What the slow crash of classic car prices says about the future of other asset classes.

The global asset class of collector cars – these beautiful machines are perhaps one of the most enjoyable asset classes to play in – is quietly but persistently and very unenjoyably experiencing a downturn that parallels and in some aspects already exceeds the one during the Financial Crisis.

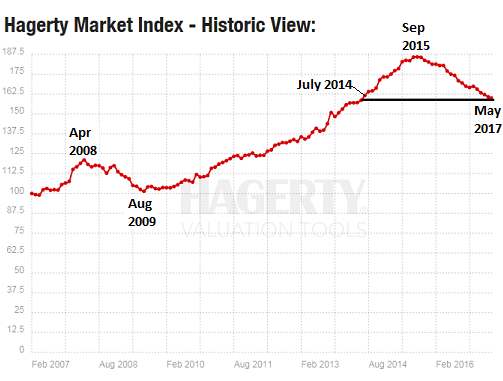

The index for collector car prices in the May report by Hagerty, which specializes in insuring vintage automobiles, fell 0.68 points to 160.06, down nearly 10% year-over-year, and down 14%, or 25.8 points, from its all-time high in September 2015 (185.86).

Unlike stock market indices, the Hagerty Market Index is adjusted for inflation via the Consumer Price Index. So these are “real” changes in price levels.

To put that into a Financial Crisis perspective: The index peaked in April 2008 at 121.0, then plunged 16% (20 points) to bottom out in August 2009 at 101.39. So the current drop of 14% from the peak in “real” terms is just below the drop during the Financial Crisis, but the current 25.8-point-drop from the peak already exceeds by a wide margin the 20-point drop during the Financial Crisis.

In the chart below from Hagerty’s May report (I added the dates), note how the index surged 83% on an inflation-adjusted basis from August 2009 to its peak in September 2015. This represents a nominal price surge (not adjusted for inflation) of 95%:

The index is now at the lowest level since June 2014. “With the latest release of values in the Hagerty Price Guide, prices have started to normalize,” the Hagerty report commented.

Among the “Drivers of this month’s decrease,” according to Hagerty:

The number of owners expressing the belief that the values of their vehicles are rising is still falling. The drop was more pronounced for the owners of mainstream vehicles, but the number for owners of high-end vehicles who feel values are increasing is also at a five-year low.

Market observers have cited a split in the market between entry-level vehicles and the top of the market, where more affordable cars are showing strength as the top end is contracting.

This is how an asset bubble during these crazy times of easy money around the globe, central bank “wealth effect,” and endless liquidity gets unwound: In small, nearly imperceptible but relentless increments with plenty of confusing ups and downs, as buyers become just a little less enthusiastic month after month, and as sellers become just a little more eager month after month, seeing whatever they’re seeing on the horizon. There’s zero signs of panic at this point, and there’s no forced selling at this point – but those tiny orderly increments add up after a while.

Prices of collector cars move similarly to those of other asset classes, such as equities or real estate, both residential and commercial. They surged up to the Financial Crisis. They crashed in a panic – hence the “crisis.” And they reacted in near-unison to central bank money printing, zero-interest-rate policies, and gargantuan bailouts of banks and industrial companies. Central banks made cheap liquidity available expressly to pump up asset prices. And that worked. But it doesn’t work forever.

This time around, asset prices are inflated far beyond where they’d been before the Financial Crisis, but there is no panic, and there is no crisis. Liquidity is still sloshing knee-deep through the system. And some of the largest central banks, including the ECB and the Bank of Japan, are still engaging in massive QE operations.

So collector car prices indicated what’s in store: Despite all liquidity and QE, prices can rise only so far, and then investors back away, gradually, one after the other.

At first, there will be talk of “plateauing,” as is currently the case in commercial real estate. Then there will be talk of prices “normalizing,” as is the case in collector cars. Then there will be talk of “buying opportunities,” and so on. This may drag on for years.

In this process, markets will prove everyone wrong – prices weren’t “plateauing, and they weren’t “normalizing,” and the “buying opportunities” were in fact, with hindsight, selling opportunities.

But given the liquidity in the markets, and policy interest rates that are still close to zero, and in some cases below zero, and in all cases way below inflation, there may not be a theatrical, panic-induced crash as there was during the Financial Crisis. More likely is a slow but relentless zigzagging lower to what may be more rational levels, which would be a whole lot lower.

But it may spread over years, and may be slow enough and uncertain enough, with enough upticks in between, that central banks don’t feel compelled to unleash more QE, and it may exasperate everyone in the markets. At some point, the economy’s main focus might shift away from financial engineering and asset-bubble betting to productive activities. And that might actually be a positive for the real economy.

