Chicago’s rents in free-fall, Washington DC’s suddenly plunge, New York’s fall to third place. But rents soar in Southern California and other parts. Bay Area and Seattle “mixed.”

Four observations first:

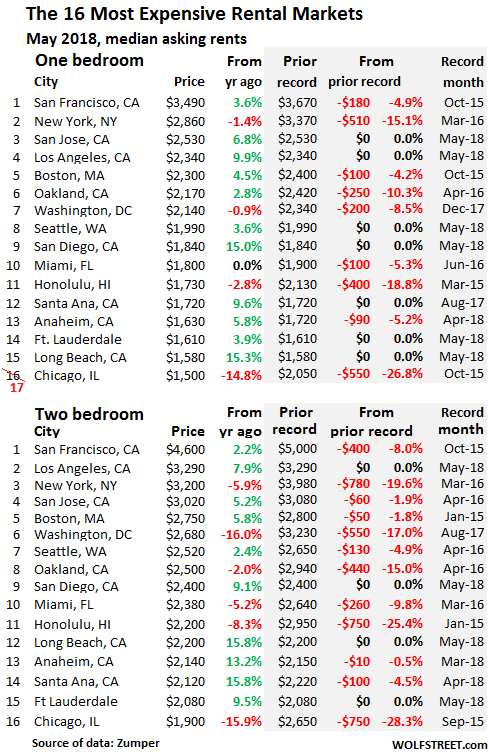

One, New York City’s median asking rent for two-bedroom apartments – long the second-highest in the country, after San Francisco – was surpassed in May for the first time by Los Angeles. Two factors: 2-BR median asking rent in New York City plunged nearly 20% from the peak in March 2016, while it soared in Los Angeles.

These asking rents do not include “concessions,” such as “1 month free” or “2 months free.” Concessions have reached record levels in New York City.

Two, Chicago rents have lost their grip. In September 2016, Chicago was still in eighth place among the 100 most expensive major metros in the US. In May, 1-BR rents fell to 17th place, bypassed by Providence, RI, and 2-BR rents were in 16th place, after plunging 27% and 28% from their peaks in the fall of 2015.

The dynamics in Chicago are, let’s say, a little special. There has been plenty of new construction. At the same time, the population has been declining as tax burdens are growing and as the city is very slowly traipsing toward what may become the largest municipal bankruptcy filing in the US.

Three, Honolulu rents are still struggling to find a bottom, with 1-BR down 19% from their peak in March 2015 and 2-BR rents down 25% from January 2015.

And four, rents in Washington DC are suddenly – did someone flick the &#@$* switch? – in major drop-off mode: 1-BR rents are down 8.5% from their peak last December and 2-BR rents are down 17% from their peak last August. Wow, that was fast.

At the same time, even as rents come unglued in some cities, in others they’re soaring by the double digits, from Southern California to less expensive markets in the middle of the country.

These are median asking rents in multifamily apartment buildings, including new construction, as they appeared in active listings in cities across the US. Single-family houses for rent are not included. Also not included are studios and units with more than two bedrooms. The data has been gathered by Zumper in its National Rent Report.

In San Francisco, the most expensive major rental market in the US, the median asking rent for 1-BR apartments rose 3.6% year-over-year to $3,490 in May, but remains down 4.9% from the peak in October 2015. For 2-BR apartments, it rose 2.2% year-over-year to $4,600 but remains down 8.0% from the peak in October 2015.

There’s plenty of supply in San Francisco. Zillow lists 1,656 apartments for rent at the moment, up 45% from the 1,149 listed in August 2016. This is not a big city. There are just 387,000 housing units in total. But here is the problem:

The cheapest units with bath (not counting rooms without bath) listed on Zillow today is a basic studio in Chinatown, for $1,100. There are only 59 units listed with an asking rent of less than $2,000. But 880 listings, or about half of the total, sport asking rents of over $4,000 (including 3-BR and up that are not reflected in Zumper’s data). Hence our “Housing Crisis.” It’s not a crisis of availability but of affordability.

This issue of availability versus affordability is playing out in other expensive markets as well.

The table below shows the 16 of the 100 most expensive major rental markets in the US. The shaded area shows peak rents and the movements since then. But I cheated. To keep Chicago on the list without expanding the list to 17, I left Providence off, whose 1-BR asking rent would have been in 16th place, and Chicago’s would have been in 17th place. In 2-BR rents, Chicago is still in 16th place. If Chicago’s ranking continues to drop, I will have to restrategize the list. The black bold “0%” in the shaded area means that these markets set new records in May:

Seattle is a saga of its own. It has possibly the largest condo- and apartment-tower construction boom in the nation. This is a huge onslaught of supply, most of it focused on the high end, in a vibrant economy. Under these supply and affordability pressures, there were periods when rents started skittering lower. But 1-BR rents just now set a new record, even as 2-BR rents remain down nearly 5% from the peak in April 2016. This is perhaps a sign that demand is weakening for the more expensive units as people make do with smaller ones.

Southern California has five cities on the list: Los Angeles, San Diego, Santa Ana, Anaheim, and Long Beach. In all of them, rents are booming, with double-digit gains in the 2-BR category in Long Beach, Anaheim, and Santa Ana.

