“Fleets are desperate for more equipment, but trucks are in short supply due to the supplier constraints.”

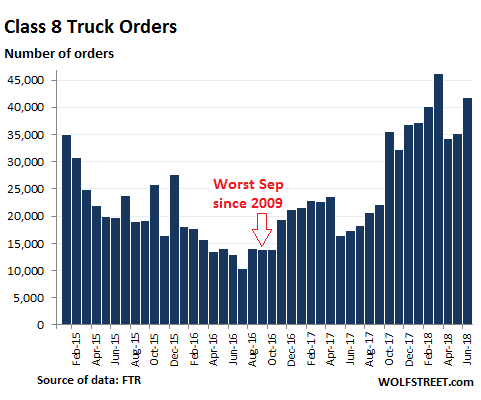

Orders for heavy trucks that haul trailers loaded with anything from junk food to oil-field equipment across the US skyrocketed 141% in June compared to a year ago, to 41,800 orders, making it the highest June ever recorded, according to transportation data provider FTR. For the first six months this year, order volume of Class 8 trucks surged nearly 90% from a year ago to a phenomenal 235,050 units.

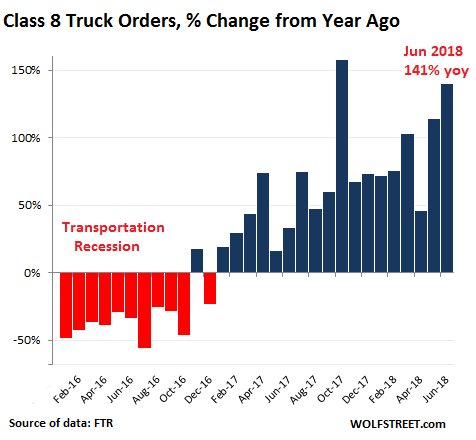

The chart below shows the percentage change of Class 8 orders compared to the same month a year earlier. Note the transportation recession when orders plunged, and truck makers were responding with layoffs. Orders began to rise in early 2017, including the year-over-year spike of 158% in October 2017, compared to the terrible October a year earlier:

Truck manufacturers “cannot keep up with demand due to component shortfalls,” FTR reported. “The backlogs are being moved out further, which is pushing fleets to get orders in sooner rather than later so they can find a build slot.”

This chart of Class 8 truck orders in units also shows that orders are seasonal, that month-to-month declines starting in March are typical, and that June is typically a weak month. But not this year:

FTR points out how the circularity of rising orders and subsequent delays getting orders filled leads to even more orders and even greater delays – which is part of the boom-and-bust cycle of the industry:

“There is an enormous demand for trucks due to burgeoning freight growth and extremely tight industry capacity. However, supply is severely constrained because OEM suppliers cannot provide the needed parts and components required to build more trucks fast enough. This bottleneck is causing fleets to get more orders in the backlog in hopes of getting more trucks as soon as they are available.”

“Fleets are desperate for more equipment, but trucks are in short supply due to the supplier constraints. This is creating a surge in orders as fleets react to this unusual situation. If OEMs were producing at capacity, the truck build this year could have been as high as 360,000 units. Orders for the last twelve months have now reached 411,000, so there are some excess orders in the backlog.”

The boom in shipments that trucking companies are trying to respond to has been enormous. Soaring freight rates, higher diesel prices, and blistering shipping volume pushed transportation spending by shippers up by 17.3% in May from a year ago, the 8th double-digit year-over-year increase in a row (Cass Freight Index). The Cass Truckload Linehaul Index, which tracks per-mile full-truckload pricing but does not include fuel or fuel surcharges, jumped 9.0% in May, the largest year-over-year increase in the data going back to 2005.

And manufacturers are complaining about it. The Manufacturing ISM Report for June, released earlier this week, which came in with strong readings, quoted some participants in the panel, including these:

“Strong economic growth continues to put pressure/strain on capacity, lead time, availability and pricing across a broadening array of commodities and components.” (Computer & Electronic Products)

“Electronic component supply issues continue to disrupt production.” (Transportation Equipment)

“Transportation costs are going through the roof right now, which definitely impacts the decisions we’re making with regard to quantities we’re bringing in versus truckload and LTL.” (Furniture & Related Products)

And these – the winners during the Transportation Recession when their costs plunged – are the losers in the transportation boom: desperate shippers that are facing soaring shipping costs and long delays.

