February was off the chart.

“We are seeing an unprecedented rise in logistics costs,” General Mills CEO Jeff Harmening told the Wall Street Journal after the company reported earnings. Shares dropped 9% on Wednesday and another 2% on Thursday. They’re down nearly 40% from their peak in July 2016.

The Maker of cereals, Yoplait, and other packaged food brands said that freight costs have surged to near 20-year highs in February. Other packaged food and snack makers, including Campbell, Hershey, Mondelez International (Oreos, Newtons, Premium and Ritz crackers), Sysco, Tyson Foods, Hormel Foods and others have all warned about rising transportation costs. And they said they’d try to pass these transportation cost increases on to their customers.

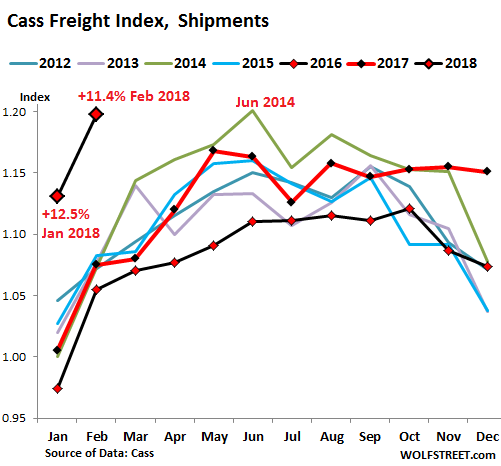

And this is what has been happening in the transportation sector in the US: Shipment volumes by all modes of transportation combined — truck, rail, air freight, and barge — surged 11.4% year-over-year in February according to the Cass Freight Index. The index, which is not seasonally adjusted, hit its highest level for any February since 2006:

February is in the slow part of the year, and yet it was nearly on par with June 2014, at the seasonal peak, and the peak month since the Financial Crisis!

In the chart above, note how the red line (2017) outpaced the black line (2016) as the year went on. In December 2017, shipments had been up 7.2% year-over-year. In January 2018 (short black line), shipments dropped from December, as they always do at the end of shipping season; but year-over-year, shipments surged 12.5%, and in February 11.4%.

The report by Cass also pointed out the consequences of this type of shipment volume growth:

Volume has continued to grow at such a pace that capacity in most modes has become extraordinarily tight. Pricing power has erupted in those modes to levels that spark overall inflationary concerns in the broader economy.

The index, which is based on $25 billion in annual freight transactions, according to Cass Information Systems, covers all modes of transportation and is focused on consumer packaged goods, food, automotive, chemical, OEM, and heavy equipment. But it does not cover bulk commodities.

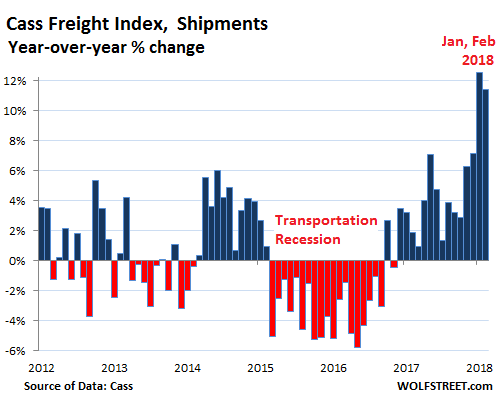

The chart below shows the year-over-year percentage changes in the index for shipment volumes. Note the transportation recession in 2015 and 2016, the surge since, and the spikes in January and February:

This surge in shipment volume of 11.4% year-over-year “is yet another data point confirming that the strength in the US economy continues to accelerate,” Cass said.

