Atlanta Fed’s “Deflation Probabilities” index: that horrifying threat (lower prices) has been vanquished.

The scourge of consumer price deflation has been brandished furiously by central banks around the world in order to justify radical, scorched-earth monetary policies, including zero-interest-rate policy (ZIRP), the entire absurdity of negative-interest-rate policy (NIRP), and asset purchases not only of government bonds but also of everything else, depending on the central bank, including corporate bonds, stocks, asset-backed securities, and, as German politician Frank Schäffler predicted with uncanny accuracy back in September 2011, “old bicycles.”

Central banks have also brandished the threat of other mayhem that could befall the earth if it weren’t for those policies, but the threat of consumer price deflation has played a critical role.

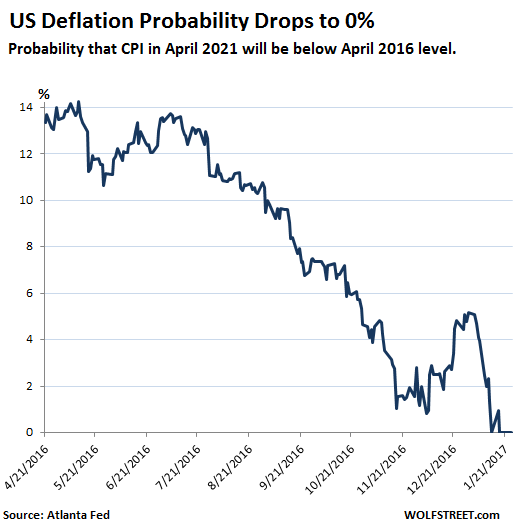

Well, those of you in the US, don’t worry: your overall prices, as determined by the Consumer Price Index, now have exactly 0% chance of dropping over the next five years, down from a probability of 14.1% in May last year.

This is according to the Atlanta Fed’s closely watched “Deflation Probabilities” indicator – closely watched by me, if no one else, because in my entire life, I’ve suffered through three quarters of mild year-over-year deflation (when prices were slightly lower than a year earlier) during the Financial Crisis, but many decades of inflation, including some in the double digits.

And during those three quarters of deflation, I experienced firsthand the horrors of discovering that I could actually buy more things with the same amount of dollars. My wretched dollars were gaining value! It was outright terrifying! I actually ended up buying more to get rid of those excess dollars and to benefit from the good deals!

And so I’m glad that the probability of this evil condition returning to the US over the next five years has fallen to 0%.

This chart is based on data from the Atlanta Fed. It shows the probabilities, as registered over time, that CPI in April 2021 will be below its April 2016 level (which is when this data series begins). This series started out high due to the collapse in oil prices:

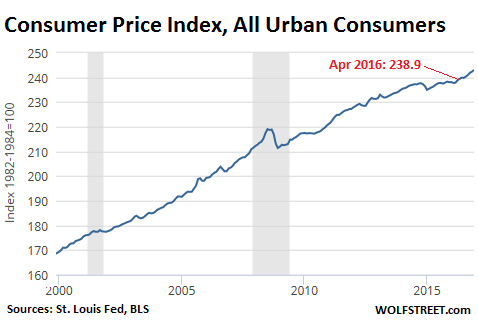

So there is 0% probability that in April 2021, CPI will be below where it had been in April 2016. At the time, CPI was at 238.9. At the last release, CPI for December was already at 243:

The Atlanta Fed’s Deflation Probabilities indicator is based on estimates derived from the markets for Treasury Inflation-Protected Securities (TIPS). Technical explanation is here. So these data points are the consolidated predictions made on a daily basis over time by the many participants in a very nervous US government bond market.

And they’re not worried one bit about deflation through 2021. They’re worried about inflation.

The Fed and the US Treasury, in an effort to create some asset price inflation after the Financial Crisis, have encouraged Wall Street to enter the single-family housing market, buy these homes out of foreclosure, drive up prices, and put them on the rental market. Things have taken off from there. And now, the government even agreed to guarantee for the first time ever Buy-to-Rent Mortgage-Backed Securities. Wall Street wins again. Read… Financialization of Rents Gets Taxpayer Guarantees

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

If the new administration succeeds in passing a tariff on imports you will definitely get massive inflation, considering we don’t make much anymore.

A piece in today’s Globe and Mail (Jan. 26) makes that case without saying those words, pointing out that free trade is the foundation of prosperity since WWII. (The author is John Kemp and comes via Reuters.)

And that it was the Smoot-Hawley tariffs that turned the 1929 stock crash into modern history’s worst Depression.

Over a thousand US economists at the time signed an open letter opposing the tariffs, unsuccessfully.

Ironically it was the US that launched one of the first country of origin complaints against Canada way back in 1984. The US was successful in preventing Canadian govts from inserting Canada- only in contracts.

They have just launched another one against British Columbia’s intention to permit only BC wines to be sold in supermarkets.

And so they should. Good luck to them, although they don’t need it, BC’s action is absurdly blatant. I want all the choice I can get.

Kemp’s piece is titled in the Globe; ‘Trump can’t require US steel for pipelines’.

He explains that although everyone’s gripe is NAFTA, (it gets all the blame in Canada too BTW, and according to DQ, it’s been bad for Mexico. A lose-lose-lose!) if you dismantle NAFTA you go to the US-Canada free trade agreement, if you scrap that, then you have to scrap GATT and the WTO.

So trade is complicated.

The Wall isn’t and here Kemp does use the word ‘fantastical’

Trump describes a Wall dwarfing the Berlin Wall. 30 feet thick and 60 feet high or something.

It’s like some medieval castle idea- or a modern day child’s.

