Russia, Japan, and the Fed dumped. So who bought?

China’s holdings of US Treasury bonds, notes, and bills, after rising in February and March, fell by $5.8 billion in April to $1.18 trillion. Thus, China’s holdings have remained within the same range since August 2017, despite threats of a trade war and rumors that it would dump US Treasuries. China remains the largest holder, a position it had lost during its era of peak capital-flight from October 2016 through March 2017.

Japan has been systematically reducing its Treasury holdings. In April, it disposed of another $12.3 billion, according to the Treasury Department’s TIC data released Friday afternoon. Over the past six months, it shed $63 billion. Since July 2016 it has slashed its holdings by $123 billion, the lowest since October 2011:

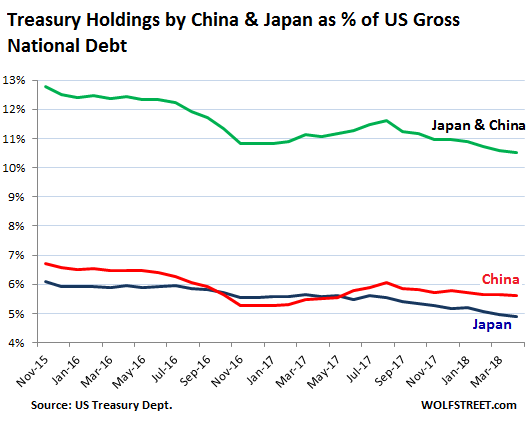

This trend is even clearer when the holdings by China and Japan are expressed as a percent of the US gross national debt: Their importance has creditors to the US, while still large, has been dwindling for two reasons:

- The US gross national debt has soared.

- The holdings of China and Japan have fallen over the past two years.

China’s holdings (red line) as a percent to US gross national debt fell from 6.7% in May 2015 to 5.6% in April 2018. Japan’s holdings (blue line) fell from 6.1% to 4.9%. Their combined holdings (green line) fell from 12.8% to 10.5%:

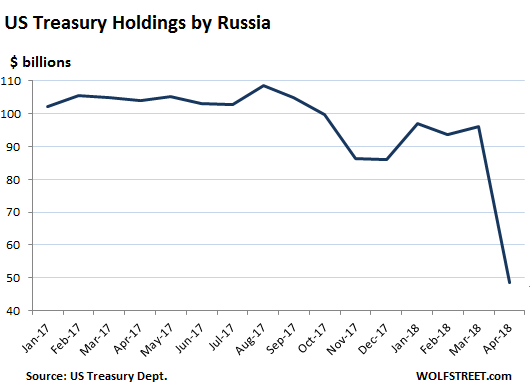

And a sharp-edged curiosity: Russia.

Russia is a rather insignificant holder of US Treasuries. In March it was in 16th place with $96.1 billion in Treasury holdings. But in April, it cut its Treasury holdings in half, to $48.7 billion in one fell swoop, which put it into 22nd place behind the UAE and Thailand. Since August last year, it slashed its holdings by 55%. Some kind of message?

The good thing is that Russia doesn’t have that many Treasuries left to sell – unlike China or Japan. It China and Japan started to pull a Russia, the scenario would be different.

Other countries added to their holdings, and the “grand total” of Treasuries held by official (central banks, governments, etc.) and non-official foreign investors fell by $47.6 billion to $6.17 trillion, smack-dab in the middle of the range of the past year.

Many of the top holders of Treasuries – after China and Japan – are tiny countries or jurisdictions with inexplicably huge balances. They include tax havens and alleged money laundering centers.

For example, Ireland, in third position behind China and Japan. It’s where Corporate American likes to register its “overseas cash.” It held $300 billion of Treasuries in April, about the size of its GDP. But this amount has plunged by $17.5 billion during just the month of April, and is down by $27 billion from January this year, presumably as US corporations began “repatriating” their “overseas cash” by selling those Treasuries and using the proceeds to buy back their own shares.

The largest holders of US Treasuries, after China and Japan.

- Ireland: $300 billion

- Brazil: $294 billion

- UK (“City of London!”): $263 billion

- Switzerland: $242 billion

- Luxembourg: $214 billion

- Hong Kong: $194 billion

- Cayman Islands: $181 billion… down from $250 billion a year ago!

- Taiwan: $168 billion

- Saudi Arabia: $160 billion

- India: $152 billion

- Belgium: $137 billion

- Singapore $118 billion

Germany, fourth largest economy in the world and running a massive trade surplus with the US, only held $86 billion in Treasuries in April. But that was up by $12 billion from March.

