Gone are the kid gloves.

“The economy is in great shape,” Fed Chairman Jerome Powell said today at the press conference after the FOMC meeting. Inflation as measured by the Fed’s preferred low-ball measure “core PCE” has hit the Fed’s target of 2%, and the Fed expects it to hit 2.1% by year-end. Inflation as measured by CPI jumped to 2.8%. “Job gains have been strong,” today’s statement said. The “unemployment rate has declined,” while “growth of household spending has picked up,” and “business fixed investment has continued to grow strongly.”

This is no longer the crisis economy of yore. But the interest rates are still low and stimulative, befitting for a crisis economy. So something needs to be done, and it’s getting done, if “gradually.”

There were all kinds of intriguing elements in the FOMC’s increasingly hawkish but “gradual” hoopla today.

By unanimous vote, the FOMC raised its target for the federal funds rate by a quarter percentage point to a range between 1.75% and 2.0%. This was expected; what’s intriguing is the unanimous vote, unlike prior rate hikes.

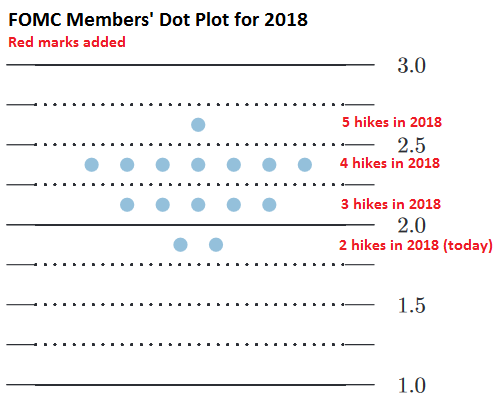

Four rate hikes in 2018 (two more this year) are now gradually being baked in, according to the median expectation of the 15 members of the FOMC, per the infamous “dot plot” with which the Fed tries to communicate potential rate moves: One member expects 5 rate hikes in 2018; seven members expect 4 hikes; five members expect 3 hikes, and two members expect no more hikes. At the March meeting, four rate hikes had appeared in the dot plot as a real but more distant possibility.

Two more hikes this year would bring the top end of the target range to 2.5% by year-end. This shows the 2018 section of the dot plot:

Rates are expected to continue to rise, three times in 2019 and once in 2020, nudging the federal funds rate to nearly 3.5%.

A presser after every meeting – oh boy. During the press conference, Powell said that, starting next January, there will be a press conference after every FOMC meeting. This idea has been mentioned a couple of times recently to prepare markets for it. Now it’s official. As in every Fed announcement, it’s no biggie, really, trust us. The move is designed to “explain our actions and answer your questions,” Powell said. It was “only about improving communications.” It didn’t mean at all that the Fed would be speeding up its rate hikes, he said.

Here’s the thing: The Fed has fallen into a habit in this cycle of only hiking rates at a meeting that is followed by a press conference. There have been four meetings with press conferences scheduled in the year, along with four meetings without press conferences. By this logic, the maximum number of rate hikes the market expects is four per year. By adding press conferences to all meetings, and thus doing away with this four-rate-hike-per-year limitation, the market will have to start expecting the unexpected – that seems to be the message.

“Gradual” but relentless. “We’ve been very, very careful not to tighten too quickly,” Powell said. “I think we’ve been patient. I think that patience has borne fruit, and I think it continues to. We had a lot of encouragement to go much faster, and I’m really glad we didn’t, but at this time, continuing on that gradual pace continues to seem like the right thing.”

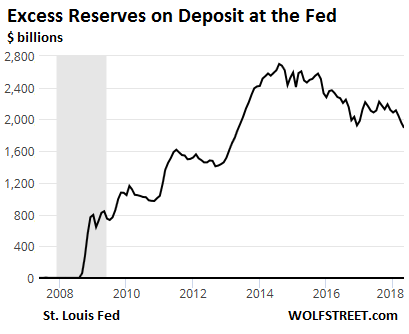

Interest paid to the banks on excess reserves gets a makeover. Banks have about $1.89 trillion in “excess reserves” on deposit at the Fed:

The Fed has been paying banks interest on these excess reserves at a rate that was equal to the top of the Fed’s target range – so 1.75% since the last rate hike, which amounts to an annual rate of $33 billion of easy profits for the banks. In theory with today’s rate hike, the FOMC would also have increased the rate it pays on excess reserves to 2.0%.

But this didn’t happen. The Fed hiked this rate to only 1.95%. This move is “intended to foster trading in the federal funds market at rates well within the FOMC’s target range.”

It’s supposed to solve a problem: The Fed has trouble keeping the federal funds rate in the middle of its target range. For example, yesterday the effective federal funds rate was 1.70%, when the Fed’s target range was 1.50% to 1.75%. The federal funds rate should have been in the middle, so around 1.625%. This has been a problem for months. The Fed is worried the federal funds rate might go over the top of its target range. So it hopes that by lowering what it pays on excess reserves in relationship to its target range, it can nudge the federal funds rate back to the middle of the target range.

Some dovish language disappears from the statement, including:

- Gone is the line: “Market-based measures of inflation compensation remain low.”

- Also gone is the line that the federal funds rate is “likely to remain, for some time, below levels that are expected to prevail in the longer run.”