Up 10,000% in 16 months? These charts truly depict our crazy times. Read… What the Heck’s Going on With Cryptocurrencies?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Sorry Wolf, I think your timeline doesn’t go far enough back. I would like to see 1980 for this asset class. that’s where we are going with these old tin cans.

20 cents on the dollar.

Wolf has raised a possible “Canary in the Coal Mine” indicator. Only excess wealth goes into classic cars. With this disappearing of money coming into classic cars, I wonder what other sectors might be next?

Wolf has done a great job re real estate and transportation assets. wolfstreet is now a daily stop for me.

I think you’re right and the reason is the aging of the buyers that think the large majority of these cars are cool and want them in order to bring back the days when they wished they had them. A shrinking pool of interested buyers and a steady supply of cars that deteriorate with time creates motivation among owners especially if those owners are estates.

Have to move the iron.

The Sept 2015 high with with the 2014 and 2017 shoulders look very symmetrical. The more interesting question I have is what the path to 100 or below will look like and how long to get there. If Apr 2008 125 was a bubble, then Sep 2015 reading of 187 is a bubble on steroids.

Wonder how many huge personal loans were taken against stocks to buy these high end assets (RE,cars,art)? Handwriting on the wall to get rid of over priced assets before stock prices dip and loans come due.

” Wonder how many huge personal loans were taken against stocks to buy these high end assets ”

Amongst the older well heeled collectors .. not so much … but among the hipster wanna be’s desperate for an ‘ authentic ‘ experience .. the nou-veau riche and trust fund babies ? Hell there’s entire websites dedicated almost exclusively to the likes of them [ re;Petroliciuos etc ] ..therefore a whole lot more than you , me , Wolf and all the banks etc combined really care to know about

Suffice it to say the collateral damage that will result once the collector car bubble completely bursts this time will be more widespread than ever in the past … e.g. its gonna get ugly out there

This sneering attitude toward the millennials is uncalled for. A guy can fall in love with a car the same way he falls in love with a beautiful woman. Look at those curves! (I’m talking about a Raymond Loewy designed Studebaker Hawk). Young fools are just as susceptible as old fools (having been both at one time or another).

Thank you for standing up for others. I am an older millennial who has always respected and valued other generations, especially older ones. I’m pretty surprised at the kvetching about millennials here by a select few.

Sorry, but I fail to see where all Millennials were dissed in his/her comment. It seemed like he/she was referring only to those who fit in the “hipster wanna be’s desperate for an ‘ authentic ‘ experience” category. How you took that to mean all Millennials isn’t clear to me.

Trump troubles appear to have rattled all those tough guys who’d banked their tax cuts. Time for Janet to make a couple spreadsheet entries and buy some futures. The team that SAVED the world.

Couple of thoughts from a owner of a restored 1966 Volvo 122S. Not the 100K Jaguar or 250K Packard, but a fun resto and one I drive alot.

1) Alot of mid-range restorations (say 25-75K) were the pride and joy of many boomers who are not retiring. They don’t use the car and would rather have the money. So these restos are under price pressure as I see it.

2) Really high end stuff may have dropped some (Jay Leno and Jerry Seinfeld crowd) but that may also be more a function of what do I do with all these cars? The prices were likely bid up over the last decade due to the belief that ZIRP would never end and where else can you put your money? Liquidity from Fed of course drove ZIRP, but liquidity specfically didn’t drive these price increases as I doubt any of these were bought on credit.

3) Daily driver restos like mine are becoming more popular with the younger generation. The car can actually be worked on by ones self, parts are still readily available and lots of technical expertise sharing on internet. Unfortuantely, young folks struggle with making enough money to fully restore something that might cost $25K, for example.

Your’s is the romantic viewpoint thats rapidly being overtaken by a very harsh reality .

Because … the thing you’re ignoring is the fact that those $25-75k restos and resto – mods are rapidly becoming a thing of the past as costs from initial purchase to repairs part etc are escalating to obscene prices as Hipster Wanna be’s line up in desperation to be a part [ in their mind ] of a past they know nothing about

Which is to say … there’s gonna be a whole lotta collectables including daily drivers such as yours languishing in driveways or rusting away in some field or woods over the next few years

I don’t think you read my post carefully. I stated that the 25 to 75K resto market will be under pressure because many of my generation are selling and want out. They’ve got a good amount of money in the car, don’t use it much if at all and would rather someone else take it. I didn’t add that this is an unaffordable range for the new generation of car buff…what you term the “Hipster Wann Be”, but clearly stated that this range will be under price pressure.