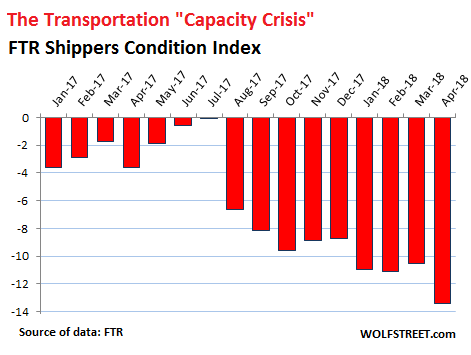

This is reflected in the FTR Shippers Conditions Index (SCI), which covers four conditions that impact shippers using trucks and rail: freight demand, freight rates, fleet capacity, and fuel price. The SCI has been solidly negative since the end of the Transportation Recession and has deteriorated sharply over the past nine months. The April index, released two days ago, dropped to -13.4, “signifying that there has not been capacity or rate relief for shippers in the current strong freight environment”:

But in this cyclical business with all kinds of ebbs and flows, the transportation “capacity crisis” will work itself out over time.

“April may be the nadir in this cycle as conditions likely will not get significantly worse for shippers over the balance of the year,” according to FTR. “Overall year-over-year rate growth is close to near-term peak. Shippers could see some stabilization in 2019 as more capacity comes on line.”

“Truckstop.com’s Market Demand Index for the past four weeks remains nearly double 2017,” said Jonathan Starks, COO at FTR. “The spot market is producing record rates every few weeks, though this trend will soon hit its peak.”

“Shippers facing significant increases in rates for truck and rail intermodal movements have not yet seen relief,” said Todd Tranausky, Senior Transportation Analyst at FTR. “However, record truck orders should begin hitting the market in the second half of the year, and we are closely watching the driver situation, which will determine if shippers see improvements as the trucks become available.”

Everything is spiking, setting off “inflationary concerns.” Read… What’s Going On with Trucking and Rail?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Incredible huh? Close 20,000 retail stores, lay off a million or so, and somehow there is so much demand for products that trucking companies “explode” with business.

I don’t suspect BS here at all.

If you talk about retail, you must include online retail and what role it plays. Online retail is BOOMING. Online retail sales are on track to exceed $500 billion in 2018. They’re growing at a rate of 16% a year.

The growth in online retail — it cannibalizes brick and mortar retail — is what causes the store closings. Online retail has fired up a boom in industrial real estate (warehouses, fulfillment centers), which is the brick-and-mortar part of online. There have been many other shifts. All of them affect trucking.

But only part of trucking is about retail. There is also heavy demand from industrial and oil-field companies, the construction industry, and others.

Wolf do you have a percentage break down on the type of hauls? I have noodled around and cant find anything.

Percentage of trucks on the road for oil sector, construction sector, retail?

TheDona,

I don’t have this data. But DAT tracks spot pricing and load-to-truck ratios on a weekly basis for each category of trailer — van, flatbed, and reefer. For ALL of them, it’s BRUTAL for shippers and Nirvana for truckers:

https://www.dat.com/industry-trends/trendlines

I spent 2 hours on the road today; dentist apt in town. I saw at least 6 fully loaded logging trucks, 6-8 flatbeds hauling excavators… logging equipment and wiggle rock trucks, maybe 4 freight trucks, and a couple reefers hauling farmed salmon. There were also numerous smaller 3 ton freight trucks. This was in 100 miles of driving on a two laned secondary highway….vancouver island.

Article seems spot on. There are also lots of adds for drivers.

I’m with Mick. Media is constantly pushing the theme that Amazon is responsible for the retail crisis. That is a gross exaggeration. Amazon is displacing a small percentage of the sales lost at bricks and mortar. There are ZERO articles about how much Obamacare has displaced retail spending. I would make a WAG that medical costs are even MORE responsible for displacing retail than Amazon.

