But nothing goes to heck in a straight line.

I don’t think there has ever been an entire sector that skyrocketed as much and collapsed as quickly as the cryptocurrency space. The skyrocketing phase culminated at the turn of the year. Then the collapse phase set in, with different cryptos choosing different points in time.

It doesn’t help that regulators around the world have caught on to these schemes called initial coin offerings (ICOs), where anyone, even the government of Venezuela, can try to sell homemade digital tokens to the gullible and take their “fiat” money from them and run away with it. There are now 1,596 cryptocurrencies and tokens out there, up from a handful a few years ago. And the gullible are getting cleaned out.

And it doesn’t help that the ways to promote these schemes are being closed off, one after the other.

At the end of January, Facebook announced that, suddenly, “misleading or deceptive ads have no place on Facebook,” and it prohibited ads about ICOs and cryptos.

On March 14, Google announced that it will block ads with “cryptocurrencies and related content,” including ICOs, cryptocurrency exchanges, cryptocurrency wallets, and cryptocurrency trading advice. Its crackdown begins in June.

On March 26, Twitter announced that it would ban ads of ICOs, cryptocurrency exchanges, and cryptocurrency wallet services, unless they are by public companies traded on major stock markets. It will roll out its policy over the next 30 days.

On March 29, MailChimp, a major email mass-distribution service, announced that it will block email promos from businesses that are “involved in any aspect of the sale, transaction, exchange, storage, marketing or production of cryptocurrencies, virtual currencies, and any digital assets related to an Initial Coin Offering.” This broadened and tightened its policy announced in February that promised to shut down any account related to promos of ICOs or blockchain activity.

The overall cryptocurrency space, in terms of market capitalization, peaked on January 4, when market cap reached $707 billion, according to CoinMarketCap. Less than three months later, market cap has now plunged by 65% to $245 billion. $462 billion went up in smoke.

Here’s how the top five cryptos did over the past few months. Together they account for 76% of the total market cap of the space:

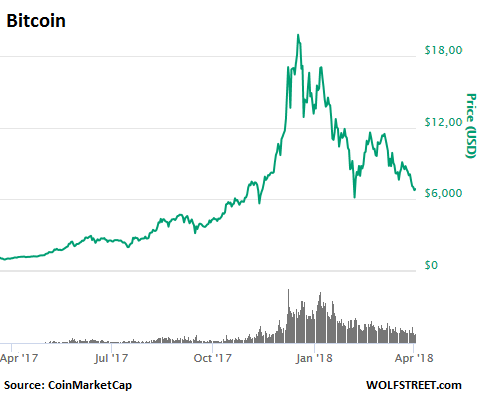

Bitcoin plunged 67% from its peak of $19,982 on December 17, to $6,573 at the moment. In just over three months, its market cap collapsed by $225 billion, from $336 billion to $111 billion. But as this chart shows, nothing goes to heck in a straight line (chart via CoinMarketCap):

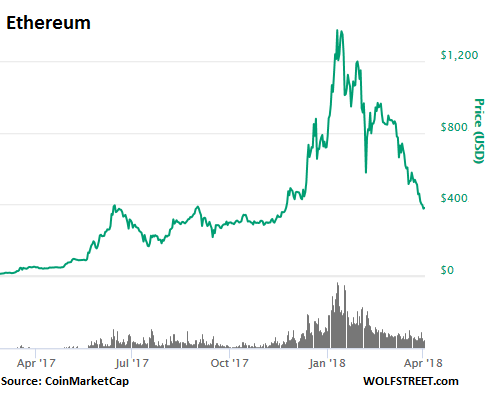

Ethereum plunged 74% from its peak of $1,426 on January 13, to $367 at the moment. Market cap collapsed by $102 billion, from $138 billion to $36 billion (chart via CoinMarketCap):