So who holds the rest of the US gross national debt?

By the end of April – to stay within the time frame of the TIC data – the US gross national debt had reached $21.07 trillion. This was up by $1.22 trillion from a year earlier! So who bought this $1.22 trillion of new US Treasuries? Someone must have!

The gross national debt and its surge over the 12-month period are split in two ways:

- Debt held “internally” by US government entities rose by $181 billion to $5.73 trillion.

- Debt that is publicly traded soared by $1.05 trillion to $15.34 trillion.

This publicly traded debt of $15.34 trillion was held by these entities at the end of April:

- 15.6% or $2.39 trillion by the Fed as part of its QE

- 40.2% or $6.17 trillion by foreign entities (see above).

- 44.2% or $6.78 trillion by Americans, directly or indirectly.

And who bought $1.22 trillion in new debt over the past 12 months?

Not the Fed. Its Treasury holdings fell by $70 billion from the beginning of the QE-Unwind through April. Foreign holdings have only picked up $109 billion over the period. Leaves $1.01 trillion that someone else must have bought over those 12 months.

But who? Mostly American institutional and individual investors, directly and indirectly, through bond funds, pension funds, and other ways.

Yields have risen over the past 12 months, and these “risk free” Treasury yields are now competitive with the average S&P 500 dividend yield. For yield investors, Treasuries are a way to lower their risk profile, while earning higher yields than two years ago. In other words, for many American investors, rising yields have made Treasuries attractive.

Gone are the kid gloves. Read… This Fed Grows Relentlessly More Hawkish

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“””But who? American institutional and individual investors, directly and indirectly, through bond funds, pension funds, and other ways.””””

YEP!! That is WHO!!

Every American will get every dollar owed to them….Most don’t realize that it won’t see them thru their last 15-30 years of life when they decide to claim their “benefit$”….

The sooner the foreign entities decide to extract their UST values for something, the better WE ALL MAY BE because it’s coming sooner or later

To quote Doug Henning: “Magic is Illusion, Illusion is Magic”.

Hold your nose and buy and i did!- Anonymous

Its magical illusion – the yield sucks but the rate sucks more?

Yes, it is illusion. Because an illusion can be a lie. And all reported figures by all governments (worldwide) are potentially lies, in service to national agenda(s). That the respondent is lying, is one potential explanation for responses that do not add up.

I am surprised Wolf did not include the “lying” explanation in his post. I would have.

ALL GOVERNMENTS LIE, ALWAYS. That is a non-cynical view of a staple of modern life.

Banks, probably.

Whoever bought them has lost money. The U.S. Issues too much of that garbage, and they lose value.

Not since 2016 but overall spot on? Thin air and printing to the moon are just lingering memes brought to you by the same people who quip about short rates skyrocketing ? Dollar collapse syndrome and the fear contained within!

I’ve been wondering for years, who’s been buying the Swiss Francs (IMO, the biggest crypto currency in existance).

I thought the SNB was basically printing Swiss Francs and using those Swiss Francs to buy shares such as Apple etc.

I just don’t understand how the Swiss Franc could have held its value as a result. Perhaps because all the other countries are printing money (QE) as well. Then as a result of everyone printing I don’t understand why the value of gold is so low.

None of the financials are logical and make any sense to me anymore.

The gold price is suppressed through manipulation of the paper gold market. As soon as the gold price rises too much, a huge amount of paper gold on the Comex is suddenly sold, often in the early hours of the morning.

Nobody knows gold’s true value at the moment due to this artificial pricing but it should be way, way higher.

The Swiss franc used to be one of the currencies of choice (together with the US dollar, German mark and, to a far lesser extent, the UK pound) for people from Southern Europe to stash part of their savings. I still remember my granparents had a “secret stash” of US dollars and Swiss francs in their house: there were many like them in France, Italy and Spain. The reason for this is exactly the same why these days people from Brazil buy T-bills and people from Argentina buy US dollars: little or no trust in the local currency.

The arrival of the much more stable euro and the “toujours expansives” monetary policies of the Banque Nationale Suisse (BNS) have meant the franc has lost a lot of its old charm, but the good old ChF1,000 banknote (nicknamed “Hardworking Swiss ant” due to its design) is still an excellent physical store of wealth and far more liquid than gold coins and bullion.