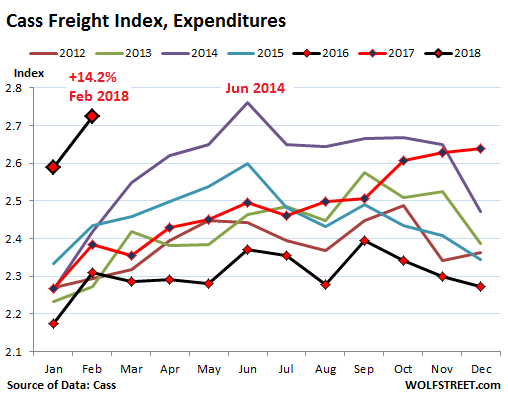

With shipping volumes surging, capacity constraints appearing, and pricing power returning to transportation companies, freight rates have increased and the total amount spent on shipping has soared. In February, the Cass Expenditure Index – which tracks the amounts spent on freight for all modes of transportation and includes fuel surcharges – soared 14.3% year-over-year:

The red line (freight spending on all modes of transportation in 2017) shows the transportation recovery; it rose throughout the year and didn’t even experience the normal season decline in December 2017. But the black line (2016) was bogged down in the transportation recession.

“Not only did the Shipments and Expenditures Indexes extend their run of positive YoY comparisons, but those comparisons have become increasingly positive, leading many to cite transportation costs as one of the many sources of potential inflation,” the report said.

Where do these costs go from here?

They’re not going to soar forever, not at these double-digit rates. The transportation sector is highly cyclical, as the above charts show, but for now they’re being driven higher, so to speak. And transportation companies will continue to have “outsized pricing power” in the short to intermediate term, Cass said.

But the authors are “less concerned about long-term inflationary pressure,” for two reasons:

- The cyclicality of the industry. It is “asset intensive and beholden to the level of economic demand for its services.” As the 2016 transportation recession has shown, prices can plunge when demand declines to where utilization rates of the equipment fall.

- Creating over-capacity. In periods like these, when transportation companies benefit from strong pricing, they create capacity by investing in new equipment — and this has already been happening with large year-over-year increases in truck orders. “We observe, then, the industry’s ability to use increased profitability to fund enough capacity to kill outsized pricing gains in the long term,” Cass said.

What are zombie retail locations that got tangled up in the brick-and-mortar meltdown worth? Some of them “little or nothing.” See Toys “R” Us and its commercial mortgage backed securities. Read… What Are Zombie Retail Stores Really Worth: Answers Emerge

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I have mentioned that I buy most things that are not gasoline or supermarket food — online.

One thing I buy online regularly (for my business) has seen its Fedex shipping cost, for over 1000 miles, go from $30-ish ground to $59.00 . In less than a year !

This, for me, is a killer and I have been scratching my head why, with no idea of why anywhere in sight.

Certainly not fuel or labor costs going up by that much in the last 12 months

Is the Federal Reserve eternal money spigot, finally paying inflation dividends, so to speak ?

You could say inflationary economics is finally “trickling down” to the masses too.

The timing is perfect too. Just when average wages are supposedly starting to rise somewhat, the stock market seems to have peaked and have turn a corner to the downside. For those not getting a pay rise within this month, you’d have to wait for another 10 years of wage stagnation before the next cycle of :trickle down” arrives? Oops.

Wolf should do a piece on the state of equities now, given that he was right on the returning bear market that y’all have been waiting for.

Hail Mary, the bears are here ….finally?

“This, for me, is a killer and I have been scratching my head why, with no idea of why anywhere in sight.”

Simply the peak of the business cycle. The economy is actually in about as good a shape as it can be. Folks are employed. Wages aren’t great but that’s the new normal. And lots of folks are like you, buying everything on line. So transportation is in super high demand, and there aren’t enough trucks on the road to meet that demand. So as we hit the marginal utilization, prices jump very quickly.

Not right. Out of kilter. Does not add up.

So it seems that the only economic sector to be enjoying high demand, higher prices and a shortage of supply is the transports. Some have jumped to the conclusion that this signals a breakout to the upside, for the economy as a whole. Wrong.

You must look at the complete field of economic fundamentals.

They are FAR from looking ‘Rosy’. Quite the opposite. There is further degradation and weakening in almost all areas of where this supposed “growth” is purported to be.

