of discontent among EU states. I think this is misguided as the US and EU should be natural allies.

The Greeks were free to leave the euro, but would they have been better off that way? They decided they wouldn’t be and accepted the hardship that entailed.

So it may well be that the Italians don’t want to go down that austere route, but then they’ll have to give up the euro. I expect they would want that even less.

But I don’t think this crisis will blow up that big; AFAIK the Italians are mainly concerned with immigration which disproportionately affects their shores. This is also the driving force behind Brexit and many across Europe and in Brussels now accept something major must be done about it. I suspect presenting that (immigration processing centres in Africa etc) as a concession to the Italians will help keep them from blowing up their finances.

After all these years I’m assuming the ECB has a credible plan for a country to leave the eurozone, otherwise the bluff to blow up the whole euro along with it is still in play.

Well I am not a Trumpeter (?) in the sense of sowing discord, if that is what you think he does. I live in Europe and know several countries, including Italy, relatively well. However the Greeks did actually vote to leave the Euro on different occasions, the referendum by Syriza on accepting bailout terms for example was understood as on leaving Euro at that point by the population for example.

Here is a local view on the austerity that was fobbed on Greeks

http://www.keeptalkinggreece.com/2018/08/20/greece-end-bailout-program-greek-opinion/

and it is nowhere near resolved either, the latest being suggestions of a public bailout of the banks.

Many say the EU was/is a part US project.

Immigration trouble is a demonstration of loss of own authority, and EU disconnect. The setting up of migrant return centres is not feasible, especially at any meaningful scale. For decades countries like France have tried/promised returns but never achieve anything close – there has to be agreement from country of nationality, migrant identity, non refoulement rules prohibit in many cases, plus the country has to pay. Migrant centers for legitimising migrant applications in Africa… like Libya still in civil war, or Morroco which does not want a refugee camp if paid? As easily in a few years Turkey will have its borders opened with visa free. No, there is no trust or good solution here but take control of own borders, unless you are an open borders person obviously. Migration is giving EU a nice excuse to form its own border management, something long planned and well before the migrant crisis, but individual nations are judging EU by what they understand its overall migration policy will be, and they think it will be open in practical terms.

I don’t know what the ECB plan is for if a country leaves, I think it would be trial by fire.

> However the Greeks did actually vote to leave the Euro on different occasions, the referendum by Syriza on accepting bailout terms for example was understood as on leaving Euro at that point by the population for example.

Was it really understood that way? My understanding (having voted YES in that referendum) is that most people in Greece thought: Let’s vote NO and then Tsipras can go back and negotiate a better deal (yes, people actually believed that)

Even now after so many years of economic hardship people do not want to leave the Euro. They remember all too well what devaluation means. The drachma traded around 50/dollar at the beginning of the 1980s. At the beginning of 1999 this was 280/dollar.

There are many ways to view the whole scenario, from questions of pride, brinkmanship, political authority, feasibility, much more besides. You know some nationalists will view your explanation as apologist, some will be happy that the feed to their investment remains guaranteed, that the wealth owners might feel relieved, that the youth have no choice. However the only visible truth brought on by the referendum is that the political will of the people as expressed, got shafted. I am not here to incite or insult, nor to belittle, but when you add unwritten layers of meaning to a blunt decision, you then lose definition. Obviously there is much improvisation in life, and the line between being voluntarily subject and having no choice is very fine, and will appear different to different people. So just some not too old polls that demonstrate that your own sentiment is far from a strong majority…unless you wish to say the repliers are just bluffing also…but where does that leave you when you ask for credibility of your own position?

https://greece.greekreporter.com/2017/01/04/poll-greeks-lose-faith-in-the-euro-currency-bloc/

http://thecorner.eu/news-europe/taking-greeks-devotion-euro-granted/60056/

As for Euro stability, well I will say it is a new model and some will disagree on what price stability means in a continental rate environment in terms of local economy and national integrity.

Really stretching my 5% here, however this is the latest Euro membership poll I could find for Greece, and accompanying analysis

https://ftalphaville.ft.com/2017/11/07/2195603/greeces-membership-of-the-euro-is-still-tenuous/

Which maybe explains it all better in another way. What is really funny here in Europe is how themes are put on then brought off the heat, without any real understanding of what has gone on sometimes, Greek Euro sentiment being one of those if the lack of recent results is as seems in search.