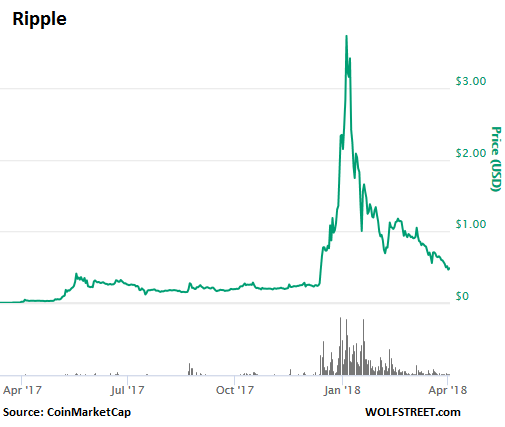

Ripple plunged 88% from its peak of $3.84 on January 4 to $0.47. Over the period, its market cap went from $148 billion to $18 billion. On March 28, when I last wrote about the collapse of Ripple, it was at $0.57, but has since plunged another 18% (chart via CoinMarketCap):

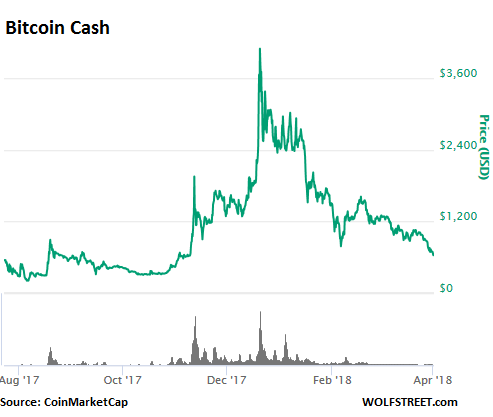

Bitcoin Cash plunged 85% from its peak of $4,138 on December 20 to $632 at the moment. Market cap dropped from $70 billion to $10.8 billion. It was split from Bitcoin last August. On November 12, I featured Bitcoin Cash, in an article subtitled “Peak Crypto Craziness?” I was observing, practically in real time, how it quadrupled in two days to $2,448. It is now back where that quadrupling had started out:

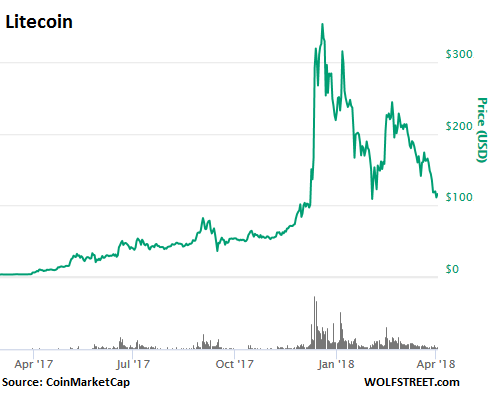

Litecoin plunged 70% from its peak of $363 on December 19, to $110 at the moment. Curiously, its founder admitted on December 20 that he’d wisely cashed out at or near the peak by selling his entire stake. The true believers who bought the tokens have been eating losses ever since. Market cap went from $19.7 billion to $6.2 billion.

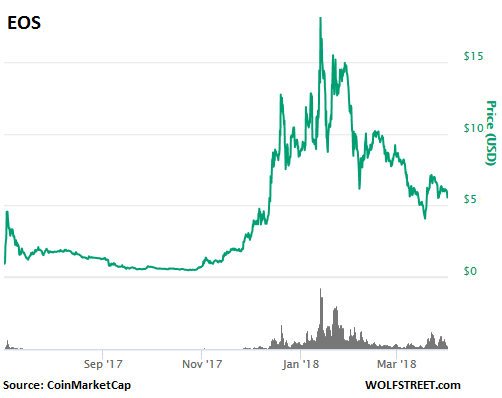

EOS plunged 71% from its peak of $18.16 on January 12, to $5.30. Market cap went from $11 billion to $4.1 billion: I pooh-poohed it on December 18 with “The Hottest, Largest-Ever Cryptocurrency ICO Mindblower.” The purchase agreement that buyers in the ICO had to sign – the ICO was not offered in the US due to legality issues – stated explicitly that holders of EOS have no rights to anything related to the EOS platform, and that they get nothing other than the digital token. Here is what the chart of this scam looks like:

And the blockchain technology (the distributed ledger technology) has nothing to do with cryptos. Cryptos merely use it. There have been a number of efforts underway for years to find large-scale commercial use for blockchain, outside of the crypto space. Those efforts have yet to bear fruit, though they may someday. All we have for now are small-scale experiments. Even if blockchain finds large-scale use, it will do nothing for these collapsing cryptos.

