During prior incidents of an “inverted” yield curve, the Fed had no tools to get the market to push up long-term yields. Today it has one: the QE Unwind.

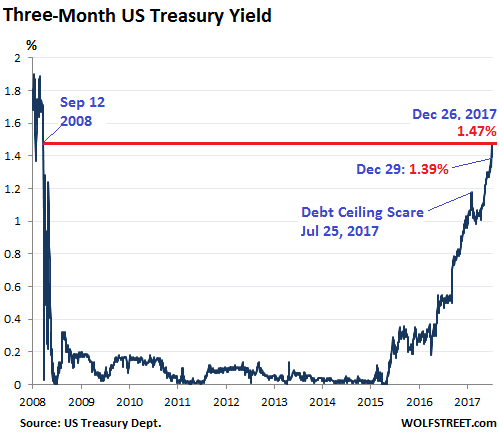

The price of three-month Treasury securities fell and the yield — which moves in the opposite direction — rose, ending the year at 1.39%, after having spiked to 1.47% on December 26, the highest since September 12, 2008. This is in the upper half of the Fed’s new target range for the federal funds rate (1.25% to 1.50%). Back in October 2015, the yield was still at 0%:

The Fed is tightening, and clearly, this end of the Treasury market believes it.

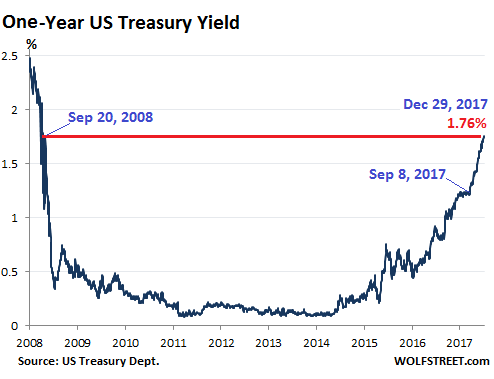

The one-year Treasury yield rose to 1.76% on Thursday, and stayed there on Friday, the highest since September 20, 2008. It had fallen as low as 0.1% in 2011 and 2014. Note the nearly uninterrupted spike since September 8, 2017. Mid-September was when the QE Unwind transitioned from vague idea to a scheduled series of events:

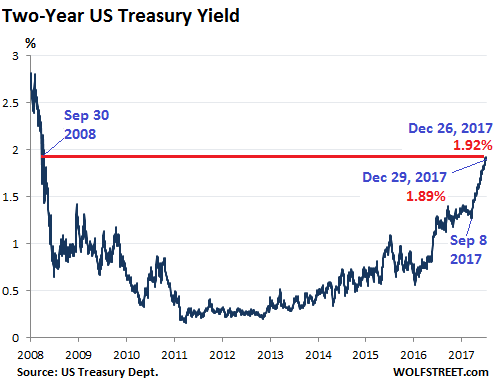

The two-year yield hit 1.92% on Tuesday, the highest since Sep 30, 2008, and ended the year at 1.89%. Note the nearly uninterrupted spike since September 8:

At this end of the yield curve, the market is convinced that the Fed is tightening, and it isn’t fighting the Fed, it’s responding to it, with prices falling and yields rising.

But with maturities of three years and higher, a cacophony has broken out, with longer-term yields spending most of 2017 defying the Fed.

This too has changed since September 8 with the three-year yield. It has now formed a spike of its own. This is new, and it shows that the believers in Fed-tightening are moving up the curve, perhaps taking the QE Unwind a little more seriously. On Tuesday, the three-year yield hit 2.02%, the highest since October 14, 2008, and ended the year at 1.98%:

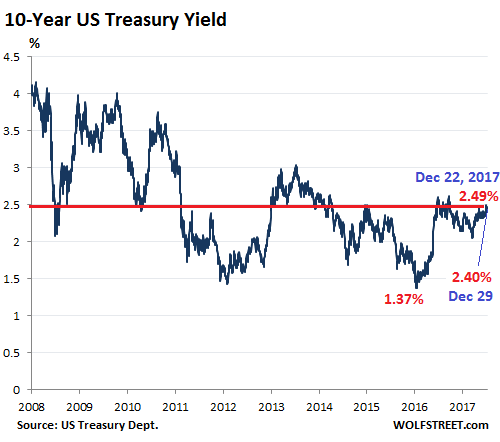

Even the 10-year yield has ticked up lethargically over the past few weeks, reaching 2.49% on December 22. That’s still down from earlier this year when it flirted with yields above 2.6%. But it’s the highest since March 16, and it’s up by over a full percentage point from the historic low of 1.37% in August 2016. The 10-year yield closed the year at 2.40%:

But it wasn’t enough. Most of the time, the 10-year yield is significantly higher than the two-year yield. But occasionally, the spread between them narrows toward zero and eventually becomes negative, with the 10-year yield lower than the two-year yield.

