And since stocks follow junk bonds….

Junk bonds started to decline in June 2014, and earlier this year threatened to implode. Contagion was spreading from the collapsing energy sector to the brick-and-mortar retail sector, telecom (Sprint), the media (iHeartMedia), and other sectors. It was really ugly out there.

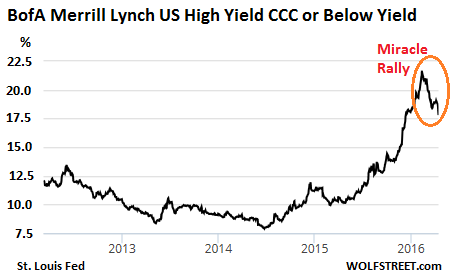

As junk bond prices got beaten down, yields soared. The average yield of bonds rated BB, the top end of the junk-bond scale, according to the BofA Merrill Lynch index, went from 4.2% to 7.07% between June 2014 and February 11, 2016. For CCC-and-lower-rated junk bonds – the bottom end of the scale, deemed to be within uncomfortable proximity to default – the yield of the BofA Merrill Lynch index shot up from around 8% to 21.5% between June 2014 and February 12, 2016.

But then the Fed heard the screaming from Wall Street about the chaos in the markets, with junk bonds losing their grip and large swaths of stocks careening deeper into a bear market. Incapable of any independence whatsoever, it brushed rate hikes off the table and changed its verbiage. What ensued was a marvelous rally all around, particularly in bonds.

In two months, the beaten-down junk-bond ETF (HYG) soared 9.1%, though it remains 14% below its recent peaks in April 2013 and June 2014. The yield of the BofA Merrill Lynch index for BB-rated bonds dropped 171 basis points to 5.36%. And at the low end of the scale, all heck broke loose. As these beaten-down bond prices jumped, the yield of the BofA Merril Lynch index for CCC-and-lower-rated bonds dropped 369 basis points to 17.8%. A huge two-month rally (circled in red):

Default or bankruptcy, no problem. It’s been that kind of rally.

So far this year, there have been 37 corporate defaults by S&P-rated issuers in the US, the highest year-to-date since 2009 when there were 53. This wave of defaults is expected to become a tsunami, not because the Fed is going to raise rates, which it might not, but because over-indebted money-losing companies with declining revenues have been pushing their luck, and investors have finally woken up.

To get a better handle on the revenue quagmire in Corporate America beyond the energy fiasco, Moody’s uses the metric of “core business revenues” which exclude “identifiable energy products.” And even those ex-energy revenues have gotten mired down.

The growth of these core business revenues slowed in each of the past five quarters, reaching 1.4% by Q4 2015, according to a report by John Lonski, Chief Economist at Moody’s Capital Markets Research. While “core business revenue” growth might tick up to a still miserable 1.9% in Q1, it “falls noticeably short of the expected 4.8% yearly increase by private-sector wage and salary income and thus warns of a further narrowing by profit margins.”

This has consequences, according to Moody’s: As “subpar revenue growth is likely” to continue, and as margin pressures increase, junk bonds’ “latest rally is susceptible to yet another reversal.”

The downgrade tango, especially at the low end of the junk-bond spectrum where companies are most likely to default, is picking up speed. According to Lonski, the “steepest” wave of downgrades to “‘Caa3 or lower’ since winter of 2008-2009 warns of more defaults.”

Caa3 rating is only about two hairs from default. So downgrading companies into that category triggers ugly premonitions. In Q1 2015, there were 12 downgrades to Caa3 or lower. In Q4 2015, there were 33. In Q1 2016, there were 66, the highest since Q2 2009.

Of these 66 downgrades to Caa3 or lower, 35 where energy related and 31 were non-energy. So this is no longer an energy issue alone. Lonski:

The latest surge by downgrades to 66 strongly supports the realization of a roughly 6.0% high yield default rate six to 12 months hence.

