A big driver is the “secular decline in the office market” that even slashed interest rates would not end.

By Wolf Richter for WOLF STREET.

There has been a recent flurry of declarations by big fund managers with exposure to the office sector of commercial real estate that office CRE has “bottomed out,” or is “near bottom,” or that “we can at least now see the bottom,” or that “while we might not be at the bottom just yet, we’re close to it,” etc.

But Fitch Ratings has come out with an updated analysis of the US office market, and it doesn’t see the bottom just yet. Far from it.

“CRE office loan performance will continue to weaken as market pressures build,” it said about office loans backing the Commercial Mortgage-Backed Securities (CMBS) it rates.

It maintains its “’deteriorating’ outlook” on the office sector through 2024, citing:

- “Sustained higher interest rates” (buying into the Fed’s higher-for-longer)

- “Slower U.S. economic growth”

- “A tighter lending environment” (banks, up to the gills in iffy CRE debt, have severely restricted CRE lending, and so refinancing maturing CRE loans can be difficult to impossible).

- “And a secular decline in office demand” (as documented by the astronomical mindboggling amounts of office space that’s on the market for lease).

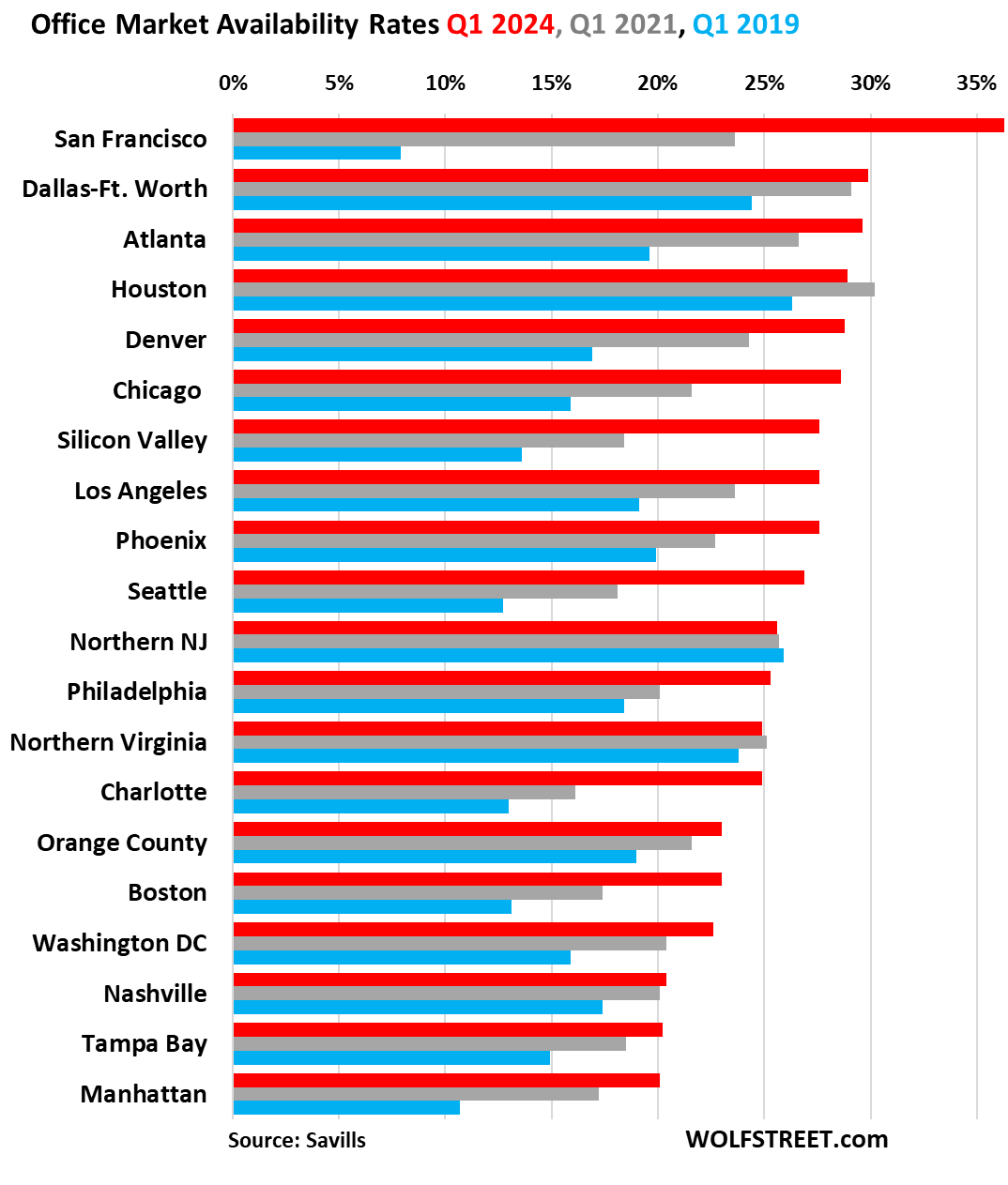

This “secular decline in the office market” has turned into a flood of office space that is vacant and on the market for lease, as companies have discovered that they don’t need this vast amount of office space, with availability rates in many big office markets at around 30%, topped off by 36% in San Francisco, which was a few years ago the hottest office market in the US (availability rates by Savills):

“These factors will exacerbate refinancing challenges, leading to rising loan delinquencies and transfers to special servicing for potential workout or modification,” Fitch said.

It raised its office delinquency forecast to 8.4% by the end of 2024, which would surpass Fitch’s peak Financial Crisis delinquency rate of 8.1%.

And then in 2025, it sees office CMBS delinquencies to deteriorate further and hit 11%.

Office values have dropped approximately 40% so far, Fitch said, compared to 47% during the GFC. But office values “have yet to bottom out,” it said.

Office CMBS delinquency rates.

In May, there were an additional $1.2 billion in CMBS office loans that had become delinquent, according to Trepp, which tracks and analyses CMBS.