Don’t be fooled by a rise in transportation costs, they are not what it seems to be on the surface. Trouble continues to brew.

As the world population has grown there are many more people to divide up the existing pies. As this continues the cost of fuel gets considerably more expensive and if fuel is more expensive so are tires and oil changes and this drives up the costs of transportation.. But this also affects everything made of petroleum based plastics..

The US has been stupid in its Corporate Capitalism.. We should have been improving our rail systems and making things more efficient on a grand scale.. Now we are going to pay the price as the growth of oil production has not kept up, can not keep up with the growth in world wide population and therefore demand.. And our Corporate leaders think that they should sell off OUR natural resources to the highest bidders. And leverage everything. All add costs to the system.

Yet I see no way we can actually have any significant price increases aimed at the consumers as they are in record debt and the cost of that debt going forward is rising..

Stupidity, ignorance and arrogance has not paid the US good dividends. Corporate Capitalism only works for a few and only can last for a while then the corporate interests start eating each other.. In the end Monopoly first then collapse.

I own a small trucking company in the New York area. One main reason my costs have increased is because of a new federal law. Electronic filing is killing my profits. That new law came into effect January of this past year.

Both Canadian rail cos are in hot water with their customers, especially farmers but including many bulk products.

The farmers are very PO’d because of the slowness to get grain to ports.

They are a powerful political force on the ‘prairie provinces’ and the last time there was a backlog the Canadian gov instructed the rail cos to move a certain amount of wheat or face big fines.

The farmers say their product is being given second- class treatment behind more valuable products like oil.

The rail cos say it was a rough winter.

They may have caught lucky PR break. Apparently by coincidence, there is a brand new reality TV series, Rocky Mountain Railroad.

I’ve seen one episode. Now I’m surprised a rail shipment EVER gets through in winter. After a helicopter drops explosives on a suspected avalanche overhang above the rails, they are buried for most the length of a football field and up to ten feet deep, with huge boulders and trees.

(I don’t think this is a RR production, but I’ll bet they were very cooperative)

The CEO of CN has been canned and the new guy has ordered 200 new locos more guys etc.

Interesting as a bread item I buy multiple of each week went up in price 11% this week!!

I suspect this shipping boom will collapse just as quicky as it has risen. Shippers are foolish to invest more money. They would be much better off to utilize existing equipment better instead. Sadly many shippers never learn from the boom/bust cycles.

Do you guys remember trains? They were a cheaper way to transport goods at a long distance, whatever happened to them?

They are still very much used to transport bulk goods over long distances, such as the “frac sand” which makes fracking possible. Or the resulting crude oil.

In fact there would be no fracking revolution (and it’s a revolution, albeit a quiet one) without an extensive railway network and miles upon miles of freight convoys.

I suspect there’s a correlation between the Cass Index (which doesn’t track commodity shipments) and the amazing boom in the US oil industry: you don’t get to beat Saudi Arabia at her own game without moving veritable mountains of equipment, let alone frac sand.

There’s a very finite number of freight trains and lorries available and the more the energy industry needs to move equipment and commodities around, the less are available for consumer goods, driving prices up.

As an aside while the US have a well developed infrastrure network allowing for the rapid and relatively inexpensive movement of drilling and pumping equipment by rail and road, in most of the world it’s just cheaper to charter Antonov and Ilyushin cargo planes to do the job. Apart from the two heavy hitters (Antonov Design Bureau of Ukraine and Volga-Dnepr Airlines of Russia) there are many smaller airlines such as Cavok Air and Motor Sich Air moving drilling and pumping equipment between manufacturers in Germany, The Netherlands or Russia and fields in remote locations in Algeria, Azerbaijan or Angola.

Buffett bought the trains and put the prices up?

Manufacturing is rebounding within the US, presumably that involves trucking capacity.

Good point. I go to the following NEARBY shipping facilities :

The obvious ones, UPS, FedEx, USPS infrequently, and there is no DHL facility conveniently located.

