Slightly good news for workers, bad news for employer profits, and combustible fuel for the Fed’s monetary-policy tightening machine.

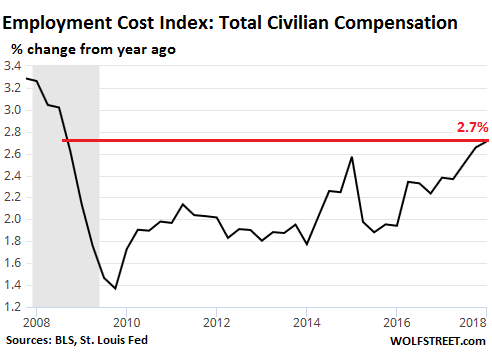

Total compensation costs for civilian workers — which include wages, salaries, and benefits of workers in the private sector and in state and local governments — increased 2.7% seasonally adjusted, over the past 12 months ending in March 2018, up from a 2.4% increase in the prior quarter, the Bureau of Labor Statistics reported this morning. This was the fastest 12-month increase since Q3 2008:

Wages and salaries account for about 70% of total compensation costs. Benefits account for the remaining 30%. As we’ll see in a moment, the surge was mostly caused by wages and salaries in the private sector. Benefit cost increases, while always too much, were in the middle of the range over the past decade. And wages and salaries for workers at state and local governments inched up less than inflation.

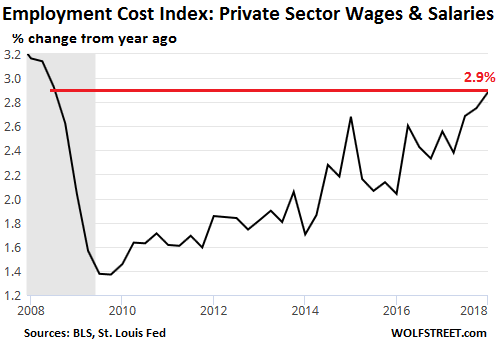

Wages and salaries in the private sector jumped 1% over the past three months, the fastest quarterly increase in 15 years (since Q1 2003)! And for the 12-month period, they rose 2.9%, the fastest since Q3 2008:

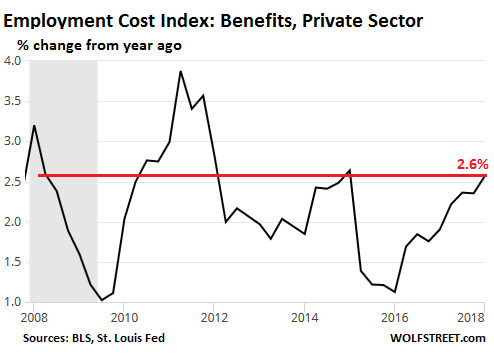

Employee benefits in the private sector rose 2.6% compared to a year ago. The sub-category of healthcare costs rose only 1.5% over the 12-month period. This chart of private-sector benefit costs shows that the year-over-year increase in Q1 was smack-dab in the middle of the range of the past 10 years:

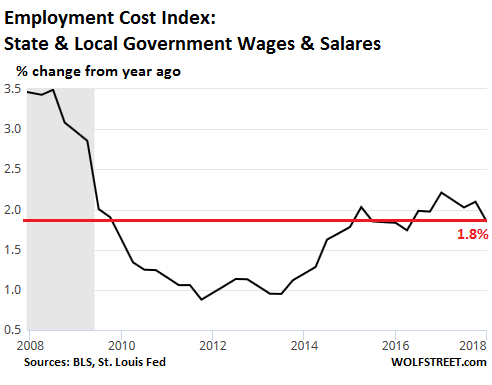

At state and local governments, it looked a little less promising for workers. Total compensation costs rose 2.2% year-over-year, with benefit costs surging 3%. But wages and salaries rising only 1.8%, roughly in line with the past three years, and below the rate of inflation (CPI):

So this time, it’s not government pay scales that push up the averages. It’s the private sector.

