Over the past 25 years, the yield curve predicted 4 business-cycle recessions, two of which didn’t come. So we handle it with care.

By Wolf Richter for WOLF STREET.

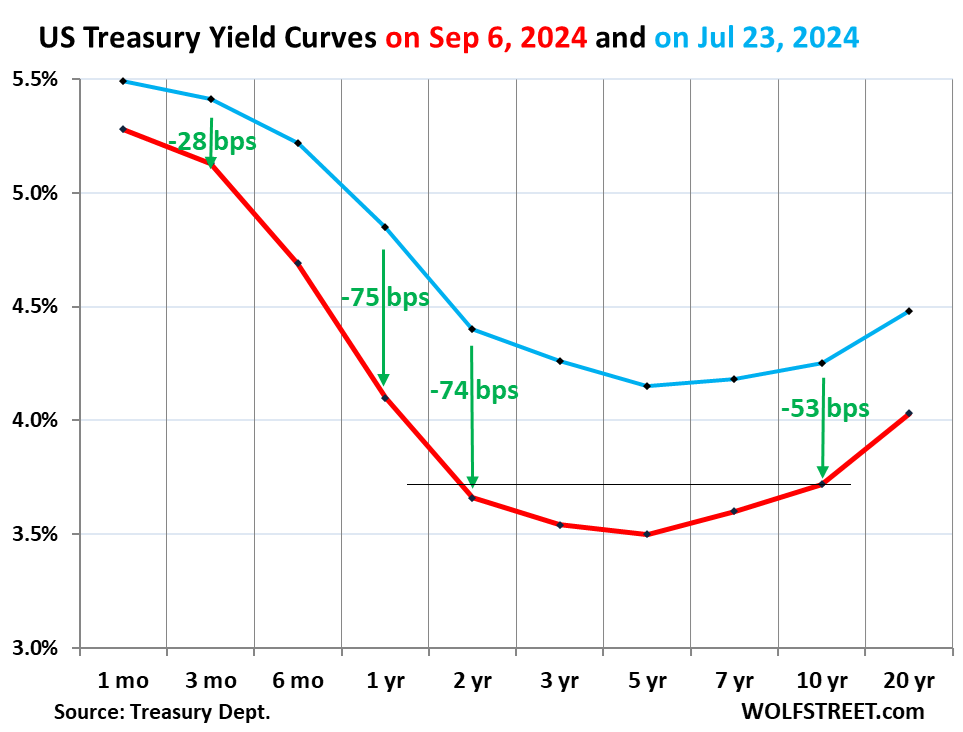

Following the jobs report on Friday that showed job creation had deteriorated from “decent” to “weak,” yields dropped across the board, except for the 30-year yield, which ticked up. Yields fell the most for 1-year maturities (-11 basis points) and for 2-year maturities (-9 basis points):

- 1-month yield: -2 bps to 5.28%

- 3-month yield: -2 bps to 5.13%;

- 1-year yield: -11 bps to 4.10%

- 2-year yield: -9 bps to 3.66%

- 10-year yield: -1 bp to 3.72%

- 30-year yield: +1 bp to 4.03%

Yields are now predicting a series of rate cuts by the Fed whose policy rates for now remain in a range of 5.25% and 5.5%.

The chart below shows the yields from 1-month to 30-year yields, on Friday September 6 (red) and on July 23 (blue). The green arrows and numbers indicate how many basis points (bps) yields dropped between those two dates, and that they dropped a lot more for 1-year and 2-year maturities than for 10-year maturities.

The 2-year yield fell 74 basis points from July 23 to September 6, and the 10-year yield fell 53 basis points. This steeper fall by the 2-year yield pushed it below the 10-year yield, and thereby that part of the yield curve un-inverted.

But the yield curve is still super-inverted at the short end; for example, the 10-year yield of 3.71% was still 141 basis points lower than the 3-month yield of 5.13% on Friday. The spread between them has been negative (inverted) since October 2022 and continues to be.

The yield curve is far from “normal.”

A normal yield curve (not inverted) for Treasury securities would curve upward all the way across. But currently, the yield curve remains far from “normal” and steeply inverted at the short end with a big sag in the middle.

Short-term yields are normally lower than longer-term yields, as investors demand more in interest to take the higher risks (inflation and rising interest rates) that come with longer-term securities. So in a normal Treasury yield curve, yields are higher the further the maturity date is in the future.

But parts of the yield curve began to invert in July 2022 when the Fed pushed up short-term yields via its big 75-basis-point rate hikes at the time, while longer-term yields were slow to follow.

So in July 2022, the two-year yield rose above the 10-year yield, thereby inverting. The rest of the yield curve inverted during subsequent months. In October 2022, the 3-month yield rose above the 10-year yield, and so the short end of the yield curve was inverted as well.

Partial un-inversion.

