“Even lower for even longer”

You’d expect at least some artificial optimism when the president of the Dallas Fed talks about oil. You’d expect some droplets of hope for that crucial industry in Texas. But when Dallas Fed President Robert Kaplan spoke on Monday, there was none, not for 2016, and most likely not for 2017 either, and maybe not even for 2018.

The wide-ranging speech included a blunt section on oil, the dismal future of the price of oil, the global and US causes for its continued collapse, and what it might mean for the Texas oil industry: “more bankruptcies, mergers and restructurings….”

The oil price plunge since mid-2014, with its vicious ups and downs, was bad enough. But since the OPEC meeting in December, he said, “the overall tone in the oil and gas sector has soured, as expectations have decidedly shifted to an ‘even lower for even longer’ price outlook.”

So how low is “even lower?”

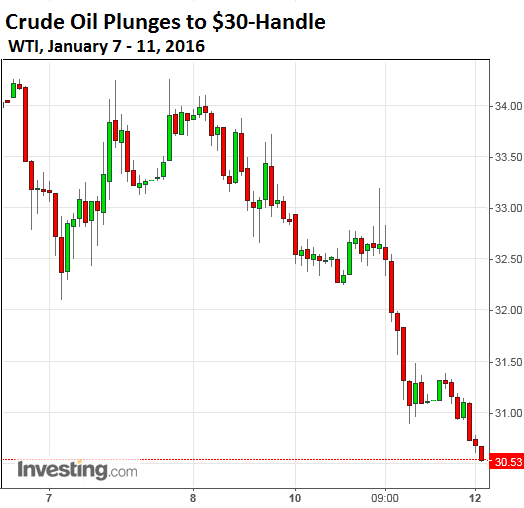

He didn’t say. But here is what is happening right now, just hours after Kaplan got through speaking. On Monday during the day and in late trading, WTI plunged through the $32-level, through the $31-level, and hit $30.53 a barrel, as I’m writing this, down another 7.1%:

This $30.53 a barrel is within a hair of the Financial Crisis closing low on Tuesday, December 23, 2008, of $30.28 a barrel. Oil had plummeted for days as traders had been checking out for the holidays. Practically no one wanted to buy oil. But on Christmas Eve, oil rose to $32.94. It was the first day of a V-shaped recovery. And on Friday, December 26, 2008, oil soared and closed at $37.58 a barrel.

Since weekly charts note the closing price of the week, it was the $37.58 that made it into every weekly chart. And these days, when folks look at long-term price charts, which are most often weekly charts – or worse even, monthly charts – they see $37.58 as the Financial Crisis low. And based on those treacherous weekly charts, much of the media has declared today’s price a “12-year low.”

Not quite. But hey….

So currently at $30.53, WTI has not yet taken out the low of December 23, 2008. But it’s within a hair.

Morgan Stanley, Goldman Sachs, Citigroup, and others have been projecting that WTI will break through the $30-line and head toward $20. When these kinds of wild forecasts first surfaced last year, they were pooh-poohed. Today they’re a lot closer to reality.

Kaplan wasn’t shy about laying out the reasons. It’s OPEC’s fault:

OPEC seems to have abandoned any pretense of production quotas, and Saudi Arabia seems to be determined to maintain its market share of production. As a consequence, it appears that any reduction in supply from Saudi Arabia will have to be accompanied by proportionate declines from other middle-eastern nations and Russia—this, so far, seems unlikely.

Inventories in the OECD countries have reached 300 million barrels above their historical five-year average and continue to swell. According to estimates by the US EIA, global supply exceeded demand by an average of 1.7 million barrels per day in 2015, and that excess supply has accumulated in crude oil inventories [I wrote about this mismatch of production and consumption and the ballooning stocks of crude oil here, including charts].

And to eliminate any wiggle room for false hope, Kaplan added:

As of today, this gap has declined to approximately 1 million barrels per day and is expected to ultimately drop to 600,000 barrels per day by year-end 2016. Our economists at the Dallas Fed believe that global excess inventories aren’t likely to begin falling until 2017. If we are wrong, the risks are that this rebalancing process will take even longer.

This mess is “further complicated” by Iran. The sanctions are expected to be lifted soon. Iran will ramp up production and sell what it can into the already oversupplied global market. Plus, it has 30 to 40 million barrels in storage, ready to be unloaded on the global markets, Kaplan said.

The prospect of all or a portion of this supply coming into the market sooner than expected has increased uncertainty and negatively impacted oil prices.