I am on a main rail corridor line, but I have no idea how to ship a package that is one foot cubic — approximately — by rail. And even if I could or would ship it, one of my shipping partners is not on the same corridor, so how is that going to work ?

There would need be some overhead agency to manage the links between the various rail systems. We might call that “RailExpress” ?

Maybe if I was shipping plywood/sheetrock, which I see go by my home frequently, and in massive quantities — or coal or grain or bulk chemicals — I would consider rail for sure. But for package shipping ? Still can’t figure out how.

Robert if you’re sending mail and packages long distances, they are going by rail already. UPS etc fill trailers bound for far-off destinations and put them on a railcar. It’s called intermodal transport.

Good explanation.

Reading about intermodal now !

https://en.wikipedia.org/wiki/Railway_Express_Agency

Rail freight is included in the data, along with trucks, air freight, and barges, as it says “all modes of transportation.”

Trucks and rail compete fiercely with each other.

Wolf,

What do you see will be the impact on transportation costs as technology continues to advance, and the possibility that autonomous trucks and other electric vehicles become more commonplace?

Would that not put pressure on rail and overall costs as cheaper modes of transportation become more commonplace?

Autonomous trucks, when available, will cut transportation costs. But railroads are also using technology to become more efficient. So I think the competition between rail and trucking will continue to be fierce. But there could be distinctions, based on delivery times, weight, etc. In some areas, trucks will always be more competitive and in other areas, rail will always be more competitive.

raxadian regarding ‘whatever happened to trains’…I recently stayed a night at La Posada (hotel) in Winslow Arizona. It’s right on the old Santa Fe now BNSF main line between LA area and rest of the country. The number of mile-long freight trains racing through every hour was truly mind-blowing!

Interesting place btw (the hotel…the town is rather dreary) with a lot of history from the heyday of passenger rail. Just about every famous person from the late 1800’s to mid 20th century probably stayed or at least ate there. Amtrak still stops there…La Posada’s lobby is the ‘station’.

ELD mandate (electronic logbook device), driver demographics (old and retiring), Capacity crunch with demand, we have told the world autonomous vehicles are coming which has told anyone under 40 to never become a truck driver, driver hour or operation which in turn you drive fewer miles per day which must be tracked above with the ELD (which is expensive to install in your truck/fleet). Many smaller TL companies are being forced out of business with the new rules.

Look at the Flatbed and TL DAT maps.

The loads per truck ratio is at an all time high.

The spot market for TL and Flatbed is 30-40% over lane rates currently. When you can’t get a truck you put your shipments on LTL which is at capacity as well nationwide. Rail is at capacity as well, but rail is slow and customers now demand two day shipping or faster for anything and everything because our competitors are following Amazons lead.

We are looking at a heavy fruit season that will drive up prices even further for everything else. Expect to pay a premium for anything moving over the road well into June. Also I am building a house and my builder sent us a 5% increase across the board if we don’t sign our contract to build by April 1 due to increased costs….. due to transportation!

Yes, this is a correct and accurate comment. I work for a 3PL and can validate this. You can bet the freight brokers are adding their standard margin regardless of net rates, which magnifies the upward price trend. Explosive growth in e-commerce is driving airfreight and parcel rates upward as well. Several parcel integrators are also revising their dim factors to account for fluffier shipments.

The way the US economy is structured now, most increases in prices to the consumer result in loss of purchasing/sales elsewhere.

And those losses elsewhere will likely eventually feed back to the increased cost sectors, resulting in reductions there.

It’s largely a zero sum game becasue wages aren’t/can’t rise.

Deficit spending and QE are the two pump primers. With QE out of play (for now), you can see how much deficit spending is required to keep the whole mess from collapsing.

Yes all this is inflationary in the sense of created fiat; however, we are largely in a stagflationary environment because of wage suppression.

It does seem as though the business cycle is indicating a peak is at hand. Blow-off top should start soon.