Step by systematic step, the Fed is “gradually” getting more hawkish. Its stated purpose is to tighten “financial conditions.” This means pushing up yields and widening spreads, and thereby pushing down bond prices, especially at the riskier end of the spectrum; making raising money, including in the stock market, more expensive; and inciting investors to be more risk averse, thereby tamping down on asset prices of all kinds.

This rate-hike cycle is different. It has now been going on for two-and-a-half years, during which the Fed hiked rates by 1.75 percentage points. The last rate-hike cycle lasted only two years, but the Fed pushed up rates by 4.25 percentage points to 5.25% by July 2006. The fact that this rate-hike cycle is so gradual allows the economy and markets, asset prices, and yields to adjust gradually – that’s what Powell pointed out when he said this “patience has borne fruit.” And it allows the Fed to keep going relentlessly.

And the riskiest bonds have are still dreaming in la-la-land. Read… Riskiest Junk Bonds Completely Blow Off the Fed, Face “Sudden” Reckoning

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I don’t think we will see more than four rate hikes this year, changing economic policy in the middle of the year would upset the rest of the government (and the Trump campain supporters). It has also been agreed beforehand it would be four rate hikes this year. And with so many currencies losing against the dollar there is no rush to make the dollar get too strong too fast.

The Fed however could speed up the unwind, as a way to put extra pressure without causing the costs of having more than four rate hikes this year.

That said, is not like I can see the future, so who knows?

If the govs vote where they put their dots…..

there’ll be a 13-2 vote for 3rd rate increase and a 8-7 vote for a fourth rate increase. And somewhere along the way there will be one lonely voice calling for a rate increase at a meeting when they don’t have a presser.

The FED has beentrlling about these rate hikes months in advance, nothing has been said in advance about them being more than four. A surprise extra rate hike alone might cause things the FED does want to avoid.

Wolf, what does this mean for housing prices in the Bay Area? When’s it time to sell and when’s it time to buy?

Let me put it this way: I don’t think now is a good time to buy from a financial point of view.

But homes are more than just an investment. And if a young couple wants to settle down and buy a home in which they plan to live for the next 70 years, and they can afford it without too much of a stretch, and they don’t mind being upside down, possible for quite a while, then why not?

If I have few hundred of thousands if dollars lying around and it won’t hurt me even a bit of I lose them then I’d buy.

Housing prices in bay area or elsewhere won’t go down unless and until there is a deep recession followed by big job loss

So the question is ‘Whe is that Gonna Happen?’

When the Fed’s Ponzi markets and asset bubbles implode – and they’re going to, in most spectacular fashion – true price discovery is going to assert itself on the housing and stock markets. Millions of ‘Muricans who foolishly paid bubble prices are going to find themselves deep underwater on a depreciating asset, and many or most will simply walk away from their “investment” and financial obligations, with the resultant foreclosures and distress sales further tanking prices. The prudent and responsible, who refused to buy into a housing bubble, will have plenty of firesale bargains to choose from.

A story on that subject. Family lived across the street from me in a modest 2000 sq ft 3/2. They bought the house for $112,000 in 1999 or so. This is central florida, not a big bubble area.

By 2006, they had borrowed an extra $200k against the house, utilizing the equity to by some sweet, sweet cars (including a Porsche 911), and start up a nail salon where they were planning on becoming fabulously rich.

The housing market tanked, as well as the nail salon, and they simply stopped all payments on their multiple mortgages. They lived in the house until 2011, when they abandoned it in place when the wife’s parents passed and moved into that house.

The bank left the house to rot in Florida’s steamy summer heat. Animal Control folks would occasionally come out to remove the raccoons from the attic and possums from the garage. In 2017, the bank put the house on the market and it was purchased for $40k, interestingly by a senior employee of the bank. He put about $50k into it and sold it to a local pastor for $180k.

I’m guessing the mortgages were bundled into a MBS which was probably repo’d by the Fed at par. Which is why, it appears, everyone made out in the process. I don’t see why that can’t happen again.

Igor, short answer is to buy now if you can afford the down-payment and have a source of income that can pay for the loan installments.

Long answer: The FED is raising rates and they do not look like they are going to throttle down, so lock-in the historically low rates as much as you possibly can and negotiate the hell out of the purchase price.

We tend to overthink this, when my own experience tells me to just follow the trends. Interest rates is a coarse instrument and it is going to affect a whole lot of financial spigots in the economy.

When the bank loan interest moves higher, you might not be able to get on the property ladder and once you miss this cycle, it might take you another decade or more to catch the next bus.

Of course, the usual tired admonitions applies…like don’t overpay against your income (which is ever more difficult), get a location with accessible transportation links, reasonably good schools and amenities bla bla bla…

My grandfather’s wisdom says this (if you’re inclined to listen): The probability of a crash in the property market is that much lower if the most recent crash was in 2008. Bubbles move among assets classes in turn (e.g. real estate -> bitcoins -> equities -> tech crash -> commodities etc. not necessarily in that order…) so if the last big one was in property or property-related, then the next crash is likely to be something else (unexpected of course).

People need time to forget the last crash, so that particular asset class which last crashed is unlikely to be the next one in sequence. When enough time has passed, and you no longer hear people mention about the 2008 sub-prime mess, then you can start to worry about the next crash in property prices. For now, most people are still talking about Bitcoin crashes and the retail apocalypse, so rule of thumb tells me housing market is still relatively safe now. So there you go. Buy now!

