“Landlords have been unable to raise rents…”

The legendary, magnificent, frequently discussed, and all-in-all mind-blowing house price bubble in Prime London finally came to the attention of the Bank of England. On its blog, “Bank Underground,” this discovery comes with a big-fat caveat:

Bank Underground is a blog for Bank of England staff to share views that challenge – or support – prevailing policy orthodoxies. The views expressed here are those of the authors, and are not necessarily those of the Bank of England, or its policy committees.

I get it. It’s not official. In official circles at the BOE, the house price bubble in Prime London and other parts of London, for that matter, is still dormant.

Nevertheless, the blog post shows some of the marvelous aspects of this creation of central-bank policies, Russian-oligarch money, the adjacent City of London financial district, and other influences.

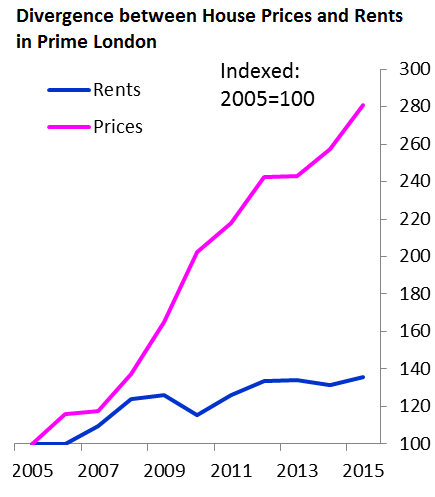

Since 2005, according to the BOE, home prices have nearly tripled! This has happened under the watchful eyes of the BOE itself, whose headquarter in the City of London would give it a good vantage point. And we’ve marveled over the years how these house prices have gone out of whack.

OK, Prime London is special (Google Maps). It includes Hyde Park in the middle, with Buckingham Palace, Chelsea, Paddington, Regent’s Park, the British Museum, etc. clustered around it. In other words, if you have money, it’s the place to be.

So the BOE is a little puzzled:

Economic theory suggests that property prices and rents should move together: rents represent the flow of housing services gained from living in a property, and prices are determined by the discounted value of all future rents.

And that’s not what has happened in Prime London, or for that matter, in any of the other cities around the world that are now proud examples of housing bubbles.

Rents in Prime London actually surged too, by nearly 40% over the ten years, but not nearly as fast as house prices:

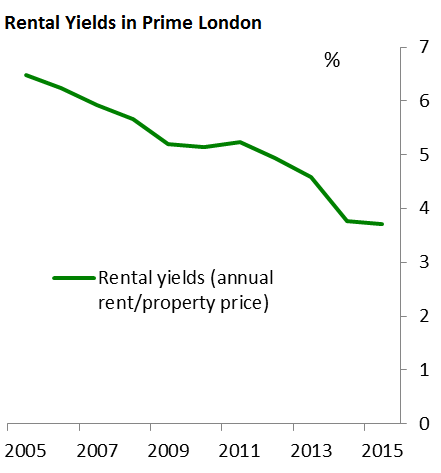

And this has a nefarious effect on landlords, because yields from rental properties have dropped “to between 3% and 4%.”

The blog post defines “rental yield” as property price divided by annual rental payments. That would be gross rental yield, before acquisition costs and expenses. Net rental yield, after acquisition costs and expenses, would be quite a lot lower that these figures:

So gross rental yield of 3% to 4% is low. Subtract acquisition costs and expenses, and not that much remains. Landlords still enjoy the tax benefits they get from owning rental property, and they cling to the big hope that property prices will continue to soar for evermore.

But the rental yield in reality is even lower. The BOE says that the median number of days it takes to rent out a property has increased to over 50 days. So if you have a vacant apartment and spend two month trying to fill it, during which you receive no revenues but have to pay all the expenses, and then rent if for one year at a gross rental yield of 3%, you’re already in the hole because you get 12 months’ rent to cover 14 months in expenses. If the tenant leaves after one year, you start all over again with a money-losing proposition.

For landlords to come out ahead, they must see big gains in property values – which has been happening, at least until recently.

So the BOE asks: “What has driven this divergence” between these skyrocketing house prices and the more slowly soaring rents, a divergence that has wrung the profits out of this deal? What has kept rents down?

In answering it, the BOE takes a turn toward the hilarious:

The most likely explanation seems to be an increase in competition between investors in the rental market. Whilst the number of buy-to-let transactions fell sharply during the crisis, it has since rebounded to around its pre-crisis levels. A higher number of properties available to let has meant that landlords have been unable to raise rents – whilst the prices paid to purchase these properties have risen sharply.

So, in other words, the BOE doesn’t lament the insane house price bubble, for which the BOE is in part responsible. Instead, the culprit is market competition, of all things, in the rental market: too many high-priced rental apartments for too few wealthy tenants.

It doesn’t occur to the authors that rents have soared to levels where landlords run out of potential tenants who can afford these rents. This condition, caused in part by loosey-goosey monetary policies, is the result of global liquidity trampling over regular folks living in London and pushing them out because they can no longer afford to live there. But then demand dries up…. House price bubbles have a nasty tendency to break apart at this disconnect.

London is not the only place with these problems in the era of central-bank market manipulation and house price inflation. In the US, the game has already advanced. Read… What’ll Happen to Housing Bubble 2 as Mortgage Rates Jump? Oops, they’re already jumping.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Now, we have a bunch of central planing academics who, at best, can spot the iceberg after it has hit the ship.

Hey bubble: Where’s the pin?

The high end of the Prime Central London market, which has seen the greatest appreciation, is not rented out. It is the playground of oligarchs and kleptocrats.

