This is the big one. It makes steel and aluminum tariffs look like a game.

If this is true – it was leaked by a “source familiar with international trade” to the Nikkei Asian Review and isn’t based on a White House announcement – then it’s going to add a lot of fuel to the already heated trade dispute between the US and China, and may ultimately make the steel and aluminum tariffs look like a game.

To punish China for its intellectual property theft, including IP infringements such as counterfeiting, and to retaliate against Chinese investment rules that require technology transfers to Chinese partners in order to set up shop in China, the Trump administration is considering a proposal by the Office of the US Trade Representative (USTR) that would impose:

- Tariffs on a large variety of Chinese products, including tech products and consumer goods like clothing.

- Restrictions on investment by Chinese companies in the US, the first impact of which we have already seen by Trump’s order yesterday blocking all Chinese takeovers of large US tech companies.

- And limits on visas for certain Chinese nationals.

The USTR also urged US allies, including Japan, to implement similar measures and synchronize their policies, according to the “source familiar with international trade,” cited by the Nikkei Asian Review.

Germany, Japan, and other countries have long fumed over the required technology transfers to Chinese partners. At the same time, Chinese companies, often state-owned, have been on a shopping spree in Germany, going after robotics know-how and other industries, which has caused a lot of soul-searching in the business community in Germany. Japan too “has long opposed China’s intellectual property practices,” as the Nikkei put it. Now the USTR has asked these countries to do something about it.

The probe by the USTR started in August last year, invoking Section 301 of the US Trade Act of 1974. The act, because it conflicts with WTO rules against imposing trade restrictions unilaterally, hasn’t been used since 1995, when the WTO began sorting out trade disputes.

But in August 2017, the USTR announced that it had “formally initiated” an investigation of China under Section 301:

The investigation will seek to determine whether acts, policies, and practices of the Government of China related to technology transfer, intellectual property, and innovation are unreasonable or discriminatory and burden or restrict U.S. commerce.

The investigation would “look into Chinese laws, policies, and practices which may be harming American intellectual property rights, innovation, or technology development.”

Section 301 of the Trade Act of 1974, as amended, gives the U.S. Trade Representative broad authority to respond to a foreign country’s unfair trade practices. If USTR makes an affirmative determination of actionable conduct, it has the authority to take all appropriate and feasible action to obtain the elimination of the act, policy, or practice, subject to the direction of the President, if any. The statute includes authorization to take any actions that are within the President’s power with respect to trade in goods or services, or any other area of pertinent relations with the foreign country.

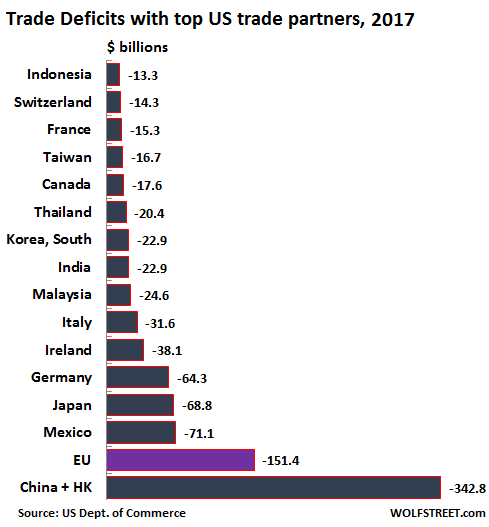

Trump had pledged to crack down on the causes of the huge US trade deficit. In terms of the magnitude of the trade deficit, no country comes even close to China (chart shows China and Hong Kong combined due the transshipments via Hong Kong):

The trade deficit in goods alone was $796 billion in 2017, of which the deficit with China accounted for $342 billion. China exported to the US three times as much as it imported from the US.

Though the USTR has tried to get US allies on board, at least the Japanese government rejected the proposal, saying that it would be difficult to implement since Japan lacks a law similar to Section 301, a US trade official told the Nikkei. The official said that Japan had proposed instead a joint suit against China via the WTO. That would make sense to say for Japan; it has only a small trade deficit with China/Hong Kong and in many months a trade surplus.

That the Trump administration invoked Section 301 rattled the Chinese government. In February, it sent its top diplomat, Yang Jiechi, to Washington on a fence-mending mission. This resolved nothing. At the beginning of March, it sent President Xi Jinping’s top economic adviser, Liu He, for a bigger five-day fence-mending mission.

It was doomed from the beginning. China had planned to send a delegation of about 40 people along with Liu He, sources told the SCMP, but the US government objected, and in the end the delegation was cut to about 10.

Liu met with Treasury Secretary Steven Mnuchin, US Trade Representative Robert Lighthizer, and White House economic adviser Gary Cohn, and afterward announced China’s intention to reduce its trade surplus with the US. According to the SCMP, Chinese state media portrayed Liu’s mission positively.

But on March 7, after the mission was over, Trump tweeted: “The U.S. is acting swiftly on Intellectual Property theft. We cannot allow this to happen as it has for many years!” It seems to have been an apt suggestion that the USTR’s proposal was on the way. The proposal’s drastic remedies and the chance that Trump would support them might have been the real reason why Cohn quit, rather than the now softened steel and aluminum tariffs that seemed to be hitting the wrong targets.

Trump’s Executive Order blocked not only the $117-billion hostile takeover of Qualcomm, but any “substantially equivalent” foreign takeover in the future. Read… Trump’s Order Stops ALL Foreign Takeovers of Large US Tech Companies

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Bill Clinton had done a “Super 301” himself ! People will say a lot about these “new” policies, and patriotism, but US MNCs have reaped BILLIONS from China, truth be told!

Even before that, in the 1970s there was the HK and Japan syndrome with joint ventures, whereupon you would see knock-offs of your product the year after you enjoyed ‘cost savings’ by outsourcing overseas.