But the ancient theory that nothing goes to heck in a straight line still holds true, borne out by the charts above, and we can expect sharp volatility and a good amount of whiplash on the way there.

And here is an update on the hated “fiat” currency, the US dollar that cryptos were supposed to annihilate or at least obviate. Read… What Could Dethrone the Dollar as Top Reserve Currency?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

cryptos are doomed

there are coming inflation in cryptocurrencies,,,nowdays over 1600 cryptos.

Buy undervalued silver coins,, selling under,producingcost .

There are 6 times more gold stored tha silver nowdays

Roger that Silver is the best value out there in my opinion The 80 to 1 Gold/Silver ratio cannot stand forever Feels That way sometimes though

Hi roger. Do either you or other readers have any thoughts on the descending triangle formation in silver that’s been developing since mid 2016? This is typically a bearish sign. I am a silver fan, but the timing seems off.

Bitcoin – what the euro would love to become but only as a coveted tulip

I bet if you transposed a JDSU chart from the dotcom bubble era onto your form here you could easily pass it off as a chart for BollocksCoin or whatever other of these stupid things there are out there.

As ever, for me it’s “wake me when Uncle Sam launches his own official/approved version.”

Charlie Lee is still laughing his ass off and wiping away the tears with everyone else’s money

…but will he be prosecuted for fraud and serve jail time for it ?

Satoshi was smart enough to stay anonymous for this very reason. If he dumped bitcoins, no one will know who to put in jail..

How is what he did fraud? He publicly announced it…….

These so called currencies remind me of the Beanie Baby craze several years ago.

+10

One of the things really hurting cryptocurrencies right now besides the crackdowns by Google, Facebook and Twitter is the fact that at this time trading volumes are near all time lows, which means fewer people are even buying into cryptocurrencies, and as a result you have a situation where a few holders of large amounts of coins can easily manipulate the markets. Inversely, there gave ben increasing amounts of trades being made in the crypto futures markets, which would imply that there are institutional investors looking to scare the small fry out of the cryptocurrency markets before going all in themselves.

Another thing, it makes sense that Bitcoin is down because the fees to make transactions have skyrocketed while the transaction times have slowed to a crawl, thus making the currency aspect of this coin very suspect. Ethereum is down drastically because of the ICO crackdown, since most ICO’s require people to purchase their offerings with Ether coins. Ripple is hated by crypto purists because it’s not open source, and because more coins can theoretically be created when volumes run low, thus making it look like fiat currency. And Bitcoin Cash is one of those forks from Bitcoin that didn’t want to go into SegWit last year and is being controlled by a rogue group of miners.

Right now the cryptocurrency market is approaching the same levels it was at after the Mt. Gox hack in 2014 which crashed Bitcoin by 90%, and it took two years for Bitcoin to get back to its then-insane valuation of just over $1,200. As for the other alt-coins, about 95% of them are going to disappear simply because they’re either scams or just half-baked ideas which have no real utility in the first place. I do think blockchain is going to be revolutionary, but it’s going to have to go through its evolutionary phase first before it revolutionizes anything.

Ok, so money-launderers are a different crowd.

But for most of everybody else, being told Bitcoin and the tooth fairy don’t exist at roughly the same time is a huge and traumatic event.

Surely the tooth fairy still exists…

ps: there may indeed be participation medals for having “invested” in Bitcoin.

Liquidity is a bitch.

Even with coordinated assalt (pun intended) buy banksters and guburments BTC is 3000% higher than it was in 2016. And it is a good thing that all scamsters will be wiped out sooner or later. New will come though when the PTB will want to jump in. It is coming to the town near you want you or not. Enjoy the ride. Frick the neysayers.

“Even with coordinated assalt (pun intended)”

That’s not a pun.

Rest of the post reads like some nutter from ZeroHedge. No thanks.

I could say many things but ICOs were a scam from the start. I wouldn’t mind if there was only five or six crypto currencies left at the end of the year.

The fat lady hasn’t sung yet and I don’t even hear Brünnhild clearing her throat.