Ironically, it would present less of a problem for the intruder than a high tech fence, which would be 300 feet wide and consist mainly of razor wire, with motion detectors, etc. It would cost 5 % that of the Wall, which some doubt can be built at all over some of the terrain.

The mere solidity of a wall is an aid to the prepared climber, and it’s mere 30 foot thickness is a help to a tunneler.

The Tweets have set off a boom in concrete stocks.

But even the Republicans aren’t going to approve this pipe dream.

The funniest part is that, when I lived in Florida, the biggest cement company was Mexican, Cemex.

This morning the Globe and Mail had a big color photo of a section of the existing fence. not sure where but it basically had nice looking fields on the US side and a pretty shabby looking town (village?) on the Mexican side.

I was surprised how minimal the fence was- I couldn’t tell height exactly but I’ve certainly seen bigger fences in town. Anyone could be across in a minute.

It was just one fence, no depth at all.

It would not be big deal to improve at least to say military base standards or even industrial park standards, and the US has every right to do so.

But with the talk of something like the Great Wall of China, and then loose cannon Spicer saying there will be a 20 % tariff to pay for it, then Trump tweets ‘if you don’t want to pay, then maybe there’s no point in meeting’

So of course the Mexican pres HAD to cancel the planned meeting after hearing that.

Apparently via intermediary Carlos Slim things have calmed down and both sides have agreed not to comment on the wall publicly.

But if the photo in the Globe is any guide, the existing border fence could easily and relatively cheaply be vastly improved.

Google some images of the border fence. In many places, it’s a tall nasty rusty steel thing. But then they stop abruptly, and there is nothing, not even a fence like people have around their backyard.

PS: there is bit of an issue re: fence depth.

Someone has to surrender some real estate for the ‘moat’

The reason the USSR built the Berlin Wall, instead of the in- depth border fence often found between countries, is that it had to be built on their side, and they didn’t want to sacrifice a wide swath of central Berlin real estate.

To be of any real use. even psychologically. a border fence has to have a minimum of two fences. with a space of at least 30 feet between them.

Deciding who will provide this buffer zone and on what terms is job one in improving border security.

Globalists trying to convince the sheep that globalism isn’t the cause of the world’s problems… “no, look elsewhere” they say (but they never say where).

I hope Trump goes full speed ahead on the tariffs and NAFTA renegotiations (or full withdrawal) and I think the inflation impacts are overblown.

Globalism is about nothing more than enriching the elite at the expense of the poor. Nobody knows this better than Trump, and he’s committed to fixing it. God bless him.

Yes there is a problem. The solution is not tariffs and other medieval tRump plans. The solution is much higher taxes on the rich and high income earners, breaking up large companies (so they are not stronger than countries), the elimination of tax havens, taxing the financialization of the economy etc. The idea is to get more money circulating and less stuck in the pockets of the wealthy. Only then will we get a break from inequality.

I am just hearing too much from people expecting somebody else (like president of us of a) to fix some problems.

What truly undermines people’s lives is unsound money. In other words, taking all the risks and privatize profits while socializing the risks as well as keep inflation all the time to undermine income while raise asset prices.

One should not expect anybody else to bring benefit. One should just ask for a fair game which requires sound money.

If you see Trump shits down federal reserve, or dismental those government guarantee programs, then he is making it a more fair game.

Anti globalization, bringing back the jobs are simply stoking inflation under the name of going against establishment for the people. He just wants to inflate all the government debt away.

Expect a life where you have a job but you can not make ends met any way. All goods, services and asset prices will go up. Before you know it, you find yourself keeps working without getting ahead while the government debt becomes worthless.

Blaming globalisation is like blaming science and technology for war and environmental problems — completely absurd.

Globalisation made you as a nation wealthier than ever but you failed to redistribute that wealth efficiently enough to foster a healthy society. Arrogance and ignorance let abuse flourish. For instance, starting with Reagan, the dismantling of the workers unions and regulations opened the door for abuse to the executives and bankers.

History will be the judge but you may well be on the trajectory for another disastrous outcome as Trump seems to plan for even more deregulation. You might all have jobs but you will find yourself working your ass off, yet still struggle to attain the same standard of living of days past and you might be drinking toxic water and eating contaminated produce.

Every one commenting is using computer power that would have cost a million dollars thirty years ago- courtesy of globalization, trade and capitalism.

BTW: if you ever look inside a computer its a real smorg of supplier countries- with of course chip design in the US but chips, power supply etc. from everywhere.

@ nick kelly, “I want all the choice I can get ” really??

how entitled…

You don’t? You want to go into a wine shop and be told we only have wines from here?

“A piece in today’s Globe and Mail (Jan. 26) makes that case without saying those words, pointing out that free trade is the foundation of prosperity since WWII.”

The thing he leave’s out is that we no longer have free trade, we have grossly unfair competition due to lax or no Environmental, Or worker, protection standard’s. Combined with massive state aid to deliberate target and destroy western manufacturing capability’s.

They stole the Sox manufactureing industry.

Now they are Targeting nuclear power and Aircraft manufacture. ENOUGH Already.

This targeting is now moving into national security industries, power supply, Aircraft manufacture, shipbuilding, Etc Etc. it must be stopped not only in the US but in the western nations everywhere.

I read the book “Golden Fetters” (Barry Eichenbaum) over Christmas. I got the impression the rest of the world was already broke and going off the gold standard at the time Smoot-Hawley was passed. The world was still trying to recover from the economic decimation of WWI. The US had built up much export capacity from WWI. That left the US on the gold standard. The US exports languished as their normal customers were not/could not buy anymore since they were out of gold and going off the gold standard. The US had hoovered (vacuumed) the gold up from WWI.

