“The next big shoe to drop will be when appraisers call a declining market in early August.”

By Wolf Richter for WOLF STREET.

The Virus has thrown the housing market into turmoil. Housing moves slowly. It took the last housing bust four years to play out. But the underlying dynamics can change quickly. So here are some of the underlying dynamics from the four counties that form the North Bay of the San Francisco Bay Area: Marin (just north of the Golden Gate Bridge), Sonoma and Napa (Wine Country), and Solano (easternmost part of the North Bay).

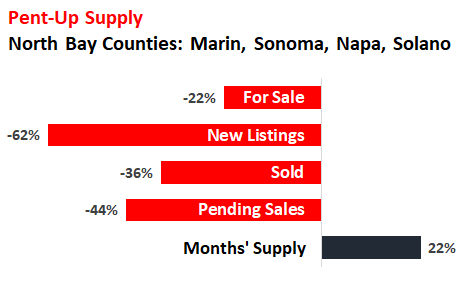

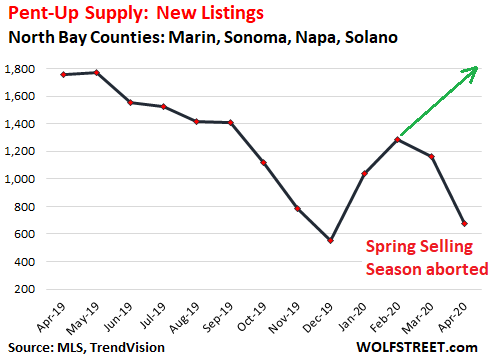

New listings plunged 62% in April from a year ago to just 675 houses and condos, after having already dropped in March. This is supposed to be the spring selling season, and new listings are supposed to surge, but sellers aren’t interested in having potentially infected people traipsing through their home; and they know that buyers are woefully absent, and it doesn’t make that much sense to list the home because previously listed homes are still languishing on the market.

The drop in new listings in March and April are early signs that pent-up supply is building up.

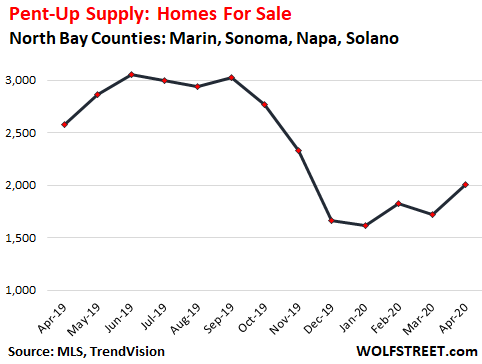

As many of the homes that have been listed in prior months haven’t sold, and despite the terribly weak new listings, inventory of homes for sale fell only 22% from a year ago (to 2,010 homes), and has been rising sequentially since January.

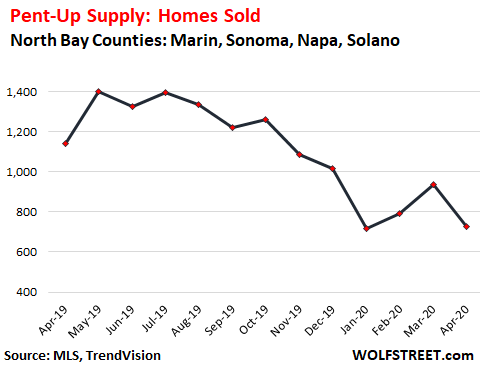

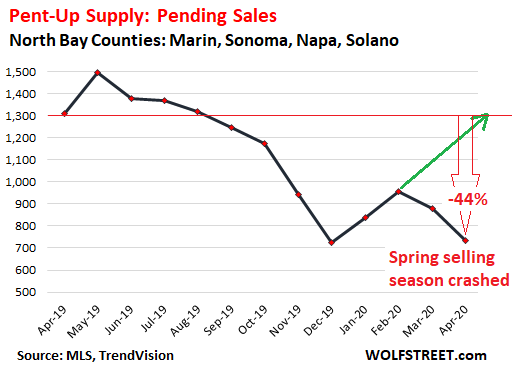

Sales are horrible: The number of closed sales, many of them from contracts signed before April, dropped 36% (to just 729 homes). And pending sales – contracts signed in April and an indication of what future closed sales might look like – plunged 44% (to 733 homes).

The drop in closed sales caused months’ supply, despite plunging new listings, to jump by 22% to 2.8 months.

The charts below show the progression for some of those metrics over the past 12 months, from April 2019 through April 2020.

This is the collapse in new listings depicting how the spring selling season crashed in March and April. The green arrow indicates where new listings went last year:

The inventory of homes for sale ticked up sequentially despite plunging new listings, as much of what was put on the market in prior months hasn’t sold yet:

Closed sales fell 22% from March to April, which is in the spring selling season when sales are supposed to roar higher. Last year at this time, sales jumped 21%. This produced the year-over-year plunge in April of 36%:

Pending sales show that the spring selling season crashed. Last year, from March to April, pending sales jumped 15%, which is in the normal range. This year from March to April, pending sales fell 17%, after having already dropped 8% in March from February. This created the year-over-year plunge in April of 44%:

Thomas Stone, a Realtor in Sonoma County, threw three issues into the mix going forward:

- Appraisals

- Already hard-to-get jumbo loans (which many homes in these counties require) made even harder to get by dropping appraisals

- The coming onslaught of new supply from vacation rentals that owners need to shed.

“The next big shoe to drop will be when appraisers call a declining market, probably in August but perhaps as early as July,” Stone said. “Due to the nature of their business, they have to wait for closed sales to show two or more months of price declines.”

“An Appraisal is a ‘reasonably supported opinion of value.’ Even though they see the train is out of control, they have to wait until it is off the tracks before calling it,” he said.