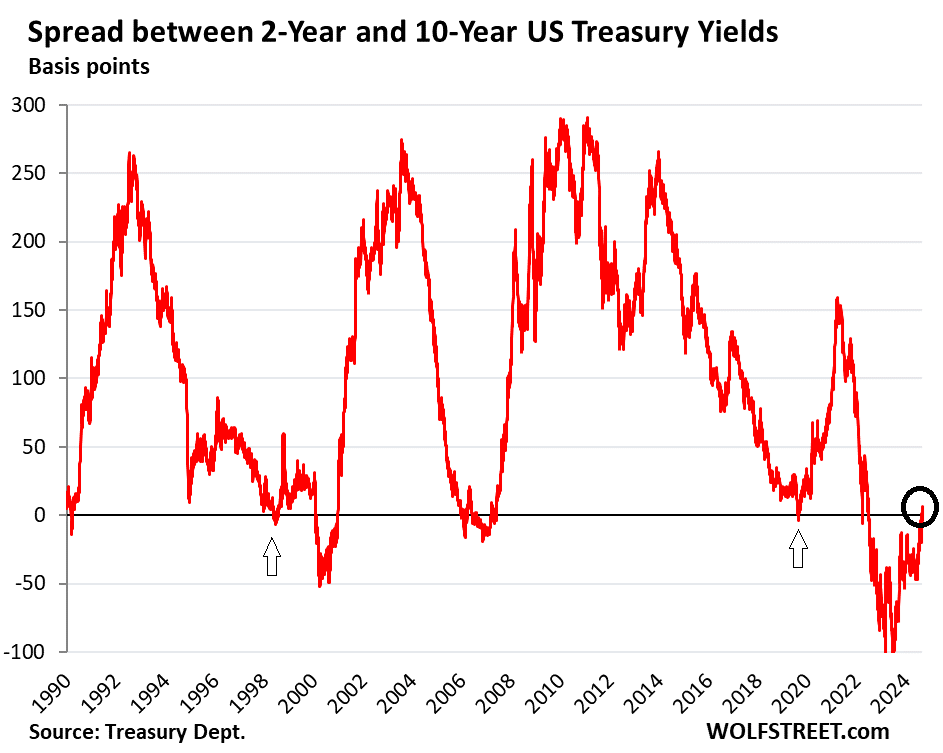

2-year to 10-year: Last week, as yields dropped generally, the 2-year yield fell faster than the 10-year yield, and fell below it, and that part of the yield curve thereby un-inverted.

On Friday, the 2-year yield fell 9 basis points to 3.66%, while the 10-year yield inched down only 1 basis point to 3.72%. So the spread between them was a positive 6 basis points, and that portion of the yield curve has now un-inverted, if barely (black circle in the chart below).

That portion of the yield curve briefly inverted and un-inverted in August 2019, which predicted a business cycle recession which then didn’t come. Six months after the un-inversion, we got a pandemic, but that’s not what yield curves predict or are supposed to predict.

It also inverted and un-inverted in 1998, and there was no recession either but a huge boom that would last into early 2000. And there was still no recession in 2000 (black up-arrows).

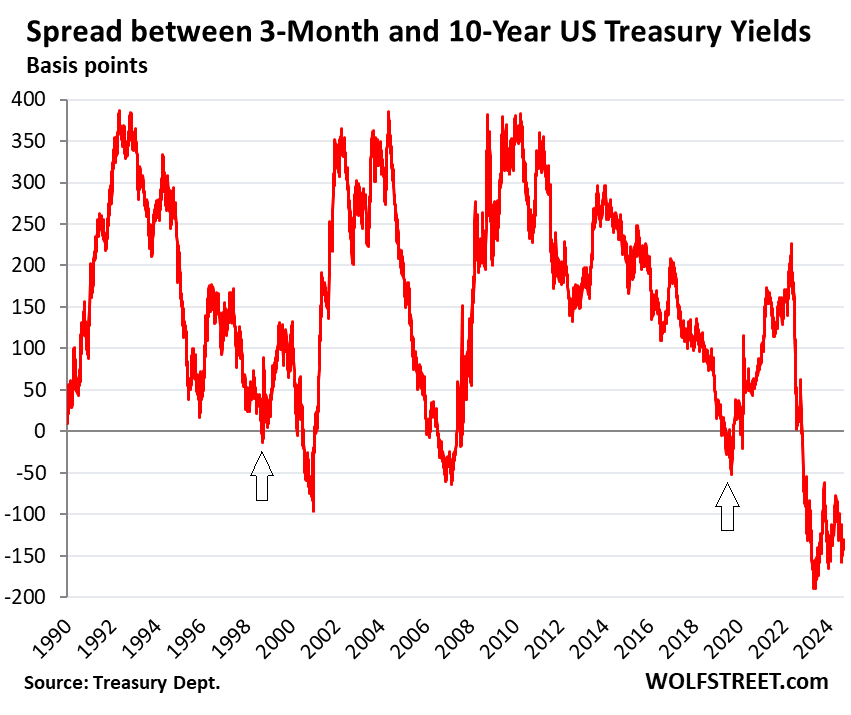

3-month to 10-year: With 3-month yields still at 5.13%, and the 10-year yield at 3.72%, this portion of the yield curve remains steeply inverted, with the spread between them at -141 basis points.

This part of the yield curve inverted in Jun 2019 and un-inverted in January 2020, and there was no business cycle recession either. But some weeks later, there was the pandemic, which yield curves do not predict and are not supposed to predict.

It also inverted and un-inverted in 1998, with no recession anywhere near (black up-arrows).

The yield curve and recessions.

The inversion and un-inversion of the yield curve was often followed by a business cycle recession. But QE started in 2008, profoundly distorting the Treasury market, and so when the Fed began cutting rates in 2019, after its feeble rate hikes through 2018 and QT through mid-2019, the yield curve inverted and then un-inverted, and there was no business cycle recession. What we got in March 2020 was a pandemic, which yield curves don’t and are not supposed to predict.