I think the stock market will be in a trading range for the rest of 2018. Risk is, It needs a good drop before trending up again, and there is still one good rally left to ride.

I will probably buy some shipping stocks once I figure out which ones. If Maersk goes below 700 EUR, might buy that.

Update: The Durable Goods data, released this morning (Friday), shows that year-to-date (Jan + Feb) durable goods shipments (not seasonally adjusted) rose 7.8% from the same period last year, and orders jumped 9.1%.

The shipments are part of the demand for transportation in January and February. The orders will be part of the demand for transportation going forward.

These are big year-over-year increases. Part of it is going into inventories, which are rising. Rising inventories might put a damper on demand for transportation later, but now they create demand for transportation.

Could this be the saving grace for GE? Locomotives are a big part of that brand.

Perhaps not exactly a saving grace, but it might help some.

The problem for GE is that there were a lot of locomotives in storage during the transportation recession, many of them on some track in the desert. These pictures are from May 2016:

https://wolfstreet.com/2016/05/04/freight-rail-traffic-plunges-aar-april-report-photos-idled-engines-transportation-recession/

So the first priority for railroads will be to put their equipment back to work before buying new equipment. But I think they’d be more willing to order some new toys now than they were two years ago.

Don’t look now, but they’re considering selling that biz:

“… GE is also said to be looking into sales of its industrial gas engine business and its railway locomotive division, among others.”

https://stocknews.com/news/ge-general-electric-company-ge-exploring-possible-sale-of-electrical-engineering/

As a long time owner of a small fleet that does specialized oversize/overweight shipments throughout the US I have seen this coming. I could grow my fleet x 3 but finding a good driver is a challenge, wages have been stagnate for years until just recently.

Government regulation has increased with the use of electronic log books and this has slowed down the transport times for carriers and many older drivers have chose to retire rather than comply. I see few younger applicants who want to get into trucking today, with traffic, fines, little home time and ELD devices that count time against you while waiting at a shippers dock to load or unload I can see why.

Rob,

With freight prices rising will drivers see a portion of that and if so, is there in your opinion a magic number in terms of income that will entice people into a driving career? In the world of manufacturing, owners and hiring managers say their biggest impediment to hiring is finding people who can pass the drug test. Is this also a big obstacle for hiring in your industry?

Corporations have been all about buybacks and dividends, not much CapEx as they didn’t want too much capacity as the fixed overhead in the next downturn kills a company. So my question is, current transportation inflation, is it simply due to lack of added capacity the last decade?

Yes drivers are starting to see a increase in pay with the rising freight rates, some are paid in percentage of what the load pays the carrier. Drug test is one of a few obstacles, the ELD has been the number one complaint as of lately and I can understand why.

To attract a driver who is a US citizen, can pass a drug test, read and write basic paperwork, I think we need to pay 100k a year plus benefits before we see any quality applicants.

According to the US Bureau of Labor Statistics the average yearly income for a truck driver in 1970 was $26,000. Considering the impact of inflation on the USD, in order to duplicate the buying power of the wages paid to drivers then, today’s drivers would need to be paid $149,000.

According to a study published in the American Trucking Association’s monthly magazine it is stated that if 6 young people get their Commercial Driver’s Licenses and enter the industry, at the end of 4 months, 5 will have permanently left the business, generally embittered. This has much to do with the deceit, misrepresentations, exploitatively low starting wage s paid and generally stone age management found at most trucking firms.

As well, there does seem to be a cultural factor at play as well, . as millennials don’t want to live in a truck and put in the 70+ hours per week typically required of drivers With or without ELD hours of service regulations and their income lowering impact, I do not think this increase in shipping costs (at least for trucking) has as much to do with increased volume as it does with driver shortage tightening of capacity.

It is possible the shipping deals Amazon is getting are cutting into the margins.

Anecdotally, my son received a toaster gift from Amazon that was accidentally shipped to our house with free 2 day shipping. We were going to ship it to him but the shipping cost was $55 via UPS. Buying a new toaster on Amazon with free 2 day shipping to his house was only $45.