Then there’s US production. The US rig count has plunged. On Friday, Baker Hughes reported that it fell by another 34 rigs to 644. Kaplan pointed out that despite the plunge in the rig count and the collapse of capital spending, “US oil production declines have been slow to materialize.”

He blamed rising production from the Gulf of Mexico, the lag between capital spending cuts and production declines, and productivity gains in fracking over the past few years.

“All this suggests that 2016 will be a challenging year for oil producers,” he said. The “ultimate timing” of any sort of balance between production and consumption “remains uncertain.” And so he concluded in his encouraging manner:

As a consequence, we expect to see continued low prices and price volatility, as well as more bankruptcies, mergers and restructurings in the energy industry.

So it’s going to be a tough few years, full of traps, pitfalls, and false once-in-a-lifetime opportunities.

Part of what is spooking the oil market is China, and the possibility of slowing demand. But China, it seems, has bigger problems. “Beneath the financial turbulence there lurks a credit crisis,” explained a UBS advisor. Read… What Will China Dump Next, After Treasuries, to Keep Control?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

At $30 Russia is bankrupted in a year, not a bad consequence.

At first I didn’t understand how Russia being bankrupt in a year is not a bad consequence. Then I remembered that I’d not consider the US and UK bankrupt bad consequences. Lady Justice is slow getting to the root of the problem, but she does eventually get there. If one is dumb enough to stomp an ant hill, and ends up covered in ants, that’s as good as it gets in my opinion.

Russia won’t be “bankrupted” at $30, $20 or even $10 a barrel. Russia has its own currency, low debt load, self sufficiency in agriculture, a strong manufacturing sector and the social cohesion to withstand extended periods of hardship. Familiarize yourself with the siege of Leningrad for an example of Russian hardiness. The US, on the other hand………

No doubt, Russians are a hardy people and will get through this debacle too. As you said, they’ve gone through much worse.

But here is where your info is wrong:

– Russia is NOT self-sufficient in ag; it’s a big importer of food.

– Russia’s manufacturing is not “strong.” It’s anemic. It makes few consumer and business products, electronics, computers, etc. Russia even has to import oil field equipment. Relatively few cars are made in Russia. Many years ago, Putin talked about diversifying Russia away from oil and gas, and the opposite has happened. Hence today’s problems.

– While Russia has its own currency, the country and its state-controlled corporations (they are to be looked at as one entity since a lot of government expenditures are carried by these companies) owe a big pile of foreign-currency denominated debt. You can’t service dollar or euro debt with crashing rubles. That’s where Russia is vulnerable. Thank god that they’re getting dollars and euros and yuan for their oil and gas exports. But that foreign currency debt makes a default possible. It’s not likely for now, but if oil, as you suggest, goes to $10 and stays there for a long time, and if the price of NG continues to drop in Russia’s markets, all bets are off.

Wolf,

Thank you for your response, I should have been more clear: By self sufficient I mean they could survive on their own agricultural resources. Yes their manufacturing industry doesn’t produce Acuras or Lexus quality products (neither does ours), however they are world leaders in nuclear technology and they make first class military hardware, cheaply by the way, that is likely to be a big earner as the chaos widens. By our standards they are a strange people: “Despotism tempered by assassination, that is our Magna Carta”.

My comment was addressed to Nicko, who is probably of Eastern European extraction and is one of those who hate Russia for various historical reasons, they gleefully anticipate Russia having terminal problems.

They will wait a long time for that.

I suspect Putin and Russia are prepared for$10 oil. They have a few aces up their sleeve, not the least of which is 20K+ tons of gold which will come in very handy when the petro dollar finally dies.

The resilience of Russia is often underestimated. Russia is global No. 2 exporter of military goods. The manufacturing sector has been significantly diversified under the reign of Putin. The national debt is very low. Compared to Russia and its indebtedness the US is already bankrupt. Before Russia enters bankruptcy because of the oil price we will see significant problems elsewhere.

if Rus defaults so what? the creditors will feel the pain even more. that w/b a classical economic jig-jitsu move on their part…….

who are these creditors u wonder….ah & thats the crux of the matter.

this time around, ‘smart’ sovereign debtors hold the stronger hand!

Is this Jim Rogers?

Russia wont be bankrupted but some Russian companies with dollar denominated debt will be. Who owns that debt? Not Russians and good luck conficating that oil field or nickel mine in Siberia for the debtholders.

