Business sales worst since 2012, inventories at crisis level, jobs next.

Total business sales fell again in February, the Commerce Department reported today. They include sales by manufacturers, retailers, and wholesalers of all sizes across the US economy. This measure is far broader than the aggregate sales by publicly traded companies, which too have been falling.

At $1.284 trillion in February, total business sales were down an estimated 0.4% from January, adjusted for seasonal and trading-day differences but not for price changes. And they were down 1.4% from the already beaten-down levels of February last year. They’re back where they’d first been in November 2012!

By segment: Manufacturers’ shipments fell 3.5% year-over-year to $444.6 billion. Sales by retailers rose 3.1% to $360.6 billion, propped up in part by auto dealers. And sales by wholesalers fell 3.1% to $395.8 billion.

With optimism running wild about a booming Fed-designed future, executives have been hoping in aggregate that sales next month and next quarter would be better. But these wishes just haven’t come true. So now, way behind the curve, they’re struggling to bring their bloated inventories in line with the reality of their sales.

Manufacturers were able to trim their inventories by 2.3% year-over-year, and wholesalers were able to whittle them down 0.6%, but retail inventories soared 5.9% after having already jumped 5.7% in January following a lousy holiday season.

This brought inventories down a tiny 0.1% from January to $1.812 trillion. But they remained 1.2% higher than the already bloated levels a year ago.

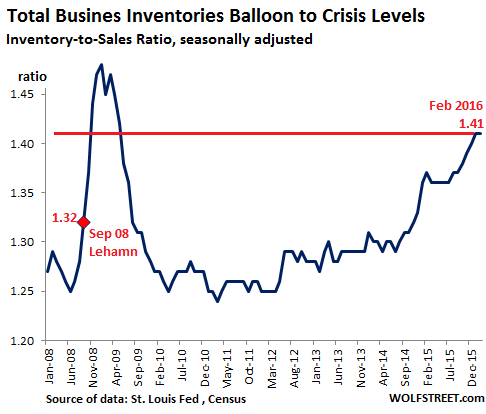

The crucial inventory-to-sales ratio, which tracks how long unsold inventory sits around in relationship to sales, is now at a mind-bending 1.41. That’s the level the ratio spiked to in November 2008, after the Lehman bankruptcy in September had put the freeze on the economy.

Inventories represent prior sales by suppliers. When companies try to reduce their inventories, they cut their orders. Suppliers see these orders as sales. As their sales slump, suppliers adjust by cutting their own orders, thus causing the sales slump to propagate up the supply chain. They all react by cutting their expenses. And if it lasts, they’ll cut jobs. Inventory corrections have a nasty impact on the overall economy.

This chart shows how the inventory-to-sales ratio has totally blown out since late 2014, and what sort of inventory correction the economy is facing:

Inventories in February were up 18.5% from the pre-crisis peak in August 2008. But total sales were up only 4.8% from their pre-crisis peak in June 2008!

Let that sink in for a moment: 4.8% total sales growth in eight years! And these sales are not adjusted for price chances, and hence inflation, that have accrued over these eight years! That’s how dismal the recovery has been for US businesses.

Part of that problem is that sales since their all-time peak in July 2014 have by now declined 5.9%! These are US sales in US dollars; exchange rate variations don’t enter into the equation.

Which exposes a conundrum that will eventually be resolved, most likely in an ugly manner.

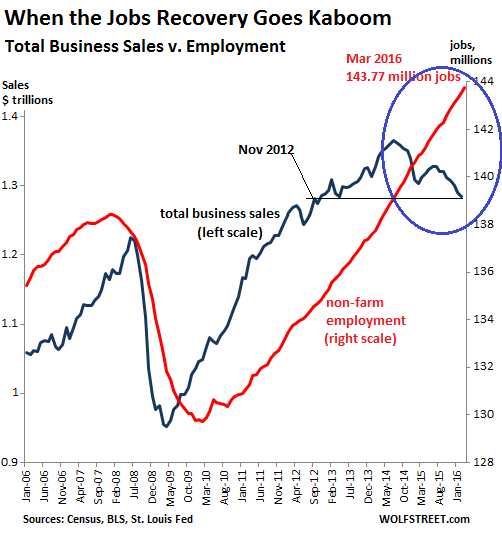

Employment is constantly being cited as one of the strong points of the economy. From February 2010 – the low point of employment in the Great Recession – through February 2016, total “non-farm employment” as defined by the Bureau of Labor Statistics has risen by over 14 million to 143.8 million.