But a little over $2 billion in delinquent office loans resolved “either because the loans flipped back to non-delinquent during the month, or because the loan was disposed,” Trepp said. Five of those loans accounted for $1.7 billion. And so they flowed out of the delinquency bucket.

“If the $2 billion in office resolutions had remained delinquent, the May office delinquency rate would have been roughly 90 basis points higher at 8.48%,” Trepp said.

With those $2 billion in office loans having come out of the delinquency bucket, the Office CMBS delinquency rate dipped to 6.94%.

The downticks in the chart were months during which larger balances of office loans were resolved than newly delinquent office loans flowed into the delinquency bucket. When those office loans are resolved and come out of the delinquency bucket, it often comes with a big loss to the CMBS holders, in some cases over 80%, when even the top-rated tranches take a loss, and sometimes at a 100% loss for all CMBS holders, such as the 46-story 1.4-million-sf tower in downtown St. Louis that was sold in a foreclosure sale for about $4 million, which barely covered the fees.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

I wonder how much CRE is currently under construction since new inventory will worsen the problem when it comes online. I see cranes everywhere when I travel.

OutWest – but are they lifting?

may we all find a better day.

I think the commercial real estate is in more trouble than what they’re letting on.

This. Epic can kicking behind the scenes.

If CRE is near the bottom, then it’s been sold as one of the biggest bait & switch doom & gloom calamities of all time.

Personally, I think it will get worse before it gets better, but that’s just a SWAG on my part. My guess is that the pivot mongers think interest rates will be substantially below where they are today, offering relief to all of these loans that will reset over the coming 12-24 months.

So I’d suspect that Fitch is more right than wrong on this one.

Are their credit default swaps on these securities? I haven’t heard anything about it…ty.

The ones that are blown over sure aren’t.

Counted eleven sticks from the boat the other day in the 77 miles surrounded by reality, but almost all are high-rise residential, new campus building, or healthcare. No office towers going up.