I warned our business against doing it, only to see the market gutted in a few years in our product category.

Andrew Grove, the founder of Intel, was especially worried about lost jobs and lost expertise from offshoring.

https://www.nytimes.com/2016/03/26/opinion/andy-groves-warning-to-silicon-valley.html

>”Andrew Grove…”

An incredible pioneer, business strategist and a wonderful man.

One thing Japan lost out on was the MITI decision to focus on memory instead of microprocessors. At a critical period in tech history the memory market ended up flooded, priced commodity-style, and the high-margin processor market was the place to be. Intel did very well, and even AMD too for quite a while.

In Grove’s 2010 Bloomberg essay, he also saw scaling as a major issue:

“However, our pursuit of our individual businesses, which often involves transferring manufacturing and a great deal of engineering out of the country, has hindered our ability to bring innovations to scale at home. Without scaling, we don’t just lose jobs—we lose our hold on new technologies. Losing the ability to scale will ultimately damage our capacity to innovate.”

https://www.bloomberg.com/news/articles/2010-07-01/andy-grove-how-america-can-create-jobs

Andy Grove was one of the smartest in Berkeley, but his focus is limited ONLY to invention, build wealth and prosperity. That is what he is made of.

What’s going on in politics is about game theory, control, sabotage, power grab. The goal is NOT about wealth and prosperity although they may need to deal with it in order to reach their true goal of dominance, both domestically and globally. Very different goal, game and what AG says, although noble and beneficial to the society, he will NOT survive the political game let alone winning it like the Trump’s and Clintons.

I used to be a 100% free trade believer, till I listened to a Vox Day / Stefan Molyneux conversation. Then I bought this book, which was referenced in the conversation. “Free Trade Doesn’t Work: What Should Replace It and Why” by Ian Fletcher.

A main point made is summarized quite well by the Andy Grove quote above. Why should we subsidize our schools/pay for our kids education/tech development only to then ship it over seas? We pretend / believe that the USA will be an endless fount of creative tech development, independent of whether there is any domestic manufacturing / industry. Clearly this is false. And clearly China is playing a smart game by picking our IP pocket right before our eyes.

I knew from day 1 (nafta) that the free trade meme was bullshit … the reason was my father who was a trade and import/export specialist for over 25 years with 13 years working for the department of commerce and was worried for years about trade balance going to shit … he would have been driven out on rails had he not been able to retire when he did . All he cared about was what was good for the us economy.

Also, I thought that after NAFTA passed back in 1995 that Mexico would become equivalent to a 51st state of America. That our ties would become so close and that they would get lifted up economically/socially, etc. etal.

Boy did I get that WRONG.

Sadly, during your days as a free-trade believer, you probably contributed to the decline of American industrial manufacturing through your political and non-political support. I remember conversations with “free-trade believers”(usually Republicans) who told me that it was an American’s birthright to get the best value for his money, no matter where the product was coming from, and that Americans losing jobs as a result of offshoring “can suck it” because they were too stupid/lazy/entitled to get a college degree that would get them a “real job”. And that college degree thing isn’t working out too well either, lately, as the flood of H1b visas and BPO/ITES offshoring prove.

China is far more advanced on robotics and AI than the US. Even with their huge population, and the prospects of them losing jobs, they advance.

Scaling in the US becomes easier with ribitics and AI to fine time and improve processes.

Interesting correlation with Tillerson being pushed out today. Much of the technology transfer from the USA was to get Japan back into the world trade scene as a player. Patent rulings allowed many US patents for televisions and electronics to be transferred to Japan as manufacturing rights agreements, circumventing patent restrictions. China took this playbook and made into a global deflationary manufacturing strategy to where even Japan had to offshore manufacturing to China. This far-reaching tariff from Trump will put a big hurt on Walmart and the hardware businesses.

I agree. Behind the scenes trade is all negotiated and planned out. What industries to cede, how and who capitalizes on them, how benefits are shared etc. The Trumpian noise we are seeing is just political vaudeville that feels “so fresh” to those inclined. Reagan raised similar noises v Japan only to “bring china in”. I have seen such nonsense play out many many times with my own eyes. I don’t cream my pants upon hearing it.

Canadian, Mexican and other countries’ export will explode because China will just export vis a vis those countries.

This smells like Ethereum’s smart contracts i.e. the contract can be smart, but how will it be enforced?

With the sophisticated surveillance technology now available to, e.g. NSA, country of origin should be possible to keep track of.

LOL. They couldn’t even find a man with a beard for 10 years. Heck they couldn’t even find those darn Russian conspirators either. The Russians developed new missiles right under our nose and they didn’t know about it either. Next you’ll say school shootings are entirely preventable because the NSA is observing. The NSA is like a boogeyman that always disappoints.

And seriously, just register yourself as a Cayman Island company or something.

Basically I think there’s many ways to go around this.

Rates – they knew exactly where the man with the beard was, just like they knew about everything else. And if something isn’t there when they need it to be, they just invent it.

And exports are going to start exploding from Canada and Mexico because China will just use those countries to export their goods into the U.S.? Yeah, like that won’t stand out like a sore thumb! Probably one of the reasons Canada and Mexico were left exempt of tariffs is because they “agreed” to keep Chinese dumping out.

China got handed technology on a silver platter when the greedy U.S. multinationals took their operations there. China would still be back in the Stone Age without it. Trump is turning that ship back around.

Many people actually DID see what was going on and they did speak up about the hollowing out of the country. It’s just that the globalists were in control and they crushed all dissent. Ross Perot was right – there was a giant sucking sound.

The winds have now changed.

Canada has already said they will enact anti-dumping laws.

Nicko2 – yep, Canada is going to play ball.

There is no way Canada, Mexico and “other countries” can replace the US’ scale as an export destination, not even close.