A lot of them may be low-paid jobs and part-time jobs, leaving many people stuck in that vast quagmire of the “working poor.” But some sectors in some parts of the country have been booming. They’ve added jobs that pay well, however unsustainable this may be, for example in the startup boom that is starting to hit rough waters.

Yet these 14 million jobs created since the bottom of the Financial Crisis contrast with the US population that has since grown by 16 million people. Economists point at the 14 million jobs and pat each other on the back. But people trying to find a decent job confront a situation where their individual slice of the economy as actually shrunk during the “recovery” [read… This Shows Why Consumers Are Bogged Down].

The conundrum is this: Total sales have been declining since their peak in July 2014, while companies continue to create new jobs – the BLS counted another 215,000 new jobs in March:

Historically, that mismatch doesn’t continue for long. When sales start falling, companies react by cutting costs. And they’ve already started doing it, albeit with a scalpel, not an ax.

Hence, job cut announcements are now reverberating through the media, for example when Alcoa disclosed on Monday that it is considering, after having cut 600 jobs in the first quarter, to cut another 1,400 jobs. But much of it happens without announcement, just a quiet drip, drip, drip – for example when word got out that IBM is laying off 109 workers at its Silicon Valley Lab, one of its two large complexes in San Jose. While job cuts in energy have reached crisis proportions, they’re now reaching far beyond energy.

Companies are showing the pain, particularly smaller companies: After 22 quarters in a row of year-over-year declines in total commercial bankruptcies, filings by companies of all sizes in March jumped 25% from a year ago, leaving ugly skid marks on the economy, banks, and investors. Read… US Commercial Bankruptcies Suddenly Soar

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I’ve heard the new $15 minimum wage in Washington has caused small businesses with tight margins to fold. Oops, there goes the low wage job growth.

FDR said, [in the 1930’s] that if a business could not pay a living wage it didn’t deserve to be in business!

But we don’t need the tax regime to worsen the business models as well.

I once commented that Obama was “a tanned version of FDR that someone brought out of cryo”.

FDR did many, many things wrong – the list is innumerable. Need an example? How about this supreme court case:

https://en.wikipedia.org/wiki/Schechter_Poultry_Corp._v._United_States

NOTE: One might have to read, think, and comprehend to reach the proper conclusion.

These days, I take comfort in the fact that in at least four billion years this whole experiment will be over. The greatest thing humanity can do at this point is flower – but so far we look decidedly like a corpse flower.

http://media.mnn.com/assets/images/2013/01/titan_arum_sized.jpg.638x0_q80_crop-smart.jpg

Regards,

Cooter

And to FDR..What if a wage earner can not or will not produce enough to justify a living wage? Does he deserve to be “employed”?….and who best determines that finding? An out of touch “high priest” like FDR? or the employer(and who the employer serves)?

So what does a $15/hour minimum wage really mean? I once hired help. Now it’s just me. Much better this way. Before, if an employee produced less than what minimum wage justified I could not keep him on board…But with all the rules of “fairness” dictated by government how could I let him go or encourage him to do better without more grief(and distraction from actually pleasing customers and making product)? Does this set-up keep the marginally employable dependent on welfare/government and unable to move forward in life or homeless?… I’ve seen this in action many times. Throw in the crazy making moving target of the value of fiat money and concurrent business cycle….ugh. How does a business ever grow? Some do but increasing government hurdles make solo operation the only sane choice for me.