And this bleeds into the difficulties of getting a mortgage. “Think getting a loan is hard now?” he said. “‘We’re sorry, Mr. Stone, but the property didn’t appraise high enough, and we can’t make the loan,’”

The North Bay with its Wine Country has a large number of vacation rental houses. They’re dead now. And this isn’t likely to change a whole lot in the foreseeable future.

“This will bring both lower rents as the owners with strong hands rent long term, and an increase in inventory as the smarter ones with weak hands try to get out while the getting is good,” Stone said.

So there you have it: A most splendid housing bubble and an equally splendid vacation-rental boom that were both caught at the peak in their most vulnerable state by The Virus that upended everything. Stone sees a very rough market for years to come.

Mall tenants’ collapsing one after the other without replacement has a pernicious impact on property prices. Read... US Commercial Real Estate Prices Plunged in April, Mall Prices Collapsed

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Even San Diego has large number of vacation rentals enbaled by short term rental via AirBnB.

It’s gonna be interesting

How many over extended AirBnb landlords defaulting on their mortgages will it take to cause another mortgage crisis?

The next stimulus bill has a Fed lending facility for residential landlords. No, i’m not joking. Kicking the can down the road.

Trying to kick the can down the road. This is how each sector of the real estate bubbles slowly deflates.

Demand will not return for a long time. Supply declined but not as much and will return faster as desperate owners try to sell. The rE demand curve and the supply curve will touch at much lower price levels.

Cheer up. Later, when there is some recovery and the regular and just printed dollars are chasing the same or fewer goods or RE, we will see high inflation in all sectors.

You may eventually get to live in a multimillion dollar home then– your current one. :-) You will wear thousand dollar suits– from thrift stores. Economics has no mercy.

I hate to ruin your doomsday party, but you are using the most overpriced market in the entire US as an example. San Fran (and other coastal markets) was going to drop substantially, virus or not. As for the pent up supply of sellers, your green arrow projection of sales also shows there is a huge number of pent up buyers. Which will be larger remains to be seen. Lastly, appraisals lag the market because they use PAST sales, so if prices are dropping, as you say, appraisals will come in HIGHER than current sales prices, not lower. Real estate 101.

My educated theory (based on 30+ years in real estate) is that this government mandated recession will only amplify and speed up whatever market changes were already happening before. If prices in a particular market were dropping, they will drop faster and further. If they were rising (as in most US markets) they will continue to rise, only faster and further.

Found the Realtor!

Has to really be location specific. Stuff in the College Area south of SDSU is selling in days for some pretty high prices (during the lockdown). I’m not talking about the mini dorm stuff but the classy older homes just north of El Cajon Blvd in El Cerrito. When the folks wake up and figure out that the lockdowns are more politically motivated than health motivated things will get going again. I doubt it’ll be gangbusters like it was as some business just won’t be back, but it’ll get going again.

…and once they open up they’ll quickly realize they were mistaken and the shutdowns weren’t politically motivated and close back down.

I hope we’re both wrong.

I think Bob has the right of it.

This whole scenario is about control, not health.

Here’s the upside: We will know – very soon – who is right and who is wrong.

Some politics and some health. Question is really about how many deaths per million can be balanced against people’s jobs and mental health. It is not just “science” as some argue, but also very much not all political as others argue.

Sweden for instance is largely open, and has current death rate of about 6 per million per day. US is partly open with 4 per million per day. Rest of locked down Europe is a little lower, like 3 per million per day.

And current lock down cannot continue indefinitely. So it is a matter of individual and government choice. The odds are such that for young healthy people, a little more opening is probably what we will continue to see. If you are over 70, the odds are very different and caution is indicated.

My wife and I have been looking constantly at listings for the last several months. So far we’ve noticed no changes to the San Diego market with many homes still going for ask or 5% above ask. Inventory is worse now than it was at the start.

I just looked at what’s for sale in our area (El Cerrito, Talmadge, Rolando) and there’s only 11 houses for sale in all these areas combined. There’s at least 3,000 houses in the three neighborhoods. My leasing agent, also a realtor, told me that everything froze in March and April but it’s like someone flipped a switch and now it’s hotter than it was before. Maybe some sectors will be going great while others not so much. Only time will tell.

I’m keeping my powder dry until I can pick up some hard assets. I don’t want paper assets. I already have physical PM but I’d like to get some farm or ranch land. I want tangible things that actually produce something and I’m going to pay cash.

Produce as in grow food or as investment? Going cash and PM bespeaks fear of going from best toward worst case scenario, in which land itself increasingly becomes nothing more than a paper asset. Only as good as the authority in which the claim is vested. The further out, the more brutal that entity becomes, and you’re only as protected as you are useful to them. In the extreme, flatland is not something you can put up a defense of. Hills work. Further out, the better. No more beaches on nice days though.

I’m not sure I understand the rant about brutal entities and hill forts.

I’m not building a SHTF bugout hidey hole. I’m planning on picking up useful assets at bargain prices. I’d lease out the land for agriculture, cattle, maybe timber.

As the saying goes, they’re not making any more land. But they’re definitely cranking out the fiat money.

No debt. Cash for deflation PM for inflation. Either way I’m ready to pick up the pieces left over from all the people who went under because they didn’t understand leverage cuts both ways and the FOMO folks who buy companies with nosebleed valuations.

@MGorback — Just a word of warning:

Contrary to physical PM, land ownership is meticulously registered. Therefore, you as an owner are marked in the gov’s files as a possible target when gov’s money gets tight.

Here in France, I bought a large acreage when I came here in 2003 and leased it to a local farmer. The lease price is under gov’s control and has barely gone up over time. Contrary to property tax and tax on lease income, which each year take a larger bite out of revenue. Plus, it’s as good as impossible to throw the lessee off, even when he refuses to pay or mistreats the property.

Granted, this is France and not the USA, but I fear your gov is going to be just as adept as mine at milking you when things get tough.

Holding stuff that keeps its value while nobody knows you have it still seems like the best strategy to me.