Have to wonder if Trump is now just getting started on his agenda, after being side tracked fighting the “Russian Collusion War” for over a year?

‘California’s largest steel company worried it could be harmed by Trump’s tariffs’

This is a rolling mill employing 1000 workers. It imports slabs which it adds value to by reducing them to usable size by feeding them through rollers.

There are hundreds of companies that will be adversely affected.

Trump probably thinks steel is steel and aluminum is aluminum.

There are hundreds of varieties of each. Hershey wraps its chocolates in a very special thin foil. No US mill makes it or is likely to.

If Trump had listened to his ‘globalist’ adviser Cohn, (who, on the news, resigned, NOT fired) or anybody who understands a manufacturing ecosystem it wouldn’t have happened. There are at least forty US jobs using or processing steel for every one making slab steel.

Then there was the genius move of exempting ally Canada but not at first, Australia. A little help from State would have helped there (also not consulted)

Oz was the ONLY US ally to fight in Vietnam.

All this is merely annoying unless you are affected, but hopefully not enough to start the overdue recession.

But if he tears into NAFTA, especially the totally integrated auto sector, look out below.

If that were to be combined with his proposed 25 cent a gallon increase on gasoline, the stage might be set for GM’s next trip to court.

Watch this Jimmy Kimmel segment. If you think Trump has any agenda other than helping himself, his family, his friends and associates to feed at the trough, you’re living in a fool’s paradise.

https://www.youtube.com/watch?v=gVh_wGJWn3c

Checkmate

Starting a trade war with China will surely cure that stubbornly “low” inflation rate!

I think that trade wars are deflationary if a trade war stifles worldwide sales.

Those who are hoping a Trump trade war will lead to an American industrial revival ought to look at First Solar’s factory in Toledo, Ohio which is fully automated and underpricing China… Where the US is vulnerable is the farm belt.. The last thing China wants is to see food used as a weapon but it is an option that China could use.

China has had a trade & economic policy that has been transparent for 30+ years and it was acceptable to industrialists for all of that time as long as they could make a buck from low wages.

David,

You seem to be ignoring the elephant in the room however with your statement that the industrialists were happy as long as they could make a buck from low wages….the fact that interest rates are RISING after an uncontested 35 year of LOWERING.

With the cost of CAPITAL RISING (interest rates)…the impetus to replace labor with capital (via productivity) is waning. The RELATIVE increases in the COST of CAPITAL is going to be MUCH GREATER than the relative increase in labor costs in a rising interest rate environment…even in an inflationary environment.

I get how China, a major food importer, doesn’t want to see food used as weapon. But what do you mean by, “…it is an option China could use?”

BTW, smart thing I read somewhere several years ago: China is short water, their importing food is akin to their importing water. eg They don’t have sufficient clean water to grow the food they need.

Yes, the stubbornly low inflation rate that created untold trillions of labor arbitrage profits.

The pendulum swings both ways but there are many moving parts.

“The pendulum swings both ways, but there are many moving parts”

Good point. Keeping track of all these moving parts that create the global economy is like wrestling with an octopus. Always another tentacle to be mindful of.

What will this possible trade war do to our agricultural exports to China? Our soybeans are already considered second-rate by China because all the GMO adjustments have lowered the protein content. We no longer control the world in agricultural commodities-Argentina and Brazil will be glad to fill the void. I know, times have changed and farmers are probably 1% of our population. However, there are more farmers than steel workers in this country. If commodity prices drop, then farmers go bankrupt, then China can come in and buy up the farmland for a song. Then who wins?

“We no longer control the world in agricultural commodities”

A noble cause! And why should the US taxpayer be subsidizing food being shipped overseas?

We are not just shipping food overseas. We are shipping our topsoil & water overseas in the form of food.

Good comment. I think China has been trying to buy meat producers so they can just cut out the middle man and ship the meat directly to China. Use are Agricultural subsidies to pay for their food. I believe China bought the U.S. and Worlds largest pork producer Smithfield foods.

Now I read they are trying to use Smithfield foods to buy chicken and beef producers.

And why are we allowing foreign ownership of farmland?

Why are we allowing foreign ownership of anything?

Liberals as usual will do their very best to support globalism (labor arbitrage) while ignoring and denying the inconvenient realities.

In the very end, corporations will learn the price paid for globalism is China has stolen their IP and now competes with them directly, in the “free” markets.

It’s a hilarious turn of events. Cutting out the middle-man, why buy anything from these US importers that reaped untold trillions manufacturing offshore when you can buy direct from the offshore factory?

“Liberals as usual will do their very best to support globalism (labor arbitrage) while ignoring and denying the inconvenient realities.”

Why you tie “liberals” to globalization is beyond me. That makes no sense. The clear tie is between big corporations and globalization.

He’s using “liberals” as a “bad word” which is about all flyover people understand. It’s like in intermediate school where if there was that weird person who dressed oddly or was interested in an unusual hobby, they were called a “morphodyke”.

“now competes with them directly, in the “free” markets.”

Well, the globalists can (will) always turn around and ask Uncle Sam for assistance (no tax, subsidies, etc.). Look at Amazon, city officials are stepping on one another to offer it the moon.

It was US corporations who lobbied for unfettered free trade and for the right to uproot American industries to whatever state that paid the least. I don’t see how you can tar liberals with the broad brush stroke of globalism when it was US corporations and US bankers who wanted protectionist walls torn down and turn capitalism loose.. Well, we got what they wanted and it is we who are paying their price.

1930s, and one group was characterized as simple, uniform in their thinking, and not complex, with the aim of demonizing them to promote a National (socialist) agenda. In the 1990s, it began again with Rush Limbaugh, this characterization method, of “liberals”. Always attributing, simple, laughable, lockstep thinking for “liberals”.