The new office developments will lease but typically pull tenants from lower quality / outdated buildings making the problem worse for banks / bondholders / equity investors of those lower quality and functionally obsolete assets. Long term, these assets will require significant equity infusions (to stabilize occupancy) or the investors give the asset back to the lender who will clear the market (in the form of a note write-down and sale), likely leading to a low enough basis reset for re-equitization or land banking by a developer. Well-located assets will see reinvestment while poorly located deals will languish unoccupied.

While I have empathy for every bleeding heart cause you can think of, I am a realist, sort of. Given the size of the pile, I’m sure the concentration of zero interest variable rate loans may have had something to do with it.

Wildly overpriced assets being revalued. The legacy of the Fed as we thought we knew.

Variable rate was what Trepp Data showed as bigger problem. Couldn’t find out much more as they are hip to my paywall dodging tricks.

But here’s who owns them; Jonathan Harold Esmond Vere Harmsworth, 4th Viscount Rothermere (born 3 December 1967), is a British peer and owner of a newspaper and media empire founded by his great-grandfather Harold Sidney Harmsworth, 1st Viscount Rothermere. He is the chairman and controlling shareholder of the Daily Mail and General Trust, formerly “Associated Newspapers”, a media conglomerate which includes the Daily Mail.

He is one of those people included when people say, “THEY are running things”….I figure.

If things really go south, as Fitch thinks, somehow the government WILL pick up the tab….and sneakily probably.

Between Reagan and the GFC, I think govt of the people, by the people, for the people’s chances likely vanished into an oligarchy of “Theys”.

Barring the kids forcing a Green New Deal….somehow…..there is always hope.

“Between”, as in, most all “leaders” during that time period, public and private.

PS; I’m a gutless econ loser, and bleeding heart type, too. At least at this point in time.

No matter where you are at, it’s ALWAYS for the first time.

Last GF (we lived in Tucson) said, “Wherever you are, there you are”……same notion.

“Variable rate was what Trepp Data showed as bigger problem. Couldn’t find out much more as they are hip to my paywall dodging tricks.

I discussed this on May 2.

https://wolfstreet.com/2024/05/02/delinquencies-of-floating-rate-office-cmbs-loans-hit-20-fixed-rate-loans-are-at-4-7/

Must have missed that. Thanks. Off learning how Healthcare is FN us up badly, probably, but we are getting FD here too.

Jingle mail for biz is smart move, for individuals it is a moral failing…..FN organized religion…..Goldwater warned us about those preachers and it’s happening.

No wonder I hate this society’s “systems”.

And to anyone who tells me to leave it then, I can trace both sides of the family back to revolutionary war…..in fact they were paid with land in the Ohio Territory, so we killed a lot of Indians and built up many other things to make life easier for all the rest of you latecomer crackers and honkeys.

@Wolf: Fitch statement in the article: “banks, up to the gills in iffy CRE debt, have severely restricted CRE lending, and so refinancing maturing CRE loans can be difficult to impossible”.

==================

Is there any data on how much “up to the gills”? My prior understanding was that banks did not have much by way of CRE debt holdings having sold most of them to investors.

Also, there are articles talking about 63 problematic banks which may go under this year. Between high interest rates resulting in flight of deposits and this CRE issue, are we going to see more banks go under?

You people need to read the articles here instead off allowing internet toxins to pollute your brain, it seems.

1. “up to the gills” means US banks have plenty of CRE loans, and they’re dealing with it — and one of the ways of dealing with it is by cutting down making new CRE loans. But the majority of CRE loans are with investors and taxpayers and foreign banks, not US banks.

Here is a series of articles on CRE and banks:

https://wolfstreet.com/category/all/banks/

2. The “63 problematic banks”

very first article in the bank link I gave you discusses this topic

There are over 4,000 banks in the US, and the FDIC maintains a list of banks that have a higher risk of failure. There are ALWATS banks on that list, see chart below.