Be careful what you wish for ‘cos there are consequences…

Guess who were the masterminds behind the oil price dive to screw the Russians and of course good ol US shale frackers? Dear leader ObaMao and House of Saud.

And who really caused the Syrian “refugee” hordes taking the EU by the storm without swords & bullets, and created ISIS along the way to screw Assad? Dear leader ObaMao and House of Saud.

Russia has survived events that will break any nation, only SCHMUCKS will chose to ignore this FACT.

“Russia has survived events that will break any nation.” Nations always survive – unless the borders are redrawn. But people lose everything they have. And people die. This happened to lots of Russians in previous times. No one wants Russians to suffer through something like that.

But Russia has mega economic problems. It’s not a questions of whether or not the nation will be there afterwards. It will be, don’t worry. What’s at stake is the well-being and wealth of the people as individuals.

I’d like to add another couple of news.

That glut in supply is about to get worse before it gets better. While the Obama Administration is fighting a vigorous rearguard action to delay for as long as possible lifting sanctions on Iran (a move purely driven by oil price considerations… we are in an election year after all), other players haven’t been idle.

ARAMCO has already announced, not without a smidge of satisfaction. the Manifa oil field will be expanded to produce one and a half million barrels a day by the end of 2016, an over 30% increase of the present 900,000 bpd production.

The Kashagan Project in Kazakhstan, plagued by all sorts of problems, will finally start production in 2016. By the end of the year it will pump 300,000 bpd, with capacity to steadily increase over 2017. Rest assured members of the Kashagan consortium (which include ENI, Shell, Total and Petrochina) will want to start getting their money back on that (up until now) financial black hole.

Those two projects alone will add 900,000bpd of supply by the end of 2016.

But perhaps you hope that natural gas will see its situation somehow improve. ARAMCO has been developing Manifa to produce 90 million scf of natural gas per day on top of crude. And Shell Prelude, the largest offshore facility ever built, will start pumping natural gas in 2016. In short bad news on that front as well.

Another bit of bad news for oil is that storage capacity is running out worldwide. China has filled her storage facilities to the brim by taking advantage of the Saudi/Russian war for market shares in the Far East (a war Russia is winning, as usual, at terrible cost for herself) and Amsterdam has run out of ULSD storage capacity, so much Gulf Coast refineries have stopped shipping their excess production to Northern Europe.

These storage facilities will make a return to normal prices, whichever they might be, far slower as these stocks will need to be brought down to more realistic figures in the future. Watch out for spot prices where stored oil is traded, such as Shanghai. Sudden drops in prices and spikes in volume may give a hint of when this will start.

Finally there’s yet another move by the Saudi, who floated the idea ARAMCO may make its long awaited IPO move in the next couple of years. May is the big word as the Saudi have given the world just enough to test the waters and remained characteristically evasive.

With Apple, the world’s most important stock, under $100 now, this may prove the IPO every hedge fund manager has been waiting for to inject new blood into markets exhausted by seven years of trading on promises and rumors, not facts.

Thanks for the info, but some don’t see this as a saudi/russ battle for market share – just a move to displace the marginal barrels – with US shale oil being 1st on the list. Have always thought it was not in Saudi interest to cause massive US shale BKs, so not betting on that and guessing we are very close to a bottom since $40 does the trick…but it does not hurt to put a little fear into the CFO’s/investing public calcs with a price spike down.

Causing mass US shale BKs would just lower the cost basis for the new buyers and keep oil lower for longer – and transferring billions in wealth from oil exporters to oil importers. These BKs will take place anyway over time, but why have the transactions take place at firesale prices – unless the Sauds could pull a Carnegie, and really doubt the US govt would allow that to happen.

Regarding natgas – specifically US natgas – what was once a weakness for prices may indeed now be a strength. Those new sources you reference would be costly to get here via LNG; and US exports now in construction generally have penalties clauses – i believe Cheniere has 87% of nameplate capacity booked with a $3.50/mcf penalty clause.

Not sure about the pipeline exports to Mexico, but they don’t build pipes without commitments and they are bldg a lot – and the estimates for exports keep going up. Have seen numbers as high as 8 mcf/day to Mex by 2020.

And – when world oil prices do rise to their new lower level, we may have half the level of US shale oil production (over the next several years). Given the level of Associated Gas produced – that is a big factor for natgas – huge.

That, and the amount of excess capital invested – that enabled this go forward cost behavior has led to what may be some incorrect assumptions about the price of US natgas in say, 2019.

