Rents in Southern California go nuts. Bay Area & Seattle “mixed.” Chicago & Honolulu in free-fall. New York City sharply lower. Washington DC loses grip. But rents soar 10-15% in many markets.

Median asking rent for one-bedroom apartments across the US rose 4% in June compared to a year ago, to $1,209. And for a two-bedroom, it rose 3.7% to $1,442. But these averaged-out national figures gathered from advertised for-rent apartments in multifamily buildings hide the city-by-city drama on the ground, with rents plunging in some of the largest and most expensive metros but soaring by the 10% to 15% in many other cities. People feel either some relief or horrendous rent inflation, depending on where they live. So here we go.

In New York City, the median asking rent in June for a 1-BR dropped 3.1% from a year ago to $2,860 and is down 15.1% from the peak in March 2016. “Median” means half of the rents are higher, and half are lower. For a 2-BR, the median asking rent dropped 3.9% from a year ago to $3,220 and is down 19.1% from the peak in March 2016.

Rents in New York had long been the second-highest in the country, after San Francisco. But last month, the median 2-BR asking rent was surpassed for the first time by Los Angeles, due to two factors: plunging rents in New York and soaring rents in Los Angeles.

These are median asking rents in multifamily apartment buildings, including new construction, as they appeared in active listings in cities across the US, collected by Zumper. These rents do not include “concessions,” such as “1 month free” or “2 months free.” Single-family houses for rent are also not included, as are studios and units with more than two bedrooms. Zumper releases the data in its National Rent Report.

Chicago rents are in freefall. The median 1-BR asking rent plunged 10.2% in June from a year ago, to $1,500, and is down 26.8% from the peak in October 2015. For a 2-BR, it plunged 15.8% and is down a breath-taking 31.7% from the peak in September 2015.

Chicago is in a special category in terms of big cities: There has been plenty of new construction in recent years, but the population has been declining as tax burdens are growing while the city is tottering very slowly toward what may become the largest municipal bankruptcy filing in the US.

In Honolulu, the median asking rent for 1-BR fell 5.6% year-over-year in June to $1,700 and is down 20.2% from the peak in March 2015. For a 2-BR, it fell 4.3% to $2,200 and is down 25.4% from the peak in January 2015.

Washington DC rents are suddenly coming unglued: 1-BR rents fell 2.3% year-over-year to $2,160 and are down 7.7% from their peak just last December. And the 2-BR rent has plunged 15.8% from last June, which was their peak. That was fast.

San Francisco remains the most expensive major rental market in the US. The median asking rent for a 1-BR apartment rose 1.4% year-over-year to $3,500 in June, but is down 4.6% from the peak in October 2015. For a 2-BR, it rose 4.0% to $4,680 but remains down 6.4% from the peak in October 2015.

There’s no shortage of supply in San Francisco. Zillow lists 1,613 apartments for rent at the moment, up 45% from the 1,149 listed in August 2016. But it’s the wrong supply.

The cheapest unit with bath listed on Zillow today — not counting rooms without bath, shared rooms with bunks, and the like — is a basic studio in the Mission Dolores area, for $1,195. And then it goes from here:

- Only 59 units with an asking rent of less than $2,000.

- 353 units with asking rents between $2,000 and $3,000.

- 1,180 units with rents over $5,000.

In other words, 73% of the apartments listed for rent on Zillow have asking rents of over $5,000! But these units include condos for rent, which tend to be high-end, plus 3-BR and larger units. Neither condos-for-rent nor 3-BR and larger are included in Zumper’s data. The median asking rent (half of the rents are higher, and half are lower) for all units listed on Zillow would be over $5,000.

Hence our local term, “Housing Crisis” — a crisis of affordability, not availability.

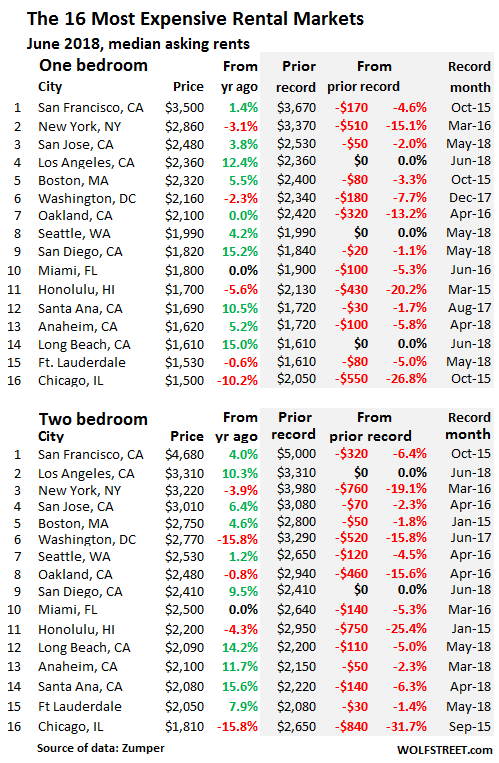

The table below shows the 16 of the 100 most expensive major rental markets in the US. The shaded area shows peak rents and the movements since then. The black bold “0%” in the shaded area means that these markets set new records in June. Note: If rents are down by a few bucks from the peak a few months ago, and red, it doesn’t yet mean that the market has turned – a turning point would require more prolonged data.