You’ve heard wrong.

http://www.seattletimes.com/business/economy/a-year-in-the-sky-is-not-falling-from-seattles-minimum-wage-hike/

http://www.foxnews.com/politics/2015/07/22/seattle-sees-fallout-from-15-minimum-wage-as-other-cities-follow-suit.html

Businesses just pass on these higher costs to consumers. If Bill makes another $500 a year due to a higher minimum wage but has to pay $500 more for goods and services, where’s the gain?

The other way around: Bill has to pay $500 a year more for goods and services (due to inflation, which everyone seems to love so much); now, that extra $500 in wages allow him to maintain his standard of living.

source? I live here and all is quiet- Dick’s (a hamburger chain) practically starts people out at $15 and there are lines there constantly-and contributes to an employees college fund

If it really makes a positive difference, why stop at $15? Why not $20? Why not $25/hour? Why not mandate everyone get $400/day and we all live happily ever after?

Exactly.

As for Dick’s hamburgers… I don’t know anything about that restaurant…. perhaps they are a premium burger joint catering to those who still have jobs and can pay the premium price that is allows for the $15 minimum wage.

But in general – if minimum wages are raised at most businesses — the costs will be passed on to the consumer. So that fixes nothing.

There is no free lunch.

As has been pointed out – why not pay Walmart staff $100 per hour?

You might “have heard it” but it’s not true.. Rush Limbaugh rambled on about restaurants closing because of 15 but it’s not true.. Shocker, huh..

All by design! Corporatocracy here we come!

If the truth about inflation were factored in, businesses would probably be reporting that they have experienced declining real sales for several years.

Share buybacks can only mask a certain amount of deterioration in revenues and earnings. At some point it becomes obvious to all.

The fact that the federal deficit has increased by about $100 billion year over year ought to be telling everyone that the economic picture is deteriorating…

Er, no. The deficit is fundamental to avoid a recession. The idea that a budget surplus is good is right only if one wants to see recessions, job losses etc. If instead you want improved GDP, lower unemployment, the Government has to spend into the economy and ramp up aggregate demand.

The fact we can’t achieve budget surpluses is a good sign. If we did achieve it then we would be in recession, or worse.

Politicians are extreme ignoramuses, economically. The MSM makes it worse.

So you believe the country should borrow to infinity?

That sounds like a recipe for national bankruptcy.

And by the way, I have an advanced degree in a financial field, and completed all the requirements for a PhD except the dissertation…

I can’t follow his logic – going with “troll” VB.

We do have folks on here that are legitimate in their confusion – and I post clarity if I have time and something to add to the stone soup – but one can’t convert the stupid (or willfully ignorant).

Regards,

Cooter

You have to define “national bankruptcy” as such a thing has never happened and is based on very political, austerity-based monetary policy. J.D. is referring to Keynesian based economic theory, well founded and dissected. “National Bankruptcy” is unfounded, based on repression and pure greed, so it could be called the ultimate capitalistic motive.

Keynesian theory is well founded? Give me a break. If we’re talking real Keynes here he advocated surpluses in good times and deficits in the bad as a way of smoothing aggregate demand and lessening the effects of cyclical downturns. Many economists today are so off their rocker beyond what Keynes thought they don’t even believe in cyclical downturns anymore… The Keynesianism of today is a monster that advocates irresponsibility as a way of life hiding behind central banking as way of gradually pushing the system to its limits. This relatively new theory will only be one part of another story in history that ended in tears.

I agree.

But the problem is that there are no good times any longer.

The only growth we have had for many years now is debt fueled… and now QE ZIRP fueled.

Infinite growth on a finite planet – is obviously not possible.

When the stimulus pushes on a string — civilization ends.

Billions perish.

As we can see – the string is starting to move

Sounds like you have mastered the full first half of Keynessian theory which is fine as far as it goes.

