So here are the charts.

Steel tariffs are now in place, and the world is grumbling and threatening retaliation against the US. Its closest partners, such as Canada, are trying to figure out how to navigate the waters. Part of Corporate America is lobbying against it and wagging its checkbook. The other part of Corporate America — the part that has been lobbying for it — is now grinning from ear-to-ear. And the media is steeped in this melee. But just who is producing all this steel, and who is dominating this trade?

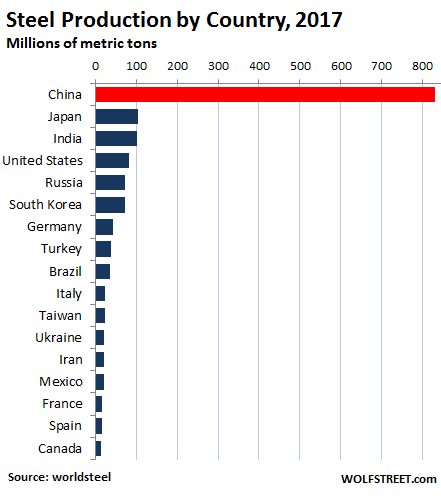

In April, China’s crude steel production rose 4.8% from a year ago to 76.7 million tonnes (Mt), the highest on record, according to the World Steel Association. This was nearly 11 times as large as the 6.9 Mt of crude steel that the US produced.

China’s production was nine times as large as that of the second and third largest producers, Japan and India, each with 8.7 Mt. World production of crude steel in April was 148.3 Mt, of which China’s share was 51.7%.

And with somewhat awkward timing, the World Steel Association, whose members represent approximately 85% of the world’s steel production, just released its World Steel in Figures 2018, with data through 2017. So here we go, step by step.

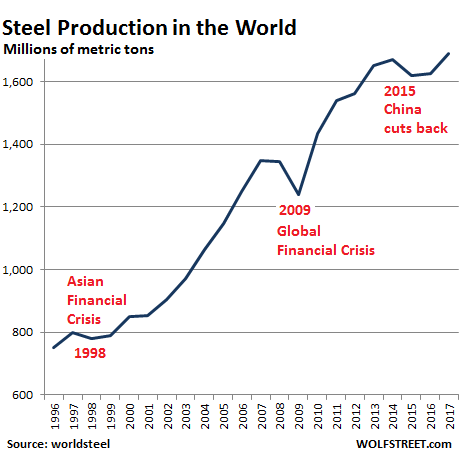

Steel production has grown sharply over the years. Since 1996, there were only three years when production declined: In 1998, as a result of the Asian Financial Crisis, in 2009 as a result of the Global Financial Crisis, and in 2015, when China made a short-lived effort to get a grip on its rampant overproduction.

So how big of a role does China play in this?

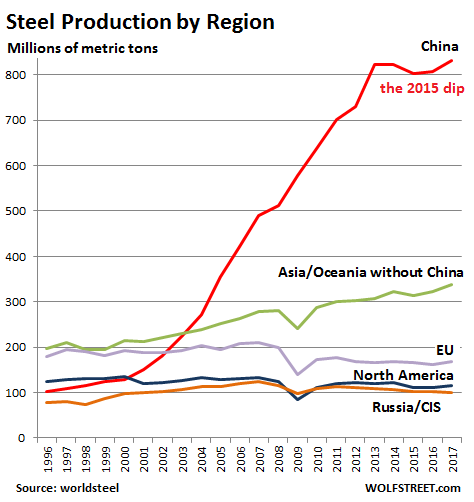

The chart below shows steel production by some of the major regions: China (red line); Asia/Oceania without China (green line), which includes Japan, South Korea, and India; the EU (mauve line); North America, the NAFTA countries (black line), and the CIS (brown line) which includes Russia, Ukraine, and others. Note that production growth in China blew right through the Asian Financial Crisis and the Global Financial Crisis, but dipped in 2015:

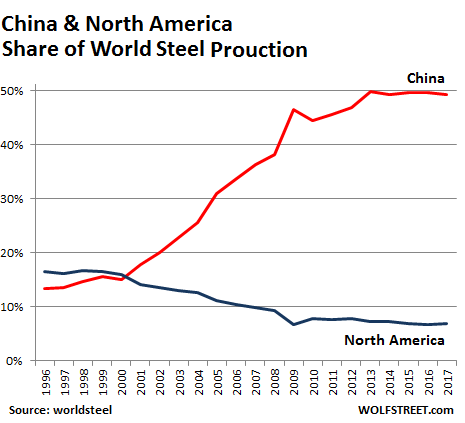

China’s share of global steel production has skyrocketed over the years to 51.7% in April. The chart below shows China’s market share (red line) that reached 50% for the first time in 2013 and has about stayed there since (2017 = 49.2%). This is juxtaposed to North America’s market share – so the share of the US, Canada, and Mexico combined – which fell from nearly 17% in 1996 to just 6.9% in 2017:

By country, below are the largest steel producers in the world, with the US ranking fourth, behind India even. In 2017, the US produced 81.6 Mt. China produced 10 times as much, 831.7 Mt. Now find Mexico and Canada on this chart (hint, look low):

Drilling down to the corporate level, we find that among the 12 largest steelmakers in 2017, five are owned by various government entities in China. The largest US steelmaker is in 11th place:

- ArcelorMittal (97 Mt) – formed in 2006 when Indian giant Mittal Steel acquired French steel giant Arcelor. Now registered as a Luxembourg mailbox company run from India.

- China Baowu Steel Group (65 Mt) – owned by the government of China.

- Nippon Steel & Sumitomo Metal Corporation (47 Mt) – Japan.

- Hesteel Group, formerly HBIS Group (45.6 Mt) – owned by the government of Hebei Province, China.

- POSCO (42 Mt) – South Korea.

- Shagang Group China (38 Mt) – privately owned, China.

- Anshan Iron and Steel Group Corporation, or Ansteel Group (36 Mt) – owned by the government of China.

- JFE Holdings (30 Mt) – Japan.

- Shougang Group (27 Mt) – owned by the government of Beijing, China.

- Tata Steel Group (25 Mt) – India.

- Nucor (24 Mt) – North Carolina, USA

- Shandong Steel (22 Mt) – owned by the government of Shandong province, China.

This involvement in steelmaking by various government entities extends beyond the giant steelmakers. These steelmakers also receive no-questions asked funding from the four state-owned megabanks in China. Many of the steelmakers’ largest customers are also state-owned. China’s central bank, the PBOC, is part of the same team and makes sure that the state-owned banks don’t collapse from the results of their lending practices to state-owned steelmakers that have turned into loss-making zombies.

It is Chinese government entities that together as a team totally dominate the global steel trade.

This data set, provided by the World Steel Association, is what we need to keep in mind when we hear that the US imports very little steel from China. Of course! Chinese steelmakers, most of them state-owned and state-funded, transship the steel to other countries, from where it either gets shipped to the US, or where it gets processed in some way and then shipped to the US. It’s just a fig leaf.