Disclaimer: But don’t blame me if you go broke from not doing your own financial calculations carefully :)

Just make sure to buy in an area that will survive the Big Earthquake. Otherwise it will be expensive and you might not see it for long.

Let me say this, if you are a speculator trying to transfer future bay area W2 earnings into your hand by front running the W2 workers, then you go ahead and gamble either way.

If you are a W2 worker and being afraid that you will never be able to buy again due to ever increasing prices, I suggest you deal with that fear.

In the end it is your competitive earning edge against other W2 workers and speculators/rent squeezers.

My rules are

1. buy when the market want cash more than they want houses. I sell when the market want houses more than they want cash.

2. Same as rule no.1 but rephrase in another way. You want to compete when your competitors are weaker than you. For buying, your competitor buyer should has worse earning than you (recession) or cash than you, and the sellers are being forced to sell at lowest possible price. (liquidity crunch, recession). For selling, you want to sell when W2 folks are so afraid of being priced out forever and are willing to max out their borrowing and drain their cash down to zero.

It’s a common joke that no two economists agree, but this divergence in opinion among the cream of the discipline raises the question: is it a

discipline at all?

‘One member expects 5 rate hikes in 2018 (three more) ; seven members expect 4 hikes; five members expect 3 hikes, and two members expect no more hikes.’

Within such a small sample (15 members) no statistical analysis (median, average, standard deviation etc.,) is meaningful.

All we can say with confidence is that there is no confidence. If we give a new drug to 15 test subjects and one gets better, twelve are unchanged and two die, what does stats tell us about the prospects of the drug ? Nothing.

The innocent explanation is simply that even though these people presumably studied the same texts, the field is no more quantifiable than a liberal arts course.

The not- so- innocent explanation is that politics is influencing the Fed.

It has been opined that anything like a true normalization of interest rates would be considered unfriendly by the Administration.

Similarly, the Fed’s repeated advice that monetary policy has reached the limits of its ability to counteract runaway fiscal policy ( over spending) would likely have populists calling for an end to the Fed’s supposed independence.

It’s a legitimate discipline if one can hold a Chair in it at a distinguished university, and be eligible for a Nobel prize.

As the world is full of fools, why question the kind of hat and bells a particular group is wearing?

Physicians used to kill most patients with rather odd ‘remedies’: now they do so with very sophisticated scientific and quantifiable ones. Very expensively.

The end is the same whatever route you take: Death.

As with physicians, so with economists.

I’ve read somewhere that the (blood) Nobel family wants the prize for economics withdrawn.

It was never in Alfred Nobel’s original group. After his death as the foundation was set up, the idea of a prize for economics originated with the (Central) Bank of Sweden.

Noble laureates were behind the Long Term Asset Management crisis (1998?) that was a precursor to the 2008 Great Recession.

The Black Swan reducing their math to rubble was the Russian default. The Fed had to get involved when it discovered that although the group had put up mere billions, they had leveraged it via derivatives to control hundreds of billions.

According to Nicholas Taleb, author of Black Swan, their method is still taught in advanced economics courses, as though nothing had happened.

That’s because Nothing indeed did happen.

Bernanke’s FED jumped right in and bailed them out!! If they had wiped out proberly, then their model would have been properly, undeniably broken and only a few cranks would ever talk about it.

Unless I’m mistaken, it was Greenspan’s Fed that bailed out Long Term Asset, with the blessing of POTUS Clinton and whoever was in charge at Treasury.

“It’s a legitimate discipline if one can hold a Chair in it at a distinguished university, and be eligible for a Nobel prize.”

Keynesian economics has been the core of most university economics curricula for more than 50 years, yet it fails to either describe or explain the real world in myriad ways. Legitimate?

I can tell you you for sure when if the asset prices start falling because of these rate increases .. fed would immediately start lowering the rates

Jon,

The deal is this: rising rates/yields, by definition, means that fixed income investments (such as bonds) are going to fall. That’s how it works mathematically. And that’s what the Fed wants.

Other investments that trade on yield, such as commercial real estate (cap rate), are in the same boat. The Fed has repeatedly pointed out that commercial real estate prices need to be targeted (esp. Rosengren).

Junk bonds are specifically targeted by the Fed, not only because it is raising rates, but also because it expressly wants to widen spreads and risk premiums. So they’re set to get hit, and the Fed is going to like it unless the market freezes up.

When junk bonds go, much of the stock market goes because a lot of the junk-rated companies are publicly traded.

So if all this happens “gradually,” as the Fed keeps saying, and thus spread out over the years, the Fed is going to be very satisfied with its handiwork.

As junk isnt listening there is potential for junk to hit reality suddenly go bang instead of simply hiss.

To a worm, who lives in horseradish, the whole world is horseradish.

Wolf, don’t you think the Feds are rising interest rates to help the pension funds rather than *fighting inflation*?

Thomas Molitor,

Good question. There is a realization at central banks that super-low yields or negative yields (Europe, Japan) cause a host of issues for pension funds, life insurers (annuities), and others that will force them (and in Europe is already forcing them) to reduce payouts, or face collapse. This is a real handicap for the economy because nearly all the money that gets paid to beneficiaries gets spent, and if you cut it, spending gets cut too.

There are many other problems with low or negative yields, and these problems get worse over time. This includes risks building up in the financial system and inflated asset prices (collateral values) that put banks at risk that lend against these assets.