With respect to my price range of daily driver resto (<25K), I strongly disagree with your statement and have plenty of evidence to suggest that these cars are and will make a comeback. Parts are cheaper than you think and regarding repairs, well most of us do that ourselves. Most can't do repairs on new cars due to the sophisticated electronics and tools required. But a 1960's, no problem Additionally, in case you're inclined, license fees are ridiculously cheap because of age and in NC where I reside, my 1966 requires NO annual safety inspection. While I don't agree with that regulatory approach fully, I'm not complaining. It's not as if I don't keep the car up safety wise anyway.

There’s the nuts/a-holes bidding up the price of cars at Barrett-Jackson having a “my d##ks bigger” contest, then there’s the people who actually work on and drive these cars.

I don’t know about you, but my 25-35 YO daughters want to keep all of mine when I kick the bucket. The problem is figuring out how to divvy them up. Most people will give them to the kids, rather than “give them away”. This will end up supporting prices for 60s-70s Muscle Cars, which seem to be the ones Gen-X/millenials like. Also not mentioned is that these cars are selling into a worldwide market now.

A properly executed resto-mod (like my buddies mid-60s Impala SS with an LS-1) will not break a sweat on a 1500 mile road trip, and get 24-25mpg while doing it. He’ll be able to drive it 5-10 years, and break even (at worst) selling it.

Remember that the cars of the 60-70s were the first cars you could rely on to do a NYC-LA trip without problems. With radial tires and a few upgrades, they will do long range road trips without problems. And for most of them, there are still enough

parts around that they can be fixed easily.

Not that I ever intended them as an investment. I’ve bought them because they are cool/interesting/fun. The fact that they have been a decent investment (so far, if I should decide to sell) is just icing on the cake.

If there is a recession, and my personal history is a guideline, my old crocks will be a better investment than my 401K.

If the economy totally implodes, we’ll have bigger problems to worry about than the value of old cars.

The prices were bid up because the sane people were 100 percent out of stocks and looking for alternate investments to stocks. There were plenty of sane people thus the great price rise in alternate investments to stocks.

Forget the top end collector market…I recently attempted to buy a reconditioned ’72 Beetle ragtop…My independent appraisal was $3,000 under what the dealer was asking…The sales manager laughed in my face and did’nt lower the price by one penny…I walked, but another sap must have paid the price because the car was gone one month later…

.

I feel your pain . In a moment of mid life crisis nostalgia I considered buying and resto-modding a VW Micro bus a couple of years ago … just to relive a bit of my past as well as create some new memories with my wife who wasn’t around back when I was crossing the US & Canada in one ..

.. that is .. until I had a good long look at the insane prices the things are selling for … not to mention what the resto-mod would of cost . At which point I decided the memories were good enough and the wife would have to make due with a few photos and some damn good stories

Everyone with half a brain including more than a few collectors both celebrity and otherwise saw this coming a good two years ago once pedestrian 911’s started costing Ferrari money … VW Micro Bus prices rose to collectible Porsche values … Toyota FJ40’s started knocking on $100k etc – et al – ad nauseam which was just about when many a collector started dumping or at least severely thinning their collections putting the proceeds in the bank rather than reinvesting into some other commodity , collectable etc .

And trust me … its only going to get worse as the months go by

I’d have to think that the same could be said of the vintage watch market. Heck, even brand new Rolex watches have doubled in price over the last dozen years.

This is what I think real estate in SoCal and stocks should be doing, but both just keep going up!

Well I think we’ve all seen this movie before back in 2006-7 for houses in Cali and 2008 for stocks.

I’ve taken some heavy beating in last 6 months of double short ETFs and TSLA shorting – OUCH…

Care to share what exactly you did choose? No leverage used? There are options and CFDs – but the latter are banned for Americans. IG offers single stock CFDs, but I don’t know if they list Tesla.

Am in the same boat – and getting very frustrated while I read Wolf’s excellent blog and David Stockman’s teasers. (What a shame, this pay-for “solution”. Surely, he doesn’t need that income stream and could opt for glory).

AUCTIONS. The writing on the wall.

I follow heavy industrial equipment auctions, mainly through Ritchie Bros. Auctioneers RBA (TSE) with 44 worldwide industrial equipment auction sites.

The auctions began peaking in the 3Q of 2016 and by the end of the 4Q 2016 were on a slow decline. As has been proven out by the RBA stock price, which peaked on December 09, 2016 at $51.81 CAD and is now trading at $41.86 CAD. Over 5 months now, of slowly trending lower.

This equipment sector is the rock solid backbone, of the construction and mining industries. What this is telegraphing, is the degree of unhealthiness of the general global economy. Despite a small uptick of global retail sales by CAT in its last report, after having suffered over four straight years of negative retail growth.