Three companies build the huge “low-speed” two-stroke diesel engines that power the largest ships in the world. Read… The Engines of the Largest Container Ships in the World, and Challenges their Manufacturers Face

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

But…but…free trade.

Good for America and middle class jobs….right?

Wait. What? China doesn’t play fair?

Tariffs are wrong/bad . With a goal of a 50 Billion$ max trade imbalance with China , take the necessary 325 Billion $ cut and evenly space the imbalance reduction out using an 8 or a 10 year plan. Use an ongoing flexible embargo capability to manage the imbalance reduction, requiring US and Chinese exporters and importers to pre-register for the month and the amount ($ wise) that they will ship. Apply the embargo when necessary.

To the US and Chinese exporters and importers: get in line and register. Considering the history and performance of Chinese Communism, allowing a $50 billion trade imbalance may in fact be too liberal and unjustifiable. Allowing a $375 billion trade deficit with Communist China is the straight jacket version of socio-economic mental illness.

Embargos are even worse. Lol. The worst thing of all are the Chinese government subsidies done under the guise of bank loans.

The US establishment really hates China. Probably because the communists of China are much better “capitalists” than we are. Chinacompletely outcompetes the US on almost every level.

The establishment had better get the US public to focus on Venezuela and how the reason for the failure is socialism, rather than the fact that it is much easier to place crippling sanctions on Venezuela than on China.

And so it goes. And the public is buying it.

Wait. You think the U.S. Has more state control than China??

They can’t even come close with regards to obesity Though they are trying

And what happened in 2001?

China became a member of the WTO in December 2001.

After that steel production in China soared.

You’ll also notice that two companies in Japan, Shin Nippon and JFE, account for 77% of Japan’s steel production.

Other countries have overtaken Japan in the steel production arena to the extent that no other Japanese companies are in the top 39 world producers.

When I first went to Japan in 1980 I had the opportunity to visit one of Kobe Seiko’s production facilities. The tour was quite interesting.

Better question, what’s not Made in China?

Freedom

Freedom’s just another word for nothing left to lose.

America’s top export: the U.S. Dollar and Treasuries

Steel is not a fungible commodity. Hot rolled, cold rolled, low carbon, tool steel, stainless are a few examples with different properties and manufacturing processes. I don’t know how diversified China’s steel industry is, but kudos to Trump for the tariffs. A healthy steel and aluminum industry is very important for our economic and national security.

We also need reform to our financial system such that it lends to industrial ventures like China’s does and not almost exclusively to extant real estate assets as ours does. Would you rather have a vibrant industrial and engineering economy, or yet another asset bubble inflated by the banks?

You are confusing ‘fungible’ with something like ‘not all the same’ when it means not replaceable by identical equivalent.

Oil is not all the same but it is fungible. WTI is replaceable but it has to be with WTI. This is why it can trade as options etc. without actual delivery.

Art is not fungible. If you have contracted to buy a serious work the other party cannot at law replace it with another. He could try to mollify you with money or a more expensive work but that is up to you.

The biggest market for something that is not fungible is real estate, especially residential. Different people can have vastly different opinions about houses with identical appraisals.

Steel does trade with options and middlemen, just not to the extent of oil.

If it were not fungible, the buyer who had inspected a a roll of sheet could refuse shipment of the roll next to it and insist on the roll ‘you showed me’

So Trump just made all products made in the US from steel more expensive than steel products made elsewhere in the world.

That benefits everyone else but the US.

And Nucor (24 Mt) – North Carolina, USA will be able to jack up prices 25% and will double or treble their profit.

Nice one Donald.

The Canadian government has just announced dollar-for-dollar retaliatory tariffs on U.S. imports. This smacks of a schoolyard tit-for-tat level of dealing but what else can one expect from the light-weight Trudeau? The main result will be to increase the cost of orange juice etc for ordinary Canadians.

Buddy: trade disputes have been going on for centuries. There is ALWAYS retaliation. When the US brought in Smoot-Hawley in 1930 OF COURSE Europe and Canada retaliated.

This time is no different. Mexico,the EU, China and whoever else is affected will retaliate. I could join you in this Trudeau- as- lightweight hobby horse but you need to find him doing something lightweight. That is easy: he should have dealt with BC luddites firmly instead of buying the pipeline they are opposing.

If he HADN’T done something re: tariffs, the country (apart I guess from you) would have called for his head. He would have been the first PM NOT retaliating to US tariffs.

I hate to agree with the protector of the rich on anything. However, if there was some invasion, without steel and aluminium we would not be able to resist long. Japan could be such an invasion target. Wars are often not predictable: financial interests such as oil guide them.

If a more aggressive branch of the Commies took over in China, war is not out of the question. U.S. Governments must protect our ability to defend our country and our allies. I would not like to live under a Chinese Commie allied government like North Korea’s.

We should reform our corrupt government, not succumb to the Commies’ even more corrupt rule.

The tariffs are not the brainchild of POTUS (!) the latter was talked into them by Sec Com Wilbur Ross.

Prediction: Ross will join the LONG list of departed staff within 90 days.

PS: the GOP senators are preparing their own battle against the tariffs.

The support for tariffs (as in 1930) is overwhelmingly political. It’s from people who don’t understand the steel industry. We apparently have ONE comment from someone in the business. a steel fabricator who is now unsure how to bid on jobs.

And to repeat: the thousand workers at one of steel mills in the US were celebrating at news of the tariffs.

Then came the announcement: there might be layoffs. The mill is a ROLLING mill. It does not create steel from ore or scrap. It imports slab steel and rolls it into sheet steel.

For every 40 such workers there is ONE working at a blast furnace creating steel from ore.

If China is over producing steel then they are under producing something else. It all washes out. The real imbalance is CEO’s getting paid 300 times a worker’s salary, and that’s a worldwide issue not specific to any country. That only happens in a rigged system. Those overpaid blowhards don’t even have their own capital on the line.

Unfortunately, there is a missing chart; that of the dollar value of production. There is a huge difference in price between plain steel, and some specialty steel.

Right you are. Japanese make hand-made sushi knives, take like a year to produce. Probably twice as good as Chinese made $9.95 kitchen set.

Chinese steel has a bad reputation, as do the quality of many products produced in China. They don’t make more of a good thing. They tend to make a good thing not as well as it used to be made.

The millennials have a term they use to account for bad Chinese quality. When they say a product is or has Chinesium, it is not a complement.

Guitars. What I paid $400 for in 1968, I just bought again for…$400. Chinese violin makers export wonderful guitars. We are clearly not in the steel business either. We’re often told that we’re a productive people. Sometimes I think we only produce lawyers and stockbrokers. Maybe I watch too much cnbc. I wish that most of the kids in law school were in engineering school. Our productivity indicates our future, I think.