Seattle stands on its own in terms of a construction boom producing an onslaught of high-end rental supply that the market has now trouble swallowing, even as affordability as become a crisis. I discussed this yesterday [Is This Going to Crush Rents in Seattle?]

Despite this phenomenal supply, Seattle’s median 1-BR asking rent matched the record set in May ($1,990), even as 2-BR rents remain down 4.5% from the peak in April 2016.

In Southern California, the rental market is going completely nuts. The area has five cities on the above list: Los Angeles, San Diego, Santa Ana, Anaheim, and Long Beach. In four of them, rents have jumped between 10% and 15% from a year ago.

Of the three Bay Area cities on the list, rents are down from the respective peaks in all three: San Francisco, Oakland, and in San Jose. In the latter, they’re barely down from the peak, not enough to pass judgement. But rents in Oakland have dropped between 13% and 15% from their respective peaks. This was once the red-hot market for San Francisco’s rent-refugees, but it is cooling off.

The table below shows Zumper’s list of the 100 most expensive major rental markets in the US, in order of median asking rent for 1-BR apartments in June, and percentage changes from a year ago.

Many of the less expensive rental markets have double-digit year-over rent increases. In fact, of the 35 cheapest rental markets at the bottom of the list, 1-BR rents jumped by 10% or more in 24 of them, and by 15% or more in 11 of them (a third!). In the 2-BR arena, it’s similar: Of the 35 cheapest markets on the list, 21 had double-digit rent increases and seven of them over 15%. And for renters living those markets, it’s really tough; for them, none of the averaged-out national numbers make any sense (use the browser search box to find a city).