Made multi-million for Limbaugh, and divided the country into disfunctional sections.

This is interesting! but i don’t know much about it..but I was wondering how much of the US GDP does China own?

How much of the US treasuries do they own? What if they stop buying treasury bonds? can the US support the debt without there buying, or what if they sold a lot? I can’t imagine China not doing something from all the tariffs and if this article/leak is true.

What if the whole world didn’t have any children for one generation..that would fix it all!

The Chinese yuan or renminbi (CNY), for all the nice words about its “internationalization”, is allowed to float in a very narrow band against the four currencies the People’s Bank of China (PBOC) is widely believed to hold in large quantities as their sole foreign currency reserves: the US dollar (USD), the euro (EUR), the yen (JPY) and the British pound (GBP).

For all purposes, however, the renminbi is still if not pegged at very least closely tied to the US dollar: the EUR/CNY exchange rate has been following closely the EUR/USD since at least 2015 and for all those aforementioned nice words about changes in China’s monetary policies, the PBOC hasn’t exactly lost any sleep over the depreciation of the yuan against the euro. More about this in a minute or two.

Regarding US debt. According to the US Treasury Department (Treasury), at 31 December 2017 China as a whole (Treasury doesn’t break up foreign holders of securities in governments, individuals, banks etc) held US$ 1184.9 billion, up from US$ 1058.8 billion on 31 December 2016 and allowing China to muscle Japan back in second place in this questionable list. Intriguingly enough over the same time frame Japan actually scaled back their treasury holdings a “tiny bit”: about $30 billion… :-)

These are the most recent data available, data for Q1 2018 should be available in April.

To get back to those monetary policies, the EU Trade Commission presently has a growing list of investigations into Chinese and Turkish imports for violating “anti-dumping laws”. They include a wide range of goods, from solar panels to steel cables, from frozen fish to leather shoes.

Among the reasons given for opening these investigations (which may lead to punitive import tariffs such as those slapped on cold rolled steel from China and Taiwan; in case you are wondering Taiwan is used merely as a transshipment point for Chinese steel to get around tariffs) are the “currency manipulation” both China and Turkey engage in with what can only be called thinly veiled enthusiasm.

No mention is made of the fact EU firms have been outsourcing in both China and Turkey with not so much veiled enthusiasm, taking advantage of those same conditions the Trade Commission may consider a cause for tariffs.

The Chinese have essentially stopped buying Treasuries some time ago. They’re largely just replacing those that mature, and their total holdings have hovered at a little over $1 trillion for a while.

So technically, China still is buying US Treasuries, just not increasing its total holdings of Treasuries. It’s been my understanding that China has to keep buying US Treasuries and maintain a large horde of US dollars in order to fuel its export economy. US dollars apparently never enter the Chinese economy directly, the central bank of China keeps it walled off from the Chinese companies and issues their own currency to the Chinese companies at the government preferred fixed rates who manufacture and sell their products to US buyers. Because of the huge trade imbalance, China can’t help but accumulate a massive horde of US dollars. The US dollar being the world’s reserve currecny means that China can use these dollars to buy stuff it needs from other countries, like oil and gas and other natural products. Still, the US dollars accumulate, and rather than let them sit there, China buys US Treasuries. Apparently if they don’t buy US Treasuries, just holding onto massive quantities of US dollars would eventually force their own currency to go up in value.

At some point Trump may offer to pay them in dollars, which may not be as inflationary as you think, because all of those dollars don’t come directly back to the US, they are used in China’s foreign trade exUS. For corporations who have to repatriate the hunt for cheap labor now transitions to robotics, which can live anywhere. China is no longer necessary, just a business deal.

The thing about trade wars is not so much who wins, but who loses more. In this case, I hate to say that Trump is right, but the US might actually have less to lose in an open tit for tat with China.

Sure, China can punish Boeing, Apple, and a bunch of other US companies, agriculture and such, but one has to wonder what China has to lose in turn. I’m sure the calculations has been made on this a while ago.

Of course, this is now much more difficult than twenty years ago considering how “as every talking heads like to say” interconnected the world economy is.

One way of looking at this questions as to who will lose more if it comes to a trade war: the Chinese export 3x as much to the US than what the US exports to China. So in that sense, it’s going to hurt China 3x as much. Obviously, the US-China trade relationship is a lot more complex. US corporate supply chains go all over China. So if it comes to a trade war, it’s going to be a big mess.

But I think the idea is that the implementation of the proposal would shake up China, and cause China to change in a way that it shrinks the trade gap and solves the IP issues, the technology transfer requirements, etc. That would be the best outcome.

I am guessing it is more than 3x. I have read many imports that are banned from China find other routes through shady Mexican or S. American shell companies.

That could be true. I always add China and Hong Kong together in all trade figures since a lot of the merchandise is transshipped via HK.

If auto components are made in China and shipped to Mexico to be installed at a Ford assembly plant, and then the finished car (containing Chinese components) is shipped to the US… those Chinese components are reflected in the US-Mexico trade figures, not the US-China trade figures.

Wolf, I think there is a simple truth to the fact that you fight a war when you can win or have a better chance of not losing. For the US, that point might have already passed, it isn’t so obvious.

If you consider the advantages, the biggest one China holds today is that it has an authoritarian government that isn’t beholden to a two or four year election cycle. The US might have bigger economic guns after a fashion, but it has a glass jaw in the form of voters who have gotten used to having everything delivered to them, and most of those don’t have a clue about sacrificing for the greater good because they’ve been told that it’s a pack of lies designed to serve the elites (and there is a good degree of truth to it), tell them that their favorite local coffee shop is going to start serving up $20 lattes because of the increased costs of commodities, they’ll cry a hissy fit.