The US had extra unused industrial and agricultural capacity from the war and during the was rebuilding years. This was how the unemployment first hit. Exports collapsed. Second since the US had a lot of the gold it made the US uncompetitive from a currency perspective.

I really do not think “free trade” would have bailed out the economy as the US already had surplus in capacity, the rest of the world was at a disadvantage to buy US goods since they had little gold to trade, and the US didn’t need the imports since it already had excess unused capacity.

To me the US’s current problems are also similar. We have “free trade”….that means the imports to the US a free..they cost us nothing of equal scarcity. The US can just print more money and issue more IOUs. Anyway if you look at capital flows, the deficit has to be financed. A 500 billion dollar deficit for example has to be financed using overseas capital. The people overseas can only lend us that capital if we give it to them to lend to us. They accumulate the money to lend back to us by selling us stuff. So because the US refuses to live within its means and pay for Government when it uses it, the consequence is to export your jobs in order for Government to get financed.

The US has the special problem of having the reserve currency. If you had an unlimited credit card, which you never had to pay off, you would not work either. That is the same effect of the dollar. The US’s greatest export are dollars. The US supplies the world with money, via IOUs, and the rest of the world supplies the US with products. All the US has to make are just more $$$s.

Boeing?

Pretty good description, to ship the jobs back to the US is to take the dollars off the international currency market, which is going to let inflation hit home, which will vastly decrease the living standards of the US citizen. Your average leftest has no idea how the overstretching of big government is the reason why Trump got there in the first place.

Correct me if I am wrong – and I am looking at the numbers presented and the scale – they are talking a 20% tax over five years – or equivalent. I recall 50B a year, at 20%, so 10B a year, over five years, 50B. And that is a big overshoot of the 10B to 12B numbers tossed around for wall cost.

Plenty of wiggle room and optics for both sides.

I don’t know what the wall costs – but this is a negotiation – if I read the cards right. Mexico will come to the table, things will get sorted out.

If not, then please folks, how much have we spent in Iraq? Afghanistan? Hell, how about VA benefits for those two wars? And this is going to end all humanity? Destroy the US? Cause the third great depression?

Pay attention to the scale of the numbers – it is in the big scheme of things, it really is rather small-ish. Not bigly.

Regards,

Cooter

The point is, the ‘wall’ is a boondoggle – meant to distract the diplorables while the real action takes place elsewhere.

Of course. Show me a 30 foot wall and I’ll show you a 40 foot ladder. But it will employ lots of Mexicans and provide something shiny for the Fox News crowd.

I went to shop for houses, and bought three at the local dollar store.

You should tell this magnificant insight to Raúl Ilargi Meijer from https://www.theautomaticearth.com/the-automatic-earth/ , a hardcore deflationisty from the highest order and contributor to zerohedge.

He shure will school you about this.

Garantiert Alter.

Deflation-ists have a strong argument.

No one knows how this really turns out in the long run.

Regards,

Cooter

When the lyin’ sunsofbitches in the gubmint discuss, or warn, about one thing — be sure to look in the other direction :

https://projectchesapeake.wordpress.com/2017/01/23/are-you-ready-for-an-inflationary-depression/

Experience has taught me that. Just like my ongoing experience, in general, is of inflation in prices, and not deflation.

Well, LOL, my income has deflated quite a bit.

SnowieGeorgie

You have to understand the monetary system to understand why deflation is a serious problem and it’s a big secret, though it is now in plain sight you are just never encouraged to look there.

http://www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q1prereleasemoneycreation.pdf

All the money in the system equals all the debt in the system, though not including the interest.

The system has to grow to pay off all the debt plus the interest, in deflation it is contracting and can easily move into a debt deflation spiral due to positive feedback.

It is the way money works which is a big secret, money = debt.

http://www.whichwayhome.com/skin/frontend/default/wwgcomcatalogarticles/images/articles/whichwayhomes/US-money-supply.jpg

M3 is going vertical before 2008.

Money = debt and a credit bubble is blowing up.

2008 bang.

Steve Keen understood and saw it coming in 2005.

Look at that tiny graph ………

Everything is reflected in the money supply.

The money supply is flat in the recession of the early 1990s.

Then it really starts to take off as the dot.com boom gets going which rapidly morphs into the US housing boom, courtesy of Alan Greenspan’s loose monetary policy.

When M3 gets closer to the vertical, the black swan is coming and you have a credit bubble on your hands (money = debt).

How to read the money supply to judge the state of the economy and what needs to be done if certain conditions occur.

It’s a delicate balancing act where the ideal is a steady rise in the money supply (debt) showing a healthy and growing economy.

When this increase is too slow or it is flat-lining, the economy will be stagnant. Like most economies round the world today.

When the money supply is going down you are heading into debt deflation. The private sector is not borrowing enough to maintain the money supply and this is a very serious problem. The Government is the borrower of last resort and needs to step in to fill the gap and keep the money supply up.

More concisely …

The money supply reveals everything about the economy:

A steady rise is ideal and is normal healthy growth.

When it’s flat or rising too slowly, the economy will be stagnant.

When it’s rising very fast, a credit bubble is forming.

If it’s going exponential a black swan is coming, you have an out of control credit bubble forming.

When it’s falling you have debt deflation and a very severe recession/depression.

It’s all linked to the debt in the economy.

money = debt

In a fiat system, when credit continues to rise, interest rates remain low because they are based on bogus CPI and on the whim of academic “gurus”. That requires ever more debt creation or the debt won’t be supported by asset prices, and then the defaults will set in motion a downward spiral.

The ‘money’ that old time economists talked about and based their theories on is dead and gone.

“New Money” has replaced that ‘money’ and as of yet economics and economists have yet to update their theories.