After all, boating accidents happen :-)

Jos Oskam:

> Here in France, I bought a large

> acreage when I came here in 2003 and

> leased it to a local farmer.

>

> The lease price is under gov’s control

> and has barely gone up over time.

>

> Contrary to property tax and tax on

> lease income, which each year take a

> larger bite out of revenue.

>

> Plus, it’s as good as impossible to

> throw the lessee off, even when he

> refuses to pay or mistreats the property.

Same here, in urban Seattle;

society carelessly mistreats us.

We’ve gangs of squatters breaking windows,

light fixtures, doors, and the washing

machine/dryer ( for the coins ).

There’s a lot of them, high on drugs;

they steal bikes, mail and packages.

The police refuse to do anything about it;

the jails are mostly empty.

We’re not allowed to evict;

so the bad tenants have chased out

the better ones.

I’ve 5 unrented rooms right now,

out of 32.

Most are not paying rent because

they know they don’t have to;

the landlord is slow to fix things.

The University of Washington is

shut down indefinitely;

buildings and stores are closed.

The (former) fraternities to my North

and South are both empty.

The 109 unit apartment complex,

across the alley, is unusually quiet.

When I first moved here, early 2006,

it was concert-level loud; now you can

hear the trees rustling in the wind.

Labor force participation is down;

it’s a long-term trend.

Fear is growing like a cancer; people

are fleeing risky stocks in favor of

U.S. treasury bonds, pinning the yield curve.

“Either way I’m ready to pick up the pieces left over from all the people who went under because they didn’t understand leverage cuts both ways and the FOMO folks who buy companies with nosebleed valuations.”

Not everybody who owns land and is in trouble is a failed speculator. There are folks who actually wanted to farm…not just build up assets or flip. I know, this concept of permanence and stewardship is hard to grasp these days.

Jeff, good point. For the things you noted, that is why my last 2 homes have been single family with a layout allowing for good privacy for additional occupant. Because not only are the laws often different for “roommates” the reality of a would be bad actor having to act badly against an owner he might have to deal face to face everyday remedies a whole lot of bad possibilities.

Bought at the right time and place, one can’t lose with land, imho. If you lived below your means, you will have some cash for opportunities as this unfolds. Having opportunities doesn’t mean screwing folks or taking advantage of others, either.

I bought 16 acres of mixed farm and woodlot about 10 years ago. Many locals thought it was a stupid buy, until they found out it was zoned residential which is a big deal in BC with the frozen agricultural land reserve. It is worth 2-3X what farm land is valued. The guy I bought it from forgot to pay income taxes for about 5 years, and actually came to me and asked if I wanted to buy him out?

I put in a pond, some gardens and an orchard and built a small cottage which a friend rents. His rent pays all taxes and insurance for this property, including for our separate home site and house. Meanwhile, the value of the property has doubled in the last 5 years. I rent the place for about 60% of the going rate. Win win win. We have wood for milling and firewood for the rest of our lives, and our own walking trails. It even provides food security with a little extra work and tilling with the BCS tractor. If stores closed tomorrow we wouldn’t starve for sure.

As for the fear of Govt oversight, I negotiated the new tax assessment by email after I finally disclosed the property had a rental in place. (Chickened out). It was one of the easiest regulation encounters I have ever had. We corresponded for awhile and I sent some pics and construction details of the cottage. I had raised the rent a wee bit a year prior to cover the anticipated increase in taxes that are due this July 1.

The price for the 16 acres? It was the equiv of two city lots in the town I had moved from several years previously. In other words, for the price of 1/4 acre of town residential with all the rules and regulations, curbs, sidewalks, oversight, and easements you could imagine, we bought 16 acres that not only pays for itself, it increases in value, and will hold its own with flee buyers looking to leave built up areas. Plus, all us locals like that we have left it undeveloped and our friend very much enjoys living there. The naysayers now say, “That was a pretty good deal”.

We are looking at another place right next door to us and have simply asked for first refusal when it finally comes on the market. If the price is okay we’ll buy it to control who lives there and protect our lifestyle. The home will be easy to rent to a stable tenant as it is on the river and has gardens, a greenhouse, etc. If we don’t do this, being rural means we could get dirt bikes and pitbulls next door. We have enough of them around. A guy down the road was taken away by RCMP last weekend, handcuffed in the back of a cruiser. He had od(eeed) on what he says were magic mushrooms, but I’m thinking meth. Broke, but always smoking with beer in the hand. It’s everywhere.

We don’t have a lot of money, but what we do have we saved or built equity by sweat construction. (carpenter). My retired friend (and his wife), who are losing their ass with their ‘investments’, just spent a month in the Canaries, go to Mexico every year, the States….you get the picture. Now, he is bitter and not only cannot retire he won’t find work this summer flying season. He is bitter because his fairy tale retirement didn’t come true after a lifetime of indulgence.

What Portia said .. in Spades!

When people are stewing in privation, throuh no fault of their own, and on the edge of starvation, things WILL change .. and new priorities be brought forth !

The Cloud People at the top of the foodchain have no idea what they have wrought !

Invest in pharmaceuticals that keep folks happy. We need more happy pills. All this Road Warrior talk is getting too scary.

Paulo, Atlas shrugged..

(((Polecat)))

Your fervor does me good. Let’s watch out that Sampson (the cloud people) doesn’t pull the Temple down on us too.

MG-Not a rant. Just summing up big issues in short. Never mentioned digging holes, filling sandbags, nor building armories. Two points…in land, always defending…think authority with power to tax and condemn under pressure of mass populations always growing, always in need, unable to pay for better. Point 2…think settlement…best bottom land goes first, is depleted, needs inputs and already priced up”…..mass production, low quality selling into markets with tight pricing. Now think water sources, timber, good grasses…high quality meats for the ones who still have the funds. Hills and canyons wasted on houses up til this event…if that stops, free of encroachment…the idea of ripping out potential farmland for housing may reverse as pressure for better domestic food meets population explosion. All that CRE space could convert over to mass housing development space in no time and not all these people can buy hillside homes. Good luck finding a paper sucker…most of these lowland farm & ranch types with RE know how to hold it from generations of experience. I expect your loser might be uphill on his little vacation Ponderosa with his own X-mas trees aplenty. Just a view from up high.