The yield curve also gave a false positive in mid-1998, when the yield curve inverted and un-inverted without business cycle recession anywhere near.

So that’s a very mixed record: Over the past 25 years, the yield curve predicted two business-cycle recessions that didn’t come (1998 and 2019), and two that came.

So we’re very careful not to put too much weight on the yield curve as a predictor of business cycle recessions. And now there are even more factors that interfere with the Treasury market’s ability to predict business cycle recessions, including the Fed’s heavy hand in the bond market at first via QE and now via QT, and now the Treasury Department’s heavy hand in the market via its bond buyback programs.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I think we can predict volatility and VIX going up until we have some more predictability in the market.

The Fed is in a no win position. If they lower rates significantly they will re-ignite inflation. If they raise rates or leave them alone then they risk a recession. Bernanke put us into this mess by keeping interest rates zero bound for almost a decade. Powell made the problem worse by taking too long to normalize interest rates. The federal government is spending like drunken sailors with no end in sight. Even with all this spending we are in an economy than is running on empty, heading for a recession or we are already in one. This will not end well. THERE IS NO WAY OUT. The smart money, like Buffet, is parked in short term government securities. The speculators are moving money into long term debt instruments to profit from the economic downturn, whenever that occurs.

You really look at all the data Wolf puts out and conclude “we’re in for a s*#+ storm”?

Dude the ice cream truck is just going to resupply, chill by the pool for a bit. 🍦

I think you have that wrong, it’s the people, especially the middle class that is in a no win position. The Fed is in a heads we win, tails the people lose position. They’re multi multi millionaires that can trade on insider information and nothing happens to them, not unlike congress.

NYguy

The middle class can do what Buffet is doing. Park your money in short term treasuries, get your 5% and sleep well at night.

Ehhhh BRK.A and BRK.B own a ton of stocks. It’s basically a mutual fund they own so many stocks.

So it’s not like he’s not 90% into stocks. If he’s sitting on cash too, well great.

Prob just looking for his next value buy to add.

T bill and chill at 5% rates is finished for now.

It seems to me that your lengthy narrative was selling the least likely political resolution too the glaring inconsistencies of life. Which one has too ignore as a matter of survival.

The asset markets are finally on the chopping block. Your rendition of the future makes it seem like a bad thing. Causing massive losses in the excessively over-priced asset markets.

People willing too pay cash for an established company stock that will pay them back in 30 years, based on the current P/E, is also a candidate for inclusion in today’s ironic episode,

I have been working in the financial markets arena since 1972 and can add some perspective to this analysis. The inversion in 1998 was probably caused by the spectacular failure of LTCM and both the Fed and the market reaction to it. The book When Genius Failed gives a play by play account of what transpired and that it famously ended with the Fed strong arming a group of about 10 investment banks into taking LTCM’s securities holdings onto their own balance sheets. The YC inversion reflected the Fed providing accommodation to the markets to support these purchases. I was at a fixed income mgt company at the time.

Yes, everything is always caused by something. And it doesn’t matter in terms of the yield curve being a predictor, because it un-inverts when the Fed cuts rates. Sometimes there’s a recession, and sometimes there’s not — that’s what we know. But that’s not very helpful.

Thx for that insight

The 98 and 19 inversions are often described as “brief”, so it’s not a surprise they are not predictive. Sustained inversions are more predictive. Maybe this time is different, but an inverted yield curve certainly predicts an un-inversion as an inverted yield curve is irrational.

Excuses, excuses, excuses, LOL

Interest rates and yield should not be swinging around going up and down all time time like a buoy in a storm but should be constant and stable over a long period of time. Interest rates should all be based on:

1) real rate of interest of 3% regardless of duration

2) projected inflation adjustment (if any)

3) risk of loss adjustment on the underlying debt

All US government debt should be financed for 30 year terms as it isn’t going to go away or get paid any sooner and the US government should be prohibited from issuing shorter term US Treasuries.

Most all interest rates should be around 5.50% and simply be kept that all that amount for the foreseeable future without anyone changing them up or down on a daily basis through a variety of methods.

Hmm, yes, I remember this – stable interest rates. Think it had something to do with Maude – I mean gold.

@SoCalBeachDude: That is much too sane. How will our oligarchs, banksters, politicians, and market manipulators funnel all the wealth upwards if we adopt this approach? Are you a commie? /s

The Fed has two mandates: price stability and full employment. Both of those are far more important to people in their everyday lives than interest rate stability.

The US, Canada, and Mexico are positioned to be successful. Bet against it at your own risk.

The 2-10 year yield curve analysis of the yield curve is market driven and therefore a better read on what the market thinks than the 3mos to 10 year which of course the 3 mos is mostly controlled by the Fed.

It is an economic indicator that worked very well in the long past ( but as Wolf pointed out, did not work consistently recently) is pointing to Recession in a stock market that is/was pricing in “Soft-Landing” .with valuations at or very near all time highs .

Because of what’s priced in to the risk markets, this indicator will be an object of interest.

I think the recessions are things of past. After 2008-2009 crisis, G7 CBs discovered that they can print almost limitless amount of currency instantly to dodge any recession. It worked every single time after that. As a result, there will be no recession ever, but ever increasing wealth disparity instead.

At first I didn’t believe it, but now I’m of your opinion too. The hope remains for a big black unexpected and evil swan to appear on the horizon

Aliens?

Who had aliens on their bingo card?