No one knows what will be used as money in the coming decades so I would not laugh off Bitcoin just yet. The Fed, under Bernanke, made clear the dollar cannot be trusted. I don’t think bitcoin has much of a chance because it’s horribly inefficient to verify transactions.

Bitcoin is a great concept from the perspective of preventing governments and banks from stealing your wealth via inflation but it is not an efficient medium of exchange for commerce so it is almost certain to fail. But don’t write the obituary until it has deceased, who knows maybe it gets tweaked so it can be used more efficiently for commerce – if so Brünnhild dies of a heart attack before she steps onto the stage.

Once all the bitcoins have been mined in the not-too-distant future, what incentive is there for the miners to maintain the block chain ledger, given the huge energy costs involved?

2150 to be exact

The transaction fees are designed to take over from the mining rewards.

To add to that, the energy usage of mining/appending is *variable* – also designed into the BTC protocol. Every 2 weeks the difficulty of finding a qualifying block to append to the existing chain is adjusted based on the rate of current mining/appending.

Which means even if the transaction fees are not as lucrative as the pure mining rewards have been, the difficulty of mining/appending will simply decrease to reflect that (decreasing energy input), and appending of transaction blocks will continue.

Somewhere for someone it will still make financial sense, due to factors like cheap hydro elec or something else.

Oh, well, so much for the free and frictionless transactions we muppets were promised…

Costs to mine now exceed $8000 per coin. Already they have zero incentive to mine more. So yeah, the transaction fees need to go WAY higher, and as power consumption continues to go exponential with number of transactions increasing, this massively failed experiment will collapses under its own weight of stupidity. Whoever designed this was dumber than a box of rocks, as clearly designing something who’s energy consumption is geometrically increasing with the number of times it is used, and number of nodes it is distributed across, didn’t even understand the basic math of cents/kwhr.

The ONLY amazing part of any of this, is that there are still rather very gullible holding this crap.

None of these crypto’s are any different in terms of power consumption, because by design, the blockchain’s most important ‘security’ attribute that allows it to even function, is a huge energy sinkhole. The utter stupidity of all of this makes it even more amazing it ever even got off the ground in the first place. This is grade school math folks.

The mining rewards are pre-determined by the BTC protocol. At the moment a miner may assign 12.5 BTC to the wallet of his choice when mining a block. See: http://www.bitcoinblockhalf.com/

This reward gradually decreases as the number of mined BTC increase, eventually ending at zero once 21 million BTC has been mined.

Also, the energy going into this depends only on how many miners are participating, which is completely voluntary.

When miners go away, the required energy input drops because mining becomes easier.

When more miners appear more energy is required.

This is to maintain the block rate of approximately one mined block every 10 minutes.

Currencies are worthless without the support of Governments. I’ll take USD cash any day of the week. Preferably $100s.

Will Nvidia chart follow same pattern, that is the 100 billion dollar question

Especially with intel about to commoditize that market as they did with SSDs and CPUs

At the moment Nvidia is financially backed by SoftBank, the Japanese junk-rated buyout queen.

Ever since SoftBank has made its triumphal entry in Nvidia, shares have gone from strength to strength following a familiar pattern: each announcement from Nvidia, no matter how insignificant has been met by a veritable buying frenzy, hinting NVDA (the Nvidia ticker) has been added by traders to the short list of shares (formerly FAANG and now given as FANGMAN: Facebook, Apple, Netflix, Google (Alphabet), Microsoft, Amazon, Nvidia) that must be traded, and traded in large volumes, whenever the company is mentioned in the news, even if for non-financial reasons.

Said trade includes the puzzling behavior known as “panic buying” which, albeit disappearing, was what market stock markets in 2017. If I understand the phenomenon correctly (I hope somebody will correct me because it makes no sense to me, but whatever), when bad news are announced for a FANGMAN or another stock market darling, such as the failure of a new product, a drop in profits or a large fine/lawsuit coming, traders don’t dump said shares but buy them to “price in” the future dip buying and associated price recovery… should the shares ever drop.

