No, it’s not Seattle. Denver is by far #1. New York isn’t even in the top 25. And it explains why rents in Chicago are collapsing.

We’re going to shake up the status quo of apartment construction reporting. First, we’re going to lay out the status quo – the classic way of looking at this, the way you typically see it, where the New York metro comes out invariably as #1.

And then we’re going to look at it by population size of the metro, for metros with over one million people. And boy, do we get surprises.

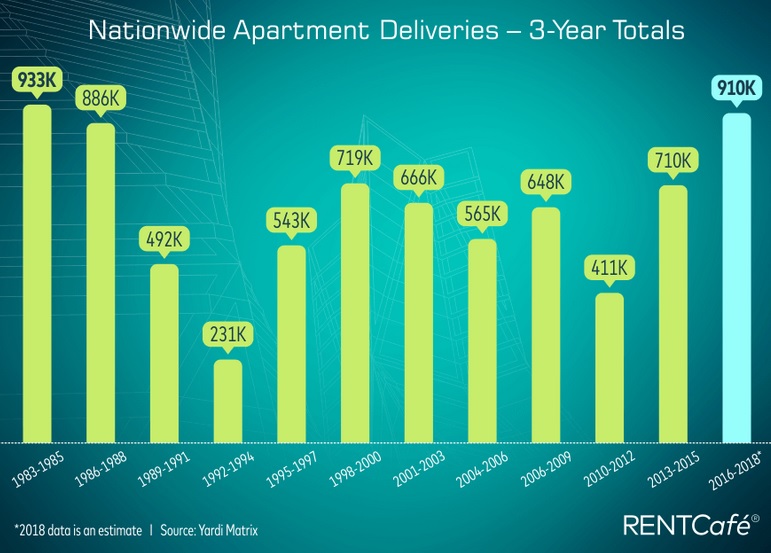

For the past few years, there has been a multi-family construction boom across the US. About 283,000 new apartments are expected to be completed by the end of 2018, just a bit below last year when apartment deliveries hit a 20-year record of 317,872 units.

Over the three years 2016-2018 – this eliminates some of the year-to-year volatility – deliveries are projected to hit 910,000 apartments, according to RentCafé, a division of Yardi. This will be the highest three-year total since the all-time record of 1983-1985 (933,000).

“As the market is approaching a saturation point, 2018 may mark the start of a construction cooldown for the next few years,” according to RentCafé.

Boom and bust: In the chart below, note the multi-year 75% collapse of deliveries following the red-hot boom of the mid-1980s (click to enlarge):

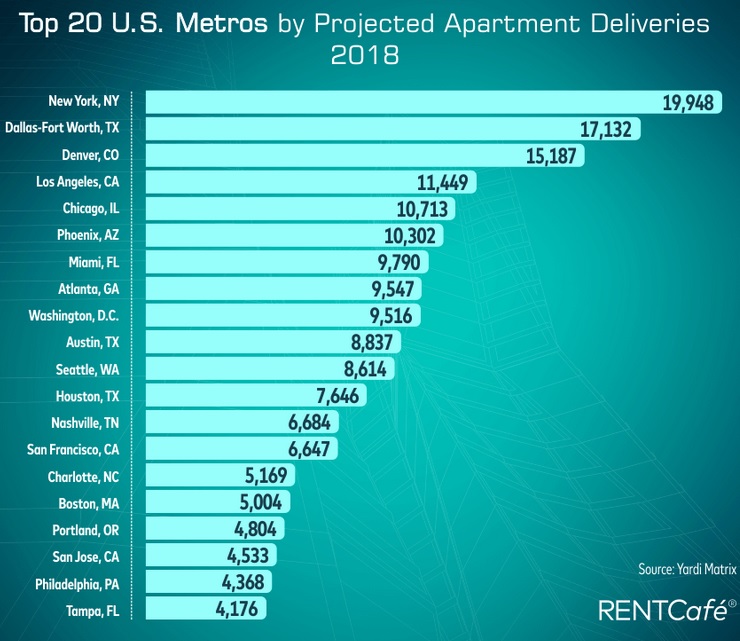

The chart below shows the top 20 Metropolitan Statistical Areas (MSAs, large multi-city agglomerations as defined by the Census Bureau) in terms of total projected apartment supply. The New York metro is undisputed #1 with 19,948 apartments to be delivered this year:

This is the classic look. It always shows some of the largest US metros near the top, with New York as #1. Part of the reason they rank so high is because they’re very large. The New York metro – officially “New York-Newark-Jersey City, NY-NJ-PA” – has 20.3 million inhabitants as of 2017 Census estimates. The metro of Los Angeles-Long Beach-Anaheim has 13.4 million inhabitants. Dallas-Fort Worth-Arlington has 7.4 million folks. But Denver-Aurora-Lakewood has only 2.9 million folks — yet it’s #3 even on this list. That set us a-thinking….