^^^This. Yeah mild recessions are a good thing to curb bubbles and excessive speculation. We can’t have them anymore though because it’s not good for our politicians. Both parties care more about winning than what’s good for the country.

Long term wealth disparity creates more social unrest and has history of destabilizing nations.

Agreed. Hard to have a recession when the government is overspending $2 Trillion a year and rising.

Ponzi- Between the Fed & it’s various “facilities,” and the out of control gov spending, you may not be too far off from the mark with that statement!

Ha ha “this time is different” LOL how many many times has that been said.

Some where only the road,we are all going to pay the piper…

Yes, we are paying. Inflation is actually a hidden tax. And asset inflation is much higher than consumer inflation.

We’ve been paying the piper with inflation for three years. The piper got rich.

More like 111 years Wolf:

Please be clear that WE, in this case WE the working and saving folx on which the strength of USA has always been based, have been paying the piper since 1913 when the massive degradation of our money began so that the banksters, etc., could be saved at our expense.

Note that the ”official” BLS calculator indicates our current dollar is worth 1/33 what it was then.

SO 3 cents!!!

Certainly we can come up with something better.

SOCAL dude has a good start above…

Yeah, abolish the Fed and bring back the gold standard, this is not rocket science

I agree with the last part about not putting too much emphasis on the yield curve as a predictor. However, the jobs report and the fact that hiring is slowing and has been in the past quarter is significant. Employment was extrememely robust following the end of the pandemic lockdowns. Employers were offering crazy money and bonuses to fill job vacancies. All of that appears to have stalled. The manufacters’ index also appears to have stalled, when those number came out a couple of weeks ago.

I keep saying over and over again that this Holiday Season, Thanksgivng through the New Year, will be hugely important. If consumers don’t spend without abandon, but instead choose to be frugal then there could be significant ramifications in 2025. Also, a lot of the consuming public appears to be diverting their money to travel and experiences. A lot of these travel and experiences are happening outside our borders, so it does not help our domestic economy. Let’s home that the recession indicators start calming down in the start of the new year. Cheers.

American consumers be frugal? Why would they do that when they have credit cards?

The 1998 and 2019 2/10 inversions appear to be like when you run your finger through the flame of a candle – not long enough to cause any damage. Maybe they were just foreshadowing the much larger inversions that came in 2000 and 2022. The latter looks so bad and deep that if there is a correlation between “time inverted” and the following recession then we’re in for a doozy. It’s hard to imagine after all of this everything will just be fine. Let’s see if inflation immediately pops again after the 0.25 or 0.50 rate decrease and if the Fed needs to pause or re-raise soon after.

Right, the 1st qtr. of 2020 was already destined to be negative.

spencer

Revisionist BS. All of 2019 was strong. Q4 real GDP growth as 2.6% and Q3 was 4.6%, well above the 10-year average for the US of just under 2.0%.

Q1 2020 started out even stronger, with January real PCE consumer spending, adjusted for inflation, up 4.1% annualized from December, and up 3.4% year-over-year, the strongest yoy growth rate since 2015.

In January 2020, the unemployment rate was 3.6%, which is historically low. In February (the survey period is in the first portion of the month), it dipped to 3.5%.

So that’s what we do know. There was simply no business cycle recession in sight.

The pandemic started in the second half of February in the US. By February 20, with Covid stories everywhere, and huge amounts of uncertainty, stocks started swooning. NBER then pegged the beginning of the recession on February 2020.

Ol’B,

You have to ask yourself: what caused the inversion?

1. the fastest rate hikes by the Fed in 40 years, which pushed up the short-term yields super-fast.

2. the fact that long-term yields didn’t follow short-term yields’ surge; in part because the Fed’s balance sheet was so huge – at the time it held about 25% of all marketable Treasury securities; and in part because Wall Street never believed rates would go so high, and stay there for so long, and then believed in rate-cut Mania, all of which kept longer-term yields lower than short-term yields.

That very fact that longer-term Treasury yields never rose to 6% or 7% as they might have otherwise, and the fact that financial conditions for most part (except CRE) have remained loose, and loosened further over the past year, may have made sure that there’s no recession. A recession should have been caused by tighter financial conditions, and much higher long-term yields, but financial conditions didn’t tighten for most of the economy (except CRE) and longer-term yields never rose that much. We’ve discussed this endlessly.

There is no secret or magic here.

You’re right. And I’m confused as hell. Either I’ll be a genius for buying three year Notes at 4% as we return to ZIRP or I’ll be a fool as inflation takes off and rates go to 8%. All of this is like nothing I’ve ever seen and I’m old. What I do know is I’ve rediscovered a love for Bourbon these last few years.

Gdp just advised up, we’re still adding jobs. unemployment is low, layoffs are low – why can’t we leave rates as they are? Sounds like our biggest issue was mass immigration so maybe focus on that instead.

Shouldn’t there be a place savers and retirees can earn a modest risk free rate on their savings? Ulta low interest rates fuel the asset bubbles in multiple ways – one of which that is less discussed is people need a return on their money, when interest rates were 1% their main options were the stock market, real estate or junk bonds

*Gdp was just revised up

@MM1: My response above to @SoCalBeachDude applies here too.

“That is much too sane. How will our oligarchs, banksters, politicians, and market manipulators funnel all the wealth upwards if we adopt this approach? Are you a commie? /s”

So 25 years ago I was a UK gilts trader and it was quite clear then that the UK GBP curve was very different to the US curve.

