Total US business inventories balloon to Lehman-Moment levels

“We do have more work to do in the US,” admitted John Bryant, CEO of Kellogg’s which makes Pringles, Pop Tarts, Kashi Cereal, and a million other things that consumers are increasingly reluctant or unable to buy. He was trying to explain the crummy quarterly results and the big-fat operating loss of $422 million, along with a lousy outlook that sent its stock careening down 4.5% during the rest of the day.

Then in the evening, ConAgra, with brands like Healthy Choice for consumers and something yummy they call “commercial food” for restaurants, cut its fiscal 2015 earnings guidance, citing a laundry list of problems, including the “strengthening dollar” and “a higher-than-planned mark-to-market loss from certain commodity index hedges.” But it blamed two operating issues “for the majority of the EPS cut: “a highly competitive bidding environment” and “execution shortfalls.”

After which confession time still wasn’t over: it would be “evaluating the need” for additional write-offs. What had gone well? Cost cutting – “strong SG&A efficiencies,” the statement called it. But the pandemic cost-cutting by corporate America represents wages and other companies’ sales.

It’s tough out there for companies that have to deal with the over-indebted, under-employed, strung-out American consumers with fickle loyalties and finicky tastes, who have been subjected to this corporate cost-cutting for years.

And so retail sales, according to the Commerce Department, dropped a seasonally adjusted 0.8% in January. That’s on top of a 0.9% decline in December. The hitherto inconceivable is happening: folks are saving money on gas, but not everyone is immediately spending all that money! It’s so inconceivable that I warned about it and other effects of the oil price crash two months ago: “Wall Street promises a big boost to US GDP,” I wrote. “What have these folks been smoking?”

But even excluding gasoline sales, retail sales were flat last month after edging down 0.2% in December. And sure, some of the savings from gasoline will be spent eventually, but there are plenty of Americans with enough money left over every month to where their spending patterns aren’t influenced by the price of gas.

But this report, an advance estimate that is subject to potentially large revisions, covers only spending at retailers and restaurants, a portion of total consumer spending, which includes healthcare and anything else that consumers pay out of their noses for. And year-over-year, retail sales actually rose 3.3%, with food services sales up 11.3%, auto sales up 10.7% thanks to prodigious subprime financing, while sales at gas stations sagged 23.5%.

So from just the retail sales report, the consumer situation remains murky.

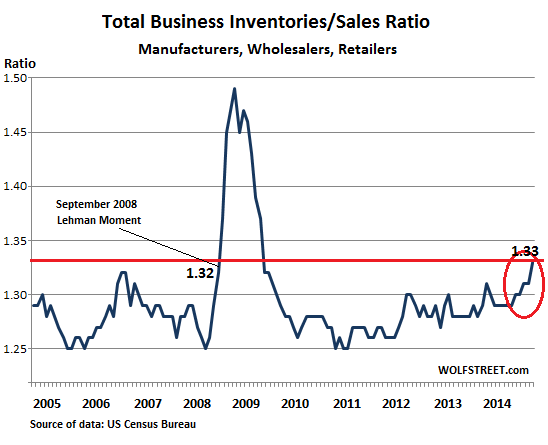

But there is another gauge that is moving deeper and deeper into the red. It has been deteriorating consistently since last summer. A couple of days ago, I reported that wholesale inventories were ballooning in relationship to sales, a red flag in our era when just-in-time delivery and lean inventories have been honed into an art to minimize how much working capital and physical space gets tied up. The crucial inventories-to-sales ratio for wholesalers had reached the highest level since the financial crisis.

Now the Commerce Department released total business sales and inventories for December, which include sales and inventories at retailers, wholesalers, and manufactures – the entire channel. And it’s even worse.

Combined sales by retailers, wholesalers, and manufacturers, adjusted seasonally but not for price changes, dropped 0.9% from November, and was up only 0.9% from December 2013 – not even beating inflation.

Retailers were able to keep their inventories stable in relationship to sales, which inched up 2.6% year-over-year. So the inventories-to-sales ratio remained at 1.43.

Further up the channel, wholesalers saw sales rise only 1.43%, but their inventories stacked up, and the inventories-to-sales ratio hit 1.22, up from 1.16 a year earlier.

And manufactures? That great “manufacturing renaissance” in the US? Year over year, sales declined 0.9%, but inventories rose 2.7%, and their inventories-to-sales ratio jumped to 1.34 from 1.29 a year earlier.