People have been talking about deflation in Japan for years and yet prices for consumers in the real world kept going up along with decreasing incomes………

Deflation, yeah right more central bank BS.

Money=promise of more at some time in the future, it is *always* exponential, but it is only when the numbers get big enough that it gets noticed.

https://en.wikipedia.org/wiki/Compound_interest

Deflation probability was at 100% since the first promise of non-existing interest was made, only the timing when the realization comes is impossible to predict, although Christine Hughes (often linked here) has a very reasonable prediction:

http://www.otterwoodcapital.com/blog/how-much-time-do-we-have-before-the-next-crisis/

Personally I think 6 months, tops.

>>>> “…why deflation is a serious problem.”

A “serious problem” FOR WHOM?

Even mild consumer price deflation is a “serious problem” for over-indebted and over-leveraged businesses because they can’t raise prices to make their income statements look better and to help pay off their debts. And it’s a problem for over-indebted governments for the same reason.

But mild consumer price deflation is good for entities that are not overburdened with debt, such as prudent consumers, businesses, and governments because their input costs are declining. And it’s great for holders of fixed income assets, such as bonds and CDs. This includes pension funds of all kinds. The purchasing power of these assets gets destroyed by inflation. But under deflation, they gain purchasing power over time!

Mild consumer price deflation is great for consumers. In the US, wages have not been rising enough to cover inflation, so real wages have been declining. But wages are downward “sticky,” so when prices decline, wages remain largely stable or decline less than prices, thus enhancing the purchasing power of consumers.

There are winners and losers of both inflation and deflation. Central banks have decided long ago to pick the winners on the inflation side and crush wage earners, consumers, prudent businesses, pension beneficiaries, etc. That’s all it is.

Very true theoretically, but prudent businesses and consumers have been weeded out in previous boom/bust cycles by bailing out the deadbeats… and the story continues.

very true unfortunately, mostly idiots and parasites left nowadays and the financially prudent are quickly eliminated.

And don’t start me talking about how this (together with many other ‘socialist’ and globalist policies) is encouraging of the human genome to deteriorate at the quickest pace in history, especially regarding intelligence ;-(

It’s that and a bit more. The central bankers fear that they don’t have any levers to use to get a macroeconomy out of a destructive deflationary event. They think they have the levers to control inflation.

That strategy does line up nicely with keeping their friends in the financial industries profitable, so inflation is a win-win, right?!

Agree, in a sane economy due to innovation and productivity gains, mild deflation should be normal except for products that run up against natural limits (e.g. lack of natural resources, too much pollution).

I haven’t seen any deflation in my lifetime, only some periods with relatively low inflation. And most of that ‘low inflation’ was due to cheating, e.g. most food is now significantly cheaper than 40 years ago in real terms but the quality is way lower as well. Same story for many services, if the price is lower now it usually means you have to do everything yourself for almost the same cost charged.

In the long run I’m sure it is economically very damaging to reward parasites, deadbeats and the cheaters. But E-con-omists clearly do not care about the future, they only care about getting rich quick without working.

We can run out of space on the planet, but we will never run out of unintelligent creations due to deterioration of the genome.

That alone is a serious risk that is gathering pace.

“Mild consumer price deflation is great for consumers. In the US, wages have not been rising enough to cover inflation, so real wages have been declining. But wages are downward “sticky,” so when prices decline, wages remain largely stable or decline less than prices, thus enhancing the purchasing power of consumers.”

Wages are sticky but employment is not. In a deflationary spiral, wages may hold steady, but layoffs and hiring freezes are the other side to that coin.* Lower prices don’t help you much when you don’t have a job.

Inflation has been the historical norm, always, even before the Fed Reserve. Most periods of growth have been accompanied by inflation, while most recessions have been accompanied by deflation. Growth AND deflation are a very rare combination for any economy, anywhere, at any time in history. You can argue why, but that’s a generality that has remained pretty consistent.

*Japan being the notable exception. Wages are not sticky there, but employment is. So in a deflationary spiral, you’re more likely to see wage cuts instead of job cuts.

You forget: inflation lowers the input costs for companies. So their margins can grow from lower costs. And thus their profits can do quite well. And their businesses can do thrive, if they’re not over-indebted.

We’re not talking about a “deflationary spiral.” Over the last 23 years, Japan’s “deflationary spiral” was actually near-perfect price stability, minor inflation followed by minor deflation. In 1993, Japan’s consumer price index stood at 100. Now it’s barely above 100. So that “deflationary spiral” for Japan is a media fabrication. It does not exist.

https://fred.stlouisfed.org/series/JPNCPIALLMINMEI

Reply to WR:

“We’re not talking about a “deflationary spiral.” Over the last 23 years, Japan’s “deflationary spiral” was actually near-perfect price stability, minor inflation followed by minor deflation. In 1993, Japan’s consumer price index stood at 100. Now it’s barely above 100. So that “deflationary spiral” for Japan is a media fabrication. It does not exist.”

The same way as the e-con-omists assertion that population must grow (in numbers) or all hell will break loose.

The Government compensated by borrowing more to keep the money supply stable otherwise it would have.

Richard Koo explains all ……

https://www.youtube.com/watch?v=8YTyJzmiHGk

When I’ve fueled up my auto and pickup, it was a hell of a lot nicer to have paid $1.50 per gallon a year ago compared to $4 in the summer of 2013, and now it is pushing back up towards $2.50.

This hits the working class with longer commutes to drive square on.

√+

The economy would have a natural mild deflation just due to productivity and innovation advances. So the Government has to constantly fight against that too.

Exactly.

– Agree. Price deflation deflation is the result of productivity increases. But A LOT OF people don’t understand WHY that price deflation occurs.