In US no one gave a damn about FX rates, the fed funds rate was set for overnight, and the rest of the curve was alway positive showing a liquidity premium for later dates.

In the UK the BofE was obsessed about propping up the £ or keeping it stable. Short term rates went up, and down, frequently responding to FX markets. Yield curves were frequently negative or just flat and if positive it was because short term rates were expected to go up again soon.

(The long end barely moved with forward rates beyone 15 years quite static, and low because of pension fund demand).

So:

Is the negative US curve anticipating an economic collapse?

Or is it just reflecting the Fed’s acknowledgement that the USD needs support nowadays?

Waller, Williams, and Logan seem to agree. They “believe the Fed can keep unloading bonds even when officials cut interest rates at some future date.” I.e., continue with QT while lowering the administered rates.

Yes, that has been the plan all year — but the rate cuts are delayed.

Who is buying treasures over 1yr? Those that think yields will drop below 3%

I am. 3 year notes to be precise. I did catch a ten-year at 4.3% earlier this year and that one will be sold early if/when rates do drop under 3%.

I think rates will have to drop. I’ve been telling myself that the Fed is finally serious about fighting inflation but I think I’ve been wrong. 2.75% ten-years and 3.5% inflation will do wonders for “shrinking the national debt”. Young people are going to have to pay through the nose for housing and gasoline but you know what – F ’em – they’ve got good knees and can stay up past 10 so Powell and all of us other geezers really have no choice but to saddle them with ugly inflation and tell them they’re lucky the lights are still on. The world of 2035 or 2040 is going to be a scary place for people whose price expectations are anchored in 2019.

There is no valid market price for Long term debt with Fed interventionism. Guys like me move in and out of long bonds with zero intention of holding them long term. Case in point. I bought TLT several more nrhs back thinking there would be a threat of recession, leading a dovish Fed to lower rates. That was a good trade, and it had nothing to do with holding for the duration.

If people were forced to hold long bonds for their duration, I think LT interest rates would be at least double.

Maybe they’re betting that long-term yields will rise again?

I bought some 18 month ones early this summer at just over 5.0% in anticipation of rate cuts.

One thing to note. A spike in Oil prices preceded 1981 recession, the 1990 recession, the 2000 recession and the 2009 recession. We are not seeing any spike in oil.

Low oil/gasoline/nat gas prices helps keep inflation low and allows people to keep spend money on other things besides energy.

It also helps businesses profits.

High energy prices are a tax on everyone. We are lucky they have been mostly flat for the past 10 years except for the Ukraine/Russia spike.

Meanwhile. I read that the average cost of a 12 ounce can of soda cost in 2020 was .33 cents and now it costs .62 cents which is an 87% increase. At least soda has a substitution via water which is probably more healthier.

Price of oil was $61 and is now $68. About a 11% increase.

High gas prices are politically unpopular. When they’re high now we just open the us reserve supply to artificially lower them.

Also in theory fracking and US energy independence somewhat changed this. Although again politics impacts that.

If you websearch “definition of a recession” what you get is a host of sites providing a lot of evasive verbiage essentially confirming that there is no consensus.

In the US, the NBER calls out the recession and defines what a recession is. Everything else is BS. So go to the NBER website and read about what a recession is. Note that it includes declines in employment and real personal incomes and other factors:

https://www.nber.org/research/business-cycle-dating

The financial world vs the real world. Fortunately, there are occasions when the former does not explicitly ruin the latter.

1998: LTCM etc., etc.

2019: Repo… oh nevermind, let’s all forget about this one.

There hasn’t been a recession since 2008. It is 16 years. A very long time in economic cycle. Inflation has been baked into the expectation that only high interest rate can cure. Now that the interest rate is coming down, inflation will re-ignite or recession has already started — we just don’t know it yet.

Strikes are popping over all over the economic sectors, delayed inflation in insurance is creeping up on everyone. Demand is taking a hit. Restaurants are suffering because fewer citizens have the disposable income to spend on dining out.

My economic training of the past tells me that recession is always the result of lack of demand. It is the excess of supply when there is no sufficient demand that triggers recession. Inflation has done the damage to demand. Government-based demand fueled by debt can only last so long before crowding out private sector investment.

Market realized the signs of recession by dropping the 2 year rate.

Inflation is a monetary phenomenon. The only cure of inflation is recession. Soft landing is the most frequently used phrase in financial press before every major recession. Just look at the wayback machine to search for news around 2008.

Be careful. In all cycles prior to 2008, money printing was never considered an option. The new option of money printing changes the rules of the game entirely. The key question now is, how much inflation will society accept?

Americans will accept whatever is given to them and clap like wet seals

Just do the John Bogle thing and buy the market. This plane only crashes due to a natural disaster or something like it at this point

What can interest rates tell us when, as you point out, both Fed and Treasury are actively managing them ? To any prudent money manager I’d say it’s just a warning to stay away from the long end because you can get killed there.

Meanwhile the Fiscal Deficit is 6% of GDP and there is no reason it can’t go to 7% or 8% so it’s hard to see how we can have any sort of deep recession that shows up in the numbers – even assuming the numbers are reliable ?

I can’t get a clear picture on China. The “narrative” tells me they are on the edge of the abyss – who knows ? They do have a savings rate of 40% I’m told. Thats got to provide options for them. Besides, maybe they are not really focused on the economy as much as on other things like a potential war with the US ?