So I added the population figures from the Census Bureau to the mix, along with the estimated apartment deliveries for 2018 from the Yardi Matrix data. The result is the number of apartments to be delivered per 100,000 inhabitants. And suddenly a different picture emerges.

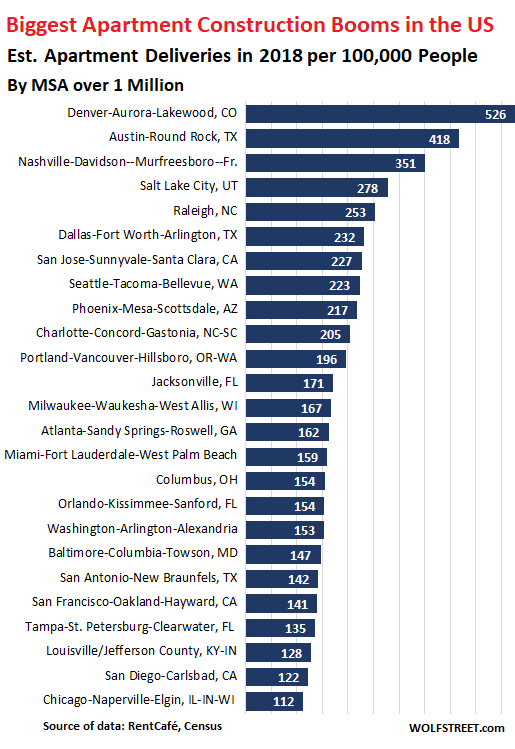

The chart below shows only metros with a population of over 1 million, sorted by apartment deliveries per 100,000 inhabitants. This is my list of the 25 biggest apartment-construction booms.

- New York metro disappears from this list, with only 98 apartments to be delivered per 100,000 inhabitants

- Denver metro is by far #1 with 526 apartments to be delivered per 100,000 inhabitants

- Austin metro is #2 with 418 apartments to be delivered per 100,000 inhabitants.

- Seattle metro, the often-cited queen of the apartment construction boom, is #8.

- The five-county San Francisco metro is #21.

One metric is missing from these dynamics: population growth or shrinkage. And it makes a difference. Look at Chicago.

The Chicago metro is in 25th place, with 10,700 apartment deliveries expected in 2019, for a population of 9.53 million. And this is a problem.

The Chicago metro has lost 27,000 people since its population peak in 2014 (9.56 million). In late 2015, asking rents peaked. Since then, with new apartment supply flooding the metro every year, and with the population shrinking at the same time, the median asking rent for a one-bedroom apartment has collapsed by 27% and for a two-bedroom by 32%.

An apartment boom that runs into a declining population ends with rents collapsing. This is a particular threat to the most expensive metros, such as San Francisco, where many people are fleeing the high costs of living every year. Only new influx from the US and overseas, mostly Asia, keeps the party going. But if there is a hiring slowdown, San Francisco too will experience population decline – which it does during every bust as people are fleeing to cheaper pastures, and the influx suddenly stops, and rents come down. Boom and bust. Always.

The table below shows the largest 99 MSAs in order of apartment deliveries per 100,000 inhabitants. But this list includes much smaller metros than the chart above. For example, New York metro with 20.3 million people and nearly 20,000 apartment deliveries is #58 on this list, just below the metro of Fort Wayne, IN, with 435,000 souls and 433 apartment deliveries, or 100 deliveries per 100,000 inhabitants. You can use the search function in your browser to find specific MSAs:

| MSAs | Population | Apt. Supply | Per 100K Pop. | |

| 1 | Denver-Aurora-Lakewood, CO | 2,888,227 | 15,187 | 526 |

| 2 | Austin-Round Rock, TX | 2,115,827 | 8,837 | 418 |

| 3 | Nashville-Davidson–Murfreesboro–Franklin, TN | 1,903,045 | 6,684 | 351 |

| 4 | Logan, UT-ID | 138,002 | 438 | 317 |

| 5 | Tallahassee, FL | 382,627 | 1,173 | 307 |

| 6 | Salt Lake City, UT | 1,203,105 | 3,339 | 278 |

| 7 | Wilmington, NC | 288,156 | 794 | 276 |

| 8 | Durham-Chapel Hill, NC | 567,428 | 1,485 | 262 |

| 9 | Raleigh, NC | 1,335,079 | 3,383 | 253 |

| 10 | Dallas-Fort Worth-Arlington, TX | 7,399,662 | 17,132 | 232 |

| 11 | Charleston-North Charleston, SC | 775,831 | 1,789 | 231 |

| 12 | San Jose-Sunnyvale-Santa Clara, CA | 1,998,463 | 4,533 | 227 |

| 13 | Seattle-Tacoma-Bellevue, WA | 3,867,046 | 8,614 | 223 |

| 14 | Corpus Christi, TX | 454,008 | 1,006 | 222 |

| 15 | Phoenix-Mesa-Scottsdale, AZ | 4,737,270 | 10,302 | 217 |

| 16 | Reno, NV | 464,593 | 994 | 214 |

| 17 | Spokane-Spokane Valley, WA | 564,236 | 1,207 | 214 |

| 18 | Charlotte-Concord-Gastonia, NC-SC | 2,525,305 | 5,169 | 205 |

| 19 | Boulder, CO | 322,514 | 642 | 199 |

| 20 | Portland-Vancouver-Hillsboro, OR-WA | 2,453,168 | 4,804 | 196 |

| 21 | Columbus, GA-AL | 303,811 | 541 | 178 |

| 22 | Boise City, ID | 709,845 | 1,260 | 178 |

| 23 | Des Moines-West Des Moines, IA | 645,911 | 1,130 | 175 |

| 24 | Fort Collins, CO | 343,976 | 600 | 174 |

| 25 | Jacksonville, FL | 1,504,980 | 2,576 | 171 |

| 26 | Gainesville, FL | 284,687 | 487 | 171 |

| 27 | Provo-Orem, UT | 617,675 | 1,048 | 170 |

| 28 | Olympia-Tumwater, WA | 280,588 | 476 | 170 |

| 29 | Milwaukee-Waukesha-West Allis, WI | 1,576,236 | 2,627 | 167 |

| 30 | Atlanta-Sandy Springs-Roswell, GA | 5,884,736 | 9,547 | 162 |

| 31 | Asheville, NC | 456,145 | 730 | 160 |

| 32 | Miami-Fort Lauderdale-West Palm Beach, FL | 6,158,824 | 9,790 | 159 |

| 33 | Madison, WI | 654,230 | 1,023 | 156 |

| 34 | Cape Coral-Fort Myers, FL | 739,224 | 1,145 | 155 |

| 35 | Columbus, OH | 2,078,725 | 3,209 | 154 |

| 36 | Orlando-Kissimmee-Sanford, FL | 2,509,831 | 3,857 | 154 |

| 37 | Washington-Arlington-Alexandria, DC-VA-MD-WV | 6,216,589 | 9,516 | 153 |

| 38 | Omaha-Council Bluffs, NE-IA | 933,316 | 1,425 | 153 |

| 39 | Baltimore-Columbia-Towson, MD | 2,808,175 | 4,117 | 147 |

| 40 | Mobile, AL | 413,955 | 599 | 145 |

| 41 | Waco, TX | 268,696 | 384 | 143 |

| 42 | Pensacola-Ferry Pass-Brent, FL | 487,784 | 695 | 142 |

| 43 | San Antonio-New Braunfels, TX | 2,473,974 | 3,501 | 142 |

| 44 | San Francisco-Oakland-Hayward, CA | 4,727,357 | 6,647 | 141 |

| 45 | Greenville-Anderson-Mauldin, SC | 895,923 | 1,215 | 136 |

| 46 | Tampa-St. Petersburg-Clearwater, FL | 3,091,399 | 4,176 | 135 |

| 47 | Louisville/Jefferson County, KY-IN | 1,293,953 | 1,660 | 128 |

| 48 | Albany-Schenectady-Troy, NY | 886,188 | 1,124 | 127 |

| 49 | Little Rock-North Little Rock-Conway, AR | 738,344 | 914 | 124 |

| 50 | San Diego-Carlsbad, CA | 3,337,685 | 4,086 | 122 |

| 51 | Chicago-Naperville-Elgin, IL-IN-WI | 9,533,040 | 10,713 | 112 |

| 52 | Houston-The Woodlands-Sugar Land, TX | 6,892,427 | 7,646 | 111 |

| 53 | Grand Rapids-Wyoming, MI | 1,059,113 | 1,157 | 109 |

| 54 | Indianapolis-Carmel-Anderson, IN | 2,028,614 | 2,203 | 109 |

| 55 | Chattanooga, TN-GA | 556,548 | 591 | 106 |

| 56 | Boston-Cambridge-Newton, MA-NH | 4,836,531 | 5,004 | 103 |