To answer to Cashboy below, the BNS has strongly expansive policies not so much to purchase foreign assets but

1) to make Swiss exports more palatable. Remember that, as a percentage of the GDP, manufacturing for export is even bigger business in Switzerland than is in Germany and Japan.

2) to make private sector debt cheaper to service though what is effectively long-term currency destruction.

The purchase of foreign assets is chiefly driven by the fact that the BNS is technically a private entity (and intriguingly enough the largest shareholder is not even Swiss but German) and has a dual mandate. Besides its role as a central bank it also acts as a hedge fund for its shareholders, which in this case are chiefly the Cantons themselves.

I should go more in-depth here but it’s neither the time nor the place. Suffice to say the Cantons have come to depend fiscally on the large cheques the BNS writes them and these cheques can only be written if the hedge fund is profitable. That’s why the purchases of US shares: they go where the money is.

“the good old ChF1,000 banknote Swiss is still an excellent physical store of wealth and far more liquid than gold coins and bullion…the BNS has strongly expansive policies not so much to purchase foreign assets but to make Swiss exports more palatable.”

Now that is a contradiction: the “expansive policies” are intended to weaken the Swiss franc to make exports more appealing, so why would it be regarded as an “excellent physical store of wealth?” (and as for the usual argument that gold or silver are so illiquid and don’t pay interest, one can always write GLD or SLV options to generate income as long as one has the bullion to cover the position).

The U.S. did a lot worse than opening Pandora’s Box when the Fed went full gangsta issuing virtually interest-free loans in the name of “TARP” and “QE” to the very banks that owned it: all the others began doing the same, and now we face the inflationary open jaws of hell.

Put it this way: one thousand francs are still worth €860 in spite of everything the BNS has done over the past decade, including an ill-judged peg to the euro.

And here’s the funny bit, ChF1,000 banknotes have always been far easier to come by than €500 ones. Which are still in circulation and still legal tender but have never been easy to get, allegedly because unsavory characters used them for shady deals. No need to elaborate any further.

And as much as this always annoys gold and silver bugs, their value has long failed to keep up with CPI increases, let alone real-life inflation: measured in US dollars gold is still where it was in September 2010. Silver is in a similar position.

And you still need to sell them or borrow against them to buy anything. Banknotes can be spended right away on a strict no questions asked basis.

Precious metals are fine in the same way having life insurance is fine: it’s nice to know it’s there, but you hope you won’t have any need for it.

Better yet, put it this way…

Gold was one of the best performing assets in the 2000s, with nominal and real returns of 14.3% and 11.7% respectively, and of 30.8% and 23.7% in the 1970s (see table in the link below).

http://awealthofcommonsense.com/2015/07/a-history-of-gold-returns/

Yes, the Swiss Franc has definitely held up relatively well against other currencies, and actually so has the dollar. But if you are the sort to be on a blog like this, you know all about the $250T of unfunded liabilities, the $1T budget deficit blowout that just happened in the USA. And the same stuff is happening in Europe and Japan. Do you really think that we aren’t going to see gold out perform paper currencies again in the not to distant future?

“…the good old ChF1,000 banknote (nicknamed “Hardworking Swiss ant” due to its design) is still an excellent physical store of wealth and far more liquid than gold coins and bullion…”

store of claims on wealth… money is fictitious capital.

Financial wealth used to be always differentiated from real wealth, but that difference has been steadily eroded by propaganda, since in the late 1800’s. Money can never be a store of real wealth, by the old definitions. Money is created ex nihilo, and destroyed everyday, hardly a store of wealth. Real wealth can not be created ex nihilo. (but real wealth obviously can be destroyed, or spoiled.)

PS, i’m not a gold bug. Sovereigns (bonds) are better than cash. (Real estate is usually the biggest investment category in any mixed economy.)

Where do you get the idea that anything is far more liquid than gold?

Unless you are way out in the sticks there is gold buyer within an hour of you who will very quickly give you US$ for a very small commission, depending on how much you want to sell.

Of course I am talking about coin or bar.

This is true anywhere in the world.

Can you go into McDonald’s and pay in gold? No more than you can with a US T bill or the Swiss note. But in many parts of the world you could make purchases more easily with gold than the other two. (One of the mysteries of gold is how the dealer in the middle of nowhere knows the world price to within one percent)

BTW: I am not a gold bug but to say that gold is not liquid is not true. It is especially liquid for large sovereign settlements where is always welcome and in some recent times, preferred.