I’m sure Amazon wasn’t taking the hit for this They likely have a huge discount on shipping compared to what regular people are paying. The shipping companies have to make that up somehow.

Nice toaster. Long ago, we used to get them free, as incentive for opening a checking account.

That whole paradigm with amazon shipping versus a regular person shipping stuff … the cost is very expensive … I don’t understand how that works but have a sneaky suspicion regular ppl are just being screwed over while amazon takes over the world …

We are in a long cycle in favor on line retail at the expense of brick and mortar. But cycles tend to reverse over time and the reasons are numerous, including governmental need for tax revenue as well as the increased cost of selling on line. I am not predicting it, but it is likely that this cycle will reverse as the factors decline that favor on line over brick and mortar.

Isn’t the argument is that demand for transportation is fueled by surge in online vs B&M retail? Less retail stores -> More transportation required as goods need to travel to your doorstep instead of to nearest retail outlet/store. Arguably, this trend may change the mix of transportation modes (e.g. drones eating market share from small/short-distance trucking)

I see that too. I do not believe in Peak Oil, on its face, as a scenario. WE WILL NEVER RUN OUT OF OIL, ever.

We, meaning all humans, will definitely run out of economically recoverable oil. As FakeBook and Self-Crashing Uber cars are showing us now, the technology magic that we will count on to render MORE OIL to be ECONOMICALLY RECOVERABLE, will wane — and finally slow to almost nothing. Diminishing returns are built into the laws of Thermodynamics. Our Universe !

My point being is that the one thing none of us expects, $5.00/gallon diesel, is clearly on the horizon.

Trains, trucks and transport ships are, at this time, mostly diesel powered.

Online trade, and possibly even INTERNATIONAL TRADE, will become majorly stressed at $5.00 Diesel.

EROEI

http://euanmearns.com/eroei-for-beginners/

And we will, none of us, believe the future that comes along with $10.00 per gallon Diesel !

I have to wonder how online retail will

hold up if shipping costs rise much further.

I would imagine Blue Apron and other online

food merchants will fold first .

my goodness, a sustained increase in energy prices would…….

DOT physical for most drivers is tough to pass. If you are a big person and have sleep apnea….. DOT might not pass you. Drug use is another obstacle (DOT drug test). Telling young people that trucks will drive themselves in a few years screams to them not to drive truck. Would you? They can swing a hammer on a jobsite and be home every night for decent money. Hard to get a driver back on the road after Christmas when you have your wife and kids begging you to stay home a few more days. Flatbed drivers are becoming extinct… imagine yourself on a flatbed tarping/covering a load of crates 40 ft long by 15ft high while it’s raining in 30 – 40 degree weather and your tired. You want to do that into your 60’s?

These trucking jobs are of course the kind of jobs coming back to America. Your choice like it always was, stand on an assembly line all day, (and those jobs coming back won’t pay the rent) or hit the open road in a big rig. The new trucks have more power, automatic transmissions (no more double sticks), ABS braking, and no multiple copies of your logbook, and little white pills. Get your wife certified and you can tag team across country.

I sent single piece of paper in an envelope via UPS from San Diego to Toronto overnight by 3pm with adult signature required and it ended up costing me $96. I’m not kidding.

Bring back the ravens from Game of Thrones!!! They are cheap, and they don’t do unions.

Just wondering, Jon-a hundred years ago could you get that done for $96, or even $96,000? May we all have a better day.

realinvestmentadvice did a write up on this exact topic today. They caution from reading too much into this as they think one-time hurricane-related effects might be at play.

I think the growth of online retail might have something to do with it too since whereas before there used to be fewer, but larger shipments to brick-and-mortar stores (to which you drove and got your merchandise), now there are more, but smaller shipments to end-consumers. This is more convenient for the end consumer but in the grand scheme of things is probably less efficient from an overall distribution perspective, leading to greater utilization of shipping resources and eventually leading to price increases.