Of the three Bay Area cities on the list, rents are down from the respective peaks in two: San Francisco and Oakland. But in San Jose, the situation is mixed, with the median 1-BR asking rent setting a record in May, but with the 2-BR rent down a tad from the peak in April 2016, similar to Seattle.

Mixed, shaken, stirred, and averaged out, all these data points form a smooth nationwide average: Across the US, the median asking rent for 1-BR apartments rose 3.0% to $1,198 in May, compared to a year ago; the median asking rent for 2-BR apartments rose 3.2% from a year ago to $1,436.

The table below shows Zumper’s list of the 100 most expensive major rental markets in the US, by median asking rents for 1-BR and 2-BR units in May, and their percentage changes compared to a year ago (use browser search box to find a city).

Down in 98th place, you’ll find Tulsa. In 1986, in one of my moves back to Tulsa, I paid $460 in rent for a one-bedroom apartment. It was new construction, and I was one of the first to move in. Today, 32 years later, the median 1-BR asking rent is $600. This is what happened: The city went through a horrible time starting in 1983, following the oil bust, until well into the 1990s. It lost about 15% of its jobs as the oil business moved to Houston and never came back. By 1988, the landlord had dropped my rent to $350; they were still trying to fill the complex! I then bought a condo in a high-rise, from a bank that had ended up with all the units on that floor. A year later, the bank collapsed, and the FDIC ended up selling the rest of the units.

Also compare these cities to The Most Splendid Housing Bubbles in the US.

