Regular prudent savers & government guarantees to the fore.

Wouldn’t it be great if a big hedge fund could borrow for five years at a fixed rate of 2.05%, just barely above the cost that the US government pays for five-year debt (1.81%)? It’s especially great considering that inflation, as measured by the Consumer Price Index, is 2.4%. In real terms, the rate on this five-year loan would be negative.

Or borrow at 1% daily rate? This would be way below the rate of inflation. And on the rare occasion that creditors gang up on you and try to get their money back all at once, the Fed steps in as lender of last resort. You can rely on that. So no biggie.

You could lend this money out at 5% or 7% or, if you’re into credit cards, at 21%, for example, and keep the difference. Or better, you could bet with this money on the riskiest trades, some of them long-term illiquid deals that might take a decade or longer to unwind. Or you could play with highly leveraged derivatives.

If you could just gather up hundreds of billions of dollars in this manner, or perhaps even a trillion, you could make some serious bucks.

If your bets blow up and the borrowed money disappears, your creditors have a government guarantee. They’re not worried about the risks you’re taking. And they’re ecstatic to lend you the money below the rate of inflation because the yield they’re getting is just a tiny bit higher than what they’re getting in their savings accounts and CDs.

That’s exactly what Goldman Sachs is now seriously pushing into – not dabbling, as it has been – as a major funding source.

“It carries … great strategic potential,” Chief Strategy Officer Stephen Scherr told Reuters today. “The ambition we have is for the retail deposit platform to grow so that it becomes a real, sizable channel.”

This “retail deposit platform” is its online bank for regular savers.

Goldman isn’t the first to figure this out. All banks in the US benefit from this cheap moolah, assuming they know what to do with it, like Goldman is hoping to play this game. Among the biggest: JP Morgan Chase – with $1.4 trillion in deposits – Citibank, Bank of America, and Wells Fargo.

Goldman isn’t in their club. But Goldman wasn’t actually a commercial bank until the Financial Crisis. In order to get bailed out by the Fed, it had to become a bank holding company overnight. Until then, it was a hedge fund and an investment bank.

Some banks are just divisions of credit card companies or other companies that need cheap money, such as American Express Bank or Capital One Bank. They advertise “high-yield” deposit products – “high-yield” only when compared to zero.

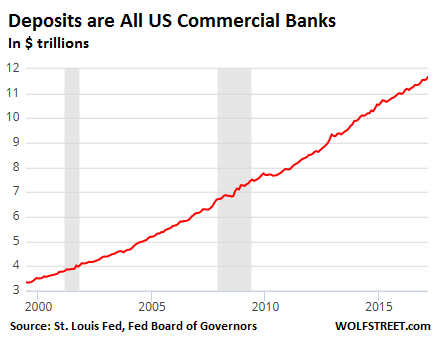

There’s a lot of money to be obtained in this manner. All US commercial banks combined sit on a mountain of deposits that has now reached $11.7 trillion:

Goldman wants to get its share of this mountain. A first big stepped occurred in April last year, when Goldman announced that its “GS Bank” acquired the “online deposit platform” of GE Capital Bank. This included $16 billion of deposits. Of that, about $8 billion came from individual savers. Scherr told Reuters that Goldman has since attracted another $4 billion from savers, bringing the total to $12 billion. And they’re going to grow the online bank further, he said.

This is how GS Bank pushes the strategy on its website:

Through its services for its wealthy clients, Goldman holds additional deposits. Total deposits on its balance sheet amount to $124 billion. Peanuts compared to the big guys.

To induce regular prudent savers – a kind of clientele that Goldman has spurned for so long – to lend Goldman their money, it has decided to offer deposit rates that are still ludicrously low, but slightly higher than those of some banks with a large deposit base.

New clients are offered a savings account rate of 1.05% and a five-year CD rate of 2.05%. By comparison, the average national rate on FDIC-insured savings accounts is 0.6% and the average five-year CD rate is 0.83%.

The goal is simple: Get a relatively stable and very low-cost source of funding – low cost because the deposits are government-insured and creditors who stay within the FDIC limits don’t have to worry about Goldman Sachs blowing up. As Reuters notes, this is “designed to boost profits” and “may help it better weather future disasters.”

So it’s time to prepare for these “future disasters.” What’s surprising is that it took Goldman so long to figure this out. Perhaps its distaste bordering on scorn for regular prudent savers has kept it from pursuing their money.

Here I dismantle the old saw that it can’t happen in Canada. Read… Can US-style Housing Crisis, “Jingle Mail” Hit Canada’s Banks?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Just purchased a 60-month CD at my local credit union at 2.75%. Why bother with Goldman or Chase?