– Let’s assume that a company has 100 employees and those 100 workers each earn $ 1000. Then (assuming those workers don’t take on (more) debt) those workers can spend (100 x $ 1000 =) $ 100,000. Then demand is $ 100,000.

When that company increases productivity then it can produce the amount of stuff with say 90 workers. Assuming those workers still earn $ 1000 then those 100 folks now earn (90 x $ 1000=) $ 90,000. In other words DEMAND has dropped $ 90,000. And that FORCES producers to lower their prices. Otherwise the amount of stuff sold (=volume) will drop as well.

The inflation bogeyman is like the dragon that map-makers used to draw on maps when they didn’t know what lay beyond a certain point. A theoretical, terrifying threat that they assume lies in wait if we go too far in that direction (i.e. allow the CPI to fall a tiny bit). When asked to define the dragon, economists talk in frightened whispers of a world where consumers slam the brakes on spending because they think that prices are going to be 0.01% lower next month.

Apparently these economists have never bothered to examine consumer behaviour, or they’d have noticed thousands of people lining up in the cold overnight for the chance to pay more for the latest iPhone, despite knowing said phone will be much cheaper in a year or less. They’d notice people buying big screen TVs, even though they know that same model will be cheaper next year. They’d see them buying new clothes, even though they know those same outfits will be on the bargain rack at the end of the season. If they’re old enough, they’ll remember the PC market in the 1990s, when prices fell every year for a decade and people kept buying newer and faster machines, even though they knew faster ones would be available for less if they waited just a few months. It wasn’t “deflation” that killed the PC market, it was the shift to handhelds and iPads.

And of course, there’s the absolute fact that people will keep buying groceries, gasoline, restaurant meals, alcohol, keep buying houses or paying rent, keep paying for entertainment, paying heating bills, electricity bills, cellphone bills, Internet bills, child care fees, insurance premiums, parking fees, taxes, and myriad other expenses that are inescapable facts of modern life. They won’t stop spending even if they want to. They can’t.

But don’t bother asking economists to square obvious and known consumer behaviour with their fear of deflation. The deflation dragon is simply too terrifying for logical argument to have any impact.

How economists deal with deflation is also a bit similar to how the military-industrial complex needs the Russia bogeyman to keep the juice flowing :-(

Trade instead of war would be much safer and cheaper policy for most people, but not for the globalist elites.

Big screen TVs have gotten cheaper, on the low end of LEDs. But since the death of Plasma, led by Panasonic a couple years ago, premium quality TVs are more expensive. Right now, a 55″ LG OLED retails for $2,500, and can be bought for $2,000. It will be interesting to see what happens to the price on the high-end machines, and if there’s a new technology that will appear.

The inflationary morons that keep touting the “dangers” of deflation, misunderstand a lot of things. For one: if deflation would really lead to consumers postponing purchases, (hence less buying, hence still lower prices, etc, etc) then inflation would lead to PRODUCERS postponing producing goods (hence less producing, hence still higher prices, etc, etc). Because in the future they would “receive more for their products”. But both cycles are clearly fallacious nonsense. Consumers start buying at some point as they never postpone forever (when they really need products, which is always the case). And producers start producing, if only because the more expensive goods become, the less people can afford them. Besides, businessmen act if margins on goods are attractive enough, not higher prices as such. Hence producers will seize the opportunity. So even in theory, both “cycles” fail to materialize. Yet, the inflationists only see one nonsense cycle and, moreover, keep it for real.

Sorry for being dense — by “inflationists” you must mean THOSE WHO DESIRE OR PROMULGATE INFLATION” – – – – and not those, like me, who see, fear and predict inflation ?

Reading your post, I thought of myself as an inflationist, because I see it coming, I fear it, and I am preparing for it.

( BTW, I would never say the same of deflation : “I see it coming, I fear it, and I am preparing for it.” LOL )

If inflationist means those who desire and engineer the coming inflation, I find the term strange to say and hard to understand.

Thanks

SnowieGeorgie

Of course I mean the so called “mainstream econonomists” and likeminded pundits who claim we MUST HAVE central bank-engineered inflation to keep people spending, or else we would have a “deflationary depression”, because of consumers endlessly postponing purchases. Which they apparently consider to be undesirable. Even among the public at large this seems to be the accepted opinion.

Strange enough, the pundits never promote hyperinflation. Yet if inflation itself were so good, that would no doubt be the ultimate way to promote producing and spending and hence our well-being. They imply not only that there’s a magical amount of inflation somewhere between “too much” and “too little”, which does the job of creating “acceptable” results, but that the central money commanders-in-chief KNOW this rate of inflation and are capable of achieving it. Ah, that neverending promise.

But this would all mean we only produce and consume because central banks (assisted by private banks with their credit creation) make money less valuable, even worthless over time. So we wholly owe our lives to them! Forget about human instinct and human needs, forget about millennia without central banking in which humans survived or even thrived. Forget about central banks blowing up currencies in hyperinflations and creating boom-bust cycles. In fact, those pundits imply we all prefer to be dead, but it’s only the central bankers who keep us alive, by tempting us into consumption. It’s not just interesting times that we live in, but an interesting world as well.

If I knew toilet paper would decrease in price via deflation I would certainly stop buying it so I could buy it cheaper next year. ;)

..NOT

AUGUST 01, 2016 Inflation Hidden in Plain Sight

Can we be honest and say that many of the reductions in value, quantity and quality are actually instances of fraud? Yesterday, I showed how Consumer Prices Have Soared 160% Since 2001 for everything from burritos to healthcare. This enormous loss of purchasing power is not reflected in the official measure of inflation, which claims inflation is subdued (1% or so annually).

http://charleshughsmith.blogspot.com/2016/08/inflation-hidden-in-plain-sight.html

Exactly Brian, thank you. The deflation boogey man we’ve been hearing form tptb for years is a cover for their financial repression agenda and nothing more. Deflation can’t be sustained for any length of time bc the central banks can overcome it by flooding the system with money. That’s exactly what happened in 2008.