Whereas comrade Xi has just cemented his power and is now able to reliably ignore any short term pain. If those idiots in Shanghai or Shenzhen want to rise up, fine, confiscate their money and send in the PLA. What’s the west going to do, send in the marines? Whine about it at the UN where China holds veto power? Slap on sanctions that will make the companies cry foul? For every Boeing plane that Xi cancels, he is going to buy something from Airbus, and Airbus is already too tied into China to do anything other than go against any reforms.

I’ve heard all of the media decry Xi as an authoritarian, I think he is viewed far more as a patriot in the only place that matters to him. China is using classic strategy of focusing on the weakness of the its biggest rivals and trying to amplify what little leverage it does have to gain advantage, leverage the China market, play off the European business interests against the US, etc, etc. Xi saw what happened to the USSR, he was in the US to see all of the natural advantages the country has. To put it simply, the games that are being played is on a different level as far as China and Xi is concerned, and at different time scales.

If it sounds like I’m being a shill for the guy, I’m pointing out the obvious. A leader with will, no checks on him, and the power of the second largest economy in the world is going to ultimately beat the strongest economy in the world where the leaders couldn’t get together on something as simple as common sense gun rules or control its own borders properly.

I think Xi’s recent success in getting rid of term limits which will allow him to become Dictator for Life can only be detrimental to China progressing further.

There’s a reason that after two centuries of constant warfare democracies and free societies have emerged triumphant over dictatorships and aristocracies to sit at the very top of the world in terms of living standards and technology.

You need a constant free flow of ideas and thought for scientific progress and social progress. A repressive government will always hinder radically new ideas from developing.

“A leader with will, no checks on him”, can undoubtedly accomplish many things much faster than a messy democracy can.

The problem with such leaders controlling everything is that they cannot possibly foresee what the right path forward is once they do get out ahead of everybody else, and their underlings will be too cowed to try to adjust the course forward for an optimal result. It’s easy to catch up and even surpass the rest of the world because that pathway is easy to see, having been trod already by others, but the future when you are in front is much murkier.

Maximum leaders are like that. They and only they get to choose what new technologies to pursue, and they cannot ever come close to being as good as a fully free thinking society that allows all ideas to come forth and be tried out.

And so it will be with Xi. I actually think China’s previous requirement of replacing the leader of China every ten years or so is what has helped freshen up the leadership and thinking of the leaders of China and contributed greatly to its growth. Things will only become sclerotic and rigid henceforth, as the government bureacracy increasingly becomes cluttered with Xi’s yes men.

Gandalf, I have removed the references to the H-guy. This figure doesn’t deserve to be named here. Comparing today’s politicians to him in any way is a fallacy. He was so evil that no one alive today can be compared to him. Thanks for your understanding.

@Gandalf.

I agree with certain parts of what you say. Because while Xi might be the next best thing to sliced bread, there is no guarantee what the next guy in line will be like. It is a problem with not having a check and balance. One thing for certain though is that Xi is more likely to be able to keep China on the fast track in this race that nations are on for the moment.

Will that ultimately result in crash and burn? Who knows. But as of today, one party rule has done ok for China in the last twenty to thirty years (from the economic growth perspective). But right now, compared to the western democratic systems, it is seeing better short term gains.

After all, can you imagine a China with a western style democracy like what we’re seeing in the US?

Wolf,

Many years ago, during a tour through China, I remember our young Chinese bus tour guide telling our group about Mao Zedong, and saying, “Do you know who Mao Zedong is? He is the Father of our country! Kind of like your George Washington!”

Mao is estimated to have been responsible for killing some 65 million Chinese during his reign, 45 million alone during the 4 years of the utterly insane Great Leap Forward.

That’s way more than the H-guy or Stalin, Julius Caesar (est. 1 million Gauls killed during his campaign against them, done mainly to steal their gold), or Titus during the sack of Jerusalem 70 AD (est. 1.1 million killed according to Josephus) or Attila the Hun or Genghis Khan.

So, naaah, Mao ain’t no George Washington. The H-guy doesn’t even come close to Mao. Mao did WIN all of his wars and his followers still control the country today, so he got to write his own history for his own people, just like Julius Caesar and the Romans did. The Romans are thus similarly remembered as the founders of modern Western European civilization, and not as “evil” people.

Gandalf,

I was very specifically talking about “no one alive today can be compared to him.” And I meant the parallel to Xi — and many similar parallels that other people make these days so lightly to living politicians (including to Trump… you might be surprised how often I see that!). I don’t tolerate these parallels to living politicians on this site.

Also, to me personally, Mao is just a historical figure, like Stalin or the Romans, or whoever. Something you read about in books. But the H-guy is not just a historical figure to me that I read about in books. It’s personal.

Navarro (Death By China) is allegedly pushing trade war buttons. I thought he was long gone, submerged under the wave of Goldman Sachs types. But wonder of wonders, the Goldman guys are gone and Navarro’s anti-China program appears to be a strong influence. Perhaps he has long training from academia on how to be appropriately obsequious. If you haven’t watched his videos for background on youtube, you should, while they are still there (see Crouching Tiger 1 to 5). Gives you an idea of Navarro’s views. Also don’t forget that the flic “China Hustle” will debut at the end of the month on an internet posting near you. The latter is more about Chinese reverse mergers than trade, but will likely be entertaining to Wolfstreet readers.

It has been observed that because the stakes are so small, Academia produces the most Machiavellian, tenacious and vicious fighters of all!

No class of people has a greater belief in the benefits of free trade than tenured economics professors. Free trade is great when someone else loses a job. But when it comes to their own jobs, not so much.

Why so afraid of China. Bcause it’sa manafacturing supwerpower thats now moving upstream.

I like my Huawei phone and my Volvo (owned by Geely). Thats so friggin funny, it aint funny. If you’re china what you gonna do. You have ambitions and keep copying things forever so you buy the technology and improve on it.