I’ll just repeat the first part of the article here since people only read the comments and skip the articles, and then wonder why they don’t understand. DO CLICK on the link and READ THE WHOLE THING:

https://wolfstreet.com/2024/05/30/nonresidential-cre-loans-are-leaving-skid-marks-on-banks/

Banks are still very profitable. The industry reported quarterly net income of $64 billion in Q1, according to the FDIC yesterday. And so overall, as an industry, they can take big credit losses, and they have started to take growing credit losses. But some banks are more exposed to risks and are more fragile than others.

Banks on the FDIC’s “Problem Bank List” rose by 11 banks in Q1 from the prior quarter, to 63 banks (blue columns), of the 4,000-plus banks in the US. The FDIC doesn’t name names, but we can guess some candidates. So there will be some more bank failures – there are nearly always every year.

Total assets on the Problem Bank List rose by $16 billion in Q1, to $82 billion, the third consecutive quarter of deterioration (red line), largely driven by the quagmire that CRE has been sinking into. The chart shows the historic context to the Financial Crisis:

CRE is starting to leave skid marks.

Noncurrent loans (where borrowers fell behind) rose to 0.91% of total loans (from 0.86% in the prior quarter), now roughly at the same rate as during the Good Times just before the pandemic. At the peak during the Financial Crisis, it had hit 5.5% (red).

The deterioration was driven by CRE loans, where the noncurrent rate rose to 1.59%, the highest since Q4 2013, driven by office portfolios at the largest banks.

Net charge-offs (when banks throw in the towel on the loan) were 0.65% of total loans, same as in the prior quarter, but up from the historic free-money-from-heaven pandemic era lows, and a hair higher than during the Good Times before the pandemic. The driver behind the increase from the free-money lows in 2022 were credit cards, where the net charge-off rate rose to 4.70% in Q1, up by 122 basis points from its pre-pandemic average. We went into the weeds of who was falling behind on their credit cards here.

Read the rest here:

https://wolfstreet.com/2024/05/30/nonresidential-cre-loans-are-leaving-skid-marks-on-banks/

I have read 2.55 trillion in commercial real estate loans due in next 5 years as of end of 2023. 1.2 trillion in next two years. Like Fitch and Wolf said. That’s a lot of money. Higher percentage of GFC. I’m waiting for it!

Is this enough to bring down the economy or more isolated to some regional banks and certain cities?

Every single thing in this article was about INVESTORS being exposed (CMBS), and there was ZERO in it about banks. These investors are pension funds, bond funds, life insurers, mortgage REITS, etc. spread around the globe. No one cares if they take losses (except their beneficiaries and holders). In the case of bond funds, holders don’t even know what’s in their bond funds, and they don’t care. Investors and taxpayers hold a big majority of CRE debt, not banks.

Why does it always turn out that me, the taxpayer, is holding the bag when the s***t hits the fan?

Because that’s how the system is designed. Act accordingly — pretending otherwise doesn’t help you.

“That’s the God planned it….” (Billy Preston/1969)

No religion or theology offered/proposed.

Jmho. Ymmv.

Press ‘rewind’ to 2008.

EXTREME wealth inequality.

Remember fitch, Moody’s and standard and poors have a questionable past, in the 2008 financial crisis, worthless mortgage rated securities were given an A rating, and SVB was also given an A rating right before it had a heart attack. The good doctor Fitch can be trusted, but I would get a second opinion.

And if you can’t see your bottom I would cut back on moose cake.

Thank wolf, 2 moose cakes for you.

At least they’re consistently wrong in the same direction.

This time, Fitch is being bearish which I think is notable.

Most banks will kick the can down the road by extending low interest loans for a year or two, hoping interest rates come down and vacancies improve enough to allow borrowers to refinance.

If neither of those happen, it will definitely get worse before it gets better. Conversion to apartments will stop soon as a glut of apartment buildings come on the market and rents for “luxury” apartments hit a wall, which they’re already doing here in Miami.

Folks got out over their skis in the preceding period from over-optimism about office growth, and cheap credit. The came a pandemic and gnarly bailout (credit and cash lower for longer). Higher-for-longer is necessary (as I note rents, gas and food prices sky high), so the piper must be paid, hopefully by those who gambled for big profits.