| Pos. | City | 1-BR rent | Y/Y % | 2-BR rent | Y/Y % |

| 1 | San Francisco, CA | $3,490 | 3.6% | $4,600 | 2.2% |

| 2 | New York, NY | $2,860 | -1.4% | $3,200 | -5.9% |

| 3 | San Jose, CA | $2,530 | 6.8% | $3,020 | 5.2% |

| 4 | Los Angeles, CA | $2,340 | 9.9% | $3,290 | 7.9% |

| 5 | Boston, MA | $2,300 | 4.5% | $2,750 | 5.8% |

| 6 | Oakland, CA | $2,170 | 2.8% | $2,500 | -2.0% |

| 7 | Washington, DC | $2,140 | -0.9% | $2,680 | -16.0% |

| 8 | Seattle, WA | $1,990 | 3.6% | $2,520 | 2.4% |

| 9 | San Diego, CA | $1,840 | 15.0% | $2,400 | 9.1% |

| 10 | Miami, FL | $1,800 | 0.0% | $2,470 | -1.2% |

| 11 | Honolulu, HI | $1,730 | -2.8% | $2,200 | -8.3% |

| 12 | Santa Ana, CA | $1,720 | 9.6% | $2,120 | 15.8% |

| 13 | Anaheim, CA | $1,630 | 5.8% | $2,140 | 13.2% |

| 14 | Fort Lauderdale, FL | $1,610 | 3.9% | $2,080 | 9.5% |

| 15 | Long Beach, CA | $1,580 | 15.3% | $2,200 | 15.8% |

| 16 | Providence, RI | $1,520 | 14.3% | $1,590 | 13.6% |

| 17 | Chicago, IL | $1,500 | -14.8% | $1,900 | -15.9% |

| 18 | Philadelphia, PA | $1,490 | 8.0% | $1,700 | 8.3% |

| 19 | Denver, CO | $1,470 | 15.7% | $1,980 | 15.8% |

| 20 | Portland, OR | $1,450 | 4.3% | $1,750 | 9.4% |

| 21 | Atlanta, GA | $1,420 | 8.4% | $1,810 | 9.7% |

| 22 | Minneapolis, MN | $1,410 | 15.6% | $1,850 | 9.5% |

| 22 | New Orleans, LA | $1,410 | 6.0% | $1,550 | -3.1% |

| 24 | Baltimore, MD | $1,400 | 10.2% | $1,610 | 15.0% |

| 25 | Nashville, TN | $1,390 | 13.9% | $1,470 | 6.5% |

| 26 | Dallas, TX | $1,310 | 1.6% | $1,790 | 1.7% |

| 27 | Houston, TX | $1,300 | 14.0% | $1,610 | 14.2% |

| 27 | Madison, WI | $1,300 | 13.0% | $1,390 | 14.9% |

| 29 | Orlando, FL | $1,270 | 15.5% | $1,460 | 15.0% |

| 30 | Charlotte, NC | $1,250 | 11.6% | $1,370 | 4.6% |

| 30 | Scottsdale, AZ | $1,250 | 4.2% | $1,890 | -5.5% |

| 32 | Sacramento, CA | $1,190 | 4.4% | $1,400 | 9.4% |

| 33 | Austin, TX | $1,180 | 12.4% | $1,470 | 9.7% |

| 34 | Irving, TX | $1,160 | 3.6% | $1,550 | 8.4% |

| 35 | Tampa, FL | $1,140 | 10.7% | $1,380 | 12.2% |

| 36 | Plano, TX | $1,130 | 3.7% | $1,510 | 4.1% |

| 37 | Aurora, CO | $1,110 | 11.0% | $1,450 | 6.6% |

| 38 | Durham, NC | $1,100 | 15.8% | $1,270 | 14.4% |

| 38 | Newark, NJ | $1,100 | 11.1% | $1,380 | 15.0% |

| 38 | Pittsburgh, PA | $1,100 | 0.9% | $1,350 | -1.5% |

| 41 | Buffalo, NY | $1,090 | 14.7% | $1,270 | 1.6% |

| 41 | Fort Worth, TX | $1,090 | 14.7% | $1,300 | 15.0% |

| 41 | Gilbert, AZ | $1,090 | 7.9% | $1,360 | 4.6% |

| 44 | St Petersburg, FL | $1,080 | 14.9% | $1,550 | 6.9% |

| 45 | Chandler, AZ | $1,050 | 10.5% | $1,280 | 9.4% |

| 45 | Henderson, NV | $1,050 | 8.2% | $1,220 | 9.9% |

| 45 | Richmond, VA | $1,050 | 11.7% | $1,260 | 6.8% |

| 45 | Salt Lake City, UT | $1,050 | 15.4% | $1,390 | 15.8% |

| 49 | Virginia Beach, VA | $1,040 | 7.2% | $1,200 | 1.7% |

| 50 | Chesapeake, VA | $1,010 | 9.8% | $1,200 | 1.7% |

| 51 | Raleigh, NC | $1,000 | -1.0% | $1,180 | 1.7% |

| 52 | Phoenix, AZ | $980 | 10.1% | $1,190 | 10.2% |

| 53 | Kansas City, MO | $970 | 14.1% | $1,090 | 10.1% |

| 54 | Jacksonville, FL | $950 | 9.2% | $1,090 | 0.0% |

| 55 | Milwaukee, WI | $930 | 14.8% | $1,090 | 16.0% |

| 56 | Colorado Springs, CO | $920 | 15.0% | $1,150 | 4.5% |

| 57 | Las Vegas, NV | $910 | 15.2% | $1,100 | 12.2% |

| 57 | Mesa, AZ | $910 | 13.8% | $1,100 | 13.4% |

| 59 | Baton Rouge, LA | $900 | 8.4% | $960 | 1.1% |

| 59 | Boise, ID | $900 | 5.9% | $950 | 4.4% |

| 61 | Fresno, CA | $890 | 8.5% | $1,090 | 11.2% |

| 61 | San Antonio, TX | $890 | 8.5% | $1,150 | 10.6% |

| 63 | Syracuse, NY | $880 | 15.8% | $1,030 | 3.0% |

| 64 | Anchorage, AK | $860 | -1.1% | $1,110 | -7.5% |

| 64 | Laredo, TX | $860 | 14.7% | $990 | 15.1% |

| 66 | Corpus Christi, TX | $850 | -2.3% | $1,090 | 9.0% |

| 66 | Louisville, KY | $850 | 3.7% | $980 | 12.6% |

| 66 | Omaha, NE | $850 | 11.8% | $1,050 | 15.4% |

| 66 | Reno, NV | $850 | 13.3% | $1,270 | 15.5% |

| 70 | Des Moines, IA | $840 | 12.0% | $880 | 3.5% |

| 70 | Rochester, NY | $840 | 15.1% | $980 | 15.3% |

| 72 | Cincinnati, OH | $820 | 15.5% | $1,110 | 15.6% |

| 73 | Norfolk, VA | $810 | 15.7% | $970 | 7.8% |

| 74 | Cleveland, OH | $800 | 15.9% | $880 | 14.3% |

| 75 | Arlington, TX | $780 | 14.7% | $1,060 | 15.2% |

| 75 | Bakersfield, CA | $780 | 4.0% | $900 | 1.1% |

| 75 | Knoxville, TN | $780 | 14.7% | $920 | 15.0% |

| 75 | Lexington, KY | $780 | -1.3% | $950 | 0.0% |

| 79 | St Louis, MO | $770 | 14.9% | $1,120 | 15.5% |

| 80 | Augusta, GA | $760 | 15.2% | $840 | 10.5% |

| 80 | Chattanooga, TN | $760 | 15.2% | $810 | 9.5% |

| 80 | Winston Salem, NC | $760 | 15.2% | $820 | 15.5% |

| 83 | Tallahassee, FL | $750 | 15.4% | $850 | 9.0% |

| 84 | Glendale, AZ | $740 | 5.7% | $960 | 6.7% |

| 85 | Columbus, OH | $730 | 2.8% | $1,050 | 7.1% |

| 86 | Greensboro, NC | $710 | 9.2% | $840 | 7.7% |

| 86 | Memphis, TN | $710 | 14.5% | $770 | 14.9% |

| 88 | Spokane, WA | $700 | 7.7% | $860 | 0.0% |

| 89 | Indianapolis, IN | $690 | 15.0% | $810 | 15.7% |

| 90 | Oklahoma City, OK | $680 | 9.7% | $830 | 12.2% |

| 91 | Lincoln, NE | $670 | -5.6% | $890 | 7.2% |

| 92 | Albuquerque, NM | $650 | 8.3% | $840 | 7.7% |

| 93 | El Paso, TX | $640 | 3.2% | $760 | -1.3% |

| 93 | Shreveport, LA | $640 | 14.3% | $710 | 9.2% |

| 95 | Tucson, AZ | $630 | -4.5% | $830 | -2.4% |

| 95 | Wichita, KS | $630 | 14.5% | $740 | 12.1% |

| 97 | Detroit, MI | $610 | 15.1% | $690 | 15.0% |

| 98 | Akron, OH | $600 | 13.2% | $740 | 10.4% |

| 98 | Tulsa, OK | $600 | 1.7% | $760 | 2.7% |

| 100 | Lubbock, TX | $590 | 7.3% | $780 | 4.0% |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Hey Wolf, Tulsa native here who is surprise surprise located in Houston. Thanks for laying these data out, as a renter for the next few years until I can manage to move back I find this very insightful.