The correlation between the default rate and the yearlong number of downgrades to “Caa3-or-lower” lagged one quarter is a very strong 0.96. According to the latter relationship, the midpoint for Q3-2016’s expected default rate is now 6.5%.

A default rate of 6.5% is big. It occurred only four times for my generation:

- 2009

- 2000

- 1990

- 1986.

The last three times were linked to, or followed by recessions. The only exception is 1986:

Similar to the current situation, yearlong 1986’s average price of crude oil sank by -45% annually and was -60% under 1980’s then peak yearlong average. In addition, yearlong 1986’s average for Moody’s industrial metals price index was -34% under its average of yearlong 1980.

Unlike today, the Fed actively confronted the commodity price deflation of the mid-1980s. A drop in the fed funds rate from late 1985’s 8.0% to late 1986’s 5.88% and a slide by the 10-year Treasury yield’s yearlong average from 1985’s 10.6% to 1986’s 7.7% helped to alleviate the stresses of the mid-1980s.

But now the Fed is still mired in its seven-year emergency zero-interest-rate policy. The fed funds rate is at 0.38%. The 10-year Treasury yield is at a minuscule 1.75%. And these rates, in contrast to 1985, “underscore the very limited scope for interest rate reductions as a means of rejuvenating stagnant expenditures.”

So, this year might be more in line with 2009, 2000, and 1990, when this sort of default rate coincided with recessions. And for bottom-fishers in the now turbulent sea of junk bonds, the two-month rally is likely to reverse. Since contagion has spread to sectors beyond energy, even a rise in crude oil prices isn’t going to provide a cure. And historically, stocks follow junk bonds, so seat belts might be required all around.

In a broader sense, beyond companies rated by Moody’s, total business sales in the US have dropped to 2012 levels. Inventories have ballooned to crisis proportions. And jobs will be next. Read… Why This Economy Is Now Running Aground

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

the collapse is here

Maybe.

Triggers:

Confirmed US nominations.

President elect.

Other negative world incidents.

If they can keep all the big US bankruptcy’s, Mostly in energy, spread out, they can manage the US, otherwise the current global financial system, Implodes.

They have been staving off the second leg, of the 08 Double dip deflation/correction event since 08, to be fair, they have done an excellent job to date.

In 20.20 hindsight they should have folded after QE 1. As it successfully put the brakes on what was about to be a Massive Global implosion. Now, they are Almost back where they started in 08 with less tools available to deal with it this time.

“they have done an excellent job to date.”

An Excellent Job LYING To All Of Us While They Protected The Too Big Too Jail Corporations, CEO’s, Wall Street & The Banksters – Who Cheated Everyone Thru Their High Speed Computer Rigged Ponzi Scheme Stock Market.

One problem with junk bonds is that yields are too low to justify the risk. Easy-money policies can only work in the short term, but they’ve gone on so long they’ve severely distorted risk-return ratios.

Zirpnirp makes the concept of a risk-free rate of return a thing of the past, as the safest vehicles return a negative yield up-front. But so does cash, so there’s no help there. The only way to make money is to invest in bonds that offer more risk than return and hope your picks aren’t the ones that default.

The system is broken, and it can’t be fixed.

“The only way to make money is to invest in bonds that offer more risk than return and hope your picks aren’t the ones that default.”

That is a stupid strategy.

Bring your cash home, or at least to a non bank controlled safe deposit facility, until you find somewhere appealing/safe to put it.

Let the hedge funds gamble their profits in those bonds, as just like any gambling house the bond market is currently stacked against the Little Guy, HEAVILY.

Yes d, it is either bullion or bullshit. I prefer the former.

A careful reading of conventional financial news suggests there is plenty of profit in bullshit.

I should have invested in antidepressants before everybody else piled on.

“Bring your cash home, or at least to a non bank controlled safe deposit facility, until you find somewhere appealing/safe to put it.”