It seems like 2025 will reveal increasing economic costs for Russia. But again, it’s impossible to know. There is so much noise. Everyone makes fun of Putin endorsement for Kamala, but I think he’s serious. Kamala is the known and the Russians have a plan for defeating the known. Trump is the unknown and those who control the apparatus will not be good sports.

But given the geopolitics it’s hard to see how we can avoid not having 10% or more of the worlds productive capacity and resources shut in by one means or another.

Be interesting how lending banks respond. My high yield saving at one is 5% while another one I am moving away from is 4.2%. Don’t have much there given the rate and tax advantages treasuries have but perhaps that could change.

How do we know there wouldn’t have been a recession in 2020 if not for the pandemic? Sure the inversion didn’t predict covid but the economy was completely warped for the next few years. Businesses were bailed out, consumers given free money, who knows what would have happened?

The stock market capitalization to gdp and real estate value to gdp charts are what keeps me in bonds for now. Seems more direct data about these sectors being overvalued compared to the other, more abstract numbers that are supposed to predict downturns.

I’ve wondered this too. We might have had a recession Q1 2020 with or without COVID but we’ll never know

All of 2019 was strong. Q4 real GDP growth as 2.6% and Q3 was 4.6%, well above the 10-year average for the US of just under 2.0%.

Q1 2020 started out even stronger, with January real PCE consumer spending, adjusted for inflation, up 4.1% annualized from December, and up 3.4% year-over-year, the strongest yoy growth rate since 2015.

In January 2020, the unemployment rate was 3.6%, which is historically low. In February (the survey period is in the first portion of the month), it dipped to 3.5%.

So that’s what we do know. There was simply no business cycle recession in sight.

This recession mongering is just silly.

Wolf — neither you nor anyone else knows if there would have been a recession in 2020-2021, but-for COVID. Yet you assert that the 2019 inversion was a “false positive.”

Your justification in this comment (the economy was strong in late 2019) is flawed. You know that the US economy can turn from strong growth to recession very quickly. Here are 8 examples.

Real GDP Growth:

Q4 1948: 3.9% –> Q2 1949: -1.0%

Q3 1953: 5.4% –> Q1 1954: -1.8%

Q3 1957: 3.1% –> Q1 1958: -2.9%

Q4 1973: 4.0% –> Q2 1974: -0.2%

Q1 1980: 1.4% –> Q3 1980: -1.6%

Q3 1981: 4.3% –> Q1 1982: -2.2%

Q2 1990: 2.4% –> Q1 1991: -1.0% [3 quarters]

Q2 2008: 1.4% –> Q4 2008: -2.5%

You (correctly) deride others for confirmation bias and failing to analyze data in an unbiased way. You might want to do some self-reflection yourself on your 2019 “false positive” narrative. Are you trying to manufacture evidence to support your “no recession on the horizon” opinion?

You have other good evidence to support that opinion. This 2019 yield curve point is not one of them.

RJC

I don’t have time to shred every data point in your comment, I’ll just shred your last one about the Great Recession.

1. You got your recession dates wrong. The Great Recession was from Dec 2007 (Q4 2007) through June 2009 (Q2 2009). You cited Q2 2008 as the quarter before the recession, which is BS, it was in the middle of the recession.

2. Q2 2008 (which you claimed was before the recession) was preceded by the negative Q1 2008 (-1.7%). In December 2007, the economy had deteriorated, and NBER, which calls out recessions in the US, called December 2007 the beginning of the recession.

3. You completely ignored the data I gave you about the unemployment rate. The labor market is a big component of a “recession” in the US, as called out by the NBER. In May 2007, the unemployment rate was 4.4% (no recession). By Nov 2007, it had risen to 4.7% (still no recession). In Dec 2007, it jumped to 5.0% (beginning of recession).

4. For a recession in the US, called out by the NBER, you have to look at the unemployment rate. You’re not anywhere near a recession with the unemployment rate at 3.5% — it’s just ignorant recession-mongering BS to claim that a recession might have occurred with the unemployment rate so historically low.

@Wolf from what I remember the start of the GFC recession was highly debated and only declared to have started in 2007 LONG after the fact by NBER.

I started my first post college job in August 2007 and then received a 6% raise when they did their annual raises in October 2007 2 months after starting. I even left for a higher paying job in August 2008 with a 10%+ raise – jobs still seemed plentiful and people were still getting good raises even in accounting/finance (what I was doing at the time) which was one of the hardest hit sectors during the GFC. I also remember being on vacation at a family members lake house and listening to two of my uncles (who were executive level professionals) make fun of all the are we in a recession and are we not in a recession talk on the news. They were saying the economy and business was strong, it was just fear mongering for the election. One had just bought a nice brand new boat and some other toys. The american consumer was strong in their opinion.

The collapse of Lehman was when everything really seemed to fall off a cliff. Depending on the industry it took a month to a few months to really flow through to other businesses. That’s when the mass layoffs started. That’s when it was like well they’re going to make me bill 80+ hours a week, but hey there’s nothing I can do because there are no other jobs started. No raise fine, thank you for not laying me off. That’s also when those same executive level relatives got laid off and it took them a significant amount of time to find new work.

Honestly 2007/early 2008 felt eerily similar to now. Lots of debate on wether a recession is coming or if the economy was strong – people seemed confused and lots of different opinions, lots of stock market volatility, housing seemed weak but prices hadn’t dropped significantly yet (at least in the area I lived), companies were still hiring and raises were still decent.