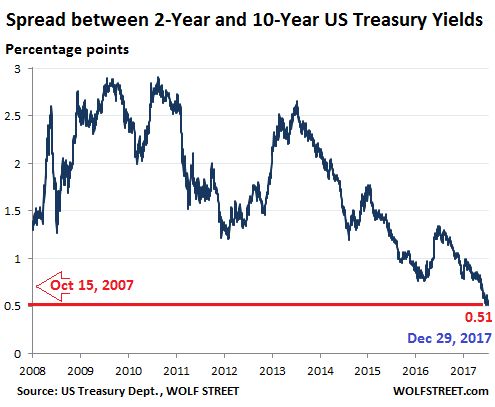

This condition has proven to be an ominous precursor. And it’s at it again, to the point where the narrowing spread between these two yields has made its way onto the Fed’s worry list. That spread collapsed to 0.51 percentage points on December 15, and also ended the year at 0.51%, the lowest since October 15, 2007:

Back in October 2007, the spread was widening after having been negative in late 2006 and early 2007 as part of an “inverted” yield curve. Not much later, the Financial Crisis cracked the veneer of the banks.

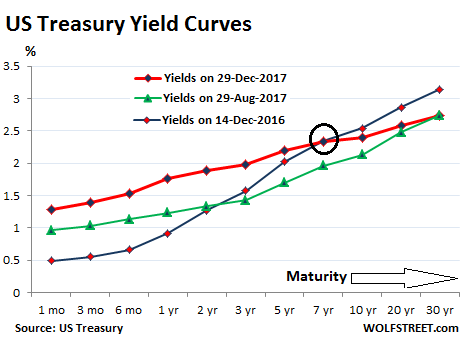

The chart below shows the yields across the spectrum for three dates:

- December 29, 2017 (red line).

- August 29, 2017 (green line).

- December 14, 2016 (blue line), when the Fed got serious about tightening.

Two things stand out:

One, the red line (yields on Friday) has “flattened” compared to the blue line (yields on December 14, 2016), with short-term yields (left side of the chart) rising in response to the Fed, even as yields of seven-year maturities and longer (right side of chart) have fallen. This is the flattening yield curve everyone is worried about.

And two, the relationship between the red line and the green line (yields on August 29, 2017) shows that the very long end – the 30-year yield – has stopped falling since the end of August, and all other yields have risen, with the mid-section rising the most. This includes the recent surge in the three-year yield noted above.

Even the seven-year yield (circled in black) is now above its level on December 14, 2016 – for the first time since March. This means that, even while the spread between the two-year and the 10-year has narrowed further, the middle of the curve – not just the short end of the curve – is now making baby steps in responding to the Fed’s rate moves and the QE Unwind.

In other words, the believers in “Fed tightening” are creeping up the curve. These baby steps in that direction are likely to continue: note the signs that the 10-year yield is starting to respond with its own baby steps.

During the prior incidents of an inverted yield curve, the Fed did not sit on $2.45 trillion of Treasury securities and $1.76 trillion of mortgage-backed securities. Back then, the Fed had no effective tools to get the market to push up long-term yields. Today it has those tools: the QE Unwind.

The Fed’s “balance sheet normalization” will accelerate as 2018 progresses: In Q1, the Fed is scheduled to shed $60 billion in securities, in Q2 $90 billion, in Q3 $120 billion, and in Q4 $150 billion, for a total of $420 billion. This is scheduled to increase to $600 billion in 2019.

And if the Fed wants to spook the markets into jacking up long-term yields, it could accelerate further its “balance sheet normalization.” For the first time in history, the Fed can actually do something that will drive up long-term yields.

It has already started to do that ever so gingerly with the first steps of the QE Unwind in Q4 2017. The market seems to be responding, equally gingerly, by selling off longer-dated maturities – the mid-range of the curve – and pushing up yields.