My family is getting ready to sell 450 acres of timber property in SC.

Thanks for that Wolf. It’d be interesting to see the report for areas the other side of the bridge as well. I wonder if people in south and east bay will move out to those more remote areas since everyone can WFH now, thereby improving the housing situation in those areas.

This situation is kind of like someone has to be the first to throw the stone.

Everyone is wondering if the stone is on target or will it miss?

Everyone is now waiting for the stone to reach the front window.

Everyone is hoping the stone doesn’t hit and break the window.

Everyone is hoping their deeply held illusion is true that housing prices only go up.

Their belief will remain true, up until the stone hits and shatters the glass.

Nobody wants to be the first to throw that stone.

Or first penguin off the ice shelf. No one wants to prove one way or the other that the dark shapes beneath the surface of the water are seals, sharks, whatever, and set off a bloodbath.

August is shaping up to be a rather nasty conjunction of forces and events.

C

I’m curious to know what will happen to the high number of multi-story developments of condos and apartments in the Twin Cities. These are recently built or under construction, and they are everywhere it seems. Will the COVID-19 situation reduce demand for this type of residential living?

My neighbors sold their home for $280k that had been in their family for half a century on a 51 foot wide by 126 foot deep lot in a good Minneapolis location. But they paid $210k for a larger home with a few acres of land just outside of Cannon Falls, MN (35 minutes south).

For the last few years the momentum has swung towards city living in multi-unit developments, but I’d bet that it will swing away to outer-ring suburbia for a number of reasons; working at home & wanting to live apart from other people.

Personally, I love my set-up, but I could have more home and more garden space if I followed my neighbors out of town, and I’d probably have a few extra bucks in the bank.

The home across the street is still not yet listed, but as I commented recently, it will be interesting to watch what happens to it in comparison to the sale next door in mid March.

The sold sign was just added to the ‘For Sale’ across the street. That took four days. Asking price was $295k.

I really enjoyed the cookie cutter automated videos from Century 21 on the various Sonoma and Lake county locales. I noted a general trend that inventory is way down, and ‘days on market’ has skyrocketed. They try to put a good spin on it, but basically it means buyers vanished in Q1 and brokers are pulling the reigns back on sellers.

Wolf, do you have any stats for East Bay? I agree for sure credit is tighter. I got the prequal I need but the process has been much slower and they are not throwing obscene amounts at me like they I used to.

Inventory is still tight in East Bay. I am hoping we start to see all that new inventory soon. Actually my agent is supposed to show me a bunch of offline inventory that she knows about. Those sellers are still receptive to certain buyers…just don’t want to deal with the market at large. Nobody will even consider showing a home right now if you don’t serve up a prequal letter.

We’ve been trying to buy in the Peninsula but it’s been way too expensive. My real estate agent keeps saying that prices will only go up. He even said this a week ago. Not sure what to do poor how long to wait (writing is an option for us so we’d like to hold out for a better price, lower taxes in the longer term). I’d love to hear more about what might transpire in San Mateo and Santa Clara counties.

Your realtor is channeling Irving Fisher. Did they tell you real estate prices have reached a “permanently high plateau”?

If you’re not under any pressure to buy you have lots of time to wait for a good price.

As the commenter said, that’s the job of the realtor, to build the perception of scarcity and demand in order to justify the prices on offer. He’s also going to have an excuse for you if prices do dip because of covid. I’m in the area too and I’m not rushing. I haven’t waited all these years only to get in now before the dust has settled after this once-in-a-century event. Real estate moves slowly, much more so than stocks.

During the GFC, the RE market took four years to bottom out. Even though I don’t expect a huge drop in the Bay area, how is it going to be this time? I don’t know but we are just getting started here.

Real estate does not take a long time to bottom out. We lost our home in Florida during the 2008 bust. Once people start to lose their jobs the market will drop in 1-2 months, that was our experience in south FL. It happened so fast there was no time to get out.

With the financial state of the average homeowner being just as bad, or worse, than the GFC 1.0 time period, I expect them to be just as shocked as we were. The only difference this time is the vultures are more prepared than the last go around. This time they may pickup what they didn’t get last time. FascismIsHere.

It really depends on the market itself.

For example Spain as a whole saw volumes go down in 2007 already and completely evaporate in 2009 but prices remained sticky until 2010 before collapsing and bottomed out around 2014.

Volume-wise the Spanish real estate market has never recovered but foreign buyers started reappearing in strength in the primest locations in late 2012 already and local markets such as Alicante and Barcelona became white hot, driven by the tourist-oriented rental market.

What will happen this time around?

I haven’t got a crystal ball but I strongly suspect countries that had a hard lockdown have become about as appetizing as a cheese sandwich left outside of the fridge for a week in August, at least to those foreign buyers who helped kickstart the recovery of Spain’s real estate sector.

I know for certain at least one (well off) Swiss family who has already put up their Spanish villa for sale: they have no money worries, they just want to get rid of the place as quickly as possible because of the lockdown. I predict many others will join them soon.

One thing is for certain: we’ll never know if these hard lockdowns were any useful but their consequences will stay with us far longer than we would like.

I am not sure where you get your information but it is wrong. Way wrong. It usually takes at least 2 year and usually longer for prices to bottom in a economic recession. I have been buying and selling real estate for 30 years and follow the cycles very closely.