Example: Back in the day UPS might deliver say one shipment of 50 toasters to your local Sears, which you and your neighbor bought from the store. Now UPS might deliver one shipment of 20 toasters to your local WalMart and 30 individual shipments from various online retailers directly to consumers. The latter involves much greater transactional shipping effort.

I suspect many trucking companies are very Leary of investing in new equipment especially in regards to the possiblity of driverless trucks coming.

Clearly laws already favor self driving vehicles. Noticed how quickly the poor women hit and killed walking her bicycle (not riding it) across a highway by a Uber car was held 100% at fault by police.

Also please note how the image in the video released was doctored. One also needs to realize that video cameras capture less detail of the scene than the human eye does and again less than what the sensors see. I just hope the women’s civil rights lawyer picks up on this important point.

From a pure engineering standpoint the Uber car accident should never have happened. First road and weather conditions were ideal. No rain nor snow nor fog. Two different objects were completely missed; first a warm slow moving non-metallic object (human) and second a slow moving metallic bicycle with shiny reflective wheels. There is absolutely no excuse for Uber’s car sensors missing both objects at the same time! These types of sensors are not affected by darkness. Bright sunlight is more likely a worst case scenario.

The part that is really troubling is that those pushing driverless vehicles already have favorable laws in place that discriminate against human driven vehicles and people walking. It is humans who now must watch out for self driving vehicles! Humans are now 100% at fault should they get into an accident with a self driving venicle!

If one owns a trucking company why would you continue investing in human driven equipment especially if insurance companies are likely to offer lower insurance rates for self driving trucks now that humans are 100% expendible colladeral damage!

I just wish this wasn’t so.

As a few people indicated above ELD (e-log) is the main driver of the sudden tightness in the market. Before drivers could cheat on their legal hours and most did. Now that hours have been drastically reduced across the board carriers are unable to meet the demand that existed before (and has been increasing). The same law is causing issues for drayage/transportation from ports and especially inland rail terminals. I import, sell and transport millions of lbs of industrial commodities and this is the worst anyone in the industry has seen it in certain sectors – it’s causing many headaches, delays and price increases. A few very large factories I work with who deal with hundreds of trucks per day feel like this is the new normal. Carriers know how cyclical the industry can be so they are all weary of adding new drivers too quickly. This will raise the price of every product soon enough (many price increases haven’t been passed along yet) and will add to inflation. Unless this cheap-money bubble pops that is – in which case carriers will be begging for freight. Interesting times. On another note, I read most articles on this site along with the comments and must say that this might be the only civil comment board that exists on the interweb – keep it up folks.

My brother is in the freight business for one of the top global carriers/forwarders.

There has been a freight “recession” starting some time ago. I don’t know the exact year.

When desktop PCs and flat screens were being “built out” there was a shipping boom. The number of pieces and, more importantly, weight was big. They did multiple shipments to get desktops built, for example: boards, chips, and finished product were shipped all over the world multiple times for parts of the manufacturing processes.

Fast forward to today. The big issue is that weight is way down. The miniaturization to phones, especially, has killed the shippers. So, this latest uptick is most likely returning to some normal equilibrium pricing.

A lot of companies went bankrupt- several truckers (big ones!). My brother’s company has downsized huge numbers of employees, and centralized operations, etc.

The BNSF Railway reported an all time high of 220,000 units (each unit is a freight car or intermodal van or container) hauled in one of weeks in the previous quarter. They are currently doing over 22% more business than Union Pacific, so far this year. They often do 100 trains in a day on their superb Southern Transcontinental Line through Winslow, AZ.

The BNSF just reported to the regulators (STB) that in spite of record volume, they still have lots of spare capacity on both Northern and Southern Transcontinentals, as well as other main lines, due to many billions of dollars of capacity improvements made over the last decade. About 3.3 billion is to be spent this year on capital improvements.

And don’t forget that Mr Buffet is sitting on over 100 billion in cold cash, just waiting in the wings.