This is where 2017 ends. 2018 will likely be the year when the effects of the Fed’s “balance sheet normalization” appear more clearly – including a yield curve that will change course, and instead of inverting, will start to tilt up at the long end, as longer-dated bonds are starting to sell off, in line with the moves at the shorter end. This would put to rest the fears about an inverted yield curve, but the selloff in longer-dated Treasuries would be a painful experience for coddled bondholders.

Leverage is the great accelerator on the way up – and on the way down. Read… Peak Good Times? Stock Market Risk Spikes to New High

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Historically, a flat yield curve meant demand for long bonds was disproportionately high, probably due to a flight to safety from equities to high quality bonds.

Today, it’s a function of central bank printing and debt monetization. No rules apply.

Tomorrow, if we are all lucky, history will reassert itself and rate normalization will return along with a yield curve that responds to economic pressures, not central bank money shenanigans. Thank the Fed if this happens.

To the down side, those who depend on the recent wave in economic thinking (Bernanke/Yellen, Japan, Draghi, Swiss, China) where central bank money printing, negative rates, debt monetization, and asset inflation are a substitute for saving, investment income from savings, and investment financed by savings will be in a big hurt. The free market in the US (hopefully) reasserting itself (over time) will be a monkey wrench in their works.

Volatility will be the end product (understatement) if rate normalization and balance sheet reduction succeed. Just imagine if rate normalization returned to the eurozone.

I’m finally earning a bit at the low end in a MM fund. Looking forward to the apocalypse.

RE: the apocalypse –

The four horsemen – The Fed, The ECB, The BOJ, and _______. To me, China is just holding the country together. The Swiss are only common thieves.

So, you are saying that the flattening yield curve is the symptom, not the cause, but manipulation is so addictive that the addicts will do it anyway?

yes

Well put, CDR. The 7 day yield on my US Treasury MMF – 1.11% – is nearly 6 times what it was 12 months ago …. finally…..whew! The Eurozone will be lucky if apocalypse is the worst that happens over there.

A few years ago, the possibility of ‘break the buck’ prevailed with MM fund management. Much of what was going on then, crisis wise, was too new to comprehend and there was some validity to the idea. Today, I think the possibility exists but is too remote to consider as more than a curiosity level risk to even a mediocre fund. People learned.

Unless someone is in an ECB oriented MM fund. Highly unlikely because I find it difficult to imagine anyone putting a dime of their own money in a MM fund with negative rates. Maybe a few true believers from Brussels, but nobody else. Then again, with their war on cash, maybe it’s the best deposit alternative available over there. Glad I live here. If this goes on long enough, maybe everyone in the Eurozone will become a Greek-like tax evader. Well, they assimilated the Romans for different reasons.

Basically, I find it rather comical that learned minds of finance mostly see the ‘inverting yield curve’ as a technical indicator that foretells the future like chicken entrails or a voodoo seer. Kreswell would approve. They write as if it is a controlling factor, not a reaction to current rate manipulation by central banks that’s perhaps influenced slightly by a flight to safety in a world that has trillions of dollars invested at negative rates.

No natural force of economics would create negative rates. That’s a new idea. They’re necessary to perpetuate QE and monetized debt, so that printed money becomes a substitute for income from savings and investment from savings. And a source of massive debt monetization.

I, for one, am sick and tired of indirectly via Fed policy supporting the QE monetary scams of The ECB and BOJ and the Swiss central bank. Bernanke and Yellen may think that replacing savings, interest income, and investment from savings with money printing and asset inflation is a great idea. Actually, I would love to hear one or both explain their logic as to why.

Most of the ‘yield curve’ dialog of late that accepts it as infallible prognostication are supporting fake economics that just as fake as much of the news.

I see the interest rate environment being consistent with the idea that there is no real market for 30y money. All of the demand for money is on the short end. This is what is pushing the short rates up. The market is signaling that the real long end is the 10y and that is consistent with the housing market. Home buyers borrow 30y money but they pay back 10y money at a profit for the GSEs.

‘Flattening Treasury Yield Curve And Recession: This Time Is Different?’

Economic theory has always held that an inverted U.S. treasury yield curve could be used as a reliable signal for a recession looming on the horizon. According to the Federal Reserve, however, this time is different!

