Have Cisco’s Financial Engineers Gone Nuts?

Cisco is, let’s say, in transition. It has been in transition for years, from networking hardware, such as switches and routers where it’s getting battered by Chinese competition, to software where it’s getting battered by… well you get the idea. The company is in a very competitive environment. And it’s trying to buy its way out of it.

In its latest move, it announced that it would acquire AppDynamics – a “performance management and IT operations analytics company,” as it says – for $3.7 billion, plucking it out from the IPO pipeline on the eve of its IPO.

That’s a huge premium over an already rich IPO price. If bankers had priced the shares at the top of the indicated IPO range, the company would have gone public at a valuation of $1.7 billion. Cisco paid over twice that.

“The fact that they were in their IPO process represented a window where we needed to make a decision,” Cisco’s VP of Corporate Development, Rob Salvagno, told Reuters in an interview.

AppDynamics isn’t huge – despite what that lofty price might indicate. And it isn’t profitable either. According to its filing with the SEC, it had $158.4 million in revenues for the nine months through October 31, 2016, up 54% year-over-year. And it lost $95 million, up 3% year-over-year.

So at that pace, AppDynamics would have a little over $200 million in revenues in the 12-month period. In other words, Cisco is paying 18 times those revenues.

If revenues increase 50% a year, for four years straight, so by the end of 2020, the company would have $1 billion in revenues, though revenue rarely grows in a linear manner like this; growth rates tend to slow down as a company gets larger. Nevertheless, if… by the end of 2020, it books $1 billion in revenues, Cisco would at that time still see a price tag of 3.7 times revenue.

How much is that? Cisco had $49 billion in revenues in 2016 and a market capitalization of $153.6 billion. So its shares trade at a rich 3.1 times revenues. This is going to be a long, long wait, if it isn’t eternal, before the AppDynamics gamble pays off.

But no matter. Cisco is an acquisition machine. And price doesn’t matter. Revenue doesn’t matter either, as we will see in a moment.

Since 2012, Cisco has acquired 45 companies, from tiny startups to not so small companies, mostly in software, including computer security, data visualization, energy management, all manner of cloud software and services, mobile software and services, video, network software and services, and so on. For 26 of them, the terms were not disclosed. So we don’t know how much Cisco spent in total for these outfits.

But for the 19 acquisitions for which the terms were disclosed, Cisco spent $18.2 billion!

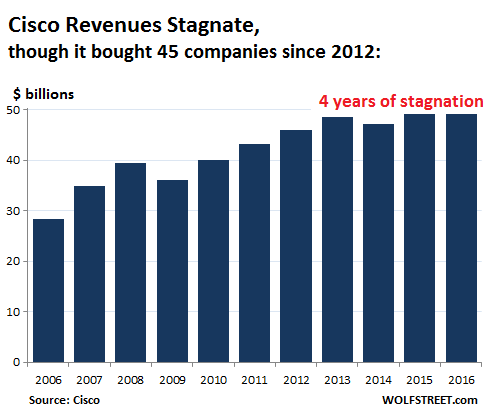

Despite all these acquisitions and the fortune spent on them, Cisco’s revenues haven’t budged much over the past four years. Revenues in 2016, at $49.25 billion, were flat with 2015, and were up only 1.3% since 2013:

So Cisco has spent well over $18 billion in five years on buying 45 companies, and revenues are stagnating?

Oh, and because revenues are stagnating, Cisco decided it had to cut costs. It blows billions of dollars on share buybacks every year, no problem. And it sinks billions more every year into overpriced acquisitions, no problem. But it has to cut “costs,” and so in August last year, it confirmed rumors that it would try to cut costs by about 15%, and to do that it would lay off 5,500 employees, or 7% of its global workforce.

But no matter. Startup investors are dumping their babies into Cisco’s big lap – and thus into the laps of public and private pension funds, stock portfolios, mutual funds, and the like that all own Cisco shares. Those investors at the receiving end of Cisco’s generous financial engineering are loving it. Without companies like Cisco, the whole system of unicorns would come tumbling down, as startup investors found their other exits largely blocked: in 2016, IPOs had their worst year since 2003.

APPDynamics is based in San Francisco. It’s part of the crazy boom, and its investors found their big-fat exit. The company had a pre-IPO valuation of $1.9 billion. So even those investors that got in at the last funding round made a bundle. Other startup investors see that too. Because everyone is hoping for those big-fat exits. And if IPOs no longer open those doors, well, Cisco or IBM or some other large company, whose financial engineers have gone nuts, might still be able to.