Petunia,

When the clerk in the 7-11 told us how he had flipped a condo in mid summer 2006, buying in the am, and selling in the pm for a nice profit, anybody from FL knew, for sure, the bubble was close to bursting, which it did very soon after that, at least in SWFL…

Lots and loots of warnings in 06 and afterward for anyone paying attention, etc…

OTOH, we bought very nice property in AL for 1/3 of price in FL,,, less than 1/6 of price in CA,,, and, guess what? It went to ”heck” a couple of years later just like everywhere else in USA.

Bottom line, as TS has mentioned, RE is all about ”local” ,, location,, local knowledge,, and, most importantly, paying attention to what is going on locally here and now, now, now.

We have ”doubled and more” in several areas over the last 40 years, after we gave up SM, and could see by long term comparison PMs don’t really provide much advance in spite of being totally safe AND very liquid, unlike RE.

Absolutely NO ”hard and fast” rules for RE, any more than there are for SM and all the other casino venues these days.

Jdog,

My experience in south FL wasn’t the first time I had watched real estate drop drastically almost overnight. In 1987, when the market crashed, I lived on Staten Island, NY. It was a bedroom community for Wall St. workers. Before the crash, houses were going for ridiculous prices and selling fast. After the crash, the next week, the prices fell and didn’t come back for a few years.

At the time, I was looking to trade up and offered $225K on a two family, which was asking $280K, but only worth $225 at most. The guy turned down my offer. Two years later, I was riding the bus with a friend of his, who told me the guy was sorry he hadn’t taken my offer.

Too true – I sold my house in Sonoma at the peak of the market for $670K just before the GFC. The buyer eventually sold it on for $360K a year later. Sometimes prices really do drop

Watch out below!

In a nitpicky technical sense it probably did take 4 years to literally hit bottom with prices grinding lower until 2012. But at least where I have paid attention (major NC metro areas), 60-80% of the decline ocurred just as you said. Once the job losses started there was a steep decline across a 6 month period or so as the tide of human misery came in hard and fast.

My experience in Denver in 2009 was that the bottom was spring 2012. It’s a little different every time when there is a down market. Realtors are always hilarious optimists.

In America, the realtor fees are paid by the seller.

No matter how friendly and nice the realtors are to you (the buyer), they work for the seller by a signed contract.

In addition, thet are nearly always paid by commission as a percentage of the sale price of the home. The bigger the sale, the more they make.

So with this in mind, take everything they say with a huge grain of salt.

True enough but should add: The seller pays the fees but the fees are priced in. Ultimately, the buyer always pays, imho. I have sold privately before but always paid for a proper appraisal to set the price. The appraisal reflects the market, which includes selling fees. I gave the buyer a bit of a price break but he didn’t get the entire waived fee. It was a sweetener.

In BC it is now illegal for RE agents to represent both buyer and seller. The buyer has his/her agent and the seller has a listing agent. They cannot do both. The prices haven’t changed, though. Who knows what arrangements are ‘under the table’?

Paulo, I have had a similar experience with selling real estate. I have found it always helps to leave something on the table by leaving something for the buyer.

In my neck of the woods in the Boston area, recently sold show smart price closings but that is what has happened months ago. New listings – yes they are happening that surprised me – IMO don’t look like anyone thinks price should be affected – yet, but I’m going off only several very recent. The Zillow says my house increased in value $5k last 30 days. (The Internets are smart). Looks like realtors and their clients are self projecting V recovery. But this is just my very local scan. Maybe Da Powell can roll out a 0% 100 year mortgage that doesn’t have be paid. Guess that might put my neighbors a step closer to an equal footing with Mr Chairman’s fabulously rich friends.

I am seeing similar in Boston. No downward price pressure yet, but I am seeing more and more recent closings starting to be around or below ask, as opposed to nearly every one going above ask since the turn of the year. So little inventory, I expect a slowdown come fall when more inventory comes back online.

Redfin has a neat “Data Center” with weekly data from COVID. It shows YoY list prices are down markedly from Feb/March, but still not negative. Interestingly, it seems the further out suburbs are seeing the most rapid appreciation, which YoY price gains closer to the city have slowed to a crawl.

Dependent on a transient population of students from affluent families, often from other regions and countries, living and studying in close quarters, Boston would seem to have some very real vulnerabilities if the virus remains untreatable.

The Cal State system just announced that the fall semester will be conducted entirely online; that will be the norm (except for outliers such as Liberty University), and many colleges will not survive. Northeastern is already mentioned as a university in trouble, and any school without a large endowment is threatened.

Boston is the ultimate college town, and college towns have been among the few places (media, finance and tech hubs excepted) not hollowed out by forty years of neoliberal economics. That’s about to change drastically.

Northeastern has a perfectly fine endowment at nearly $1.1 billion, and is financially stronger than most colleges across the country. Cal State has 23 campuses, which makes testing and tracing infrastructure infeasible or insurmountable. Strongly disagree that this will be the “norm” for single-campus public and private institutions.

Plenty of schools will open up just fine in the fall, especially with the data showing this virus is as deadly, or less, than the flu for anyone under 45. Early reports from most well-ranked schools are showing deposits are on target and students plan to attend in the fall, remote, hybrid, or otherwise.

As much as I would be content to see this doom and gloom prediction to come true so I could buy a larger property, I don’t see it.

sc7,

The idea that anyone can predict whether colleges will be open to in person classes this fall based on the data we have right now is a complete fallacy. I would suggest that it is very possible that online college in the fall will be the rule and not the exception, as in person classes require very large crowds and mixing of people from all over the country, the students are not particularly vulnerable to fatal disease, but faculty certainly are. I think in person college is a good deal less likely than in person elementary and high school for those reasons. WSJ agrees, and has recently run an article about the possibility of as many as 1 in 5 small liberal arts colleges being bankrupted if in-person school does not happen this year.