Dr. Foss of the BEG did a presentation on this issue last March…with a full paper coming out any day. See slide 5 for natty:

http://www.beg.utexas.edu/energyecon/thinkcorner/CEE%20producer%20benchmarks%20part%202.pdf

The present oil wars can be surmised as “Saudi Arabia vs The World”.

If the fight with US and Canadian fracking outfits is what makes the news, ignored but much more critical are fights for supremacy with Russia for the all-important Far Eastern market, with fellow OPEC member Iraq over Europe and with large non-OPEC producers such as Angola.

Saudi Arabia and its ally/protectorate Kuwait are pretty much taking on every other producer to increase both their market shares and their weight inside OPEC, whose role has been often called into question due to the large scale use of fracking and the discovery of large oilfields ouside the OPEC reach, such as in Brazil and Kazakstan.

The Saudi/Iraqi fight for supremacy in Europe was born when Iran, one of Europe’s most important suppliers, was effectively driven off the market by sanctions. Instead of simply splitting the Iranian loot among themselves, Saudi Arabia and Iraq started to fight among themselves with a ferocity rarely seen before among OPEC members. There are suspicions the Iraqi may be pumping Iranian oil (with Teheran’s tacit blessing) from Kuzestan, thus both bolstering its production and allowing Iran to partially circumvent sanctions. Regardless, should Iran be back in the fray by the end of 2016, it will be curious if this will become a three way fight or Iran and Iraq will form an alliance of convenience against the Saudi.

I confess I am not very up to date regarding US natural gas production and market dynamics.

What I can tell is the Russians have been flooding Western Europe with natural gas like never before. Price has declined 42% year on year at entry points in Germany and Austria. They are driving Norway’s Statoil against the wall and North African producers, such as Algeria and Tunisia, are feeling the pinch as well, as France and Italy shift their preference to dirt cheap Russian natural gas. They are being forced dropping their prices to survive the Russian onslaught.

Just yesterday the Bulgarian government announced work on the South Stream pipeline will resume. Bulgarian PM Boyko Borisov explictly told he had “the EU sanction” to resume the project (now fully owned by Gazprom, which bought out Italy’s ENI and France’s EDF): all of Washington’s maneuvering to both deny Russia a market and favor its Gulf Allies have come to naught.

To this it must be added the question mark that is the potentially largest natural gas producer in the world: Iran.

Teheran would just love exporting all that natural gas but has to find a way to latch unto the network of pipelines connecting Central Asia to both China and Western Europe, the two most interesting potential markets.

When you hit Peak Oil does Wolf carry on about this subject as often as we have lately about the glut? It could happen any year.

“Peak Oil” is a just a term for academic exercise. I have a book on my shelf titled “When the Oil Wells Run Dry” written by an engineer in 1945!! We will likely never know peak oil as we keep finding more petroleum in non-conventional environments of deposition and creating new technology to bring it to surface.

Environments of deposition. Nice seeing that term here, as it was my area of expertise academically and in the industry. It gives me a warm and fuzzy feeling. Just one thing to add. There aren’t really any new EoDs. We have known the petroliferous nature of unconventional resources like some shales, very fine grained sandstones and coal for a long time. And while technology is important, the major development that brought fourth exploration for and production of these resources was the $80+/bbl oil price and the $5+/mcf gas price.

Regards

Two things I would keep an eye on. First, storage which is at record levels. This “excess capacity” overhangs the market somewhat and depresses prices. When we see some this being liquidated that should be at least a modest positive. Second is the U.S. dollar. Dollar strength has exacerbated some of the commodity carnage witnessed recently. If we assume (and I’m way out of consensus here I know) that the Fed reverses course, aborts the rate rise strategy and re-embraces QE, this might also help commodities as well as gold.

Merlin,

Your statement is partly true, but misses ‘cost’. Certainly unconventionals can ramp up, but at what cost? They are already drilling 10,000 feet++ in 10,000 feet of water. Ask Petrobas how well their deepwater is doing?

My wife and I do just fine with gas at a rate of $5.00/US gal. We don’t need to drive all that much and are financially secure. But if our modern industrial economies with their corpulent….ooops oppulent lifestyles are forced to use $5-$10 gas all bets are off. The collapse would be so loud our ears would hurt. That would be right before the whining, “You didn’t tell us we shouldn’t burn all the cheap easy stuff first”.

Yeah, I’m sure people just change their energy consumption habits just because they see $10 crude that is priced way out of fundamentals, and forget that same crude was priced $100+ only 2 years ago.