Oddly enough, I don’t know any of these people that are constantly buying through Amazon that’s helping to force retail closures.

What is never mentioned in these articles about truck demand is that the EPA is forcing a certain percentage of it. They imposed new regulations for emissions for the big trucks. So a LOT of this demand has NOTHING to do with shipping but being forced to comply with EPA standards. I don’t know all the juicy scoop on it. Here is one article. I’m sure that trucking companies weren’t being forced to junk trucks (motors) but as they wore out they were required to buy something that was compliant.

Here is something alluding to it, I’m sure it would be easy to search and find more:

https://www.overdriveonline.com/gliders-losing-altitude-emissions-regs-crack-down-on-pre-2010-engines-crimping-a-hot-market/

Guy Daley,

Amazon is just the largest online retailer out there. There are hundreds of thousands of online retailers in the US. Some of them use platforms like Amazon and Ebay. Others have their own platforms. ALL major brick-and-mortar retailers have online operations, some of them very successful. They know they HAVE to in order to stay relevant. This includes Walmart, Macy’s, Best Buy, etc. YOU might not see online as a threat to brick-and-mortar, but brick-and-mortar retailers know it’s a lethal threat to them, and they invest large amounts of money in their online operations to duke it out online and stay relevant. Read some of their earnings reports!!

And the thing about diesel emissions regulations that you mention has been going on for years, and the industry has adjusted to it. The boom in truck orders started in 2017. The article about Glider that you linked is a joke in this context. The company buys new truck chassis without engines and installs old (pre-2010) remanufactured diesel engines into them without emission controls to dodge the emission rules and sell a cheaper product. They outfit just a few hundred trucks a year, when total industry orders now amount to 410,000 for the past 12 months. Glider isn’t even a rounding error in the equation. I have no idea why you bring this up, and what sort of evident of anything this is supposed to be.

Wolf,

Would any of this “boom” be related to the Military Industrial Complex? With more than 42 wars going and more on the way in Africa as well as the rumors of an Insurgence into Mexico for several reasons, that’s the biggest business going right now. Otherwise, we have tracked an economic slump in many parts of America, especially the more rural areas. There is also a growing social unrest and a sell-off of American infrastructure to consider and how these elements will affect markets at some point in the very near future. We don’t see stability in this anywhere. Our business is booming because there are a tremendous amount of issues with people, economy and even lethal disputes. We work in the real world here where we see the effects of reality.

R7 Resolutions

Sorry you are not participating in the recovery.

It is mostly about shale. It just shows to what extent shale is a waste of resources. Conventional oil will only need a small fraction of all that fleet, which will need to be retired pretty fast because of the load on it.

Mick,

Interesting point, you do have to wonder where the shipping growth is that is driving the demand. E-retail is after all only about 10% of total retail. You wouldn’t think even the high growth rates in e-retail would drive the trucking demand that much that fast. I wonder if it is a result of increases in hauling petroleum/petroleum products for export and pipeline growth has proven problematic.

Old Engineer,

Take out gasoline and other fuel sales, auto sales, and grocery sales. They’re largely protected from online for now. They account for about 50% of brick and mortar retail. The other 50% of brick and mortar retail is under heavy attack from online retail. Online retail has now eaten 21.6% of their sales. These are the retailers in malls that are now toppling.

Online retail sales are on track to exceed $500 billion in 2018. They’re growing at a rate of 16% a year. Ignore it at your own risk.

Read this to help you understand the dynamics in retail and check out the charts:

https://wolfstreet.com/2018/05/17/brick-mortar-meltdown-pummels-these-stores-the-most/

I have a few pieces of the puzzle for you.

If you think trucking has exploded, just wait until you see air freight. It’s beyond crazy: I am seeing old turboprop airliners no passenger company manager in his right mind would touch with a pole these days pulled out of mothball, converted into freighters and put into service as fast as safety regulations allow. Russian and Ukrainian airlines flying Cold-War-vintage Antonov and Ilyushin freighters (I love the drone of those big Ivchenko turboprops) have made a making a killing moving oversized cargo all over the world.

The reasons are complicated and many, but just think about how supply networks have changed over the past decade: they have grown to include the whole world and demand much faster delivery.