The surge in private sector employment costs – particularly of wages and salaries – has figured high on the Fed’s inflation-worry list, based on the classic theory that rising wages and salaries will help create demand from consumers that have more money to spend which will help push up inflation; and this additional demand will enable employers to raise their prices to maintain their profit margins as their compensation costs rise, now that consumers are making more money. That would the beginning of the circularity that the Fed frets about.

This type of data is precisely what confirms the Fed’s more hawkish bent. And it comes on top of the other factors the Fed has been mentioning in past pronouncements, such as “elevated” asset prices, the “search for yield,” and the risks to “financial stability” that they pose in a highly leveraged financial system. But it’s not the type of data, at least not yet, that will make the Fed deviate from its plan to move “gradually” so that the economy has plenty of time — years, as the first rate hike was over two years ago — to adjust to higher rates and tighter financial conditions.

Bonds, junk bonds, spreads, commercial real estate, “leveraged loans,” over-leveraged companies… all get named as risks to the banks. This is why “gradual” tightening will continue for a long time. Read… Now Even a Fed Dove Homes in on the “Everything Bubble”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Memories…

Mr. Greenspan once sited wage and employee benefit increases as a major source of price inflation.

”Let me stress,” he said at one point, ”that the current rate of inflation, let alone an increase, is not acceptable, and our policies are designed to reduce inflation in coming years.” – Alan Greenspan

He then continued hiking rates and caused what he later called “wrenching” changes in wages and employment.

What will Jerome do?

I think he will do the same.

I think this stems for CB’s understanding that wages are the last inflation-shock absorber and once that spring snaps back inflation waves will diffuse very quickly through the economy (in a positive feedback loop): It is no solace that your salary is +10% if everything else is CPI+10%+delta

Personally, I am starting to think that the market will dare the FED and deliver a turn-in-box if necessary to force the FED to backpaddle (losing the remaining credibility it has left) Then we will witness another much larger bubble soon thereafter until something very big gives.

*meant turd-in-box

The cash labor force enjoys these rate hikes, no unions, no collective bargaining, just raise the price you charge you clients. Go ahead Jerome, Make My Day!

Might this be a sign that companies are finding it harder to recruit skilled people ?

More like is getting harder to get unpaid interns and minimun wage workers to do everything and then not sue for fair and or unpaid wages.

So much for “a rising tide lifts all boats”.

Labor shafted again.

Short term – short sighted.

This recent uptick in worker compensation does not make up for the past 10 plus years of compensatory erosion. You must ask yourself a question; Do I really feel more well off financially today, than I did 10 years ago? Be honest with yourself. Well, do you? That’s what I thought.

Speaking only for myself……… Yes.

Very very much so.

10 years ago was 2008-I was a car salesman (now retired) and 2088-9 were horrible!

That is the wrong question to ask, as, normally a 35yo should in theory be doing much better than her 25yo self even if the general standards of living are eroding.

10 years. You must be kidding. Labor compensation has gone down since 1980 and the advent of deregulation. I went from management to union and back to management and received a 60% increase in wages due to union wage scales in a year from 1979-80. Get real.

If there are two things the Fed seems to be very good at is over-reacting and under-reacting. The Federal Reserve, which is not actually Federal in the true sense of the term, and has no actual reserves, was established in 1913 to supposedly help smooth out economic wrinkles (booms & busts). But at times, it seems to be the very source of such occurrences, or at the very least, has helped to substantially increase their severity. Most Americans have no idea that the Federal Reserve is owned by non-governmental financial interests, many of which, are actually foreign.

“Regarding the Great Depression,… we did it. We’re very sorry. […] We won’t do it again.” ~ Ben Bernanke, Nov 8, 2002

What’s that old saying? “Once burned, twice shy.” And there’s also the other one: “Burn me once…”

But at times, it seems to be the very source of such occurrences, or at the very least, has helped to substantially increase their severity.

Another one cracks the code.

Looks like the Gigs/Scraps economy scams that allowed to save cost in hiring are ending. No more unpaid interms wotking for months to get “valuable job experience” or minimum wave jobs were you end doing way more that it says in your contract and don’t get paid for the extra work…

Here:

https://www.theguardian.com/news/2018/mar/27/why-im-suing-over-my-dream-internship

https://www.theguardian.com/news/2018/apr/17/get-rich-quick-silicon-valley-startup-billionaire-techie

Really enjoyed that second one. Thanks!