For all three combined, the inventories-to-sales ratio rose to 1.33 in December, after climbing methodically since summer. The last time it was rising to this level was in September 2008 – the Lehman Moment – when sales up the entire channel were beginning to grind to a near halt, a terrible condition that morphed into the Great Recession. That propitious September, the inventories-to-sales reached 1.32, still a smidgen below where it is today:

Optimistic merchants and manufacturers expect sales to rise. They plan for it and order accordingly. If sales boom and draw down inventories, the inventories-to-sales ratio remains lean. That’s the rosy scenario. But that hasn’t been happening recently.

In our less rosy reality, sales are not keeping up with expectations, and inventories are piling up. The increase in inventories adds to GDP, and so from that point of view, they beautify the numbers. But from the business point of view, growing inventories caused by lagging sales can turn into a nightmare. And unless sales can somehow be cranked up for all businesses across the entire country to bring down these inventories, orders to suppliers will be trimmed – and that ricochets nastily around the economy with all kinds of unpleasant secondary fireworks.

“Here in Houston a number of projects have been canceled, engineers are put on ‘hold,’ and everyone is waiting for the other shoe to drop,” an engineer in the energy sector wrote. “Not pushing the panic button by any means” is how the Texas banking regulator phrased it. But it’s looming in front of everyone. Read… Oil Bust Hits Office Construction Boom, Banks, Suppliers – But Hey, “So Far” No Apocalypse

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

More good insights into the coming “SNAP DEPRESSION”. A term I am suggesting for the rapid drop in economic activity for no explainable reason, save one: People have finally figured out how bad the situation really is.

Of course there will be pockets here and there of spending and profits but by-and-large, this stark realization has settled in on the vast majority of average Americans.

I see 2015 as a crisis year. The Fed is major boxed in with policy and perceptions. Congress and the President will be unable to come together for the next 2 years. Internationally, grand chess master Putin likely has a few surprises left to unhinge the American imperial status; enough to throw into further doubt our future. These things are already conspiring to bring down the economy.

I am a retired business analyst. Inventory was a small specialty of mine. What many people do not realize is that inventory is simply another way of saying money. As inventories rise, an increasing portion of your operating capital is tied up. Even worse, there are carrying costs associated with inventories including storage, handling, insurance, taxes, and in the case of food products, spoilage. Offsetting those costs without even larger layoffs won’t be easy. If sales don’t start moving soon, there will be hell to pay.

The business inventories to sales chart looks much different when viewed in longer-term historical perspective (1992 to now). You can access it from the FRED website: http://research.stlouisfed.org/fred2/series/ISRATIO

Prior to 2005, the ratio was always greater than 1.30. Indeed, the average appears to be between 1.4 to 1.5. Could the author comment on the data points prior to 2005? Why should a ratio of 1.32-1.33 indicate a critical threshold?

You’re right. Inventory management, which has become an obsession, has become much better over the past decades, with just-in-time delivery, automated electronic real-time ordering (forget that monthly stock order), computerized tracking of merchandise and materials throughout the supply channel, and a million other innovations.

As Jungle Jim has pointed out, “inventory is simply another way of saying money.” Every business tries to minimize the amount of money tied up in inventories.

So what we SHOULD see is a continuation of the dramatic long-term decline of the inventories/sales ratio. What we ARE seeing now is the opposite.

Why is this important: because someday, businesses around the country – these are national numbers – will get their inventories back in line, either by increasing sales or by cutting orders. Since sales aren’t going where everyone wants them to go, businesses will eventually cut orders to fix the inventory problem. And in the past, that triggered business-cycle recessions.

Very perceptive comments!

I believe we will see the economy meet the definition of a recession this year.And that is with every buerocrat in the fed govt hell bent on making the numbers look as good as they can.

I think what remains of the middle class “got it” years ago…about 2006. What’s happened now is that the plug has been pulled on life support: QE is finished and now the patient in going into convulsions… Which would have been ancient history by now if deleveraging has taken place instead of getting bought off with more debt.

Five years from now, these will be ‘the good old days’. Its not a pretty picture.

I may sound like a broken record, but consumers have changed the way they shop and the CEO’s haven’t noticed. Middle class families use to be aspirational and boast about all the expensive things they bought, but no more, now they boast about the latest bargain.

To illustrate my point further, there is now a popular show on one of the cable channels called Extreme Couponing, where they show you how to shop in supermarkets and get free or near free items. You can acquire hundreds of dollars worth of products at zero or near zero prices. The single biggest point the show makes, inadvertently, is that there is no brand loyalty any more. Price is everything. The fact that the CEO of Kelloggs doesn’t know this, speaks to his distance from his customer, and he has plenty of company in the C-Suites.

Good points about the middle and working class consumer. True purchasing power is shifting ever upward on the class scale, and billionaires tend to spend more on jewelry and designer beauty products, less on Pop Tarts. Every new boutique mall developer is chasing after retailers like Tiffany and Sephora.