For Italy what very much stands out now is how Lega are polling over the last half year, overtaking M5S.

My comment was specifically about having the euro as a currency versus going back to (a new) drachma. Even in the poll results you have provided it is stated: “According to the spring Eurobarometer survey, 62 percent of Greeks are in favour of the euro”.

So people say joining the euro zone was wrong, they are not at all confident the EU will survive, they feel they are not represented fairly BUT they feel the alternative would be worse. I cannot see how the poll results contradict my statement .

This is an astonishing result for a country hit with the worst depression in a long time and shows that even if Greeks are not at all fond of being part of the EU they would not trade their Euros for a new national currency.

As for “being voluntary subject” vs “having no choice” I would say it’s a standard case of having our cake and wanting to eat it too.

A few years ago now, I sat in my local Coles store & wondered why the price of olive oil was twice that of canola oil.

From clearing the lant to the shelf it is much cheaper to produce olive oil.

A 4 litre can of Moro olive oil cost $26 Australian.

So I wrote to a well known Atheist & Agnostic Expert in New York.

I had been reading his articles & commenting for a long while.

Then I wrote to two Environmental Economists, 1 in New York & 1 in Chicago.

I swear before God – 3 months later the shelf price of olive oil fell by half & has remained compare with the price of canola oil ever since.

But also – the olive grower industry was in crisis & ready to pull up the olive trees.

At the same time Spain was experiencing olive oil shortages – Australia was now exporting quality olive oil to Spain.

I did nothing but notice & pass it on to 3 prominant persons in the USA.

Italy’s government is increasing spending on pensions and the poor, how terrible, much better to follow the US and send it all to billionaires.

If you believe that, I have a bridge you may be interested in.

Don’t believe all the rumors it collapsed due to complete lack of maintenance though. ;-)

It’s really pot calling kettle black if you look at the evolution of government spending

https://ourworldindata.org/public-spending

there is a per capita of gdp ppp chart in there. EU is no different, the above standoff is all a political argument over who chooses spending , who makes the rules. Italians might prefer their own country and leaders, which I think is fair enough…at least it would be more locally accountable…but hey, some prefer dictatorship also…usually not foreign though.

Mine was a joke in poor taste based on the catastrophic collapse of a motorway bridge in Genoa back in August which caused great loss of life. My love of gallows humor is seemingly not shared by 99% of the world. :'(

I’d have a lot to say on the matter, as I am part Italian and speak the language, but I risk becoming very rude so I’ll just stick to my horrible jokes for now.

I understood that, and personally as I am not Italian I am in no position to take position in Italian domestic affairs, which is why I try to keep my view as from the sideline. For several other countries I have a much closer say wrt . I have to be quiet now too because I am somewhere near my 5% :-) .

->Mine was a joke in poor taste

Like everything else, humour has its fashions. For example, in certain political US political circles, ridiculing victims of physical abuse has become the very height of humor. ‘Poor taste’ doesn’t begin the describe it, but it’s popular because it’s founded on entrenched social perversions which are cultivated for political advantage.

-> I’ll just stick to my horrible jokes for now.

Try coming up with one about financial crime, destructive avarice, and abuse of power that shames the perpetrators and not its victims. Humor is in large part based on the natural preference to identify with the strong and to disparage the weak, so you will likely find it nearly impossible.

For similar reasons, you can expect the Italian financial crisis to be resolved in favor of financiers to the detriment of their Italian subjects.

->much better to follow the US and send it all to billionaires.

The US can afford to send all its wealth to billionaires because there is no poverty in America, and no injustice. Pharaoh has decreed it. Show some appreciation. Italians are wrong to provide relief to the poor and deferred pay to the elderly, because they just waste it on survival and fail to contribute adequately to the bottom line, and billionaires are justified in conspiring to do away with them.

Remember, if you want to give bread to the poor yourself, that’s okay, you’ll be praised as a saint, but if you start asking why they’re poor, you’re just a commie and you’re asking for it.

If you really want to help, give generously to the banks. The article clearly shows they need everything you’ve got.

Already gave to the banks and bank bondholders in 2008, didn’t I?