I do not think you can tell much from aggregate data on Chicago. Some areas are warzones. Some areas are nice. The warzone boundaries shift.

Nonsense. That didn’t happen overnight, so comparing the YoY is very reasonable and tells a lot.

Look, I think Chicago is way underrated but facts are facts, people are leaving. Something is not working there.

They’re leaving mostly because of high taxes, crime, overall corruption in government, and frankly the weather, as it is freezing cold for half of the year. Plus with a few exceptions the schools aren’t much to shout about either.

The employment report is pretty strong today. Rent will probably bounce back.

Not really when you consider that over 100 million are not included in the labor force Things aren’t what they appear from the mainstream presstitutes

I am tired of listening to this. Does NOT matter if those people are in the labor force or not because demand’s going up everywhere. Perhaps the gloomers are equivalent to the presstitutes?

Excerpts from today’s ISM purchasing managers index report (quoted from a poster in Naked Capitalism):

“We are currently overselling our forecast and don’t see an end to the upswing in business. We are very concerned, however, about the tariffs proposed in Section 301 and are focusing on alternatives to Chinese sourcing.” (Transportation Equipment)

“Very difficult to hire skilled and unskilled labor.” (Food, Beverage & Tobacco Products)

“Sales remain strong. Lead times and direct material costs are soaring.” (Machinery)

“Suppliers are seeing price increases and trying to pass them on.” (Miscellaneous Manufacturing)

“Severe allocation, long lead times and upward price pressure, particularly in the electronic components market, continue to hamper our ability to meet customer demand and our shipping schedule.” (Computer & Electronic Products)

That’s main stream media story. Do you know why are you here? We are here for facts, not stories peddled by main stream media. Tesla is basically collapsing, but it’s shares are $292; is that because Tesla is making profit like there is no tomorrow? No, because of all the stories which are told.

Late cycle boom – Wash, rinse, repeat – Same as it ever was…

Employment is a lagging indicator. That does not mean a crash is coming but when I hear people beating the employment drum I start to watch for signs of recession.

Ha – You still haven’t figured out the relationship between media and uncle Fraud? Uncle Fraud wants YOU the consumer to remain confident and apparently you are because you rely on them for your information. good for you.

Perma bears (myself included) have repeated the same thing for what about 8 yrs now? I think we perma bears are actually the “mainstream” now. and we just “parrot” back what we read on doom blogs. We all think we a “contrarian” and really clever, but we are really mainstream.

We have all heard the same thing over and over since 2009….”this is all a money printing house of cards”, “its all fake”, “it will collapse any day”. “employment data is fake”, “all milenials live at home”, “subrime auto loans are about to collapse”. “student loans will take everything down”, “we are on the cusp of a pension collapse”.

Problem is that has been repeated now for easily 9 straight years. Yet this market keeps going on and on and on and on and on. To the point in Aug this will be the longest stock market rally EVER. And in one year this will be the longest recovery EVER.

The wage growth was nothing to talk about though

What happens when this volatility hits the rent-backed magic money machines Wall Street is hawking?

If single family homes are getting bought up with increasing vigor by institutions, then that adds to supply, no? Do you suppose the pro formas build in cyclical dips to top-line revenue or do they assume straight-line forever growth?

This is also part of the CRE story. With cap rates plunging, the only way to make assets perform is to defer maintenance. But at some point in the future, those costs will have to be written back in.

If companies had not decided to stop the working from home deals, this would hwve collapsed years ago already.

I don’t see how a renter can independently get some answers to a smell test. How does a small landlord figure out the rent? S/he either hires a real estate agent or does some research on the web. The real estate agents need to get the task done, so they do some cursory research. In either case, research is looking up the asking rents from big corporate landlords or Zillow. The corporate landlords have a bunch of MBAs who are equally clueless. They have data models but why bother when Zillow is publishing the output of its data model? If the landlord spots an arbitrage, his rents reflect the information. Zillow can then simply update models and everybody can then use Zillow as the source.

So I conclude it is Zillow that’s driving the rent hike. Going rents are being borne by the market because the renter won’t move due to laziness, kids in school, office close by, or something else. So there’s a bluffing game afoot and most renters blink.

I say independent ways of verification are missing because the Zillow phenomenon may be driving a tulip mania. It will be interesting to figure out the contribution of Zillow to the rent raise phenomenon.

If you’re a small-time landlord and you’re not sure what the market for your unit is, test it! Start out high and come down. At some point, you’ll start getting some foot traffic. If no one bites, come down a little further. Also: fix or update what seems to be getting in the way — it’s not always price alone.

The method you suggest is what I have seen the small landlords do. Zillow is what they use as the starting point. When they reduce the prices, Zillow faithfully reflects the prices *until* the unit is rented. It does not tell what the unit rented for. Instead, it reverts to the price point it thought it should go for, in the first place. May be they don’t get updated numbers.

Obviously, I am just sampling the data, so I may have seen a bad batch.