Private sector means service sector and the service economy is a vicious loop which filters into government spending. You get a raise and everyone is waiting for you. As for government jobs I see teachers in many states have walked out for higher pay and won. Hasn’t made it into the data apparently. There is a myth that raising rates cools inflation, the Fed ought to back off the rate hikes. The Fed needs to pay attention to the long term trend, which is deflationary, which can be fixed by raising rates, even if there is a short burst of inflation, the next recession will take care of that.

Why do we think the Fed doesn’t want inflation?? Inflation is the hidden tax that quickly wipes out debt load.

I think they want as much inflation as they can get (3,4,6%) but in these times, it has been mostly stagflation with devastating effects except for the very well paid.

Wage and salary increases come with a cost since very few industries have any significant productivity gains. In fact, the only real gain left for most is downsizing their staff. Of course government continues to think they are entitled to cost of living increases but that too has consequences with people boycotting tax increases by leaving for good (aka the northeast tax donkey’s).

It’s a complex situations, but I don’t expect wage/salary inflation to start and spiral out of control like the 70’s. Unions and baby boomers were the two main drivers for that and those conditions do not exist now.

Wages and salary increases for many less skilled jobs are hamstrung due to overseas wage arbitrage.

The Fed wants higher rates (badly) because they want some dry powder. So I agree they are happy to see this inflation.

It is really not a lot of inflation yet. Seems to me the scarier risk is still the other way. Expect 4 rate increases this year but then a pause. Something will go wrong . . . Wish I knew what for sure. :)

I think that’s more Jim Rickards B.S. The first thing they are preordained to do, is protect the dollar. The second priority is monetizing government spending, you can’t do one without two. They have to raise rates in order to get government funded, and that means competing with the stock market, which is their nemesis at present. Reallocate or Die!

[Why do we think the Fed doesn’t want inflation?? Inflation is the hidden tax that quickly wipes out debt load.

I think they want as much inflation as they can get (3,4,6%) but in these times, it has been mostly stagflation with devastating effects except for the very well paid.]

Inflation is a scam…

Question, can an oz. of gold buy the same item it could 30-40-50 years ago?

Bring back gold!!

Time to RAISE EM UP ! And crash the economy…but not raising them would be worse. The fools put themselves in this position

I wouldn’t mind seeing longer charts, it doesn’t even look like the wages have recovered from the last recession. Inflation has grown faster than the wages.

Chart inflation on consumer goods, make sure it includes fuel and food for real world effects. I have a feeling these wage charts would look horribly tiny in comparison.

Once a year in September, I post an article on the real wages by gender going back to the 60s, based on data from the Census’ American Community Survey which is released at that time. This is brutal and depressing data, especially for men, and once a year is enough :-]

Here are the two from last September:

https://wolfstreet.com/2017/09/12/the-terrible-facts-about-the-real-earnings-of-men/

https://wolfstreet.com/2017/09/14/so-exactly-which-households-got-the-spoils/

One possibility:

1) Employment costs rise, causing inflation, causing the Fed to raise rates for whatever reasons are on the table at that moment.

2) Rates going up and provide interest income to savers who weren’t eviscerated over the previous decade. This income is spent by many, especially retired people. Also, employees who earn more spend more.

3) The economy expands due to this spending. Demand-pull inflation results, causing rates to go up more per Fed dogma.

4) More income due to rising rates is earned from saved capital, causing more spending, and more economic expansion. Employment costs rise due to competition for trained employees because of economic expansion. Wages are spent on discretionary stuff.

This is a positive feedback loop that all but the globalists benefit from. Rejoice.

There is already a lot of inflation due to how cheap credit was, that caused the dollar to lose value in the States, while it won value outside the US due to a combination of everyone wanting to get dollars while they were cheap and a lot of other currencies losing value.