They sell cast iron claw foot tubs for a third of the price I was paying in 2004 Quality seems pretty good but time will tell

True. And….

‘Part of Corporate America is lobbying against it and wagging its checkbook. The other part of Corporate America — the part that has been lobbying for it — is now grinning from ear-to-ear’

But what are the relative sizes of these two parts? One number I’ve heard is 40 to 1, that there are 40 US jobs using steel as an input for every job as a PRIMARY steel producer.

One of the larger US steel mills is negatively affected because it is a rolling mill. It imports Chinese slab steel and rolls it into usable sheet.

It employs a thousand people, but now says it will have to lay off some. .

None of the charts show exports: they show production. China is the world’s largest producer. Aren’t they also the largest user? Largely for their fairly crazy infrastructure and apartment boom.

The allegation is that the number one exporter of steel to the US, Canada, is actually reshipping Chinese steel. it would be nice to see elaboration of this.

Why should a primary steel producer in Canada be affected?

In the soft wood dispute, the US has handed out a variety of tariffs to Canadian mills, including a few exemptions or very small tariffs.

Lastly; the world is awash in steel and will be for the forseeable future.

The Trump enabling reason for the tariffs is national security, enabling him to go around Congress where the actual commercial and jobs case would be argued.

This is ridiculous. Even if the world including Canada decided to gang up on the US in a steel embargo, the US could run on its own scrap (now exported) for years, because of course in this national emergency, all nonessential uses would end.

And can you imagine what the US would do to the gang THEN in the name of national security?

The scenario just might work as a paperback thriller.

nick kelly – and China was reshipping steel from Mexico too.

Admittedly off topic by mentioning aluminum, but this is interesting about tariffs, in general. From CBC tonight: (snippet)

“Trump wrote a cheque for $600 million to Canadian aluminum producers,” said Jorge Vasquez of Harbor Aluminum in Austin, Tex., who has served as an adviser to both the U.S. International Trade Commission and the Canadian Trade Tribunal.

In effect, Trump’s actions transferred more than half a billion dollars from the U.S. economy to Canada’s since March.”

Plus, the anger north of 50 is palpable. This is coming on top of softwood traiffs for the 5th time. There will be a process of Canada actively seeking out new markets and economic partners starting with TTP, and onwards. China? There is also a spontaneous reaction against buying any product US made from people I talk to. Add to that 16 billion in retaliatory tariffs beginning July 1 on selected goods with political impacts. The Country is cheering for retribution.

The consensus here is that US consumers will be eating the tariff costs much like softwood.

As an aside, and purely anecdotal, this has emphasised to many the need for market diversification, particularly with energy. As we are the largest providor for US energy imports, look for eventual higher prices with Trans Mountain expansion and eventual Energy East reversal to the Atlantic coast.

Apart from the tariffs, themselves, what is truly galling is the effrontery of the action. Sometimes, insulting friends is irrevocable. That is what I sense is happening now. Anger is growing by the minute. This is a very angry divorce in the making for sure. I sense it cannot be fixed or made right…..kind of a last straw event. If people thought Canada would turn turtle and cave they were sadly misinformed. What a shame to see this unfold. SAD. (couldn’t resist) :-)

regards

But the Canadian government just scr*wed their own consumers – they’ll have to pay 25% more for US cucumbers!!!!

The unknown fact is that Canada has a trade deficit with the US when you take in goods AND services (the US is the one with the surplus).

There is a growing groundswell of boycotting US products where possible. I have seen it too, and am pushing it whatever chance I get.

The big one is travel. A friend who usually spends 3 months a year in Florida is so pissed that he is looking at spending his money in BC this year instead. Multiply that a few times and add in pissed of Europeans and the US economy will feel it (Europeans increasingly coming to Canada instead).

Trump could be the greatest gift ever for Canadian nationalists.

Now I understand the Russian collusion case that Mueller is investigating.

The tariffs are going to cause Canadian hockey players to boycott the National Hockey League thereby creating more openings for Russian hockey players. These Russian hockey players will earn hundreds of millions in dollars every year. At the end of season they will all sell the dollars they earned and convert them into Rubles.

This is likely to cause a massive imbalance in the currency market that causes the stock market to crash worldwide. I now understand Putin’s plan and why he worked so hard to infiltrate the Trump campaign. One can only hope that Mueller figures this out before it is too late.

Embargos are even worse. Lol. The worst thing of all are the Chinese government subsidies done under the guise of bank loans.

Unfortunately Canada and Mexico brought it upon themselves by trans-shipping Chinese Steel. If you want tariffs against China to be effective you have to put up tariffs against Canada and Mexico or renegotiate / abolish NAFTA…….

Shane – exactly!

Paulo – “There is also a spontaneous reaction against buying any product US made from people I talk to.”

Where do you find a US-made product? They all seem to have “China” stamped on them.

If someone wants to sell me millions of tonnes of steel for an IOU then I am happy to comply. Steel, of the Chinese type, is not high-tech, and the stuff is polluting and unpleasant to produce, so why not let the Chinese do it?

Generous attitude. Still, I really do understand the sentiment.

https://www.nytimes.com/2017/02/16/world/asia/beijing-air-pollution-china-steel-production.html

Chinese people are good people just like we Americans are. (Not so much the two governments). Lack of proper pollution controls or prevention is killing many Chinese.

Only as a direct analogy, rare earth metals are everywhere, and not really so much rarer in North America than in China. The cost of producing such wonderful metals is greatly increased by EPA mandates in America, but not so in China. People are dying from coal-use and steel / rare-earth metals production. Just to name a few of the many pollution creators.

I know that Chinese citizens’ health is a small part of the Administration’s concern (if any part!) but might we want human-centered concerns to surface here ?

I do know I am a broken record with my usual singular focus in this area . . . sorry.

The Chinese govt is allowing this to go on on purpose. It is the Chinese govt’s job to protect their workers not ours. We have enough problems here already to worry about the concerns of Chinese workers. Sorry but I had enough of this ideology a long time ago.

In a closely-related area of concern, would you support efforts to not buy goods produced by very-young child labor ? India comes to mind.

If so, how is that different ?

And from a strictly trade-balance concern, doesn’t lack of worker protection and pollution control confer an “unfair” monetary trade advantage ? I often read of American Labor Unions raising that concern w.r.t. trade agreements.

RD,

In general I don’t care how other govts deal with their workers. In the middle east they are practicing a form of indentured servitude/slavery and we never complain about it because we need the oil. Countries, like India, who supply the workers benefit from the salaries sent back home. I don’t think it’s our business if this works for the parties involved. We are imposing value systems on these people that they don’t share.

China is hell on earth, in many quantifiable ways.

As for pollution controls….when the civilian disease/dying vs wage quotient becomes a problem then maybe….and only maybe…action will be taken.

But don’t get your hopes up. China lacks clean water and that is the limiting factor for their growth.