I’m not recession mongering, hard to say if we’ll get a recession or not. My biggest point is I think the 2019 data point is hard to analyze because of COVID. Also depending on how this plays out, if we get a recession I think the yield curve inversion might need to be fine tuned to ‘if the yield curve inverts for xx months, we get a recession’. The 2019 inversion was so brief it might just be an outlier. If we don’t get a recession, then yeah it’s lost it’s predictive value. Hard to say. We’ll probably find out in the next 6-12 months.

First, in Feb 2020, the unemployment rate was 3.5%, which is extremely low, and it had dipped. You don’t go from 3.5% to 5.0% in two months in the business cycle. In 2007, it took all year to get to 5.0%. You’re not anywhere near a recession with an unemployment rate at 3.5%. Period.

Second… In 2006, cracks in the financial system became obvious even to my then untrained eye. I sold all my stocks (over a year too early). The cracks kept getting bigger and bigger and more glaring, and I couldn’t believe that the stock market didn’t see it — until it finally blew up.

The Great Recession and unemployment crisis was a consequence of the Financial Crisis, which caused the entire economy to grind to a halt for a while, and it was a consequence of many things, including the then budding mortgage crisis, which was a consequence of horrible lending practices in the financial sector combined with a sharp decline of home prices off a ridiculous housing bubble.

I’d never seen anything like that. I watched it for two years, just incredulous that it kept going without blowing up. The signs that it would blow up were everywhere. But the economy kept going in 2006 and 2007 because everyone just ignored the issues. Then in late 2007, the S started hitting the fan. In response, in February 2008, Congress passed a stimulus act with the first stimulus checks ever, as far as I can remember.

Today, there’s nothing like that. The banks have shuffled off most of the residential mortgage risks to taxpayers and global investors. Banks have shuffled off the majority of the CRE mortgage risks to taxpayers (multifam) and global investors. Banking is in a very different place. Bad mortgages and plunging home prices aren’t going to blow up the banks anymore (but taxpayers and investors). That was one of the big triggers of the Financial Crisis – and it doesn’t exist anymore today.

Asset prices are very much overvalued across the board, and there will be problems with them. Private credit may create some problems, but it will hit banks tangentially, rather than directly broadside them. So this is a very different situation than in 2006-2008. No comparison.

I understand that there are people who see a financial crisis in everything, and that’s fine. But financial crises don’t happen often in the US. There was only one in my life. But run-of-the-mill recessions happen quite often, and they’re not a problem. But there are also signs that they’re developing, and you cannot just make up a recession without the signs.

This is all bullshit. Yellen rigged the long end of the curve, that’s why this is inverted for so long. This indicator is now useless.

Say goodbye to 5% money market yields and hello to future earnings revisions for stocks — great times ahead!

“Money fund yields inched lower to 5.08% (down 2 bps) on average in the week ended Sept. 6 (as measured by our Crane 100 Money Fund Index, an average of 7-day yields for the 100 largest taxable money funds) after remaining unchanged the week prior”

Over here in Thailand, the inflation rate dropped to 1.2% in 2023, down from 6.1% in 2022.

Lady luck and U.S. policy have been sweet for me in the last couple of years. I converted USD to a lot more Thai baht than usual, as the dollar exchange rate peaked during fed rate increases. And I parked other dollars in 5+ percent short-term T-bills. Will keep it there until rates drop below what I can get here.

Upcoming holiday in Scandinavia will suck a little share of the extra money out of the U.S. system.

Scandinavia one of the highest cost areas of the world especially for vacationers. That will take a lot of funds just stay away from food and alcohol and you will save a bundle

Given the coordinated actions of many central banks, and their proxies, around the world, I’d argue that the yield curves on government debt is largely meaningless as an indicator of anything. Yield on corporate and private debt is something else. Historically speaking, between 5-7% on the ten year is “normal”.

Interesting times, we’ll see if my comment actually gets posted, as the other three have not.

I keep driving past gas stations that drop prices everyday, and as the yield curve un-inverts, as my money mkt rate falls below 5%— while tech stocks get beat down, it kinda feels like normalization is unfolding its dark wings at an accelerated pace.

“ Not even a forming hurricane in the US Gulf of Mexico could halt the decline in oil prices, with ICE Brent dipping below $70 per barrel and marking the lowest level it has been since late 2021. ”

A few years ago, $30-$65 was the normal range for WTI, with prices falling far lower part of the time. Prices are still just slowly coming off the 2022 spike, amid all-time record production in the US, and talks of a glut. US production is the most prolific and most undisciplined in the world, regularly crashing the global price of oil with rampant over-production. That is because there are many producers in the US that all go out to maximize production, while the other big producing countries have just one to a few state-controlled entities where production can be reined in by the state.

What I find unusual is the level of valuation for xom and cvx, relative to oil values. As oil prices fall, primarily because of weaker recent demand, these oil giants are hovering near record highs — maybe people are chasing dividends, but seems like future value would be declining— at least temporarily. I don’t get the mkt optimism and I’m inclined to think these oil soaked black swans are headed south.

As yields drift lower, this type of distortion has a something about to break vibe.

Oil companies hedge a lot of their production. They have long-term supply contracts. A big part of their prices are stable.