After the crisis people was desperate for jobs and accepted conditions and salaries that were frankly quite bad but as time passed and the currency lost value they dared to fight back against the abuse, if only just because they really couldn’t afford not to.

Is the beginning of the end, without munimun wage slaves or “contractors” and with cheap debt becoming a thing of the past companies like Uber are doomed.

The thing is when the idiots who buy stock on these zombie unicorns will realise this.

That my friends, I have no idea.

Wages haven’t recovered from the last crisis in many sectors of the economy. You understand of course, there are two economies. 1) Things we have to have and 2) Things we’d like to have/nice to have.

Of the have to have, those areas that are monopolized (e.g., utilites, many government functions, health care, college, and many industries that are consolidating) are getting some price increases and providing some wage increases to support their have-to-have businesses. Everything else is screwed and results in people dropping spending on everything but essentials……and even then on less essentials (stagflation). That is why so many nice-to-have businesses and industries are failing.

There is still, way too much largess in the US economy. Could you cut your electric bill, water bill by 20%. Yes you could with a little bit of effort. That is what is happening and will continue to happen (except for the top 20% or so).

This US economic restructering has a long way to go. But the lower end continues to expand and suffer as the Fed tries to inflate away our huge debt load.

Stay tuned.

The top 20% and the bottom 80% in the US might as well live on two different planet really.

I don’t get any this.

1. The Fed keeps rates low allowing speculators and corporations to reap huge benefits via financial speculation in asset price inflation; This is not inflationary???

2. Suddenly workers get a raise and the Fed will panic because now, Joe-blow has a few extra bucks in his pocket to deal with with his rising health-care and housing costs that are a direct result of said asset price inflation.

So asset price inflation is good so long as workers don’t get their share of prosperity?

We’re not talking about too much money chasing too few goods here (which are made mostly in Asia at slave wages), we’re talking about an artificial inflation that was caused by the Fed’s policies.

With rising rates the consumer would lose both their credit cards and home equity loans, students would pay more for their loans, cars etc.

Since the economy is 70% consumer driven, I’d say that the rate increase fears are overblown. The Fed can’t go much higher without destroying the economy. It won’t happen -rate cuts by the end of the year.

The Fed’s policies demand inflation, and they’re getting it.

Why are wages considered inflationary but profits and asset prices are not?

Why is a one (1) teenie weenie itsy bitsy wage increase at one brief snapshot in time in a sea of a very long period of wage decreases consider inflationary, but “blow out” earrings by rich gigantic monopolies not considered inflationary, or nose bleed asset price not considered inflationary?

Because people want to be rich while living in a democracy. In other words, human beings are delusional.

As Getty said a good while ago, “It’s easy to become a millionaire, if that’s all you expect from life.”

As much as I would like to agree with you, I think it is because rich people horde money while poor to middling people spend it. This is why the vast central bank money-printing and ZIRP policies have created only a tiny fraction of the inflation you’d expect from such an expansion of the money supply. The money has been effectively bound up in wealth and horded by the 1% (OK, maybe 7%, but a small minority of the population).

If rich people hoard money, then inflation will not be an issue especially asset inflation. The poor by definition can’t be buying houses, etc.

As I said, you can’t have it both ways. Do rich people save more? Sure, but because they have more money to save in the first place. They don’t get rich by saving, because I am a champion saver with no debt, and I don’t see a lot of money in my bank account.

But the rich do spend their money – on investments and assets, thus causing super duper ultra massive INFLATION.

But not the kind of inflation we saw in the 1970s, the kind that pops up every time you fill up your gas tank or head to the grocery store. Asset bubbles are not inflation in the Weimar way we have been taught to think about inflation, or, if you are old enough, the way it was experienced in the 1970s (the only really significant period of inflation in the advanced capitalist world since WWII ended).

James Levy, people do see inflation in food and rent. What are you talking about? Rental has been CRAZY the last few years.

Your definition of inflation seems to be super static i.e. it has to be the 1970’s definition of inflation, whatever that means. Let’s be real, inflation is something that impacts our day to day. Doesn’t have to be just gas or whatever.

Timbers, I completely agree with you.