Also, rising prices is NOT inflation and declining prices is NOT deflation. They are both monetary phenomena.

If inflation is so low, why are prices going up?

Part of the problem is the reliance of U.S. government economic statistics, which are widely accepted to be politically motivated and, unsurprisingly, wrong. Cue John Williams:

1980-based CPI: 9.8%

1990-based CPI: 5.8%

Official U.S. CPI: 2.0%

http://www.shadowstats.com/alternate_data/inflation-charts

They wanted to bring inflation down, and they succeeded, by gaming the numbers, regardless of certain realities.

Purchasing power of U.S. consumers, adjusted for inflation, hasn’t been barely keeping up, or slowly declining. It’s been dropping like a rock for years. This has also been according to policy, which is designed to enrich the wealthy to the destitution of the general population.

Believe what you like. I believe I’d like another brandy.

If we are really honest, we would say that the real fraud is the official consumer inflation report.

Companies usually only raise prices because their costs have increased. They then become the scapegoats when the government inflates.

Wait… >>”Companies usually only raise prices because their costs have increased…”

Companies raise prices because they can, and they always raise prices IF they can … IF they don’t start losing business to competitors due to these higher prices. Real competition keeps prices low and innovation high. M&A activity is the corporate reaction to competition: it removes competitors from the field and allows for bigger price increases.

Yes, I agree … “IF they can … IF they don’t start losing business”, yes, competition is the key, and price is a function of competition, improvements in technology and manufacturing processes, cost of labor, demand, taxes, etc etc. Notice also that in certain market categories, a general level of price increase will take place – the result of the usually temporary increase in the cost of inputs for that market category, but the effect of inflation, taxes, and regulations are persistent over longer periods of time unless technology and methods can reduce costs.

The goal of every business is surely to get the maximum price for their products, but price is not something you set because you’re just greedy unless you want to go out of business. Even monopolies are vulnerable if they price too high because of the threat of substitution, rendering the monopoly’s product obsolete.

Assuming perfect stability in the prices of all inputs, and normal competition in a company’s market, no inflation, and stable taxes, prices would not significantly increase. Even monopoly markets show price stability, or even decreases, as long as the monopoly gets a satisfactory return.

An example of this would be Standard Oil, when the monopolistic/M&A activities of Rockefeller reduced the price of oil by something like 80% by the late 1800s, and the price remained there for 90 years, at 2 dollars a barrel, despite inflation of some 400% over that period of time. Just applying the CPI to the price of the early 1900s should have resulted in an oil price of 10, but it remained at 2 (in inflated dollars! – in 1900 dollars it would be about 40 cents) until the late 1960s.

Even today, the price of oil, adjusted for inflation, is the equivalent of less than the 2 dollars a barrel of the early 1900s.

As alluded to above; actual economic growth is marked by falling real prices due to technological advances and increased productivity. (e.g. Computers getting cheaper etc.) So regardless of what nominal prices are; we actually progress only when pr

I sent my neighbor Trump a note requesting he should seriously consider dissolving the FED.

Getting more goods for the same dollar is as terrifying as peace breaking out, at least for the government. No marginal creep for stealth tax revenue increases, and no pork for congressmens’ and senators’ contributors – and voters.

So what are the chances you can obtain a small business loan while prices are falling? If I were the lender I’d be rejecting your loan application and hanging onto my appreciating asset (cash).

During the financial crisis, margin calls forced asset liquidations.

Absolutely right. In fact, the Fed doesn’t care about consumer prices. The Fed cares about asset prices and wages. Deflation in asset prices causes bank loans to go upside down, and banks to go under. Increasing wages cause profits to go down and less money available for asset purchases. Everything the Fed does makes sense with the correct filter.

It IS terrifying from an environmental point of view, if you look at what is happening with all those cheap plastic junk products from e.g. China. The result of strongly falling prices for junk is really that people buy more of this (although this sure doesn’t apply to many other goods).

I don’t have a problem with falling prices, but we should be able to include the real cost of production and recycling or responsible disposal into the price…

“Steady as she goes, Gilligan.”

“Aye aye, Skipper”

Now that’s our monetary policy. Our economy is now going to be manipulated by a reality tv star/crook with a big mouth and a paper thin skin. We are one step away from tariffs and a trade war. My kids are just starting out in life and have mortgage debt. I guess if it all falls apart we can build some small houses on the property. (No basement).

As alluded to above: real increases in wealth due to technological advancement and increased productivity always result in lower real prices. There in no other way to increase human wellbeing, than for real prices to fall. Of course falling prices don’t cause growth per se. However our government masters minds believe that we can be tricked into prosperity by money printing, which may (and does) obscure real declines in our standard of living and papers over debts as far as the eye can see. Deflation is actually a very good thing if it’s the result of increased productivity. It’s also a good thing, incidentally, if it’s the result of a depression brought about by excessive malinvestment, debt and speculation. Unfortunately such things are openly enocouraged by Keynsians and their fellow travelers in public office. There should be no attempt to obscure real prices as we all live in the real world. Well some of us do.

John Maynard Keynes never advocated using monetary policy to stimulate inflation. The current policies are the result of Milton Friedman’s Monetarist program and follows neo-classical/neo-liberal economic dogma, much of which Keynes rejected out of hand.