| City | 1 BR Rent | Y/Y % | 2 BR Rent | Y/Y % | |

| 1 | San Francisco, CA | $3,500 | 1.40% | $4,680 | 4.00% |

| 2 | New York, NY | $2,860 | -3.10% | $3,220 | -3.90% |

| 3 | San Jose, CA | $2,480 | 3.80% | $3,010 | 6.40% |

| 4 | Los Angeles, CA | $2,360 | 12.40% | $3,310 | 10.30% |

| 5 | Boston, MA | $2,320 | 5.50% | $2,750 | 4.60% |

| 6 | Washington, DC | $2,160 | -2.30% | $2,770 | -15.80% |

| 7 | Oakland, CA | $2,100 | 0.00% | $2,480 | -0.80% |

| 8 | Seattle, WA | $1,990 | 4.20% | $2,530 | 1.20% |

| 9 | San Diego, CA | $1,820 | 15.20% | $2,410 | 9.50% |

| 10 | Miami, FL | $1,800 | 0.00% | $2,500 | 0.00% |

| 11 | Honolulu, HI | $1,700 | -5.60% | $2,200 | -4.30% |

| 12 | Santa Ana, CA | $1,690 | 10.50% | $2,080 | 15.60% |

| 13 | Anaheim, CA | $1,620 | 5.20% | $2,100 | 11.70% |

| 14 | Long Beach, CA | $1,610 | 15.00% | $2,090 | 14.20% |

| 15 | Fort Lauderdale, FL | $1,530 | -0.60% | $2,050 | 7.90% |

| 16 | Chicago, IL | $1,500 | -10.20% | $1,810 | -15.80% |

| 16 | Philadelphia, PA | $1,500 | 7.90% | $1,700 | 6.90% |

| 18 | Portland, OR | $1,460 | 7.40% | $1,790 | 11.90% |

| 19 | Atlanta, GA | $1,440 | 14.30% | $1,810 | 13.10% |

| 19 | Providence, RI | $1,440 | 6.70% | $1,520 | 7.80% |

| 21 | Denver, CO | $1,430 | 15.30% | $2,080 | 15.60% |

| 22 | Minneapolis, MN | $1,420 | 15.40% | $1,810 | 4.60% |

| 23 | New Orleans, LA | $1,400 | 5.30% | $1,590 | -0.60% |

| 24 | Baltimore, MD | $1,330 | 0.00% | $1,610 | 9.50% |

| 24 | Dallas, TX | $1,330 | 3.90% | $1,780 | 1.70% |

| 24 | Nashville, TN | $1,330 | 15.70% | $1,470 | 5.00% |

| 27 | Houston, TX | $1,280 | 13.30% | $1,650 | 15.40% |

| 27 | Madison, WI | $1,280 | 9.40% | $1,410 | 15.60% |

| 29 | Scottsdale, AZ | $1,250 | 4.20% | $1,880 | -6.00% |

| 30 | Charlotte, NC | $1,240 | 9.70% | $1,360 | 5.40% |

| 30 | Orlando, FL | $1,240 | 14.80% | $1,470 | 15.70% |

| 32 | Sacramento, CA | $1,230 | 7.90% | $1,440 | 15.20% |

| 33 | Austin, TX | $1,190 | 14.40% | $1,470 | 11.40% |

| 34 | Irving, TX | $1,170 | 5.40% | $1,620 | 15.70% |

| 35 | Tampa, FL | $1,160 | 10.50% | $1,380 | 12.20% |

| 36 | Aurora, CO | $1,150 | 15.00% | $1,470 | 7.30% |

| 36 | Plano, TX | $1,150 | 6.50% | $1,540 | 6.20% |

| 38 | Durham, NC | $1,120 | 15.50% | $1,290 | 15.20% |

| 39 | Newark, NJ | $1,110 | 14.40% | $1,390 | 15.80% |

| 40 | Pittsburgh, PA | $1,100 | -3.50% | $1,350 | -6.30% |

| 41 | Gilbert, AZ | $1,090 | 10.10% | $1,360 | 1.50% |

| 42 | Henderson, NV | $1,070 | 9.20% | $1,250 | 12.60% |

| 42 | St Petersburg, FL | $1,070 | 12.60% | $1,540 | 7.70% |

| 44 | Buffalo, NY | $1,060 | 15.20% | $1,330 | 2.30% |

| 44 | Richmond, VA | $1,060 | 10.40% | $1,280 | 6.70% |

| 46 | Chandler, AZ | $1,050 | 9.40% | $1,250 | 7.80% |

| 46 | Fort Worth, TX | $1,050 | 14.10% | $1,270 | 15.50% |

| 48 | Chesapeake, VA | $1,040 | 7.20% | $1,200 | 4.30% |

| 48 | Salt Lake City, UT | $1,040 | 15.60% | $1,380 | 15.00% |

| 50 | Virginia Beach, VA | $1,020 | 5.20% | $1,200 | 1.70% |

| 51 | Raleigh, NC | $1,010 | 1.00% | $1,200 | 4.30% |

| 52 | Phoenix, AZ | $980 | 11.40% | $1,200 | 11.10% |

| 53 | Jacksonville, FL | $950 | 9.20% | $1,100 | 0.00% |

| 53 | Kansas City, MO | $950 | 15.90% | $1,100 | 8.90% |

| 55 | Las Vegas, NV | $920 | 15.00% | $1,100 | 12.20% |

| 55 | Milwaukee, WI | $920 | 15.00% | $1,120 | 15.50% |

| 57 | Boise, ID | $910 | 5.80% | $970 | 9.00% |

| 57 | Mesa, AZ | $910 | 13.80% | $1,080 | 10.20% |

| 57 | Syracuse, NY | $910 | 15.20% | $1,070 | 8.10% |

| 60 | Colorado Springs, CO | $900 | 15.40% | $1,100 | 0.00% |

| 60 | San Antonio, TX | $900 | 9.80% | $1,170 | 12.50% |

| 62 | Fresno, CA | $890 | 4.70% | $1,080 | 8.00% |

| 63 | Baton Rouge, LA | $870 | 8.70% | $940 | 2.20% |

| 63 | Des Moines, IA | $870 | 10.10% | $910 | 2.20% |

| 65 | Anchorage, AK | $860 | -4.40% | $1,070 | -10.80% |

| 65 | Corpus Christi, TX | $860 | -4.40% | $1,090 | 9.00% |

| 65 | Laredo, TX | $860 | 14.70% | $970 | 14.10% |

| 68 | Louisville, KY | $850 | 7.60% | $960 | 15.70% |

| 68 | Omaha, NE | $850 | 10.40% | $1,060 | 15.20% |

| 70 | Rochester, NY | $840 | 15.10% | $1,000 | 14.90% |

| 71 | Norfolk, VA | $830 | 15.30% | $1,000 | 11.10% |

| 72 | Cincinnati, OH | $820 | 15.50% | $1,060 | 15.20% |

| 72 | Knoxville, TN | $820 | 15.50% | $930 | 13.40% |

| 72 | Reno, NV | $820 | 15.50% | $1,200 | 15.40% |

| 75 | St Louis, MO | $810 | 15.70% | $1,140 | 14.00% |

| 76 | Lexington, KY | $800 | 1.30% | $950 | 1.10% |

| 77 | Arlington, TX | $780 | 14.70% | $1,050 | 14.10% |

| 77 | Cleveland, OH | $780 | 14.70% | $890 | 15.60% |

| 77 | Winston Salem, NC | $780 | 14.70% | $820 | 15.50% |

| 80 | Bakersfield, CA | $770 | 5.50% | $900 | 0.00% |

| 80 | Columbus, OH | $770 | 10.00% | $1,070 | 11.50% |

| 82 | Chattanooga, TN | $760 | 15.20% | $810 | 6.60% |

| 83 | Augusta, GA | $750 | 15.40% | $850 | 9.00% |

| 83 | Glendale, AZ | $750 | 8.70% | $1,000 | 11.10% |