Rent costs have risen astronomically the last 10 years due to the speculative money flowing into RE, and that’s certainly decreased my quality of life.

When I was a medical resident between 2011-2015, my salary increased by $2k each year I was in the program, from $44k when I started to $50k when I finished. All those raises were more than eaten up by rent increases over the same time period. I actually had to downgrade to a smaller, older basement apartment even though I was making more money.

Most other things I buy seem to be getting cheaper and better over time, but housing continues to be outrageously priced and out of reach.

“Could you cut your electric bill, water bill by 20%. Yes you could with a little bit of effort.”

It really depends……………..

The first I thing I did when we moved into our new place was to replace all the tungsten filament light bulbs with the new CFC efficient bulbs.

Some of them actually are still working and it is over ten years now. At that time they were expensive to purchase.

As they dim and the quality of light being produced is no longer good or they burn out, I replace those with LED type light bulbs. Better quality light and even more efficient than the CFC’s. The price is cheaper than I paid for the CFC’s and if they actually last as long as they are supposed to, I’ll never have to replace them as I probably won’t be around!!

Not possible to increase the efficiency in house in that area much anymore other than by not using them.

You can also replace old appliances with newer more efficient ones that use less water and electricity, but you’ll pay a high price for the efficiency which hopefully will offset some of the cost. Replace when the old appliance dies. Bosch makes some really nice, efficient, and high quality washing machines and dishwashers.

You can also turn everything off at the switch and save the so called ‘vampire’ electricity costs too.

I don’t know what kind of split system A/C’s inverters you Yanks have, but here in Oz the ones they sell (or used to sell) have a little heater inside them which keeps the system warm when turned on, but not in use. I’ve tried to find out how much these systems consume, but the manufacturer wouldn’t provide the data and it isn’t in the manual. My guess based on looking at the meter is that the multiple systems we have would use between 1 and 2 kilowatts a day depending on the outside temps. Not many people know about this or seem to care.

That is a huge use of electricity for just having something on standby. Turn the the things off at the fuse box and when needed turn them on 30 minutes or so before use and you’ll be fine.

One of the people at the clubs was complaining last month about his last electricity bill – A$1300 for 3 months and there are only two people in that house. The neighbours across the street from us had those kinds of bills 5 or 6 years ago (Three teenage kids in the house!!). I wonder how much they pay now with the price having more than doubled in the last ten years.

Solar Panels? Here in Oz the price of systems are still subsidized a little by the government. The cost of a cheap system has fallen through the roof too. You can get a system with 6 kw of panels and a 5kw inverter with installation for around $A5000. Ten years ago 1.5kw of panels and a 2kw inverter would set you back A$3000.

How about in the USA? They appear to cost quite a bit……………..

Electricity costs? Here in Oz the standard contract rate for peak hour electricity in Victoria is now 40 cents per kwh.

The problem with LEDs is that unlike power saving bulbs that either work or do not, LEDs are made of many smaller lights and if only one of them gets screwed you have to relace the whole thing.

You think you are saying more money than with power saving bulbs but you really are not.

Philips makes an excellent product and the cost of a pack of three regular bulbs is now only A$11.90.

https://www.bunnings.com.au/philips-8w-806lm-warm-white-a-shape-es-led-globe-3-pack_p8908712

A cheaper product can also be bought from a company called Luce-bella and at 6 regular bulbs for $A14.95 the price is cheap.

https://www.bunnings.com.au/luce-bella-10w-bc-led-warm-white-a-shape-globe-6-pack_p4320774

I’ve bought both company’s products and the Luce-bella seems to have a brighter light, but the specs are the same.

When the LED replacements for halogen type down lights came out years ago I bought some cheap (crap) from Hong Kong and despite them being advertised as Cree products (I don’t know if they were or not!!) all burnt out quickly.

So when Philips bulbs were on sale I went and bought them and replaced the halogens again.

These are the types:

https://www.bunnings.com.au/philips-5w-410lm-warm-white-gu10-led-globe-2-pack_p4331782

So far with well over 1 1/2 years of use they have had no problems and all are still running ok.