Of all the problems the Fed is worried about, I think pension funds would be near the bottom of the list.

HYG is making new highs. Gradual works when fiscal and monetary policy dovetail.

Ambrose Bierce,

HYG is NOT making new highs. It’s down nearly 10% from its peak in June 2014. Over the past 52 weeks, it has also been zigzagging lower.

HYG will get crushed. Loaded to the gills with junk bonds that have yet to see any sense of reality coming their way, it faces rising yields and widening spreads — and when the selling starts, it faces a junk-bond market that suddenly becomes illiquid.

I don’t know what you are looking at. I agree there is a lot of whistling past the rate hike graveyard, but there are reasons why junk bond holders aren’t worried, and it may be that a liquidity squeeze makes any collateral more valuable.

Still the FED is paying IOER….. Paying banks to not lend.

yeah but they backed off a bit.

The talk of “policy mistakes” has baffled me for decades. The Fed clearly knows when it raises rates after a long expansion and bull market (e.g. to the point of inverting the yield curve), it will almost certainly trigger a bear market and recession.

People who say the market is controlled are only half right. They control it to create bull and bear markets. If the market were controlled (to prevent bear markets), how did we get two terrible bear markets within 10 years (2003 and 2009 lows)?

It’ll happen again.

wkevinw,

It’s never a “policy mistake” if the Fed’s policies cause markets to rise. It’s always a “policy mistake” if the Fed’s policies cause markets to fall. “Policy mistake” is one of the expressions Wall Street uses to try to browbeat the Fed into submission.

– The FED getting more hawkish ? Powell has said that the banks are too tightly regulated (or something along those lines).

https://apnews.com/b048ec79b43d4410bf33286f8e02233e

– The problem was in the 1990s and 2000s that, bit by bit, regulation was getting looser & looser.

The Fed, without any oversight or public discourse, can lower rates and buy all manner of securities and bonds, thus unleashing an economic boom. When they themselves decide the boom has gone on too long, they can then slowly raise rates and run off their balance sheet, thus containing the boom they unleashed. That’s the plan.

We all know this, right? It’s all out in the open now. They’ve shown the country just how powerful they are.

If the current rate normalization results in a market crash and deep recession, the Fed is going to get blamed big time and the Fed will probably be restructured. If they succeed without real harm to the economy, the Fed will still lose. It will only be a matter of time before a political entity (one of the parties in control of the Executive or Legislative or both) takes over the Fed for their own purposes. It’s too tempting to use that institution as a lever of power to implement policy or to stay in power.

I think the Fed (as we know it) is toast. And it’s their own damn fault. Bernanke stepped way out of bounds and essentially broke the social contract in the last crisis. This will come home eventually.

I agree with your first two paragraphs, and they are a succinct summarization of how the Fed wields power.

But the Fed is only going to be reigned in or dissolved by an act of Congress. Today’s Congress is owned lock, stock and barrel by Wall Street, K-Street and the Fortune 500 globalist-corporatocracy. In my lifetime, nothing will alter this power structure I’m afraid.

+100

Absolutely correct.

Bernanke was handed a can of worms. He had barely found his desk when the crash hit.

Greenspan is the culprit and has partially admitted it.

It was Greenspan who decided that even mild recessions must be avoided, i.e., that the economic cycle could be tamed.

At the merest hint of a slowdown he would cut interest rates.

The result for markets in everything was known as the ‘Greenspan Put’

The ‘put’ being an protective sell option. This meant that it was safe to take risks because Greenspan would always bail you out.

So when he handed over to Bernanke, all asset classes were overvalued and there was no ‘dry powder’; rates were already historically low.

And then it emerged that all those mild recessions that Greenspan had magically made to disappear had actually been bottled up into one BIG one.

No doubt, Bernanke did step out of bounds. As George Bush put it in that emergency meeting: “This sucker could go down”

He wasn’t talking just about GM.

The US banking system was on the verge of collapse.

Nick – No joke. I’m old enough to remember when if you worked at all, even a part-time job at a bakery or something, you could sleep under a roof, use a real bathroom, take showers etc. Maybe it was in a rooming house (6 rooms, 1 bathroom, everyone has their day of the week to clean, people running the place live upstairs). It was a sort of social contract; you work, you get to live like a human being.

Now, a good number of people who are homeless, work. Officially I’m homeless since I live in a structure not intended for human habitation, and I work.

Oh, if I’d only had the wisdom to leave the US for Europe as soon as I turned 18!

Isn’t this like adding a grain of sand to the sand pile? There comes and unexpected point where we experience a ‘phase shift’ much as we get vehicle blockages on freeways when that one extra car added is enough to stop out the whole carriageway?

My feeling is that we are headed for a sudden disturbance in the markets the like of which nobody can foresee.

“I sense a disturbance in The Force”……….

“Move along. Nothing to see here”……..

“Economics” is a behavioral “science”…..nobody really knows what the “crowds” are going to do. To believe that “economics” is like erecting a tall buildings is delusional. It’s like watching a spread of dominoes and waiting for the first one to fall and hit the second…etc…etc.

One commenter mentions Greenspan and his revelation testifying before Congress some time ago that he (para) “….made a mistake in believing all those years as head of the FED (and before) that markets would naturally stabilize because business would realize where their interests lay. I never will forget that moment watching him. I was absolutely stunned! As an octogenarian who grew up during the Great Depression and spent my “formative” years in the “true” open markets of the produce business I learned early on that those with the mostest get the mostest. And you better not turn your back for too long or you would be economically dead in the water. It is/was all about trust. How well do you trust your banker today????