Just another written note on the wall for all who want to read it.

Those who don’t? The coming surprise will be epic!

Thanks!

Further evidence of the auction slow down.

The number of reserved bid lots have been decreasing.

This points to financial pressure on the vendors to sell, no matter what the auction price is.

I also would like to see an expansion of that chart back to earlier the 1980.

Why

What I see at a glance, is 2 corrections from cyclic peaks. In similar time frames.

So the Commodity may be at the bottom of a new dip.

MAY BE.

Classic vehicles, are simply Commodity stores of wealth, to some of their owners.

Writing on the wall?

https://www.youtube.com/watch?v=Nsdo6Xy8fPU

Not a classic but I bought a used 2014 Boxster 2 weeks ago from a private seller. Decided to give myself a nice BD gift.

Seller paid little under $50k for a certified loaded 2 yr old car shy of 10k miles 9 months ago. I paid little under $40k with 21k miles. Original sticker almost 3 yrs ago was $72k so it lost 45%. I should have waited 6-12 months for a better deal but the price was right and right options so bit the bullet.

Makes me wish I still had my ’73 914…

Yeah, I just bought a 2016 BMW X3 still under manufacturer warranty for 45% off of the original purchase price, too. I’m sure the deal would have been even better if I’d waited another 6 months, but not too shabby.

987 Boxers and BMW X3s and X4s are super cheap now, also the Fiat Barchetta is a good drive.

Classics are nice but good paint and rust free comfort is very cheap in newer cars, this is the real competition for old cars..

Future demand is for cars that run on batteries, have wifi and bluetooth and drive themselves. No one will understand how a V8 engine works and won’t want to get their hands dirty pumping GAS. Yick! lol These cars may be valuable NOW but you have to consider the future demand and what a buyer is willing to pay for it down the road.

Most of these cars should not be bought as investments and certainly not on margin/credit. But they can be very enjoyable to work on and great fun to drive. Maybe even more so than a new car. I bought a ’64 corvette a few months ago and I’m having a ball. In great condition and for less than a new truck. I don’t worry about the resale but I’m pretty sure it will depreciate less than a new car.

Perhaps for some, but not for me.

I drive a ‘classic’ 1995 Lexus SC400 with a near mid-engine V8 (motor and transmission are pushed down and back so the front hub line sits at the center of the front cylinders). She’s got rear wheel drive, ABS, traction control, cruise control and nothing more; just the way I want my car.

Of course, I have high-end brakes, suspension, wheels and tires to make the car grip the road like a slot car, and don’t forget keeping a spare donor car (a ’94) in the garage to take parts off of as needed.

The SC400 is my car of choice, and I’ve owned a few over the last decade and a half. It looks great and is fantastic to drive. My current one has 93k and I’ve got under $12,000 ‘invested’ in it. IMO nothing matches it for drivability and price.

One way I gauge the economy is the number and price of horses offered on Craigslist is my area. Horses are expensive to own, but many working class people make the sacrifice to keep a horse for emotional reasons. In 2009 Craigslist was flooded with horses –‘free to a good home.’ I’m not seeing that yet, but I do see falling prices and increasing desperation on the part of the sellers.

This. That’s a very good micro indicator of when working/upper middle class peeps are significantly pressured. That’s Jenny’s/Mommy’s/Daddy’s pride being sold so that they can pay the bills…..at the very least.

Only the working class (emotional/leisure/pack animals) and the upper middle (4-H, dressage/show, competitive) will make such animals a priority.

Agreed, I am noticing this as well. However the higher end European breeds are not coming down in price one bit.

I am betting it will be true for all assets EXCEPT stock. The powers that be don’t care about anything else except the Indexes. They’ll burn down this country if need be in order to maintain those numbers.

“Prices of collector cars move similarly to those of other asset classes, such as equities or real estate, both residential and commercial.” – Wolf

What about undeveloped real estate? There’s been big money invested in it: Ted Turner in Montana and Jim Justice in West Virginia, for example.

When crappy Ferrari 308s sell for $90000…..having had a hard time selling for $30,000 a few years ago you know it’s a bubble. A 550 Maranello was lucky to be bid to $70,000 at auction in 2013…..and now people are asking $175,000…..

A Delorean is now a collector car……that sums up the market…bail while you still can.

Janet Yellen purports to see no bubbles.

Yep, I follow the market and you can throw 70’s 911’s in there as well. Those things have tripled in value in the last 5-10 years.