A great many people will not pay $50,000 tuition for a small liberal arts college if a year of that education occurs with the student in your parents basement instead of a bucolic leafy campus on the East coast. You can bet many of those kids will be doing online college locally locally for a year instead. This may not affect the ivy league but the next tier down and small liberal arts colleges are at great risk.

What will the chart look like when

Pent up Supply crosses

Debt out the Wazoo?

Thanks for another technical term to add to the Lexicon!

(Might be time for a new series of Beer Mugs.)

Hello, the interest rate of US 10-year Treasury bonds peaked the 15th of October 2018 at 3.2%. It is actually at 0.68%. Now 3.2% of 100 equals 0.68% of 470. Does this mean that 10-year T-bonds emitted then are now being sold at 4.7 times the price they will be redeemed at?

No. The math works differently.

This sounds like a good job interview question to make sure you’re not hiring someone incompetent.

The interest rate is indeed 4.7 times higher. $100 invested at 3.2% compounded annually is worth 1.032 * 1.032 * … * 1.032 * 100 = (1.032)^10 = $137.02 at the end of 10 years.

The question is how much do you need to start with to get $137 with a 0.68% interest rate. That would be 1.0068 * 1.0068 * … * 1.0068 * X = 137. In other words, (1.0068)^10 * X = 137, or X = 128.02

10 year bonds are therefore sold at 1.28 times the price.

Great, thanks.

With fed printing press is kept on, how do you know such potential supply will crash the market? Nevertheless the new construction is weak since 2009 due to zoning, material and industry consolidation.

Housing the hard demand and its inflation has been strong even overall inflation is weak.

Plus

Foreigner buyers have just about disappeared.

Next “uber wework” pre pre IPO unicorns millionaires not being minted at such a furious pace.

“So there you have it: A most splendid housing bubble and an equally splendid vacation-rental boom that were both caught at the peak in their most vulnerable state by The Virus that upended everything. Stone sees a very rough market for years to come.”

The Case-Shiller 20-City Composite Home Price Index showed US home prices have been rising through February 2020. Housing prices have been rising faster than CPI and PPI inflation since 2011.

Real estate agents have been using virtual house tours to avoid hosting open houses.

San Francisco, Seattle, Miami and Manhattan were described as housing bubbles during recent years. San Francisco is on the fault line.

One statistician estimated annual homeowners insurance is about $2300. Insurance rates are higher in Florida beach communities exposed to the threat of major hurricanes.

Super, let over indebted AirBnBoomer rentals go tits up. They have been ruining housing markets in every nice town in the World for over a decade while skirting regulations and safety requirements that commercial lodging must follow.

There are some nice home rentals out there but I’d never vacation in some geezer’s backyard or basement. The AirBnB homeowners that justified an insanely high purchase price of their primary residence based on turning part of it into an unregulated short term rental will be in trouble for sure but the AirBnB superusers are likely to get crushed if tourism doesn’t snap back. They bought the hype and may end up with a bag of hype in the end.

I do not see tourism snapping back. Happy about this. Tourism homogenizes and sanitizes nice or unique places, ruining them.

“Super, let over indebted AirBnBoomer rentals go tits up.”

From the data I’ve seen only about 25% of hosts are 60+.

It’s funny how “boomer” has taken on a new definition. Now it just means someone older than millenial.

It’s a new “insult”…. “OK, Boomer”.

Somehow, there’s a certain ilk that believes that life is a zero sum game and, because some random “Boomer” has something, that fact means that the entitled, more deserving one, has been deprived of their destiny.

Haters gonna hate.

I don’t remember having that attitude towards my parents… I was on the other end of the spectrum where I (as one of the hated “Boomers”) did what I could to make my parents’ life better as I recognized what they did for me (and it wasn’t bequeathing me $millions).

Local Real Estate Markets and home prices are dependent on local economies.

If your market is heavily dependent on foreign buyers or tourism the hits will come more quickly and harder.

If your area has a more resilient economy prices will hold up better.

It is that simple, look at the economic base of the area where you wish to buy and you will get a pretty good idea of how it will react to the new reality.

@Tom Stone

With alcohol sales way up, I wonder if even though home prices in the North Bay may drop, will the vineyard land values go up?

@Michael Gorback

In the past the non winery regions in California that had the right weather and soil, land owners would lease there land for vineyards.

Ridgetop, vineyard land is interesting to value, it takes @25 acres to have an economically viable vineyard in Sonoma County, defined as one that will on average over five years provide a profit.

Smaller vineyards are classified as “Small Farms” and they only make sense economically due to our tax laws, consult with a qualified CPA for details.

In an economic downturn you will see hedonic adjustments, fewer $25 to $50 dollar bottles of wine sold and a lot more sold in the sub $25 price tiers.

Lower wine prices= lower grape prices=lower values for vineyard land.

With a small vineyard you are buying a lifestyle and a great way to shelter a high income, no more and no less.

Amen to that. We know a family that wrote off their entire life with a small vineyard. Cruise to Europe? A chance to pour their wine for potential buyers. Stays in hotels? Cold call the Maitre ‘d or the chef.

Vineyard vehicles, buildings were owned by separate LLCs and leased to each other. Great lifestyle, not one cent of taxable profits. It’s all legal.

Yep ! Our community is gonna take it in the kiester, good and hard !

Even with newly developed virus-induced protocols, things likely will not bounce back. Plus, our small city has 2 downtown building project developements in the very early stages of construction – predicated mostly on, you guessed it .. TOURISM!

We’re screwed!

I have two unoccupied houses for sale in Las Vegas. If a large chunk of the economy shuts down, residential housing becomes a larger percentage of the overall economy. It seems kind of foolish to be selling at this time, but my homes are too beautiful and I don’t want to fix and clean them up again when the next tenants move out. There is a program called Home Is Possible. If you have a credit score of 640 or better, you can make no downpayment and you can ask the seller to pay closing costs. Monthly payment ends up being less than the monthly rent, so why do people still rent? Those who filed for bankruptcy after the last housing crash have already fixed their credit and bought houses again. Our system is very forgiving to those who default on their debts, so risk is minimal.