Not a crisis economy, certainly: it is The Crisis economy, and it’s global.

The ‘recovery’ is a delusion, dearly purchased through unwise – and ultimately destructive – policies.

In nearly every economy we see steady impoverishment of the mass of people, ever-less able to buy the goods and services produced by their economies, the decline of infrastructure; the erosion of the quality of goods.

And that’s just an edited list.

Not to mention the most important factor of all: never-ceasing environmental degradation.

Exactly, Cynic. We got a huge energy boost to our economies through the industrial revolution and the oil age as we moved from horses and oxen to burning coal and oil. After easy oil peaked our economies should have started shrinking in line with the declining productivity of new energy sources. Instead we activated the debt turbocharger to maintain the increase in our presence, activities and impact levels.

In real terms, though, our overly complex and large societies require huge ongoing energy input just in order to stall their decay, never mind to support further complexity and size. Whilst we desperately seek ever more marginal expansion, the real decay we see going on in the core, both in physical and social infrastructure, is entropy at work.

We are living in a wafer thin illusion of prosperity (for the few) covering a fundamental rot that can’t be usefully addressed through monetary or fiscal policies. Once we reach the peak of the exponential curve for debt growth we are going to be in for a reality that our societies are entirely unprepared for. Unless ecological collapse and/or climate change gets us first, of course…

That is the pessimistic version. It is a possibility. Alternatively, the debt push buys us enough time for an energy breakthrough that mitigates/prevents the fossil fuel caused collapse (via environmental degradation or depletion). Coupled with reduced birth rates, the improved energy situation manages the population growth rate decline. Also a possibility. Hard to lay odds on them…

I believe you are correct. Political Economist Mark Blythe points out that the post-war economic regime of full employment and rising standards of living was deliberately killed in the period 1979-84 as a willful act of elites. It was replaced by a neoliberal emphasis on marketizing everything, using “trickle-down” and “wealth effects” to stimulate economic growth, globalizing supply chains, and financialization. That neoliberal order was in worse shape in 2008 than the old order had been in 1978, but the elite consensus was to bail the whole thing out rather than kill it off and replace it. This led to the bailouts/TARP/QE/ZIRP policies that have dominated the global order ever since. The rich insisted on being made whole, and they have been, at the expense of most other people. How long they can keep it up is anyone’s guess, but mine is–not too much longer.

I read the other, and it was on the Internet so it has to be true, that neo-liberalism was a reaction to growing government power in the economy after the Great Depression. Led by the Hayek types of the world, globalization was the key to reining in government power. By making most major corporations global, you could crush labor union power and constrain government’s regulation and taxing power because you could always threaten to move more jobs overseas and reduce government income.

And the key was using the language of economics to make people believe there is no alternative (TINA). While not a Trump supporter, I can understand that he is in a fight against the true PTB if he wants to rein in globalization.

“The economy is in great shape”

BLS – Average Hourly Earnings up 2.7% YoY in May

BLS – CPI up 2.8% YoY in May

Great economy for who?

Average hourly earnings are meaningless. Like everything else in this economy, the bulk of the rise in wages is largely confined to the top 10% of professional/managerial types. The exception are those states that have pushed through an increase in their minimum wage rate. Most people are still not seeing any rise in purchasing power, or are slipping slightly. When anyone throws you aggregates like that, demand to see the breakdown.

Good comment. In my humble opinion it is not only what you state but it is the definitive way that “market proponents” visualize the privatization of everything. That is NOT good. So far there are many who believe that privatization of everything will lead to a “rationalization” of everyone’s desires/needs thru “market forces”. That is delusional. It will take a really “Great Crash” to come to our senses that there are some things that are to rendered to markets and some that are not. “Capitalism” is not only a force for the production of goods and services but on the other side of the coin it is absolutely destructive to human survival on this planet. Somewhere in not very distant time we are either going to realize this or we will perish as a species. Either we overcome the greed of the few for the benefits for the many and understand our position in the universe as a species or “Mother Nature” will shed a small tear as she allows us to disappear from this beautiful planet. The choice is completely ours to make.

Lance Manly,

You just described the Fed’s Goldilocks economy, with inflation rising slightly faster than wages :-]

By using hedonic manipulation, the Fed can get the numbers to come out any way it wants. The Fed can have a Goldilocks economy, but working people can’t.

A good article

The mother of all price fixing schemes …who benefits from price fixing? Those doing the fixing. For everyone else, it’s lucy, charlie brown and a football.

“Great economy for who?”

For the “War Party Of The Rich”, of course. The too big to jail bankers and Wall Street… you know- the friends of the Fed.

The multi-millionaire Demopublicans and Republicrats …. our rulers.

I can’t imagine the Fed stopping anytime soon because the US markets are still pretty strong. The Fed would need to see some chaos in the foreign markets because of dollar shortage. EMs would need to tank like in 2015.

Jerome Powell has already made perfectly clear he won’t lift a finger for foreign markets or lenders and several governors agreed it’s not part of their mandate to prop up the Bombay NSE or junk-rated fishing companies from Chile. It’s hard to argue with that.