Real inflation is robbing you blind. Why bother with a 60-month CD? I’d buy physical precious metals instead – the best way to protect your wealth against the Keynesian fraudsters at the Fed.

Dry powder for when the stock bubble explodes. It’s better at a credit union than in the mattress.

Physical precious metals have not protected anyone’s wealth over the last decade or so. Buy land you can grow or build something on.

Yeah, that worked out well over the last decade.

The problem is finding one. Not all countries have solid, reliable credit unions…

True!

But in the U.S. any Federal Government employee or retiree can join a Federal Credit Union and get the same de facto protection the congress routinely gives itself. Executive branch employees can ride their coattails. Same goes for Government- Wide BC&BS health insurance.

The canadian govt has to get a grip on regulatory oversight that are ignoring serious non compliance by our big banks and investment industry. That are actually tabled in law. Rather than ignoring these protocol and finger pointing re what isn’t inked in law yet eg best standards etc (as to why these entities like osc who say they are onboard re amendments on improving best standards from suitability.. why not proactively educate retail that advisors are not the same bird as an adviser as they wait for changes in law…and many retail invest on line szo why are regulatory oversight ignoring basic consumer protection protocol like vetting contract clauses for conplinace with industry law and code of conduct. rather than sidestepping delegating and piling up a whole range of excuses for not ensuring this very basic item is ticked off properly?

bkennedy,

What? You make no sense.

Wow. That is a lot of cash. No wonder housing prices are shooting up. Are we on the verge of very high inflation.

Low interest rates

Central Banks buying all types of assets (bonds and stocks)

Any risky venture’s are being packaged and sold as bonds that will be backed by the FED. That is were all bad debt goes to die?

I think that is part of the plan which you can see in Japan. The central bank buying everything or a better term “hoovering everything up”. Then when they own it all they can dictate who can have what when and how. The only two I missed out were why and which and they will tell you yours is not the reason to why but we can dictate which, who, what, when and how.

On the one hand, we read recently that half of Americans don’t have $500.00 to cover an emergency, and on the other hand we see from Wolf’s chart above that deposits sitting at US Commercial Banks have almost quadrupled in 17 years to $12 trillion.

Empirical proof of the malaise one could argue.

And on another hand we have the inflationistas telling us that governments are going to inflate their way out of this mess but i’ll bet that those same people will make the same money when that bill is inflated to $5,000.

I don’t get how inflation works…..when it affects everything BUT MY income.

Real inflation only works when it does effect your income. The high inflation rates of the late ’70’s could only continue because the country was still unionized, and workers got automatic cost of living adjustments. That’s where Paul Volcker and Ronny Reagan stepped in to destroy the unions.

We haven’t had a real inflation problem since then. ‘Cause you can’t pay higher prices without higher income.

Inflation never works. It’s always destructive. Volcker was right to crush inflation in the early 1980s. Had a guy like Volcker been running the Fed in the 1990s and 2000s, there would have been no housing bubble, no Great Financial Crisis, no QE, and possibly no long term Japanese style stagnation like we’re seeing now. Recessions would have been allowed to happen in 1997-98 (Asian contagion) and 2001. Volcker has even publicly stated he would not have intervened monetarily in either instance with interest rate cuts the way Greenspan did; he’d have let the economy and the business cycle sort itself out.

If 100 million people have $500 each that would be $50 trillion, so to get to $12 trillion they only need to have $120 each.

Noting the panic unfolding regarding Home Capital and run on deposits this is not a trivial issue

Averaging what high end earners have on deposit with average folks who may not even have a savings account distorts the issue. Payday loan abuse would not be such a, issue is so many weren’t dependent on this as a crutch to get from week to week. Ditto pawnbrokers

You’re only off by a factor of 1,000. 100 million people with $500 is $50 billion total. To get to $12 trillion they would need $120,000 each.

That’s the problem with too many zeroes, it’s easy to miss a few and lose perspective entirely. A billion seconds is 31.7 years, a trillion seconds is 31,700 years–two completely different time frames.

I can see banks liability (deposits) of $12 trillions.

there are no details on banks total assets, risk assets & ratio.

There is no disaster ? ! Why such a dark forecast.

Every thing is fine, under control.

Car loans are intended to keep the industrial sector moving.

Student loans are intended to keep the young in

the classroom, fed, housed and educated. Not in the unemployment line.

Better than hanging in the streets and rioting against everything, burning or killing.

That’s the cost of peace.

The loans are not intended not to be paid back. The students know.

21 % c/c loans ?