It wasn’t me that said gold is il-liquid. This does require some balanced presentation, as there are things that are very liquid, as in large volume and seconds per transaction, vs low volume and hours per.

Maybe CALPERS?

Short term treasuries at 2% yield are an OK place to park money for a few months as rates are going up but remember interest is taxed at your top ordinary income tax rate at the federal level (Treasury interest is not taxed at state level).

Qualified dividends are taxed at your long-term capital gains tax rate which is 0% up to $77k and 15% up to $479k for joint filers. So, for some retirees, qualified dividends can be a better deal than Treasury interest.

well i guess that answers why the feds started to raise interest rates

I did not need to read the end of your article *but I did* to know that it is mostly Americans buying American debt (because we are pissing almost the entire Planet Earth off and giving it reason to DUMP USD), in part because I am among them as my CD rates move into the 2% towards 3%.

And notice the DRIP….DRIP….DRIP…ONE DAY YOU’LL WAKE UP AND THE USD IS NO LONGER THE RESERVE CURRENCY…as more and more nations dump the Evil Empire Dollar as we antagonize ever larger sections of Planet Earth because of constant and relentless U.S. aggression, it’s only a matter of time before we see in our life time the demise the USD as the worlds reserve currency.

I do not see the US Dollar falling in value in relation to most currencies in near future. My basis for this is that if you have worries about your local currency ( Venezuala, Argentina, Brazil etc.) you convert that into US dollars. I also have this sense that the US government is trying to destroy the Euro to give more credibility to the US dollar.

The problem with the dollar losing its reserve currency status is that something else has to take its place.

there currently is nothing to do that or it would happened VERY QUICKLY..

Not only have we pissed off foreign holders of dollars with relentless, belligerent foreign policy (as far as I can tell there is no region on earth McCain doesn’t want invade – I mean liberate) but we have also proved to be very poor stewards of the value of the reserve currency.

The Fed now has stated, as official policy, devaluation of the dollar. In the past the Fed at least gave lip-service to preserving the value of the dollar – even still the dollar has been sinking like a stone. Now that official Fed policy is to devalue the dollar we can count on the currency losing value at an accelerated rate.

Why would a central bank explicitly state their policy is to devalue their currency and why would anyone want to hold the currency now that devaluation is official, stated policy?

Cash is trash, do not hold currency!!!!

The ESF (Exchange Stabilization Fund) is buying and black holing them. Just as Bill Holter and Rob Kirby have said for years now, this fake market is about to run out of cliff. The mere fact that there has never been a failed Treasury auction is enough to prove the manipulation going on. Everyone is in on it though, that’s why the Emperor still has beautiful clothes. Ever wondered why Russia, China and Germany etc. are hording and repatriating their gold? It’s not rocket science dear Watson.

Buy stamps and US treasury bonds, is good for the country, is good for you!

Ehem, anyway, how does the FED new policy affects the holders of these bonds?

Wolf

Your not supposed to look at that man behind the curtain, Just like the Fed can create and destroy money, it can create phantom buyers, and destroy reality. Now keep your head down, and stop asking logical questions.

i am a russian citizen

and i applaud our government’s decision

to get rid of that instrument of american imperialism

next month sell off the rest of that garbage

I’ve been moving money from CDs to short-term treasuries since the yield is better, and there is no state tax (important when you live in California)

Correct me if I’m wrong, but doesn’t the FOMC operate in secret and never has been or ever will be audited? So they sell with the right hand and buy back with the left.

Does anybody really believe the Cayman Islands holds that much in Treasuries?

The Fed reports its Treasury holdings and purchases in various places, including on its balance sheet. And the Fed is currently NOT buying. If the Fed felt like it needed to manipulate bond yields DOWN (buying Treasuries would do that), it would simply stop raising rates first. But it’s trying to get yields to move up, and so it has been raising rates and has been reducing its bond holdings.

Corporate America (Apple, Microsoft, etc.) is huge holder of Treasuries, and they hold them in Tax shelters outside the US, in places like Ireland and the Cayman Islands. Both of those planes have seen their Treasury holdings plunge as Corporate America is now selling those bonds to fund their share buybacks.

“The Fed reports its Treasury holdings and purchases in various places, including on its balance sheet”

How do you know this statement to be true? The Fed has stated many things in the past that turned out to be false, or flat out lies meant to manipulate economic participants.