But from my corner of the world, what I see is this, the numbers are set by Zillow and they are finally assimilated by Zillow at the end. In that sense, Zillow is the God of renting. Rent values come from it and when their use is over, these numbers rise to their heavenly abode, which is also Zillow.

We have never been able to get as high a rent as our zillow estimate says we should, and quite frankly, especially for the rental estimate I have found Zillow to be very inaccurate and always high, at least for our neighborhood. We are tenants in the home we live in and again rent for hundreds less than the Zillow estimate.

The asking rent listed on any of the sites, including Zillow, is what the landlord puts in.

People get this confused with the second number that Zillow shows, the Rent Zestimate®

So for example on this apartment in SF, you see the asking rent of $4,200 (this is what the landlord is asking for), and then you also see in small print the “Rent Zestimate®” of $3,695 — this second number is based on Zillow’s imagination and has nothing to do with the landlord.

https://www.zillow.com/homes/for_rent/San-Francisco-CA/67394604_zpid/20330_rid/38.008607,-122.150116,37.627284,-122.741318_rect/10_zm/

God Zillo!

Or for apartments, just look at similar sized places in the same zone and see how much they are charging. That way you save some time.

Guido: I totally agree. I keep saying this; I just recently moved, and good one bedroom apartments in South Bay are generally $1600-1800 and nowhere near the inflated $2,530 that Zillow prints; there are so many vacancies even at $1600-1800. If they ask for $2,530, no one is gonna even bother to go and look at it.

And even at $1600-1800, I see a lot of Indian tech workers 3-4 of whom live in a one bedroom apartment and divi the rent 3-4 ways.

It’s all smoke and mirror. Zillow says $2,530, and when a fool who doesn’t do his homework sees $2000 thinks he has a bargain.

How do people make it? Where do the seniors go? Tulsa? I just had my wife try and guess what SF median was. She was off by $1,000 and she was guessing as high as she could imagine. I simply no longer understand why the streets are not full of angry mobs? Then, I wondered about suicide? It’s only jumped by 24% in the last 15 years. (sarcasm/irony alert)

“You become irrelevant very easily in the Bay Area,” Meyer said. “The rapidly changing technology is very different and didn’t exist a generation ago. Today, if you don’t know the spreadsheet program that just got developed, there’s someone 20 years younger than you who gets the job.”

Evolving job market

The quickly evolving job market might also help explain why suicide rates among the middle-aged, whose professional skills tend to be less current, have jumped more than most, Meyer said.”

https://www.sfchronicle.com/bayarea/article/Big-increase-in-suicides-in-state-nation-7304842.php

Paulo – I’m very low income (going into tech was a very poor choice) and went to the local ER for a medical problem last night.

I got absolutely f*cking 5-star treatment. I got a CT scan to see if I’d broken anything in my brain; I had not, and I and the doctors were able to suss out the underlying problem and I’m getting treatment for that. The prescription will cost me $10 at most. Because people up to 200% of the poverty line are treated for free and my being at about 120% of the poverty line, my treatment will be free. The doctors urged me to come back if I have any problems or questions. The hospital itself is excellent; I even got to watch Seinfeld on the TV in the room I was in.

Transport to/from was by cab (no smart phone) and overall it cost $50 because I’m a generous tipper. That’s a gas tank fill these days. How many of you have a friend who’d take you to/from the hospital, the from being at 2:30 in the morning, for a tank of gas? Think carefully now … darned few.

In flyover country it’d be “just f*cking die”. There are reasons why people stay in the Bay Area and this is a big one.

About middle-aged suicides, I hear you. Electronics technician is about as current a skill as buggy whip maker. Buying/selling electronics surplus is a thing now, but it only makes a bare living. Street musician pays fairly well, but since I can’t afford barber college or any kind of trade school, I think training myself in sign painting, a thing I have a little bit of a background in, may be my best hope.

Thank you for spending someone else’s hard earned money since healthcare is socialized, then bragging about it.

eeeeew…. REALLY??? i feel like you wiped snot on me first thing in the morning.

Jon – unlike yourself, 66% possibility of being overweight or obese, I’m at my ideal BMI. I honestly thought that since I’m thin, very physically active, etc. that my blood pressure would be fine. I thought I could drink at a certain level and be fine.

I got a sudden headache after lifting something heavy (heavier than one of your 12-oz. curls; I work for a living) which got better the next day and then WORSE in the evening after. From what I remembered from First Responder and the first half of EMT school, this was Not A Good Sign.

If I were a Real Self-Sufficient American(tm) I’d have called myself a wuss, “just walk it off” etc. Brain bleeds are great; they can progress over days and one day you go to sleep and don’t wake up (this is actually Darwin doing his bit on Real Self-Sufficient Americans(tm) by the way). If they’re caught early enough, if I remember my training right, they can be cured with drugs, no surgery needed. Sooner checkup = cheaper.

So I used a combination of light rail and taxi cab to get down there, got checked out, and it was determined that while I might look healthy as a horse, be very active, thin, etc., my blood pressure was sky high. No more drinking for me, non at all from here on out.

My prescription cost me $5.50. It’ll be an 8-day taper down and then no prescription needed at all.

