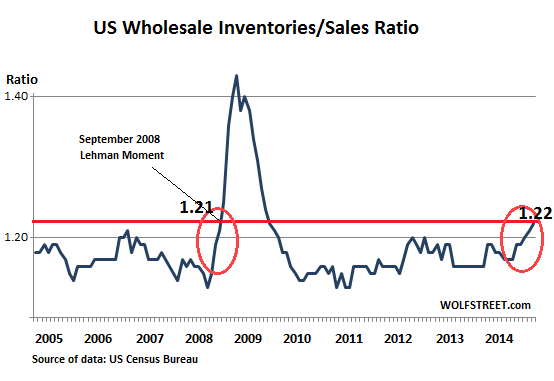

Wholesale inventory-sales ratio balloons to Lehman-Moment levels.

A lot of economists, particularly those quoted in the media, claim that rising inventories are a sign of confidence, that merchants believe that the future is rosy, that sales will be good. There is some truth to that. Merchants stock up for expected good times. But when these hopes of good times turn into sales that are less than rosy, these inventories begin to pile up, and the ratio of inventories to sales suddenly takes a nasty turn.

Inventories tie up precious working capital, so companies manage them aggressively. But in the US, wholesale inventories have been ballooning since summer. And they now have become a red flag for the economy.

Part of the problem: hopes meet crummy sales. December sales by merchant wholesalers (except manufacturers), adjusted seasonally but not for price changes, fell 0.4% from November to $449.8 billion, the Census Bureau reported today. Year-over-year, they rose a mere 1.4%!

The good part: sales of durable goods jumped 7.3% from a year ago, with a number of big gainers, including electrical equipment up 13.4% and metals up 14.3%. But non-durable goods sales dropped 3.5% from a year ago. Wholesales of petroleum products, including gasoline, plunged 13.7% for the month and 29.4% from a year ago.

Among non-durables, drug sales – not including pot and other things that are still controlled substances on the federal books – rose 17.8% from a year ago to $44.7 billion in December, in line with America’s intention of turning an increasing part of its wealth over to Big Pharma.

But wholesale inventories rose to $547.6 billion by the end of December, up 6.7% from December 2013 – though sales had inched up only 1.3%.

Durable goods inventories jumped 7.8% from a year ago. Among the standouts: automotive up 9.3%, computers up 12.6%, metals up 13.0%, hardware up 12.8%. Among nondurable inventories, drugs shot up 19.9%. But don’t blame petroleum products, such as gasoline held by wholesalers, for the rise in inventories: petroleum products inventories plunged 19.1%

The crux of all this is the ratio of inventories to sales. It shows the level of inventories wholesalers carry in relationship to their sales. It indicates whether they’re short on inventories or overstocked.

In December, the wholesales inventory-to-sales ratio reached 1.22, after rising consistently since July last year, when it was 1.17. It is now at the highest – and worst – level since September 2009, as the financial crisis was winding down:

Rising sales gives merchants the optimism to stock more. But because sales are rising in that rosy scenario, the inventory/sales ratio, depicting rising inventories and rising sales, would not suddenly jump. But in the current scenario, sales are not keeping up with inventory growth.

OK, sales of gasoline and other petroleum products plunged as the price plunged. But their inventories dropped too. At $16.9 billion, these inventories are always lean. Dwarfed by most other categories, they don’t impact overall inventories that much. The inventory/sales ratio for petroleum products rose to 0.34 from 0.30. So this isn’t the big cause of the inventory problem.

The cause is elsewhere. Some of the standouts: the inventory/sales ratio for Automotive rose to 1.56 from 1.52 a year ago, for Professional Equipment to 1.09 from 1.03, or for Computer Equipment to 0.88 from 0.79.

But unless an unlikely miracle happens on the sales side, wholesalers will begin managing their inventories more aggressively to bring them in line. And to do that, they’ll trim orders to their suppliers, which will percolate through the economy.