Nvidia has benefited a lot from panic buying, especially at times when cryptocurrencies (especially volumes) were crashing, hinting miners were not buying Nvidia products, and top of the line ones to boot, with as much enthusiasm as before, or when some graphic-intensive videogame was not selling as much as developers hoped, dashing hopes gamers would buy more powerful (and much more expensive) graphic cards in large quantities.

SoftBank has just announced grandiose plans to “invest in more than 100 companies” by 2020 and traders are sharpening their knives and hoping for more lucrative trades but… rating agencies continue to shake their collective head and keep SoftBank firmly into financial junk territory. Only ferocious financial repression by the Bank of Japan has stopped said rating agencies from moving SoftBank deeper into junk and as that repression is supposed to last a thousand years or more, there’s no need to worry.

Or there is?

First time I heard the name SoftBank was from my phone when I connected to 3G over in Japan 3 years ago. Since then it feels like every other aqquisition in tech I hear their name.

They bought out ARM across the street a few years back in San Diego.

A couple of months ago, when used graphic cards were going for double the original prices online, my son walked into Best Buy and bought a brand new one off the shelf for full retail. The new one was a better deal than any of the online used options.

Local microcenter, there isn’t one on the shelves.

Nvidia GPUs aren’t good for Bitcoin, that requires dedicated application specific chips. But they’re used for mining Etherium and other alt coins.

I’ve run into a few people each with 6 to 10 of the 1080 (~$700ish/each) cards running mining operations. When I last looked, a $700 video card would generate $80/mo or so after power costs (15 cent kw/hr) based on one of the calculators online. No idea what it looks like right now.

One person I met with 10 GPUs running said his was converted to cash weekly and deposited in his bank account weekly.

About a month ago the Wi-Fi router in my workshop died an untimely dead after years of service, so I went to the nearest PC parts shop to buy a new one.

I took the occasion to ask the owner about the impact cryptocurrency mining operations have had on graphic cards.

Mind this was when crytocurrencies had already crashed but there was still some hope Asian dip buyers would swoop in and save the day.

He said the only scarcity he had seen was at the top end of the market, but that manufacturers had already announced (apart from a hefty price hike of course) an increase in manufacturing capacity for 2018 and faster shipping to end retailers.

If this is true it means graphic card manufacturers really believed inflated cryptocurrencies were here to stay.

And it also means there’s a whole lot of graphic cards coming on the market over the next months: it will take some time for manufacturers to adjust to the new reality and slash orders and shipments and unless cryptocurrencies manage another dead cat bounce that will lead to, you guessed it, a glut in GPU’s.

While manufacturers are unlikely to slash list prices (their shareholders do not like the sound of it), there are many other ways to cut the price for end users to empty the warehouses.

Otherwise I predict a whole lot of extra work for the people of Guiyu.

I wonder what happened with all of those “stolen” coins?

Were they resold into the market or hoarded to be sold or used at the the “peak”? The “peak” that they could help create by holding vast amounts of coins.

Or were they just a scam – did they never exist at all?

My theory is that cryptos are a scam/impractical for more reasons than I care to list and when the SHTF other currencies are what you want to hold. My scenario of going to your local Chinese restaurant and getting Yuan out of an ATM was partially realized last week. While waiting for my takeout, I watched the cashier count a large wad of cash, non US.

Wolf, you can never out-idiot an idiot. Like all questionable finance it will move to offshore accounts and tax paradise locations where an already complex system can be further convoluted. And there it will linger until the next batch of “believers” comes around.

I’ve always thought crypto currencies are an incredibly interesting experiment based on a block chain ledger. And while on one hand I laud the research getting to the point where the first successful real world release and use of one(in the form of Bitcoin) occurred as part of that experiment, I abhor the fact people have and will lose a lot of money speculating on it. And given the amount of useful electrical energy used in these proof of work algorithms as the basis for transactions and mining, people should be glad to see society come to its senses and reject them as an actual replacement for our monetary systems.

Society never accepted this crypto stuff, just a tiny number of true believers. Then a whole bunch of market-timing scammers jumped in, looking to unload on all the “greater fools”.

I’ll concede there probably were a minuscule number of crypto transactions between true believers, but I seriously doubt many transactions of substantial value were ever transacted in cryptos.

Does anybody know how many of that tiny group actually bought a car (or bag of groceries) with a crypto?