IBM is in trouble, and desperate hype is apparently required. Read… Big Shrink to “Hire” 25,000 in the US, as Layoffs Pile Up

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I think any company bought by a big outfit is almost certain to be a disappointment. There’s bound to be a certain “over the line” effect as buyees feel they’ve made it and pull up and relax.

“performance management and IT operations analytics”

That doesn’t even mean anything! Pure word salad, but with an IT garnish.

These are pretty much standard and obvious terms in IT industry.

I bet the salaries of the top officers have not stagnated for the last four year.

“For 26 of them, the terms were not disclosed. So we don’t know how much Cisco spent in total for these outfits.”

Please forgive my naivety, but shouldn’t a publicly traded corporation disclose this information? There are surely some confidentiality situations, but Cisco has acquired 45 companies since 2012, and it keeps shareholders in the dark as to what it is spending all but 19 times out of those 45. To me, that’s not confidence inspiring.

I have owned a bit of Cisco stock, but sold out in mid March of 2016, and don’t plan on buying anymore-not that it matters to Cisco’s Board of Directors if I have a few hundred shares or not. However, thanks to their secrecy, maybe enough small investors might walk away, and cause an effect on them.

Zukerberg disclosed the price of Oculus Rift that Facebook purchased in 2014, but had to disclose it once again in the court recently as it happened to be $1B north of initial ($2B)

I myself am finalizing negotiations with Cisco for my startup company. It provides bleeding-edge consulting services to select financial blogs.

I have a company too; it forecasts the future. Let’s do a merger, a we’ll sell it to Cisco at 4 times the price. I know a few dupes, oops, I mean managers at Cisco.

It’s a good thing WR is keeping track of these things. Dilbert and The Onion can’t keep up with them.

Cisco knows what they’re doing! I give it 7 months and watch it light up from stagnation!

I guess they haven’t met any of their stone age managers, have you? These are people who still work in 2000 mindsets.

Good thing they didn’t have these super low interest rates in the 1990’s or that bubble would’ve been much bigger when it burst. Kind of like the current tech bubble of companies with huge offices (expensive leases), lots of debt and I.P. that’s not generating much revenue from clickbate.

Cisco is a major global corporation.

There were 150 such major corporations globally, that defaulted in 2016 and that is 40% more than the previous year of 2015.

Of those 150 corporations, 75% are domiciled in the US, with 50 being in the oil and gas sectors. Emerging markets accounted for 28 of the total defaults, with Europe’s total being just 12.

Cisco’s recent collection of buyouts is a furthering of the financialized economy. Risk that is associated with debt is still high. Pretending that debts are assets rather than liabilities, has led many to believe this false construct and to lull them into a perception of perceived wealth. This is dangerous financial ground to be in possession of when the global economy is balanced on a knifes edge, with a new leader who is unpredictable.

“There were 150 such major corporations globally, that defaulted in 2016 and that is 40% more than the previous year of 2015.”

In the end there can be only one. When that goes it will make global economic collapse all that much more efficient.

Yields on junk rated euro denominated bonds are still much lower than their dollar counterparts: presently short term bonds issued by Veneto Banca (B rated) yield 5.7% while those issued by Popolare di Vicenza (BB- rated) yield 3.72%. Similarly rated US companies operating in US dollars would kill to have the same yields.

I would not be surprised if junk rated US companies started issuing more and more debt in euro and Swiss francs to take advantage of highly repressed yields in Europe: Indian companies have already started to increase their issues in these two currencies and other countries are likely to follow.

Cisco and IBM are great examples of the ever more marginal returns on investment of the tech industry. The high-flying growth days are over. Time for some great new invention that’s not silicon based.

Cisco is doomed; they know their managers are old with old mind sets. They can’t come up with anything smart; so they have to keep buying small companies at outrageous or else their revenue would have been far below what it is now.

Managing all these heterogeneous little companies with different cultures i itself is a big task; so, there is not going to be any benefit except making Cisco’s books look good.

With virtualization, and cloud computing, the demand for network hardware will keep decreasing since all network devices can be virtualized and replaced by a piece of software; much cheaper, and much easier to manage. The little market that is left for Hardware devices will be snapped up by the Chinese companies since most Cisco products are far from being complex systems, and are relatively easy to duplicate.

As for software, Cisco could never compete; real software companies will crush it like a bug.

You have to be dumb not seeing that Cisco can’t come up with a new product or idea.