What’s wrong with this theory is that people and their elected representatives want to spend money they do not have, when the economy is good, and spend even more money they do not have, when the economy is bad.

John, you are an ignorant fool. If your theory were correct then Zimbabwe would be the most powerful country on the planet.

Is that how you personally live your life? Germany as of 2011 had a budget surplus of $220,000,000, they have a pretty good economy.

Utter nonsense. To be financially successful as an individual, you must spend less than you earn, and save some portion of the difference as a store of your labor for bad times/retirement. The same applies to a company and to a country.

Keynes’ theory is useless as it doesn’t take into account human nature, and in particular the penchant for leaders/politicians to buy votes/loyalty and debase the currency in the process.

Growth is all about stimulus i.e. debt QE ZIRP subprime

Strip those away and collapse will come quickly.

Now add in the just announced bankruptcy filing by Peabody Coal.

Which is one of the worlds largest coal producers.

With a workforce of 8,300 people. How many will retain their jobs after the bankruptcy proceedings have run their course?

The knock on effect of this will be significant. From the waitress serving coffee, to the railroads, heavy equipment maintenance, and all downstream ancillary suppliers of the mines. To say nothing of the mining communities, who are no strangers to tough economic times.

By the time the numbers will have been crunched, the job losses could very well number over 10,000 unemployed from this one event.

Peabody has said Australian assets are ringfenced, however Australian assets are controlled by Gilbitrar entity that is linked to the bankruptcy proceedings (source @MichaelWestBiz)

I am very confident that, in the long run, US Coal is still King. One has to look at supplies, demand, and particular the trends over time – and there is a significant interruption due to subsidized frack gas.

What is happening now is the destruction of a legitimate job base, through Government Meddling, such that the base can be destroyed and picked up for pennies on the dollar. Pensions under the bus, workers on the street – who might eventually get their jobs back at much lower rates.

I am no where near sophisticated enough to invest in coal right now, but if I could buy straight up mineral rights on coal and wait – I would do it hand over fist.

This crap with frack gas, which is the big displacement of coal demand, will crater one day – and folks will want cheap coal after that happens.

Long term thesis – but it is money good.

Regards,

Cooter

Right now gas fracking is taking place mainly in the U.S., but similar geological formations exist world-wide, so it would seem that energy recovery from the process has nowhere to go but up. Would this not keep energy prices suppressed indefinitely?

The “technology” for fracking has been around since the 80’s. It isn’t new. It was never deployed because it wasn’t economically viable. Maybe one could argue about the combination of features used in modern frack – but the core argument stands – it isn’t really new.

With the advent of huge amounts of cheap money, looking for a grave, oil company CEO’s (rightfully from their perspective) stood up and promised a return on that money (which will never exist – but this is the sales aspect of business – not the engineering aspect of business).

To make my point very clear – maybe their is oil on the moon. Going to start up a company to produce there?

This highlights that ECONOMICALLY recoverable hydrocarbons are what one needs to pay attention to – and to exclude the NON-ECONOMICAL hydrocarbons from the equation. If technology really changes the boundaries, then so be it, but if that was the case we wouldn’t be awash in oil company layoffs, defaults, etc.

Coal is proven to be economical – it is displaced currently due to (1) cheap natural gas due to cheap credit and (2) government incentives due to CO2, emissions, and the like.

So, the bet you have to take – in the long run, is – will (1) and (2) hold?

Regards,

Cooter

the problem right now is the bankrupt with D in P financing will beat up on the non-bankrupt.

yes, i agree, but they’re hard to find at the right price.

meanwhile, nat gas is cheap. it’s going up, sooner or later.

“inventory-to-sales ratio ” is crucial.

” Companies are showing the pain, particularly smaller companies: ”

I am a small business owner. I was pretty strong in January and February, actually pretty strong for those months,

but if simply you go on the basis of # of phone calls received per day as a measure, March and early April has been surprisingly terrible. A considerable and noticed drop if I had to guess > 20 %. I expect March and April # s to be below February.