It got a bit further than that. I mean Newegg was accepting Bitcoin for awhile. Also of course we all know it was heavily used on the black market for drugs and other under the table stuff. As far as I know Bitcoin was the only one every being used this way. All the other coins seem to survive as speculative assets tied to Bitcoin. Though Bitcoin and all the rest are so volitial I don’t think anyone can use them as currency anymore.

It’s like people don’t realize it can’t be both. No one will use a currency which could grow by 100x over night or crash.

Yes but what would it take for society to “believe”? Collapse of the global central banking system, massive shutdowns, economic depression, one world government oppression of any and all nations or individuals who don’t go along with their regulations? Just look at the WH, what would 45 do as businessman?

Time for a reverse mine, cryptoers. Take a page from the stock market. When SHTF, people would do a reverse stock split, so yours would be reverse coin mine …. 3 for 1 and you are back at 20K!!!!

When my brother and I used to argue, I used to tell him to go to “heck” (out of respect for our mom), and he used to laugh at me. Then one day I actually said the word: H-E-double toothpicks, and he got so mad at me.

Nothing goes to heck in a straight line, depending on the length of the x-axis. This is as straight as it’s gonna get, and it’ll go straighter-er to heck very soon.

It appears that folks have finally caught on to the $USD Tether scam. On every Bitcoin pull back, tethers are magically added to compensate. These tethers are supposedly 1:1 to the dollar, but nobody knows where (which bank, which account) these tether-backed dollars are held.

Then you have unending hacking and theft problems, it’s hard to cash out, and difficult to transact, and voila! mark to zero.

Crypto isn’t money, it’s a very sophisticated, esoteric scam. Blockchain may have a legit use at some later time, once all this Ponzi is shaken out.

This is not a Ponzi scheme (requires ever more new investors to pay off promises made to previous investors).

No promises were made regarding cryptos. The price (sans market manipulation) is determined at auction between buyer & seller. Cryptos were not issued by any official entity, had zero backing them, had zero intrinsic value, and are only “valued” by evangelistic true believers. This is the age-old classic “pump & dump” dressed up in 2018 duds (“dud” being the operative word).

Pet rocks and beanie babies were worth inflated amounts…until they weren’t. The fact that any of these schemes have any value left is a stunning tribute to some pretty intense cognitive dissonance and belief in the Easter Bunny.

You’re right. My bad.

Theoretically, crypto currency was a great concept; but it has been turned into such a huge scam. At the moment, the only difference between a fiat currency and a crypto currency is that fiat is controlled by governments, while any sleazy idiot now can create a crypto currency. At least governments, as ugly as they are, have to show some degree of control and discipline.

To say nothing of the fact that they will send people with very serious facial expressions, and guns, to your house if you don’t pay your taxes in the currency they issue.

What irony. Those shadow-economy folks thought they had the perfect way to launder their money, but now they are being taken to the cleaners as Bitcoin craters. Think about it, if you bought $10M of Bitcoin, and now it’s worth $5M, you would have been better off keeping the suitcase full of money and enduring a 2% inflation loss.

But the “winner” is Bitconnect (BCC), which went from 13 cents to 435 dollars and now is at 72 cents, from a market cap of 700,000 dollars to 2.7 billion dollars and back down to 7 million, all in about a year.

https://www.youtube.com/watch?v=vabXXkZjKiw

I am still not seeing any impact on the real economy though.

I remember people panicking when the dot com boom went to hell.

Right now, everything seems pretty calm. Heck no one’s “screaming” from the futures pit.

There won’t be a visible impact. Only a modest portion of the losses are falling on US players. The remaining losses are spread around. In terms of concentration and magnitude, it doesn’t compare to the dotcom bust. That’s why this will be allowed to go all the way.

I think Bitcoin itself is ok, but the vast majority of the other cryptos are scams, ponzis, pump&dumps. The manic speculators and gamblers have taken over and Bitcoin’s price is affected as well. It should rebound eventually, when the speculators are gone. But not the others.

It won’t rebound when the speculators are gone. It will find its true price in fiat.