| 57 | Fort Wayne, IN | 434,617 | 433 | 100 |

| 58 | New York-Newark-Jersey City, NY-NJ-PA | 20,320,876 | 19,948 | 98 |

| 59 | Minneapolis-St. Paul-Bloomington, MN-WI | 3,600,618 | 3,520 | 98 |

| 60 | Stockton-Lodi, CA | 745,424 | 716 | 96 |

| 61 | Ann Arbor, MI | 367,627 | 353 | 96 |

| 62 | Augusta-Richmond County, GA-SC | 600,151 | 576 | 96 |

| 63 | Baton Rouge, LA | 834,159 | 800 | 96 |

| 64 | Worcester, MA-CT | 942,475 | 871 | 92 |

| 65 | Santa Maria-Santa Barbara, CA | 448,150 | 399 | 89 |

| 66 | Cleveland-Elyria, OH | 2,058,844 | 1,781 | 87 |

| 67 | Los Angeles-Long Beach-Anaheim, CA | 13,353,907 | 11,449 | 86 |

| 68 | Lansing-East Lansing, MI | 477,656 | 400 | 84 |

| 69 | Savannah, GA | 387,543 | 318 | 82 |

| 70 | Syracuse, NY | 654,841 | 532 | 81 |

| 71 | Colorado Springs, CO | 723,878 | 570 | 79 |

| 72 | Knoxville, TN | 877,104 | 684 | 78 |

| 73 | Richmond, VA | 1,294,204 | 1,001 | 77 |

| 74 | St. Louis, MO-IL | 2,807,338 | 2,088 | 74 |

| 75 | Kansas City, MO-KS | 2,128,912 | 1,569 | 74 |

| 76 | Greensboro-High Point, NC | 761,184 | 556 | 73 |

| 77 | Las Vegas-Henderson-Paradise, NV | 2,204,079 | 1,597 | 72 |

| 78 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD | 6,096,120 | 4,368 | 72 |

| 79 | Deltona-Daytona Beach-Ormond Beach, FL | 649,202 | 453 | 70 |

| 80 | Sacramento–Roseville–Arden-Arcade, CA | 2,324,884 | 1,592 | 68 |

| 81 | Buffalo-Cheektowaga-Niagara Falls, NY | 1,136,856 | 755 | 66 |

| 82 | Winston-Salem, NC | 667,733 | 403 | 60 |

| 83 | Wichita, KS | 645,628 | 381 | 59 |

| 84 | Pittsburgh, PA | 2,333,367 | 1,326 | 57 |

| 85 | Oxnard-Thousand Oaks-Ventura, CA | 854,223 | 456 | 53 |

| 86 | Virginia Beach-Norfolk-Newport News, VA-NC | 1,725,246 | 910 | 53 |

| 87 | Oklahoma City, OK | 1,383,737 | 714 | 52 |

| 88 | Columbia, SC | 825,033 | 418 | 51 |

| 89 | Cincinnati, OH-KY-IN | 2,179,082 | 1,093 | 50 |

| 90 | Birmingham-Hoover, AL | 1,149,807 | 566 | 49 |

| 91 | Bridgeport-Stamford-Norwalk, CT | 949,921 | 450 | 47 |

| 92 | New Orleans-Metairie, LA | 1,275,762 | 602 | 47 |

| 93 | North Port-Sarasota-Bradenton, FL | 804,690 | 349 | 43 |

| 94 | Memphis, TN-MS-AR | 1,348,260 | 568 | 42 |

| 95 | Fresno, CA | 989,255 | 405 | 41 |

| 96 | New Haven-Milford, CT | 860,435 | 306 | 36 |

| 97 | Riverside-San Bernardino-Ontario, CA | 4,580,670 | 1,515 | 33 |

| 98 | Detroit-Warren-Dearborn, MI | 4,313,002 | 1,319 | 31 |

| 99 | Hartford-West Hartford-East Hartford, CT | 1,210,259 | 339 | 28 |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Real estate bubbles and busts have turned into a game of Whac-A-Mole, and it’s looking like the Mole has a lock on it.

I may be new here, but I’ve looked over the last few hundred articles posted by Mr. Richter and other contributors. Is it just me, or is the world really run by invincible, professional, high-end grifters?

It’s like I can’t tell if I’m just being starkly realistic, hopelessly cynical, or terminally naive, and the scotch isn’t telling me anything I don’t already know.

” Is it just me, or is the world really run by invincible, professional, high-end grifters?”

The world had always been that way. Today, thanks to the internet, it’s a lot more obvious to all. One grift ends and is replaced by a grift involving the fix to the last grift – it’s the foot in the door. And you can always count on about 1/3 or more of everyone to loudly support the current grift as unpaid volunteers.