And the funding that makes the hospital part paid for for me is a private non-profit fund paid into by non-asshole rich people (they do exist) and in fact the hospital has been in San Jose since the 1860s or so, so they’ve had time to invest the charity money and make it into more charity money.

I harbor a not-so-secret theory that a good number of you people don’t live in California and don’t know what the hell you’re talking about as you snipe from Gary Indiana or whatever backwater barely-berg you’re stuck in.

And whatever wealth I am able to amass; I’ve got another 30 years to do so in; will go to places like this fund, Planned Parenthood, and such organizations. Oh, and George Soros, gotta leave something to George Soros.

If you are in tech, you basically have to have no life. My manager messages Friday evening at 5:30 PM that we need to get this program done. I said fine, it will take 2 days to do, and he goes why? This is so easy; I thought you can do it tonight! And I’m one of the best programmers that these morons could hire. They expect you to spend your Friday evening not only to work, but also do the work that takes 2 days in a few hours. And the icing on the cake is that you will do it for free; yum yum.

Of course no way, I’d do it. If they can find someone better, they can be my guest. But just imagine the expectation; I doubt any other industry is like this.

Tell them no? If you don’t then they will walk all over you.

I’m in tech, in expensive area but make pretty decent money. Can’t buy a decent house (single income, could easily buy $700K+ if dual income) but otherwise feel it’s overwhelming how many open jobs there are when I’m looking for better opportunities (working on moving that salary up even higher so can do it on single income.)

i just finished Corey Pain’s BRILLIANTLY epic book, LIVE WORK WORK WORK DIE: A JOURNEY IN THE SAVAGE HEART OF SILICON VALLEY.

i felt nauseous reading it much of the time because it underlined what i felt already and feared. i figured i must MUST be missing “something” as i didn’t understand who ANYONE would/could get off on completely annihilating their own in their own home because you can NEVER relax or enjoy anything because you’re constantly famished and greedy or afraid someone’s gonna take your stuff so’s they can eat or sleep inside from the elements.

Corey Pain’s book: it’s the only book or THING i’ve read about where we are now and how cruel and savage this vision of worldwide domination feudalism and cheap labor is and more importantly WHERE DID THIS ABSOLUTE MEANNESS COME FROM???

jon’s comment above is WHY I’M ABSOLUTELY TERRIFIED TO GROW OLD HERE AND BE BROKE. when i passed out on the street, right before, i choked out a request for water to an oblivious tech kid who told me to go inside and get water myself on his way out.

jon’s comment is chilling and COMMON now and why i actively sabotage whatever i can NOW before i get too old to fend off jon and the likes of jon foisting me out onto the street and wiping their snot on me til and beyond my death.

i’m working out for the inevitable revolution i don’t want to happen like i fear it will.

There is a difference between paying for services used and what something costs, rather than bragging about getting services for free. You got them for free because someone else subsidized them essentially. I’m not a supporter of capitalism in the healthcare industry either.

He didn’t get it for free. He’s a taxpayer, just like you and me, and he’s paying sales taxes, and some of this money is put into healthcare here. It’s a form of insurance.

When someone who is insured by Anthem needs that $1 million cancer treatment, Anthem (hopefully) covers it, but his premiums weren’t nearly enough to pay for it, so other people are paying for it. The entire principle of insurance and risk sharing is based on this.

Wolf, I don’t quite agree with what you are saying about healthcare. If you are an independent contractor and have ACA (ObamaCare) and do qualify get a subsidy, you pay massive premiums with massive deductibles, so people below the poverty line get health care for very, very cheap. This is how ACA is set up. You can make as little as $50k a year in the Bay Area as a self-employed contractor and have monthly premiums that are $1,000+ a month with $8,000 deductibles. So I think it is a bit bad taste when someone brags about how cheap they get ACA because they live below the poverty line. This IS at the cost of others! I know some people who game the system and don’t show taxable income (yet have decent net worths), and they get dirt cheap ACA. It isn’t fun to hear this for people who work very hard, save their money, live very healthy and never go to the doctor, but are faced with gigantic health premiums via ACA. T

In many other industries it’s called, “forced overtime” and or, “wage theft” and if you don’t do it you eventually get “marginalized”. Of course there are the labor laws that apply but 99% of the slaves aren’t even aware.

(I was deeply involved with the forced overtime violations many years ago and fighting the company on behalf of others mostly younger unaware youngsters damn near killed me)

To provide the tech positive anecdote…. I’ve been in tech for twenty years, switching from hard science academia. I’ve never regretted it and can’t think of a better life. Telecommuting, great salary, work that is enjoyable, smart colleagues, meritocracy, less regulation and credentialing…. tech has it all. Yes, early in your career you will have to sacrifice for the greater good and pull some all-nighters. The smart people known when to do this and when to push back. If managers never give you credit you walk and get a better job.

Nothing changes about SV tech life which is why my son dropped SV and went to work for the State of Calif. a 8 to 5 job and now has weekends and evenings to enjoy his life.

Gov’t, and Unionized.

Sir your son is a genius! Congrats!

They opened some new affordable rental housing in SD, 800 for a studio, and income less than 58K a year, and they were oversubscribed by a factor of about ten. Do they factor these into the data?

The data is based on apartments listed for rent in the various commercial apartment listing services. I don’t think that affordable housing is advertised that way. They’re handled separately in most municipalities.