In my area, the cranes are all residential, as a charming region turns into something like Stalinist-residential or prison style linear massive housing blocks. I am already thinking hat may be the next overhang. I don’t want to be handed the bill for that either.

Here in SoCal, it is not just the upper floor office spaces that sit empty. The ground-floor restaurant tenants are disappearing, thanks to the governor’s financial engineering with wages. What will come back at length may well be server-cook robots or remote screen-based staff from across the world (if not bots too). And his housing initiatives will deface whatever is left of bedroom communities. How this affects remaining office culture is to be discovered.

That has nothing to do with ground floor “restaurants” that is large fast food operations and they pay that wage in Europe … so … what it is really showing is the issues with retail, food, etc for small business owners who have been historically pessimistic the last 2 years as cheap money and equity growth have left them behind and paying the bill … more large companies and high network people to take over more market share which creates these deeper cycles of rise and fall since the volume of Americans can not keep spending …

Raising minimum wage has such a small impact on the local economies compared to the massive spike in the cost of rent. The minimum wage has a small effect on a few business owners, high rent is transforming entire regions and generations.

China has come ashore. As Sam Walton taught us. Cheaper always wins.

That’s not the way it works in BMW circles.

What about the Isetta? My favorite BMW.

Phleep, your posts are usually insightful or amusing. This one misses the mark. Doubtful Gav’s minimum wage shenanigans make much difference, and certainly not this quickly.

Full disclosure: I am not a Gavin supporter. At all.

You sure had me fooled.

That has more to do with the lack of office workers that frequented those restaurants. If you needed 10 people to staff your operation, and gave them all a $5 an hour raise just so the lowest employee made the new minimum and the rest didn’t get mad they were now making the same, you’re talking about around $70 an hour extra cost including employer covered taxes. A slight raise in prices should cover that. While wages do have an effect of inflation, it isn’t as much as made out to be.

Cole,

Add in the rising costs of anything and everything….taxes, rents, food, deliveries, insurance, garbage collection, along with the extra on the wages.

With the menu prices going up as well. The restaurant at this point is very vulnerable.

If I’m not mistaken, the restaurant business in this country is in trouble, a lot of restaurants ‘can’t afford’ to be open.

These are hard times, I look to the value menu when I’m to dine. If no ones watching I’ll dig through the garbage for a bite…..

A local, well liked restaurant here in town in a strip center just was told it’s new rent is $23,000/month rising from $13,000/month. They are closing up. Sad.

Most of the economic troubles and insolvency we’ve seen in retail is due to the real estate bubble, as the value of real estate as a speculation token has been more profitable than actual productive uses for those properties.

Hence all the empty real estate and sky high prices. As long as real estate prices keep going up, we’ll keep seeing more empty units. If the fall ever comes, it will be a long and hard fall, as it will take a long time for new businesses to form to take advantage of the lower prices, and to get over the inflationary skittishness.

We’re seeing this happen in residential as well; empty units being held like Bitcoin; bought and sold with Monopoly Money, no one living inside. Some get real sensitive when you suggest that housing itself is one of the biggest asset bubbles of all time.

My point is that the increased wages are actually fairly small and not the reason why they are shutting down. Less traffic is a huge reason along with the increased cost of the food itself and everything else.

Did you actually do the math, or pull it out of the backside? You obviously don’t run a restaurant, and you don’t care that many prices have soared. I’ll use my shop , in financial district of Boston as example. I have reduced the staff size due to wage inflation. Hourly wage is now $25./hr..add all taxes, plus workers comp. WFH, has decimated the number of clientele. A price increase doesn’t cut it anymore. Rent went up. CAM charges and real estate taxes have increased. (real estate taxes are expected to climb, as mayor has announced an increase to cover her new 8% inc. budget)

A combination of all makes this unsustainable. As my lease expires next year…I’m not renewing.

Would you like to leave a tip? 20%, 30%,40%? Better yet, want to pay it forward?

should read…..Hourly wage is 25/hr. Then ADD taxes, etc.

I work on a boat that docks in the Seaport during the summer.