My wonderment is if the current grifts will grow so large to nominate all of us into world wide Darwin Award candidates. I personally think the EU is well on the way to becoming a finalist in a few years.

This does not surprise me in the least. I lived in Colorado Springs for a while and while it gets cold, it’s a dry cold and it’s just not a big problem. Same with the heat, dry heat yadda yadda. It’s a very salubrious climate, and until modern medicine, it was a popular place to go to get over TB (or not). There’s lots of “Nature” to see, too – handy when the grand-kids come over.

Plus two words: Legal weed.

Totally agree. The Front Range area, between Colorado Springs and Ft Collins is one of the nicest places on earth. Too bad they are in such a rush to screw it up and cover every square inch in suburban sprawl. I spent 10 days out there last August and the amount of development, particularly to the south and west of Denver, is just staggering.

One question, when you say apartments – do you just mean rental, or are you counting condos as well?

Apartments here means rental units in new buildings that were designed as rental buildings (commercial real estate) to be sold to big investors.

These are not condos that are rented out individually by their owners.

@Wolf You missed the biggest of all cities. Sydney & Melbourne. Please look at the RLB crane index figures for perspective.

http://assets.rlb.com/production/2018/04/11044517/RLB-Crane-Index-Q2-2018.pdf

There’s about 600+ cranes in all australian capital cities (350~ of which are in Sydney). There’s about 340-360 cranes in all of north america (Canada + USA)

Yes, but as far as I know, we haven’t annexed Sydney and Melbourne yet :-]

The charts only have American cities, it isn’t a word wide article. If you have some Australian based charts for us to enjoy, please share.

Windering where does San Mateo county fit in, seeing as SF is #44 and SJ is #12…

San Mateo is one of the 5 counties that make up the San Francisco metro (SF, Marin, Contra Costa, Alameda, San Mateo).

I suspect DFW is more at risk than the local economists/pundits estimate as well. There was an interesting shift in jobs growth in the June employment numbers between Houston and DFW with the Dallas area cooling a bit…

https://aaronlayman.com/2018/07/dfw-adds-10000-jobs-in-june-cpi-still-running-hot/

https://aaronlayman.com/2018/07/dfw-adds-10000-jobs-in-june-cpi-still-running-hot/

Simple but excellent methodology.

Anecdotal stuff: In the Chelsea neighborhood of Manhattan.

New rental building, 100 units. The rental market is soft but the building is immediately officially full. Studio goes for 3k/month. 1 bed 4-4.5k/month. Which is a lot of money.

Truth: 25% of apartments are off market and were never offered.

Perplexed here.

Marie,

Don’t be perplexed. This apartment game was cooked up by Obama in his last term. Basically, the Federal Gov. via Fannie and Freddie are financing the lions share of these for future acquisition when they fail financially. They will then be turned into low income/subsidized housing.

I am seeing in Charlotte continued starts in the face of withering rental demand. The only way this can be answered is stated above.

So the country gets a nice boost in the economic arm with all this construction, millenials and others get apartments for awhile and then later when the Fed pulls the next round of QE (and it most certainly will), these failing properties will be “acquired” and turned over to local public housing.

That’s a very interesting idea. I’m going to be looking for that. I’m continually amazed by how we have a homeless crisis, and an unemployment crisis, when there are both jobs and property available. Add to the current con of collecting extra taxes to “resolve” these issues the use of Federal tax dollars to finance projects expected to fail just ads to the grift.

You won’t be continually amazed if you read Marx. Or even books like “The Jungle” by Upton Sinclair.

it’s just capitalism operating as designed.

Did Obama pee in your coffee, too?

“I am seeing in Charlotte continued starts in the face of withering rental demand. The only way this can be answered is stated above.”

The only thing that explains a boom in apartment construction and why it might continue is an absurd conspiracy theory about housing being built explicitly to fail financially so it can be turned into low income/subsidized housing at some point in the future?

Really? That’s the only thing that could explain it?

If Obama “cooked it up” last term, what is Trump doing to stop it?

Smingles,

Potential low-end housing units might be considered a smart investment considering Uncle Sugar and Hud rentals…deep pockets, and all that. Consider also that God obviously loves the poor, as he made so many of them. Can it be considered a business model to exploit Governmental subsidies?

Why would Trump want to stop it? The apartment boom has been and continues to stimulate the economy. What’s not to like?

There might be other explanations but none near as good as the one I have provided. Wait and see.

The intentional act of leaving real estate off market skews everything. In Hong Kong, I would swear that 50,000 to 200,000 units are continually off market / empty. Also, if real estate were under the same scrutiny that bank accounts and brokerage accounts were under, the continual money laundering / money hiding game that is going on internationally would come to end and perhaps real estate would reflect its true value: about 1/3 to 1/2 of current prices in wealthy cities.