In other words the warm winter was a pull forward. Didn’t need to buy your winter coat at all and don’t need a Spring one, already bought it in February.

Crash in new business March and April will be felt 6 months from now.

I have the feeling I am not alone; ergo increases in layoffs and building inventory is no surprise to me.

.

.

.

just saw by Mish – so true:

https://mishgea.files.wordpress.com/2016/04/bi41.png?w=529&h=294

https://mishgea.files.wordpress.com/2016/04/bi7.png?w=529&h=295

https://mishgea.files.wordpress.com/2016/04/bi21.png?w=529&h=293

.

.

Don’t have any debt and HOLD ON!

Just like in the great depression – if you didn’t have debt, then sales were just way down – it was debt that sank everything (and workers went with it). However, there is an “other side” so to speak where things finally pick back up.

A lot of deadwood needs to burn, but we will someday get to that other side … and that is the time to be owning a business. Until then, batten down the hatches!

Regards,

Cooter

Ditto, small business owner here. January and February felt like pre 2008 and a long over due boost. Then March died and April is a dud so far. I sell to retailers (better art galleries), they say the same thing. These are the 3 remaining survivors of 2008 where once it was 22 retailers.

(As a side note to the $15 an hour doomers, none of my retailers pay less than 40K a year to their sales staff. Why? because you pay crap, you get crap. And, further, if they are not paid a decent wage, then you will be providing them with government hand outs…take you choice).

Just did taxes and year sales were down 10% for 2015, expenses up 15%….utilities, taxes and government fees, rent, supplies. Those expenses make me wonder why stay in business at all.

And, the customers of my retailers are not working class folks, they are the well healed and those folks have closed the purse….just ask Tiffany’s.

does seem like necessary costs are going up, doesn’t it?

Im totally baffled by the economy and how the dollar along with several other currencies have not crashed.. Like a plane doing a nose dive… Our national debt is beyond rationale and Im perplexed over why the central banks have called there special meetings this week… Most Fed prez don’t like meetings unless they need to go see the mistress… What is really fascinating is the manipulation in unemployment, inflation and now the financial engineering of the banking system and companies.. Totally baffled. When I went to school 10 x 10 was a 100.. not 1228 or 13,000…

Ever play at a family poker game with the duggar-martingales? Everyone doubles down – and you get pushed out.

This is exactly what we have for markets today.

Doesn’t mean you are wrong though – you just can’t play a big game with mostly idiots. The fact that daddy duggar-martingale has deep pockets doesn’t help your situation.

Actually, on that point, how the hell do you win? Quad down on the stupid and front run them?

My apologies if your career says you have to play (part of the problem), but if it doesn’t – step away from the table and find meaningful, purposeful things to do with life (or capital).

Nothing is good anymore and you never know when the music is finally going to stop.

Regards,

Cooter

Dear Cooter,

This is not Zerohedge. You don’t need to comment on every single post as you do on Zerohedge.

Please refrain, post something important.

I don’t read zerohedge and I am interested (so far) in Cooter’s comments.

Is this why stocks were rallying again? Darn, Dow 50K here we come

Don’t worry, the stock market is just a diversion. Soon enough the real economy and gravity will reassert itself.

My hunch is the housing bubble will run another 2-3 years to buffer the crashing sectors of the economy, much like 2001-2005. Loan requirements are beginning to get looser and many markets are still well below 2008 price levels, and well below thresholds that scare off private investors. Mortgage rates have room to drop. Sounds crazy but bubbles usually live longer than anticipated.

They can loosen the loan requirements all they want, but if you don’t have job security or a good job market in the area, the house is just an anchor that will sink you. This is the reality that has taken hold especially with younger people.

As for the current bubble, election years are always awash with money. Come Janurary you will see the circus leave town and reality reassert itself.

It is so strange- I watch Nightly Business Report almost every evening, and you would have no clue whatsoever that any of this is happening (they were determinedly cheerful before CNBC took them over, but they are positively on Ecstasy since.)