Not to mention the same average joe shmoe won’t even see most of the savings in crude anyway.

Mark my words – Expect some sable rattling and armed conflict in ME, soon

Saudis and their Sunni minions and Iranian with their Shite cousins are all loathing the low oil prices not to mention deep hatred that run thousands of years. So what to do? How about some lobbing bombs over the narrow strait thru which bulk of the ME oil must pass thru? Oil price sky rockets and longer they pretend to be in “limited” war the better for their depleting treasury and only way to appease the people.

BTW – all of 9/11 terrorists were Saudis, Osama, Al Queda and the new puppets they created ISIS/ISIL

The opec countries need the revenue flow to keep paying their debts. This is also true for fracking operqtions as well. Add Iran to the mix and oil will keep being pumped. The real question is what will upset this trend? Yeah, war looks like the answer.

First we got the Russians hooked on cheep loans to ramp up their oil production to 10 million barrels per day when the oil was $100 per barrel. Then we cut them out from western finances which made it impossible for them to roll over the debt. Then we crashed the oil price to 50… 40… 30 USD. The ruble followed and crashed by 30… 40… 50 per cent, the Russians still get as many rubles for the oil, which makes it possible for Russia to run their oil companies, since the production is in rubles.

Today we give the Russians $30 per barrel and then we demand them to give us the small profit they make to pay us the money they own us.

Is this “theft” ?

This is the kind of thing that I don’t understand. OK, the Russians borrowed money when oil was high. Suppose no one would lend them money then? That would have been just as aggressive. So the world produced too much oil and the price crashed? How did ‘we’ do that? Fracking companies in the United States did it, oil sands companies in Alberta did it, oil companies everywhere in the world did it, it’s not a conspiracy — it’s a misallocation of resources, which happens all the time under capitalism.

C’mon ! What’s the fun in that ? It’s business as usual !

History shows that when the oil price comes back, it comes back with a bang. It is anybody’s guess how much of this excess oil is due to lower price, which forces producers to pump more oil to survive. That leads to more rapid depletion of reserves, and they are not making cheap oil any more. Hedge accordingly.

Hopefully Putin will also expose further truths while defending Russia’s interests, I felt a collective sigh and a palm to the forehead when he revealed ISIS was stealing Iraqi oil..

I wouldn’t be surprised to hear Saudi Arabia has been creating genocide against the Shiites tribes occupying eastern Saudi Arabia where algae collected millions of years ago eventually becoming oil fields.

Why oil under $30 per barrel is a major problem

A person often reads that low oil prices–for example, $30 per barrel oil prices–will stimulate the economy, and the economy will soon bounce back. What is wrong with this story? A lot of things, as I see it:

1. Oil producers can’t really produce oil for $30 per barrel

A few countries can get oil out of the ground for $30 per barrel. Figure 1 gives an approximation to technical extraction costs for various countries. Even on this basis, there aren’t many countries extracting oil for under $30 per barrel–only Saudi Arabia, Iran, and Iraq. We wouldn’t have much crude oil if only these countries produced oil.

2. Oil producers really need prices that are higher than the technical extraction costs shown in Figure 1, making the situation even worse.

Oil can only be extracted within a broader system. Companies need to pay taxes. These can be very high. Including these costs has historically brought total costs for many OPEC countries to over $100 per barrel.

Independent oil companies in non-OPEC countries also have costs other than technical extraction costs, including taxes and dividends to stockholders. Also, if companies are to avoid borrowing a huge amount of money, they need to have higher prices than simply the technical extraction costs. If they need to borrow, interest costs need to be considered as well.

3. When oil prices drop very low, producers generally don’t stop producing.

There are built-in delays in the oil production system. It takes several years to put a new oil extraction project in place. If companies have been working on a project, they generally won’t stop just because prices happen to be low. One reason for continuing on a project is the existence of debt that must be repaid with interest, whether or not the project continues.

Also, once an oil well is drilled, it can continue to produce for several years. Ongoing costs after the initial drilling are generally very low. These previously drilled wells will generally be kept operating, regardless of the current selling price for oil. In theory, these wells can be stopped and restarted, but the costs involved tend to deter this action.

Oil exporters will continue to drill new wells because their governments badly need tax revenue from oil sales to fund government programs. These countries tend to have low extraction costs; nearly the entire difference between the market price of oil and the price required to operate the oil company ends up being paid in taxes. Thus, there is an incentive to raise production to help generate additional tax revenue, if prices drop. This is the issue for Saudi Arabia and many other OPEC nations.