Well, you have to eat, to pay your bills, to pay for the accumulated

interest on debt. That is what the government doing.

70 % of government debt is accumulated interest. the rest is peanuts.

The gargantuan derivatives overhang, in the hundreds of trillions by conservative estimates, is going to be the ultimate undoing of our financial house of cards.

President Cohen is going to make Amerika grit again.

It is OVER folks. There is ZERO chance that any form of justice will every reach the consumer and savers again. You are cooked.

At these interest rates I’d just as soon keep the damn money under the mattress. Just like internet ad revenue, deny them the money.

I think I shall join the hoards of folks who have their cell phones glued to the foreheads and walk into traffic hum a happy tune

MeMe Imfurst – funny

Not all have cell phones glued to their head. Some have more important objectives such as “keeping up with the Kardashians”.

Yes let’s all pull our money into cash and let’s see how fast this thing crashes…

@ Meme Imfurst: “At these interest rates I’d just as soon keep the damn money under the mattress. Just like internet ad revenue, deny them the money.”

Great advise. With the recently changed (2013) banking laws, as soon as you deposit cash into a bank, you become an UNSECURED creditor. That means that the secured creditors (bond holders and stock holders) will get first priority on getting their money back in line in case of a bank failure/bankruptcy.

So is getting $200 a year in interest worth risking your $10,000 in cash stash? I think not…

Your deposit is insured by the FDIC up to 250,000. That’s the entire point of this post.

@David G LA: “Your deposit is insured by the FDIC up to 250,000. That’s the entire point of this post.”

Read this and think again…

http://www.mybudget360.com/fdic-insures-47-trillion-in-deposits-with-a-136-billion-deposit-insurance-fund-this-is-like-going-into-a-hurricane-with-a-99-cent-store-umbrella/

ALL insurance works that way. US auto insurers do NOT have enough capital to cover an accident that involves all at once 240 million cars and kills 100 million people. Dragging this sort of nonsense out is ludicrous and shows zero understanding of how insurance works.

Even during the Financial Crisis, no FDIC insured depositor lost a dime. This includes me with a CD from WaMu. Never noticed the difference.

Mike,

While uninsured depositors MAY have to stand in line behind some creditors in the bankruptcy of a failed bank, insured depositors never have to stand in line to get their money back. Most times when a bank becomes insolvent it is acquired by another bank. Depositors suffer no losses. However in rare cases which an insolvent bank is not acquired by another bank and the bank has to be liquidated, the FDIC pays off insured depositors and the FDIC stands in line in the insured depositors place. The uninsured depositor however will have to file a claim to try to get back at least some of their money.

Also stockholders and a lot of bondholders are not secured creditors as you mistaken state.

And the situation with the FDIC insurance fund is not as bad as many ALT media articles make it sound.

When you are classed as “Too Big To Fail” also “Too Big To Jail” you have arrived at the bankers nirvana. ‘Systemically Important’.

SNAFU FUBAR “banking” is not what it used to be.

To be a “true bank” in todays world, you must be made of ceramic material with a slot in the top, into which you deposit physical wealth.

Withdrawals made by hammer. (sarc off)

Banks make their money from interest, most of it mortgage.

Something like 70% of all money put into circulation stems from mortgage lending with interest due on top of it.

I’m convinced that the investment bankers don’t produce anything close to the net income people pretend they do. Rather, I suspect a lot of interest income goes towards covering the investment bankers. Or maybe they just break even after factoring overhead and wages/bonuses.

I’d love to see a major bank’s income statement filtered for the investment banking division. I want to know what’s left in gross profit, let alone after expense.

I don’t understand why Goldman is pretending to need deposits in order to lend. Banks don’t need it. There are no fractional reserves. They can make a loan today for whatever amount they want. And then after that, they can borrow the proportionate reserves from another bank or even get it from the Fed, an outfit they control.

“the FED steps in a lender of last resort”

So the FED has got your back carte blanche.

The FED created money out of thin air .. so how is this going to alleviate the overall problem ?

The FED will take the currency to infinity & BINGO.

Everyone is back at square one / numero uno.

A card game can go on for only as long as the players have cash.

If every player brings US$1.000.000 to the table X 10 players .. they should all bet real small .. or the game will be over soon.

A casino has rules ..

The US FED is a free for all / grab what you can & run man !

Kind of game.

At Crown Casino Melbourne .. 10% is all the customer can win .. not each customer mind .. but as a collective.

Their motto is “there is a sucker born every minute.”

Casino management did not come down the last shower.

Pin the tail on the donkey.

Who’s the donkey ?

The FED.

Nooooooo

Guess again.