But Nestle, Kelloggs, etc. seem to be fighting back. Next time you go grocery shopping, look at the actual choice of brands in a given product. On my local supermarket shelves there is often just ONE MAJOR BRAND taking up endless shelf space. Last visit I calculated something like eight linear feet of Bush’s baked beans and absolutely no other choice, period. Same with canned soup, boxed rice, wine and so on. If you want something else, you’ll have to lie on the floor or climb a ladder to find it.

Hard not to suspect what I’d call kickbacks isn’t involved.

What I have noticed is the fake bottom on the Hagendaz pint of ice cream.Is it getting deeper?I have switched brands when wanting a premium ice cream.Also Post cereal boxes are smaller so is the content bag.I do not like when manufacturers resort to trickery.

In the mean time the stock indices are hitting all time high along with margin borrowing while stock hitting 52 week low is growing.

Hmmm… last time this happened was, ahem, fall of 2008?

The market can remain irrational far more that the bears can remain solvent.

The stock market (and several other key markets) are being supported/propped by the Fed/Treasury, et. al. These are not free markets a anymore. The reason they are being propped is obvious. They believe the stock market represents to most the health of the economy. Therefore, if the stock market is UP, life is good. Also, most of the insurance industry and pension systems rely on an up market. So up it stays.

The Fed and government will keep it propped up until they can’t. Simple as that. The can’t will be a black swan event that nobody anticipated that will shock the average person into selling. The Fed cannot keep the market up if there is a tsunami of selling. Right now, volume is very low but masked by all the HFT trading. That is also why the government won’t shut down HFT; they need it to hide the sorry stock market volume.

Mike R. said, “The stock market (and several other key markets) are being supported/propped by the Fed/Treasury, et. al. These are not free markets a anymore.”

We don’t get such a precisely concise understatement that often, that I should let this inviting opportunity go to waste.

Consider, encyclopedic volumes have been written about why the price of a barrel of oil recently has dropped 50% It’s laughable when the reality that escapes everyone’s analysis, is so broad and as I already said, understated.

Why did the price of oil drop? Because it’s rigged.

The truth is, there has been a huge glut and continually growing oversupply of oil since the Lehman moment. And what occurred as this oversupply grew, and grew and grew? The price of a barrel of oil doubled and then tripled.

Why did the price of oil continue to go up for five going on six years post Lehman? Because it’s rigged.

The very same reason the price of a barrel of oil recently dropped so precipitously.

Literally everyone involved had this little oil-market maneuver well in hand, completely controlled, measured and taken advantage of, LONG before the price of a barrel of oil budged a nickel.

Yes, we live in interesting times. But don’t think for a moment there’s one chance in a million that Russia isn’t doing exactly what it’s been asked to do. Things have not been better in Russia in a thousand years. Do you know why things have not been better in Russia in a thousand years?

Because Boris Yeltsin cut a deal. And that deal has given Russia the Golden Key to prosperity and security.

Now, get out there and do you part too. Everything is well in hand. The dollar is not going to collapse. And the United States is not going to fold. So just stop biting your nails, and being an alternative media, Nostradamus-wannabe clairvoyant phony and BTFD!

There’s money to be made! I wish the all could be California GIRLZ!

Perhaps Don Robertson would be kind enough to elaborate in a tangible way on his claims about the “Russian deal” and if he has the real key to making a profit off the current situation then please let us in on his secret.

It is obvious to a lot of us that the entire Reality Space is being manipulated and that the financial markets are rigged. What is not so clear is what the end game is, who is controlling it, and how to play and benefit from whatever the agenda is.

Most of us are full time some-thing else’s, not full time investors or financiers. We’re just trying to figure out a safe place to save money to pay for our retirements and leave something to our children. We have no desire to be junkie gamblers with the audacity to believe we can outguess the Fed or GS/JPM computer alogrithms. I have a BSEE and an MSEE and have designed pacemakers and implantable defibrillators for 30 years while raising 4 children, most that time as a single mother. I am by no means stupid or lazy. However, the “logic” of the current market is beyond me as it appears to be rigged and manipulated by several powerful factions working in concert for their own benefit at the demise of the outsiders like me. They drive the markets and public opinion any way they wish with Fed e-dollar volume and social-media behavioral engineering, herding the markets and muppets one way, then abruptly creating chaos and benefitting from the 180-degree stampede.