I just watched a documentary about fracking in the states and how it’s destroying aquifers Very sad indeed that people will have to drink that garbage

Many people seem to believe government entity steel production represents free trade.

√

You forgot to add sold below true production cost.

It is “free” trade! They give us tangible stuff and we give them paper…so it is in effect free. If there were an honest money, system such imbalances would be self-regulating and not materialize. When you run out of honest money you have to do more for yourself. You naturally have to throttle down you imports and it puts your own people back to work.

Buying stuff on credit (being able to make “money”) is not a long term stable way to operate and have a thriving society. It has all the same moral hazards of our welfare system. If the USA keeps its trade deficit going, the USA will be not much different that a third generation welfare queen living in Philly.

As long as the US can live with itself by having a significant portion of its people un/under-employed. The people are losing one form of mental diversion in life. That will inevitably lead to increase in demand for psychological therapists to treat the mental delusions that are fostered by the idleness, unfulfilling work and the associated family financial problems the unemployment brings.

Wolf, you need to mention that China IMPORTS the great majority of the iron ore it needs to produce all that steel, as iron ore mined in China is generally lower grade and needs more coke and thus causes more pollution, which China is actually trying to reduce. In fact, China consumes 66% of all of the world’s iron ore that is traded, the majority from Australia and Brazil. So in this globalized world trading system, Australia and Brazil are the silent beneficiaries.

Here’s a list of all the countries China imports iron ore from:

http://www.worldstopexports.com/iron-ore-imports-by-country/

There is more history to this – it is worth noting that during the Great Leap Forward, Mao called for an immediate expansion of steel production in the country as a step to modernize the country. The local Communist cadres, in their zeal to follow Mao’s commandment, got all the peasants to gather up anything that had steel or iron in it, which meant cooking pots and pans and tools, and they MELTED IT ALL DOWN and submitted it to the authorities as their contribution to the final count towards increasing “steel production”.

Which of course led to yet another mass famine as the peasants now had no tools to work the fields or cooking pots.

So, digging up all of Australia and shipping it to China, which is what the modern Commies are doing, is a much better idea for increasing steel production.

Equally interesting I think, is a list from the same source of the countries that export iron ore:

http://www.worldstopexports.com/iron-ore-exports-country/

As Gandalf implies, Australia heads the list.

Trump making steel and coal great again is like going back to the whip and buggy after motor cars were manufactured. If China wants to produce and sell steel for 1/2 its value, let them. Why don’t we focus on software engineers, algorithms, developing robotics? The worlds largest hotel chain doesn’t own a unit (Airbnb); largest taxi service doesn’t own a car…you get it. Making coal great again now that it is at a 35 year low won’t work because it doesn’t pencil. Can you imagine sending your son into a caol mine where he can get black lung disease? Are we back to that in this day and age? Really? How about protecting our intellectual companies from being ripped-off? The proposed sanctions on ZTE were focused in the right direction but Ivanka needed 13 new trademarks in China at the same time of the release? Thank you again Wolf for the great venue to hold open discussions.

The delusion of the muppets strike again. The qualification to do AI is much higher than you think. Google accepts on PhDs when it comes to building the core of their AI components.

US students lag their global counterparts when it comes to math. The world of AI is ALL math. Half the PhDs doing AI are foreigners. Actually it could be more than half.

It’s true that software engineering does not need a PhD. But nowadays, you need to be able to solve problems found in geeksforgeeks.org in order to pass engineering interviews. And those are much HARDER than digging coal.

Saying that software engineering is as easy as coal digging is the ULTIMATE delusion. Goldman Sachs, please do God’s work and throw muppets to the wall.

That’s the problem. Most people can’t contribute in the white collar arena, and robots are taking the core manufacturing jobs. All the education in the world won’t change this fact. Yet all people want to contribute and need to contribute to have any sense of self worth.

Maybe we need more people focused on arts, humanities, education, environment, etc. and things that build a sense of community. Today’s dog eat dog society is not sustainable in the long run. Time to put restrictions on the chase for material goods, which don’t provide real satisfaction anyway.

Putting all people to work serving the top 10%, who have all the spending power, is not the answer.

+1. Community building is the answer. Building real communities will automatically reduce power accumulating in the hands of the 1%.

It’s certainly not weapons that caused the Soviet Union to disintegrate.

But the same trick cannot be applied again, because it turned out to be an illusion. The word “white liberal” is often used as a joke in China. They certainly want to emulate our “prosperity” but none of that liberal stuff.

The old-order Amish never abandoned the whip and Buggy, Mike, and there are those of us who think they are none the worse for it.

Some of us have arrived since horse and buggy days and don’t have that to revert to, but our way of life is sylvan oriented and “retrograde”, according to modern fashion.

But we don’t care; as a matter of fact we depend on it.

A large influx of converts would run us out!

I get the fact that Trump wants to reduce the trade imbalance to the US but putting trade tariffs on things isn’t the way.

Wolf. Good articel, but writting that arcelor Mittal is a Lux letter box is harsh. Arbed was created 1886 in Lux and produced 1.8 Million tone of steal 1939. Later Merged 2002 with Spain aceralia and French Usinor. Became Arcelor. Then Mittal came in a bought it and kept head office in Luxembourg. So even if there are many letter box companies in Lux this one actually has a history and still production in Lux.

OK, maybe a little harsh… But only Arbed in that whole group was a Luxembourg company. Yes, as Wikipedia sez, in 1939 Arbed produced 1.8 million tonnes of steel — that was WWII and Luxembourg was integrated into Germany and it had to supply the German war effort at maximum tilt. In the 1970s steel crisis, Arbed, run into trouble. It eventually got a big bailout by the government of Luxembourg (1980s). In 2001, the French steel giant Usinor engineered a three-way merger with Arbed and the Spanish Aceralia, and that trio under French leadership became Arcelor.

In 2017, all steelmakers in Luxembourg combined (which includes companies that are not part of ArcelorMittal) produced 2.2 Mt of steel. This represents about 2% of ArcelorMittal’s total production.

Steel is important for war. Not just ‘trade war’. China’s ramping up of steel production (and denuding others’ capabilities) is a strategic move I would guess. America loses its capabilities in this field at its own peril. Some things cannot be ignored.

Good observation, and the rationalization, at least, for the administrations action using “national security” law.

In the 1930s, Japan built her much of her war materiel using imported steel scrap from the U.S.

The US is still a large exporter of scrap and if necessary could run on its own scrap for years.

These WWII scenarios are to be polite, fanciful.

But let’s write a chapter for fun. Is the proposed war with China?

Well then China has to invade Australia to secure high- grade iron ore.

In that scenario,there is no role for battleships or tanks but some for nukes.

In a nuclear age aren’t tanks and aircraft carriers meaningless? They are only needed when you go to war against a country without nuclear capability.

I think the arms buildup these days is more about profits.

Unless you are going to obliterate all the population and resources and just leave the place uninhabitable.