This Time Is Different…

So the Fed is vaporizing a trillion dollars over two years to lift the long interest rates. That is not pocket change but it will have little impact if there is truly a worldwide run for safety.

Another trillion is just another sprinkle on the cupcake. Here is one of the best detailed reads I have stumbled upon lately explaining the collapse of 2008. At the bottom of the article there are other links detailing 2007 and 2009 as well. (and what was that recent visit to Ft. Knox all about? wink wink) With all the global financial skullduggery, it seems as though we are living the X-Files (or the F-Files?). https://www.thebalance.com/2008-financial-crisis-timeline-3305540

The Fed is fighting itself, they keep (whistling past the graveyard) hiking with asset bubbles all around can the economy tolerate (real) interest rate hikes (rates > CPI) ? LIBOR is on an even steeper rise, while Euro junk yields are below UST. One central banker lies and the others swear to it, the Fed has no autonomy, no independence, and no accountability. Rates will collapse. They cannot stop it.

Gyrations in asset prices in themselves are not a big deal, the problem is the flip side of those prices, the corresponding debts – when asset prices deflate, the debt remains, and this is what rips the economy apart, like a building that is half resting on the ocean and half resting on land, when the tide goes out.

U.S. has deleveraged a little since the last recession, so not likely to be the worst in the next one – places that never deleveraged in the last recession or leveraged their way through it (China, Canada, Australia, Scandinavia, a number of ’emerging’ markets, etc.) are likely to take the worst of it this time. McKinsey’s ‘Debt and not much deleveraging’ report is likely to be a good guide to the next blow-up.

We are rapidly sowing the seeds for world wide depression.With us long rates rising it will suck capitol from the rest of the world unless they reciprocate with like rates.That will put increasing pressure on asset prices.Crises will feed on crises. Stock-up on popcorn!!

I think it’s more like: Rates will rise. They cannot stop it.

Given that algos do 99% of the trading, and that the Federali Reserve

will raise rates incrementally in predictable quarters, the markets will price it in, and incrementally adjust along with telegraphed CB prognostications. The new Fed Chair will merely carry on with former Fed Chair rhetoric, and the markets will follow suit in lockstep like they always do. No grand long bond crash will manifest if the CB normalises in small increments, but the CB will end up stopping rate normalization mid stream due to the fact that the QE unwind will not be there to pick up any slack in real GDP as corporations will no longer be able to fund Share Buybacks, and will actually need to either increase productivity, or consolidate assets, and ultimately downsize, or head for the exit signs, all in unison.

QE unwind will take time to create market contagion, but once it starts, the CB will have trouble taking up the slack. Ergo, that’s when they will opt for QE Infinity once again under the Keynesian guise of needing to restimulate a systemically dysfunctional market cycle. The BIS is already working on Cycle Drag Theory instead of Summers’ Secular Stagnation hypothesis which they don’t like on theoretical grounds & implications for structural changes going forward.

MOU

Exactly my thoughts and few has said it better than you did.

Believe me or not…the share buybacks ones are really just the “conservative” spectrum in corporate behavior. I know at least a handful of Fortune 500 pursuing remotely plausible projects (aka Moonshots) that are clearly non-feasible; but given the low internal IRR, (and even negative rates in some cases), and the “free” money thrown in by the herd investors, any and all projects can be funded.

In fact, the more Unicorn-sounding the project is, the more management buy-in and excitement you get… just like how simply associating your company with Bitcoin-or-blockchain-anything now gives your share prices a nice boost. lol

The startup Unicorns looks a little desperate now and the old industry stalwarts are also looking a little harried for real growth versus the current financial wizardry. Everyone still has some time given the additional slack from Trump’s tax cuts that will once again favor mostly the big corporates. In other words, stock market will likely be fine and crawling up the wall of worry for the next half year of 2018 at least. Beyond that, its anyone’s guess when the volatility will pickup.

Despite the rhetoric from Yellen, my take is that real interest rates will not be moving up anytime soon. All the volatility is being ring-fenced within cryptos, and it will burn off, figuratively and financially, the masses of stupids. Strangely, I think the CBs have successfully co-opted the Crypto-craze now to wipe off some of the excesses from printed money. From my assessment, CBs win this hand now and the mass of stupids converting their fiat cash to chase the cryptos are the stupids helping CBs destroy some of the printed excess. So, in a twisted way, these mass stupids are really helping the overall economy and playing into the plans of the CBs. Ya’can’t have everyone gettin’ rich, so the mass stupids are given a dream once again and encouraged with mass media articles about so-and-so raking it in with crypto currencies to goad the rest into it….and they WILL fall for it.