Just to give an example Sonatrach, the Algerian State-owned energy colossus, has signed a contract with Cavok Air, one of those Ukrainian freight companies of above, to regularly shuttle heavy equipment between their gasfields near Ghardaia to Germany and The Netherlands for overhaul and back. ExxonMobil had a similar contract in place with Volga-Dnepr for their operations in Hela, Papua-New Guinea, but I don’t know if the present climate of Russophobia affected that.

Is this expensive? Of course it is, but not as much as you can imagine.

Not only is intense competition between freighter airlines driving prices down (there are presently five airlines in Ukraine alone flying Antonov An-12’s, and more aircraft are being pulled out of mothballs and reconditioned) but all things considered using aircraft allows to have fast access to a variety of potential vendors, thus putting further downward pressure on costs.

This business is highly cyclical: as soon as a snag is hit (my personal shiny ChF½ coin is on a deadly combination of raising interest rates, rapidly heating inflation and too many companies getting aboard and forcing margins down) the downward cycle will start again.

Of course there’s an alternative, which is what affecting the maritime industry: such massive distortions as to make the industry to drown in perpetual overcapacity.

The Shanghai Containerized Freight Index is presently at 675. It was 816 during the first week of January. This means shipping containers from China to abroad is on average about 15% cheaper than six months ago.

Trade wars? Perhaps, but my shiny coin is once again on too many subsidized ships competing in a stagnating market.

“This business is highly cyclical: as soon as a snag is hit (my personal shiny ChF½ coin is on a deadly combination of raising interest rates, rapidly heating inflation and too many companies getting aboard and forcing margins down) the downward cycle will start again.”

+ tariff wars?

Fascinating reply!

Thanks

Also And

MC01 comment about Trade networks changing in the past decade, reminded me of the 1970s gold market.

What’s changed since then?

who could you trade gold with/where was demand for gold coming from in the 1970s?

South America, China; Russia, the Middle East?

Global wealth has exploded since 1980. What’s happened to the gold supply? What’s happened to the supply of currency?

I work for one of the big six North American railways and we cannot keep up with the demand for freight of all kinds.

Minimum capital investment for years. Then, suddenly, we must have capital investment. Boom-bust-boom-bust. When a society acquiesces to central planning (i.e. the Federal Reserve), it becomes less stable. We had boom-bust cycles before the Fed and these were the product of bank lending practices. Easy money-hard money-easy money-hard money. Fractional reserve lending or any form of legally sanctioned counterfeiting is the problem and the Federal Reserve was never the solution, only an exaggeration.

Thank you Amazon!

More seriously, how is the current trade war affecting Truck building?

What happens when the inevitable recession finally comes and tapped out consumers no longer have a wealth effect or home equity values to make them feel like spending and demand for goods goes down? This sounds like a mobile version of a housing boom. Just wondering.

Wolf. Do you think this boom is sustainable or is it debt fuelled growth.

This industry is super cyclical. The current boom is blistering and not sustainable in this industry. At some point, all these orders will lead to overcapacity and rate cutting. If this coincides with even a mild slowdown in the goods-based economy, I’m going to be writing about the “transportation recession” again.

There are already indications that it might be peaking sometime this year. But I don’t think we will see a downturn this year.

“Everything is spiking, setting off “inflationary concerns.” But not wages. I work at Johnson&Johnson an ultra rich gigantic corporation that highed Liz Fowler who wrote Obama’s CorprateCare not-healthcare healthcare “plan” so she could work her dark magic for J&J. Starting Monday, office trash will no longer be picked up at their huge office and manufacturing plant in Raynham MA. Employees working in offices will instead deposit their trash at to-be-designated localatiind. Do you think coin operated bathroom stalls are next? Did I mention health insurance alone rises each year faster than wages (thanks Obamanation! Thanks Hillary! Thanks Trump!) and I won’t even MENTION car insurance. Riminds my when I worked at State Street when they started hiring thousands of low paid Indians to replace American workers in Quincy MA. Get the point?

I also worked at J&J and saw my retirement health insurance go up around 15% in 2018 the largest increase year to year I’ve ever experienced.