The Fed is not audited by anyone, who knows what’s on their balance sheet or if they even keep a strict accounting of the money they create. Their so called “balance sheet” might not account for all of the money they have created. The Fed is intentionally opaque and secretive, they have an open and widely reported balance sheet but they could still be creating money and not reporting it on any balance sheet.

In testimony before Congress Bernanke told those who questioned him to piss-off, and told congressmen the Fed is an independent body that operates beyond the control of Congress. No one knows for sure what the Fed has been doing – the balance sheet could be meaningless. There are known-knowns and known-unknowns, when it comes to the Fed you must admit there is much you are simply not allowed to know.

You may choose to trust them but it looks like the Chinese, Japanese and Russians are not as willing to give them the benefit of the doubt (the Fed simply have not earned it).

You said: “The Fed is not audited by anyone, who knows what’s on their balance sheet or if they even keep a strict accounting of the money they create. Their so called “balance sheet” might not account for all of the money they have created. ”

This is a big and I think willful misconception that keeps cropping up because people want to believe in it because it feeds their theories. But it’s wrong.

Every year, every entity of the Federal Reserve System is audited by independent outside auditors – the same auditors that the biggest US corporations are using. This auditor is currently KPMG.

The “Audit the Fed” movement in Congress is not about a financial audit (including the balance sheet) but about an audit of the discussions at the Fed, of insider trading by individuals, and things like that.

Here are some of the regular financial audits of the Federal Reserve System and other audits:

Every year, KPMG audits the Board of Governor’s financial statements, which include the “balance sheet” we’re constantly discussing here. Here is the 2017 audited Annual Report of the Board of Governors and the combined Federal Reserve Banks:

https://www.federalreserve.gov/aboutthefed/files/combinedfinstmt2017.pdf

Each of the 12 Federal Reserve Banks is also audited annually by an independent outside auditor (currently KPMG). For example, here is the New York Fed’s 2017 Annual Report, audited by KPMG:

https://www.newyorkfed.org/medialibrary/media/aboutthefed/annual/annual17/Full-Report-4-3.pdf

Every year, the Government Accountability Office (GAO) conducts reviews of Federal Reserve activities.

The Board of Governor’s independent Office of Inspector General (OIG), similar to OIGs at other federal agencies, conducts audits, evaluations, and criminal investigations relating to the programs and operations of the Board of Governors, as well as those Board functions delegated to the 12 Federal Reserve Banks. The audit results are sent to Congress and are published.

The 12 Federal Reserve Banks are subject to annual examination by the Board of Governors, whose results are included in the Board’s Annual Report (see above).

Too soon for me to buy any. I’m still in MM funds. My main one is at 1.9% 7 day average today with no risk of capital loss unless the world literally ends on short notice. That’s not a lot but it’s a 1000% better (not much of an exaggeration) than this time last year and before that and it will be going higher as time passes.

All rates on all normal debt (not considering euro trash or the like) will rise for the next couple of years before interest rates normalize. This means all debt purchased today that has a term of more than a very short time will suffer capital loss just by sitting there. Holding to maturity is OK for individual bonds, but I prefer funds, and their value reacts immediately to interest rate changes.

For example, a 3% capital loss would take a year to make up in interest earnings. A 3% loss is easy to realize in this environment. A quick visit to Yahoo charts for bond funds will show it clearly.

After normalization, I plan to create a nice mix of safe and high risk debt, as high risk debt in a good mutual fund is not really that high risk. That’s maybe by the end of next year. If there’s a big dip before then I’ll consider jumping there.

Think of rising interest rates as adding to personal income and, as a result, I suspect the velocity of money is slowly rising. Rising rates, more than anything else, are what is causing the economy in the US to recover. As people spend their new interest income, the economy expands. Stock flippers are on borrowed time though as their costs rise … I have no idea where the point of pain is for them.

Look under the covers on your MM. They are most likely treasuries too, as the SEC had most brokerage companies switch settlement accounts to government securities a couple of years ago. This was so the government wouldn’t have to bail out a bunch of MM speculation again like they did in the financial crisis. (Think Lehman.)

I know. But they’re managed well so the risk needed to cause a capital loss there would be world shaking. Things are not the same today as they were a decade ago.

Worlds shake all the time, it’s our time reference that’s suspect.

You know that old saw, “Real men don’t eat quiche”? The other one is, “Real preppers don’t buy paper….just toilet paper”. :-) Oh, wait a minute…….

slightly off topic:

Abnormally low rates for an extended period are deflationary and cause the economy to contract.