We have already crossed the Rubicon probably back in 2014 or thereabouts and now this QE has to go on indefinitely or else…

After what I’ve seen printed about cryptos over the last two days I am fully in agreement with your above assertions. The CB is most assuredly attempting to short the heck out of Bitcoin et al. And yes, we have crossed the point of no return, but I would say that that was crossed in March of 08 when Bear was murdered outright.

MOU

Let’s see now, the US is 9 years into business expansion and that is a helluva long expansion, the FED is removing liqudity and for the next financial year, the US governmet is going to borrow even more than they have hitherto. Almost 110 months of expansion, that is one of the longest periods in modern time, so the peak must be near and how is the economy going to play out with liquidity being removed at the same time as the government will need to borrow even more ? Interesting times …

In addition, the new tax bill will probably cause huge stock buybacks like the previous one did almost 15 years ago. A lot of those funds that companies are keeping “abroad” are in fact already invested in the US, a lot as US government bonds and to free up these funds for stock buybacks, to “repatriate” this money, companies will have to sell those government bonds at the same time as the government have to borrow even more from a market with reduced liquidity. Interesting thought indeed.

Here’s an entertaining couple of images …

https://imgur.com/a/vKm5K

Could someone properly knowledgeable on this matter please inform me (and readers) : Is the MONEY (the Principal payment from Treasury) which will be repatriated from the Fed back to treasury, as “QE Unwinds” (via Fed letting it’s bond holdings “run-off”) being counted in “THE DEFICIT” figures bandied about from the tax cuts?

Someone please……there’s no way to find this out from the web. Perhaps Wolf can ask OMB in his official capacity or such, or someone? It is not a small amount of money we’re talking about!

Once the treasuries come due and the principal is paid from Treasury to the Fed, the Fed destroys the money. It’s not given back to the Treasury. Therefore, the reverse QE doesn’t reduce the fiscal deficit.

In other words, the base money is printed as part of QE, then extinquished as part of reverse QE.

Not sure if that answers your question.

this was exactly the question. are you sure about the “destroy” part, and “not given back to the Treasury”? I’ve heard otherwise: any money left in hands of Fed after deducting for its running budget (~$1bn or so), is repatriated every year back to Treasury.

I think you are confusing principal paid back to the Fed (Treasuries or MBS paid off) with profits made by the Fed from interest paid on these securities. There is money left over at the Fed (we hope) after paying all of it’s operating costs plus a dividend paid to the shareholders (I’ve read the dividend payout is 5%) and these leftover funds are paid to the U.S. treasury. So part of the profits, earned as interest from MBS and treasuries, is paid to the treasury and part is paid to the shareholders. Of course this means part of the interest paid by the treasury is remitted back to the treasury from the Fed – but only part of it.

It has never been clear to me how the dividend paid to the shareholders is calculated – 5% of what? If the Fed pays a 5% yield to it’s shareholders how is the Fed valued to pay out the yield (what is the market cap of the Fed). Perhaps this refers to just 5% of the profits – but I doubt it.

I think I have said this a dozen times in the last several years, but here goes again:

The Fed does not “print” or “destroy” money. That is just a figure of speech. When FRB “buys” bonds it does so by recognizing the bonds as the backing for new reserves, and credits the reserve account of the selling entity, which could be a FRB member bank or the UST directly. This is what really happens when people use the phrase “printing”, a misnomer.

In the other direction, when FRB allows USG bonds to mature without “buying” replacement ones of at least the same amount, the UST general account at the FRB must be reduced by the same amount as the value of the bonds. This is what people call “destroying” money, again a misnomer.

Now, the USG had better find someone else to sell new/replacement bonds to, or else the UST reserve account at FRB will go to zero or worse. Most of the time a buyer can be found, as long as the interest rate offered is high enough.

The main reason that I dislike the faulty print/destroy terminology so much is that it causes simple-minded people to think that there is an alternative to “destroying” the “money” (debiting the UST reserve account) to pay off the bonds. But if you allow that, that REALLY is equivalent to printing money. You are then allow the existence of money (reserves) that is backed by NOTHING. That will truly “debase the currency”, to use another popular expression.