Somebody wearing boots will still need to go and occupy the real estate. They will need assistance machines of some kind, and various tools.

The Technology of conflict has changed a lot. Some of the Basics, cant be changed.

Please, let’s extinguish the free trade MYTH once and for all:

https://theconservativetreehouse.com/2018/04/04/very-important-economic-confrontation-neil-cavuto-vs-larry-kudlow/

Consider that if the US moves manufacturing of products with a high iron/steel component to China, they are going to want to source their steel from China also.

So when Sears moved production of some Craftsman tools to China, China increased steel production with a subsequent reduction in the US. But all Trump did was place a tariff on raw iron/steel, not on the tools.

The net effect is to cause a small increase in US production of steel, a large price increase, increased profits for that industry, increased costs for US-based manufacturers that use steel, and subsequent reduced international competitiveness.

What Trump should have done was place a tariff on the end products that use steel. That would force companies to move manufacturing of higher-value products to the US, and they would begin sourcing more steel from the US.

Excuse me, but I have a question that nobody seems to be thinking about…..

I’ve been to some of these abandoned steel mills in this country and I know it is going to take a massive investment of capital to get our steel industry up and functioning again, and it will be a while before there is any return on that capital. From what I’ve seen in this country, no one wants to tie up their capital for that long when there are faster ways of using it to make profits. Certainly there have been no large capital investments of this type made in this country for years.

So what will really happen because of these tariffs? Will corporations actually take on the job of rebuilding our steel industry and take on the capital and labor costs that will go with it, or will they keep their capital “liquid” and just pass on the costs of the tariffs to the consumer?

For the life of me, I can’t understand why our investors would rebuild steel mills when they must know that sooner or later, political pressure will cause these tariffs to be reduced or even removed…..but perhaps I am wrong?

Karen,

Totally agree with you there. These tariffs and trade barriers just increase costs for consumers and profits for the producers.

Some TWO-THIRDS of steel made in the USA is from recycled scrap iron, e.g. crushed cars and the like. So only one-third is made from raw iron ore. We’re actually pretty efficient at recycling now. This recycled steel is made in electric arc furnaces, with Nucor one of the leading companies.

The U.S. once produced 3/4 of the world’s steel, but lost much of this steel industry because the big US steel manufacturers became complacent, continued to rely on the old open hearth technology and did not invest in the newer, more efficient basic oxygen technology to compete with the emerging European and Japanese steel producers that used this new tech. Bloomberg explains the history of this decline in the US steel industry here:

https://www.bloomberg.com/view/articles/2018-03-05/steel-history-shows-how-america-lost-ground-to-europe

Some additional thoughts: Almost all scrap steel and iron in the US has been recycled for decades. Already back in the 1980s, we had a dumpster parked outside the body shop, and all steel and iron parts that the techs removed from the damaged cars went into it. Aluminum went into a different dumpster. Periodically, the recycling company would come by and pick up the dumpster. Scrap steel has value.

But now the US exports scrap steel and iron (14 Mt last year down from 24 Mt in 2011) because there just isn’t enough demand from steel mills in the US.

https://www.statista.com/statistics/209360/iron-and-steel-exports-in-the-us/

The giant old steel mills will never come back. The processes and equipment are different now for the majority of steel being made and, like virtually every other manufacturing process, far fewer people will be required to produce the product.

The uncertainty as to the life of the tariffs and whether they’ll change in one day or 1 week or 1 year mean that a 5 to 10 year project costing a billion or so to create a new mill is very much a gamble.

The most immediate effect will be over-time at existing mills, incremental production increases and plenty-o-profits for the mills that are running.

There are new steel mills being built in the U.S; for the most part, they are not the old ones rehabilitated:

https://www.trainorders.com/discussion/read.php?1,1755542

Aluminum, also:

http://wchstv.com/news/local/braidy-industries-building-aluminum-mill-in-boyd-county

I lived in steel/coal country long after the mills were closed. From my understanding, new mills are much smaller and more efficient. They don’t need the scale of the old plants anymore.

How I lone for the days when I had a great heavy industrial job and was able to move from southern farm poverty to the now defunct ‘middle class’. But alas, they will build new capacity when the US minimum wage is reduced to $3 and all benefits are cancelled. In the mean while, they will use their windfall to buy back their own stock, further enriching themselves.

They probably won’t need human labor as most of the plant will be automated Engineers and the CEO that will be about it

Sci Fi. Mills are capital intensive not labor intensive. Plants were automated years if not decades ago. All new plants are automated people still work there, they are just not in the US.

Generally speaking, and it’s a broad generalization, steelmakers outside of Asia have seen stagnating or declining outputs since 2006.

To give a few examples, ArcelorMittal’s production is a massive 19Mt below where it stood when the group was formed in 2006 and ThyssenKrupp’s is a hair breadth below (0.2Mt) where it stood in 2007. Nucor has actually increased steel production since 2012 by about 10% or 2Mt but it’s more than offset by US Steel’s continously falling production, down a massive 34% or 7Mt since 2007.

Nucor’s success can be attributed to their business model.

Many big steelmakers, starting from pretty much all these Chinese State-owned colossi, run several so-called integrated steel mills, which carry out all steps of steel production, from smelting iron ore to producing rolled steel. These steel works are built around gigantic blast furnaces, which cannot be idled when demand slows down or dries up because of energy costs (heating them up again is extremely expensive) and especially structural stresses. To cut a long story short, cooling down a blast furnace can result in such structural stress as to produce cracks which can result in expensive repairs and even more expensive downtime.

Nucor, like many other smaller steelmakers, relies instead on so called mini-mills, much smaller facilities which obtain steel using electric arc furnaces. These furnaces are much more economical to build and run than blast furnaces and production can be reduced or even stopped without damaging the equipment in times of lean cows.

The downside is that electric arc furnaces run almost exclusively on scrap metal. Sponge iron and/or pig iron can be added to keep the chemical balance of the final steel but they are not the main material.

Electric arc furnaces were introduced at the beginning of the XX century, but started to become attractive for large scale steelmaking in the 60’s and really came of age in the 80’s with new and attractive methods to produce steel wire and sheet metal.

Nucor is a US steelmaker that invested, and heavily so, in new technologies and continues to do so. Many smaller “regional” steelmakers are doing the same. Their production may not increase at the same pace as that of Asian producers but they have a more than viable business model. The same cannot be said about companies like ArcelorMittal and US Steel, which have been slashing capacity for over a decade now and don’t seem to be finding a bottom.

Its called “forced investment.” The money is extracted by taxes (or borrowing) and invested in the iron and aluminium industries through governmental koans, grants, etc. As a last resort GSE/GOE [government owned/sponsored enterprises] can be created.

The production data is important but is of little value for trade analysis purposes without reference to NET steel usage within the each nation to see how they are dependent on export or import.