There is a simple solution to the under-utilization problem. Not simple politically– just simple in implementation. I call it the failure to use tax. I devised it to solve the housing problem for places like Jackson Hole where hundreds of 10-25 Milllion dollar house are only used for golf week over the Fourth of July and Christmas week while the work force that builds their houses and mows the lawn lives in their cars or commutes 100 miles a day over an avalanche swept pass.

The rule states: If a house or apartment is not occupied for 50% of the time in any given year its tax rate rises to 30% of true value. The Owner can either rent their mansion at a price that finds an occupant, or build and provide a rental that is priced at the median price that prevails in the entire state. The tax is earmarked for renter support or public housing support. If the homeowner fails to pay his taxes his property becomes the property of the county housing authority and the 10,000 ft mansion is remodeled into smaller 2,000 sq ft rent controlled apartments.

But public housing is always a total disaster you say? What about Vienna Austria? 300 Euro to live in quality middle class housing with complete cost stability and security? Vs $3,000 In New York, San Francisco or Seattle.

https://www.huffingtonpost.com/entry/vienna-affordable-housing-paradise_us_5b4e0b12e4b0b15aba88c7b0

This seems to be normal procedure for new developments. No one wants to flood the market data with a bunch of vacant units. When we moved to Manhattan (July 2001, impeccably timed), we saw one unit advertised in a new high-rise. We checked it out but didn’t like some aspects of it, so we asked if they had more, and they started showing us around… that building had lots of still vacant units, and we chose what we wanted (considering size, floor, view, rent, etc.).

I moved to Austin 10 months ago. It truly is a fun city. Nice people, lots to do and a nice climate (except for summer, 110 on Monday!). I rented a furnished condo downtown as a placeholder to give me time to make a longer-term decision and get to know the city. I’m on a high floor and from my balcony the horizon is littered with construction cranes. Everywhere. And it’s all residential. Just next door they’re building the largest residential tower east of the Mississippi.

People here talk about the net migration rate of 100-150 people a day. But I suspect most of them are recent college grads who can’t afford the rents/prices that are being quoted for these units. I’d like to buy a place but with all of this supply coming online in the next couple of years think I’ll rent. Feels way too much like 2006-7.

Your feelings are accurate Lou Hang in there

We are thinking about moving from Seattle to Austin to escape the homelessness, traffic, high housing costs, etc yet still live in a city with good food, amenities, quality of life. Modern new suburban homes look like they run about 1/2 what we’d have to pay here.

I don’t know what to tell you about buying versus renting. We could have bought, but sat on the sidelines and rented for the last 4 years, watching prices/rents go higher and higher. We’ve probably spent $120k in rent the last 4 years. We’ve saved more than a downpayment in an S&P500 index fund, so what we’ve paid in rent has been more than made up for with appreciation in the stock market. At some point you need to pull the trigger and buy, but you can’t wait forever for a correction to finally occur like we have.

I’d just go ahead any buy, but hedge your bets: get something that’s 1/2 what you can afford, put down 20% and get a 15 year mortgage. Minimize paying interest and fees. You won’t be that heavily invested in the property and you’ll have lots of equity early with a 15 year mortgage if you want to move in a few years. The S&P500 is a better wealth generator over time than real estate anyways.

If you’re trying to escape homeless people and traffic, Austin is not the place for you. Sure, housing is “cheaper” than Seattle, but so is nearly everywhere else in the country.

Mark excellent comment. Just one thing regarding your last sentence. Average return can be misleading. And it is especially dangerous thinking (assuming we are) in a bubble.

For example, give me $100 and I’ll guarantee you 25% return PER HOUR for two hours. Two hours from now you have $24 left. How? In hour one you lost 90% so you’re down to $10. In hour 2 you did much better, earning 140% or $14. Adding the $10 + 14 = $24. Percentage-wise you made -90% added to 140% = 50% divided by 2 hours = 25% per hour.

So you earned an average 25% per hour, but in reality lost most of your money.

That’s not how ‘Average Return’ calculations in the stock market work. Absolutely no one uses the method you’ve shown here.

They use CAGR – Compound Average Growth Rate based on the Total Return (which includes dividends).

Austin hasn’t been quite the same since Leslie Cockran left.

https://en.wikipedia.org/wiki/Leslie_Cochran

Why even consider moving to Texas into the jaws of the New Dust Bowl?