There’s no shortage of dollars in the world, starting from all the overseas profits large corporations from India, Japan, Mexico etc have stashed abroad chiefly in US Treasuries, but a strengthening dollar and rising rates in a US dollar environment are starting to affect operations across EM, chiefly because bond issuers did the huge mistake of assuming the Yellen Fed would last forever.

Countries where governments and corporations with mostly or even wholly domestic operations (and hence little or no US dollar revenues) issued US dollar denominated dollars with gusto are sweating copiously.

When you can fabricate all the data like America does it makes it easy to quote predict the course of interest rate hikes. Only the insiders get to see the real data.

The FED, Central Banks (other), hedge funds, brokers, all live in castles and they believe that they are ‘technically’ superior to all of us. Likely they all have some degree in finance (grade score not disclosed) which means, at best, they are right 50% of the time (the other 50% is not reported). Thus, we are to follow and not ask questions.

I ask questions all the time. My friends get tired of them because I rock the boat.

Is the Fed and other Central Banks fearful of the “fat tail”? The thing that is beyond the edge of the bell curve, beyond normal distribution that that they rely on, the out-of-no-where surprise? I think so.

The world is at record debt, speculation, derivatives exposure, wild options positions, contracts on the edge, out of control asset price tags, and emotions as well as irrational reactions are just as out of control. So, one little ‘fat tail’ is all it will take to bring one hundreds of LTCM type explosions. That one thing no one is expecting. What ‘expert’ saw the USSR’s Central Bank would default on their bonds, or how that would domino around the world? Now ask yourself, how many countries have bonds which can not be repaid but are borrowing more. Companies buying their own stock to settle insider options, and then borrowing against the company. Corporate Debts in foreign currency not their own. Some one is telegraphing to the rich to sell, and they are. Are you?

“Some one is telegraphing to the rich to sell, and they are. Are you?”

My wealth is non-monetized (a boundary of mountain land + tools to use it).

I never bought stuff ostensibly sharing other’s enterprise in their control (fiat-priced bonds, stocks etc.) – nothing to “sell” of the sort you mean, blindfaith.

” What ‘expert’ saw the USSR’s Central Bank would default on their bonds, or how that would domino around the world? ”

maybe not the collapse of the soviet union, but martin armstrong predicted the 1998 russian financial collapse:

https://en.wikipedia.org/wiki/Martin_A._Armstrong#Predictions

While Armstrong may have been good at seeing black ducks in a pond of white swans, he was not an expert, and certainly not one with a degree and or holding any spot of influence.

Look around you today, there are many self proclaimed experts who can “see” ‘financial collapse for this USA and many countries too, but defaulting on bonds…nope that blind sighted everyone and to drive home the shock, a major country, a world power, with a central bank that could print Rubles, a seat holder at the Security Council to boot. The Unheard of black swan in the flesh.

A country can have a financial collapse, and still make good on their bonds, we did, most have. Today, We are surrounded with candidates, who gave up their power to print their own currency. Italy, Spain, Portugal, Greece….the list goes around the world, and the black swans do not observe boundaries or boarders.

Think for a moment of the countries who use ‘reserve currencies’, the Green Back or Euro for example, as their own, debts included. Is it not a possibility that this 1/4 point FED rise might well break the backs of some camels, or perhaps trade decreases, so the payment funds are depleted. Tic Tic Tic.

Precious metals are popping nicely this morning. It’s almost like the smart money doesn’t believe for a second that the central bankers intend to tighten for real or halt their mainlining of financial crack cocaine into “the markets.”

Gold is up 0.5% at the moment. This isn’t exactly “popping.” It remains in the middle of its 12-month trading range. So as far as I can see, there is no special message in this 0.5% “pop” :-]

So with the rate hikes, how does one preserve wealth ?

Falling real estate prices, a flat to falling stock market,

and bond prices are falling . A stronger dollar and higher inflation ?

Something has got to give.

“How does one preserve wealth?”

First, redefine “wealth” for yourself. Wolf’s first reply, supra, shows one way. Define it out of the realm of money! Pricing of your assets at any given time won’t matter.

I could not care less what the current price of real estate is where I live. The VALUE of my mountain boundary “Eden” isn’t defined that way.

In terms of capital preservation: Short-term (1 month to 2 yr) high-grade fixed income instruments such Treasuries, high-grade corp debt, FDIC insured CDs and the like, all held to maturity, provide low-risk returns of 2-3%. This is a better environment for conservative investors primarily focused on capital preservation than we’ve seen in 9 years.

So this new environment sounds slightly stagflationary. Build up dry powder for the next Fed induced bubble. Perhaps the

best bet is to pay down the mortgage , even at these low rates.

Does the Fed still track money velocity ?

There is a huge lag in velocity and they don’t track M1 any longer? I expect velocity will go negative at some point, money goes out of circulation faster than they can print it

It’s always good to pay down debt to comfortable levels, but, it is not good to only do that. One should have enough left over to also build an emergency fund of about 3 months income.

What happens with a decent buffer is that those emergencies goes away. Dishwasher craps out, old car dies -> one just buys a new one -> hardly an emergency. No juggling of overloaded CC-ards needed.

I recently fixed my mortgage at 1% for 3 years *just by asking*. Personally, I think mortgage rates will go to 3% p/a over the next year or two. But I don’t know that. Obviously the banks thinks differently.

So, I *could* make higher payments now to keep the monthly payments about the same in the case rates go to 3%, but, right now I’d rather keep that money liquid in a couple of funds and maybe plonk it in there as a lump sum payment after the 3 years are up to lower my mortgage payments. I am paying myself before I pay the bank.