Of course deflation is no longer in the picture because the Fed’s policies were way behind the power curve even before the election of Trump:

Bill King: “Trump is a Common Sense Revolution & China, Japan and the Fed in BIG TROUBLE”

https://www.youtube.com/watch?v=j5kj1hQmuHQ&t=0s

The real culprit here is Yellen and Fed. Those are the true criminals, who are holding interest rates artificially low and manipulating the economy to benefit the few and prop up the stock market.

Trump is doing his best, but eventually he will find that it’s Yellen and those criminals thwarting him at every turn. The real question is what will he do about it?

After a recession the FED try to move the economy back to the

old GDP growth trend, back to normal.

That’s to reflate from the low point, not inflation.

The US economy had failed, after 8 years and trillions of stimulus

dollars, to reach the old trend.

The stimulus was used by the smarter guys to inflate the DOW

to 20K.

Real income, meaning real wage x weekly hours – is falling.

Oil inventory is rising again to the, almost the same high level

of 2016 Q 1.

Retail inventory is rising. The auto sector inventory is high.

I read all day long about Indian engineers replacing workers in

the tech sector.

Before we reach inflation, we have to finish the job of reflation.

I think that we are facing a prolong deflation.

inflation, deflation, good, bad, birth, death. While we debate inflation/deflation is good or bad, or even what to do about it, should we first question whether it is wise to meddle with the natural ways of being to our own interest?

Who is it suppose to decide what’s good and what’s bad? Like wolf said, good for who? at what time?

If you give the power of to decide on inflation of deflation to anybody, i am sure that entity will use the power to their advantage since everybody is a competing member to control resources in this world.

What’s good for him/her will be bad for other people.

You can debate whether inflation is good or bad but nobody should have that kind of power of power to decide on which side to take.

The founders of this country knows all government powers should be balanced and limited but here people are talking about making inflation of deflation happen at will using money printing powers while it feels there is nothing wrong about using that power.

Central banking has been one big inflate-away game as long as it exists, and it got even worse when it was fully unleashed after the FED left the gold standard; this caused all financial prudence to go out of the window. Due to this policy, only those profiting from inflation (speculators, freeriders, financial idiots and criminals) will remain. An epic crash is baked into the cake.

The federal government left the gold standard twice, once in 1933 during the Great Depression and again in 1971, essentially destroying Breton-Wood.

In 1933, it was done to stop waves of bankruptcies when creditors could demand payment in gold, and there of course was never enough gold because creditors lended against fractional reserves.

It was done again in 1971 because the USA had reached its own internal “peak oil” and would have to start importing massive quantities of expensive oil from the Middle East. President Nixon faced the choice of slashing federal expenditures and massively reducing the standard of living of the American people, or devaluing the value of American debt held by European creditors.

Obviously he chose the first because he was a strong believer in being reelected to office.

Undoubtedly, a gold standard can go off the rail, too. The purist example of this is the Dutch tulip craze. At that time, there was no paper money. Still, tulips assumed the role of gold, and could be temporarily exchanged for goods. On the positive side, it did not last long unlike the present fiat caused trials of life.

Yes, the gold standard is just as arbitrary as the FIAT money system. It’s all subject to laws, paper documents, to establish a value but which can be changed at the government’s whim. Only the “Full Faith and Credit” of the government supports the currency. Once that is lost then inflation goes hyper.

– Roosevelt didn’t abandon the gold standard in 1933. Gold was re-priced from $ 25 to $ 33. It meant effectively that the USD was devalued. But the gold standard remained.

– The gold standard was still in place in the 1920s and it didn’t prevent the growing debt bubble in the 1920s.

– Bretton Wood was ditched because of the outflow of USDs in the 1960s. Think: Vietnam war & the “Guns & Butter” policy.

In 1929, there was a gold standard, but there was also for the first time the FED setting interest rates, regardless what the market was doing.

As the rule of economic game, monetary system always have two conflicting aspects. One is discipline, which makes the game fair and rules out the reckless ones. The other one is elasticity, which facilitates expanding shrinking economy.

Gold standard is simply a policy to enforce discipline and of course it can be repealed by the government by encircling police and military violence power.

My point is that if you give “anybody” the power to actively change the monetary system, that person can be bought with speech fees in exchange of wealth transfer favor by ado denying discipline and the wealth transfer will be done under the name of creating elasticity to help economic system.

If in 2009, there was no bailout, banks will fail, investors wiped out, home owners recked. people will go on street to enforce discipline and people will go bankrupt and go to jail. The swamp will be drained. We do not need any leader to drain the swamp.

The point is the FED is not running with a guiding policy that is written like a constitution. Rather it is up to greenspan Bernanke or Yellen to decide. They can be bought and the country loses any discipline and wealth transfer will happen.

Gold standard or not is not the essence. The essence is the FED is running without constitution and it is up to human to decide.

Worrying about 2022 is wasting precious time at its finest. A whole lot of crap can happen between now and then, and will. We are in the Twilight Zone with the Fed, the Executive, Congress and SCOTUS, not to mention open corruption in the markets. Our goose may be well cooked by 2022.

– CPI is a joke. Take e.g. Healthcare. It accounts for about 17% of US GDP but it has weighting of only 4% in the CPI. This is ONE way CPI understates inflation.

Balance sheet deflation!

China has unloaded trillions in dollars to defend its currency and yet growth of its money supply keeps needing a fresh nightly boost?

Do yourself a big favor; the people doing business news are journalism majors!

– Why do people Always blame the government ? Just look at how the corporate sector tries to squeeze every penny out of the consumer. Because they want to make a profit, right ?

– And the corporate sector is actually undermining their own demand. Something A LOT OF people are also unaware of.

Everybody wants to make more profit, there is nothin wrong with it and let’s all compete to see who makes more! If they charge you more, do not buy and the market will force them to correct.