“There is an enormous demand for trucks due to burgeoning freight growth”

Surely this cycle is anticipated ??

Surely the truck makers, all the way down the line know to be prepared ??

“You’ll get the call t come in any day now guys, be prepared.”

Time is money.

Parts are best purchased in a downturn & stored.

Cheaper.

Surely storage space is the factory floor.

It leaves less room for the mice to run around.

Maybe not – but it sound good.

My father used to work for the General Electric plant that manufactured diesel electric locomotives (BTW, it’s been sold by GE).

They used to take 90 days to manufacture a diesel locomotive, from order to delivery.

One day some bigwig assigned to the plant by corporate HQ decided that the plant would cut the time needed to make a new choo-choo in half every year for the next five years.

The engineers immediately did the math and realized that 1 divided by 2^5 = 1/32, so the bigwig was demanding that they would be able to make a train in 90/32 = 3 days, rounding up a bit.

IOW, he was demanding the impossible, but he had to obeyed anyway.

They eventually managed to get the manufacturing time down to 20-something days, but it was not feasible to get it into single digits. The bigwig was promoted and left, and that was the end of that.

The real purpose of the exercise was to reduce inventory. GE hated to have inventory – i.e., physical parts not yet assembled – on its books, it was “dead money” from the POV of the financiers who ran GE. Dividing that number by four made the books look good, and that was the real goal.

“Just in time” is really a euphemism for “low inventory” because the money guys run American industry and they’d rather have the books looking good than have a robust, non-fragile industrial supply chain.

It takes 40,000 parts to build a diesel locomotive and you can’t order, transport, and assemble them in 72 hours, but that was the mentality of GE at that time. They were constantly comparing the industrial divisions with GE Finance and berated the managers endlessly because they couldn’t match the 33% annual returns that the money guys were able to make in a good year.

Now, in 2018, the Finance division has more or less destroyed GE. They’ve been kicked off the Dow Jones Industrial Average, and they are selling off the industrial divisions to try to pay off their debt.

Maybe the new owners will actually be sane, maybe not. At this point, the older diesel electric tech is looking rather long in the tooth, and there’s little chance that anyone in North America will invest the money needed for brand new “bullet trains”, as the Asians have a huge and most likely insurmountable lead.

Emanon,

Excellent insightful comment and story.

Your last paragraph said that diesel-electric technology is “looking rather long in the tooth.” Do you mean in general , or do you mean GE’s technology compared to what its competitors have developed?

If you or anyone else can shed light on this, that would be great.

In the US, freight rail lines are not electrified. So given this constraint, who would have the best technology to pull trains that are several miles long?

Interesting thought, the cost of electrification infrastructure for cross country freight hauling. Maybe diesel-electrics are still the cost effective way, for thousands of miles cross country.

PUBLISHED: DECEMBER 1, 2011

VANCOUVER,BC– Westport Innovations Inc. (TSX:WPT/NASDAQ:WPRT), the global leader in natural gas engines, today announced that it has entered into an agreement with Electro-Motive Diesel (EMD), an original equipment manufacturer (OEM) of diesel-electric locomotives, to integrate Westport’s high pressure direct injection (HPDI) technology and natural gas fuel system technologies into an EMD locomotive provided by Canadian National Railways (CN). The consortium is expecting to demonstrate the natural gas locomotive as part of the previously announced Sustainable Development Technology Canada (SDTC) project with CN and Gaz Metro.

Technology tends to follow an ‘S curve’, where the initial rate of improvement is high, and then it flattens out into a plateau at the top as the tech matures and incremental improvements become harder and harder to do, and more difficult to justify spending R&D money to achieve meager results.

http://www.galsinsights.com/tag/s-curve-pattern-of-innovation/

Browse their website for ten minutes and you’ll see what they have been up to lately.

For example, the older “AC4400” was named because it increased the horsepower from 4000 to 4400, a 10% increase. Nice, but not revolutionary.