Proof:

The sales pitch for QE level low rates is that loans are now cheap and the economy can expand because business and individuals can borrow cheaply.

The reality:

Higher rates create personal income, which is spent. Low rates cause personal income to contract.

If personal income is contracting, the amount spend by individuals must decrease, unless their spending is subsidized from savings, destroying capital in the process. You can’t spend income you no longer have.

People spend less on everything. Business has no reason to borrow because the business is not expanding, it might even be contracting. Rates may be low but business does not expand because the cost of money is low, they expand because business is growing and they must expand in order to prosper. Expansion begets expansion.

Less spending causes business stagnation. Personal income decreases due to lowered interest rates and business slows down due to less consumer spending. Employment stagnates and the quality of jobs deteriorates. It’s a vicious circle.

Inventory becomes an expense, rather than an asset. Prices slowly fall to match available income, aka deflation.

Thus, deflation is created by interest rates that are too low for too long, aka, central bank QE and interest rate management. The Fed actually created and enforced the situation it claimed low rates were there to fix. For nearly a decade. (The questions that raises are profound.)

OTOH, commodity prices are based on both investment paper flipping and consumer demand. The general level of prices can rise if paper flippers are more active flipping commodity contracts because interest rates are excessively low. Thus, inflation and deflation at the same time are not only possible, but certain.

What’s the sense in “investing” in debt the Fed is going to print (inflate) away?

the debt represents collateral and should we go into a deflationary spin that collateral might look pretty good, assuming the dollar would go higher in such an event. the risk is that you might not get paid your principal, which would make the US a third rate country so that won’t happen. From a hedging standpoint offsetting the yield risk is not as difficult as it used to be and the possibility of double digit rates pretty far removed. In short the bonds are still ‘sterilized’ to use Bernankes term, a foolproof noninflationary method of payment and that would work if China was serious about capital controls.

The concept of a “deflationary spin” is delusional.

Deflation is impossible without sound money. When consumers are hard up for cash the government and central banks simply print up currency and give it away. Two recent examples:

1) Mortgage refinance provided by the Fed at rock bottom interest rates. Home owners were given mortgages at artificially low, subsidized rates and received windfall savings, from a drop in mortgages payments, of several hundred dollars every month. The windfall to home owners was stolen from savers – no matter the wealth was transferred to borrowers who spend (and never save) and prevent deflation.

2) Cash for clunkers – money handed out to consumers to purchase new vehicles. As we have seen, this in fact caused inflation in the price of new vehicles of about 15%.

Deflation cannot happen without sound money – we don’t have sound money. The recent episode, referred to as deflationary, was in fact a period of lower inflation then the Fed wanted, but there was still inflation. Stuff cost more now then at the depths of the great recession. Prices went up and the money supply grew – there has been no inflation.

Would not touch a US Treasury Bond with a 40′ barge pole. ANY treasury or corporate bond for that matter.

Holders will not be able to buy a Big Mac with the refund cheque. And that is what they have intended all along.

Well said. Bonds are just another form of currency and bond yields are kept below the rate of inflation – so what’s the point in holding bonds if you are guaranteed to lose real wealth.

This has been simmering for years but things seem to be suddenly coming to a boil. The Fed will need to allow extraordinary inflation in order to keep asset values from falling. If the Fed let assets deflate and the cost of money go up the very wealthy of society (the Fed’s constituency) would have their wealth extraction mechanism crimped and they would not be happy – inflation is our path.

Do not own bonds (cash by another name). Cash is trash – stay out of cash!!!!

At this juncture skin-in-the-game represents road rash down the road IMHO. Have to side with Old Codger on the cold reheated BIG Mac too.

yummy stuff!

MOU

Russia sending a message by selling US treasuries?

How about: we’re broke.

Very smart moves…they sold the treasuries (no dumped and pulled the rug out from under T bills) to fund the buy back of Russian corporate debt held in US dollars. Russia does not need dollars any longer for international settlements. Take the aluminum tariff for example, and look under the covers. It is to force, or try to force, the company into a financial death trap of one billion bucks it can’t pay, because the aluminum buyers are ‘afraid’ of US retaliation. That debt was bought by the Russian government, so the debt is now in Rubles not dollars, and owed to no outsider. Now the aluminum can be sold via Euros, Yen, or whatever thru third parties without tariffs. Russia just told the US to shove it, and our leaders are fuming over it. CHECK>, your move Mr. Pres.