What is wrong is the competition game is rigged by the government since they set up rules by using police and military power.

It is surprising to me after all these cycles of wealth transfer, people are still looking for leaders that will help transfer wealth to them as opposed to support leaders with good principles that maintains fairness of the economic system with sound money as underlying bed rock.

– And the corporate sector never rigs the competition, right ? Never heard of the word “cartel” ?

– The amount of money is constant. That means that someone making a profit comes at the expense/the detriment of someone else. It possible to increase the amount of money and that’s called “creating more credit/debt”. But then e.g. the government has to go deeper into debt.

– And A LOT OF companies make a profit at the expense of the government (think: e.g. healthcare, defense spending).

The real driver in the economy is inflation, no average person is making too much money. The new thing I’m seeing is a reduction of inventories in most stores. You can see they are all cutting back on selections. I think the decline in demand is not just about money, but also about quality. People are holding back on buying more junk, I know I am. A few days ago, my favorite women’s store was having a one day sale, 40-50% off. Even at half off I didn’t think it was worth the money.

Take a look at the Baltic dry shipping index!

You may want to develop a fresh hobby cause you are looking at the best at what’s left over until at least another half decade (probably never?)

Allow me a second and next time you buy a consumable product look at the shelf label and its black and white?

Buy the 40% off item or the store with die!

Okay, Wolf Richter, you owe me.

Three whole quarters of deflation are good enough for me to win our bet. You owe me one drink at the place of my choosing the next time I’m in San Fran. (I’m cheap.)

:)

Meanwhile, how can Atlanta Fed make an inflation call when gold prices are ‘languid’?

https://www.bullionvault.com/gold-price-chart.do

Don’t see any inflation here, either:

https://www.quandl.com/data/USTREASURY/REALYIELD-Treasury-Real-Yield-Curve-Rates

Q: Does the Federal Reserve System track the markets? A: They have to so they might front-run them.

Q: How does the System miss all the divergences in depth/volume, bonds/stocks and more importantly in foreign exchange. Inflation is in places like Mexico and Turkey.

Ha, that’s a good one. These 3 quarters happened in 2008/9 (maybe I should have said so in the article but I thought it was clear from the 2nd chart in the article .. that big dip). So that’s ancient history I was talking about, reminiscing about the good ol’ times of 2008/9. We have not had a single quarter of yoy deflation in the CPI since. Our bet started a few months ago for future quarters, not ancient history … so no, I don’t owe you – but we can have a drink anyway :-)

Q1: yes, the Atlanta Fed’s data is derived from the 5-year TIPS markets, as played by innumerable market participants, and it changes on a daily basis. So it’s strictly the “market’s” expectation of deflation.

Q2: these market expectations about deflation are strictly for the US. But the market participants see what’s going on in the world (dollar, energy prices, inflation elsewhere, central bank words and actions, fiscal plans, etc.) and base their trading decisions on that.

– Gold doesn’t react to inflation. It reacts to whether or not REAL interest rates are negative of positive. If e.g. rates rise faster than (e.g. CPI) inflation then gold will move lower or stay flat.

– Another factor for the price of gold (or any other product/commodity) is what it costs to produce an ounce of gold.

Gold as an investment vehicle is based on irrationality: a total asset wipeout in a crash.

Gold as a basis of a monetary system is based on rationality that gold reserves rise slowly but steadily, and so should the money supply.

Something intelligent, factual, realistic, and very true.

Gold is completely unreliable as a store of value. It’s value is established at a whim of the government. It might be the extraction cost. It might be anything. You can never know, long term.

– Yes, but “irrationality” applies to other investments as well. Think: stocks, bonds & real estate. So, what’s new here ?

For those with short memories, when Bush promised Fox he would build the fence, Fox told Bush the problem was the traffic in illegal narcotics going to El Norte. Then he proposed to legalize drugs in Mexico, since he felt that Mexicos drug enforcement budget was basically going to subsidize the American consumer. Oi Yey! Some adjustments were made, and the fence didn’t get built, the drugs kept coming, and the Mexicans kept up their minimal efforts to contain it. Of course a lot has happened, some more lax drug laws, probably more states not holding up DEA enforcement, much less immigration enforcement. Trump meets a gaggle of blue states who won’t comply, and should he appoint some social conservatives to Scotus the rift will grow. The fence will be seen as an encroachment on states rights, and while ultimately these ultra right wingers tend be states rights supporters, when they are not they are perceived as deep state goons, passing laws like eminent domain (which is largely ignored or overridden by local laws) and Trumps sense of the American experience, is let’s say limited, so the possibility of internecine conflict far outweighs any international threat.

For consumers, deflation is generally good. The end-user has more purchasing power with their money.

But who is it bad for? The fools that loaded up on debt, thinking that the good times would continue forever. They are receiving less cash with which to use to pay their excessive debt burden.

The honest central banker would set as their goal the purchasing power of the unit of currency; this is the only thing they have to bring to the marketplace. Currency inflation means that they are continually selling something into the market for less than it was worth yesterday (figuratively speaking). This is how the banker is stealing the real assets out of the economy.

Inflation requires more inputs to get the same result, as each unit is worth relatively less than it was yesterday. Honest currency retrains the efforts of the banker to keep monetizing the assets of others.

deflation doesn’t do one much good when you have no money to buy anything.

as to 0% chance, so what? that’s an easy call, prices will be higher in 2021, duh.

now, as to economic policy. if we make things in this country americans want, they will buy them. if we force them to buy them, is the rest of the world going to buy them?

let’s rebuild our shipyards, to sail where? merchantmen or gunboats? or both.

ah, the future’s clear. murky. both.

“soon enough, chris hauser,” as my buddy jerome used to say.

but i’m optimistic, i have to be.