Very often, oil companies will purchase derivative contracts that protect themselves from the impact of a drop in market prices for a specified time period (typically a year or two). These companies will tend to ignore price drops for as long as these contracts are in place.

There is also the issue of employee retention. In a sense, a company’s greatest assets are its employees. Once these employees are lost, it will be hard to hire and retrain new employees. So employees are kept on as long as possible.

The US keeps raising its biofuel mandate, regardless of the price of oil. No one stops to realize that in the current over-supplied situation, the mandate adds to low price pressures.

One brake on the system should be the financial pain induced by low oil prices, but this braking effect doesn’t necessarily happen quickly. Oil exporters often have sovereign wealth funds that they can tap to offset low tax revenue. Because of the availability of these funds, some exporters can continue to finance governmental services for two or more years, even with very low oil prices.

Defaults on loans to oil companies should also act as a brake on the system. We know that during the Great Recession, regulators allowed commercial real estate loans to be extended, even when property valuations fell, thus keeping the problem hidden. There is a temptation for regulators to allow similar leniency regarding oil company loans. If this happens, the “braking effect” on the system is reduced, allowing the default problem to grow until it becomes very large and can no longer be hidden.

More http://ourfiniteworld.com/2016/01/19/why-oil-under-30-per-barrel-is-a-major-problem/

Beginning of the End? Oil Companies Cut Back on Spending

Steve Kopits recently gave a presentation explaining our current predicament: the cost of oil extraction has been rising rapidly (10.9% per year) but oil prices have been flat. Major oil companies are finding their profits squeezed, and have recently announced plans to sell off part of their assets in order to have funds to pay their dividends. Such an approach is likely to lead to an eventual drop in oil production.

I have talked about similar points previously (here and here), but Kopits adds some additional perspectives which he has given me permission to share with my readers. I encourage readers to watch the original hour-long presentation at Columbia University, if they have the time.

Controversy: Does Oil Extraction Depend on “Supply Growth” or “Demand Growth”?

The first section of the presentation is devoted the connection of GDP Growth to Oil Supply Growth vs Oil Demand Growth. I omit a considerable part of this discussion in this write-up.

Economists and oil companies, when making their projections, nearly always make their projections depend on “Demand Growth”–the amount people and businesses want. This demand growth is seen to be rising indefinitely in the future. It has nothing to do with affordability or with whether the potential consumers actually have jobs to purchase the oil products.

Kopits presents the following list of assumptions of demand constrained forecasting. (IOC’s are “Independent Oil Companies” like Shell and Exxon Mobil, as contrasted with government owned companies that are prevalent among oil exporters.)

More http://ourfiniteworld.com/2014/02/25/beginning-of-the-end-oil-companies-cut-back-on-spending/

A Glimpse Of Things To Come: Bankrupt Shale Producers “Can’t Give Their Assets Away”

The end of America’s oil “miracle” is coming and there’s nothing Wall Street can do to stop it. At this point in the game, no one is going to finance the oil patch’s cash flow deficits and the fundamentals in the oil market are laughably bad. As Bloomberg reports, Wall Street is about to have a serious bout of “indigestion” because recent auctions suggest that “some bankrupt oil and gas drillers can’t give their assets away.”

http://www.zerohedge.com/news/2016-01-20/glimpse-things-come-bankrupt-shale-producers-cant-give-their-assets-away

For some reason my Warren Buffett comments didn’t make it… let’s try again:

Warren Buffett’s Berkshire lost $11 billion in market selloff

Warren Buffett’s $390 million loss on Wal-Mart’s stock is nothing next to the Walton family’s loss

Warren Buffett loses $2 billion in two days

Warren Buffett says he’s lost $2 billion on IBM

Warren Buffett: My $100 billion blunder – Fortune

Warren Buffett is far from infallible….

He does seem to do quite well when he trades on insider info handed to him by Obama though….

I think that is referred to as cronyism…

They did “make it,” but you put them under a different article. They’re right here, links and all:

http://wolfstreet.com/2016/01/17/facing-the-reality-of-a-bear-market-in-oil-and-stocks/#comment-28744

Also, my system puts any comment in the moderation queue that has more than one link and exceeds a certain length. I have to release it then, which can take a little while, so you might no instantly see it.

Thanks for the clarification. Will try to keep them shorter and without so many links.