| 85 | Greensboro, NC | $740 | 12.10% | $840 | 3.70% |

| 86 | Memphis, TN | $730 | 14.10% | $770 | 14.90% |

| 86 | Spokane, WA | $730 | 12.30% | $900 | 4.70% |

| 86 | Tallahassee, FL | $730 | 15.90% | $850 | 10.40% |

| 89 | Lincoln, NE | $700 | 0.00% | $930 | 6.90% |

| 89 | Oklahoma City, OK | $700 | 11.10% | $820 | 9.30% |

| 91 | Indianapolis, IN | $690 | 15.00% | $820 | 15.50% |

| 92 | Albuquerque, NM | $660 | 6.50% | $850 | 9.00% |

| 93 | El Paso, TX | $640 | 3.20% | $770 | 2.70% |

| 93 | Shreveport, LA | $640 | 14.30% | $740 | 13.80% |

| 95 | Tucson, AZ | $630 | -1.60% | $850 | 0.00% |

| 96 | Wichita, KS | $620 | 14.80% | $750 | 13.60% |

| 97 | Detroit, MI | $610 | 15.10% | $680 | 13.30% |

| 97 | Tulsa, OK | $610 | 3.40% | $770 | 5.50% |

| 99 | Akron, OH | $600 | 11.10% | $760 | 13.40% |

| 99 | Lubbock, TX | $600 | 9.10% | $790 | 5.30% |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

This morning I drove my wife to San Francisco (about a mile from downtown) and told her that I’d wait for her to finish her meeting. I drove for an hour and could not find a @#$!* place to park. All garages were full. I kid you not. From San Mateo to San Jose, the situation is not as dire but not much better. I’m old enough to have gone through two booms/busts but I have never seen anything like this.

You guys sure love your vehicles, the streets are littered with them everywhere. Most people are numb to it and don’t notice until they need a place to park. Vehicles are best used as domiciles not transport. If you need to travel from A to B a bike is much more efficient. If your wife rode her bike to the meeting their would be one less car looking for a place to park.

Off topic I know, but just sayin your cars scattered everywhere and ripping down city boulevards at 60 mph aren’t helping the situation.

As for the cost of shelter here in Seattle I’ll have to take Wolf’s word for it that things are “mixed”, I don’t even look anymore. I’m no longer a consumer of shelter.

From where I sit I see a lot of affluent people fighting over a limited supply of properties, and the trouble is every time one rich guy pays an inflated price for a house another rich guy gets stuck with those dollars that he then needs to unload on a different asset – and round and round we go on the Fed’s debt slave merry-go-round.

Have both a daughter and granddaughter living in SF and they love it! They don’t need a car!! That’s one thing about SF; it has (even so controversial) one of the best pubic transportation systems. I was born and raised in SF during ’30’s and left around 1955. When younger I could travel all over SF on Municipal railway. My granddaughter lives in the Mission Dolores district and yes, rents are high; 3 individuals share that apartment. My daughter lives in the avenues and only used her car on weekends to go down the Peninsula. What makes SF pretty good for public transport is the physical size; it is restricted by the Bay and the Ocean.

These are asking rental rates, but they won’t necessarily find a paying tenant at those prices. Double digit falls in asking rates are a clear sign of desperation; double digit rises are a sign of confidence and greed.

Do you have any data on rates for active signed lease agreements or vacancy rates for the different cities?

Exactly. Asking prices are just asking prices. And where there is a LOT of high-priced new supply coming online, the median asking price will skew upwards even when there is huge vacancy rates. The current situation in Seattle is a prime example of this effect.

One thing I want to remind everyone of is that the number for San Jose is $2480 for one bedroom. Take a look at one bedroom apartments on CraigsList for under $1800; note that I have put $1000 as the lower limit to filter out spams.

https://sfbay.craigslist.org/search/sby/apa?hasPic=1&min_price=1000&max_price=1800&max_bedrooms=1&max_bathrooms=1&availabilityMode=0&sale_date=all+dates

The above link is for Friday night when many buildings don’t advertise, and the number is still 235 apartments. On top of that each building has one ad, but has anywhere from 4 to 10 vacancies. You do the math and see how many one bedrooms are available for under $1800. The number they are giving us is $700 or almost 40% higher than what the average rent is.

2 bedroom is far worse; buildings basically beg for people to rent their 2 bedrooms since even one bedroom at $1800 is too expensive.

The point that I’m trying to make is do your own on the ground search, and don’t be fooled by numbers from RE companies; they inflate the rents numbers so that if they ask you for such a rent, you don’t feel cheated.

Note that this is not a criticism of Wolf; he loves numbers and he has to get numbers from any source that provides them. But do your own search and don’t rely on the numbers. Don’t let these RE vampires to milk the public even more.