See Huawei , which is now coming with it’s own patents and Linkin Co (cars)…knock off with good Swedish/Chinese engineers.

So if you have a mega home market like China does, why give it up to foreign companies….duh. Develop the know how locally and leverage that into global companies. This is beneficial for the world economy cuz more affordable goods becomes available to the poorer parts of the worlds popuation. The US is slowly loosing it’s LEAD, and the high margins it probably can command from the advanced technology. Now if China and India decides to keep it’s brain power and engineers at home Silicon Valley will be in for a world of hurt.

Bingo… China has been leveraging their strengths for years to further their goal of becoming #1. In the 90s, it was to leverage cheap but talented labor. In the 00s, it was to leverage the expanding middle class and the markets. These days, they are leveraging the US denominated debt and their money all around the world. But these enticements were all about how to get ahead. JVs and other mechanisms that has been setup offers a consistent theme to help along with technology transfers.

Example: Hey Airbus, you want us to buy more of your planes, come, build it in China, but we need a JV. Oh, you don’t want to? Fine, we’ll buy it from Boeing. Good, now that you’ve come around to our way of thinking, Kiss my ass please.

Then the next day: Hey Boeing, we’re happy to buy your planes, but what’s in it for us? The frogs and the krauts make just as good, and they’re tossing in incentives like building a factory here in China. Do you want us to buy the 200 Boeing 737s or not? We could just buy A320s.

All the while, the technologies have been shifting slowly over to COMAC, and eventually that will take on both Airbus and Boeing. This has happened over such a long period, that the West is actually not

thinking about it as a threat until it becomes too late.

Looks like China needs a PeePee tape

If these tariffs were to cover a very broad range of goods it will pu American consumers in a worl of hurt. Almost everything the buy except food comes from China. And retailers from Walmart to Apple will also be hurt. If the tariffs are only on China then eventually manufacturing will be redistributed to other countries but that will take time. There is a huge manufacturing investment in China and it would take a lot of time and money to relocate. And some price increases would probably be permanent.

Sounds like a brilliant political move that could be a financial disaster.

Well, Americans buy too much stuff already. Certainly too much food (look at the obesity and also food wastage rates), though presumably most of that is actually produced in the USA. But too much crap from Walmart made in China! As George Carlin famously said, people “buying s*** they don’t need with money they don’t have”. Do people really need a new $800 smartphone every two years? And how much of these purchases is really consumer debt?

There was a telling article in the WSJ years ago that I never forget, comparing attitudes to credit cards in different countries. Whereas many Americans have multiple cards (and store cards), in the EU people use them much less. They interviewed a young German woman who only had one and claimed to use it only in emergencies, the rest of the time paying cash. Imagine that!

I visit Japan fairly often and there is a huge contrast in how people live and especially how long they keep things before getting rid of them. And no McMansions!

Pavel – In other words, they live more like I do. I just spent $240 on a smart phone + case + 2 screen protectors and am on a $40/month plan. Mostly it’s to be able to text, the lingua franca of this age.

I get around by bike/bus/trolley/train, and am on a laptop that’s at least 5 years old, maybe a bit older (and performs really well, really, it runs rings around a new Apple).

I use a debit card, which is pretty much the same as cash, and I use cash quite a bit too.

I call it living a modest life. The thing is, to live how the average American considers their birthright, I’d have to run like mad, work 2 jobs, and be miserable to have a car and an apartment.

Because I’ve not departed from my “modest life” and stuck with working for my friend, his business has grown and that’s brought about the move to a larger building, and this as resulted in my soon moving from a 140 square foot office which I actually have the use of maybe 70 square feet of, to a 12X16 loft which will be all my own. That’s almost 200 square feet. I’ll even have an honest-to-goodness Japanese futon, the kind that folds up in 3 sections, up there. Turns out they sell them at the betsuin temple store in Japantown so I don’t have to go all the way to Mitsuwa Marketplace to get it, or up to SF.

I think this may be what’s going on with “the Millennials” or “hipsters” – they’ve realized the car and McMansion etc are either not achievable or are only achievable by working themselves to death, so they’re scaling down. Why fret over having a nice car if you can get away with having a nice bicycle? Why go to Applebee’s or Marie Callendar’s if you can learn to cook at home?

yes OE, with no real wage growth in many months, the consumer price inflation resulting from tariffs will put a squeeze on disposable incomes.

Anything that might encourage companies to return manufacturing to the U.S. would be welcome. An increase in the price of frying pans at Walmart is ok. The dastardly plot by U.S. companies and politicians to export U.S. jobs has had a devastating effect on the economy and society of this country. I did not vote for Trump, but I would applaud any move that caused a return of U.S. manufacturing, which made this country great.

I agree that returning manufacturing to the US is good. But the initial shock of cost increases to consumers and retailers is going to be painful. In addition it seems more likely companies will just move the production to other countries in southeast Asia and Latin America with some cost increase over present prices, even if not the whole 25%.

I think the problem is cultural. If I go to the store to buy a spatula, it’s $7 and made in China. This is because it’s gone through the hands of several middlemen before it gets to me. A US factory can certainly make a spatula as well made, for less.

I keep harping on this but an American could set up in their garage and make any of a number of things, from brooms to house slippers to you-name-it, and sell them online. Sell them locally. Any sort of way. Those cheap $10 Chinese sneakers in Wal-Mart aren’t $10 any more, they’re $39.95. That $3 broom is $14.95.

The thing is that everyone’s pushed to go to college and if you work with your hands, it’s because you’ve failed in life.

My understanding is that Germany, by contrast, actually encourages manufacturing and the trades. And they’re doing well.