Never forget that money (cash currency or reserves) always must be is a CLAIM on something, or else it is worthless. That something used to be gold, now it is USG bonds that are in turn being perceived as being backed by USG property and USG future income (taxes).

I think I’ve said this a dozen times the last several years – the Fed does, in fact, create money and lots of it.

The banking system also creates money, scary amounts of it.

I think you may be confusing people – whether one considers it “printing” or immoral is based on an understanding of the mechanics.

They are “printing” at present (giving the bond issuer purchasing power by taking it away from everyone else who transacts in dollars) with an arrangement wherein they will “destroy” the money at a later date (when the bond issuer repays).

Over the infinite time horizon, you are right that no money is created, but that’s not to say there is no net change in money supply at different timepoints along the bond maturity. They can create booms and busts (the business cycle) by lowering rates (buying bonds with printed money supply) to later create a bust with high interest rates (selling purchased bonds and burning the received money supply).

If they weren’t “printing”, then anyone else could play their role. They are in a position of privilege because they can reallocate everyone’s purchasing power to themselves (“printing”) out of thin air to buy bonds – with the arrangement that they will later “destroy” received money. All simply because they (unlike everyone else) can issue new money in return for a promise to be repaid.

Reply to Jus7me: Correct or the Fed could just put an entry on their books of “Payment due from Treasury” and there would be no need for the Treasury to replace the retired bonds. This would be even less costly to the Treasury than returning the net interest on the bonds. If the Treasury does reduce its general account at the Fed and replaces the bonds, to the extent the replacement bonds are purchased with deposits held by the private sector and not by banks, and since this represent no new expenditures by the Federal Government which creates new deposits in the private sector, deposits and the money supply would be reduced.

Kiers: I’ll try to help your understanding, which indeed limited and faulty at the moment.

1. Only *profits* of the FRB are returned back to the UST.

2. Return of profits does not in any way shape or form cancel any debt that the UST has to anyone. That ought to be clear, I think?

3. Deficit refers to the yearly shortcoming of income versus expenditures in a specific year. Pronounced Duh-fecit by John Boehner (sorry, could not help myself),

4. National Debt refers to the accumulated sum of deficits.

5. When FRB bond holdings are allowed to run-off (mature and be paid without new bonds being purchased), some one else than the FRB had better be willing to buy new bonds or else the old ones cannot be paid off.

6. please read also what I write below about the abominal misuse of the terms “printing” and “destroying”.

These are separate items:

1. The “deficit” is a an accounting figure based on government accounting, showing the difference between tax receipts and outlays, as accounted for by government accounting methods (including the books of the Department of Defense that are such a fiasco that the government auditor regularly says that they cannot be audited). The Deficit figure is not reliable.

2. The “debt” is the actual amount ($20.5 trillion) of outstanding Treasury bonds. This is a reliable number. The Treasury department publishes this on a daily basis. It is the amount the government owes different entities, which include private investors (the Treasuries in your portfolio), other government entities, such as the Social Security Trust Fund and government pensions funds, the Japanese, the Chinese, etc., and of course the Fed.

3. The Fed’s holdings of US Treasuries. When the Fed reduces its holdings of this US government debt, in basic terms, it drains money from the market like this:

When securities mature, they’re redeemed. Whoever holds them gets paid face value, and the securities become void and disappear. So when the Treasury securities that the Fed holds mature, the Treasury Department transfers the money to the Fed. If the Fed doesn’t buy other assets with the money, that money just disappears.

The Fed creates money, and it destroys money. But it doesn’t sit on trillions of dollars in a cash account. Here’s an explanation of Fed balance sheet accounting.

http://libertystreeteconomics.newyorkfed.org/2017/08/a-closer-look-at-the-feds-balance-sheet-accounting.html

Since the Treasury Department doesn’t have the money to pay off maturing bonds – as the US government runs a big deficit – it raises this money in advance by selling bonds at regular auctions. In other words, the bond market gives the money to the Treasury Department to redeem the maturing bonds. If the Fed holds these maturing bonds, the Treasury Department gives this money to the Fed. And the Fed destroys it.

So neither the DEFICIT nor the DEBT will be impacted by the Fed’s actions or the QE Unwind. The deficit remains the same, and the debt remains the same. It’s just a questions of who holds the debt: the Fed or investors.