Depends what one considers “wealth”. For example: “In America if you are healthy you could be considered very wealthy”. All others are secondary. My very cynical immigrant father said you have only one “friend” in America: “Your wallet”. Very cynical but in many ways very true. Another French immigrant at the time (our neighbor) always said he only trusted the seller who gave him what he showed, not the article from the “back room”.

High interest rates will always get us. What will finish us though is

what we can’t see. Derivatives ,option trades ,off balance sheet

liabilities etc.Full transparancy would make us so much safer.

Look what low interest rates did to Japan and now to Europe. High interest rates are the lesser evil for the working poor.

The only way to determine that would be to literally count the homeless and the destitute in each area in order to know which policy hurts the poor more. When I lived in Wales, far from the richest part of the UK, most people were poorer than stereotypical “middle class” Americans, but I saw none of the hard core poverty I saw when I lived in NY, Jersey City, or here in rural Massachusetts.

Same old cycle in process. Raising rates because the economy is doing “great”. Until it isn’t. The bottom third is already showing distress signs in their debt problems. Raising the rates will continue to erode their positions. The Fed, as per its usual lagging behavior, will stop when the SHTF.

Read today the Fed might slow the rate of balance sheet reduction. That’s preposterous, considering that the main beneficiary of QE is corporate bonds and that market is not showing any stress. Rate increases can come about in two ways, one of them is reducing liquidity. When does raising rates equal a credit contraction? With the massive leverage in the global system they can lower the table by cutting the legs and asset prices will continue to levitate. The Fed meanwhile has to ignore its role as regulator, and get off the back of those nice people at DB, and just listen to Larry Kudlow. Can you see where this is going?

Don’t worry about what you “read” about the Fed’s QE unwind. It will keep going. There are some natural limits with how fast the “roll-off” can proceed, because it requires that enough securities mature during that that month, and that enough principal payments on MBS are passed through to hit the caps the Fed has set. Those caps will reach $50 billion a month in October. That’s a big number. And there will be many months when there will not be enough maturities and not enough principal pass-throughs to hit the caps, but that’s the mechanics of the process. It’s not a new thing the Fed has decided.

https://www.themaven.net/mishtalk/economics/fed-is-rethinking-its-balance-sheet-unwind-expect-lower-lt-rates-higher-gold-CZGUgnLyEUGRudt_0DCaTw/

The sheer size of all bonds in aggregate will overwhelm new supply. its like there’s a recession in bonds, over production bites back. The Fed will keep reducing their balance sheet.

Ambrose Bierce,

You’re the second commenter that posted this misleading headline here, without having read the entire article linked. So I will say the same thing:

Please read the whole article, not just the headline, before you post the link of that article. This headline is very misleading.

Mish slapped on his own headline on a big piece of a Bloomberg article he cited, and there was nothing in that Bloomberg article about the Fed rethinking its QE unwind. Nothing.

However, there was a quote in it from a Wall Street crony, a BofA guy, who WANTS the QE unwind to slow down. This is the quote in the Bloomberg article upon which Mish hang his hat:

“Mark Cabana, a Bank of America rates strategist, said in a report published June 5 that Fed officials may stop draining liquidity from the system in late 2019 or early 2020, leaving $1 trillion of cash on bank balance sheets.”

That’s it. The Fed isn’t rethinking anything. But a BofA strategist WANTS the Fed to rethink.

Your comment is very interesting. Can you elaborate on the second part of your statement?

How will the hawkishness play out with a dovish ECB still pouring liquidity in?

So far dollar is way up against the euro today.

Liquidity does not seem to be helping the Southern European countries, but is keeping them afloat- for now.

Fed’s balance sheet is sinking but slowly.

US rates are the highest in the developed world. That will keep interest rates down I think because of buying.

Is this capitalism? I think everyone should be taught finance in school so they have a clue as to what is really going on. And I am glad Powell is not an economist. Apologies to you economists out there in advance you are not all alike.

the ECB will end QE in December. It has already tapered down to €30 billion a month. So this is ending. Draghi will depart next year. So this too is ending.

I noticed the Chicago Financial Conditions Index actually loosened from March until today, and financial conditions are as loose today as they were at various points of 2013 and 2014, despite the dollar strengthening and QT having began in earnest.

Wolf, any idea why? We did see conditions strengthen a little bit at the start of the year, but I would’ve thought the combo of QT and dollar strength would’ve had a more appreciable move. Then again, I don’t fully understand the FC Index, so perhaps I’m missing something operationally (such as the inputs are lagged and take time to flow through, or something).

The weekly St. Louis Fed Financial Stress Index also loosened in recent weeks. The riskiest junk-bond yields (CCC) have dropped to lowest level since 2014. Spread and risk premiums have narrowed. I’ve been writing about this: investors are still chasing yield in the riskiest areas, even while yields are rising in higher-grade debt. These “financial condition” indices measure among other things how hard it is for risky entities to raise new funds, and it’s still extremely easy and cheap for them to do so.

This is why the Fed will keep going on its path: It wants to see financial conditions tighten. That’s the transmission channel of its monetary policy. But that has not happened yet.

“This is why the Fed will keep going on its path: It wants to see financial conditions tighten.”