I still check actual rents, here in Seattle, and I would only agree with the term “mixed” to describe rents here if the meaning of the word mixed has been changed to mean “insane”.

The problem, I believe, with your reported rental data is it includes “income capped” apartment complexes – you can’t make over 44k, as a single person, and rent in these complexes. If you qualify the rent on these 1 bedroom units start as low as around $1200. When you add these units, built for baristas and other service workers, into the mix it skews the data. The average professional, making more then 44k, is stuck paying $2500 to $4000 for rent and landlords are very picky about who to rent to.

A generation priced out of houses is going to see a sharp drop in the fertility rate. The average young women will think twice before making babies with a guy living with his parents or four other dudes sharing a 2 bedroom apartment. This makes me wonder how well Bernanke/Yellen thought through their great asset inflation (currency debasement) policy. The policy served Ben very well, he appears to have been given a quid pro quo position at a high frequency trading hedge fund – where I’m sure he is richly compensated for whatever “work” he does, but his debasement policy left an entire generation without hope of living independent in a secure housing situation. But I guess the important thing is the central bankers are doing very, very well when they step through the revolving career door.

Someone should ask Ben if he has personally written any HFT algorithms that have brought profits to the firm and wonderful benefits to the economy overall, or is his position a little more managerial or bureaucratic as you might say – nice work if you can get it!

Oh, but I’m sure those who raise these issues are really just the crazy fringe of society, crafting headwear out of tin foil. What could possibly be corrupt about the ex-head of a central bank collecting millions for a figure head position from the finance world into which he sent a tidal wave of easy money?

The mega landlords expect your income to be 3 times the rent. A person earning $44K would only qualify for a $1200 a month apt. They would have to get a roommate earning more than that to qualify for a $2500 a month apt.

This doubling and tripling up of people in homes is what is suppressing demand. I saw this in Florida with the married children moving back in with their children. Once you get used to it why bother moving out.

In 2018, NYC metro will add 60k in new apartment, there is 250K vacant apartment off the market for various reasons, and NYC is building 10k apartment for low income people. Type in Williamsburg, Bushwich, Long island city in Craigslist, and thousands of apartments will show up, all we need now is a recession for the dominos to fall, all of those were financed to the max.

The DC rental price decline may be at least partly related to shrinkage in Federal employment.

http://www.standard.net/Business/2018/03/18/DC-economy-slows-as-federal-employment-shrinks

Residential sales are not so easy anymore, either.

Three or four years ago, good houses in Arlington, VA (a suburb of DC ) were being bought at high prices, torn down and replaced with McMansions. That has stopped; my son, who recently retired as an AT&T employee doing government contract work, has been having difficulty selling his house there.

I don’t think it would be possible to do it with Zillow, but if there was widespread fake listings on Craigslist for apartments at much lower prices I wonder if it could take the market down over time? Really getting the incorrect data into Zillow would be the ticket and that would be difficult.

A friend’s wife used to work for a large property management firm in California and I know she said it was her weekly duty to call all the competitors every week and fill out a spreadsheet for the bosses with the upcoming price changes and any specials that were upcoming. All the companies colluded together to fix prices so the market didn’t move much. This was Silicon Valley.

Most of the big apartments have software that dynamically price apartments now. No more calling with a spreadsheet. This software is hooked into major anaytics firms that get much better rent data then Zillow. The dynamic pricing literally changes by week with the software do to supply and demand and seasonal. Nov-March it is always cheaper.

I wonder what is going on in Hawaii…………more supply??

When we used to vacation in Hawaii you could rent a one bedroom condo in summer between US$800 to $1000 a month. Last time I checked those prices for vacation rental units were around the US$3000 a month area.

In the USA now when you rent an apartment what costs do you have to pay for? Just the rent or are other things included such as water, cable, etc?

Does the landlord pick up the monthly condo fees or are those passed on to the renter?

Here in Oz when I rented you had to be careful depending on your rental contract.

Way back then if you had a one year contract you paid for water used, but not the fixed monthly water and sewer fees. Garbage fees were included too.

However, if you wrote a multiple year rental contract then the renter was responsible for paying all of the water costs…………

In the US, the lease needs to spell out what is included in the rent payment and what is not included. Condo fees (HOA fees) are included. I have never heard of a lease that says the rent payment does not include the HOA fees, and that they need to be paid by the tenant separately. I mean, maybe somewhere this crazy conditions exists, but for the owner, this is a huge liability: what if the tenant pays the rent – and therefore you cannot evict him — but he doesn’t pay the HOA fees and you lose your condo (unless you pay them anyway)?

If you rent a house in an HOA in Florida you have to pay an application fee to the HOA which is usually $100-200. The landlord pays the monthly fee but not this application fee.

When I had my condo in Hawaii I paid the monthly fees and the tenant paid rent. IIRC the water was included in the monthly fee as there were no meters for each individual unit.

At that time the fees were under US$100 a month and the condo was cash flow positive to me………………

Something that would probably be difficult to do now in Hawaii even with low interest rates.

Like Wolf says, what is bundled into the rent varies from one apartment to another in the US and it just depends what is specified in the rental contract. I’ve never seen HOA fees separated as a separate monthly expense, though.