Also a losing strategy, given the cost of a safe-deposit box and a real inflation rate of 9%.

http://www.shadowstats.com/alternate_data/inflation-charts

Perhaps there are opportunities in the pikes and pitchforks industry.

I wonder if wolf or the other commentators are investors. I assume that the 6.5% high default rate is over a 12-month period. So, that means that I lose 6.5% of my capital in that time. (At worst, not all defaults involve a full loss of capital). But I get 17% income on my the portfolio. That gives me a 10.5% net return. I would be very happy to buy on that basis, particularly as the downside risk has been substantially netted off.

You’re mixing up the numbers. 6.5% is the average default rate for ALL HY bonds that Moody’s rates across the entire spectrum.

So at the top end of the spectrum, the BB rated bond index yields 5.36%. Their default rate is smaller. But HY Bonds rated B- under the S&P system have a default of about 10%. Bonds rated C- have a default close to 100%… they’re on the verge of default. Next step down is D for default.

Also, much depends on the recovery rate of a bond. If it has a first lien on good collateral, it’s recovery rate can be high. But if it is unsecured, its recovery rate can be zero.

Distressed bond investing (bonds with a yield spread of 10 percentage points or more above Treasuries) can be VERY profitable, but you have to time it right, and you have to know what you’re doing, or else you get sucked down into the hole, and you have to read and understand the contract of each bond that you’re investing in, and you have to know and understand what the collateral is for each bond, and what claims you have to it, and who is ahead of you. There are a million things to sort through to make an educated decision.

And then there’s the problem of trying to sell a bond like this. In troubled times, it’s very hard to find a buyer for a particular issue at a reasonable price. Ideally, you buy low in troubled times and hang on to it until it either defaults or matures. If you HAVE to sell it during troubled times, you get screwed because there’s no liquidity.

AND, as retail investor, you don’t have access to the info, and your broker doesn’t even sell you junk bonds.

I hope this is helpful in understanding at least some of the issues involved.

Dear Wolf,

Thank you for making it quite clear that this will end badly.

“There are a million things to sort through to make an educated decision.”. The number of time I have read that a fund manager simply does not have the time or is to lazy to read all the details of an investment, is a great opportunity for the “investment banks” to sell off their garbage at great profit.

Here we go again. So Mr. Wolf, do you think the US government will bail the mess out once again when that dam breaks?

That’s the big question. I’m pretty sure the government won’t. But the Fed might. That’s who did most of the bailing out last time.

In fact, by not raising rates, the Fed is already trying to prop up the bond and stock markets. That’s kind of a bailout too.

If I may interrupt, the US Federal Reserve has proven to be more than willing to let other central banks go ahead and “experiment”, to then observe the results.

That’s why, unless a lot of political pressure is applied, ZIRP’s are not coming to the US.

Japan hasn’t started buying corporate bonds outright, but the Bank of Japan has been buying ETF’s and JREIT’s hand over fist for a while now, not to mention every sovereign bond that isn’t nailed down… and they are bringing out the crowbar.

Despite now owning 52% of the Japanese ETF market, the BOJ has failed in almost all its stated goals. Only consumer inflation is flaring up, and not as much as Haruchiko “Kamikaze” Kuroda would like.

So directly meddling in financial markets doesn’t work as originally intended… may be direct purchases of sovereign bonds will do the trick?

Despite much fanfare, the ECB has been purchasing small volumes of investment grade corporate bonds since Mario “Banzai!” Draghi dragged out his monetary bazooka. Among the others, ENEL and Terna, two Italian companies, both partially State-owned, were included. Now that program has been much expanded in scope. How it will work? If sovereign bonds are anything to go by, the risks far outweigh the potential benefits.

In spite of the Punch and Judy Show about “fiscal discipline” it is proving exceedingly difficult to restrain governments at the receiving end of the ECB largesse. The French and Spanish governments openly flaunted deficit rules last year and got away with it. The Italians will most likely follow suit.