Mistresses and yachts don’t come cheap. Don’t you have an extra kidney you could sell?

> Italy’s government is increasing spending on pensions and the poor

That will surly help the economy…

The poor spend all they get; pensioners too – on the whole – if the pension is low enough.

So directing cash at them might well be of use in pimping the stats, which is the principle art of government today…….

Italy holds the upper hand. Should they decide not to play ball the banking sector contagion would spread globally. Once that genie is out of the bottle there is no telling which banks and businesses would survive. Everyone would be gravely affected. The E.U. wouldn’t risk it. The Italians could also export their immigrants into Brussels and Germany. I’ve seen it first hand, African immigrants are a real problem for Italy. There are just too many men of fighting age panhandling on the streets of Rome, Milan, Genova, and other major cities. If Italy really wants out of the European Union, then it would just be a matter of time before they find a way out. Should Italy increase their government expenditures then all the European countries will want similar largess. I think the E.U. In its current form is a failed institution and talks should commence on reforming it before the whole experiment is flushed away.

“There are just too many men of fighting age panhandling on the streets of Rome”

When obviously they should instead be fighting in the Colosseum.

Someone here once said: “Sure, You can always blow you brains out at the table and shut down the restaurant for a few days”.

Nobody cares about “contagion” any longer; it’s all written off, priced in and there are systems in place which was not there in 2008. The Italians will be really happy (Not!) to bail-in their own banksters!

The pan-handlers are allowed to be there to be the visible official bottom of society, their presence represents a common grievance to safely divert public attention away from the elite looting, incompetence and fraud – including attention towards the crooks who employ illegal immigrants!

The outcome will be indentical to that of Greece and Cyprus. Bribery will be paid. Anybody who does not accept EU diktat or bribery will be fired.

The government and central bank of Italy will not be allowed to print their own currency, which is the best long-term solution of all for common Italians.

The masses will be controlled via “their” banks’ ATMs that spit out only Euros that can be printed only by the ECB.

Any bailouts “to Italy” will first go to investors in Italian bonds. And the people of Italy will only go every deeper into debt.

It’s amazing how certain movies explain the behavior of the Elite so well. Here’s one of the best examples — “The International” — in an amazingly short clip that sums up the strategy perfectly:

h……….ttps://www.youtube.com/watch?v=LFqx2sROwsE

Mispricing of rick on Italian government bonds seem so obvious. Their 10 year is yielding slightly more than the US bond. Italy can’t print euros and their banking system is still loaded with non performing garbage. Looks like shorting their bonds is an easy trade for the foreseeable future.

“The biggest fear is a return of the credit crunch that throttled Italy’s recovery after the euro debt crisis seven years ago” Add to this Powell’s comments that a repeat of the financial crisis is possible (and maybe preferable to a crisis we don’t understand) The markets have pushed higher assuming that runaway rates have no effect, until just this week, when HYG dropped sharply. If markets have been pricing new QE into their valuations a (sympathetic) Fed reversal should rocket them higher. Italy like Greece is the lever on a much larger problem. The US is still hot money central. but if European rates catch up that could change. Got LIBOR?

Funny thing is, is italy who invented banks to be more or less how we know them today. The main difference from those old times is that there wasn’t any government that rescued private banks back then. If the bank sunk? Bad luck bro!

This faux Capitalism were earnings are private and losses are staticed should have never started. And can’t end soon enough.

Germans and Italians don’t think the same way, and they don’t live the same why. They have little in common. Why do people think they can live together under the principles of a common EU financial budget? Also, what are the benefits of that?

The benefits of a common currency are dubious as best. The common currency just replaces one set of problems with a different set of problems. Each country should be accountable for its own finances and decision-making. Separate currencies allow for that accountability.

The common currency makes cross border travel easier when you have napkin size countries, but this is not an issue when credit cards are universally accepted.

It also makes price comparison easier. Why does certain stuff cost different in two countries using the euro? There are gaping differences in prices and wages between two neighboring euro countries, and this is the driver of outsourcing to the east.

But I am sure this was not the main goal of the EU empire builders.

The goal was a Darwinian selection of sorts, say strong German companies would take over Italian ones, and make Italy great again. This didn’t happen except in the post-soviet block.