I’ve probably lived in at least 10 different rented apartments and it’s all over the place regarding what is bundled. In a university-owned rental I lived in, they bundled in landline phone, internet, cable TV and all utility bills. One of the last rentals I was in, I had to pay electricity, internet and phone but not natural gas (only used for the oven/stovetop), water or garbage. In that place, I’d try to do some baking when it was cold since I had to pay for electric heat but not the natural gas and baking helped keep the apartment warmer (and better smelling).

Whether tenants get charged individually for utilities often comes down to whether each apartment has individual metering for things like electricity or natural gas or if there is only one meter for the whole building. The trend seems to be for newer buildings to have more individual metering so that the landlord doesn’t have to predict costs for tenants’ use of electricity, natural gas or water and include those costs as part of their rent.

On a tangent, what is standard and included in an unfurnished rental seems to vary from country to country, too. A refrigerator along with built-in kitchen appliances like stove/oven and all plumbing fixtures are generally included here.

I was shocked to find out from a friend moving to Germany that many unfurnished apartments where he moved do not typically include plumbing fixtures like the kitchen sink and maybe even some bathroom items like sink or toilet. He said he would’ve been expected to bring his own fixtures to be hooked up when he moved in for many apartments. He avoided the hassle by moving into a rental formerly occupied by an American who didn’t want to uninstall the kitchen sink or other plumbing fixtures or take them with him when he moved out. I guess the Germans are picky about their plumbing fixtures? Taking your sinks and toilets with you from apartment to apartment seems very odd to me.

Yes, things differ by country.

The last apartment I rented in Japan had no lights except in the bathroom and toilet, heating, or any appliances.

You have to buy them.

In addition at that time you had all the other costs and fees as well:

One month rent in advance;

One month rent to the RE agent as a fee;

Three months security deposit;

IIRC two months ‘gift money’ to the owner for the ‘privilege’ of renting the place from them. Luckily that was a one-time payment and not needed upon renewal of the rental contract.

And then was the deposit for the telephone to NTT – that was a whopping 100,000 yen back then. When we left we sold the ‘bond’ or whatever, but I don’t recall how much we got it for.

Now there are many apartments for rent that don’t require the ‘gift money’ so that is better.

Parking wasn’t included in the rent and that was IIRC 15,000 yen a month.

(And FYI many landlords in Japan will not rent to foreigners and it is totally legal. Nothing you can do about it.

In fact at that time there was actually a law on the books that prohibited a landlord from renting to foreigners for a period of within one year of construction if the building had been financed in part or totally by the Japan Housing Finance Authority or some such entity.

Evidently the law was put in place originally the Allied Occupation Force and then kept by subsequent Japanese governments. I don’t know if it still on the books or not…………….. Probably though.)

I thought maybe International students would be a culprit for high rents in SD and guesed UCSD sould have a large number of Int students. I found this site below. Interesting data. China is No.1 counrty source for Int students, UCSD No. 2 for largest Int Student enrolements ( 14,300 Int studens enrolled. Helps support rents but wouldn’t be a pillar). interesting that the total number of Int student enrolement started declining in 2016 and even further in 2017.

Lots of interesting data. Quick read with nice graphs also.

https://www.migrationpolicy.org/article/international-students-united-states#Geography

Believe it or not we have around 700,000 international students in Australia. Yet our population is 1/14 that of the USA!

Wow, great source of economic activity for the country. The article I posted, above, lists this economic benefit, for the 1.1mil students in the US as…

“International students contributed nearly $37 billion to the U.S. economy and created or supported more than 450,000 jobs, according to NAFSA estimates.”

Hey – speaking of rental housing, anyone have thoughts on http://www.roofstock.com? You can buy rental housing sight unseen! Looks like a marketplace for institutions to dump inventory…

My daughter is paying 5k a month rent in San Mateo so she just purchased a home in Half Moon Bay with her boyfriend at 1.1M and put down 750K. Her new monthly house payment split with her boyfriend is 1K a month. She saves almost 50K a year by biting the bullet and buying a house over rent. She has a small business and would like to hold onto the cash but home rental cost makes her decision for her.

Awesome.

But wait… not everyone has the cash to put down $750K. So you cannot compare rent to mortgage payments with that kind of down payment :-]

Not really cause she could just buy Amazon stock with the 750k and double her money in a few years!

My daughter would have loved to put the money into other ventures that on paper might generate a good return but rental cost in the Bay Area today challenges those conventional views which is why I made the post to show in real time how the combination of high housing prices mixed with very high rental cost are forcing people to make unconventional choices.

Surprised by the rental price growth in San Diego

We don’t have lot it high paying jobs

@Alex with the high blood pressure:

High blood pressure usually has a genetic basis. Abstaining from ethanol will probably not be sufficient to treat your hypertension. Please check your blood pressure frequently. You can do so for free at many pharmacies. Untreated hypertension causes cumulative weakening of the heart and damage to the small arteries in brain and kidney, as well as being a risk factor for heart attack and stroke. If the lower number (diastolic) consistently exceeds 85 mm mercury, you should consult a physician for treatment.

Sandy – thanks for the advice. Indeed, the plan is to firsts get fully detoxed from ethanol and then see if my BP gets down to normal range. If not, then I need to work on getting it down to normal, through changes in diet, medications, whatever it takes.

I have one of those automatic testers and these days am checking myself at least once a day. I have to keep myself in good shape to be useful in the coming Socialist Revolution!