Domestic treasury bond buyers don’t face the same problem with currency exchange losses. And in the current environment those bonds can be collateralized and used to trade in just about anything, and I would suppose that if a foreign entity were selling their currency loss is the US buyers gain.

I suspect, but certainly can’t prove, that the US is monetizing some portion of the debt. I think this started somewhere after the financial crisis in 08. The Fed is likely NOT the executor, but is aware. More likely within the Treasury, or a special top secret office. If we are monetizing, the whole thing would be justified on national security; thus the secrecy.

My belief is based on what Russia and China and others are doing with respect to gold and forming non-dollar systems of exchange. They are putting in place a system that will, in part, replace SWIFT and the US reserve currency dominance, somewhere down the road. Their strategy like all in the past, is to be patient and let the US blow up its own currency.

Stay on this story/hunt, Wolf. Nobody is reporting where the Treasury buying is coming from!

But wait… I explained where the buying is coming from: American institutional and individual investors. As yields have risen after eight years near zero, those Treasuries are becoming attractive.

But won’t they lose when the bonds fall in value? Is that a capital loss unless you hold to maturity? Which means if you need to raise liquidity for whatever reason, then you may be selling bonds at a loss?

This is why I am cautious about advising people to invest in treasuries.

If they hold a Treasury to maturity (1 month, 3 months, 1 year, 2 years, etc.), investors will get cash for face value. And they got the interest. So no, they won’t lose money.

If they decide to sell before maturity, they might lose a little on short-term securities and a little more on long-term securities.

What happens is this: you buy a 2-year Treasury note today that pays 2.5% yield, and next year at this time, newly issued 2-year Treasuries pay a 3.5% yield. So you sit on your investment until maturity (2 years) when equivalent investments are starting to earn more money over those 2 years. So there is an opportunity cost associated with it, but not a loss.

If yields rise the bonds value in the secondary market drops. Sellers take a loss, buyers are compensated. If you in the business of advising people you should be more cognizant of their risk tolerance, the real problem at the moment is everyone is cookie-cuttered into the same stock index fund programs. Such thinking assumes there is no moral consequence to making an investment decision. After all stocks always outperform bonds in the long run. So let me share this, being old and rich is no great shake, but being old and destitute is the worst and there are a lot more poor elderly than the other kind.

You “concluded” that is where the buying came from. You didn’t prove that. How would anyone know if investor buying adds up to the 1 trillion or so issued??

There are only three entities for this purposes:

1. increase in debt outstanding

2. owned by foreign entities, which are reported

3. owned by non-foreign entities, which are American institutions and individuals.

Unless you believe in Martians, there is no one else.

So if the total increase = 4, and change by foreign entities = 1, then change by non-foreign entities (Americans) = 3, based on 4 – 1 = 3.

Also, given the immense wealth of American households ($100 trillion) and of American institutions, $1 trillion amounts to less than 1%. So it isn’t really all that much.

well… what is the odd that the world decide to leave USD as their major trading and reserve currency ???

The US $ holdings of the Russian CB is a rounding error even lower than you might expect from an economy the size of Canada’s but supporting about 4 times the population.

So with the average Canadian being 4 times as wealthy you would think there would be 4 times the number of billionaires in Canada.

But guess what? There are four times as many in Russia!

So we can say, roughly, that Russia has 16 times the inequality Canada, which is not itself a socialist paradise.

As for ruble debts etc. Russia can’t buy much with rubles. It’s sort of stabilized now at a US penny or so but in December 2015 it fell 22 % overnight. Due to it’s exchange controls it is not considered convertible.

The only market where Russia is a large player is oil and gas, mainly supplied by Soviet legacy wells.

Incredibly, Russia is not self-sufficient in oil and gas field equipment.

They won’t accept rubles for their oil.

But who? Mostly American institutional and individual investors, directly and indirectly, through bond funds, pension funds, and other ways.

Yields have risen over the past 12 months, and these “risk free” Treasury yields are now competitive with the average S&P 500 dividend yield. For yield investors, Treasuries are a way to lower their risk profile, while earning higher yields than two years ago. In other words, for many American investors, rising yields have made Treasuries attractive.

Lets see…….3% yield minus 10% currency inflation……..

Those pension funds should be back in the black any day now….LMAO!….

H did NOTHING wrong!!!