In addition to hedging, it’s depends on the price it cost them to buy the land and develop the well. Per barrel break even points can vary significantly depending on location and when the well was drilled. Energy demand crashed in 2020 so my guess is there was a lot of land/reserves for sale at dirt cheap prices this creating lower break even points so they’re more profitable at these prices. Avg life of a well is 10 yrs, so the mix will be slowly consisting of these cheaper wells. Last time energy really peaked was 2014 a lot of the more expensive wells will be slowly coming out of production. Basically $60 a barrel is great if you’re break even point was $20, but sucks if it was $70.

Un-inverting term spread fits nicely with falling oil and yields falling off cliff— which correlates with Yen strength, which takes us back to yield differentials and carry trade unwind being further amplified by Fed rate cut.

Can you explain this a bit more? Why did the yen carry trade unwinding impact the US stock market?

Carry traders use devalued currency as a way to amplify leverage into arbitrage opportunities — they could simply get the differential between currency or bond prices, but lately there’s more excitement in supercharging the arbitrage into bets in equities, like nividia — instead of getting ten times leverage, people want 400%+.

The Yen has been the perfect tool for this trade because of Japan’s zero rates, but as the Yen increases in value, as the Fed cuts rates — the arbitrage is less interesting.

The carry trade moves to where differentials are more profitable — some people think the Euro will be falling soon and become an alternative to Yen. Regardless of the currencies or bonds, these traders generally chase leverage in momentum equities.

The main thing throwing off the game is Japan changing its tune on zero rates, and the possibility that this carry trade liquidity has boosted equity prices. If that Yen liquidity drains away , stocks go down faster.

The spread between the 10-year and 3-month yields is most predictive 12 months into the future. Additionally, the value of the spread itself carries probabilities. For instance, if the spread is barely negative, the probability of a recession is much lower.

In 2019, the spread predicted a recession in 2020, which coincidentally occurred due to COVID-19. Specifically, the spread in February 2019 indicated a “High” probability of recession by February 2020 and a “Very High” probability by July 2020.

In 1998, the first “High” warning appeared in August and remained elevated, with some fluctuations, until November 2000. Although we did Not experience a recession in 2000, the market peaked in August 2000 and didn’t recover until 2003. This is crucial because our (my?) primary concern is not the recession itself but the timing of the next significant market crash. In this regard, the yield curve has been quite effective.

However, a caveat is that the yield curve has been signaling a recession since July 2023, yet the market has continued to perform well. Perhaps this time is different, after all.

Furthermore — I’ll suggest that this decline in oil is going to influence Fed rate cuts — because a significant decrease in energy costs will influence CPI.

Essentially the oil mkt is currently in the process of lowering inflation — taking rate cuts off the table.

The only thing stopping the Fed, is the shadow area of labor revisions, which everyone is dancing around — but it’s not hard real data that can be quantified in the next month or two. If the Fed is sat dependent — the have no reason to cut.

In addition, besides oil and inflation falling — friggin yields are dropping like a rock — so please tell me why even a quarter pt cut is necessary? 50 is totally off the table and this dovetails nicely with higher for longer ….

I know — too many stupid posts

Some interesting discussion here. @Wolf argues it’s time to cut, but there’s no sign of recession.

If there’s no sign of recession why cut? Let’s be honest nailing the soft landing requires a lot of luck and perfect timing. They’ll most likely overshoot or undershoot. If given a choice, a mild recession is better than 3% inflation for the foreseeable future. Especially because if inflation starts to increase they’ll call it transitory and be slow to raise again so really we could be back to 4-5% inflation pretty quicky. With GDP numbers where they’re at and jobs still being added seems like we could wait a bit.

Also no one’s saying there will be another GFC, just that there’s a lot of bubbles even to the untrained eye and that historically an inverted yield curve indicated high probability of recession since the fed would cut based on a weakening economy. The similarities I see are in the attitudes of the general public and the media.

Wolf, thanks for your very accurate analyses.

If you give a look to the U-1 Unemployment series (since 1948 on FRED), what is your conclusion? No recession in sight?

So what we actually have in sight and can see:

1. Layoffs are low. Initial claims for unemployment insurance compensation are low and “layoffs and discharges (JOLTS) are low. So business are not shedding lots of people.

2. But businesses have slowed the pace at which they create new jobs. The three-month average of job creation slowed (after big down revisions) to “weak” from “decent” in July.

3. There has been a huge surge of immigrants (including illegal) into the US starting in 2022 that has been difficult to impossible to tabulate in the data. But these people are looking for work and many of them are already working. Those that are still looking for work count as unemployed and push up the unemployment rates, including our headline rate (U-3) and the narrowest rate you cite (U-1). But this increase in the unemployment rate was driven by new arrivals and not by layoffs, as in past recessions.

4. In August, the unemployment rates dipped or remained unchanged (except for U-6, which rose) and remained in the normal non-recession range. See chart below.

5. Q2 GDP growth was 3.0%. The Atlanta Fed GDPNow estimate for Q3 is 2.5%, above the 10-year average of 2.0%. So that’s solid growth, not a recessionary number.

Here is the long view of U-3, our headline unemployment rate:

And here’s the shorter view of all 6 unemployment rates:

So for a recession, the labor market would have to show some actual negative readings on nonfarm jobs (which we haven’t seen yet), and it would have to show a significant increase in initial unemployment insurance claims (which remain low), and it would have to show some actual declines in GDP (which is still growing at a good clip).

Wolf, thanks for your extensive and documented answer.

We shall seen if this time is different from the 76 past years…