HA HA HA ~ !

I agree ! There seems to be 2 worlds in business news, the forever cheerful – including “Dow 200,000 on it’s way !” and then there is this and similar blogs “hey look at all that rust on the steel frame holding that thing up ?!”

Hi Wolf,

Any perspective on how much of the inventory increase and sales declines is caused by the change in oil prices?

It would seem that the timing of those shifts could be a major root cause beneath the shifts you describe.

Thanks

Good question/thinking, Thierry. Here are some data points:

Oil sales and inventories in the report are in dollars (most other reports on oil that we look at are in barrels).

Wholesales of “Petroleum products” – which includes oil, gasoline, etc., fell 34.8% to $30.4 billion. Inventories FELL 9.1% to $17.2 billion. Both a function of lower price.

But here is why in the vast US economy, it really doesn’t have that much impact on overall business sales and inventories: petroleum products account for only 2.4% of total business sales, and for less than 1% (0.95%) of inventories.

And note that petroleum products inventories actually fell (in dollars). So they didn’t contribute to the increase in inventories.

The economy is running flatline- no real growth, maintenance mode only. The BLS job numbers are pure baloney as are the business birth-death model numbers. The economy has hollowed out family wealth such that the next official recession will pitch millions of families into public assistance pools. The market recovery led by highly defensive stocks on minimalist volume shows no real animal spirits at play, just a renewed reach for yield. The old adage about a year too soon being better than a day too late is about to be demonstrated BIG TIME to current bag holders.

Most middle class families have lost more in the financial crisis than they can ever recover, due to age or the lackluster recovery. The reason the economy is flat is because people don’t have enough spending money. Some things really are simple.

I would eat out as often as I could, if I could afford it. I have a list of stuff that I need to replace. I would gladly go out and buy it all today, but I can’t. We eat out on special occasions and we have to budget for it. We are tackling the list of stuff we need a little at a time, it has items from underwear to furniture on it.

The economy will never recover because they gave the money to the wrong sector. The money should have gone to the bottom where I assure you it would have been spent and would have lifted all boats. This is the mistake they won’t admit.

“The economy will never recover because they gave the money to the wrong sector. The money should have gone to the bottom where I assure you it would have been spent and would have lifted all boats. This is the mistake they won’t admit.”

That just says it all, doesn’t it?

But it’s not a new thing. The rest of us have been “trickled down on” since the 80s. This is Ronald Reagan’s real legacy.

There is in my view so much nonsense spouted it is hard to know where to begin.

Take Larry Fink of Blackrock for example. Why would any youngster care too hoots about saving for a pension that would/might only be payable some 40 years hence? It’s not the youngster that is frightened by the future, but Larry Fink whose sprawling empire depends upon a steady flow of revenue from people prepared to tie up their savings indefinitely. Revenue that is used to fund the expectations of those currntly on the conveyor-belt

As for institutional investors piling into miniscule yield bonds issued by governments, why risk investing in an indebted private company that might go broke when for the same amount you can buy into a country. There is more to a country than its economy.

The stock market is a gamble, a casino, for traders. It is not the place for long term saving let alone pension funds.

To attract the gullible, the system promises the earth. The problem is that too many people get sucked into a system they don’t understand and by the time they come to their senses it is too late to do anything about it.

I release my comment above is in the wrong place. Never mind, it’s the gist that counts!

Inventory is a product of economy of scale and competition. Companies over-produce, over order, to get the unit price down. Then get stuck with too much because there is not enough demand to soak up the slack. The world is awash with excess merchandise. It doesn’t help that yesterday’s good idea is obsolete today. To free up cash-flow, companies lay off workers which in turn reduces demand further. One solution would be to rduce stock availability which woukd push up prices but that presupposes the customer desire would continue.

I read an article yesterday on Zero Hedge about a data center in NJ. As a techie, the description of the technical services offered there only reinforced it as a front running paradise, for those with the right access. I wouldn’t invest a penny in the markets today such as they are.