In 2022, the seaport hotel garage charged $25/day weekday rate. In 2023 it went up to $38/d and this year its $42/d.

Must be tough being in the financial district. The Seaport is jam packed, at least whenever I’m there.

Sure, I’ll leave tip.

Hope you have always lived very modestly……if not, your real problem is in the mirror, and don’t threaten the mayor…..please consider that two tips totally free.

You are quite welcome……glad to help a fellow econ loser.

These capitalists whine and whine. Where is the: “in a capitalist system the risk takers are rewarded, so buck-up?” Doesn’t business school teach these fools about business cycles? No wonder capitalists don’t like socialism, because they couldn’t lobby the government or Wallstreet bankers and the Federal Reserve by extension to dump their losses on the workers.

Now you’re catching on — socialism for me; capitalism for thee …

Yeah, that was really good Gary…..and eg is awake……awoke?

We seem to be in a CRE bust right now. Does anyone know when the last CRE boom was? I know rents were high pre-pandemic, but I am thinking back further, trying to get an idea how long the CRE cycle might be?

NYC in the 80’s had a CRE bust when the city was also broke. They got out of it by giving tax abatement of 10+ years, which allowed landlords to upgrade the buildings and keep tenants.

The bust had started in the 70’s with the loss of manufacturing and printing companies. Those buildings created what we now know as the loft craze. Lofts were large and dirt cheap back then.

I would love a small office building to live in. 😍

“It raised its office delinquency forecast to 8.4% by the end of 2024, which would surpass Fitch’s peak Financial Crisis delinquency rate of 8.1%.”

Superficially reassuring. The CRE shoe never really had a chance to drop in the GFC, because with the long lag time for CRE to really take a hit (think long leases), the central banks had already decided to do “whatever it takes”. So the GFC comparison isn’t all that great.

On the other hand, as the work from home are drained without physical interaction with another human being other than one’s family who frankly hopes he/she returns to the office.

There may in fact be a stampede to purchase many of these properties that are currently on deep discount sale. Retail, eventually.

I wish these work from home folks get called back to the office soon too, as that would free up the golf courses during the week for us retirees.

Their lawns are so groomed I am waiting for Arnold, Jack, Tiger and Rory to show up.

Best high speed dirt bike riding I ever had!!!!…..and at night with no lights…..absolutely no fear of hitting anything or even high-siding!

Oakmont CA….think it’s highly rated, too….I agree 100%!

Doubtful. Hybrid was already happening before the pandemic sped up its adoption by about a decade.

2019 is never coming back.

It feels like this is why big companies, especially banks like JPM Chase are demanding employees to come back to the office 5 days a week even though there is no need. They are trying to protect their investments. We’re in a negative feedback loop too. The longer offices stay empty, the more businesses that benefited from them (restaurants for example) close up, further driving a decline in traffic and an increase in vacancy.

Those “ big companies, especially banks like JPM Chase” are creating a recruiting and retention headache for themselves, since the best employees able to find more flexible work arrangements will do so while the face-time drones hang around.

Prioritizing your real estate portfolio over your core business isn’t exactly genius either.

How does Chase having employees come back to the office protect their investment?

Interesting article in the WSJ yesterday regarding this subject. My favorite part was where they noted that Calgary (the focus city of the article) had increased services, etc., based on the boom time taxes and expectations and is now being forced to increase taxes on remaining businesses to make up for the losses in CRE. No mention of cutting said “services”.

DM: From hot to not – Housing markets in this area, Florida, are cooling the fastest in the US as pandemic boom fades

New construction is soaring – bringing the number of listings up to pre-pandemic levels – which is cooling competition, according to fresh analysis from Redfin. This is on top of intensifying natural disasters and rising insurance costs, which are already discouraging prospective homebuyers from settling in the area. The housing market in North Port is cooling fastest, according to the real estate company, followed by Tampa and Cape Coral. The cooling of these former red-hot markets shows the pandemic-era homebuying demand boom in Florida fading further into the rearview mirror, Redfin said.