The retired Treasuries should be replaced with new corporate bonds or you will have some disconnect. That was the nature of the QE swap. Corporations selling bonds, USG selling bonds trying to raise money, at a time when China turns vertical and consumers are tapped out. When supply overwhelms demand the bond vigilantes assert themselves. And the only way for USG to promise higher interest rates to bond buyers is to systemically destroy the currency. That might look hyperinflationary or they might destroy asset prices, which would at least help out the economy. And so if you see GDP creeping up you might not applaud too loud.

2. says it all.

what don’t people understand?

Fascinating stuff. Awesome work on data collection and presentation, Wolf.

I can repeat what I shared a few ago as it seems relevant. Recently my 14 month CD’s at 1.35% matured, and I rolled them into 1.65% CD’s. A noticeable interest rate increase. I would like to get back into the market all it ever does is go up and the price level terrifies me at these prices.

Even if the drop started tomorrow, it would take 2-3 years for the market to bottom, so why not get yourself a higher yield on a three-year CD?

I am thinking rates will climb by a year from today. I have 3 CD’s about 4 to 5 months apart. I started at 1.35%. I renewed one several months ago at 1.45% but probably could have gotten 1.55% had I been open to moving to another bank (“new funds”), and just about a week ago another at 1.65% but with this at 1.65% I move it to another bank (“new funds”).

Well, Wolf, I have to apologize. I have persistently disagreed with you that rates would rise significantly in the near future, but it appears I was wrong. Your charts clearly demonstrate a significant rise in the <10 year rates. I'm still skeptical about high they will go or for how long simply because of the incredible dependence on low rates. But clearly things are moving. Be interesting to see what effect the tax bill has on deficits and what effect deficits have on interest rates.

No need to apologize. We’re all just trying to figure things out.

Thanks for clearing up my misunderstanding. Have noted and corrected my thinking.

OK, I’m still trying to put this together in simpler terms, trying to keep track of the “real” money, so let me know if I got this right.

1. When the global financial meltdown happened in 2008, the USG took a number of steps intended to prevent a complete lockup of the economy – bailouts, fiscal stimulus, etc., that increased the Federal debt by trillions of dollars of deficit spending.

2. The FRB also tried to stimulate the economy by drastically dropping the Prime Rate to zero, however there was now the problem of the Treasury needing to sell all those extra bonds to fund the extra USG debt.

3. The world financial markets were in a liquidity crisis, as massive amounts of “real” money had been loaned out for stuff that was now worth much less (e.g., houses, stocks). It would take a few years to offload these assets to re-establish liquidity. Lowering the Prime Rate to zero helped a lot with the liquidity crisis by giving free money to the banks. And, to prevent the mass quantities of extra Treasury bonds from excessively competing for this now reduced amount of “real” money in the financial markets, and thus to keep interest rates on bonds of all types low, the FRB swept up trillions of dollars worth of those Treasuries for its own accounts, essentially sequestering it from the world financial markets so as to not drive up interest rates in the bond markets. This was Quantitative Easing.

4. Now that the world economy is chugging along finally, liquidity in the financial markets has been re-established, and inflation is rising from the massive expansion of the money supply, the FRB is unwinding the QE by releasing these Treasuries for sale back into the open world financial markets. The increased flood of Treasury bonds competing for “real” money in the world financial markets has the effect of causing the interest rate bids for those bonds to rise. Which is what the FRB wants now, increased interest rates.

5. The Trump tax cut is going to raise Federal debt even more, so that will also increase the amount of Treasury bonds bidding for this money. And corporations will have more money, which many will use to do stock buybacks to keep their stock prices up for a time.

6. Wolf has already pointed out a number of high profile and high flying companies (e.g., Tesla, Netflix, Amazon) that generate little or no profit and/or run massive amounts of deficits funded by cheap junk grade debt, and seem to be kept afloat only by their speculatively high stock prices and the free money policies of the FRB in the last ten years. So that is surely one giant bubble about to explode.