If you were to segment the price appreciation into rental and non-rental, you would see that the apprecation of the rental properties has been much more in line with rents.

Four percent seems pretty thin- except in a world of negative rate bonds.

And given the appreciation it’s worked pretty well- up until now.

Another view on this. Changes to buy-to-let schemes (probably long overdue).

http://www.telegraph.co.uk/news/2016/11/16/buy-to-let-crackdown-will-end-the-dreams-of-middle-class-investo/

I would suggest that not only high rents have driven out prospective middle class renters, but the changed demographics within also.

Having friends that live in Camden Town, they say its common now to refer to the capital as “Londonistan”.

I think I’ll adapt the old saw about computers to fit the new paradigm. To err is human, to really foul things up requires a Central Bank.

The central bankers remind me of myself as a kid when I got a Gilbert chemistry set for Christmas. I wonder what will happen if I put some of this into the beaker………..

So now the BOE should call the home builders and make them a sweet low-interest offer to start building like mad.

That ought to leave those property owners high and dry so banks can swoop in and foreclose.

These guys are slick, rinse and repeat.

Sunday Times reported already falling rents in prime locations around London of up to 36 %. One celebrity has also lowered the price of its property for sale from 2.2 mill to 1.7 million pounds. I am curious what they will report tomorrow.

Heinrich and that reduction in price in pounds is even worse than it first looks as the pound has been pummeled lately roughly 18 percent versus the dollar Seems to me this could increase demand from foreigners

Fortunately it is a rich mans bubble.

Let m have it.

The word ” Economist ” reminds me of the definition of the word ” Expert ” where ” X ” is the unknown quantity and ” Spurt ” is a drip under pressure.

In Netherlands, if you buy a property at current prices, gross rental yield would be at most 1-3%; main reason for the low yield is our mortgage tax deduction, which effectively subsidizes 50% of the cost of a home for buyers, but doesn’t apply for rental properties. Any higher than 1-3% and you are unlikely to find a renter, because the current rents in the Dutch free market are already around 50% of income. Although banksters and politicians may nut understand, it’s quite difficult to pay more than 50% of your income on rent especially when mandatory healthcare, energy bills and various taxes requires 20-40% of income.

One can get higher yield by splitting a normal home and renting out rooms as apartments e.g. for foreign workers or migrants ($$ …) but this means much higher investment up front and higher maintenance, plus you probably have to bribe some government worker to get permission. And hope that they don’t start a pot plantation in the property ;-)

Many of the more expensive rental properties in my area seem to be empty most of the time, so the owners are basically banking on appreciation just like in London and until today that has worked great for them as prices keep surging ahead (way above official inflation).

Asking rents in the free market keep going up with prices, this year again 7-10% depending on area. But it’s difficult to find out what is really paid in the free rental market. I have been renting the same apartment for 6 years now and despite 3-10% yearly rent increases according to the statistics, I have had one rent increase and one decrease. I’m paying almost the same now as 6 years ago and I’m sure the landlord would find it almost impossible to find a new renter if they increase the rent significantly, and having no renter for months would cancel any potential gain from increased rent.

It’s certainly different in cities like Amsterdam due to much higher incomes in the financial sector, many expats who get compensated by their employer etc. (a bit more similar to London). But even there I get the impression that most ‘landlords’ bank on appreciation and see a renter as some potential icing on the cake.

Perhaps it’s fair to say if government subsidizes some asset class or offshoring, those programs are quite successful most of the time at least to cause a bubble. In other cases, schemes or technology that doesn’t work or cannot compete has a brilliant but brief shelf life.

I think the BoE blog has missed the point. In the UK commercial property investment market, something I know a lot about about since it is to do with my work, there has been an uncoupling of the link between property price (capital value) and rents. The same principle applies to residential (including the prime London market.)

Property investment fundamentals, what the BoE bloggers would call economic theory, are being ignored because buyers are not reckoning prices by reference to rental income (yield) but in comparison with yields available elsewhere, particularly Stock Market dividends and cash on deposit.

SM volatility is par for the course, but what investors dislike more is the uncertainty of dividend yield. Most companies are maintaining or reducing payouts to shareholders. Either way the return is not keeping pace with inflation but more impoetantly it is not keeping pace with a desire to be in control. With property a well-advised or experrienced investor knows what they are getting from day one. No complicated accounts to analyse, let alone creative accounting. And although property is an illiquid asset, unlike stocks and shares that can normally be sold within a minute or two, landlords feel like they have arrived in a higher status than mere shareholders to whom most companies pay lip service.

All those factors and others combine to overcome the downside of property. Rental payment is a legally-binding contractual obligation. And even if the rental income is nil, the investor still has a store of value. Whereas with stocks and bonds, the investor could lose the lot and end up with nothing to show for it.

And although the prospect of capital gain has traditionally been the reason for property investment, there is nowadays no reason to think that is the only reason.

Another point. Talk about low yield only applies to prices paid by new buyers or if you value by reference to current prices. By reference to historic cost, most landlords will be getting substantially higher yields.

People aren’t thinking deeply enough about the subject, houses, art, stocks have all become “proto-money”, in other words substitutes for what used to be the real thing. In a world a ZIRP or NIRP currencies, where not only real but *nominal* rates are below zero you are going backwards holding bank money in any form. So money sloshes into money substitutes that might hold their purchasing power (stocks, art) or provide at least some current income (houses), when both of those functions are supposed to be functions of the money itself. When CBs themselves buy real estate and stocks the circle jerk is complete. Get your wheelbarrows ready because you will soon need them to buy that loaf of bread…unless you can pay the baker with 100 shares of GM that is.