Through the looking glass! A return to normal interest rates and they (actually we as we will all be caught up in the bursting asset bubble and possible depression) are all dead.

It is this type of economically useless/counterproductive activity that is a major cause for the stagnation of the real economy, along with using borrowed money for stock buybacks and dividends, as it starves investment in new products and services by legitimate businesses.

As I read this article I kept waiting for the part where the workers pay the price. It is the same refrain for every corporate song, eh?

Not to be disappointed, there it was! “cut costs by about 15%, and to do that it would lay off 5,500 employees, or 7% of its global workforce.”

The next part goes like this, “Stockholders seem to be taking a big hit today, on Cisco”.

And , “Cisco managers have petitioned the US Govt to help speed up restructuring plans with an eye on a taxpayer underwriting proposed restructuring strategies”.

Last, “Cisco Board members have announced that the company management bonus will remain intact for this year. Citing the need to attract, retain, and adequately reward the best and brightest of management has never before been so important as it is right now during this difficult time”.

I was laughing my * off when I read

“Cisco Board members have announced that the company management bonus will remain intact for this year. Citing the need to attract, retain, and adequately reward the best and brightest of management has never before been so important as it is right now during this difficult time”.

Cisco managers and bright, as far as technology is concerned, are light years apart. Even Yahoo managers are far brighter than Cisco managers.

Strangely, I thought they might be technically bright, but lousy on the business side. How bright is it to buy into low margin home router business where Asian competitors can run circles around you?

Cisco managers are bright all right, but for 20 years ago. They are stuck. Most of their stuff are using tools and software stuff from 1999.

In software business, you have to keep re-inventing yourself annually; unfortunately, it is just part of the game. Most Cisco managers couldn’t even start talking about new technologies, let alone actually understand new technologies. What keeps them going is government contracts, and lots of legacy hardware and software they sold in their boom years, 15 years ago.

By the way, Cisco is probably one of the worse offenders as far a hiring H1-B visas are concerned. Just go to Cisco campus at lunch time, and you will wonder if you are in America. Tens of thousands of employees in those buildings, and hardly any Americans.

In the New World Order everybody will be an American, so visas will not be necessary.

The U.S. does not actually have an IT industry. India has an IT industry. It just happens to be located in the U.S.

Let me know if you find someplace that’s different.

Crazy stuff, does this indicate silicon valley’s circling the bowl or what?

What are the chances that Cisco executives call President Trump asking for government contracts to keep them afloat? His response will be: How many jobs will you create here?

Cyrus,

You hit on the two main reasons tech companies buy other companies. They do it to buy growth, new products or lines of business, which they can’t develop on site because they don’t have the talent. And they do it to buy talent, because all those H1Bs are basically useless.

The dirty little secret of Silicon Valley is that most acquisitions are mostly expensive hires. They are bribing the talent to come on board.

good point Petunia , acquisitions are done to acquire technical talent, maybe patents, customer base for vertical marketing and other reasons. But as this example manifests CISCO’s search for top line growth via acquisitions hasn’t born any fruit.

It would be interesting to see what CISCO”S objectives where in these endeavors .

Sometimes they are killing the competition with a bribe. How many acquisitions are closed after a couple of years of languishing in the fold, too many to name.

That is plan B, plan A is to cooperate with the other company then entice the talent with million dollar bonuses, then gut it. Works like a charm, and is completely legal.

The H1B program serves a specific purpose. To provide companies with cheap IT labor. Labor that is priced about 20 less than American workers. Also, H1Bs can hope jobs like so many American workers. Once you join a company on an H1B, you have to stick with that company for many, many years before getting your GC.

I work in the datacenter space and don’t really see Cisco much anymore. Juniper for the routers, Arista for the switches, and a bunch of other players for load balancing and security appliances.

The problem is we’ve gone from dial up and DSL to broadband. There is a law of diminishing marginal returns for ever faster speeds on networks. At 100 megabit / second any incremental speeds almost become meaningless at the desktop. Its only on the backbone of the Internet where ever faster speeds really matter.

Think about this how much more can one achieve on a Windows laptop running Windows 10 over Windows 7? Almost nothing. The same effect is coming into play with networks. Ever more less to sell to the stupid punters (opps) / customers

And you can buy 4×16 core blades for $5k and run 50 vms on it. The bottom has dropped out of the market. That’s why they have to come up with the latest BS trends: big data, iot, and AI. Half-baked solutions in search of half-baked problems.