What about the fact that fuel prices have doubled even tripled, and you want to daily an original v8?…..nuts

Barret Jackson 2017

1971 Chevrolet custom K5 Blazer 4×4, $220,000sold

That’s completely nuts

The top has just blew

That was nuts, but it came with a full tank of gas, and a

good used spare tire.

The other day, I saw a breaker’s warehouse. About 100 Porsche 944s. Select parts are getting scarce.

Personally, I discovered the Porsche Boxster convertibles. Bought 3 to try out the 2.5, 2.7 and 3.2 liter flat six models. Paid 3.5 – 5 grand for each. The “S” had a damaged front bumper…

Brilliant fun cars. Bought in the UK for about half the price of German left hand drive Boxsters. One had 178,000 miles and was still going strong.

$ 350 buys the tools to read out the data. Check the hours of the airbag, check the mileage and rev ranges. Any abuse of the engine to stage 3 or higher? Walk away!

There are nice affordable cars which may lose $ 1,000 a year. But TBH, it doesn’t make sense to me to go after a resauration project costing the down payment to a lovely condo or house in Etowah county, AL.

New cars tell a similar story: Mercedes has been offering 0 down, 0% interest leases for 169 € or such for their small car-vans with about 1.5 tons weight.

With the pipeline being jammed, it’s “kicking the can” time all around.

I’ll pick up one of these classic muscle cars for a song at the coming firesale of distressed assets when our Fed-blown asset bubbles implode.

The sp500 hit a high in Oct 2007 and a low in Mar 2009, which makes your chart a lagging indicator, not a leading one.

“And that might actually be a positive for the real economy.” Might?

What you see at a gathering of collectable cars/motorcycles these days is a disproportionate amount of gray hair. Somewhere along the line, this will add to the bust.

Except a lot of us grey hairs have kids. Who are fighting over who gets the car(s) when we kick the bucket. Which affects resale. Like the current owners, they will keep them rather than “give them away”

At least out here in Flyover, interest in hot cars hasn’t slackened among the 20 year olds. Their ability to generate the income to buy them has been seriously compromised. But by the time they hit 35-40………

My perspective is from Silicon Valley. It is good to know that there are places where enthusiasm for classics is alive and well.

Always remember, that at one point in time, all of these “collectibles” were just used cars. The challenge now is to determine what cars will be future collectibles, that you can buy at used car prices, and drive in the meantime. And recognizing that my criteria for “good investment” is “cool/rare/hi performance car that I can have fun with for a few years, then resell and break even”.

This is harder than it looks, because most mainstream cars are the functional equivalent of toasters nowadays. No guts/performance. One toaster/car looks like the next.

Owning “gas guzzlers” as daily drivers is not a problem if you only have to drive 8-10 miles in light traffic to get to work. Also……..something relatively exotic cost a lot less to repair, if you can afford to let it sit until you can get it fixed for the “right price”.

As we say in the airplane maintenance business: “Fast-Cheap-Right………..pick two”

I have personally developed my own criteria for future collectible cars of this type. I’d telly you what they are, except for the fact that I don’t want to get in a bidding war with you chumps :)

Year to unfold? Stock market is ready to crash after the summer. It will be very fast. Collectable cars are not leverage as equities which are bought on margins. In a stock market downturn people will need to cover their position fast. Gold and silver probability will go down too.

This is the first time I can remember my favorite econo-pessimist wax hopeful on the long term. So have the central banks found the answer, ya think, to perpetual growth? Permanent excess liquidity, by historic standards?

I think investment does not turn from asset bubbling to actual production, until demand…read “wages” responds. There was a little sign of that last year in the US as wages did make a little rally, due I think to the mass pressure on the minimum.

The central banks are nudging up from near ZIRP at the behest of the banks, that are strangling under the no-decent-spread-without-going junk syndrome. At the first sign of slowdown, they will sneak the rates back down again. My bet is it’s the banks which will crack. Right now it’s only dodgy investments that are supporting bank profits.

I hope yer not saying, Wolf, that after about eight years of up, that there’s no down on the horizon…

We are reaching the end of the ICE age (internal combustion engine). If you have paid a few million dollars for a classic Ferrari you have to face the fact that you won’t be able to drive your beautiful car unless you brew your own fuel.

Also it is likely that once self driving cars really get established it will be hard to buy insurance for the road if you are a fallible human driver.

Guess I’m nit picking here. Is the math wrong? If real change of index is -14% and the CPI chg is positive 2.8%, wouldn’t the nominal change of index be -11.2%?

Man, if only I bought one of those classic cars AND some fin pieces of original art work. Nothing better than enjoying an asset AND seeing it appreciate.

At least I’m long real estate, but it’s probably time to reduce exposure.

Sam