From figures above and consumption data from 2016 it appears that the US is in need of less than 20 million tons a year import, while China is at most has a net export of less than100 million tons, roughly 14% of total production

I mentioned this last time and people didn’t believe me:

“Chinese steelmakers, most of them state-owned and state-funded, transship the steel to other countries, from where it either gets shipped to the US, or where it gets processed in some way and then shipped to the US.”

I remember people saying how the US can check etc. People, it took the US 10 years to find a man with a beard. The delusion in this country is just crazy.

When I first read the article, I wondered about those international steel permutations.

Any data, Wolf?

Proof?

“People, it took the US 10 years to find a man with a beard.”

Well, OBL died of kidney failure in December 2001. Perhaps you are referring to Mr. T?

ADDENDUM:

The other part of the China steel production story is metallurgical coal, or met coal, the mined stuff that is heated/partially burned until it turns into coke, which is then used to reduce iron ore into pig iron, the first step in steel production.

Again, Australia turns up as the leading supplier for China’s steel production, with Mongolia second but producing increasing quantities of this stuff. The Aussies really are China’s silent partner and main beneficiaries from providing the raw materials for China’s economic boom.

During the mid 2000s to 2012, as China’s steel production was ramping up and before these other met coal mines had opened up, China was IMPORTING LARGE QUANTITIES OF MET COAL FROM THE USA! That dropped off as the Mongolian production ramped up, and then increased briefly in 2017 during Trump’s initial detente with Xi, and dropped off again – the numbers seems to be dependent on Trump’s latest mood swing regarding engaging in a trade war with China.

So, yes, this is a global trading system, and the complete story of China’s globally dominant steel production is …. complicated.

This article proves why free trade theory is nothing but a farce. Economists talk about comparative advantage as if it were still 1850, totally ignoring the overwhelming role that finance now plays in international trade. But then again, I doubt that there are more than a handful of academic economists who understand how finance even works, such is the state of “modern” economics. It would be cynical to believe that free trade isn’t good as an ideal, but only a naive fool would believe it’s possible in the real world.

As a person in the steel fabrication business, these tariffs have injected a lot of forward uncertainty into our business. I bid projects that may be done in 6 months or in 3 years. You try to predict the future with your crystal ball…let’s just say my first 2 quarters were much slower than they should be because we began to put steel priced at 10 to 15% more in 4th quarter last year whereas the optimist competitors of mine got the jobs at the lower steel price inputs—good luck with that in the next year or so. You should know that the steel mills and warehouses will not hold prices for any length of time–in the last big steel price rise, prices from the mill were being held for one week….that gives you just 7 days to prepare a estimate, submit your bid and get a contract signed…not a realistic time-table for anything when your submitted bid has to be held firm anywhere from 30 to 90 days. There are major cost impacts all the way around.

Wilbur Ross may hold up a Campbells soup can and say, “it’ll only add 0.002 cents per can”, but he doesn’t acknowledge all of the thousands of projects with hundreds or thousands of tons of steel that are built every year–the rebar, the structural steel, the steel joists and deck, the light gage metal studs, the stairs and rails, and the decorative items. What an ignorant ass.

We ALWAYS had a “buy American” policy in our company regardless of what an owner or buyer allowed. We had more respect for our producers and their employees and knew that a virtuous chain of events happened with the support of our industries–far more than our current President who favors his steel material AND fabrication from China. As with his children’s projects, also.

Uncertainty is the devil–and the random on-and-off means that the only prudent way to proceed is to assume the worst and price in to the 95th percentile of probability. That means the buyer, and ultimately you, will pay more and it ain’t going to be $0.002 cents more at dinner. The way has now been cleared by Trump for a future where we and our business will exist at the pleasure of the current resident of the White House–individuals and businesses attacked for displeasing the resident, random agreements and broken agreements roiling the markets continually. This is how a large part of the world exists–we used to call them banana republics–at the whim of their leader, where there is no discussion or method to the policy other than the half-hidden games of the person in power who somehow comes out quite well in the end.

You mean people still buy into that “ burial at sea” fiction?

The point of Trump’s tariff, for U.S. citizens, is to encourage builders inside the U.S. to choose locally manufactured steel products first, because they will appear to be the cheapest option, despite the fact that they are actually the more expensive option if you were allowed to buy outside the U.S. By placing ourselves [myself included] in this protective economic bubble, the price we pay includes the value of retaining the industrial knowledge, skill, and production capacity (ie. manufacturing plants) at home. It also includes the protection against artificially low prices maliciously subsidized by foreign governments in an attempt to starve out their competition (ie. the U.S. and other countries).

This is fine as long as U.S. steel manufacturers recognize that this protection is temporary, and continue to reinvest their capital in efficiency improvements, rather than rest on their good fortune and come to rely on the tariff as the only reason they are still in business. I suggest that they may need help with that.

Ultimately its irrelevant whether or not the United States is able to meet world production demand of any product at any cost anywhere in the world–its not a race to the bottom. What matters most is maintaining our independence, self-reliance, and quality of life.

Our trading partners will bitch and moan, but ultimately if they raise their prices, we start making it at home. That’s a good thing for the U.S. producers short-term, and ultimately a good thing for U.S. consumers long-term as it provides more opportunity for them to become producers instead of [as has been the case increasingly over the past 10 years] idle consumers.

Honestly, I don’t care if we didn’t trade devolved to the point where we only trade unique goods and services exclusively, or not at all. Its a better worst-case scenario than becoming COMPLETELY HOPELESSLY DEPENDENT on the benevolence of our trading partners to continue to supply us honorably and at a price we can afford.

We’ve already seen Chinese rejecting our imports in several categories (corn, beef, and our waste for processing). As soon as the U.S. produces nothing exceptional, then we produce nothing unique, then we produce nothing at all [worth trading]. As with forcing a job on our pot-smoking 18-year-old xbox-playing homebody, bringing our manufacturing back home is exactly the wake-up call we need to avoid late-game disaster when mom and dad are no longer around and the industrial knowledge has left the family.

The pricing game is that the domestic producers will increase prices to near or at tariff-laden steel. Add in the effects of restricted supplies, and there are no savings to be had. There is free money on the table for domestic producers, and they won’t turn that away. Whether a on/off/on/off tariff game encourages anyone to invest significantly is another guess. More likely not.

By the way, has anyone looked at who is shorting the market on the days when these tariffs are announced ? Anyone who gets a call during “executive time”…?

Trump is playing a game he cannot possibly win. The only answer is more trade, not less. China will have the largest economy by 2025 (by some metrics, they are already the largest economy).

“Trump is playing a game he cannot possibly win.”

P 44 is playing a game nobody wins .

The fact that china, an export dependent economy, thinks it can play this game with him, and come out ahead.

Says worse things about teh administration of china than it does about P 44.

P 44 is big loud ugly American who filed action in the WTO against china for demanding IP and technology transfer, for market access.