I would say this is entirely a function of where you live in San Jose. I am sure you will find sub $1000 if you look hard enough, but you might not like where you live.

If you consider for example rent in north San Jose vs east San Jose , you might find a substantial difference in rent, even then it’ll vary from neighborhood to neighborhood.

No, we are talking about the whole south bay including high price places such as Sunnyvale. If I can get a great one bedroom apartment for $1800, then I’m not gonna rent a one bedroom apartment in a dump like San Jose even for $1500.

Correction: If I can get a great one bedroom apartment for $1800 in Sunnyvale.

I agree. I own close to 900 units nationwide (with investors) and these rents are far higher than what I see in many markets. I think the data is sourced primarily from class A advertising sources that B’s, C’s and small mom and pop owners don’t use. Often the large brokerage houses ignore anything under 100 units in their reports which is quite often the cheaper product.

“Median asking rent” — the numbers cited in the article — means half the asking rents are higher, half are lower. So if the median rent is $2,480, and there are 3,000 units listed for rent in total, then 1,500 units would rent below the median including some that would go for a lot below the median.

I don’t think median or mean would make a huge difference as there’s not many huge outliers to skew the data. From the source website (Zumper):

“This data includes more listings than most other rental websites and is sourced through a combination of proprietary listings posted by brokers through Zumper Pro and 3rd party listings received from MLS providers.”

I can almost guarantee that it excludes Craigslist which is free and is a major advertising tool for smaller and cheaper apartments. This type of data is very difficult to track accurately.

I also scanned some listings on Zumper and there does tend to be a skew towards higher end and larger apartment complexes. Not surprising as their sources appear to be more expensive advertising methods.

Plus we don’t know whether their data for cities includes cheaper suburbs which are part of the MSA but I doubt it.

The Craigslist listings have all kinds of other stuff in them, including SROs (single-occupancy room hotels), vacation rentals, rentals in a different city or rural areas, even in other states, roommate situations, etc. That’s what I found when I just did a search for “apartments for rent” in “San Francisco.”

Craigslist is useful, but you have to comb through the unrelated stuff that people stuck in to get your attention, and you cannot get any kind of data from this pile of unrelated listings.

Wolf: I understand these are median prices; but given how expensive rents are, I doubt many are stupid enough to rent $4000/month one bedrooms. So, even for median this is way too high.

These are median ASKING rents. They say nothing about how many people are signing leases or if anyone is signing any leases or what leases they sign. They’re like advertised prices.

Thanks for explaining Wolf; now, that I understand; it is what the price they are advertising.

But like some stubborn mule, they don’t want to face the reality, and they think they can keep this ponzi going.

To clarify my previous post about having a granddaughter who lives in SF in the Dolores area renting a original 1 Bdrm lower floor of which was a 2 story “flat”……converted into “three living spaces” per flat, with one kitchen in each and wall heaters that work or don’t work in the winter…rent: $3900 month per “flat” (converted 3 living space living) That is a reality.

yoy comparisons shouldn’t be affected

The vast majority of the ads on CL you link to are studios not 1 bedroom. And some are just rooms in someone’s house/apartment. You’re comparing apples to bananas dude.

Hi ….. These rents are horrendous, I live in Chiang Mai and thought we were paying a high price at $450USD…most Thai singles live in bedsits with no cooking facilities, primitive washing facilities, and are paying 3500bt ($109USD a month)…regards bryan

Honesty all I can think is “Why the heck this darn bubble won’t crash already?”

Answer: Because is many bubbles not a single one and cash is quick to move for the next one?

Eh, whatever.

The bubbles won’t crash as long as trillions in central bank “stimulus” are sloshing around the financial system.

Exactly so. The rents are high because there is so much money sloshing around and available to pay high rents. You can’t squeeze blood from a stone, people pay those huge sums because they have those huge sums. Of course this locks out people who were never targeted by the central bank’s money cannon (those lowly debt slaves can still live in Compton – for a price).

A year back I was looking to buy a 2br 2ba condo to Rent out … I found that it’s difficult to get more than $1800 per month and I gave up on the endeavor as the numbers were not making sense

I am talking about San Diego

Also not to discount Wolf..but $2450 in san Diego for 2br is way too high..

Jon, we own a small complex in a nicer part of Pacific Beach. We are renovating our 50 year old units as they turnover. We got $1875 for our last 1BR (May) and $2275 for our last 2BR (Feb.). I think the Zumper data is accurate. We set our rates via what we see in Craigslist for our specific neighborhood, and solely use that for our ads. Our units have been getting snapped up really quickly. I presume demand is strong because Federal spending — via the Navy, defense contractors, NIH funded biotech — is still strong in San Diego, which flows through to attorneys, restaurants, etc. Just my gut sense.