Likewise, the “AC44i” went up to 4500 HP. The extra hundred horses are nice but are an improvement of just over 2%.

http://www.getransportation.com/locomotive-and-services/AC4400-and-dash-series

The newest locomotive is even named the “Evolution” because it’s just a bit better than its predecessors. GE spent a lot of money ($600 million since 2005), but quite a bit was to reduce diesel emissions, which is required to meet new rules for the environment, but doesn’t help much from the POV of moving lots of stuff from point A to point B.

http://www.getransportation.com/locomotive-and-services/evolution-series-locomotive

https://www.up.com/aboutup/community/inside_track/ge-tier-4-11-17-2016.htm

They do have some coal and natural gas powered variants, but the cost of switching all of the infrastructure to support such vehicles would be huge, and the benefits doubtful. Coal is just too dirty for modern standards, gas is risky because it tends to explode.

I shudder at the idea of multiple natural gas powered locomotives colliding at high speed in an urban or suburban area. Ka-boom!

Thisdoesn’t leave me with a lot of confidence in GE’s jet engines.

I always got the impression GE was a hotbed of idiotic management fads, they’d rather look good than make good products.

At my previous job, the company had a small fleet ( < 10 ) of "not large" tractor trailers to haul their product to larger regional hubs for long haul distribution. All J.I.T., btw. The company is successful with tight margins.

I knew the general manager well, and he told my how he maintained the trucks — he bought somewhat USED trucks at a substantial discount — which — when combined with certain credits for improved mileage and pollution stats, made it easy for him to roll over the fleet before it needed major repairs. And a a very good cost.

I was not on the trucking side of the house and simply ate lunch with the drivers in the small cafeteria. That's how I gained my sparse knowledge of trucking.

The GM was rightly proud of how he managed to continuously upgrade the fleet, at low cast, while delivering improved performance.

How much of this rather large new truck demand might be as a result of federal (or state?) credits for reducing pollution, while increasing fuel efficiency ?

I’m guessing that the trucking business will react to this much like the building trade has reacted. They’ll just be taking longer to deliver.

Trucks are ordered. What about the drivers? Will the shortage be big enough to drive up prices?

If retail trade is so bad in the US, how come road and rail freight is so stretched for capacity?

Retail is not “so bad” in the US. Where the heck does this keep coming from? Retail is up about 5% yoy, thanks to online retail which is booming.

Brick-and-mortar retail at malls is in trouble, but not retail overall.

PACCAR is down near 24% this year, they produce these trucks said to be in high demand yet……

How I would interpret it: The stock market is supposed to look into the future. This business is so cyclical that the next order-downturn is guaranteed. It’s just a question of when. The stock market sees this coming too.

During the Transportation Recession, PCAR bottomed in Jan 2016, so way ahead of the end of the transportation recession. The stock is now doing a similar thing, anticipating the next move of those orders.

As I’ve said here, there’s no way this order momentum can continue.

All the engines made for class 8 tractors have been of poor quality the last 8 years or so. All the EPA regs on exhaust. They’re not dependable. Lots of breakdowns. Very expensive.

Look at the class 8 truck orders for just the tractor with no engine or transmission. I forget the name for this.

HR,

” lots of breakdowns ” You are correct. Driver for mid-sized air freight company stated to me he received a brand new 2017 freightliner Cascadia. It now has 80,000 miles on it. Has been in shop 8 times over past 6 months for warranty repairs, each time tying up unit for a week or more. Trucking companies, more and more, are just leasing power units, not buying.

As well, I do not see drivers’ wages increasing commensurately. Younger people just are not coming into the business and, given pay and working conditions, I cannot blame them. Companies are well aware of the driver shortage situation, yet they are increasing truck orders? Something is going on here that is not readily apparent. Any thoughts, anyone?

Perhaps horsepower requirements have hit the brick wall of emissions regulations? I am seeing more rigs stuck on the side of the interstate these days with the engine cowlings tilted open and the drivers on their cell phones…

Down here truckers just keep running their 30 year old trucks. Margins are super tight. They know new trucks are unreliable garbage. Also the old trucks pay less taxes and insurance. Only transnationals run new trucks. Friend of mine recently blew up his engine. Dropped in a rebuild and kept running his 83 cabover. Owner operator makes aprox. $1000 a week doing day runs back and forth from the port to the city 50 miles each way. 7 days a week.