Possibly more critically, the sovereign bond market is drying up. Nobody buys bonds anymore if not in the hope of selling them to the ECB at a profit down the road. Yields are so ridiculously low they are not worth the effort.

This is giving mutual/pension fund and insurance company managers nightmares, as one of their main sources of guaranteed, almost risk-free yield is drying up.

QE was kind of like a “continuing bailout” too for the banks. Not doing so hot off the govt teet. I can’t even fathom what kind/volume of printing that will happen when this thing rolls over.

Wolf,

Your comments are absolutely correct. When investing in distressed debt, it is critical to understand the EXACT terms of the bond and where you are in the chain. This is especially true now, in an era when so many recent junk bonds are “covenant lite.” A lot of investors who imagine themselves secured will find that they are, in fact, that most miserable of creatures: the unsecured creditor.

Wolf, thank you for that comprehensive reply. I clearly mixed up the figures.

I invest through high-yielding (mainly in unquoted but secured debt) funds that are quoted on the LSE. They net out with a distribution yield return of 7% to 10%, after defaults. Yes, liquidity is poor (spreads of around 5%, which will undoubtedly deteriorate when times get tough) but I rely on the managers to do the individual debt selection. I hold until it is the ‘right’ time to sell.

In comparison, the HY bonds sem to be poor value, with investors apparently paying for the liquidity that they do not achieve.

I think they want the global economy to implode. It looks like that is the only way the establishment can remain in place. Panic and fear is what they sell and the only thing they know how to manage. This would allow them to perform the reset they desperately need. They don’t mention the national debt anymore because they know they can’t pay it. The reset will allow them to promise all bond holders some return on their holdings. And of course, the dummies will fall in line and to get some of their money back while totally ceding political control.

I knew things were bad when Trump entered the race. He would probably prefer to be in the economy making money. But it can’t be done any longer, without accounting tricks and financial manipulation. His candidacy, to me, is the evidence that the system is so broken even rich guys can’t make money anymore. Under those circumstances how is the small investor suppose to survive?

…….’the incredable shrinking investor’……..

blink…. and they’re gone !!

Um, I’m pretty sure Trump has “little man syndrome”…;-):

http://www.theguardian.com/us-news/2016/apr/17/nude-donald-trump-painting-illma-gore-lawsuits

But seriously, that there are a not an insignificant number of people who think Trump is a credible candidate, let alone President, is appalling.

So who in the race do you consider a credible candidate? I’m coming up short.

Daffy Duck.

He only got 0.00000065% of the primary vote, though.

Easy: Bernie and Hillary (Disclosure: I despise her and Bill) and maybe Kasich.

Trump is a buffoon.

Cruz is the reincarnation of Joe McCarthy.

To reiterate my point, it’s frightening that so many think Trump’s at all competent/qualified.

The most important aspect of the present micro/macro economic condition is, you want the return of your capital, rather than a return ON your capital. Preservation of capital is key to financial survival.

The junk bond sector is but the tip of the leaf. These bonds, along with NINJ mortgages, auto loans, consumer loans, credit card debt, have all been churned together by the TBTF banks and sold OTC (over the counter) as AAA rated “investments” called Collateralized Loan Obligations (CLO) or Asset Backed Securities (ABS) derivatives.

Who bought these “weapons of mass financial destruction” in search for yield? Pension funds. Insurance Companies. Hedge Funds. Sovereign Wealth Funds. The list goes on and on. This is where the “root” of the debt problem ends up. This is where the rubber meets the road.

The global derivative nightmare is coming home to roost. The recent events in the European banking sector and in particular within Germany this past week, prove this out. The decaying financial rot is spreading.

Read about recent high level meetings with Yellen and Obama as well as among Federal Reserve and Treasury. The government will bail or indefinitely delay the oil industry collapse. It will be done surreptiously and they may deny it if questioned. Basically, the banks balance sheets won’t show the stress that is there and creditors will be made whole as needed.