Cost of living index in a nice city with a year round spring climate:

Santiago Chile— about 50%

Medellín Colombia 32%

Bariloche Argentina– The Aspen of South America 34%

Lou, I’ve been in Austin for a couple of decades. The 2001 tech crash had some impact, but 2008 barely made a dent and housing prices barely slowed down – maybe they stopped increasing temporarily, but that’s about it. The growth in this area has been unreal, largely driven by tech.

Actually this feels like 2006-7 combined with 1999 to me.

Um… Austin is west of the Mississppi….

My peeps are in Austin. It smells, tastes and moves like you took the entire Atlanta metro and put it inside I-285. Bad transportation infrastructure, entrenched progressive control of the local and county political function, and you can’t even get a bag for your stuff at HEB.

Actually, I hate the flipping place. The traffic, the noise, the this, the that. We left Atlanta ten years ago to get away from places like Austin is now.

Oops, early morning commenting.

You’re correct, been going to Austin for the last 30+ yrs. All my friends/relatives are leaving or have left. Place has become unbearable.

I live in Charlotte and it is booming as far as population growth and apartment construction. It’s hard to believe there are places building at a 2X greater rate.

Between US apartment const and Chinese building practice the reasons for our booming logging industry is abundently clear. Even tilt up’ pre-fab practices requires form ply, bracing, and smaller wood framed structures. Despite the 22-27% tariffs on Cdn softwood the off-road logging trucks (with 16′ bunks) cannot keep up. The new trend is using highway trucks with lots of self-loaders on the bush roads, and they haul 12 hours per day 7 days per week, and have done so for approx the last 9 years. Your apartment building frenzy, plus single-family detached McMansions, has spread prosperous tentacles to all corners of the World, including the BC Coast. This wow interest rate era is a good time to make money for working people, and paradoxically a good time to save for when it all comes to a crashing halt. It will crash, has done so in the past, and said slowdowns always loom large for prudent people. It is never different, ‘this time’.

There is so much ‘noise’ these days its hard to hear the reality unfold. Too many distractions.

Your figures actually do not reveal much about the rents in Chicago.

The reality is that the building of new apartments/condos in Chicago

is almost entirely limited to downtown and north/northwest.

The demo there is white, younger and more affluent. BUT there are not

enough to ‘balance’ the new construction.

“Your figures actually do not reveal much about the rents in Chicago.

The reality is that the building of new apartments/condos in Chicago

is almost entirely limited to downtown and north/northwest.

The demo there is white, younger and more affluent. BUT there are not

enough to ‘balance’ the new construction.”

uhm…you contradicted yourself as that’s precisely what Wolf WAS SAYING, yeah???

Wolf,

Any idea on what drives a multi family to be apartment/rental vs condo/owner?

And maybe, the same question/answer: What would cause these new multi-family rentals to convert to condo in the future?

There are a number of reasons to convert. All of them have to do with how to best profit from the property.

A fairly common one is this: Sometimes there are balance issues in some markets. When condos are running hot and new condo supply is low, while new apartment construction is depressing rents, thus making it harder to sell the whole building, some developers convert apartments to condos and sell them individually.

When an established apartment building converts to condos, there are different reasons — and they could be all over the map. For example, in San Francisco, converting older apartment buildings to condos was a way to get around rent control as you can still rent out the condo but always at market rent (condos are exempt). But after the City decided that this was being abused, it tightened the rules, and these conversions are now difficult to do.

When condo bubbles get close to peaking, there are a lot of conversions as landlords want to cash in on the peak of the condo bubble. This usually helps in popping the condo bubble :-]

Glad to hear about the apartment boom. With interest rates rising, my retirement will provide me with some income to spare. A furnished apartment for a 2nd home for the cold months might be on the horizon in a couple of years. Life is looking good, thanks to rising, normalizing interest rates.

Cdr Im with you there brother/sister I have a hobby of watching Zillow for real estate in some select areas that I’m interested in and have noticed a definite trend towards longer on the market and decreasing asking prices It may get very interesting for buyers indeed Just keep your powder dry and wait for the whites of their eyes sort of thing

I sold a house in a Midwestern capital city in 2012. The house is for sale again and it appears it will be sold for around the same price as 6 years ago. Not all cities have seen amazing price growth. That is good for people who want to retire to lower cost cities.

“Not all cities have seen amazing price growth.”

Yup. House prices in about 2/3rds of the country are still at or below 2007 levels, and not predicted to get back to those levels until 2025 or so, according to Trulia.

True. I live in an area with high real estate taxes. Literal mansions and/or very nice and large custom homes, all existing, can be had for very cheap. For $450,000 to $600,000 you can get something totally amazing. Sometimes eye-popping. These would cost millions in real estate bubble towns.