I’m not a FL person, but as a second hand observer, the high cost of homeowners insurance must be a huge factor.

And what would cause that, I wonder? God? Which one?

NBay – although we ‘Trust’ in the gawds, curious how often they seem to skip on the bills of their acts…

may we all find a better day.

Wolf, there’s a small update on the St. Louis AT&T tower.

Yes, it was sold for $4 million 1-2 years ago, but it was sold again at an even lower price earlier this year…$2.5-$3 million this time around.

It’s a consummate hot potato now.

I’ve visited the tower several times over many years’ time. It’s a ridiculous monstrosity with almost NO parking garage spaces, and the whole building is only monolithically designed for one company’s defunct operations (AT&T).

Demolition seems to be the only way out, put the building out of its misery.

Thanks. I guess that’s another quick 25% loss. Can’t lose money in real estate. I wonder what it would cost to tear down this old monster. Then there’d be room to redevelop the whole area with residential and mixed use and revitalize it to get some people back into downtown. Detroit did a great job with that over the past 15 years.

There is one other semi-interesting option besides demolition….

Why couldn’t AT&T buy back its old legacy tower for what would be chump change for the company (sell building for $200 million, buy back for $3 million)?

— Public relations boost with beleaguered St. Louis downtown, maybe even tax breaks could be worked out

–Can turn entire 44-story facade into giant neon AT&T billboard

–Top floor of this building is actually pretty nice inside, and could be a high-end restaurant/retail with public observation area from top of building

That’s the best possible idea I can think of to save the building, however anemic it would be compared to the tower’s heyday.

I don’t know what a complete redevelopment would cost, but the ideas I presented above would seem a lot cheaper even with a nice restaurant/retail/observation on top floor above giant 42-story neon advertising.

*correction – Probably better to have programmable LED advertising alterable on the fly rather than ancient, immutable neon lighting (lots cheaper anyway).

AT&T should buy it back and relocate poor performing Execs there for permanent office duty. Add in the CEO for the top suite.

Have you been to downtown St Louis?

Happy1: Are you asking me that question? Or Anthony?

I’ve been to downtown St. Louis a fair number of times, even though I’m far from the city itself.

I’m aware of the dire shape downtown STL is in, at least until you work your way out to Central West End area.

Downtown might work for brief day visits (the Arch and so forth), but not for a long term working arrangement, not more than small teams maybe.

Holy cow. At that price it’s significantly less than even land value. Buyers seem to be pricing in demolition costs..

Look, real estate, like so much, is a boom and bust area. The funny part is the levitation of residential real estate in so many areas over what the prevailing wages can sustain. Just like CRE. The real termis overfinancialization. Easy money led to huge expansions in value with thin equity. Now when it goes south, pffft goes the balloon with higher interest rates.

Look at residential real estate- these high rates mean unaffordable housing. Nothing more, nothing less.

Rents are now below replacement costs. So either rents rise, or house prices fall. Funny how some of the vulture funds that bought cheap houses have been gradually exiting. Nothing like banking profits.

CRE is worth the dirt after 30 years. Going to be a lot of crushed dreamz in real estate.

The post pandemic CRE mess will collide into post election humiliation next year, primarily because inflation will continue being sticky, set against the backdrop of tariffs and tax cuts amplifying the wealth effect. The likelihood of immigration enforcement will also pressure wages. Lots of catch-22s ahead that I feel will result in stagflation, but obviously stocks go far higher … as CRE melts. Good times ahead.

Inflation is colling down.

Biden unveiled new plans to forgive students loan.

Asset markets making new records daily.

Every is awesome.. Move on guys!

This CRE is a small fish. some investors kay lose money.. thats it.

CRE in SoCal is very soft. My company was retained by a bank to act as property manager for a 27,000 sq ft building that was foreclosed upon. The building appraised for $17.9m in 2022, and the bank had a $10.3M perm loan on the building to take out a construction loan. A recent appraisal puts the estimated replacement cost at $11.3m. Meanwhile, there wasn’t a single bidder on the court steps at the opening bid of $4.65M.

What property type is this property, office?