Pacific beach it means close to beach and that too a nice part .. ofcourse you would get this rent

I am talking about places which are not close to beach like mira mesa.. poway.. scripps.. san marcos… where 2br 2ba are for 1800.

Btw..a quick craiglist search gives 3000 2br 2ba rental apartment available for san Diego

John G,

Yes, those are spot-on in PB depending upon parking, proximity to the beach, Crowne Point, etc. Tenant base is gentrifying away from the student days of the 1980s. Also with the high GIMs, the ROE for upgrading is solid value-add.

Jon, a guy recently bought a duplex in Vista for $550k and fully upgraded the property. Good sized 2/2 TH with double garage for each unit – maybe 1,000 SF each side. He got $2,000 and $1,900 about a year ago and one tenant vacated and the unit was re-rented – rental rate unknown. I would guess Vista rents lag Poway due to Poway’s superior schools.

“I presume demand is strong because Federal spending”

AKA corporate welfare.

Jon: For 2 bedrooms they need to beg for people to rent them. Since the rents are high, most people have moved down to one bedroom and studios. No one is renting them except people who have a family and have to.

I totally agree Jon. There is no way that these numbers are accurate. As usual, you should never trust any company in RE industry, even if they pretend to be outsiders.

As I said before; they just want fools to look at these numbers and think that they are paying a fair price if they are offered let’s say $2200 and the number says the rent is $2500.

I’m a single 28 yo male, thinking about relocating from the Bay Area, CA to Dallas, TX.

Thoughts? Lots of jobs and lower cost of living.

I just moved to Austin from Dallas after living in Seattle for 11 years. Dallas, you can rent a decent place for around $1200 … a nicer new place for $1700. Home prices are moving up fast …my brother sold his 895 sq ft condo for $190k in a nicer area in 3 days .. as a 28 year old it may work just fine for you

Puzzling why SF has high rents when there are needles and feces, and bodies on the sidewalks, some dead, in the best places to live in the city.

I can understand why folks are leaving Chicago besides what Wolf points out. 125,000 gang members, many are MS13, outnumbering the police 10 to 1.

And, Baltimore….I thought you got paid to live there, can’t imagine, same goes for Oakland .

These cities have one thing in common…over crowding and aggressive traffic in the top 57.

The other thing I can not balance is what jobs are paying to support these rents. $2,400 rent means you need to make around 96,000 to 115,000 a year. There is something missing when the median income is 40 to 60.

Also, something we have noted about our 1BRs over the last year: existing tenants are having boyfriends and girlfriends moving in and newly renovated units are being leased by boyfriend/girlfriend couples, which is an entirely new phenomena for us. Before one year ago, we only had roommates in our 2BRs. I think this is one way ordinary young folks — teachers, admin assistants, retail —are coping with these now ridiculous rents.

I agree with you

In my neighborhood where sfr can cost a million.. I see many cars parked in front of a house .. meaning

Multigenerational family

I agree. When I was in Seattle I rented rooms from people for a number of years … it was the only practical solution to the f’g gig economy that things turn for the worse really fast

You’re making way too much sense dude, this is what I keep telling people, when I was growing up, the benchmark was always 25% of your income goes to rent or housing, it is now easily two thirds, something doesn’t add up, it just feels like there’s some form of manipulation or corruption going on somewhere, I’m sure there are thousands and thousands of property management corporations around the country, but it’s almost like in reality there’s only 10, and they have a complete and total monopoly on the industry, 2 years ago I kept telling my neighbor It’s ok, we just got to wait this out… well we’re still waiting

I always consider the daily numbers….$60-$120 per day for an apartment with after-tax dollars? Cash up front plus deposits, then food, transportation, etc etc. (A student loan)?

Pretty soon some of these cities will look like Hong Kong, with some forbidden no-go zones that careless outsiders disappear into. Laundry flying from the rickety fire escapes.

What is holding it together? I’m not talking about the ‘Economy’, or whether a downturn is on the horizon, that’s a given. There are always downturns to negotiate. Rather, how does anyone pretend there is a “Dream” ready to achieve? I can see it would take a solid plan and some big bold risks to escape the hamster wheel. I would not know how to even start or understand how someone scrambling to stay ahead has a spare minute to even think about getting ahead? Crazy Cooter moved to Alaska for a reason. Smart guy.

The Dust Bowl ‘Okies’ had the promised land of CA to migrate towards, and that was a decades long nightmare of exploitation. Where do people go now? I guess a young single can look for a recuiter office. My folks did when WW2 broke out. They also had no choice and no other options.

regards

Those numbers for Tampa are way off, a 2 bedroom is around $2,100 which the majority of the population in the area can’t afford. They are being filled by all the NY transplants, wealthy students from up north and HB-1 visa workers. I know people that have to drive 60-70 miles away just afford a place.