The only catch is that real estate taxes come to about 4% of sale price. We have some new local politicians who are trying to fix this – finally – but it will be slow and only in small increments. All thanks to public pension costs.

From an economic point of view, someone planning to live in one for only a few years could do OK, cost wise, even with astronomical real estate taxes.

For example

House $500,000 (San Francisco value in the millions)

Taxes $20,000 (10 years = $200,000)

Sale in 10 years $500,000 to $700,000 or more if taxes go down by then)

Total cost, not much, cheaper than rent.

1

cdr the mistake you are making in your calculation is assuming price appreciation will continue And you know what they say about making assumptions

Not really, all these homes cost much less today than they did a few years ago. My big assumption is they stay the same or possible rise enough to cover some or all of the tax bills. At worst, cheaper than rent for a much smaller place. These have huge lots, 4000+ sq ft, upscale everything. The catch is astronomical tax rates.

Andrew, that’s a reflection o the fact that the data is for MSA’s.

If you looked at the same data by Zip code for any MSA you would see that the construction is usually concentrated in a few areas, for a number of reasons.

With the available data and for the purposes of this evaluation, MSA level data is appropriate ( Apples to Apples).

Excellent data analysis! Keep up the good work.

Even if the Denver market jumps to the top based on your methods, it needs to be noted that there has been a huge increase in the number of people migrating to Colorado due to its mild climate and an increase in relatively high paying jobs available in recent years. The supply of housing is still not keeping pace with demand, but there are signs that a state of equilibrium is being reached.

Where are the Seattle construction numbers coming from? There were supposed to be 8k completed in the first half of 2018 alone and another article you did cited 25k currently under construction. Last year had over 10k completed and the pace supposedly picked up this year.

These numbers also only include Seattle proper and not units outside the city such as one with 500 units opening now in Issaquah, but the population figures include the entire metro area.

All numbers are for MSAs — deliveries and population. So they match.

I had previously reported that 10,500 units were delivered in 2017, based on a different measure by a different data firm. And that 25,000 were “under construction.” This “under construction” number entails a multi-year process, from when the building leaves the planning and approval phases until the unit is “delivered.” So if that process, including delays, etc. is 2-3 years, it’s pretty close.

https://wolfstreet.com/2018/06/28/is-this-going-to-crush-rents-in-seattle/

And most of ’em are built like crap.

Tiny apartments for tiny wallets, where the commode doubles as a dining stool.

I see it more here too, proof Millenials aren’t the environmentally conscientiousness creatures they pretend to be…

https://www.washingtontimes.com/news/2017/may/21/denver-snuffs-annual-420-pot-rally-three-years-ove/

Would you consider this a proxy in the cause of building more affordable housing? Whether it’s done by or through government or private initiatives. Sixty is the new fifty, (we live longer) a house in the suburbs is now an apartment (we don’t live as well).

I live in Chicago’s Gold Coast/Old Town area, they are building a lot of “luxury” apartments all over the area and the loop/river north. Which is happening everywhere. But I believe there will be a real Luxury housing collapse in Chicago despite that the housing prices aren’t as inflated as other cities.

I’m patiently waiting to make my move. My guess is after the 2020 election.

Some things to keep in mind with the chart of apartment completions going back to the 80’s. The US population was much lower in the 80’s, so the apartments built *per capita* were actually a lot higher in the 80’s then today. So it isn’t “really” a record number of units being built today per capita, not even close.

Also, they built a ton of apartments in the 70’s too. So the supply being added in the 70’s and 80’s was much, much higher in aggregate not only in absolute terms, but FAR higher in per capita terms.

AND…..they UNDER built apartments for about 20 yrs in the 90’s and 00’s. So in 2010 there was a huge pent up demand for apartments that is still not being fulfilled (especially work force affordable apts). So I do not think this apt boom the past few years is anything close to the 70’s and 80’s.

So I think its being overstated how many apartments are being built today. AND..everything being built is class A high rent. So there is still a MAJOR shortage of Class B and C middle class apartments….and that shortage is not likely going away any time soon.

There may be some softness in the class A space for a few years in a few select downtown areas of metros. But I think the overall rental market will be tight for years to come.

Agreed. Not that I have any hard evidence on numbers. But just looking around Charlote and other regional cities, whether or not the new developments are explicitly advertised as ‘Luxury”, they have to look.

It’d take a recession followed by job losses to show softness in rental market.

Rents have gone too high and a lot of gentrification happening all over the place.

It’d happen for sure but no one knows the timings.

So, move to Denver or Austin? Is nice over there?

9,000 in Austin and 1,500 for Inland Area of SoCal? Seems a tad outta whack?