Vadim

I have a bucket full of pet rocks from an ex-wife. Maniac speculators and gamblers took over and ruined their price, but they’re about to bounce back.

There is no need for me to be greedy, and it’s a little bit of a sacrifice, but I can let this batch go fo $500/pound (I’ll pay the shipping).

This is the right thing to do.

J. Chip

You could always claim that they are moon rocks …

You can’t send the pet rocks instantly to anyone anywhere almost anonymously with cryptographic proof and there is no liquidity to sell them. There is some value in Bitcoin. Perhaps it will take 20 years to rebound though, I don’t know. Maybe the dollar will be dead by then.

It warms my heart to see the blind greed that drove the crypto bubble, finally collapse in on itself to now result in prices approaching what eventually might be considered a bargain by the 2nd wave of smart money.

It’ll be that flop sweat of those panicking out of devalued fiat currencies in major economies such as Japan that mint the next wave of millionaires.

Long live alt-coins, death to Bitcoin.

On March 14, Google announced that it will block ads with “cryptocurrencies and related content,”

Hehehe, I am getting adds right now for borrowing at only 13.99% APR with “banknorwegian”. As an investment (and when travelling in general), Norwegian is somewhat of a lucky lottery ticket already and now they are adding banking!?

Those people who really need a loan enough to go for 13.99% interest will perhaps not have the funds at hand when Norwegian goes bust and the receivers call in those loans? One would think!

Is this “Norwegian” the same as the low cost airline Norwegian Air Shuttle?

If so can you explain where they are getting the money for their expansion? I mean… this company owns 13 Dreamliners and have a further 15 firm orders plus 20 options. That’s more than Air India. And then there are the hordes of 737NG’s and the 100+ 737MAX they have ordered.

Gulf companies which behave similarly are deep in the red (Etihad lost an horrific US$1.4 billion in 2016 alone) but are backed by mountains of petrodollars and effectively function as diplomatic tools (“We’ll buy Airbus and Boeing airliners, lots of them, but in return…”).

What is backing Norwegian Air Shuttle? I doubt Boeing accepts “a wing and a prayer” as payment.

Norwegian Air Shuttle does, indeed, own 20% of a bank with “Norwegian” in the title.

Wall St Journal had a recent article (https://www.wsj.com/articles/norwegian-air-easy-times-desperate-measures-1521654170); summary:

o airline is rapidly increasing it’s growth rate (you already knew that)

o unknown if airline owns or leases its planes (unknown what market is for used 787 & 373-800)

o airline has a highly leveraged balance sheet

o airline recently raised a significant amount of capital at a fairly high price

o airline stock down 30% over last year

FYI: I’m flying back from Spain in about a month, and Norwegian has great prices!

I’ll break the two posts rule to thank you.

From what I was able to piece together, the 737’s are owned by a firm called “NAS Asset Management”, which is 100% owned by Norwegian Air Shuttle, and all the aircraft of this type I’ve seen are EI registered (read: Ireland, lease capital of the world, albeit Switzerland, Belgium and Germany are burning the midnight oil to catch up).

The Dreamliners are owned by Norwegian Long Haul, yet another company 100% owned by Norwegian Air Shuttle, and were originally EI registered as well, but the company was forced to re-register them to avoid a big fine: most are now LN registered (Norway) but a few are G registered (UK) by Norwegian Air UK, yet another 100% NAS-owned subsidiary.

There’s also the flight attendant issue, which will sooner or later result in a big fine and/or additional compliance costs but let’s leave it here for the moment.

It seems to me this will be yet another Air Berlin. Hopefully the Norwegian government will behave like its German counterpart (no bailout) and local bankruptcy courts will make the company’s demise as painless as possible, again as was done with Air Berlin.

And let’s just hope this is not yet another Alitalia soap opera…

FYI: I’m flying back from Spain in about a month, and Norwegian has great prices!

Good Luck! Norwegian used to be OK, very similar to Air Berlin.

Then they began to adopt the Ryanair Culture: Booby-trapped ticketing process with pre-selected surprise charges for this insurance, that seat, food, drink, new luggage fees/sizes, and recently dumping passengers in the airport for 20 hours with the “Ready in N + 2” hours excuse, where N is current time.