I don’t see how forcing China to give the same rights of ownership to American companies that Chinese companies get in US as a problem. That simply means US manufacturers would directly manufacture in China….We should force them to give union rights to their workers and the right of the IBEW to organize their workers.

Dear Felix_47,

Comrade Xi is looking at your proposal and saying, but we are in a communist paradise of equals. Our worker already have rights. Surely you jest. And what a rotten scoundrel you are for trying to force us to come to your way of doing things, trying to sow discord amongst the people.

*tongue firmly planted in cheek*

You can tax or even ban imports of Chinese- made clothing (with shoes second largest category of imports at 19 %) but don’t imagine this will have any effect on US jobs.

In the short term it will greatly increase the price of budget clothing hurting lower income folks.

That is the bad news. The good news is just the cancellation of the bad news (why do I bang my head on the wall: it feels good when I stop)

After 6 months to a year max, a lot of the Chinese share will be taken up by their current competitors: Pakistan, India, Sri Lanka etc, etc.

So you will shrink Chinese imports by substituting others.

Unless you want a permanent clothing tax on the US consumer of at least 100 percent (i.e. double ) there is no possibility that Americans are going to sew clothing panels at a speed and a wage to be feasible.

The only possible exception for sweat shop production inside the US would be by undocumented immigrants.

This is going to lead to an explosion of inflation because it will limit the Chinese ability to repatriate cash to the US. It wasn’t China who told rubbermaid to move to China. It wasn’t China that forced Apple to move there either.

The US is blaming China for US companies going there. Now they’re a manipulator?

US companies moved there because of greed. They got away with it because Congress is the most corrupt collection of whores on earth.

This is going to send the stock market into a tailspin and usher in QE 4, 5, 6, …. or as Faber says,, QE infinity.

Gosh, maybe that cheap labor wasn’t so cheap after all.

I had been wondering what sort of attack there might be in the face of the new petroYuan arrangements. No country has ever been allowed to sell oil for other than dollars. But buying? It is not like we are going to bomb Saudi Arabia or China outright…. These general complaints about China are about things that have been going on for decades. Why tariff socks and whatnot now? Quite the coincidence.

Having said that, bring it on. Cheap socks and petrodollars are both too long in the tooth.

? Since when can’t you sell oil in dollars? Russia doesn’t sell oil in dollars. Neither does Saudi Arabia.

You can buy in any convertible currency. Saudi quotes the price in US$ and you pay whatever your currency is trading at re: US$

As US imports from Saudi grow much smaller and China grows larger there is talk of China ‘compelling’ Saudi to quote in yuan at whatever the two agree on. But that hasn’t happened yet.

US imports from Saudi Arabia were never very high. Saudi Arabia doesn’t price their oil in dollars. They don’t nor have they ever delivered oil to the US futures market. All Saudi Oil is sold through delivery contract.

As to their “quoting” oil in dollars, they went off dollar quoting during the Bush administration. As to the price, unless you are privy to the contracts they sign with refineries, you have no way of knowing what the price is.

Any quote they publish is an Opec benchmark used to calculate Opec nation quota’s.

You don’t contract with the refinery. You contract with Saudi Aramco. The quotes for the OPEC basket, Mid East Crude, and Dubai all around 62 US are on site ‘Oil Price’

Saudi Aramco contracts with refineries. Those refineries in Europe are owned by BP, Total, yada …

Saudi Aramco doesn’t use listed prices because they don’t sell oil in futures markets. I’ve already told you that. each blend of oil to each refinery has it’s own unique characteristics based on sulfur content and API grade,. The oil from Safaniya offshore is different from Ghawar, which is different from Abqaiq which is different from Hofuf.

Oil prices are negotiated based on economic, refinery, political and delivery characteristics. Oil sent to Egypt is discounted because of an agreement to protect red sea pipelines by Egypt.

The fact is, nobody knows what saudi arabia sells oil for or how much because it’s a state secret. The opec basket price is used to negotiate opec quotas. The benchmarks are used as start points in negotiations. For spot oil, or api grades without enough volume to be hub priced, a bid ask spread is proposed by Platts and negotiated from there.

US$ always acceptable. Others negotiable. (Which is where we began)

I think all we can agree with is that the stock market will go …. up.

Because this is definitely making America Great Again.

Anything and everything makes the stock market go up. The law of gravity has been repealed and it can only go up forever. Print those dollars, buy those stocks!

All I know is that I can buy a Chinese knock-off carb for my antique Honda motorcycles for $14 delivered, (after I forgot to drain crap ethanol fuel before storage and they varnished up). Bolt on, already tuned, start up 1st kick. New parts not from China? $80+/per. Also, the Chinese manufacturing pressure has kept the price of small gas engine motors within reason for ag and industrial users as opposed to having to buy crummy Wisconsin built motors; a State at war with its workers and Unions, by the way.

China or Wisconsin? I used to always buy NA made products until about 5 years ago. Now, first choice is Canadian if it is within 20%. After that I don’t care where parts are made as US manufacturers don’t care about their own workers in any event. If they did, they wouldn’t have started offshoring 30 years ago.

Here is the irony. We have marketing boards in Canada to protect certain ag industries; eggs, poultry, and dairy are a few examples, including wheat. We pay higher prices for all of these products in Canada than what US consumers pay. Plus, our export prices are higher. The purpose of these marketing boards are to protect our Agriculture Industry and our smaller farms from the juggernaught of US multi-nationals. The attack on NAFTA and the hardball attitude of US NAFTA negotiators are attempting to undermine our economic sovereignty and choices in how we construct/protect our economy. In particular, access of dairy from Wisconsin into Canadian markets is cited as a primary objective for a new agreement . And now here is the US, implementing protectionist policies that will drive domestic prices higher for their own citizens, and further limit choice. I submit that these protected industries will become less efficient over time, and that any short-term savings and profits that arise from protectionism will go to shareholders and execs in the form of dividends and bonus rewards.