Kent

I took a straw poll from resellers of used Cisco equipment and they all are struggling to “Re-invent” an idea as to what to upgrade on “America’s Corporate networks”. When you have a phone and an ethernet drop on employees desk or workstation you’re pretty much done. I’ve 10 year old Cisco router that does VOIP connections and it can run at 1Gbps speed. We’re using 25megs up and down.

Router / Switch Technicians I know can’t truthfully justify network upgrades to most networks. Sure at an ISP there is always a bottle neck but on most networks are you running more than 1Gbps / to a workstation and that technology is now OLD.. No new increased speed requirements needed..

Big data is an absolute necessity; without big data Google, Yahoo, Amazon, Netflix, Facebook would not be possible, or at least development for them would be far more difficult and expensive. Processing of data from most physics experiment like European Super Collider, or Human Genome would be absolutely impossible without big data. So, big data is not just a hype.

IOT will make smart grids, smart homes, intelligent transportation and smart cities possible.

AI is good for manufacturing, and military probably loves AI.

So, although there are a lot of hype, and a lot of companies try to cash in with made up ideas, but overall these technologies are here to stay because they have their uses.

Wow, you said it. Cisco is going the way of Sun Microsystems.

I remember seeing a Cisco exec on one of the financial channels in early December. The stock-talking bimbo gleefully asked: “How many jobs will Cisco create when Trump (*swoon*) gives you a massive repatriation tax break?”

The Cisco exec, with all the personality of a used sweatsock, replied: “None. We will use that money for expanded mergers and acquisitions.” Swooning stock-talk bimbo looked like she was hit with a bucket of urine.

Reminds me of LU in the olden days.

Great article. But what is not mentioned is that a lot of former Cisco managers and executives moved over these would be Unicorns in the boom years and now, through their connections into the “mothership”, are being bought back into Cisco. It’s corporate corruption on an epic scale.

I suppose even at this late date I might catch it but here it goes:

I do not work for CSCO. I am a new investor though I think the stock itself will drop in price — they have boatloads of cash even to continue to pay a minnow like me should things get tough.

Everyone knows that CSCO switches and routers have been dropping in sales – the fact that CSCO can maintain such high revenue by other projects (other than financial engineering) says something about where CSCO is planning to go. At work my phone, our IM application (Jabber) and our main group meeting app (WebEx) are all owned by CSCO. You add all that data collecting with CSCO’s business relationship with IBM and Watson and you have quite a new revenue stream should it continue to mature (not to mention IOT). CSCO and IBM are working on being Commercial Big Brother – not something I prefer but hopefully I can make few bucks from it (the dividend itself is better than a Treasury)

The last two paragraphs are an excellent summation of the craziness.

Retired Fidelity Magellan Fund manager Peter Lynch had a great term for this activity: Diworsification. And Cisco has proven it exceeds in that category better than almost any other company ever has. And it showed an excellent plan for funding one’s own retirement:

1. Create a new techie-type business, even if it’s in name only;

2. Open a Silicon Valley office with the proceeds from the first round of funding;

3. Hint that an IPO may be coming within a few months;

4. Wait for Cisco to swoop in and buy you out;

5. Repeat steps 1-4 above.

I remember when they bought the Flip camera company a few years ago. The very next weekend, there were pictures of trash bins filled with the cameras.

It’s not like the product was a technological breakthrough. It didn’t have any great potential, but it sold well when it was introduced. However, the only real value the company had was what it already built; ie., its inventory.

They just threw the whole company’s value into trash bins!

While I like the company’s past, it has shown absolutely zero inclination to build upon its value for the future. They still generate plenty of cash, but they always find a way to waste too much of it on buybacks to fund their executive stock option plans. Although I hear they intent to be slightly less generous in that category in the future. About damn time!

The company needs a complete overhaul of its executive suite. They give an example of the sloppiness that comes from having too much past success and too much cash coming in. They can’t find proper ways to utilize the money!

These are all financial engineering; Cisco has 27 billion debt. And do I even trust companies who say they have this much and that much cash parked outside of US? Makes me wonder how much of the cash these companies say they have outside US are simply accounting tricks.

Actually it is 34 billion, that’s in billion debt: http://quicktake.morningstar.com/stocknet/bonds.aspx?symbol=csco

Come on guys, don’t try to put lipstick on a pig.

Pretty common story in tech. Have a look a Yahoo! they bought a boat load of crap and the needle hasn’t moved one bit. Part of this is the VC culture where they all sit on boards of other companies and buy each others garbage as a means to keep each other whole. One giant Potlatch.