This was one of the things that happened in 2008, prior to the Lehman Moment. The inventories/sale ratio in January 2008 was 1.16 – just where it was in December a year ago. But then it rose. In September 2008, it reached 1.21, below where it is now. The next month, it hit 1.25. Check out the chart above. By then, the economy had entered a terrible downward spiral, with sales plunging and inventories ballooning, triggering a near shut-down of the ordering process throughout the pipeline. And even if something much milder happened these days, which is likely in the near future, it would still muck up our rosy scenario.

As the collapse of the price of oil is beginning to reverberate through the economy, the banks and private equity firms that have funded the fracking boom and benefited from it, must have a V-shaped recovery in place by late 2015, or else. Read… Wall Street Has a Dream About the Price of Oil

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Another good analysis of slowing conditions. We’ve been in a minor “boomlet” over the last two years. Domestically, it has been driven by, what else?, real estate development. Lots of apartments, infill single family houses and more commercial. Not that it’s actually needed; we have enough of all of it already but the developers (bless their little hearts) have to earn a dime and the banks as well. Anyway, this is coming to an end. Where I live in Charlotte NC, the single family buildout is ending, existing house sales have stalled and while apartments are still being announced, I give that bubble till mid-2015 before the banks shut the funding spigot.

Of course the rest of the world is in the ditch in a major way, so what remaining economy we have in exports is taking a big hit.

Finally, even auto sales are slowing/running out of steam. Most of the people that couldn’t live without a new car after the doldrums of the past 7-8 years have gone out and borrowed again…..the usual suspects. Rick Rodeo and his shiny new pick-em up truck. The typical BMWs and a few mini-vans to boot.

So I agree fully that this boomlet is winding down. It was not sustainable and was fed again by credit and investments in non-productive assets.

It will be quite interesting to see what happens next.

The sales numbers are not keeping up because of all the discounting. Every time I walk into a store I head for the sales rack. If I don’t need it and it’s not a good deal I don’t buy it. On my last shopping trip the bill was $49 with savings of $81.

We are due for a downturn. Although in the nineties, the economic expansion was pretty long. I wouldn’t rule out the possibility of a repeat of the nineties:

“cautiously optimistic”

Up here in Canada, the real estate market is showing more signs of trouble. We now have the widest price gap between condos and houses we’ve ever seen. Of course the MSM tells us it’s due to rabid demand for houses, but look below the surface and you’ll find massive over building of condos, and they’re not selling.

The official real estate stats reporting organization has gone so far off the deep end with its exaggeration of the numbers that lots of people are noticing. The consumer protection agency is in a heated dispute with them which is ongoing in the courts.

Canada is in much worse shape than anyone realizes and it’s just about to get far worse, thanks to oil.

I just finished reading “The Canadian Revolution: From Deference To Defiance” by Peter C Newman. It chronicles the transformation of Canada from a socialist state pre-Brian Mulroney, to an American satellite/ neoliberal state post NAFTA.

The author states that the early 1990’s was a time akin to the great depression in Canada. In fact, it seems from this book that Canada has been in some form of decline since the 1970s.

Given that that the Canadian dollar has dropped 20% in the last year, I’m wondering if all the Chinese buying up real-estate will get cold feet and dump their holdings.

Any Canadian care to comment on the state of the Canadian economy, and when was the last time things were looking up?

I’m in south Florida where Canadians in large numbers come for the season. They are all condo owners. Many Canadians bought during the bottom of our financial crisis at rock bottom prices. At the time they were the only ones with money. Those Canadians should have very positive equity. The season here is in full swing, all the expensive stores and restaurants seem to be holding on. From the look of things Canadians might be hedged by investments in the US.

We’re not due for a downturn. We never came out of the last one.

The Canadian economy can be best described with one word: Oil. Where is that these days?

I’m with Petunia on the bargain bin shopping. I also buy in bulk if it’s something we use at the house like detergent or paper products, coffee, canned goods etc. at a good price. We differentiate between needs and wants focusing primarily on needs. A new car isn’t a ‘need’, a dependable car is. The purchase of a new car is an emotional outburst.