7. Speculation: what happens if a major perturbation to the U.S. or world economy happens, e.g., war in Korea, war in the Middle East, or if Mexico elects Obrador in 2018 who then gets into a fight with Trump and NAFTA is abrogated and we get into a trade war. Trade and/or oil supplies will be disrupted. The U.S. and world economy will go in the tank again. BUT, now the FRB will not be able to solve this problem by simply lowering the Prime Rate to zero and doing another QE. Because these external trade disruptions will all have the effect of increasing the cost of doing business in general and the cost of goods and/or oil that come from trade with other countries. Inflation will skyrocket at the same time that the economy tanks, even if the FRB returns to a zero Prime Rate and QE. Stagflation, in other words

Gandolf,

Your analysis is ok in a textbook, view from 50,000 or more fashion, but still needs more work. The real world is not so clean and a lot of fake ideas rule in that world. Some terminology problems, too.

People, not abstract ideas, make decisions and people are subject to influence. People follow crowds because crowds offer security.

The Central Bank crowd printed money at first to add liquidity to the system. Then the people who run the crowd they follow noticed printed money is free money and is unlimited if handled properly. Somebody then noticed that savings and investment and investment income could be replaced, in theory, with printed money, debt monetization, low rates and asset inflation. QE was born.

Each country embodied QE for differ reasons. The US used it to make a few filthy rich, and to support the big overall picture of low rates, and low wages, and flexible labor sources. Printed, unlimited money was a secret sauce that, unfortunately, was really a means to suck wealth from the middle class into the highest and lowest classes.

The Eurozone uses QE to subsidize their economy and would cease to exist if it ever stopped. The Swiss use QE to buy equities. The Japancse do it because they think printed money is a great way to live for free. The Chinese do it to hold their social structure together.

The ‘search for inflation’ is a false goal. Low rates to negative interest rates and money printing as a substitute for investment are deflationary. Middle class income goes down, not up. Inflation in that environment is hard to create. Central Bankers lie a lot and make up theory as needed. Nobody challenges them on it because the people who matter, the top of the upper class, make out very well with this plan.

Basically, a long time ago people robbed banks for money. Then they bought banks. Then they bought central bankers by taking over the economics profession and developing some insane theories that promoted extreme wealth for a few. Central Bankers are really just employees of these people.

Sorry, but the truth is not in the lofty areas of higher purpose. The people who run central banks are no different from anyone else. A more realistic description of how the world works is to understand how life in the gutter works and clean it up a bit. That will place you in the proper location to figure out the rest.

The Fed is backing away from the worst parts of the gutter a little at this time.

It’s pretty amazing how US rates have been running higher than even European junk rated paper.

that is because no one is throwing money at our junk paper.

tossing it underhand, maybe.

The flattening curve could be indicative of the market thinking that the tax reform will be quite stimulative in the short-term which will force the Fed to raise rates albeit at a slow pace with Powell. However, long-term factors are pushing down the impetus for inflation

1. Less regulations equal cheaper cost of goods

2. Demographics are skewing towards older people who don’t spend as much on stuff

3. Energy is a major factor in long-term inflation. America’s energy supply has never been as secure as it is now. This keeps energy prices down.

I think a flat curve doesn’t necessarily portend for a negative outcome.

Hey Wolf, when we’re getting QE Unwind updates can you try to take a look at this, if it turns out to be applicable? This is a really interesting question that hadn’t crossed my mind at all. For 2017 obviously treasury remittances won’t show up in the noise, but as the unwind ramps up it should show up if the monetary base isn’t actually being destroyed by QE.

As an aside, this may actually be an interesting reconcilliation to the whole “QE vs ‘they’ll never stop printing'” debate..

Per David Collum’s ‘Year End Review’ :

//quote

“That aside, the governors have pondered reducing it [QE] very slowly by letting the assets expire, but how? The balance sheet expanded when the Fed created money “from thin air” with a simple spreadsheet entry and then bought bonds and who knows what else. By statute, all interest payments (minus expenses) are remitted back to the Treasury. In essence, the interest paid by the Treasury to the Fed gets returned to the Treasury: The Fed monetized Treasury debt (free money). When a bond expires, the Treasury pays the principal to the Fed. So here is the big question: does the Fed extinguish it with the stroke of the same accounting pen that created it, in turn negating the original monetization? Alternatively, the Fed could pass the principal back to the Treasury, making it a permanent fixture of the monetary base. I asked some smart people about this: nobody knew, although David Andolfatto, vice president of the Federal Reserve Bank of St. Louis, was confident the money would be extinguished.”

//end_quote

To the quote from Collum: “does the Fed extinguish it with the stroke of the same accounting pen that created it, in turn negating the original monetization?”

Yes, that’s what the Fed is doing in principle.