Excellent

https://mishtalk.com/2016/04/13/inventories-and-sales-how-bad-are-they-study-in-pictures/

Since our government seems to love deficit spending so much, why not invest in something that will do some actual good?? Take the space elevator idea: for less than a Billion we could put thousands of grad students and scientists to work figuring out how to make nanotube cable. All the money would be spent supporting actual people and equipment, and directly enter the economy. Likewise, building the elevator thereafter puts people to work.

This is better than giving hundreds of billions to banks. And such a project is aspirational, it would give us all hope and ennobles our future even if it doesn’t work out the first time. So for less than one bank bailout we would have created millions of jobs and opened up space for true human exploration and development. New technologies would be invented, and we’d have a gigantic new frontier to settle and explore (space).

Too bad it’s just a dream, that all we’re doing is chasing ‘consumerism’ in a race to absolute income inequality. There are so many worthwhile projects, and not all in science either. Each could be made to directly strengthen the middle class, and would more than likely pay for itself. Such big projects always did in the past.

It’s safe to say that in our new economy sales will be disconnected from job growth.

It’s all priced in.

SOMETHING is driving up the Baltic Dry Index, which rose over 6% just today. Maybe international trade is strengthening while nobody notices.

http://stockcharts.com/h-sc/ui?s=%24bdi

Check out commodities. Iron ore, for example, has been rallying. It’s up something like 50% or 60%… though industry insiders say it won’t last. Too much oversupply still. The Baltic Dry Index reflects shipping costs of “dry” bulk commodities. So iron ore, copper, grains, etc. are the place to dig for an explanation.

Someone is stimulating somewhere…

I suspect China is building more ghost everythings….

That would be positive news … as it will delay the inevitable cataclysm awhile longer.

I’m thinking Italy or Argentina in September for the next edition of my End of the World Bucket List.

That follows after a planned month skiing in Queenstown

I am confident that if China throttles up on more ghost towns we’ll make it through into Q3… thank you China…

Isn’t it fantastic knowing with such certainty that the end of days is imminent?

It makes for completely stress free living.

Just like one fella said. People don’t have enough spending money. to increase sales, create savings, and contribute to the velocity of money moving through the economy; real wages have to rise and over all taxes & fees need to come down significantly for single people making less than $50,000 per year, and families making less than $100,000 per year. That would bring on prosperity.

It is a long established ‘rule of thumb’ that Consumption makes up two-third of the US GDP, which is about US$17 trillion today. That equates to about US$11.33 trillion of Consumption a year or US$944.4 billion every month.

When “retail inventories soared 5.9% after having already jumped 5.7% in January following a lousy holiday season” the writing is on the wall that the US consumers are tapped out, when about 95 million people are out of the job market and 45 million are living on food stamps.

China’s export has fallen by 27% and the Baltic Dry Index has fallen to its lowest for a long time, show that world ocean trade is at a standstill.

To avoid a recession, (technically, two quarters of negative growths) the US must ramp up Govt spending and promote investments and, of course, manufacture endless wars around the Middle East for the MIC.

Hanging above all this ominous downturn, like the Sword of Damocles, is the 1.5 quadrillion Derivatives. Once that unwind the game is over, as the too-big-to-fail US banks will fall over a cliff, with trillions of dollars of exposure to Derivatives.

Have the regulators fallen asleep, I wonder?

Interesting reading the comments. I have only one thing to ask:

1. If we continue to give senior citizens (not productive anymore) a COLA in most years due to a rising CPI, why are not minimum wages of workers adjusted the same way? This would maintain their standard of living to the same extent geezers are maintained.

2. Conversely, IF you argue the seniors “earned it” well then, I would submit to you that any “earned increases” be granted when, if, and only in the amount minimum wages are increased.

3. I would further suggest increases in elected official pay be increased by no more than minim wage workers increases.

There, that should piss off dam near everybody.