The electricity use for the halogens is 50 watts per hour. The Philips is only 5 watts per hour. Usage costs for the regular halogen for 4 hours use for one bulb is 200 watts x 40 cents per kilowatt or 8 cents per period of time. The LED bulb uses less than one cent.

Each LED light saves about 50 cents a week in electricity compared to the halogens. The bulbs cost me about $4.00 each on sale. Payback in terms of saved electricity is 8 weeks. I am well ahead. I just wish that I bought more when they were on sale (At a grocery store no less!!)

And by the way, you can no longer by the old tungsten type filament bulbs in Australia any longer.

We converted our entire place to LEDs a few years ago. None of the bulbs have failed so far. And the light they emit is very nice (as opposed to the florescent jobs we had in those sockets before).

Yep, the light is better and the there is no wait time for the bulbs to ‘warm up’.

The older CFC efficient types tend to get really weak over time and the light seems to be yellowish when they get old.

No problem for lights that are only used once in a while such as in closets or under the house.

The next lights I want to change are the halogen flood lights in the backyard. We only use them once in while. There are already some LED type lights for that, but they are expensive and I’m going to wait until they’ve been on the market a while.

The other area where I haven’t changed yet are the couple of lights with dimmers on them. I find it hard to pay A$12 for a light bulb that is used infrequently. If and when it burns out, I’ll change over.

The other one is a chandelier type light with multiple small bulbs and so far I haven’t been able to find anything for it at a reasonable cost (One place had bulbs at A$24 a piece!!!)

I would think that there is still a huge amount of savings in the lighting area to be found in changing over to LED’s.

Ten years ago the 100w light bulb was still common. Then it went to 23w CFC’s and now 10 to 16w LED’s.

Amazing isn’t it? The light in the bedroom was a 75w tungsten which we switched out to a 3 LED light with 5w bulbs that provide 100% more light at 20% of the cost.

The game has been roughly the same since 1970s when we got off the gold standard.

That is: accumulate modestly cash flow positive assets and a personal home using as much long term debt at fixed rates as you can stomach and hold for the long term. Eventually The handy work of the Fed will dissolve your debts and boost your networth over decades. Just ask WBuffet

And of course be thrifty at all times. Avoid conspicuous consumption at all times. Use disposable cash for asset aqusisiton.

For workers that took out 30year mortgages or refinanced in the last decade they will be rejoicing at higher wages with respect to their fixed debt obligations. Those who rolled the dice on ARMs will see those wage gains go straight to Mr Bankster.

Just play the game.

True: but it is a game which only works for a prosperous minority.

What would happen, for example, if all were to follow the traditional rules of prudence and not indulge in conspicuous consumption?

Mass unemployment, mass failure of retail and service businesses, in other words: Collapse.

In fact, you too will have to consume conspicuously in a strategic sense, to keep the machine functioning.

Above all, the increasingly impoverished mass of people have to behave foolishly and drive consumption., and not save.

It is their sole purpose in the system.

Sick, of course, but there it is.

That’s why it’s a game.. only a few understand the rules (wolf street readers)

If everyone followed the above rules the Gov’t and the Fed would have to change the game to stimulate economic activity. And then there would be new rules to abide by, which of course readers of Wolf Street would soon master

The massive liquidity surge post GFC was soaked up in asset bubbles. Combine this with extensive arbitration of the worlds labour markets you ended up with a collapse of the velocity of money. Those folks with money didn’t spend and those who have a very high propensity to consume were squeezed. This led to populist rumblings.

Logically things have to reverse to stabilize. The dangerously inflated asset bubbles have to be deflated gradually to avoid systemic risk to bank capital. Liquidity has to be drained from the system to do this. Those folks with a high propensity to consume have to have access to the remaining liquidity in order to increase the velocity of money to offset the decline in liquidity overall. This is much more appropriately gained through wage and salary increases than through increased destructive redistribution policies.

This rebalancing takes time and is not without its hazards. There may be a case for tariffs by the reserve currency provider to help mitigate labour arbitrage and provide fiscial relief. There would appear to be enough egregious abuses built up to justify such an initiative.