They are going down, IMO. They are cirkling the drain close enough for one to smell it. Like Hertz and Hamlin’s Toys, DK.

Those days of flying “budget” are Over for me, once the fee-ing and gouging is all done one pays maybe 30 EUR more for a full-service flight and I cannot be arsed with the hassle and stress it is to fly “cheap” over 30 EUR. I make that amount faster than it takes to un-tick all of those booby-trap travel options!

—

For Spain, I often use Luftwaffe from Copenhagen via Zurich, typically about 100 EUR per “leg” if one books in decent time.

South sea bubble.

I’m beginning to yawn when I see these articles. A currency based on the price of electricity and the processing power of a cpu? Yeah, that’s the foundation of a stable society. Not to mention millenials using their credit cards to buy these things.

What happened to the detailed analysis on the auto industry ? People like cars, it draws eyeballs. I’m having to go to zerohedge to get my fix.

https://www.zerohedge.com/news/2018-04-02/subprime-auto-bubble-just-burst-buyers-are-suddenly-missing-showrooms

I’ve been saying for well over a year in various articles and interviews that auto subprime is in trouble, that default rates are soaring, that subprime customers are switching from new to used, and that this was one of the reasons for the decline in new vehicle sales. If you had come around for the past 18 months or so, you would have already known all that, and it wouldn’t have been a surprise.

Ha, actually, I just looked it up… I’ve been on top of auto subprime problems for over THREE years. How time flies! Here’s one of the early-warning articles from January 2015:

https://wolfstreet.com/2015/01/09/subprime-auto-loans-spike-sales-industry-in-denial-implosion-to-hit-broader-economy-more-than-banks/

Everybody and his grandmother can issue a cryptocurrency. Cryptos therefore have unlimited competition. Unlimited competition does not sound like a value proposition to me.

LOL! I’m not surprised given your past “analysis” of cryptocurrencies that you delude yourself into thinking that it is the end for cryptocurrencies. It just shows how little you understand about how technology evolves over time. It’s the equivalent of when the internet was stuck waiting for the rollout of technology that enabled streaming and presentation technologies that allowed for better quality customer experiences. Maybe you were one of those guys who at that time were talking about the ‘end of the internet’!?! In any case, once payment channels as well as the accompanying better customer experiences are rolled out, we’ll see how doomed cryptocurrencies are.

The same applies to blockchain. Many of these companies that you cited are scared because they know that their whole business model is in the process of being blown apart. What do you think is going to happen to social media once it moves over to censorship free, completely secure blockchain platforms that rewards both content producers and consumers? Oh that is already happening. One of the most prominent is called steemit. Similarly with blockchain based decentralised search? It’s already happening. One example is called bitclave. What’s clear is that you don’t see what is coming. Google searches are becoming more useless. The same with posting information on social networks such as Facebook or Twitter. People will move more and more to these censorship free platforms as more people are search queries and social media postings are censored or suppressed.

This is so hilarious every time someone compares cryptocurrencies to the Internet. NO ONE needs cryptos. They serve NO function in the economy other than a form of online gambling. These comparisons just crack me up….

Blockchain technology (distributed ledger) might some day have a large-scale use, but that’s far from certain. And when you buy cryptos, you’re just buying a digital entity that someone concocted, not a slice of “blockchain,” or whatever.

I’m sorry that you have lost so much money on your cryptos. But that’s not my fault. On the contrary. You should have carefully read my articles last fall and earlier this year and sold your entire pile of ctypros, and you would have walked away with a lot more money.

Apparently you didn’t like my comment on the Sites pushing Cryptos being Controlled Opposition.

Since they started pushing them when the Dollar & Bonds Started their Downward Trajectory in the Fall of last year – When they should have been telling everyone to pile into Silver & Gold as Safehavens.

Any Sites That Have To Censor You Should Be Considered ‘Controlled Opposition’.

Absolutely clueless about this Technology it’s just getting started.

I concur, the crypto collapse is “just getting started,” except it has already taken them down a lot: BTC down 67% right now, ETH 73%, and XRP 87%, and that’s just the biggest three, so this counts. The collapse is more than “just getting started.” It has advanced beyond the initial stages I’d venture say :-]