At the end of last week The Eu stood up at the WTO and lambasted P 44 over his metals tariffs, very loudly.

Then very quietly filed and almost word for word complaint regarding IP and Technology transfer for market access against CHINA.

china has pissed EVERYBODY that matters off.

china will learn that you cant do that no matter how big you think you are.

Probably just after they learn the their supposed Eu and other friends, currently supporting them against P 44 verbally, are bigger friends with others, than they are with china.

30 to 50 years from now every nation bordering the Western Philippine sea is going to have much bigger problems than trade to deal with. .

Vietnam has the beginnings of this early thanks to chinese damming of the Mekong.

If this trade spat puts the world into another down leg of the 2008 recession, by the time it ends, things may be very different for nations bordering the western Philippine sea.

Said sea which may have taken 1 or more of those stupid chinese reef bases back under its control by then. As the reality is that Global warming driven by chinese and indian pollution is causing sea levels to rise much faster than models predicted, and the Western Philippine sea. Is A SEA SURFACE AND CO2 HOT SPOT, thanks to pollution from India and china.

Its Quiet ironic really Texas and much of india will see huge temperature increase and desertification, making much of central india uninhabitable. Southern china along with much of southern Vietnam is going under the sea. Global warming biting the home of the Modern oil industry, and the two biggest global polluters, first.

I agree with the tariffs on certain imported raw materials

when the need is based on self defense. The best place to

enact tariffs is on processed goods. Say 10-15 percent across

the board. Use the revenue to lower the Medicare age and

watch as companies bring back production to the US.

Access to the US market has got to be worth more than

access to third world markets.

The chart missing is steel consumption. And to that end per capita consumption. It should be rising in the EM, America finds some need to replace infrastructure, while many nations need to build it in the first place. The myth that China is America in the 30s is solidly misplaced. We are approaching peak global population, China even has a policy to that end. The tariffs meanwhile should serve to replace polluting (ROW) steel producers with clean industry in the US, and a good start on climate change. Does Trump really think these things through?

For example…

The “landmark” steel tower of the new eastern section of the San Francisco Bay Bridge was made in China, shipped in sections to the Bay, and assembled on location (ca. 2011). At the time, the story was that, after decades of offshoring, the US had lost its capability of even building this type of large steel structure.

I rather suspect that the main reason for going to China was cost, not lack of ability to construct such a large steel structure.

You just have to look at the steel keel of the latest US Navy carriers to realize that the US still can build gigantic steel structures, if you have $12 billion or so to spend building it:

https://www.naval-technology.com/projects/george-h-w-bush/attachment/george-h-w-bush5/

And, googling the topic of the landmark tower of the Bay Bridge, it seems to have been quite a boondoggle and a really bad idea based on a totally untested concept – I wouldn’t be surprised if the bolts or cables holding it together corrode and break suddenly at some point in the future and the whole thing came crashing down

https://www.sfgate.com/bayarea/article/Bay-Bridge-s-troubles-How-a-landmark-became-a-6021955.php#photo-7392909

Yeah, lots of troubles with that %&$*@# bridge, including that the steel bolts that are supposed to hold the bridge together during an earthquake are snapping, even without earthquake. They were made in Ohio, from the wrong kind of steel.

But it is a gorgeous bridge, and I love driving across it because now the view is awesome in every direction, no matter whether you’re coming or going, which wasn’t the case with the old double-deck cantilever span, part of which collapsed during the last earthquake (which is why this new span was built in the first place).

BTW, here is the span under construction in 2007. I took this photo while sailing past it. On the right is the old cantilever section (fixed after it collapsed during the last earthquake). The new tower was put in place years later at about the location from which I took to photo.

The old section on the right has now been demolished piece by piece (that was interesting to watch from the new span) and the steel has been recycled :-]

Click on the photo to enlarge it.

Ohio? You lie Wolf. Everything made in America can NEVER fail. I mean just look at Tesla. That thing is so incredible that all the executives are quitting in droves. They just know that America is so incredible that companies soon will not need executives, it will be self driving. Then you have other American “products” like private equity, various kinds of derivatives. They are examples of American exceptionalism. Hei isn’t “outsourcing” an American product as well?

Muppets and their delusions ….

Sorry, but the cracking bolts were the result of designer/specifier stupidity–any bolt above A325 in strength (sort of equivalent to grade 5) should not be galvanized (dipped in molten zinc for corrosion resistance) without extreme caution and careful metallurgic study due to effects on cracking characteristics (how many grade 8 or stronger bolts that are used in auto assembly do you ever see galvanized?). It’s a basic knowledge deficit. The whole bridge design issue is the same as in the Miami pedestrian bridge collapse–trying to do too much (cool design awards!!) for what is needed with not enough attention to details and connections and too much going on in small areas of the structure.

I guess Lenin was correct after all with “The capitalists will sell us the rope with which to hang them”.

We are all about shortsighted, shameless labor and cost arbitrage by multi-nationals. We’d sell our grandmother for a 5% cost reduction. Jobs leaving the US and our living standard going down? Who cares as long as the next quarterly profits are up and I get my cheap TV.

I’m all for truly equitable and free trade but addressing this issue is long overdue and I’m glad that this current administration is not afraid to touch it.

Tarrifs do not work. That will have retaliatory consequences. Tit for Tat is never a viable solution. Whether literally or in the sense of a verbal argument. Think constructively. China leads in Steel Production because of the unlimited supply of inexpensive labor. U.S. Labor is expensive and costly. The only effective way is to produce steel at competitive prices. It’ called Business. Not for the timid.

When you are a net exporter of finished goods tariffs suck. When you are a net importer of finished goods, tariffs help your manufacturing base. It’s either tariffs or a weaker dollar.

Tariffs are necessary to protect US labor and the health of the country. Your statement implies it would be OK for all production to move to China where wages are lower. Does China grant you a voting right? Does China give you property rights? Does China respect your human rights?

The freedoms people enjoy in the US are very valuable and don’t come cheap.

Should the US put exporter’s needs over the needs of

US citizens ? Hey, it just business to sell out your citizens, right ?

Steel making is a mature technology, anybody can do it. The Chinese over produce for their ‘cities to nowhere’ and the oversupply get’s dumped on the world market in anyway possible. The graph above, steel production by country says it all. Tariffs would revive domestic steel. We may be paying a few grand more for our cars but it’s all borrowed/printed money anyway. The neo-liberals will have their usual trade related tantrums in the usual financial rags, but a generation of trade related dogma has proven them all wrong.

Gentlemen;

If you open one of those inspirational books like Mechanical Engineering Handbook you will not find therein such things as Chinese steel,American steel,Zanzibarian steel…

But you’ll find there 1095 carbon steel,440C stainless steel,303 stainless steel etc.

There is abso-f…-lutely no difference between 440C steel made in the US and 440C steel made in China.Except for the price.And the price difference is tremendous.