I’m not saying any of this is good; just what will happen. No collapse yet. This will essentially go on until the rest of the world says no more.

For those of you in a pension plan I suggest you go through their quarterly financial statements the same way you would your RRSP (401K). You won’t see every investment detail, but you will see summaries and be able to infer the health of the plan and their investment direction. One example is the BCGEU, (which I am not a member, by the way), the BC Govt. Employees Union. Many years ago all public sector Unions in BC divested themselves of Govt meddling and the raiding of said pensions to finance Govt infrastructure projects, etc. Apparently, this was not done in many states and cities in the United States whose pensions are now in trouble. Detroit is example of this. As I understand it the US Govt even raids SS contributions for general revenue, (but correst me if I’m wrong).

Anyway, a few years ago the BCGEU got out of energy sector investments as a direct resultof member pressure. This was mainly due to global warming concerns and the dirty aspect of Oil Sands production. They sold out when the price was high, and now with the collapse of oil prices to $40/bbl currently, the decision was a wise one in hindsight. Many pension plans have energy investments and have watched their value drop, accordingly.

I used this example to simply say that all pension plans are not created equal. Some are quite sound and stable, although if the whole economic ship goes down it doesn’t really matter, does it?

Nice to see Canadian bankers still follow increasingly uncommon, boring, good sense.

I agree with Mike R who states “this will essentially go on until the rest of the world says no more”. The problem is the rest of the world is backed into the same corner as the U.S. and they can’t say no more even though they understand that some day the music will stop. They must keep the continual financial schemes going or the global economy does implode.

What they do is what they’ve been doing forever – lie and deceive the public. Investors have been buying into the false euphoria since February. Oil has rallied relentlessly pushing the stock market up relentlessly. Based on what? A production freeze meeting that is another head fake, that anyway will do nothing to curb and diminish a massive supply glut. And investor sentiment that Central Banks will collude to keep the scheme going in perpetuity. All this bad news is irrelevant in the big “scheme” of things. The FED has our back so buy buy buy and don’t ask those silly questions about how it all defies logic.

“But now the Fed is still mired in its seven-year emergency zero-interest-rate policy.”

The greatest fairy tale of all is that the Fed is the Good Fairy. What they have been doing is providing money, virtually interest-free, to the very banks that own it, with which to pick the bones of the many resource producers presently teetering on the ropes, for pennies on the dollar. And in the process getting a twofer: being able to deny savers any return whatsoever. (and when they can get away with it, even charging them interest on their savings, NIRP. If that’s a Good Fairy, I’d hate to see a Bad Fairy.

if you don’t like those bonds, don’t buy them.

as to current bond prices, lack of liquidity tends to preserve prices, need for liquidity is a different matter.

if you don’t like those bonds, don’t buy them.

I think the Fed is desperate to make the system hold together until Hilary is elected (i.e. until Trump and Sanders are no longer candidates- dead or alive). Also they would like to not have a Brexit. This financial hurricane is starting to make pigs fly.

“Dead or Alive” I have a hunch the establishment has this point in mind….

“So we have a vast gambling culture, and people have made it respectable. Instead of betting on horses or prizefights, we can bet on the price of securities or the price of derivatives relating to securities, and we can bet on athletic contests. We have a huge amount of legalized gambling. And of course the public market, which operates every day with transactions, is an ideal casino. And there are a whole bunch of people who want to own a casino and make a lot of money without losing money on inventories or credit.”

– Charlie Munger, Berkshire Hathaway vice chairman February 11, 2016

http://www.tilsonfunds.com/MungerDJ-2-16.pdf

To wit:

It’s All Suddenly Going Wrong in China’s $3 Trillion Bond Market – Bloomberg

http://www.bloomberg.com/news/articles/2016-04-18/it-s-all-suddenly-going-wrong-in-china-s-3-trillion-bond-market