I guess we’ll just have to ramp up soybean production and sales up in Canada to supply an expanding market.

As an aside, the afore mentioned aluminum industry is already 2/3 more efficient in Canada and China than US operations, mostly due to new construction of plants, upgrades, and lower energy costs. Furthermore, the aluminum workers in Canada are some of the highest paid workers in the industrial world. Hourly rates are between $32 and $45 per hour….+ full benefits. The average wage in US smelters is $22.

10 western aluminum smelters closed in 2000-2001 due to an ‘energy crisis’. From Reuters: “The West Coast power crisis was caused by a toxic combination of too little generation capacity, a chaotic pricing model and the machinations of traders who manipulated the flawed system.

So, if you want to know who killed the northwest aluminum smelters, it was Enron. ”

https://www.reuters.com/article/us-aluminium-ahome/can-trump-resurrect-u-s-aluminum-and-who-killed-it-anyway-andy-home-idUSKBN1A201M

Protecting the past is a lost cause for the US, imho. This will not end well. I taught my grand-daughter a new expression this past summer, “Suck it up, Buttercup”. Falling behind? Trying to trip up competitors doesn’t work. What’s next, cyber espionage and fires of mysterious origin?

There is No “Free Trade”–There Is Only the Darwinian Game of Trade

March 12, 2018

https://www.oftwominds.com/blogmar18/game-trade3-18.html

Stop trading with China. End NAFTA. Buy Across State Lines Healthcare.

The Hundred-Year Marathon: China’s Secret Strategy to Replace America as the Global Superpower – 2016 paperback

https://www.amazon.com/Hundred-Year-Marathon-Strategy-Replace-Superpower/dp/1250081343

IMO, not so “secret.” Anyway, “A capitalist will sell you the rope you hang him with”, AKA – a foolish fixation on short term gain where the long term game is literally given away.

Contrary to popular belief Chinese people have demonstrated a stunning shortsightedness that makes Wall Street look far sighted. Just look at the last decade. Instead of allowing their imbalances to work themselves out in the aftermath of the financial crises they went on a debt binge that created by far the biggest bubble in history. They also managed to isolate themselves almost completely with short sighted and ill thought out annexations of their neighbors’ territories, in doing so ensuring they will be at a huge strategic disadvantage in the long term.

Maybe this is completely off base but I have to imagine if a trade wars leads to increased consumer prices on vast amounts of goods that this sooner or later will cause wage inflation to balance thing out.

I’m guessing you’ll primarily see shrinking profit margins, as consumers today can’t really afford major price increases.

If interest rates continue marching higher (I doubt they will go significantly higher than where they are today, but hypothetically), consumers will have even less money to absorb price increases and producers will have higher input costs as well as higher capital costs, doubly eating into profit margins. At least that’s what I guess would happen.

I don’t think any significant wage inflation is likely, personally.

Wage inflation won’t help the 42 million retirees, a cohort that will continue to grow by 10,000 people retiring per day for the next 12+ years. They don’t receive wages that may or may not increase…but they sure as heck will be impacted by consumer price inflation if and when it increases in a meaningful way. Incidentally, seniors are also known for being avid voters. Implementing trade policies that stoke CPI just might turn out to be a classic case of “Careful what you wish for…”

I don’t know if Trump is right or wrong, but you have to give him credit for at least trying to fix a trade mess he inherited from a couple of truly horrible presidents.

If the US wants to restrict something, should start with the biggest prize of all: US property…and adopt a policy some other countries have: No ownership of US property except by US citizens. Period. Maybe if US citizens could find an affordable place to live again, they wouldn’t mind paying a little more for some US produced goods.

I wonder if this is a cover for the Chinese to devalue their currency?

The Art of the Deal?

Finally something major is being done about this. Trying to go through the WTO hasn’t worked, Obama’s tentative tariffs didn’t work. Time for a change.

In other news. Muricans don’t even know how to produce cars anymore:

https://www.zerohedge.com/news/2018-03-14/teslas-top-financial-execs-suddenly-quit-amid-reports-high-volume-flawed-vehicles

LOL. The President is definitely doing the right thing. If we don’t stop this trend, the next thing is that we can’t even make our own breakfast no more. The only thing we’ll do is produce frauds like Elon Musk, Elizabeth Holmes, and Wall Street.

Tesla never knew how to mass-produce anything. Tesla is not a manufacturing company. It fabricates a small number of niche products. Musk thinks he can release beta versions of his products because he never made the transition from software to manufacturing. This has nothing to do with Americans and everything to do with a failed approach to manufacturing by a software billionaire.

Hi Wolf:

Actually I think Elon Musk’s real skill is in milking tax payers!

Yes, that too.

it took Trump of all people to come down hard on the Chinese, Most of the media is pro-Globalist, so we only get one side of the story. This is something that should have been done years ago but successive administrations have been too week or too corrupt to act. Sure, a trade war may increase inflation and yes it may tank the stock and housing bubbles, but is that really such a bad thing? And just maybe, some manufacturing jobs may come back to the states. The tech companies and globalists say, well everyone will eventually be a computer programmer, that is a monstrous lie or at the very least pervasive propaganda fed by a compliant media. Tech jobs are disappearing overseas as fast as manufacturing jobs and jobs in the services or gig industries aren’t going to provide americans with the financial security to survive in today economy.

With CCC testing, IP is the price of access to the Chinese market.

One of the benefits of having a president, or any politician, that has a strong business background, is that they know how to play the game. Within days after Trump proposed imposing tariffs, investment restrictions, and visa limits, we can already see results:

“China’s premier promises ‘wider opening’ of economy”

http://abcnews.go.com/International/wireStory/chinas-premier-promises-wider-opening-economy-53864906