The process was tilted to achieve the ultimate objective. If a country had a long history of deficits, and achieved one single compliant budget (through hook and crook), in they went.

Through this fudging and bending, the EU empire was built, and I was wandering if it will stop when it reaches Vietnam. Now, the chickens…

->The benefits of a common currency are dubious as best.

The Divide and Conquer strategy wasn’t producing optimum results, so they decided on the Team of Oxen Under One Whip approach, which they’ll reverse once they’ve figured out how to split up the fees.

I’m still trying to find the humour in all this, so far without success. I’m sure the billionaires find it hilarious.

Also, what are the benefits of that?

Stability and Trade. You buy or sell something and on delivery the price is exactly the agreed price? In addition, you don’t have to covert currencies and pay conversion fees and “scalping” fees?

The “new set of problems” ideally would be smaller than the old set*, but, sometimes people set in their ways will find new ways to continue their old games. And then come unstuck because the rules changed.

There is nothing “accountable” about an insider elite blowing up their country’s currency for the benefit of themselves (and their Swiss bank accounts). “Markets” are a very poor substitution for “Enforcement”.

*)

I think it is plausible that, if one amortised the total European conversion fees and exchange rate scalping costs over the years since the EUR was introduced, their sum would be higher than the costs of bailing out the PIIGS. In which case the EUR improved things.

For those who’d like to watch a parody about the EU, there is a movie from the nineties, The Gravy Train: https://www.imdb.com/title/tt0099698/?ref_=nv_sr_2

In true fashion, it probably received EU subsidies.

Why does everyone think that Italy has to leave the Euro? A dual currency scheme would work just as well……

I would expect a dual currency to be very unstable – that is probably why it is not taken seriously as an option.

Exactly. Wouldn’t that make Italy like all all those emerging markets that lend in dollars whenever they need sound currency and then get into all sorts of trouble when the dollar (rates) rise?

Any foreign investors would lend and want to be paid back in euros/dollars, not Lira v2. But the Italian government could only raise Lira v2 through taxation.

Nothing gives bankers heartburn faster than a government that actually spends money that might just help their own people. Bankers have a creed that all money is their money, and they just hate to see some ordinary person who isn’t slowly starving while working the maximum amount of overtime.

Ok, not sure I quite get this, but isn’t the Italians basically facing a no-win situation? If they accept the ECB’s proposals, they become more or less like Greece and watch their society start to unravel. If they don’t accept what the ECB says, the ECB can squeeze them like a teenager doing a pimple.

The only other alternatives is to leave the EU, which is going to be a whole other mess, but doing so would effectively end the EU and cause all sorts of other chaos. Is that about the size of it?

Mind you, watching the PIIGS countries go through these ongoing contortions to satisfy the EU is like watching a slow train wreck. This has been more or less ongoing for a decade. I guess Greeece is ok for now, but the Italians and the Spanish are both horribly exposed. It’s too bad, none of them could turn things around like they did with Ireland.

It is what the Tsipras – Varoufakis government should have done when they came to office – for the gutless wonder they were.

SYRIZA made out like they represented the people & the best outcomes for their beloved nation & we watched to see their expected scuffles with the EU.

I was bitterly disappointed to find out that they were fakers.

Sometimes life gives you the ball.

“God only knows you begged for the chance.”

And they folded like a telescope right before our eyes.

I believe that the EU bosses are all bluster & no balls, they need the EU to stay in tact.

Viva Italia !!

How is it that Jean-Claude Juncker is not retired due to ill health??

The man is past being able & functional in any real sense of the word.

ALSO :- remember Donald Trump’s promise to build the walls & fences.

What ever happened to that promise ??

Mexican concrete companies were at the table & Mexican workers lined up for the promised jobs.

What the hell went wrong Mr. President ??

interesting article – The Electronic Intifada – Gaza “Laboratory” boosts profit for Israel’s war industry.

The money has obviously been better spent – hey.

Albeit statistics show that Mexican illegals are crossing the border to the US at an all time high ?? – maybe they have not switched on the Vast Surveillance Regime …YET !!

remember if you owe the bankers a 100,000 euros you have a problem like Greece.. if you owe them a few billion They have the problem. Italy?