How do rising rents for larger apts (2br+) correlate to the foreclosure rates in cities where the uptick doesn’t seem to make sense. Are people getting foreclosed moving to the bigger apts? I saw the rents rise in Florida as more and more people got kicked out of foreclosures. While the foreclosure rate nationally is down, you may be seeing some areas experiencing a housing bust. Maybe the housing bubble burst is in Wolf’s chart.

Looks like a seasonal pattern on the west coast, do they count vacation rentals in the mix? its been unseasonally cool in the west which means a nice time to get out of Chicago. whereas we used to be a mobile workforce, we are now a mobile leisure-force

Year-over-year growth rates (comparing June 2018 to June 2017) are by definition NOT seasonal.

I don’t have a scientific way of proving this, but I think some large management companies are tying rents in the Bay Area directly to the NASDAQ via dynamic pricing algorithms. I posted a Twitter thread on the subject, which you can find at:

https://twitter.com/AaronGreenspan/status/1009626217463443459

One would expect the stock market to impact demand for housing units perhaps, but I have never before heard of the level of a stock index being factored *directly* into rent quotes on a daily basis. That appears to be happening—or it’s some other phenomenon I cannot explain.

I think it’s also likely that rental price fixing has been ongoing between major Bay Area real estate holders for a while, based on a conversation I had with a clueless salesperson for one of these companies a while ago. If I remember correctly, they indicated that at weekly meetings, conference calls would take place where rents would be discussed not just within the company, but with competitors as well.

Aaron Greenspan: It is almost given that these major Bay Area real estate holders are colluding; there are so many vacancies, but they don’t advertise it. The building that I recently moved to has now 5 empty apartments (in a 20 apartment building). When I wanted to rent, I said I don’t this one, do you have any others; and the answer was no. Now, that I have moved in, I can see the empty apartments. There were 4 before, but someone moved out this week. So, now they have 25% vacancies. The old apartment that I moved out of was in much worse shape since for 2-3 month you could see someone moving out every 10-11 days. They are hiding all the vacancies. That means they are colluding with each others.

1) Rents, high-end housing, and CA housing prices are leading housing indicators (in aggregate, since markets are local). The first two appear to be in decline. I don’t have info. on the third in any detail yet, but my suspicion is that this is also starting to rollover.

2) All of this craziness in housing is due to 1) Machinations of the Fed, Gov’t and GSEs (quasi-gov’t.). to directly reflate the housing bubble 1.0 into 2.0. Too many in the banking cartel would have had to take it on the chin otherwise. Bailouts and QE all around. On the house (read taxpayer). 2) Foreign buyers and “hot money” flows due to synchronized global central bank stimulus. 3) All other unconventional buyers, flippers, speculators, etc. funded by said “hot money”. Well, “mission accomplished”, except for the unintended consequences of low home ownership rates and high un-affordability (again). So much for gov’t. objectives, but it was never about Main St.

3) On the effectiveness of the Fed, Gov’t., GSEs. Are we better off now in massive housing bubble 2.0, or something else? Are markets wildly distorted? Is there true price discovery or just another large helping of moral hazard?

In terms of “It’s A Wonderful Life”, is the bizzaro RE world we’re living in closer to Bedford Falls or Pottersville?

“Where have you gone, [George Bailey] ?

Our nation turns its lonely eyes to you

Wu wu wu”

History has shown that asset bubbles don’t end well (read badly). Maybe “this time it’s different”, or maybe not. There certainly will be enough apartments to go around this time when the music stops.

I’ve been mentioning Pottersvilles since the Fed opened up PE, Banks and Hedge firms as RE buyers. Of course Obama removing the foreign buyer tax on homes in 2015 took it to another level. All Obama did was cozy up to bankers, a shill he was, says yoda…

The housing price fix created by the govt, fed and treasury with the backing of FIRE industry was the biggest heist of wealth the world has ever seen.

They have gamed everything, Coupe de Tete complete…..people couldn’t believe they could game the libor back in the day. I look forward to the move down. The fed blew it and by not letting price discovery happen, it will now be worse. We are at the top….enjoy the beatings coming

Great point about 2br in SF. Front the front lines. “median asking rents” can be deceiving, although it is the best data point out there, case in point SF, and specifically the east bay.

I haven’t noticed a single rental signed over 4.75k/month in June, and rentals in excellent shape under 4k go.

From being on the ground as a landlord, we assume prices go up in tandem with the RE market, or equity market. Nope-prices move with wages. And to rent a 5.5k/month house you need credit and a job with a salary (Bonus not included) of 200k a year. Just not as many people out there with that income looking for a rental.

Nice story; except real people have eyes. They can drive around Bay Area and see all the vacancy signs all over. There are no buildings with no vacancy signs almost anywhere. Are potential tenants lining up in front of your apartment starting from 4:00 AM??

Give me break.

80% of Craigslist for-rent ads are total BS.

1.If you do image search on the pictures in the ads your search results will lead you to the website of a decent 4 star hotel somewhere in Zanzibar.

2.Many ads in different cities are exact copies of each other like “We are 3 professional females in our mid-20’s with a cat ( meow !)”