3 years ago I attended a private presentation by Proctor and Gamble on the state of the economy. It was eye opening to understand how they saw the consumer market. They stated that there were 3 main groups of public consumers. By far the largest was single head of households, with a mean income of 37K per year feeding and housing multi-generations in near poverty, whose major economic outlays were housing and transportation. They asked the rhetoric question, “How the heck do you sell them anything?” The answer was lower quality, smaller size, and lower margins. The next largest group was retired people whose major economic outlays were medical, travel, and pets. Then the other group was single males whose major economic outlays were electronics and internet services. Neither of the latter presented great opportunities for growth for P&G either.

Thoughtful Girl is absolutely right. There’s no out-guessing the FED. We all must begin to feel really stupid by understanding the FED has a constituency, which is the banks, which are mostly impossibly insolvent due to deflationary times for the credit markets. These deflationary times are being intentionally inflicted to scuttle the poorly thought out and now declining ascendency of the dull, plodding and methodical Chinese government.

Now concerning, providing for a family. Put your money in the bank. There’s nothing like money in the bank.

Gold isn’t even like money in the bank. You don’t buy the groceries or pay the rent with gold. In fact, it’s just about to be proven for all time, that gold has become just another manipulated commodity. That’s a small PART of the end game right now.

It’s like I told a lifelong friend of mine just recently. He’s in Hanoi. I’m in northern Maine, 250 mile NE of Montreal, Quebec. It’s nice here, in the summertime. It’s nice in the winter time too, if you’re a snowy owl come south from the tundra of northern Ontario.

My friend in Hanoi was considering buying gold just now. He mentioned it to me, seemingly asking me what I thought of his intention.

I suggested he buy copper instead. Copper has really been beaten down. It’s suffering because the Chinese government has stepped in, to demand that Chinese businesses stop using copper as a monetary metal and as collateral (shadow banking) in their offshore trading.

(The Chinese are being forced to devalue the Yuan. And Chinese businesses with large amounts of capital tied up in monetary metals, will cheat the devaluation scheme, potentially making the communist government look more crooked than it really is.)

My impression is, gold can really get beaten down a lot more still. An ounce of gold at ~ $1250 an ounce seems like a big price to pay for a thimble-and-a-half full of a yellow metal that has very few viable commercial or industrial uses left anymore, because the price has been driven so high.

The U.S. government has had an ongoing strategy meant to drive the price of gold higher and higher. That’s my take on the gigantic worldwide mouse trap they’re building. No one believes me on that count. But, time, and a very loud CLAP of the trap shutting, is going to make believers of everyone, is my guess.

Copper on the other hand is in constant demand. It is generally, or partially, consumed in the processes of its industrial use. And there’s no cheap way to get copper out of the ground. (Gold also can be a byproduct of copper production.)

I’m not saying stockpile copper, even if that might be a good strategy for companies that use copper in their manufacturing processes. I’m saying, buy copper miners that are stable, multi-billion-dollar companies that aren’t going to go belly-up from a single, simple miscalculation about where the ongoing market manipulation is going to deliver us next week.

I say this, because copper has suffered its price drop. Sure copper could go lower. But it also could go higher too. There’s a window of opportunity only so big. And patience is the key word. Markets get shaken up and down repeatedly to move the weak-kneed players out of the money.

Other than that, with what you can afford to play in the market, buy large caps that are going to continue to rise as they have risen since the massive decline forged by the intentional Lehman collapse. The five year DOW and S&P 500 charts show exactly what is going on.

I do not expect that trend to change one bit. The markets are rigged. Buy low, and don’t sell because you think whatever you’ve bought has gotten too high, and cannot go any higher. Everything has gotten higher than that, repeatedly for going on six years now. The large drops are -nothing- compared to the ongoing bull market.

But what ever you do, do not put more money on the line, more than you can simply ignore, and check once a week or once a month.

Volatility is guaranteed. But looking at what’s been the trend since the initially (wholly contrived) collapse, investing in the USA is where all the money is going to end up before too much longer.

Why? Because everyone else is taking it in the pants!

Exxon/Mobile is still doing exploration work for Putin’s Russia, right now. You tell me who’s going to rock the boat.

India is now growing faster than China. And my buddy in Vietnam says things are budding there too.

But understand, in the bedroom drawers, and under the mattresses of every modest home everywhere in the world, peasants and laborers are still squirreling away dollars. And when some oligarch from China decides he really does want to relocate his family outside the confines of overpopulated, vastly polluted, communist Asia, he puts all his money into dollars first, and then he buys real estate somewhere in the U.S. of A.

Take a look around, Thoughtful Girl. Life is pretty good. Sure, it’s a drag to be stuck inside of Mobile with the Memphis blues again…

But it’s far and away better than being stuck in polluted Shanghai with a hundred million Elvis wannabes.

I knew Kellogs was in trouble. They are one of our key shippers but the freight has dropped off as of late. General Mills is kicking their butts on price.