The market is probably betting that:

1. The Fed will have to beat a retreat before it sees financial conditions tighten

2. The Fed (and ECB) cannot tighten financial conditions as it can cause all hell to break loose (e.g. Italy, EU break up etc.) and thus does not believe it will happen

and given this… “it’s still extremely easy and cheap for them to do so.”, it looks like the market is winning right now.

May be the market also thinks, the Fed is going about it so “gradually” (can we say “gingerly”) that tight financial conditions are light years away.

The rubber meets the road IF the tightening has the effect that the Fed wants. We will then see who blinks first. My guess is it will be the Fed and the ECB!

“The economy is in great shape,” said out-of-touch, Fed Chairman.

The commodity market is not the economy. Full employment with great swaths of underemployed and “gig” employment is not great.

The Fed is known for raising rates into the mouth of a recession – they better raise them fast if they want some room to cut. I don’t think 2 to 2.5% will be enough to prevent a hard landing – whenever that comes.

I remember W Bush repeating that phrase in 2006

A contrarian thought (to Wolf’s) here…

https://www.themaven.net/mishtalk/economics/fed-is-rethinking-its-balance-sheet-unwind-expect-lower-lt-rates-higher-gold-CZGUgnLyEUGRudt_0DCaTw/

Mish may be wrong. I am not sure what will happen. But for me to believe that the Fed will tighten when it can cause all hell to break loose, (some point will prove to be the last straw on the camel’s back – also all the CBs are in the tightening boat), I will have to see it happen.

KPL,

Please read the whole article, not just the headline, before you post the link of that article. This headline is very misleading.

Mish slapped on his own headline on a big piece of a Bloomberg article he cited, and there was nothing in that Bloomberg article about the Fed rethinking its QE unwind. Nothing. However, there was a quote from a Wall Street crony, a BofA guy, who WANTS the QE unwind to slow down. This is the quote in the Bloomberg article upon which Mish hang his hat:

“Mark Cabana, a Bank of America rates strategist, said in a report published June 5 that Fed officials may stop draining liquidity from the system in late 2019 or early 2020, leaving $1 trillion of cash on bank balance sheets.”

That’s it. The Fed isn’t rethinking anything. But a BofA strategist WANTS the Fed to rethink.

Wolf,

You got me wrong here. My point was not about the Fed rethinking about QE. It was to show that Mish’s thinking that the Fed will have to rethink QE (while in this post of his he quoted the Bloomberg article, that has been his thesis for a while) is diametrically opposite to yours and would have liked your comment on it (both your blogs are on top of my list). Obviously only one is going to be proved right. As of now you are being proved right (for all the wrong reasons in fact – the market does not believe the Fed and is thus taking the rate hike and QT in its stride as you have been showing time and again).

May I dare say I am with Mish (even though he has been wrong for a while now) because I fully expect the Fed and ECB (and other CBs) to cower and run once the markets turn. Markets will turn once it really believes the Fed’s intent. The irony is the moment the markets believe and turn, the Fed will run for cover.

Only time can tell who is going to be right. As of now you are in the driver’s seat!

Got it :-]

Mish sensationalises those grains of sand that suit his agenda at every and any opportunity.

Hence just like Zero hedge, he get’s very few long term visits, he also has several other very bad biases.

biased personal agenda financial drivel is F%^$ F%^$ useless.

we should get Wolf and Mish mano y mano. Fed balance sheet lightening and raising rates are approximately the same thing (at different ends of the curve) but retiring bonds does cause credit to contract while the Fed can raise short term rates (and pay banks IOER) which offsets liquidity issues at least at the short end. and while I agree that Powell is committing suicide by tweet if he bails out foreign companies what about Chinese companies hiding inside Nasdaq shells? and what about all that sweet Swiss cash printed out of thin air? he could feel conflicted.

“The Fed has been paying banks interest on these excess reserves at a rate that was equal to the top of the Fed’s target range – so 1.75% since the last rate hike, which amounts to an annual rate of $33 billion of easy profits for the banks. In theory with today’s rate hike, the FOMC would also have increased the rate it pays on excess reserves to 2.0%.

But this didn’t happen. The Fed hiked this rate to only 1.95%.”

………….

=========

To me, this news is almost as important as the hike.

Considering that we are now “voluntarily” participating in what Jocob Rothschild described in 2016 as “surely the greatest experiment in monetary policy in the history of the world”, the private CB experimenters might be interested in finding out the effect of manipulating one of the “variables” in what I would argue is more an experiment in human behavior than it is monetary policy. Specifically, just exactly HOW would a carefully managed, gradually larger and larger spread between the two rates affect the behavior of the owners of the excess reserves?

What to prevent Europe’s banker’s from borrowing from the ECB

and using those funds to buy T bills ? Wouldn’t this stregthen their

balance sheets with the carry trade and prevent US rates from rising

as fast as they normally would ?

because the ECB doesn’t have real money? the tax cut law put a real bite in European bankers liquidity, the experts tried to get ahead of it and calm the plebs, but LIBOR is on fire. It looks like (today) a good old fashioned credit squeeze. and the Powell Fed has been ‘regulating’ DB which by implication impairs other foreign banks who want to do business (as usual) here. Looks like some firewalls are going up, which means time to torch the building for the insurance money.

The major reason behind this can be the incoming of American investors money into the domestic economy which was previously invested in foreign markets. From the very beginning of 2018 investors have bought their money back to us equities market.