Take for example maraging steel.That is the very stuff nuclear reactors and M16 firing pins are made of (among other things).

The price of maraging alloy 350 at the onlinemetals.com (american distributor) is 20 times higher than at the Alibaba.

Regarding Nucor:

They are using German equipment to make steel from scrap (not from iron ore !).You may read about how Nucor re-invented itself with German help in the 80′ in the book “American Steel”

US Steel was bought by Arcelor Mittal and probably closed down.You’ll see US Steel ruins alongside Lake Michigan when you’ll visit Chicago.

Bethlehem Steel went belly up down the sh… creek in 2003.

This is sad.Even more sad is this constant stupid sheepish bleating:

“American steel gooood,very gooood,Chinese steel baaaad,very very baaad”

Like it. And of course he decides to strike at CHINA via steel and THEN finds out they are number eleven, while buddy Canada is number one. It is obvious this was news to POTUS. But who knew steel was hard?

Wait until we get to autos, where there is no domestic US support for auto tariffs. I mean from the industry. Of course there is support from the usual. This is a REALLY complicated industrial ecosystem where the apprentice’s ‘help’ for the US auto sector could seriously harm it.

Re: all the Chinese steel supposedly being reexported by Canada. We know for certain there are primary steel mills in Canada, so at least SOME of the steel going into the US from Canada is made in Canada.

So the obvious question about the reexporting allegation is: how much?

And please don’t bleat if the export from Canada is actually something made of steel, Chinese or otherwise.

The tariff is on the raw material. Canadians are allowed to make and sell things made of steel.

Donald Trump presumably wanted to save jobs by imposing tariffs on steel.What jobs ?

Time required to produce one ton of Steel (USA)-

1900: 70 man-hours/ton

1929: 13 man-hours/ton

1982: 10 man-hours/ton (US Steel)

1987: 3.8 man-hours/ton (US Steel)

Reference:

Engineering: Its Role and Function in Human Society edited by William H. Davenport, Daniel I. Rosenthal (page 96)

And it is much much less now,since 1987.Steel just appears out of the f… nowhere.What jobs Mr.Trump tries to save ?

Market for specialty steel is different.Sandvik (company from Sweden) makes all razor steel in the world.Small pocket knives from Sandvick steel cost well over $100.You can bend the blade at 90 degree angle or even shave your forearm-to impress your friends.

But you can’t compete with a company which perfects and improves steel-making process for more than 300 years.

The Tariffs P 44 is using, are as outdated as his dinosaur thinking.

How does the cheating nation compete?

Pollution.

It allows emissions, poor/no waste disposal standards, and unhygienic manufacturing methods that even the US will not allow.

Sub standard facilities.

It builds dangerous structures that are cheap and environmentally harmful that put workers at risk and kill them when thy collapse suddenly. With many issue like no fire alarms, fire escapes, for workers Etc etc.

Sub standard and unsafe working conditions.

Workers are in, unhealthy, unventilated, dark, dirty, dangerous conditions, with no safety equipment supplied by the employer. With poor or no facilities to eat or take breaks if they are even allowed to take breaks during the working day.

Undeclared below cost state aid, and undeclared state ownership.

Companies have large or total state ownership, free state funding, are not required to make a profit, get loans from banks they never have to repay that the state instructs the banks to turn into equity if the banks have to high an NPL ration, at state directed price and to hold at that price until the state allows them to sell at a state directed price. basically more, free money for ever. Free land, free buildings, free electricity. No Taxes.

And the Biggies IP theft, technology theft, and copy-wright violations.

Write new tariffs, to tariff those methods, and things that the cheat is using.

Then all goods made by the cheat or goods that contain things made by the cheat will be tarrifed to some extent.

china is cheating on steel, so anything that contains chinese steel, is tarrifed. No matter where the product is made.

Then go to the WTO and tell them this/these country/’s is/are cheating like this, so we will tariff this by a large amount. At the same time remove/reduce other tariffs on nations that dont cheat or dump in your country and allow you similar access.

Then globilisation might start to do what it was supposed to. Help those at the bottom the most, instead of making china the biggest in everything, and allowing china and india in particular to abuse the global system and planet. like no nations ever have before.

The only way to make china play fair, is to turn “Made in china” into a global death sentence, for any company involve with it.

No matter how much china and its supporters pontificates otherwise.

china is still a HUGE trade surplus based economy.

So Ultimately (Untill china controls all the high tech manufacturing, which it intends to do, Which the West MUST NOT ALLOW TO HAPPEN), it needs us, more than we need it.

P 44 is doing things that needed to be done some time ago THE WRONG WAY.

Wait, I thought the US is a bastion of free trade and money printing? That your Fed prints not only to protect Wall Street banks abut also European banks? What is there stopping you from printing some, lend it to your steel makers? Why you should have done that to all your manufacturing before you first lost it to Germany, then to Japan, then to Korea (both vassals of yours), then to India’s Arcelor for a short while, and now to the Chinese. Wolf, explain why that did not happen?

“Rates”; I agree AI and other algorithms are math and thank God my land development career can rely upon engineers as I would not cut it. Yet as a youth in this day, is one to dig coal or fearlessly progress forward? While software engineering (or cad support and other less sophisticated derivations) are “not as easy as digging coal”, shouldn’t we prepare the new generation for this inevitable job market outcome? Your point however is valid and some will fall short and that is fearful.

“RD Blakeslee”, living in a world of the horse and buggy is my dream. Unfortunately, disruptive innovation happens and it not only kills jobs but is deflationary in the process: https://en.m.wikipedia.org/wiki/Disruptive_innovation

You both have genuine perspectives and ideals I cherish.

– OMG. I knew chinese steel production was high but wasn’t aware that it was this extreme.

– And how much money are these chinese steel producers losing per year/month ?

– It was Paul Krugman who already pointed out in the mid 1990s that asian countries depended too much on (cheap) labor.

– It was Michael Pettis who pointed out that the chinese economy was turbo charged by the (over-)emphasize on stimulating production and (under-)emphasized on stimulating domestic demand. The result was a strong rising Trade Surplus throughout the years.

– But as a result of this over-emphasis on production, already in say the late 1990s, early 2000s there was (way) too much production capacity in China and it resulted in a financial crisis at the same the Asia crisis broke out.

And one of the things CCP china does with all that extra steel is build 20,000 TEU container carrying ships and effectively give them to china COSCO. Again and again and again.

Which is why international shipping is now such a mess. As china COSCO is operating those free ships, below cost to take everybody Elses business as the CCP told them to.

They will keep on doing it until the western shipping companies go broke, or something stops them.

That is just one of the problems caused by CCP chines steel over production.

Nobody wins a trade war, or for that matter any war.

When dealing with CCP china, they will not change their path, until the people who dare to oppose them. PROVE that they will pull the trigger.

cultural footnote here: 1983, “All the Right Moves”, Tom Cruise

XLNT post, Wolf, thx.