“Catch the knife I’m dropping” is what I just read.

The reason I’m so optimistic about risk assets is that everybody seems to think they are the only ones who aren’t expecting a V-shaped recovery. They think their call for an L-shaped or U-shaped recovery is oh-so-contrarian. I’ve seen this too many times before. The opposite always happens. How many people do you know who are like Ciovacco and are open to the possibility of asset prices going higher? I can’t think of anyone else, so if you know someone, I’m very interested because I like to see the different viewpoints.

The problem is that most people don’t have a lot of exposure to risk assets… most people are on the liability side of the equation… So you have a relatively few people globally all on the same side of the asset boat with only central banks machinations to sell to, owning assets that will be non performant for some time (and some depreciate to 0 faster than others).

It doesn’t matter what most people say when most people aren’t exposed to all the downside in risk assets… (most are exposed to the downsides in lack of access to credit and jobs).

I see prices coming down for 170m2 top apt’s in Jakarta (where I live mostly in SEA) by about 50% for rentals, and I’m sitting on my hands for the next few months waiting for these folks to get washed out before I lock in a long term structured lease at firesale prices in the local deprecated currency, preferably after these asset heavy folks file for chapter 11.

My friend in LV is managing 6 homes in AirBnB and is a superhost.

He is hurting big time as LV is all dependnt on tourism.

I always marvel at how everyone seems to be getting rich in real estate. The sheer number of workshops, seminars, facebook groups, and even UFC fighters who talk about “making money” in real estate is astonishing. Many have forgotten that Justin Gaethje, who won last Saturday’s main event said he eventually wanted to make money in real estate after his win over Dustin Poirier. In the post-fight interview, Henry Cejudo, who won the co-main event, said he wants to retire and get into real estate. Inside the octagon, he literally told the world “I am the greatest combat athlete of all time”.

That is HILARIOUS !

Paul Volcker supposedly said — tho I can’t prove this (someone help me!) — that one of his motives for raising interest rates was because he heard people were speculating in houses — and he disapproved, obviously.

Sure enough, you can see an uptick in ‘real’ house prices from 75 – 80.

https://www.advisorperspectives.com/images/content_image/data/a6/a60db3ec2161d260bc3bc8466db21857.png

Of course the thinking of Volcker’s successors could hardly be more different from Tall Paul’s.

Inflation as measured by CPI rose from 5% to nearly 15% during that time. That’s a lot of inflation. And it was threatening to spiral out of control. And policy makers figured that it was time to stop it or else. So there was some political will to do what it took.

There have been a number of routs in my lifetime .It is caused

by too many sellers and not enough buyers. This time though

the gov’t is printing like mad thereby reducing the value of

our fiat currency.If anything holds up the value of real estate

it will be fear of high inflation.

This gets more like the 70’s. Markets tanked but RE was boffo. Different age and wage demographic. New housing lead the way, lots of homes built in the 70s, most of them crap. Also huge for commercial, the industrial park was born. Four cement walls poured on site.

It is normal for people to exhibit hope in the early stages of a economic correction. It is called normalcy bias.

I too have been through a number of routs, and I have made money from each one.

I have never seen one like this though. This one is the granddaddy of economic corrections, it is a perfect storm.

A normal correction is a result of over inflated asset values combined with unsustainable consumer debt. In 2008 you had unsustainable debt concentrated mostly in real estate.

Today you have unsustainable debt in many areas, combined with a staggering amount of small business bankruptcy, combined with a massive amount of lost income by almost every business, corporation, and individual world wide. There is money destruction happening on a scale the world has never seen. It dwarfs anything being attempted by governments to mitigate it.

This has set in motion a feedback loop of events that now will continue to feed upon itself for years.

Jdog –

Now that was a very coherent summary. Thank you.

On a side note, hospitals continue to lay off healthcare professionals on a daily basis in Washington state while hospital utililization is dropping on a daily basis.

Healthcare professionals across the board are asking (or should I say begging) our governor to begin loosening restrictions now in a meaning was because somebody’s gotta pay the rent.

Risk-averse politicians are in full control. Housing is going to get crushed…thankfully, I sold both of my rentals 3 years ago. In cash now.

Where is the money destruction? There may be credit destruction, job destruction and lots of purchasing power, but I don’t understand this money destruction meme. The FED is digitizing like crazy.

loss of purchasing power

yep, good view of what is about to transpire…..

anyone buying real estate at this time is walking into a perfect storm…

Prop 13 is gone, taxes are going up to pay for all this. Most folks will not recover, this depression will humble all the debt lovers…

2021 is going to be ugly

The most “fashionable” investment in the last 10 years has been the “passive income” trend where people buy property to lease out to tenants or to list on Airbnb.

In a macroeconomic sense these activities add little economic value as they don’t produce a good or service, they just rent out an existing asset.

Since this investment is made with leverage and these people are last in line for any kind of economic-stimulus from the government (since renting things doesn’t stimulate the economy). I’m very interested if this all ends badly for them.

Why did it become so popular, and not just in the US?

Because everything else is failing.

Even primitive tribespeople seek profit where ever they can get it, usually slaves and cattle.

Perfectly rational behaviour.

You know, the Lairds of old .. back in the middle ages, at least made a pretense (when they were’nt battling each other, for crown and glory) of caring for their herds, be they serf or beast. That can’t be said of our contemporary ones!

They think all of us mokes as godins, to be eradicated!

A: I’m in that demographic. Of the six rentals that I have, I bought empty lots and paid/mortgaged for the money to build the homes. Does that change your theory on “these activities add little economic value”?

I always felt good that what I’m invested in is quite tangible.

And I’m even more interested in “if this all ends badly for them”…

Yes, home building creates a good.