3.Chinese students of English who presumably post this BS use funny expressions like “you pay for sewage”.

4.Sometimes they try to make you send them a down payment via Moneygram.And they send you a copy of “Barrister Agreement”.Did anyone ever met a Barrister in the US ? What kind of Animal is that ?

To post on Craigslist one must receive a verification code sent to your local number.I guess that Chinese Merry Pranksters found a way around it.

No, they are not. You put a minimum rent there depending on what you are looking for, and you filter out 80% of the BS.

Also, you can do what I did here to filter out almost anything, but buildings, even filter out those who want to share, or rent their granny units or whatever the hell they call it. The following is for one bedroom under $1800 in South Bay with all the garbage filtered out:

https://sfbay.craigslist.org/search/sby/apa?query=-roommate+-share+-master+-private+-furnished+-cottage+-law&hasPic=1&min_price=1000&max_price=1800&max_bedrooms=1&max_bathrooms=1&availabilityMode=0&sale_date=all+dates

I opened the link you provided-the ads look real ( only prices are surreal ;-) .

I am describing my apartment-hunting experience in Chicago in 2015.One woman tried to convince me that she suddenly found out-of-state job and wants to rent her luxury apartment for $800 per month.

She could not meet me in person but if I send her deposit via Moneygram then landlord would give me the keys.

And she sent me this “Barrister agreement”.

Consumer Reports:

5 Warning Signs That Craigslist Rental Listing Is Probably A Scam

https://www.consumerreports.org/consumerist/5-warning-signs-that-a-craigslist-rental-listing-is-probably-a-scam/

I forgot to add :

1.Many craigslist for-rent ads steer you to some apartment-renting website that recently popped out of nowhere (yes,we have this apt but you must sign up first)

2.Realtors don’t mention the fact that they are realtors and pose as owners or landlords.Probably nowadays to be a realtor is something to be ashamed of.

Yeah, in most metro areas Craigslist has become practically useless for rentals as it’s been flooded by the REIT-owned cookie-cutter apartment complexes. The thing is that if that is the kind of place that you are looking for as a tenant then there are better, far more organized and useful search tools to help you find run-of-the-mill apartment complexes. The rest of the listings are either scams, links to other rental websites, or to real estate agents who can show you “many homes” in the area. Trying to find Joe-wants-to-rent-out-his-home in your typical suburban US metro area on Craigslist nowadays is like looking for a needle in a haystack.

@Max Power & all who are in the know

===there are better, far more organized and useful search tools===

Would you point me in the right direction ?

I am set for now but it never harms to explore opportunities open to us in troubled times ahead.

For apartment complexes I would start off with rent.com. These are the “Apartment Guide” folks who’ve been around for decades. This said, once you use rent.com to hone in on the complexes you’re interested in, I would also recommend going to those complexes official website and seeing the actual floor plan availability as the price ranges shown on rent.com and many other sites are just that — ranges. Actual availablity of units within those ranges will vary widely.

For “Joe’s house” just look in Zillow. For this purpose I would have liked to recommend a more egalitarian and less-commercial tool like Craigslist (and in the past this was possible) but unfortunately for the reasons I mentioned in the other post, it’s become a very difficult excercise to use it for this purpose. I wish Craigslist had an “ignore apartment complex” checkbox.

Thanks

Considering the sharp and rapid decline in American buying power, many US rental markets seem to be clogs in a giant Ponzi scheme, generating revenue for Wall Street criminals. Who foots the bill? Corrupt pension funds are good candidates, but there are countless other ways to rob public resources.

I would lay the blame more on central banks who through their loosy-goosy policies have pushed asset prices to the moon. Wall Street is just following the path of money laid down for them by the CBs.

I find it interesting that both Tacoma and Vancouver, WA are not listed in this top 100. Tacoma is to Seattle what Oakland is to San Francisco; somewhat less expensive, but not to be confused with, or folded into, if costs are to be compared. Likewise, Vancouver is more closely bound to Portland, although the housing market is completely different due to several mitigating factors; taxes being the primary one.

In an interesting comparison, Tacoma and Raleigh, NC (#51 on the chart of 100) were almost the same size 30 years ago. Now Raleigh has doubled in size compared to Tacoma. However, housing prices in Tacoma are considerably higher than those in Raleigh.

I have 16 apartments in two buildings in downtown Chicago. This article is RIGHT! I’ve had to roll back apartment prices to four years ago to attract tenants, and even then, they all “just have a couple more I want to look at” and disappear. Toughest rental market since at least 2006. Developers overbuilt here for sure.

Thanks for your boots-on-the-ground info and confirmation of the data!!

Among San Francisco’s classics: https://www.sfgate.com/bayarea/article/San-Francisco-human-waste-feces-homeless-Reddit-13044317.php#photo-15812691

I am sure rent will skyrocket!!!

I mean where are the tech geniuses that can solve this problem?