Some appraisers, who I actually respect, have been saying that pent-up demand can lead to more sales. While I realize that on the surface it makes sense, less supply could lead to more demand, I didn’t understand how it can be possible in this uncertain environment with so many people out of work to have good demand. Kudos to Tom Stone for saying it as it is and for you for explaining it well.

When a mans income depends on a certain outcome, it is normal he is going to be prejudiced toward a certain point of view.

The fact is that houses are not worth their current prices, not even close.

A dirt lot, with a 2×4 frame and some drywall and siding is not worth half a lifetimes earnings.

The only thing that supports housing prices is the belief that someone will buy the house from you for even more money in the future.

So long as people are secure in their belief of the greater fool coming along they are secure in their decision to go deeply in debt to buy.

But what happens when that faith gets shaken? What happens when unemployment spikes to 25% and then does not quickly recover?

Are people still eager to take on staggering mortgage payments?

Or do they get cold feet, and decide to wait and see what happens?

What has driven home prices in large part has been FED/Bankster/Government policies that have encouraged the debt you refer to.

Sillycon Valley….. left 15 years ago…the last house we had has turned over 3 times since and has only increased in “value” 25%…I’m thinking the last buyer might be there for awhile…we don’t really miss anything bout the place except the winter weather ?

Fred :

Credit Cards debt is down 9% from from $860B on Mar 4

down to $780B on May 1st, or minus $80B.

Makes sense.

Most stores and restaurants are closed. No one is traveling.

Banks are building reserves for the lost causes. I wonder if that’s what is bringing down aggregate credit card debt.

Fed policy here is to keep everyone in their million dollar home if only to protect the collateral value, relative to GDP. One way to keep prices high is to freeze supply.

Maybe people in SF are finally figuring out that paying $2M for a house surrounded by homeless people maybe isn’t the way to go. SF, NYC and Seattle will all get beaten up real estate wise. Secondary cities like Bend, Boise, Santa Fe, Bozeman, etc will do well. I predict we will see a massive population shift from mega cities towards smaller cities and small towns. Where would you rather be if you’re afraid of the ‘Rona? In an apartment in SF surrounded by hundreds of people 24/7? Or on 2 acres somewhere in New Mexico or Montana?

Mentioned this in a few threads ago but worth mentioning again in a real estate thread….

House in my nabe, one street away, went pending in 10 days. Suburban single family homes in quiet, safe neighborhoods with top rated schools will always be in demand. This was (and is) the only house for sale on that street or my street. Zillow shows my home is up $25K since the ‘Rona started. When I saw that I kind of rolled my eyes. But seeing how fast that house sold and given there is no other supply, makes me think it’s not that far off.

Boise and Bend will get crushed too

Yeah, I am quite sanguine with respect to housing prices. Over the last 2 months, we’ve seen a bunch of stuff that’s been truly shocking from oil trading negative, unemployment level that’s truly off the chart, etc, etc. But the fallout seems to have been “pretty limited”. Like Wolf, I was expecting a bunch of hedge funds blowing up after the oil fiasco, but none so far.

Overall, the world’s economy seems to be pretty stable.

“I thought the wings falling off this plane would be bad, but we’re still pretty high up so that’s a relief!”

Wolf, any chance you could add a look at the condo rental market? In Portland, OR we seem to have a enormous boom in these buildings but I can’t imagine anyone is renting them now. Seemed like a bubblle even before covid. All I hear are stats on homebuilding which seems misleading when the supply is increasing through these plentiful new towers

Anecdotally. …. I know a handful of people trying to buy in the East Bay.

I have a hunch the commutable communities (Lafayette, WC) in the East Bay that offer yards with their homes might see an uptick from still well employed people fleeing the denser environs of SF/OAK.

All the brand new ~5 story condo buildings? Good luck to them. They will go the same way of the big office buildings of WC which required being sold 3x before profitability.

Wolf,

accelaration, concentration, and irrational exuberance are back. Just like the set up before the first leg down.

Irrational exuberance very notable in the usual suspects, plus the new crop of Tesla-like stocks (multi-billion caps with 15-50 price/sales, e.g. Shop, Twlo, Veev, Now, etc) all hitting new all-time-highs on the daily basis. They must go up, or else.

The second leg down can’t be far out.

andy,

I still want to see the Fed back off further in terms of total dollars. It’s going to shift some of its actions, but I want to see the total to go down further. This market cannot stand on its own two feet. Heck, it doesn’t have any feet.

But isn’t it all about the incomes that support house purchase prices? If the lower quartiles of the economy are getting hit, then won’t the top end of the income scale still continue to earn? And won’t that sustain prices in places like the SF/Bay area?

1) The DAX cannot get it up.

2) AMZN cannot close the gap.

3) MSFT under the RSI line.

4) Red AAPL for sale, because its overripe in lower high.

5) Dr. Faust sent the QQQ to hell today at noon time.

6) Behavior Econ never ending water drop “nudging” tortured the white house for 3.5 years.

7) IF NDX close on Fri below 8832 the trend is down.

8) Buy & hold Forrest Gump, because life is like a box of chocolate.

9) Coffee & chocolate send people to the dentist and the cardio.

10) Chemical & disinfection kill the virus, keep us safe, but cause cancer.

I’m beginning to understand your spells.

‘Fraid I can’t go with 9).

Just stay away from SBUX and MARS

Wolf,

I’m waiting for your next write up on the SF luxury condo situation. Things were bad last year, it will be even more difficult this year. I wonder if they’ll start putting COVID-19 guards as features to these condos.

Right back on Marketwatch again, Wolf.

Uh oh, the last time your comment made it onto Marketwatch, if took two months for reality to catch up… let’s see two months from now… that would be.

GASP… July

This is good news for me. I was looking to buy some property in the prestigious Tenderloin District. I work in SF a few times a year so I’m very familiar with that hidden gem!!!! Great scenery, fresh clean air, fresh clean sidewalks!!!

?